The average pension in Finland is one of the highest in Europe, as of 2021 its amount was about €1,716, while men have a higher benefit than women. However, tax is withheld from pension accruals, the amount of which is calculated in individually on a progressive scale. Its value cannot exceed 22%. You cannot combine receiving benefits and wages. There are three main pensions in the country - labor, national and guaranteed. Payments are also provided: for a widower or widow, according to age, in case of loss of ability to work, for a child (in case of loss of a parent).

Helsinki, Finland

Finnish pension system

Finns who are on a well-deserved retirement receive several types of payments. Insurance premiums of hired workers and individual entrepreneurs are sent to state or private pension funds, companies or cash desks. The legislation obliges employers to insure their employees aged 17-67 years in excess of monthly earnings of €58.27.

Labor pension in Finland

Both Finnish citizens and foreigners who have worked in the country for a certain time can apply for labor benefits. Residence in the country or possession of its citizenship is not required. This is the most common type of pension benefit in the country (62% receive it).

National pension (old age) in Finland

The national pension (or old-age pension) is paid from the budget and is assigned to those who either have not earned enough to pay for their labor, or its amount is less than the minimum, which for single pensioners is €1299.88, and for family pensioners – €1157.71 (i.e. this is the minimum amount of the labor pension; if it is higher, then the national pension is not paid at all; if it is lower, the national pension is calculated individually). The rule applies to both native residents and foreigners whose duration of residence in the state exceeds 5 years. For EU citizens this period must exceed 3 years.

The maximum amount of the national pension is assigned in the absence of a labor pension. For a single applicant this amount is €628.75, for a family applicant – €557.79. When receiving a labor pension, the amount of the national pension is calculated individually.

Guaranteed pension in Finland

In cases where the amount of labor and national pensions is less than the subsistence minimum, the pensioner receives the missing payment, which is called guaranteed.

Pension reform 2021

The Finnish government announced that the pension system needed to be modernized back in 2014, and at the beginning of 2021 the changes came into force. Mainly, the reform affected the increased retirement age.

Officials explained the need to delay the time for a well-deserved and paid rest by the general improvement of the nation and the increase in life expectancy. Now women in Finland live on average up to 84 years, and men - up to 78.5; back in 2012, these figures were lower: 78.66 and 75.15 years, respectively. And since people live longer, they can work longer.

Photo: norden.org

According to another version, pension reform is associated with the aging of the nation. Today there are about 1.4 million pensioners living in Finland, that is, more than one in four residents. There are more and more pensioners, but fewer and fewer working Finns. In such a situation, the state has to increase the number of working citizens by increasing the retirement age.

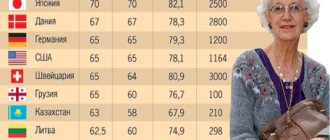

So, from 2021, the retirement age in Finland has increased to 65 years for both men and women. However, if this measure does not help maintain a balance between workers and pensioners, then Finnish politicians are talking about the possibility of a new increase in the retirement age from 2027.

An exception has been made for people employed in hazardous industries or doing hard work - they can retire after 38 years of service.

Photo: Worklife-blog.org

Today Finland is interested in its citizens working as long as possible. Those who continue to work after reaching retirement age are entitled to a pension supplement. There is also a law in Finland that prohibits an employer from retiring an employee before he reaches 68 years of age if he wants to continue working.

Retirement age in Finland

After the 2021 reform, the retirement age in Finland was 65 years for both sexes, with the possibility of entering a well-deserved retirement from 63 years old, provided that the amount of payments was reduced by 0.4% for each month not worked until the age of 65. If an applicant is interested in continuing to work after 65 years of age, then for each month worked after reaching this age he will receive a pension bonus equal to 0.6%. The upper limit for calculating the premium varies from 68 to 70 years, depending on the year of birth.

Workers in hazardous industries, as well as employees whose line of work involves an increased risk to life, have the right to early retirement, subject to developing a preferential length of service equal to 18 years.

