General information

The country's authorities adopted the first law on universal national pension provision in 1913. In the period from 1930 to 2021, the minimum income tax rate for individuals. persons increased from 8.6 to 32.2%.

In 1910-2015 the share of taxes in GDP was increased from 8.4 to 44.2%.

You can find out what kind of pension they receive in Greece, Bulgaria and Canada on our website.

What are the benefits?

The old-age pension is financial assistance that is paid to Swedish citizens upon reaching retirement age. The amount of the benefit depends on the size of your salary, work experience and your own savings.

Pension payments in Sweden consist of 3 parts:

- Basic (national).

- For years of service.

- Personal savings (private insurance for pensioners).

Swedish Pension Administration

How do pensioners survive in Sweden? The sign provides more detailed information about payments for older people.

| Type of benefit | Description | Nuances |

| Allman pension | State pension payments. | More than 18% of annual income goes to the state pension fund. Funds for pensions are not allocated from all income, but from approximately 7.6%. Everything that a person earns in excess of the required salary does not affect the increase in the amount of benefits. |

| Tjänstepension | Work benefit, which is paid to everyone who was officially employed. | Funds for this type of pension are paid by the employer and stored in funds. If desired, a person can choose a fund independently. |

| Eget sparande | Personal savings. | Personal funds invested in securities are subject to income tax as they grow. This duty can only be avoided if you declare personal funds as pension savings. |

Swedish citizens pay taxes on pension contributions.

A hard working person will be able to claim a fairly high pension by the age of 65. Its size will be lower than the previous salary, but the tax on it will also be small.

Swedish pensioners live quite modestly. The benefits include providing a small discount on travel.

Pensioners' monthly expenses, if converted to rubles, are approximately 40 thousand rubles.

Find out what pensions are paid in Ukraine and Moldova on our website.

Other types of payments

There are 2 types of minimum pension in Sweden. The most common type of benefit is called garantipension. These are guaranteed pension payments paid from the state budget and intended for those who have lived in the country for more than 3 years. The full benefit is received by those who have lived in Sweden for more than 4 decades. For each missing year, a reduction factor is used.

You can learn more about the types of pensions in Sweden from the video below.

Benefit calculation is based on prisbasbelopp. There is no analogue of the obtained figure in the Russian Federation. In Sweden it shows inflation.

Along with the garantipension, older people are provided with cash assistance to pay for utilities. If the pensioner lives in his own home, the amount on whom. services are only partially covered.

The amount of the supplement to pension contributions depends on:

- living area;

- all income of a pensioner;

- number of family members.

If the period of residence in the country is less than 4 decades and the state pension has not been earned, the person is provided with an elderly benefit called äldreförsörjningsstöd.

The benefit amount is small. Additionally, the person is provided with a free grocery package.

The amount of pension contributions of a Swedish citizen who has a state of emergency depends on the amount of his social contributions. He is not paid any long-service allowance.

Social size contributions for a businessman are no different from the percentage paid by employees. Also, a person who has an individual entrepreneur undertakes to regularly make contributions to the state pension fund.

Encouraging late retirement in Sweden

Also in Sweden, cash assistance is paid to women who have lost their breadwinner. This type of benefit is called änkepension. It was abolished in 1990, but if the marriage took place earlier, the woman has the right to receive such a pension. The size of the änkepension after tax is 3 thousand CZK.

The benefit, which is based on the income of a citizen of the country, is called inkomstpension. Each year, 16% is withheld from salaries and other taxable payments. This money goes to the country's pension fund.

You can find out how to immigrate to Sweden here.

When do Swedes retire?

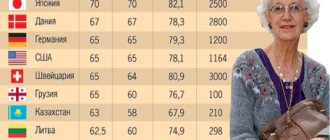

Sweden is one of the countries with the highest life expectancy. Men live on average up to 80.5 years, women - up to 85.3 years.

In Sweden the retirement age is 65. A person can decide for himself when to go on vacation - at this age or later. In the second case, the amount of pension contributions will be larger. The maximum retirement age is 67 years.

