Life of Canadian retirees

The legislative draft in the state in question indicates that Canadian citizens can retire when they reach the age of 60 to 70 years. At the same time, the payment system has a multi-stage meaning; it can be characterized by a multi-stage value. In addition, she has a stable character.

An important point is that upon reaching a certain age, payments can be received not only by native Canadians, but also by immigrants who have the citizenship of the specified state. A certain list of conditions will need to be met.

In Canada, different types of contributions are currently used and several pension funds operate. Tax deductions to the state pension fund are made by all persons who officially have employed status. The tax rate is represented by a fixed value and is equal to 4.96 percent. This figure began to apply in 2013.

The calculation is based on the amount of wages accrued to the citizen every month.

Reference! A similar percentage is subject to collection from persons who do not belong to the group of self-employed. For employers of this category, the interest rate is equal to 9.9%.

Main types of pension contributions

You can calculate how much a pension is in Canada. But there are a few important points to consider. In general, payments consist of 3 parts:

- The provincial part is directly dependent on the “white” salary. It can be issued after 60 years of age. If you postpone it, the amount will increase. Payments go until the end of life every month. This portion averages $600 per month. It is taxable. The maximum you can receive is up to $1100.

- The federal portion is paid from age 65. It does not depend on income, but on the number of years lived in Canada between the ages of 18 and 65. The average payout is $350, with a maximum of $600. They are also taxable and payable for life.

- Supplements are additional payments from the state to people who had a low income. It can be obtained after 65 years of age. It is not taxed. If the family has no source of income, the premium will be more than $1,000 per month. Calculations are carried out individually. As income increases, the additional payment decreases accordingly.

Consequently, the size of a pension in Canada is directly dependent on length of service, income level and the number of years lived in the country. This is a completely logical approach. The country's economic interest lies in officially employed people who regularly pay taxes to the treasury.

Canada Pension System

Accordingly, the director of a large company pays more to the state, which means that in old age he will receive checks with large sums. But in addition to government payments, there are also private pensions. They deserve special attention.

Private pensions

The type of pension in Canada can be judged by voluntary programs. According to them, the person makes deductions himself. He can also receive money from his employer.

For example, there is the RRSP-Retirement Saving Plan program. Using it, you can earn income from saved money, invest savings to buy real estate or pay for education until you retire. With its help, Canadians officially reduce their taxes.

Occupational pension funds are funded by employers or trade unions (rare). Approximately 40% of Canadians participate in such programs.

Work pension

The payment amount depends on how much the person earned and declared. The “white” salary is taken into account accordingly. Every month about 5% of profits are taken from workers. Self-employed migrants contribute more to the budget – 9.9%. But a person with a minimum income level is exempt from paying tax.

Old age pension

This is a pension that is paid from the federal budget for old age. It is claimed by migrants who have lived here for at least 10 years. Only years after 18 years are taken into account. These payments are called Old Age Security Pension (OAS).

For example, parents and a child lived in Canada. When he turns 17, the family moves to America. Then he returns to his homeland at the age of 50 and begins to work. At 65 people retire.

It turns out that he has accumulated only 15 years of living, which will be used in calculations. All years until adulthood are not counted.

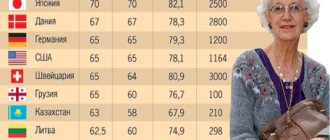

Retirement age in Canada

Today the retirement age is 65 years. This applies to both men and women. There is an opportunity to delay the registration of pension status, however, the government authorities of the state in question have introduced a limitation on the specified period. It is equal to 4 years and 11 months. In this case, a citizen, if there are grounds prescribed by law, can receive payments.

The fact that the person resides in the territory on a permanent basis and has permanent registration is taken into account. This option provides that a person can receive a joint pension, the amount of which, upon reaching old age, will increase payments by an average of 31%. However, not every person can take advantage of these privileges.

Including:

- persons who have not resided in the territory of the state for a twenty-year period;

- citizens who left the country for more than six months or lived in another country.

