How to calculate an old-age pension for a man born in 1960

The amount of old-age pension (Pst) is calculated using the formula:

wherein:

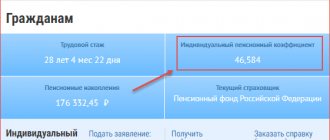

- IPK - citizen (number of accumulated points);

- Spk - the cost of one IPC (pension point);

- FV - the amount of a fixed payment to the old-age pension.

The cost of the pension coefficient and fixed payment are established by law and are indexed annually. To calculate the size of the pension, you only need to substitute the value of your IPC and use the FV and SpK standards established for a specific year.

- For those retiring in 2021, the security will be calculated taking into account the cost of a point of 98.86 rubles, and a fixed payment of 6044.48 rubles. Using these standards, the calculation will be made for men born in the first half of 1960.

- For those retiring in 2022, the calculation will be made taking into account the cost of a point of 104.69 rubles, and a fixed payment of 6401.10 rubles. These standards will be applied when calculating for men born in the second half of 1960.

It should be noted that the difference in the established standards does not mean that the pension amount for those who became pensioners earlier will be lower. For men born in the first half of 1960, it will be assigned using the standards established for 2021. And from January 1, 2022, the amount of the payment will be recalculated according to the standards approved for 2022 - this is the principle of annual pension indexation (see).

Additional payments may be assigned to the pension amount calculated by the formula on the grounds provided by law. For example,

- for 30 years of experience in agriculture and living in rural areas;

- for work experience in the Far North and equivalent areas;

- for dependents (minor children or full-time students);

- EDV (disabled people, combat veterans, Chernobyl survivors, and so on).

Minimum pension

Taking into account the fact that the standards for the minimum required amount of the IPC for the assignment of an old-age pension are known, it is possible to calculate the minimum amount of pension provision for men born in 1960.

- When applying for payments in 2021 (these are men born in the first half of 1960), you need to have at least 21 points. Therefore, the minimum amount of the old-age pension will be 21 × 98.86 + 6044.48 = 8120 rubles. 54 kopecks

- When applying for a pension in 2021 (for those born in the second half of 1960), at least 23.4 points are required. Accordingly, the minimum payment amount will be 23.4 × 104.69 + 6401.10 = 8850 rubles. 85 kopecks

Let us note that the material support of a non-working pensioner should not be less than the cost of living of a pensioner in the region of his residence. Therefore, if the calculated and assigned pension is lower than the PMP in the region, the pensioner is entitled to a social supplement to the minimum.

An example of calculating a pension for a man born in 1960

Nikolai Mikhailovich was born on April 14, 1960. He is going to retire and wants to know what his retirement age is and how much he will receive when he becomes a pensioner. The conditions for the minimum length of service are met, and the IPC is 85 points.

- According to the stipulated schedule, the retirement age for Nikolai Ivanovich is 61.5 years. Taking into account his date of birth, he can retire from October 14, 2021.

- When assigning old-age security to him, the following parameters will be used: the cost of one coefficient is 98.86 rubles;

- fixed payment - 6044.48 rubles.

Based on the value of his IPC, the amount of the assigned pension will be 85 × 98.86 + 6044.48 = 14447.58 rubles.

If Nikolai Mikhailovich does not work after retirement, his pension provision will be indexed annually. For example, from January 1, 2022, it will be recalculated taking into account the indexed cost of the point and the fixed payment. The payment amount will be 85 × 104.69 + 6401.10 = 15229.75 rubles.

