Foreign citizens and stateless persons permanently residing in Russia have the right to an insurance pension on an equal basis with Russian citizens, provided they comply with the conditions stipulated by Russian pension legislation.

The collapse of the USSR, which occurred due to the criminal policies of the country's supreme power under the leadership of Gorbachev, radically changed the lives of citizens of the former Soviet Union, throwing back all the social achievements of previous generations many decades ago. Due to certain processes that arose in the newly independent republics, citizens were forced for various reasons to move from one CIS state to another. Moving, which in itself is quite a complex matter, is aggravated for moving citizens by a host of difficulties that arise in the everyday, legal and social spheres of their new place of residence, including in the field of pensions.

Legislative basis for guaranteeing citizens' rights to pension provision

In Russia, legal norms have been adopted that provide certain guarantees of rights to foreign citizens entering our country with the dream of settling in our state on a permanent basis. However, difficulties still exist, and they continue to poison people's lives. The right to pension provision for citizens who came to live in Russia from the former republics of the USSR, with the exception of refugees and internally displaced persons, is exercised at their place of residence on the territory of Russia.

In order to resolve the difficulties encountered by citizens in the field of pension provision, the CIS member states concluded the “Agreement on guarantees of the rights of citizens of the member states of the Commonwealth of Independent States in the field of pension provision”, concluded on March 13, 1992 by the governments of Armenia, Belarus, Kazakhstan, Kyrgyzstan, Moldova, Russia, Tajikistan, Turkmenistan, Uzbekistan and Ukraine. This agreement was not signed by the republics of Azerbaijan and Georgia.

The “Agreement” in its essence is just a framework document that establishes the basic principles of pension provision for citizens. The main postulate of the reached Agreement was the statement that pension provision for citizens living in the CIS countries and members of their families should be carried out in accordance with the legislation of the state in whose territory they are staying. Each state is directly responsible for the pension provision of its citizens.

In addition to the “Agreement”, separate bilateral agreements were concluded between the Government of the Russian Federation and the governments of some former union republics of the USSR (Belarus, Georgia, Latvia, Lithuania, Moldova, Estonia) in the field of guaranteeing the rights of citizens.

Citizens who came to Russia for permanent residence from the union republics of the former USSR, with which a bilateral agreement on pension provision has not been concluded, are assigned a pension on the basis of Russian legislation, while periods of work in the territory of other states after March 13, 1992 are not taken into account in their work experience.

The “Agreement on Guarantees of the Rights of Citizens...” dated March 13, 1992 applies to work experience developed during the existence of the USSR. In accordance with paragraph 2 of Article 6 of the “Agreement...” citizens of the states party to the Agreement take into account the length of service acquired in the territory of any of these states, as well as in the territory of the former USSR during the time before the entry into force of this Agreement.

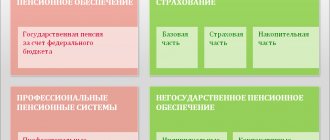

Pension reform in the Russian Federation

In Russia, the retirement age for men is 60 years, for women - 55. Such age limits were established back in 1956. The government of the country decided to change the retirement age.

Demographers predict that men will live to 75 on average and women to 85. Such studies became the basis for carrying out pension reform and changing the retirement age in Russia, which will reach the following marks:

- 60 years for women.

- 65 years for men.

The reform will be implemented gradually. The results of the innovations will be the following:

- The size of pension payments will increase for those citizens of the Russian Federation who are already retired.

- Pensioners' savings will gradually increase.

- The government will have the opportunity to further increase pensions.

Raising the retirement age will not affect the following citizens:

- Preferential categories.

- Industrial workers working in dangerous and harmful conditions.

- Mothers of many children.

- Disabled people.

Changes on pension issues in Russia

Due to the increase in the retirement age until 2021, the government has frozen funded pension payments. This was done in order to get out of the economic crisis.

Changes to the retirement age in the Commonwealth have been a long time coming. Thus, in Belarus, a similar reform was carried out in 2021. The government has raised the retirement age for men to 63 and for women to 58.