Raising the retirement age in Finland

The increase in the retirement age (previously it was 59 years for both sexes) is associated with an increase in life expectancy, a decrease in the birth rate, a change in the age pyramid and, accordingly, an increase in the burden on the budget. As of 2020, the average life expectancy for women is 83.9 years, for men - 78.4 years.

What benefits are there for pensioners?

In addition to the pension payment itself, older Finns are entitled to other types of financial support.

These include:

- housing benefit;

- pensioner care allowance;

- payments for a dependent child;

- housing allowance of the deceased spouse;

- payments to front-line veterans.

In addition to material payments, Finns who have retired have the right to medical services, social assistance in the form of care and other forms of support from the state.

It is also useful to read: Retirement age in Belarus

Pension amount in Finland

Factors influencing the amount of the pension payment are average monthly earnings and the number of years worked. It is believed that in 38 years you can save up a relatively large amount.

It should be noted that the contributions of the future pensioner are accumulated in pension funds, taking part in investment projects. This leads to an increase in the amount of pension savings. Also, the amount of savings is influenced by the increasing coefficient, which increases with the age of the applicant. The savings indexation mechanism is used to protect them from inflation.

Average pension in Finland

The average labor pension in Finland according to data for 2021 was €1,656. For men it is €1871, for women – €1241. The most economically prosperous areas are the region of Helsinki and the Åland Islands. According to data for 2021, the average benefit increased to €1,716.

Minimum pension in Finland

The total amount of labor, guaranteed and national pensions cannot be less than the minimum subsistence level - €775.27.

If the pension is lower than the subsistence minimum

If the amount of labor payments is less than the subsistence minimum, the pensioner is additionally paid an incomplete national pension. If the work benefit cannot be calculated, the national pension is paid in full.

Example from BBQcash. The pensioner earned a labor pension at the rate of €120 per month. The size of the pension payment received from Russia is €150. Then the amount of the national benefit will be: €628.75 – €120 – €150 = €358.75. However, the minimum subsistence level of €775.27 is €146.52 (€146.52 = €775.27 – €628.75). The missing amount will represent the amount of the guaranteed pension.

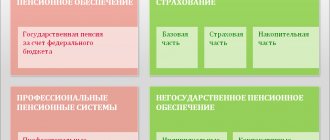

About the types of Finnish pensions

In Finland in 2021, there are various pensions provided by the country's pension system. Social insurance for older citizens is carried out by the organization Kela, which, in addition to payments to pensioners living in the country, can also provide other benefits.

Retirement age

The retirement age in the country is the same for both men and women; you can apply from 65 years of age, but it is acceptable earlier; 63 years of age can also be considered as retirement age, but early retirement is fraught with a smaller amount, although not significantly. For processing, on the contrary, it will increase every month.

More information and pensions in Finland can be found in the video below.

If you retire early, your pension will be reduced by 0.4% every month. If, upon reaching the 65th birthday, you continue to work, the pensioner will be able to receive a large pension, which will increase by 0.6% monthly. Pensioners in Finland can receive a pension calculated according to different criteria, since the country has several different types, such as:

- labor;

- folk;

- guaranteed;

- age;

- for loss of ability to work;

- water or widower's pension.

If a Finn has not worked enough years or for other reasons his retirement pension is less than the minimum or even completely absent, then this is not a problem. Kela will have to pay a guaranteed and national pension, which can be counted on upon reaching the age of 65, but possibly earlier if the person has not worked due to incapacity for work.

In Finland, pensions are taxed depending on the income received. To make it clearer, we can assume that a Finnish citizen drove a bus for 30 years and worked in the same place. The total working experience is 40 years, so his pension will be, for example, 2200 euros with a tax deduction of 22%, leaving him with 1716 euros.

A citizen receives a pension, which depends on income during the period of work.

What salaries do residents of Finland receive can be found on our website.

If the pension is lower than the subsistence minimum

If the pension turns out to be insufficient for the subsistence level, he is additionally paid a national pension, but not the full one. A full national pension is only due in cases where there is no labor pension at all. Its amount is 629 euros, it will be slightly less for a married pensioner in the amount of 557 euros.