Retirement calculator for men

| Year of retirement | Retirement age | |

| 1959 | 2020 | 61 |

| 1960 | 2022 | 62 |

| 1961 | 2024 | 63 |

| 1962 | 2026 | 64 |

| 1963 | 2028 | 65 |

| 1964 | 2029 | 65 |

| 1965 | 2030 | 65 |

| 1966 | 2031 | 65 |

| 1967 | 2032 | 65 |

| 1968 | 2033 | 65 |

| 1969 | 2034 | 65 |

| 1970 | 2035 | 65 |

| 1971 | 2036 | 65 |

| 1972 | 2037 | 65 |

| 1973 | 2038 | 65 |

| 1974 | 2039 | 65 |

| 1975 | 2040 | 65 |

| 1976 | 2041 | 65 |

| 1977 | 2042 | 65 |

| 1978 | 2043 | 65 |

| 1979 | 2044 | 65 |

| 1980 | 2045 | 65 |

| 1981 | 2046 | 65 |

| 1982 | 2047 | 65 |

| 1983 | 2048 | 65 |

| 1984 | 2049 | 65 |

| 1985 | 2050 | 65 |

| 1986 | 2051 | 65 |

| 1987 | 2052 | 65 |

| 1988 | 2053 | 65 |

| 1989 | 2054 | 65 |

| 1990 | 2055 | 65 |

| 1991 | 2056 | 65 |

| 1992 | 2057 | 65 |

| 1993 | 2058 | 65 |

| 1994 | 2059 | 65 |

| 1995 | 2060 | 65 |

| 1996 | 2061 | 65 |

| 1997 | 2062 | 65 |

| 1998 | 2063 | 65 |

| 1999 | 2064 | 65 |

| 2000 | 2065 | 65 |

| 2001 | 2066 | 65 |

| 2002 | 2067 | 65 |

| 2003 | 2068 | 65 |

| 2004 | 2069 | 65 |

| 2005 | 2070 | 65 |

| 2006 | 2071 | 65 |

| 2007 | 2072 | 65 |

| 2008 | 2073 | 65 |

| 2009 | 2074 | 65 |

| 2010 | 2075 | 65 |

| 2011 | 2076 | 65 |

| 2012 | 2077 | 65 |

| 2013 | 2078 | 65 |

| 2014 | 2079 | 65 |

| 2015 | 2080 | 65 |

| 2016 | 2081 | 65 |

| 2017 | 2082 | 65 |

| 2018 | 2083 | 65 |

| 2019 | 2084 | 65 |

| 2020 | 2085 | 65 |

Deposit "MEGA Online" Moscow Credit Bank, Person. No. 1978

up to 7.7%

per annum

from 1 thousand

up to 1100 days

Make a contribution

Men born between 1960 and 1962 will also need to add one year each until 2026. But those whose age is counted from 1963 will begin to retire steadily at age 65.

The procedure for calculating pension payments

To navigate the new pension formula, you need to understand the terms of the Federal Law “On Insurance Pensions”:

- individual pension coefficient (IPC) is a special value that depends on the amount of contributions to compulsory pension insurance (and therefore on salary) that employers transfer;

- fixed payment - the amount guaranteed by the state is similar to the fixed base amount provided in the law “On Labor Pensions in the Russian Federation”;

- - multipliers that were created to motivate citizens to retire later than they became eligible for it.

The new formula for calculating old-age insurance benefits looks like this:

Where:

- SP - old-age insurance pension;

- SIPC - the cost of one coefficient (point);

- IPC - the sum of accumulated pension points;

- FV - fixed payment;

- K - premium coefficients (for IPC and PV they have different values).

Calculation of pension for a man born in 1961

The amount of the old-age insurance pension is calculated individually, depending on the formed pension rights. The payment is calculated using the following formula:

SP = IPC × SPK + FV

wherein:

- SP is the amount of the assigned insurance pension;

- IPC is the individual pension coefficient of a citizen, calculated in points;

- SPK - cost of one point;

- FV - the amount of the fixed payment (basic part).

At the same time, only the value of the IPC depends on the citizen, and the values of the PV and SPK are established by law.

Men born in 1961 will become pensioners in 2024, therefore, when calculating the pension, the values of the fixed payment and the value of the point established for 2024 will be used. According to parts 7 and 8 of Art. 10 of Law No. 350-FZ of October 3, 2018, the cost of one point in 2024 will be 116.63 rubles. , and the fixed part is 7131.34 rubles.

Accordingly, in order to independently calculate his future pension, a man only needs to find out his IPC (see also example of calculation).

It should be noted that several types of additional payments are included in the pension payment calculated using the formula:

- in the presence of disabled family members who are supported by a pensioner (for example, minor children);

- for 30 years of experience in agriculture and living in rural areas;

- for living in areas with an established regional coefficient;

- when a pensioner is assigned disability group 1;

- for 15 years of experience in the Far North or 20 years of experience in areas equated to the Far North.

If the pension calculated according to the formula, together with the additional payments assigned to it, is below the subsistence level of the pensioner established in the region of his residence, a social supplement up to the subsistence level is due. only non-working pensioners have the right to such an additional payment .

Minimum pension amount

The size of the pension directly depends on the size of the individual pension coefficient (IPC). Therefore, the minimum payment amount will be assigned if the citizen has the minimum IPC value.

To apply for a pension, a man born in 1961 needs at least 28.2 points. Substituting the minimum IPC value into the pension calculation formula, as well as the cost of a fixed payment and one point, we obtain the minimum monthly payment that a man born in 1961 can claim:

28,2 × 116,63 + 7131,34 = RUB 10,420.30

Calculation example

Ivan Ivanovich was born on May 22, 1961. He wonders when he can retire and how much he can expect to receive. He has enough experience to apply for a pension; the IPC value is 74 points.

- In accordance with the schedule, Ivan Ivanovich will be able to become a pensioner from May 22, 2024, when he celebrates his 58th birthday.

- His pension will be calculated taking into account accumulated pension points. The payment will be 74 × 116.63 + 7131.34 = 15761.96 rubles.

Moreover, if Ivan Ivanovich quits and becomes a non-working pensioner , the payment assigned to him will be indexed annually. Such an increase will be made as a result of the annual increase in the value of the pension point and the amount of the fixed payment.