Previously, age thresholds were raised in a similar manner in Kyrgyzstan and Tajikistan. In Armenia, both men and women retire at age 63. A similar situation is observed in Moldova.

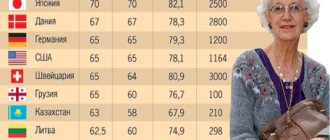

In other countries of the Commonwealth of Independent States, reforms to raise the retirement age were carried out earlier. Retirement times are as follows:

- Azerbaijan - 65 years for men, 62 years for women.

- Georgia - 60 years for women, 65 for men.

- Kazakhstan - 63 years for men, 60 years for women.

In Uzbekistan, members of the government reached an agreement that the retirement age will gradually increase to the global one. In the Baltic countries, the retirement age will be increased to 65 years, which caused protests from citizens of Latvia, Lithuania and Estonia. The reforms will be carried out during 2025–2027.

In many European countries, due to a rapidly increasing aging population and low demographic rates, the retirement age is changing and will reach 67 for men and women by 2025.

Mandatory condition for granting a pension to foreign citizens

The fundamental condition for the application of international agreements on guaranteeing the rights of citizens on the territory of Russia is the fact of permanent residence of a citizen on Russian territory, this fact can be confirmed by: ★ a passport of a citizen of the Russian Federation indicating registration at the place of residence; ★ residence permit (for a foreign citizen or stateless person), with a note about registration at the place of residence; ★ certificate of registration at the place of residence.

The condition for permanent residence in Russia for a foreign citizen is to obtain a residence permit, which is issued no earlier than six months from the date of receipt of the “Temporary Residence Permit” on the territory of the Russian Federation (except for citizens of Belarus) with a validity period of 5 years. A temporary residence permit is issued by the migration service department after six months from the date of application. The procedure for obtaining a residence permit lasts more than a year (except for citizens of Belarus).

Calculation of the insurance period for citizens who arrived in Russia from the CIS countries (except for citizens of Belarus)

From the contents of the “Agreement” it follows that when determining the length of work experience, periods of work activity that took place in the territory of any state that signed the “Agreement” should be taken into account, including periods of work in the territory of the former USSR. For citizens who arrived in Russia from the CIS states that are parties to the Agreement, when assigning a pension, their work experience includes periods of work that took place before March 1, 1992 on the territory of the USSR and periods of their work after this date on the territory of the CIS states that signed "Agreement".

At the same time, the insurance experience in the relevant types of work (preferential experience), accumulated in other countries that have signed the “Agreement”, is equal to the corresponding Russian insurance experience in the relevant work in accordance with Russian legislation (Order of the Pension Fund of the Russian Federation of June 22, 2004 No. 99r “On some issues of implementation pension provision for persons who arrived to their place of residence in the Russian Federation from states - Republics of the former USSR).

For citizens arriving from states that have not signed this agreement, when assigning a pension, only the work experience acquired in the territory of such states before 01/01/1991 is taken into account.

The work experience available to citizens who arrived in the Russian Federation after 01/01/2002 can be included in the calculation of the insurance period for receiving a Russian pension only on the condition that during this period insurance contributions were paid to the pension authority of the country in which the work was carried out. activities and an additional bilateral agreement on pension provision for citizens has been concluded between this country and Russia. Such periods will be included in the insurance period if there is a certificate of payment of insurance contributions from the pension fund of the country where the work was carried out.

For citizens who arrived in the Russian Federation from Lithuania, Moldova and Georgia, the work experience they acquired in these republics during the existence of the USSR until December 31, 1990 is taken into account according to Russian legislation. And periods of work in the territory of these republics after 01/01/1991 are taken into account in the insurance period on the basis of certificates of payment of insurance contributions for compulsory pension provision (social insurance).

Armenia

The average pension in Armenia is 42,000 drams (almost $86, or a little more than 6,700 rubles). In the country, people retire at 63 years (women) and 65 years (men).