The income-based benefit is payable from age 61. At the age of 65, a pensioner has the right to receive guarantee payments from the state.

What is the amount of pension payments?

In 2021, the amount of pension contributions may amount to 62-82% of the average salary.

For people who have never worked, as well as for people who have a small income, the minimum wage is 800 euros.

In kroons this amounts to 7.2 thousand.

The size of pension payments depends on the state of the country's economy. Due to the economic crisis, pensions are being reduced. If the economy is growing, it is regularly indexed.

The average pension in Sweden depends on 2 factors: gender and country of birth. More detailed information is indicated in the plate.

| Category of citizens | Benefit amount (crowns) |

| Male person born and permanently resident in Sweden | 14 thousand |

| Female person born and permanently resident in Sweden | 10 thousand |

| Person of male gender and foreign origin | 12 thousand |

| Foreign-born female | 9500 |

The size of the äldreförsörjningsstöd is 5.6 thousand CZK/30 days. If a person has a spouse, the assistance will be less. It is not subject to tax. Against this background, the amount of assistance for paying rent or utilities is increasing.

The average pension in Sweden in 2021 is 1697 euros or 18480, and the guaranteed pension is 11600 kroons/30 days. The amount is taxed, after which the pensioner receives at least about 10 thousand crowns.

Find out how to obtain Swedish citizenship on our website.

“Successful” decision of the authorities

The Swedish state prefers to keep older people in nursing homes. Many old people willingly move to boarding houses themselves. There they receive quality care and have the opportunity to communicate with each other.

The level of maintenance of boarding houses for the elderly is very high. The horrors typical of Eastern European nursing homes are not observed there.

Retirement age

The retirement age in Sweden is the same for men and women and is 65 years old..

Citizens have the right to receive a state pension when they reach 61 years of age, although the amount in this case will be smaller.

The guaranteed pension is paid only after age 65. Swedes can work after 65 years of age if they have the consent of the employer and the corresponding desire. This length of service is taken into account when calculating the pension and leads to its increase.

When do Swedes retire?

Sweden is one of the countries with the highest life expectancy. Men live on average up to 80.5 years, women - up to 85.3 years.

In Sweden the retirement age is 65. A person can decide for himself when to go on vacation - at this age or later. In the second case, the amount of pension contributions will be larger. The maximum retirement age is 67 years.

The income-based benefit is payable from age 61. At the age of 65, a pensioner has the right to receive guarantee payments from the state.

The pension amount is known in advance

Each pension payer receives an annual report on how much money is in his individual account and what pension he can count on upon reaching retirement age. These are not percentages, not hints or exaggerations, but a specific figure. When a person retires, he receives exactly what is stated on his report.

The retirement age for receiving such payments is 61 years. You can go and apply for a pension right away, but most Swedes continue to work in order to receive additional bonuses from the state: a guaranteed pension of 65 and a 10% bonus for each year worked beyond the norm.

Amount and principles for calculating pensions in Sweden

For 2021, Sweden has a minimum pension of 800 euros, and the amount of all contributions is about 65-70% of the average salary. The benefit depends on the state of the country's economy at a particular point in time, as well as the gender and place of birth of the individual. Below are the retirement ages and benefits for men and women in Sweden.

| Category of citizens | Retirement age and benefit amount |

| Swedish male resident | From 61 to 65 years and 1500 euros |

| Swedish female resident | From 61 to 65 years and 1000 euros |

| Male foreigner | As a general rule, from 65 years and 1200 euros |

| Female foreigner | As a general rule, from 65 years and about 900 euros |

How do Swedish pensioners live?

Sweden is distinguished not only by its high quality of life, but also by the life expectancy of its citizens. The average life expectancy for women is 84 years, and for men 81 years. The number of pensioners increases every year, as does the average life expectancy, so the state was forced to raise the retirement age.

Pensioners annually receive a document where they can see an approximate calculation of their pension, both work and state; if desired, they can include the calculation of personal savings.