If the pensioner continues to work, then such an increase will not affect him. He will only be entitled to a recalculation in August, within which additional length of service and points acquired after retirement will be taken into account. But after dismissal, his pension benefits will be indexed on the same basis as non-working pensioners.

Pension reform 2021

According to the age

- In 2021, the retirement age will increase by 0.5, which means that men will retire at the age of 60.5, and women – 55.5. Pension payments for the current year 2021 will be made in 2019-2020.

- In 2021, the increase will occur by 1.5: women. – 56.5 years old, male – 61.5 (21-22).

- In 2021, the retirement age will increase by 3 (women - 58; men - 63) (24).

- 2022 will be characterized by an increase of 4 (women - 59 years; men - 63 years) (26 years).

- Starting from 2023 – 5: women. – 60 years old, male – 65 years old (27).

For these groups of people, retirement follows length of service, namely 25-30 years. The specific length of experience depends on the position and specialization. The system described above was retained, but with the transformation as a waiting period of 5 years.

Stages, depending on the year of experience:

- 2019 (in 0.5 years) – pension in 2019-2020;

- 2020 (1.5 years) – in 21-22;

- 2021 (3 years) – in 24;

- 2022 (4 years) – 26;

- 2023 (5 years) – 28

The reform spells out specifics for people living in the represented region. The standard period is reduced by 5 years, however, now both men and women will be able to terminate the employment contract at 60 and 55 years, respectively.

Men:

- 55.5 years (1964) – 19-20;

- 56.5 years (1965) – 21-22;

- 58 years old (1966) – 24 years old;

- 59 years old (1967) – 26 years old;

- 60 years (1968) – 28

Women:

- 50.5 years (1969) – 19-20;

- 51.5 years (1970) – 21-22;

- 53 years old (1971) – 24 years old;

- 54 years (1972) – 26 years;

- 55 years (1973) – 28

Also, starting from 2021, the requirements for the minimum period of work experience of municipalities will be tightened. service, which makes it possible to receive payments upon reaching compulsory length of service, presented in the form of an additional benefit to the old-age pension. Taking into account all the reforms, the female part of the population will receive a pension upon reaching 56 years of age, and men - 61 years of age. Do not forget about length of service in the civil service - the period of work experience will be 16.5 years.

According to insurance experience

The reform carried out affects all aspects of establishing a pension, with the exception of the insurance period, which means the period of time during which contributions to the Pension Fund were made for the employee. Previously, before the adoption of the reform, a person required 9 years of qualifying experience. In the absence of this condition, the citizen could only receive a social pension.

For 2021, the situation has changed and now the years of insurance experience will increase according to retirement age, for example:

- 2019, 10 years of experience will be required;

- 2020 – 11 years;

- 2021 – 12 years;

- 2022 – 13 years;

- 2023 – 14 years;

- 2024 – 15 l.

The calculation of the IPC will be carried out in accordance with the previously established (2015) law.

The required lower limit of the individual pension coefficient in different years:

- 16, 2 – 2021;

- 18.6 – 2021;

- 21 – 2021;

- 23.4 – 2022;

- 25, 8 – 2023;

- 28.2 – 2024;

- 30 – 2025

Having carefully studied the nature of the changes, one can find an increase in the IPC by 2.4 up to 2025 inclusive. However, it is unknown whether the growth will continue or stop, but no changes in the coefficient are expected in the near future.

Conditions of appointment

The procedure for calculating pensions is the same for everyone. In 2021, only women born in 1962 have the right to retire in old age, since men have not reached the required age of 60 years. An exception is persons who, due to their work activity, can apply for early retirement:

| Category of beneficiaries | Age, years |

| Persons who worked on List No. 1 | 50 |

| Persons who worked on List No. 2 | 55 |

- How to find out your tariff on Megafon

- Cookies with nuts - step-by-step recipes for making shortbread, curd, chocolate or oatmeal

- Hairstyles with loose hair for every day

To calculate security, you should contact the Pension Fund, the Multifunctional Center, through the State Services portal or directly to the employer, providing:

- passport;

- SNILS;

- documents confirming unaccounted labor activity (certificates, contracts, extracts, work book).

Retirement age for men born in 1961

According to current standards, men retire at age 60. In accordance with the Government bill on pension reform, adopted by the Duma in the 1st reading and changes proposed by the President of the Russian Federation, the retirement age for men will increase. For those born in 1961, it will be 63 years old, so the expected year of retirement is 2024 (instead of 2021 if they retired under current legislation).

How to calculate your pension

Every person who retires can calculate their pension independently, knowing the formulas and parameters for calculating it. It is possible to make an online calculation, and there are also calculators available. If you can’t make the calculation yourself, you have the opportunity to contact the Pension Fund to learn how to calculate or request information about future income.

General formula

The formula for calculation will look like this:

- P = PV + LF + MF, where PV is a fixed share (basic);

- LF – cumulative fraction;

- SP – insurance share.