It is very expensive for the population of Armenia to pay for utility services. The average amount of these expenses is about 4,000 rubles, of which almost 2/3 goes to pay for gas. Armenian pensioners spend the rest of their money on food, the prices of which, by the way, are quite reasonable. In villages, many pensioners produce their own food, sometimes even selling it.

Those pensioners who have some additional income live well in Armenia. Many Armenian pensioners live with their children, who take full responsibility for providing for their elderly parents. By the way, in the tradition of this people there is also such a thing that if parents, for example, have two sons, then the elderly parents live with one of them, and the other helps the whole family financially. In general, Armenian pensioners do not face too much financial difficulties, but lonely people probably have a hard time.

To Kuban across the sea: where to move from Moscow - the best options

Living within your means, or How to determine the line between frugality and stinginess

Lawyer Valentina Dublina told how to achieve the promised salary

How pension provision is provided for citizens arriving from Belarus

For citizens arriving in the Russian Federation from the Republic of Belarus, as a state allied with Russia, exceptional opportunities are provided for obtaining a residence permit without first obtaining a Temporary Residence Permit in the Russian Federation. They can apply for a residence permit immediately after registering for migration at the place of their new stay in Russia, and the period for obtaining a residence permit has been reduced for them to three months. The assignment of pensions to citizens arriving from Belarus is carried out in accordance with the Agreement between the Russian Federation and the Republic of Belarus “On cooperation in the field of social security” dated January 24, 2006. This agreement is based on the principle of proportionality. Pensions for citizens are assigned and paid taking into account the length of service accumulated by the citizen in the territory of the corresponding party to this agreement.

When calculating the insurance period, the length of service earned by the citizen in the territories of both states is summed up. Moreover, the calculation and confirmation of length of service is carried out according to the pension legislation of the state in which the relevant length of service was acquired. Citizens, at their own request, can submit an application for the appointment and payment of a pension in accordance with the pension legislation of which they are citizens. In this case, the provisions of the Agreement dated January 24, 2006 will not apply.

The Agreement establishes the following procedure for the appointment and payment of pensions for old age, disability, loss of a breadwinner, and long service (Article 23 of the Agreement):

★ for periods of labor activity in the territory of the former USSR that occurred before March 13, 1992, the pension is assigned and paid by the state in whose territory the citizen who applied for the pension permanently resides; ★ for the work of citizens, in the period after March 13, 1992, in the territories of the Russian Federation and the Republic of Belarus, each state separately calculates and pays pensions to citizens, in accordance with the insurance period acquired by citizens on its territory. That is, Russia will be responsible only for the experience that a citizen acquired on its territory, and Belarus for the experience acquired from it.

Periods of work after March 13, 1992, which took place on the territory of third countries, are not counted either in the insurance period or in the total length of service.

How Russia can become a leader in the production of a new type of fuel

In Russia, with its point system, pensions are the highest in the CIS - although, of course, not as much as the Russians themselves would like. The average amount in September 2021 slightly exceeded 14 thousand rubles - and from the Commonwealth countries only Belarusians and Kazakhstanis came more or less close to it in this indicator.

When making calculations, we did not look at the level of salaries by country or the level of GDP - we simply studied average pensions and converted them into rubles.

Armenia

Armenia has recently introduced a mandatory funded system for the formation of labor pensions, but it is quite nominal. The bottom line is that citizens are forced to deduct 2.5% from their salaries, and the state reports another 7.5%. This partly forms the final payments.

They, in turn, consist of the basic pension and labor pension - and it directly depends on the length of service. That is, in Armenia, unlike many other countries, the impact of salary levels on pensions is not at all that great. Here's how they talked about the calculation formula in the Ministry of Labor of Armenia:

“The accrued pension consists of the basic pension (16,000 drams) and the labor part of the pension, which depends on the length of service, the cost of one year of service (before 10 years it is 800 drams, after 10 years - 500 drams), a variable coefficient, which is equal to 0.1 for one year of experience with 10 years of experience and 0.01 per year with up to 40 years of experience. To illustrate, the simplest example of calculating a pension: with a work experience of 10 years, the pension is 24,000 drams. This figure is obtained as follows: 16,000 + 800 × (0.1 × 10) × 10 = 24,000.”