If the amount of the pension paid does not allow a citizen to pay rent or travel, he is guaranteed to receive additional support from the state.

Every pensioner has the right to move to a nursing home, or to receive help with cleaning, washing and cooking in their own territory.

A citizen submits an application, and after consideration, a social worker is sent to him, who will come and help around the house. Or, at the request of the person, they are sent to a nursing home.

Despite all the loyalty of the state, it will be more profitable for it if the pensioner goes to a nursing home. Therefore, if he cannot pay his rent for housing, instead of help, he may simply be evicted. All cases are considered on an individual basis. Women are more likely to receive this benefit.

It is worth noting that Sweden has an agreement with the EU countries. According to it, even if a citizen works in the territory of another country, the length of service is taken into account as general.

It is also useful to read: Retirement age in France

Nursing homes in Sweden

Many people deliberately choose boarding schools. Here they receive full medical and social care and communicate with peers. Nursing homes also provide a cultural program for residents. Accommodation in such boarding houses costs no more than a month's pension, so the services of the institutions are available to all elderly citizens.

Types of payments for pensioners

Pension security consists of several parts:

- government contributions;

- work benefits;

- personal savings.

Government benefits are paid to all pensioners in Sweden and amount to 18.5% of annual income. In this case, the amount is calculated not from the entire income, but from its part, that is, from 7.6%. They consist of a conditional accumulative part and bonus deductions.

Premium deductions are 2.5% of the total amount, which can be disposed of immediately; this part of the money can be invested in securities or sent to a fund account.

If a citizen has not created an investment portfolio by the time he reaches 65 years of age, he receives a significant increase in his contributions.

The working pension is paid by the employer as 16% of earnings, which are transferred monthly to a selected fund. You can choose the fund yourself. This type of pension is only possible for those who were employed in an official job.

Attention! Personal savings can be represented by securities, the profits from which are taxed.

If, when purchasing securities, you register them as pension savings, then you do not have to pay taxes. However, in this case, general tax is paid on the entire pension.

In general, taxes take away a third of all pension contributions. However, citizens do not complain, because taxes used to “eat up” half of their contributions.

Swedish pensions

This article briefly outlines what is important to know for those born in 1940 or later who want to know about their future pension. You can also read about how pensions change depending on the situation in the country and your retirement age. For example, you have the right to start receiving a pension (in Sweden the pension consists of different parts, which we will talk about later) from the month you turn 61 years old. But the longer you postpone this moment (preferably until you are 65 years old or even older), the more money you will receive every month.

It is important to know that everyone must apply for their pension themselves from the Swedish Social Insurance Administration (Försäkringskassa)

.

On a special form ( ansökningsblankett

) you answer certain questions, attach the necessary information and they determine what kind of pension you will receive.

What is important to know if you are starting to think about retirement?

If you live and work in Sweden for a long time, your pension will consist of different parts. One part of it is called general ( allmän pension

).

It in turn consists of inkomst-, tilläggs-, premie-

and

garantipension

(see below for more details on these parts).

The general pension is assigned to the Försäkringskassa

. Every year you receive a large orange envelope in the mail telling you how much you have already earned and how much you will receive.

You will receive another part of the money from your employer ( tjänstepension

).

Most receive approximately 10% of the salary they had before retiring. You can check your amount ( allmänn pension + tjänstepension

) on a special website www.minpension.se.

If you also personally save money into any pension funds, then you can find out from them what you can count on, and they will send you their calculation ( pensionkalkyl

).

What does it consist of and what influences the size of your allmän pension?

Each working year adds new money to your overall pension

.

Additions to this part of the pension occur in the form of certain pension contributions. You pay part of it yourself in the form of income tax ( skatt

), and part is paid by your employer.

These two contributions create so-called pension rights ( pensionsrätter

) and amount to 18.5% of the part of your salary that counts as the basis of your pension.

16% of them are added to the part that depends on your salary, and 2.5% is the so-called premium pension ( premiepension

).