The procedure for determining the insurance part

The fixed share is set by the state. Each citizen has his own savings share. Therefore, we need to know how the insurance share is calculated. There is a calculation principle for this:

- SCh = PK/T, where: SCh – insurance part;

- PC – pension capital;

- T – estimated time that compensation will be paid, measured in months

From this formula we do not know the value of pension capital, which must be calculated in a new way. The capital consists of the values of the conditional pension capital (CPC) and the estimated payment (RP). The old-age pension is calculated using the formula:

- RP = SK * ZR / ZP * SZP, where: SK is the coefficient for length of service. It is equal to 0.55 (for men with 25 years of experience, women with 20 years of experience). For each year worked beyond the length of service, 0.01 is accrued, although this figure should not be more than 0.75.

- Salary/salary is the ratio of wages to the average earnings in the country. Its level should not be more than 1.2.

- SWP - the average salary is calculated by the Pension Fund in the amount of 1,671 rubles.

After calculating the estimated payment, you can find out the amount of conditional capital:

UPC = RP – BC / T, where RP is the estimated compensation, BC is the base part, T is the estimated time of payment, measured in months.

To calculate the insurance part, we only need to know the value of PC1, which can only be found in the Pension Fund of the Russian Federation (PFR). When you know all the data, you will be able to calculate the insurance share, and ultimately calculate what benefit you can count on when you retire. Every year the state increases pensions. This is affected by indexation and inflation. Indexation is an increase in the amount of payments that is made annually.

Benefits of retiring later than retirement age

Now it has become to some extent profitable to retire later than the established age, since bonus coefficients are established for each year of later application for an insurance pension.

For example, if a citizen insured in the compulsory pension insurance system wants to refuse to receive a pension for three years, then due to increasing coefficients, the PV will increase by 1.19, and the insurance pension - by 1.24.

Premium coefficients are one of the main points of the current formula for calculating pension payments. The values of the coefficients are given in Federal Law No. 400-FZ “On Insurance Pensions” and are calculated taking into account the amount of time the pension was not received.

Increasing the fixed payment to the insurance pension

The fixed benefit (FB) is a guaranteed amount that the state adds to the insurance pension. From January 1, 2018, the value of the PV amounted to 4982.9 rubles. When determining the value of the PV, the coefficient for increasing the PV is applied, established in accordance with Part 5 of Art. 16 of Law No. 400-FZ of December 28, 2013

This coefficient is used when assigning an old-age insurance payment after the right to it arises or when refusing to receive an already assigned insurance pension.

The coefficient is determined based on the number of full months that have elapsed since the date of emergence of the right to an insurance payment (including ahead of schedule), but not earlier than from 01/01/2015 to the day of its establishment and that have elapsed since the termination of the transfer of the insurance pension due to refusal from receiving the established insurance pension, but not earlier than from 01/01/2015 until the day of its restoration or the appointment of the specified payment again.

The table below shows the dependence of the size of the bonus coefficient for the pension fund on the period for which the citizen suspends receiving pension benefits:

| Number of years after the right to a pension arises | Premium coefficient for PV when assigning a pension | Premium coefficient to PV when assigning early pension |

| 1 | 1,056 | 1,036 |

| 2 | 1,12 | 1,07 |

| 3 | 1,19 | 1,12 |

| 4 | 1,27 | 1,16 |

| 5 | 1,36 | 1,21 |

| 6 | 1,46 | 1,26 |

| 7 | 1,58 | 1,32 |

| 8 | 1,73 | 1,38 |

| 9 | 1,9 | 1,45 |

| 10 | 2,11 | 1,53 |

As can be seen from the data presented in the table, if you do not go on a well-deserved rest within 10 years after receiving the right to it, but continue to work, then in addition to the additional insurance period (hence, pension points), the person will receive an increase in the PV of more than 2 times.

Under certain conditions and circumstances, the size of the PV may also increase on the basis of Part 8 of Art. 18 of the Federal Law “On Insurance Pensions”. These circumstances may be:

- whether the pensioner has disabled dependents;

- reaching 80 years of age or establishing 1 disability group;

- having at least 15 years of experience in the Far North.

Increasing the individual pension coefficient (IPC)

The insurance pension will increase by the corresponding premium coefficients with each year of late application for its appointment. For example, if you apply for the establishment of security 5 years after reaching the legal age, the amount of the IPC will increase by 45%, and if you apply after 10 years, then by 2.32 times.

The table shows the coefficients for calculating the insurance pension if a citizen decides to postpone applying for its establishment:

| Number of years after the right to a pension arises | Increasing factor | Increasing coefficient if you have the right to early retirement |

| 1 | 1,07 | 1,046 |

| 2 | 1,15 | 1,1 |

| 3 | 1,24 | 1,16 |

| 4 | 1,34 | 1,22 |

| 5 | 1,45 | 1,29 |

| 6 | 1,59 | 1,37 |

| 7 | 1,74 | 1,45 |

| 8 | 1,9 | 1,52 |

| 9 | 2,09 | 1,6 |

| 10 | 2,32 | 1,68 |

Retirement periods for citizens

As a result of the reform, the concept of “pre-retirement” was introduced, meaning the status of people who have 5 years left before retirement. During this period of time, this category of people has benefits in the form of social guarantees and assigned jobs.