If a pensioner managed to earn only 100 euros of labor pension, and according to his age in the Russian Federation he receives 150 euros, then he is entitled to a national payment in the amount of 629 euros. 100 and 150 are subtracted from it, resulting in 379 euros of the national pension, which is added to cover the shortfall.

Find out what pensions are paid in Ukraine, Sweden and Moldova on our website.

As for the guaranteed pension, it is available even to those who decide to move to the country and have lived in the country for at least 3 years. This pension is equal to the minimum and its amount should be 760 euros. Returning, for example, the national pension is 379 euros, to which we add 100 Finnish and 150 Russian. That missing amount of 131 to 760 euros will be the amount of the guaranteed pension.

Learn more about pensions in Finland from the video below.

If we do not consider individual cases, the average pension in Finland is a work pension. Its size is around 1632 euros, and for men it is slightly higher, about a couple of hundred. The largest earned pension payments are in the capital region and the Åland Islands, which are controlled by Finland.

The procedure for applying for a pension in Finland

To receive labor benefits, you must submit an application to the organization that has been collecting contributions for the last 2 years, or to the pension fund or KELA (the government agency responsible for social payments).

The statement may be oral. To do this, you will need to make a declaration of will by calling 020 692 202 or at a service point.

After submitting the application, a package of documents is collected, including an identity card, tax card and bank account statement. Depending on the type of pension benefit, the list of documents may differ, so it is useful to check with a tax consultant.

It usually takes one and a half to two months to process the application, after which the applicant receives a pension applicant card. Relations with the employer must be terminated by this time.

Discounts, benefits and allowances for Finnish pensioners

A 50% discount is available when visiting swimming pools, using public transport, and using long-distance planes and trains within Finland. Discounts also apply to visits to museums and theaters, gyms and water parks. Upon turning 70 years old, a pensioner receives a discount on residential cleaning.

If necessary, older people can receive discounts on care when using the services of appropriate agencies. If care is provided by relatives, they can also count on receiving an appropriate payment.

For low-income pensioners, often single people who rent housing, the state provides assistance with housing payments. The amount of assistance is calculated individually. An amount of €500 is taken into account, which should remain for personal needs after all mandatory payments have been made.

Privileges

The state supports older people not only with benefits. There are benefits for older people in Finland - 50% on:

- public transport pass;

- moving within the country using different types of transport;

- pool membership.

Discounts on admission apply to water parks, gyms, theaters and museums. People over 70 years old receive discounts on home cleaning. Funds may be used for special care.

Relatives who help pensioners can receive money. To obtain financial support, you should contact the municipal authorities.

If renting a home takes up a large part of your finances, you can count on compensation. The size of the benefit depends on the composition of the family, place of residence, and the amount of other payments. After paying the rent, you should have about 500 euros left for various needs.

How do pensioners live in Finland?

The amount of payments is approximately 50% of labor earnings. This amount is enough to buy a car or a country house. Many older people prefer traveling around the world.

According to the Ministry of Social Security and Health, approximately 6% of pensioners in Finland live below the poverty line with a monthly income of €1,100-1,200 (82,500-90,000 rubles).

Is it profitable to work in retirement?

According to Finnish laws, you cannot receive benefits and continue to work. At the same time, if you continue working after turning 65, the amount of pension payments increases by 0.6% for each month worked. The law provides for a limit of 68 years, before reaching which the employer does not have the right to force an employee to take a well-deserved rest. Finnish citizens can therefore take advantage of the opportunity to increase their retirement income by 14.4%.

What kind of work do you need to do to get a bigger pension?

Highly qualified specialists can boast of high payments after leaving work: doctors, teachers, engineers, knowledge workers (scientists). Their pension payments range from €2300-4500.

Retirement age

Until recently, the retirement age in Finland was 59 years. However, after the pension reform, the age increased. The state has established a single threshold for men and women, after which they can retire.

Today, it is 65 years old.