The minimum experience may be 10 years, and the age for both sexes is 63 years. However, there are ways to receive payments earlier - for example, at 55 years old. But for this you will have to work hard with contributions to the savings fund - by the age of 55, there should be enough accumulated money so that a person can receive five basic rates at once (16 thousand drams = 80 thousand drams) monthly - and so on until the end of his life.

80 thousand drams is not a fantastic figure. The average salary in the country is about 120 thousand - that’s only 15 thousand rubles, and the average pension is even less - 40 thousand drams, that is 5.2 thousand rubles .

Azerbaijan

The pension system in Azerbaijan is partly similar to the Russian one. There are three main types of pensions: old-age pensions, disability pensions and survivors' pensions. About 50% of local pensioners receive the first one. It consists of three different types - minimum pension, insurance and funded. Here, as in Russia, the majority of payments are already generated by insurance. The only thing is that funded funds are calculated based on the average amount of contributions to the social insurance fund - citizens must transfer 25% of their monthly salary there. More precisely, their employers usually do it.

The country will soon have the highest retirement age among the CIS countries - by 2027 it will reach 65 years for both sexes. Now it is gradually increasing - in 2021, for example, it is 64–61 for men and women. And if men will reach the ceiling by 2021, then women – by 2027. The minimum experience is 25 years, also regardless of gender.

The average pension is also not the lowest in the CIS - in August 2019 it was 232 manats, or 9,073 rubles . In 2021, the government plans to raise the bar to 11,500 rubles, but these are just plans for now.

Belarus

In Belarus, there is a more or less standard option for calculating pensions - they depend on length of service and average salary. In order to receive a full monthly payment, you need to work for at least 25 and 20 years for men and women.

The amount of payments will be about 55% of the average monthly income for a career.

The retirement age in the country is gradually increasing from 2021; this process will end by 2022. Men will retire at 63 (now 61), women at 58 (now 56).

The average pension for the CIS countries is quite decent - as of September 2021 it was 446.8 rubles, or 13,807 Russian rubles .

Kazakhstan

Kazakhstan has a rather complex system for calculating pensions. As in Russia, its size consists of several factors, the main ones being length of service and income. Taking them into account, the state can assign one or more types of pensions to its citizens: basic, labor or funded.

Those who were granted a pension before 1998 had to be content with the basic option - with allowances, of course. For the rest, labor and funded pensions have been calculated since then. The main part of payments for ordinary workers is labor - it can be received by those who have worked for 25 or 20 years (for men and women, respectively) and have reached the ages of 63 and 59 years, respectively. Moreover, in 2021, the country raised the retirement age for women - now it is gradually increasing in increments of six months per year and in 2027 it will reach the same 63 years as for men.

The size of a person’s income also makes a significant contribution. The bonus for it is calculated based on the three most “highly paid” years of experience; the final amount of the pension cannot exceed 75% of the average monthly income.

As for the average pension, in the country as of June 2019 it was 85,785 tenge, or 14,215 rubles .

Kyrgyzstan

In Kyrgyzstan, 63-year-old men or 58-year-old women who have worked for 25 and 20 years, respectively, can retire. The calculation system is as follows: a very small base part, its size depends on the length of service, plus insurance - it is already formed based on the amount of deductions from the salary.

The average values for the country are small - only 5820 soms, 5280 rubles .

Tajikistan

In Tajikistan, the situation with pensions is the most difficult in the former CIS. Local pensioners are the poorest. The country itself, of course, is also not rich - it is at the bottom of the list in terms of GDP, but the situation with pensions is terrible. The average pension at the beginning of November 2019 is 303 somoni, which is 1978 rubles per month. The maximum since September 2018 is 850 somoni (5523 rubles). That is, not a single pensioner in the country receives more than this amount.