According to the age

- In 2021, the retirement age will increase by 0.5, which means that men will retire at the age of 60.5, and women – 55.5. Pension payments for the current year 2021 will be made in 2019-2020.

- In 2021, the increase will occur by 1.5: women. – 56.5 years old, male – 61.5 (21-22).

- In 2021, the retirement age will increase by 3 (women - 58; men - 63) (24).

- 2022 will be characterized by an increase of 4 (women - 59 years; men - 63 years) (26 years).

- Starting from 2023 – 5: women. – 60 years old, male – 65 years old (27).

For teachers and medical workers

For these groups of people, retirement follows length of service, namely 25-30 years. The specific length of experience depends on the position and specialization. The system described above was retained, but with the transformation as a waiting period of 5 years.

Stages, depending on the year of experience:

- 2019 (in 0.5 years) – pension in 2019-2020;

- 2020 (1.5 years) – in 21-22;

- 2021 (3 years) – in 24;

- 2022 (4 years) – 26;

- 2023 (5 years) – 28

For persons who worked in the Far North

The reform spells out specifics for people living in the represented region. The standard period is reduced by 5 years, however, now both men and women will be able to terminate the employment contract at 60 and 55 years, respectively.

Men:

- 55.5 years (1964) – 19-20;

- 56.5 years (1965) – 21-22;

- 58 years old (1966) – 24 years old;

- 59 years old (1967) – 26 years old;

- 60 years (1968) – 28

Women:

- 50.5 years (1969) – 19-20;

- 51.5 years (1970) – 21-22;

- 53 years old (1971) – 24 years old;

- 54 years (1972) – 26 years;

- 55 years (1973) – 28

For state and municipal employees

It is worth recalling that for civil servants the retirement age is increased gradually (6 months per year) from 2021 until 2021 inclusive. Then the pace will align with generally accepted legal boundaries.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

Thus, male civil service employees will retire by 2028 (65 years), but female employees - by 2034 (63 years).

Also, starting from 2021, the requirements for the minimum period of work experience of municipalities will be tightened. service, which makes it possible to receive payments upon reaching compulsory length of service, presented in the form of an additional benefit to the old-age pension. Taking into account all the reforms, the female part of the population will receive a pension upon reaching 56 years of age , and men - 61 years of age . Do not forget about length of service in the civil service - the period of work experience will be 16.5 years.

According to insurance experience

The reform carried out affects all aspects of establishing a pension, with the exception of the insurance period, which means the period of time during which contributions to the Pension Fund were made for the employee. Previously, before the adoption of the reform, a person required 9 years of qualifying experience. In the absence of this condition, the citizen could only receive a social pension.

For 2021, the situation has changed and now the years of insurance experience will increase according to retirement age, for example:

- 2019, 10 years of experience will be required;

- 2020 – 11 years;

- 2021 – 12 years;

- 2022 – 13 years;

- 2023 – 14 years;

- 2024 – 15 l.

According to the individual pension coefficient (IPC)

The calculation of the IPC will be carried out in accordance with the previously established (2015) law.

The required lower limit of the individual pension coefficient in different years:

- 16, 2 – 2021;

- 18.6 – 2021;

- 21 – 2021;

- 23.4 – 2022;

- 25, 8 – 2023;

- 28.2 – 2024;

- 30 – 2025

Having carefully studied the nature of the changes, one can find an increase in the IPC by 2.4 up to 2025 inclusive. However, it is unknown whether the growth will continue or stop, but no changes in the coefficient are expected in the near future.

Calculation rules

The basic principle of calculations is the conversion of all working years of a person into certain points. Their calculation is influenced not only by the number of years worked, but also by the amount of contributions made to the Pension Fund. And they, in turn, depend on the income a person receives.

Calculation of points

Depending on various circumstances, the number of points awarded may vary significantly. They are influenced by the following factors:

- periods of work before and after 2002 (this is a transitional moment when the new pension system was introduced);

- number of years of work experience;

- actual receipt of different salary levels;

- different working conditions.

The latter conditions include representatives of certain types of professions or the presence of difficult natural conditions caused by territorial residence in certain regions of Russia. Such circumstances include:

- professional activities of teachers;

- work of doctors with the population;

- work of rescue teams;

- the profession of miners;

- people working on the railway;

- employees involved in geological research.

And also any professions if people were forced to live and work in the territories of the Far North or their place of residence was equated to these lands.

Calculation of points before 2002

To carry out the conversion to points from previous years of work, it is necessary to make special calculations, which have some differences for male and female genders. The scoring procedure will be as follows:

- First, the experience coefficient is established.

- Next, the salary coefficient is calculated.