In addition to the time when you received a salary, the time when you were at home with small children, studying, serving in the army or was sick is also taken into account. This part of the pension contribution is carried out by the state. All your rights to a pension are listed below: 1. The part of your salary that is contributed to the pension is collected in a special pension account ( pensionskonto

). The total value of this account depends on all pension entitlements throughout your life and the amount of annuity from this account. Rent depends on changes in the level of average wages in the country. In recent years the rent has been approximately 3%.

2. Premium pension account ( premiepensionskonto

). The bonus pension (2.5%) is saved in special securities funds that you choose yourself. The higher your salary, the more you place in these funds. In other words: the size of your bonus pension depends entirely on your salary and how well your money is invested. You can choose up to five different funds and you can always transfer money from one fund to another for free if you think that another fund has more favorable conditions.

If you have not made an active fund choice, they are automatically allocated to a special pension fund called Premiesparfonden

.

This is a general joint stock fund, which is managed by the seventh AP fund ( AP - allmän pension

).

The growth of this part of your money is registered in your individual account with the Office of Premium Pensions ( PPM -Premiepensionsmyndigheten

). The income from this part of your money varies depending on how well or poorly the funds in which your money is placed are developing. This can be tracked by the invoices that you will receive from PRM.

New pension system

In 1994, the government introduced a new pension system. The most important reason for this was that the old system required more and more financial resources, which became increasingly scarce as people live longer and there are fewer jobs. But there was another reason for changing the pension system. The fact is that the previous so-called ATP

the system did not take into account, for example, the income of those people who worked all their lives and whose salaries were constantly increasing. The new system tracks changes in salary and other income throughout a person's life.

The new rules for calculating pensions fully apply to those people who were born in 1954 or later.

Components of the new pension.

The general part of the pension consists of three parts - a pension from your income, a pension from bonus funds and a guaranteed pension.

If you were born between 1938 and 1953, then your pension also consists of three parts: the first two are the same, and the third is called the added pension ( tilägspension

).

This part is calculated in accordance with the old rules for the ATP system and the so-called “folkpension ”

.

The earlier you were born, the greater your added pension will be. The pension ( inkomstpension

), calculated from your salary and the years you have worked, and the added pension are the two largest parts of your future pension.

The pension from securities funds ( premiepension

) began to be calculated only in 1995. Therefore, for those people who are already receiving a pension or are going to receive it, this part is very small.

As for those who have not earned a pension at all, or it is too small, then such people have the right to a guaranteed pension ( garantipension

).

Both rights to a pension and its amount may change.

The pension, which is calculated depending on your salary, always changes depending on changes in the country's economy. That is, the better things go in Sweden, the higher your pension will be. The state of the country's economy is measured, in particular, using inkomstidex

– an index depending on the size of the average salary. This is the same figure that changes the annuity in your retirement account (in recent years the annuity has been quite stable - approximately 3%).

The part of the pension that is calculated depending on the funds you choose will depend on changes in these funds.

How is your pension calculated?

When you decided to retire and sent a request to försäkringskassa

, then your pension (

inkomstpension

) is calculated by dividing the money that has accumulated in your pension account by a special figure called

delningstal

. This figure is calculated depending on the average life expectancy of your peers or, in other words, how many years on average you will receive your pension (meaning for life). That is, the older you are, the lower this figure will be, the higher your pension will be.

The added pension is calculated as 60% of the 15 years during which you received the highest salary. To receive a full pension, you must work for at least 30 years. This form of pension only applies to those born between 1938 and 1953. The earlier you were born, the higher your added pension will be.

The pension is recalculated every year

It is important to keep in mind that the two parts of your pension, inkomst-

and

tilläggspension

will be recalculated at the end of each year.

This is because your salary and other factors that determine your pension change from year to year. The only difference is that the size of the pension itself varies depending on the average salary, but the so-called tillväxtnorm

, which is equal to 1.6%, is also taken into account.