If desired, citizens can retire at the age of 63. However, in this case the amount of pension payments will be reduced. Allowed accruals will be reduced by 0.4% for each month of retirement before the established age. At the same time, for the fact that a person continues to work after 65 years of age, he is entitled to an increase in the size of his pension. Moreover, a certain amount of additional payment (0.6%) will be made for each month worked.

| Year of birth | Lower limit of retirement age in years | Age limits for insurance in years |

| 1954 and earlier | 63 | 68 |

| 1955 | 63 years and 3 months | 68 |

| 1956 | 63 years and 6 months | 68 |

| 1957 | 63 years and 9 months | 68 |

| 1958 | 64 | 69 |

| 1959 | 64 years and 3 months | 69 |

| 1960 | 64 years and 6 months | 69 |

| 1961 | 64 years and 9 months | 69 |

| 1962-1964 | 65 | 70 |

| 1965 | Depends on life expectancy. It is expected that the age limit will increase by 2 months per year from 2030. | 70 |

Finnish pensioners for the most part receive good benefits. Many people can afford to go on a trip, buy a car or even a small country house somewhere by the sea. In Finland, the state is trying to build a pension system in such a way that every elderly citizen can lead a comfortable life after finishing their working career.

Pension for foreigners

A foreigner who has worked in Finland for some time has the right to receive a Finnish pension after retirement in his home country.

If a Finnish pensioner has left for another country

If a Finnish citizen has moved for permanent residence to another country, he will also be able to receive a Finnish pension, but its amount will vary depending on the local tax system. Between Finland and France, Portugal and Spain there are agreements on a 3-year withholding of taxes in favor of Finland after emigration, after which the taxation system of the host country will apply to the pensioner’s income.

Pension in Finland for Russians

For Russians, like other foreigners, the amount of pension payments will be determined by the amount of accumulated funds. According to Finnish law, time spent working for the benefit of the state is not a matter of principle. After working for several months, you can apply for labor benefits.

The right to receive a national and guaranteed pension is acquired after 5 years of residence in the country after turning 16, subject to registration in the national insurance system. When calculating them, payments received in Russia are also taken into account, namely, the Finnish pension is issued with a deduction of the Russian part.

State support for pensioners: benefits and allowances

To maintain a decent standard of living for people of retirement age in Finland, the following benefits are provided:

- 50% discount on public and railway transport;

- discounted tickets to theaters and museums, cultural events;

- preferential visits to interest clubs and sports sections.

Also in Suomi, this category of citizens is provided with a housing allowance. Its size is calculated taking into account that after payment for living the pensioner has at least 500 euros left.

Benefits for pensioners

In addition to pension payments, a number of additional benefits are provided for older people in Finland. The most important of them is an allowance for rented housing. Its size is individual and depends on many factors. The amount may be lower than the monthly cost of renting an apartment or house. The benefit is calculated in such a way that after the monthly payment of housing, the pensioner has 500 Euros left to live on.

In addition to benefits, Finnish social security may provide additional benefits. Due to certain reasons, including chronic illness, disability, benefits are paid without fail.

Types of benefits for pensioners:

- Financial support benefit - if a pensioner is paid only a guaranteed pension, then he can request this type of assistance from municipal authorities;

- Housing allowance is not taxed and is determined by the sum of a person’s total income;

- Care allowance – support and assistance in living for a sick or disabled pensioner and caring for him at home. Relies on pensioners with chronic diseases and disabled people.

There are also a number of discounts for pensioners:

- travel on public transport;

- travel by train, plane;

- discounts on cultural and sporting events (club card for the pool, theater and cinema tickets).

Social assistance for pensioners

The guaranteed income established at the legislative level allows citizens of the republic to maintain a normal level of financial well-being and the possibility of termination of labor activity. As stated above, no Finnish pensioner can receive a pension lower than 784.52, unless the withdrawal was early (under the new pension system reformed in 2021).

So, the financial support of Finnish pensioners is at a high level (not lower than the European average), the state guarantees a minimum income of 784.52 euros. The retirement age in 2021 was adjusted upward by 2 years.