- Calculate the product of these coefficients and multiply the resulting number by 1671.

- Also, the total amount is increased for valorization.

- Subtract 450 from this amount.

- Multiply the total by 5.6148.

Based on this, a final score is obtained, which is added to the calculated scores for activities since 2002.

Seniority coefficient

This is a conventional unit, which is obtained in the form of a fraction. When calculating it, the following rules are used:

- For men who have worked less than 24 years, the coefficient is set to 0.55, regardless of whether it is 3 years or 20 years. And for work beyond this time, he is added 0.01 for each subsequent working year.

- For women who have worked for less than 19 years, a coefficient of 0.55 is assigned, and for each subsequent year 0.01 points are added.

Salary coefficient

Its essence is to convert all funds earned by a person into real money at the moment. As an assistant, a comparison is made between the average salary of a person and that of the country at that time. The highest coefficient is considered to be 1.2. Exceeding this value is unacceptable.

Valorization

Before calculating it, it is necessary to multiply our two obtained coefficients by each other:

Next you need to make the following calculations:

Now we must also take into account valorization, which will change the points received in the following proportions:

- By 10% for everyone, if the person had any experience before 2002 directly.

- 1% for each year if the person had working days before 1991.

These amounts must be added to the final numbers obtained in the course of our calculations. You can clearly see these calculations in the video presented.

https://youtube.com/watch?v=gF_b5puc23A

Calculation procedure

The accrued pension for women consists of a fixed part and an individual part. The latter is divided into four separate components, each of which has its own calculation method:

- Estimated amount of pension capital until 2002

- Insurance pension from 2002 to 2014.

- Pensions from 2015 to 2021

- Non-insurance periods.

Determination of the estimated amount of pension capital until 2002

- The duration of the insurance period of the future pensioner until 2002 is determined through the “experience coefficient” (SC). The size is calculated using the formula:

| Number of years of experience until 2002 | Size |

| 20 or more | 0.55 + 0.01 × (number of years of experience – 20) |

| Less than 20 | 0,55 |

Please note that the SC cannot exceed the value of 0.75 - this norm is established by law! Even if the resulting figure is greater than this value, 0.75 is taken for calculation.

- The average monthly earnings coefficient (AMC) is calculated. For this purpose, the average salary for 2001–2002 is taken. or for any 60 months, after which this value is divided by the average monthly salary in Russia for the same period. The result obtained is limited to a maximum value of 1.2, with the exception of women born in 1964 who worked in the northern regions during this period. The coefficient for them is 1.4–1.9.

- The size of the estimated pension for January 2002 is determined. For this, the following formulas are used depending on the size of the insurance system:

| SK | Formula | Note |

| More than 0.55 | RP = SK × KSZ × 1671 – 450 | Provided that RP = SK × KSZ × 1671 is less than 660, the value of RP is determined to be 210 |

| 0,55 | RP = (SK × KSZ × 1671 – 450) × (number of years of experience before 2002 / 20) | Provided that RP = SK × KSZ × 1671 is less than 660, the value of RP is determined to be equal to 210 × (number of years of experience before 2002/20) |

- The duration of the insurance period until 1991 is determined. In its absence, the pension supplement will be 10% of the determined RP. An additional 1% is added for each full year.

Features of calculating insurance pensions from 2002 to 2014

- Receive notification about the status of your personal account. This can be done at the territorial branch of the Pension Fund or through the government services website.

- The total amount for the years worked must be multiplied by the product of indexation coefficients calculated taking into account inflation. For the period from 2003 to 2015 it is equal to 5.6148:

| Year | Indexation coefficient |

| 2003 | 1,307 |

| 2004 | 1,177 |

| 2005 | 1,114 |

| 2006 | 1,127 |

| 2007 | 1,16 |

| 2008 | 1,204 |

| 2009 | 1,269 |

| 2010 | 1,1427 |

| 2011 | 1,088 |

| 2012 | 1,1065 |

| 2013 | 1,101 |

| 2014 | 1,083 |

- The monthly amount of the insurance pension is divided by the age of survival - 228 months.

- The result obtained is divided by 64.1 - the value of the pension point at the beginning of 2015.

Pension amount from 2015 to 2021

After 2015, each insured person is awarded pension points depending on the amount of insurance contributions. The legislation provides for an increase in the minimum insurance period (by 2025 it will increase to 15 years) and the minimum number of points to 30. Pension rights that a person earned before 2015 do not expire; they are converted into points and taken into account when calculating the pension. More details in the table:

| Year | Minimum insurance period | Minimum number of IPCs |

| 2015 | 6 | 6,6 |

| 2016 | 7 | 9 |

| 2017 | 8 | 11,4 |

| 2018 | 9 | 13,8 |

| 2019 | 10 | 16,2 |

| 2020 | 11 | 18,6 |

| 2021 | 12 | 21 |

| 2022 | 13 | 23,4 |

| 2023 | 14 | 25,8 |

| 2024 | 15 | 28,2 |

| 2025 and later | 15 | 30 |

Non-insurance periods

The calculation of pensions for women born in 1964 is made taking into account “non-insurance periods”, each of which has its own size:

| Non-insurance periods | IPC |

| compulsory military service | 1,8 |

| receiving unemployment benefits | 1,8 |

| being on sick leave subject to receipt of compulsory social insurance payments | 1,8 |

| period of care for a disabled person of group 1, an elderly person over 80 years of age or a disabled child | 1,8 |

| participation in paid public works | 1,8 |

| moving or relocating to a new area for employment in the direction of the state employment service | 1,8 |

| detention if the person was subsequently rehabilitated | 1,8 |

| parental leave from birth to 1.5 years of age (until 2015 - no more than 4.5 years in total, from 2015 - no more than 6) | 1.8 – for the first child |

| 3.6 – for the second | |

| 5.4 – for the third and fourth | |

| the time during which the spouse of a military personnel was unemployed due to the inability to find work in the area where the spouse was sent for service (maximum 5 years) | 1,8 |

| residence abroad of Russia by the spouse of representatives of embassies, diplomatic missions, etc. (maximum 5 years) | 1,8 |

Calculation of insurance pension for those born before 1967

According to Federal Law No. 400-FZ of December 28, 2013, the calculation of pensions for those born before 1967 and eligible for payment is subject to general rules and occurs using the following formula:

SPS = FV × PK1 + IPKtotal × SPB × PK2, where:

- SPS – old-age insurance pension;

- FV – fixed (basic) payment, the amount of which is established by law and revised annually;

- PC1 – premium coefficient to PV;

- IPCtot – the amount of PB accrued for the entire length of service;

- SPB - the cost of one PB on the date of calculation (the amount is revised annually);

- PC2 – premium coefficient to the total IPK.

Determination of the amount of estimated pension capital until 2002

To determine the number of PB earned by a citizen for work activities before 2002, the following steps must be performed:

- Calculate the experience coefficient (SC):

| Floor | Experience until 2002 | SK size |

| Men | Less than 25 | 0,55 |

| 25 or more | 0.55 + 0.01 × (number of years of experience – 25) | |

| Women | Less than 20 | 0,55 |

| 20 or more | 0.55 + 0.01 × (number of years of experience – 20) |

Important! Regardless of the result obtained, the maximum value of the SC is limited to 0.75.

Example:

- The woman, born in 1961, has 28 years of work experience. SC will be 0.63:

0,55 + 0,01 × (28 – 20) = 0,63.

- The average monthly earnings coefficient (AMC) is calculated. The average salary for 2001–2002 is taken. or for any 60 months. The result obtained is divided by the average monthly salary in Russia for the same period of time (for 2001–2002 - 1,494.5 rubles).

Important! Regardless of the result obtained, the limit value is limited to 1.2, with the exception of persons with northern experience. The KSZ for them is set from 1.4 to 1.9.

Example:

- Median income for a man born in 1961, 2000–2001. amounted to 1000 rubles. KSZ = 0.67:

1 000 / 1 494,5 = 0,67.

- The estimated pension (RP) is determined as of January 2002:

| SK | Formula | Note | |

| More than 0.55 | RP = SK × KSZ × 1671 – 450 | Provided that RP = SK × KSZ × 1671 is less than 660, the value of RP is determined to be 210 | |

| 0,55 | Women | RP = (SK × KSZ × 1671 – 450) × (experience until 2002 / 20) | Provided that RP = SK × KSZ × 1671 is less than 660, the value of RP is determined to be equal to: 210 × (experience until 2002/20) |

| men | RP = (SK × KSZ × 1671 – 450) × (experience until 2002 / 25) | Provided that RP = SK × KSZ × 1671 is less than 660, the value of RP is determined to be equal to: 210 × (experience until 2002/25) | |

Example:

- A man born in 1961 has a SC of 0.65 and a CV of 0.68. RP will be 288.58 rubles:

SC × KSZ × 1671 = 0.65 × 0.68 × 1671 = 738.58. Since this value is greater than the established minimum of 660, 450 is subtracted from the result obtained. The RP in this case will be equal to 288.58 rubles.

- The valorization procedure is applied to the received RP - increasing the pension rights accrued before 2002. If a citizen did not work before 1991, the size of the RP will increase by 10%. For each full year of service before 1991, 1% is added in addition to 10%.

Example:

- RP for a woman born in 1961 = 650 rubles. Experience until 1991 – 12 years. The valorization amount will be 793 rubles:

650 × (10% + 1% × 12 years) = 650 × 22% = 793.

- An adjustment value of 5.6148 is applied to the final amount - the product of the annual indexation coefficients from 2002 to 2014.

Example:

- SP – 793 rub. Index (2003 – 2014) – 5.6148. The amount of pension capital will be 4,452.54 rubles:

793 × 5,6148 = 4 452,54.