This means that if, for example, inkomstindex

(which changes depending on the increase or decrease in the average salary in the country) increases by 3%, then these two parts of your pension will increase by only 1.4% (3 – 1.6 = 1. 4).

If, for example, inkomstindex

increases by only 1%, then these two parts of your pension will decrease by 0.6% (1 – 1.6 = –0.6). When things get worse in Sweden, the pension decreases. In other words: when the market situation is low, pensions do not grow as quickly as prices.

Continue working or retire? Work longer and increase your pension.

In Sweden, the retirement age for men and women is 65 years. You, however, have the right to work until you are 67 years old if you want it and your employer agrees to it. And even longer. The longer you work, the higher your pension will be. This increase depends partly on the fact that you continue to receive a salary, and partly on the fact that your pension is calculated for fewer years (which, remember, depends on the average life expectancy of a generation). The increase in your pension is approximately 10% for each year you work after age 65.

For those born between 1938 and 1953, there is a special rule called garantiregel

.

This means that they are entitled to the same two parts of the pension ( inkomstpesion

and

tillägspenion

) as if the pension was calculated under the new pension system that came into force in 1994.

If you belong to this category, then perhaps your work after 65 years will not give you an increase in your pension. It is better if you specifically consult försäkringskassa

before you continue to work after retirement age.

You decide for yourself when and how you will start receiving your pension.

You have the right to receive three parts of the pension ( inkomst-, tilläggs-

and

premiepension

) from the very month you turn 61 years old. But the longer you work and do not take a pension, the higher it will be.

You can start receiving a guaranteed pension only when you reach 65 years of age.

You can receive your pension not only in full (100%), but also in part (25%, 50% or 75%) and you can continue to work all day or part of the day. If you continue to work, then the pension, of course, is recalculated upward every year. Your inkomstpension, tilllägspension

and

garantipension

you must always take in equal shares. As for the premiepension, you can decide absolutely independently whether you will take it in its entirety or part of it.

You have the right to manage that part of the pension yourself, which is called premiepension

: You have the right to transfer money into a traditional insurance policy or leave your money in those securities funds that you yourself have chosen (no more than five funds) or in

the Premiesparfonden

.

If you choose an insurance policy, all your securities will be sold and you will receive a certain guaranteed amount every month. If you leave your money in securities, the amount you receive may change depending on how things are going in these funds. Please note that you cannot change your initial decision later.

The article is based on the information brochure “ Arbete eller pension?

”, published

by Försäkringskassan

. Translation: Mikhail Lyubarsky

Discuss the article on the Swedish Palm forum.

Useful links:

Article "" Arbete eller pension?

” in Swedish

Forsäkringskassan

PRM funds (forum topic)

Disability pension in Sweden

In a clear sense, there is no disability pension in Sweden. But there is an alternative called early retirement. To receive this benefit, you must prove a complete inability to work, that is, in most cases, be bedridden. But here there is a nuance - the patient’s age must be from 30 to 64 years. Most often, early retirement is granted temporarily, for 3 years, and then reviewed. So it's very difficult to get it. Such a pension is tied to the possible salary of a given citizen and is usually equal to 64% of it.

Help for the unemployed in Sweden

The main condition for receiving benefits is work experience. If a foreigner managed to find a job in Sweden, but for some reason was unable to continue working, he is entitled to payments. The amount is formed from contributions to the insurance organization A-kassa. It is important that the applicant works at least 80 hours within 6 months.

Calculation features

It is produced according to the established scheme. The basis is the income for the last year before dismissal. During the first 200 days, an unemployed person receives 79% of his previous earnings, then only 69% is credited to him. The law sets a payment ceiling. For 100 days after dismissal, it is 911 CZK per day. Then it decreases to 759 CZK. Unemployment benefits are subject to personal income tax.

How long can you receive benefits?

Social benefits in Sweden are not open-ended for the unemployed population. The benefit is withdrawn after 300 days (or after 450 if there is a dependent child). Moreover, the recipient will be checked to see how active he is in searching for work. If the beneficiary takes part in the Aktivitetsstöd program, the period of being on the benefit is included in the length of service. This is important for retirement.