It is important to take into account the fact that if there is a deferment, the citizen loses the right to receive bonuses. Currently, the retirement age has been set at 65 years. This value applies to both male and female representatives. At the same time, it is possible to register a pension status earlier and later than the specified period.

It is also useful to read: Retirement age in the USA

Federal immigration programs

There are many programs that can be used to obtain permanent residence status, and below we will look at the main ones. Recently, the Express Entry system has appeared, with the help of which priority candidates are selected, whose applications for status are considered before others. Provinces also turn to this system for selection into their programs.

How does the Express Entry system work?

Participation in Express Entry is the fastest way to obtain permanent residence status. Each account registered in Express Entry is assessed according to a special system - points are given for level of education, work experience, knowledge of languages, and practical skills. Invitations are received by the leaders in the number of points who meet the quota - for three programs in total for 2021 it is 71,000 people.

Advantage in this system is given to applicants who have received a greater number of offers from employers - additional points will be awarded for each offer. This makes it easier for the employer to get the necessary employee in the shortest possible time, and the applicant himself can find a job even before entering. To participate, you need to go to the Canadian government website, where you can apply for your own Express Entry profile. To do this, fill out a special questionnaire, based on which the system will determine which of the available immigration programs you are suitable for.

To participate, you will need the following documents: a translated diploma and its supplement from an accredited organization, as well as a certificate confirming that its owner has mastered English or French.

Federal Skilled Worker Program

To obtain Permanent Residentship status under this program, you must work in your specialty for at least one year out of the last ten, or receive an approved invitation from a Canadian employer. Also, to participate, you must be in good health, confirmed by a medical commission, and have no criminal record. The minimum amount in accounts for approval of documents is $12,300.

Points in the program are awarded for: education, knowledge of languages, work experience in the profession, age (maximum points are given if the immigrant is from 18 to 35 years old), work invitation, adaptability.

If everything is clear with the previous parameters, then adaptability deserves a separate explanation. Points are awarded for it if you or your spouse/partner: studied in Canada for at least two years; worked in the country in a profession from list 0, A or B; have relatives in Canada; know the language at 4 according to the CLB system for English or NCLC for French; received a job offer.

We will not give the exact number of points that can be awarded for each category, since these values change frequently. The latest numbers can be found on the same website where you create your Express Entry profile.

Federal Skilled Trades Program

To obtain Permanent Residentship status under this program, you will need two years of work experience within the last five (and necessarily in the specialty that is required for entry), as well as either a contract for at least a year, or a certificate from one of the provinces proving that your profession is in demand there.

You will also need to pass English (or French). The minimum CLB/NCLC pass level for listening and speaking is 5, reading and writing is 4.

What is the main difference from the previous program? The Trades Program is designed for workers in categories A and B from the NOC list, which means that to participate in it it is enough to have a secondary education. Please note: this program does not allow entry into Quebec, where its local equivalent operates.

Canadian Experience Class

Intended for temporary workers who decide to settle in the country on a permanent basis. The criteria for it are softer than for the previous two, but to participate you must have worked in Canada for at least a year. Language proficiency required is CLB/NCLC Level 7 for workers in occupations categories 0 and A, and level 5 for category B. There are no other requirements. Like the previous one, this program does not apply to Quebec.

Moving times and costs

All three programs discussed earlier have similar requirements in terms of registration, so we will talk about the time and cost of obtaining a residence permit in Canada about all of them at once. Application time – with high CRS scores (depending on the year, usually more than 420), there is a good chance of getting approval in a few months. On average, this takes several years.

The services of a good consultant who will resolve all issues and provide full preparation will cost $5,000. You can do this on your own - it will be cheaper, but not so guaranteed.