- The calculation of PB earned before 2002 is carried out. To do this, the resulting amount is divided by 64.1 - the cost of one PB as of January 2015.

Example:

4 452,54 / 64,1 = 69,462

- 16 foods that boost immunity

- Funeral benefit: amount of payments

- Is it possible for pregnant women to cut their hair?

Calculation of pensions from 2002 to 2014

The process of calculating PB accumulated from 2002 to 2014. (inclusive) obeys the following algorithm:

- Contact the Pension Fund or through the government services portal to receive notification of the status of your personal account through the government services website.

- Since the amounts indicated in the document are given without taking into account indexation by the percentage of inflation, each of them must be multiplied by the appropriate coefficient:

| Year | Increasing value |

| 2003 | 1,307 |

| 2004 | 1,177 |

| 2005 | 1,114 |

| 2006 | 1,127 |

| 2007 | 1,16 |

| 2008 | 1,204 |

| 2009 | 1,269 |

| 2010 | 1,1427 |

| 2011 | 1,088 |

| 2012 | 1,1065 |

| 2013 | 1,101 |

| 2014 | 1,083 |

- The resulting figures are added up, after which the final amount is divided by 228 months - the survival age.

Example:

- The pension capital of a man born in 1961 is 1,315,000 rubles. SP will be equal to 5,767.54 rubles:

SP = pension capital / survival age = 1,315,000 / 228 = 5,767.54

- The number of earned PBs is calculated. To do this, the insurance part is divided into 64.10 rubles. – cost of PB as of 01/01/2015.

Example:

- Insurance part - 5,767.54 rubles. The IPC will be 89.977 points:

IPC = insurance part / cost of PB as of 01/01/2015 = 5,767.54 / 64.10 = 89.977.

Accounting for pension points since 2015

After the reform, insurance premiums are converted into PB and stored in the citizen’s personal account. The maximum number is legally limited:

| Period | Number of PB |

| 2015 | 7,39 |

| 2016 | 7,83 |

| 2017 | 8,26 |

| 2018 | 8,70 |

The calculation of the amount of PB is determined by the formula:

PB = SUSV / NRV × 10, where:

- PB – number of pension points;

- SUSV – the amount of paid insurance premiums;

- NRV is the standard amount of contributions to the insurance pension (the amount is 16% of the maximum contributory salary, the amount of which is revised by the Government annually).

Example:

| Period | SUSV | NRT | Number of PB |

| 2015 | 83 000 | 115 200 | 7,205 |

| 2016 | 90 000 | 127 360 | 7,067 |

| 2017 | 95 000 | 140 160 | 6,778 |

Determination of the general IPC

Taking into account the above, the calculation of the IPCtotal can be represented as the following formula:

IPKtotal = IPK2002 + IPK2002–2014 + IPK2015 + IPKnon-insurance, where:

- IPK2002 – number of PB earned before 2002;

- IPK2002–2014 – number of PB earned from 2002 to 2014. (inclusive);

- IPK2015 – the number of PB accrued starting from 2015;

- IPC of non-insurance - the number of PB earned during the time during which the citizen did not work for the following reasons:

| Non-insurance periods | IPC |

| Military service as a conscript soldier | 1,8 |

| care for a disabled child, a person with 1st disability group, an elderly person over 80 years old | 1,8 |

| detention if the person was subsequently rehabilitated | 1,8 |

| leave to care for a child up to 1.5 years of age (until 2015 - no more than 4.5 years in total, from 2015 - no more than 6) | 1.8 – for the first child |

| 3.6 – for the second | |

| 5.4 – for the third and fourth | |

| the time when the spouse of a military serviceman was unemployed due to the inability to find work in the area where the spouse was sent for service (maximum 5 years) | 1,8 |

| residence abroad of Russia by the spouse of representatives of embassies, diplomatic missions, etc. (maximum 5 years) | 1,8 |

Rules for calculating pensions for citizens born before 1967

Monthly deductions upon reaching old age are divided into 3 types of payments: basic - fixed, insurance and savings. The value of the PV is equal to 4 thousand 982 rubles by 2021. 90 kopecks and is subject to annual indexation based on the inflation rate. Residents of the Russian Federation independently choose how and where to transfer payments:

- For insurance benefits - 22% of the salary, of which 6% will go to the joint tariff of the fixed payment account.

- To create two pensions. 22% of the salary will be distributed - 6% (joint tariff), 6% (funded part), 10% (insurance deduction).

The calculation of insurance pension contributions is considered through the relevant sections. It is possible to calculate savings benefits using the formula: NP = C / PD, where: NP is the amount of savings accumulated on a specialized share of the personal account of the insured citizen and PD is the period of survival during which the citizen is paid a pension payment. For the current year it is 246 months.

You might be interested

- Will maternity capital be paid in the amount of 1.5 million rubles for the third child?

- Pensions for labor veterans

- Categories of federal beneficiaries

- Payment of insurance premiums to the Pension Fund