The age for calculating the labor pension in the country is 63 and 58 years for men and women, respectively, the minimum length of service is 20 and 15 years. This one is pretty simple. The only thing that is unclear is the calculation of the final monthly payment. The law only says that “the pension capital will be calculated through an automated program” and then divided by the survival age - 180 months, or 15 years. It seems that the Tajiks themselves do not understand exactly how the computer calculates this “pension capital”. In addition, men in the country live 74–76 years, that is, several years less than expected. Thus, they simply cannot receive part of the money.

Moldova

In Moldova, as in most other CIS countries, there is a gradual increase in the retirement age. Men have already reached it - 63 years, women will reach it by 2028. Moreover, the insurance period required for a full pension is the strictest in the CIS - both men and women will have to work at least 34 years after 2024 in order to receive a decent pension.

The formula is as follows: the total length of service is multiplied by the cumulative coefficient (1.35%) and multiplied by the monthly average income. Such mathematics allows the population to receive an average of 1895 lei, or 6.7 thousand rubles .

Uzbekistan

Uzbekistan has the lowest exit threshold so far – 60 and 55 years old, the same as it was in Russia quite recently. But even there it is being raised - from 2022 there will be a gradual increase to 63–58 years for men and women, respectively. The required experience is 25–20 years. Everything is not easy with the pension system in the country - they are trying hard to reform it, but so far it seems to be not very successful: the last time the government published average figures for pensions was back in 2017 - then it was 492 thousand soums. At the exchange rate of that year - approximately 3.5 thousand rubles .

Ukraine

Even though the country left the CIS, it would be a crime not to consider it. Until recently, the retirement age in Ukraine was low - 60 years for men and 58 for women. Now everything has changed - the country is undergoing a reform, and the exit age is tied to length of service: the more you worked, the earlier you can start resting. For example, with 16 years of service, you can receive a pension only at 65 years old, with a 26-year career - at 60 years old. Moreover, the bar for the required length of service is also growing – and by 2028 it will reach 35 years. That is, every year, 60-year-old Ukrainians will have to have a year more work experience in their work books than their predecessors.

The calculation is carried out using a rather complicated formula in which three indicators are multiplied: the experience coefficient (for example, with 35 years of work it will be 0.35), the individual salary coefficient (in other words, this is your average salary divided by the average salary in the country for three years ) and the average salary in the country (again, yes). The output is something like 3020 hryvnia ( 8022 rubles ). But these are the figures of the Pension Fund of Ukraine; the real ones may be lower.

How pension provision is provided for citizens arriving from Kazakhstan

Since the Republic of Kazakhstan has not concluded a bilateral agreement with the Russian Federation on pension provision and offset of insurance contributions, pensions for citizens arriving in Russia from Kazakhstan for permanent residence are established taking into account Russian legislation and the Agreement between the CIS countries of March 13, 1992. When assigning a pension, only work experience in Kazakhstan for the period before 2002, including the Soviet period, will be taken into account. At the same time, the period of work in the USSR will be subject to valorization (the amount of pension capital will increase by 10%).

Work experience on the territory of Kazakhstan after 01/01/2002 will not be taken into account when assigning a pension in Russia, since, in accordance with Russian legislation, in the period after 2002, insurance experience is taken into account only when paying insurance contributions to the Russian Pension Fund.

Tajikistan

In 2021, the average pension in Tajikistan is 303 somoni ($31, or about 2,400 rubles). It is worth noting that this amount is indicated taking into account the increase in payments made in September of this year.

In this country, women retire at 58 and men at 63.

So, what can a simple pensioner in Tajikistan afford with that kind of money? Very little actually. Basically, this money is spent on meeting the smallest needs or purchasing essential food products. Many Tajik pensioners are forced to look for additional sources of income; some are helped by children.

Don’t rush to rejoice if you become your boss’s favorite: expert advice

Russians have discovered a way to go on vacation for a year at once

How much does a sports journalist earn in Russia?

Pensioners in Tajikistan do not make large purchases, but they regularly receive humanitarian aid from the state (on holidays).