Labor pension for long service

The long-service pension (tjänstepension) is a salary deduction paid by the employer. Most people who are employed are entitled to such a pension. Students, unemployed people or those working in enterprises that do not have a collective labor agreement, as well as private entrepreneurs do not receive long-service pensions.

There are several organizations that pay pensions for long service. They enter into contracts with various employers. The size and payments of such pensions vary depending on the decisions of trade unions and employers.

General pension

The general pension is a state pension (allmän pension) that is provided to everyone who has lived and worked in Sweden. It is paid through the Swedish Pensions Agency, which has an official website: www.pensionsmyndigheten.se. Every year, money earned during work, study or maternity leave is credited to the pension account of each citizen. The general pension consists of three parts: income-based pension (inkomstpension), premium pension (premiepension) and guarantee pension (garantipension). Earnings-based and bonus pensions can be taken from age 61. Guaranteed pension – from 65 years of age. In 2013, the average general state pension was CZK 8,900 (after tax). For 6% of Swedes receiving an old-age pension, the total pension did not exceed 3,600 crowns, for 34% it was in the range of 3,600–8,300 crowns. 7% of pensioners lived outside the country.

Private pension funds

Sweden also provides for such a measure to increase social protection as pension insurance funds.

A fund in Sweden, designed to ensure a dignified old age, is a very popular type of financial activity for citizens - 38% of Swedes transfer part of their income to increase their own pension savings.

There are two ways to participate in a private pension fund. First, become his client, which implies an individual pension plan, according to which a set amount is paid monthly. Another option is to simply open a special bank account, to which you can transfer any amount at any time, depending on your desire. The invested funds will be returned to the client either in the form of payments from the pension fund or in the form of bank interest.

The country also has a high level of medical and social services for pensioners. This social protection measure is guaranteed by the Health Law of 1982, which provides equal quality of medical services for all segments and groups of the population.

It is noteworthy that students who receive the profession of both doctors and paramedical workers undergo practical training in Sweden in a boarding home for the elderly. Among these trainees there are also immigrants from Russia and other countries of the post-Soviet space; students consider their participation in social assistance for the elderly to be a good experience in introducing them to the humanistic values of Swedish society.

Features of the pension system in Sweden

A distinctive feature of pensions in Sweden is the multifaceted structure of receiving payments. According to the law, the main part of the benefit and various allowances are allocated, which can also relate to social, professional and other types. The private savings of senior citizens deserve special attention.

The pension system consists of three parts:

- single allowance;

- pension for length of service;

- pension savings in private funds.

The basic pension applies to all citizens of the country who have lived on its territory for at least forty years. It does not matter how much they earned from official (or unofficial) work and whether they worked at all during this time. As for pension payments for professional activities, the amount of the benefit is determined depending on the tax revenues that the Swedish citizen transferred to the state treasury.

Tax payments that affect the final size of pensions in Sweden are not only 16% income tax, but also all kinds of contributions for medicine, education and social services, as well as for business activities, provided for by the basic law of the country.

You should learn about the bonus part of your pension (savings in private funds) separately from specialized institutions. All residents can use the services and make their own decisions. Thus, they take care of their well-being in advance and keep their savings in a safe place. And they additionally receive interest for trusting private companies. This is a fairly common practice in Europe.

“Working” part of the pension

In addition to the general pension, there is also a voluntary working part - tjänstepension.

These are pension contributions provided for in the employment contract of the employer, trade union and employee. In Sweden, 9 out of 10 employees have such a contract. The largest part of any pension is just additional work. It is very important, and when applying for a job, Swedes choose companies that have a collective labor agreement. The sooner you start working in a company that contributes such a pension, the larger its size will be in the future.

It is usually calculated as 4.5% of wages. If the salary is 30 thousand Swedish kronor, then tjänstepension will cost 1 thousand 350 kronor per month. If you are a private entrepreneur, then transferring this part of the pension is your own task and responsibility.