Other federal programs

In addition to these three programs, the largest, there are other programs at the federal level.

| Program | Description |

| Atlantic Immigration Pilot Program | It started in 2021, so far in a pilot format, and it is expected to accept 2,000 people, but then, if everything goes according to plan, the number of immigrants accepted under it will increase. It operates in provinces with access to the Atlantic Ocean, with the exception of Quebec. |

| Caregiver Immigration Program | It allows residence in the country provided that the sick, disabled, children or elderly are cared for. Both work in medical institutions and at home is allowed. The quota for this year is 18,000. |

| Business Immigration Program | Designed for startups who can generate jobs and grow the economy. In addition to them, permission under this program can be issued to farmers who are ready to buy land and manage it, to cultural and sports figures. |

There are several family programs through which you can obtain Permanent Residentship status by visiting relatives. Under Spouses, partner or dependent children, a person already living in Canada can take custody of another and thus secure residency. Typically, this program requires a probationary period of two years. The quota for it is high - 64,000.

Parents and Grandparents is a variation of the previous one, which allows you to provide permanent residence for parents or grandparents. This year, it may allow 20,000 people into the country.

Is it possible to postpone retirement?

A Canadian citizen has the opportunity to delay the registration of retirement status. In this case, receipt of payments is delayed for five years. This makes it possible to receive increased payments. The amount of salary in old age depends on the amount of income.

A working person is charged 4.9%. This value is calculated from the monthly income. Payments are made every month. Citizens classified as self-employed must make transfers in the amount of 9.9%.

Attention! When a citizen receives the minimum pension amount, he has the right not to pay tax payments. Speaking about counterparties with the maximum level of profit, private types of tax rates are used.

BC Government Seniors Supplement

Persons residing in British Columbia and receiving Old Age Security + GIS are eligible to receive additional assistance from the government. The supplement to already paid contributions is calculated “automatically”. If the senior decides to leave British Columbia, the additional benefit is paid for 6 months.

Provincial supplement amount

A single retiree will receive $49.30 per month, a spouse will receive $60.25 (total of $120.50), and a person receiving a spouse's benefit will receive $49.83.

Retirement benefits for Canadians

The size of the increase depends on the amount of salary paid to the pensioner; the fact of whether the person is in a marital relationship also has an impact. To confirm your income, you will need to file tax returns, which must be done annually. However, the deadline for submission is limited to the end of April.

If a citizen requires additional assistance, he needs to perform a certain sequence of actions.

Including:

- if a person plans to enter into a marriage relationship, then he needs to fill out a special form. Similar rules apply to the situation when a citizen divorces;

- to download the form you will need to go to the official Service Canada portal;

- when married citizens do not live together apply for an additional payment, they can receive additional payments intended for a single pensioner.

These actions assume that the person contacts the authorized body and submits a completed application. If a person receives basic payments and uses additional payments, then the amount of his security is on average 1.5 thousand dollars per month.

At the minimum, married couples receive $1,090 each. The amount is indicated per month. The amount of the allowance for a person with additional income is reduced depending on the profit for the month.

Important! When a citizen’s income is 17.4 thousand dollars, he will not be able to count on an increase. For family individuals, this limit is set at $23 thousand.

How is pension calculated?

For Canadian pension contributions, the value is set at $1,066 per month. The indexation process is of annual importance , and it is constantly implemented in early January. A prerequisite is to take into account the level of inflation.

It is stipulated that it is permissible to register a pension status only after a citizen reaches seventy years of age. Pension payments, which are calculated for each month overworked or underworked by a person until he reaches 60 years of age, can be increased or decreased. The approximate amount of change is half a percent.

Over the entire period of time, pension contributions can be increased or decreased by approximately 31 percent.

Minimum, average and maximum pension

The amount of pension payment depends on how many years citizens have lived in the territory of the state in question. This means that a person can expect to receive benefits in full or in part. At its maximum, monthly payments equate to approximately $573.

This amount is paid to those who have lived in Canada for more than 40 years.

The amount of a partial pension depends on how many years a person has lived in the country:

- 10 years before retirement age;

- 14 years old.

In the first case, the amount is set at $143, in the second – $200.

Allowances

Almost all citizens who live in Canada are entitled to allowances. They are referred to as GIS. This amount is due to those who have a monthly income level that is less than the subsistence level.

The amount of the increase is affected by marital status and income . The higher this indicator, the less the increase will be. When a citizen receives 17.4 thousand rubles in a month, this deprives him of the right to receive an additional payment. For a family of pensioners, this value is 23 thousand.

Reference! The amounts paid to pensioners are correlated with the cost of living. If a citizen is single and has applied for an allowance, then the amount will be about 1.5 thousand rubles.

It is also useful to read: Pension and retirement age in Italy

general information

Pension contributions are strictly mandatory for all employed persons. The percentage of income is fixed. Since 2003, its size has been 4.96%.

The same figure is relevant for the employer. If the taxpayer belongs to the “self-employed” category, the rate for him is doubled.

Pension contributions are levied on income falling within the interval between the fixed minimum and maximum. Parameters may change annually.

Main types of pension contributions

You can learn more about pensions in Canada from the video below.

There are 2 types of state. pensions in Canada. Information about them is presented in the plate.

| Type of pension contributions | Description |

| OAS | Main state a pension that is paid to all persons who have reached the age of sixty-five and have lived in Canadian territory for more than a decade. |

| SRR | This type of pension contribution is paid to Canadian citizens starting at age 60. The main condition is to make contributions to the SRR every 30 days. |

If a person has lived in Canada for more than 2 decades, then pension contributions are paid to him even when he leaves the country.

Payments to a person who has not lived in Canada for 2 decades and left the country for 6 months or more are temporarily suspended. They resume when the person returns to Canada.

A person who has reached the age of 65 and intends to leave the country for more than 6 months is obliged to notify the employees of the relevant service about this fact.

What pension is in Bulgaria and Greece can be found on our website.

How is the calculation carried out?

The amount of pension contributions for Canadian citizens today is $417/30 days. Indexation is carried out annually, in the first ten days of January. In this case, the inflation rate must be taken into account.

You can retire to a well-deserved retirement strictly before your seventieth birthday. The calculated pension for every 30 days that were underpaid or overworked before the sixty-fifth birthday changes up or down. The size of possible changes is 0.5%.

Over the entire period, pension contributions can be increased or decreased by up to 31%.

Find out everything about pensions in Canada from the video below.

How much do Canadian retirees earn?

The amount of contributions that retirees receive in Canada depends on many factors.

| Type of payment | Size | Nuances |

| Old Age Security | 25% of the amount that was earned by a person within 10 years. This amount is divided by 120. | This plan is relevant even if the pensioner has another source of taxable income. A full pension can only be received by those who have lived continuously in Canada for 4 decades since reaching the age of 18. A person who has lived in Canada for less than 4 decades is entitled to receive 1/40 of the full pension contributions. In some cases, when immigrants receive OAS, their length of residence in the United States is taken into account. |

| TheSPP | 25% of average annual income. The average pension size is calculated taking into account both the employee’s salary and length of service, as well as the amount of contributions to this program. | The program is based on mandatory contributions for all Canadian citizens who work in a company or own their own business. To receive such payments, you must fill out the special form in a timely manner. form. The largest pension contribution today is $738/30 days. |

| RRSP | 17% of the amount of income for the previous 12 months. The amount of annual contributions is constantly limited. | Duties on savings are levied only when a person begins to use them. The amount accumulated in this program can be used to purchase the first property in the country. Over the course of 15 years, it must be returned to the fund in equal shares. |

| GIS | The maximum amount is $484/30 days. | This is an additional pension. An application to receive it must be submitted annually. It is usually paid to single elderly people. |

Features of payments to emigrants

Pension payments may be provided to a person with migrant status. In this case, it is necessary to comply with the condition that he resides in the territory of the state for at least 10 years. In addition, they check whether the person provided information to the pension authority every year about the state of his pension account. This account must be opened with the Canada Pension Authority.

Payments are calculated after a person submits an application and provides the necessary documents . Canada currently has agreements with 49 countries that provide for the possibility of mutual exchange of royalties. For this reason, there are often no difficulties with pension transfers.

Thus, the average standard of living of citizens in Canada is 82 years. In the near future, it is planned to consider a draft law on raising the retirement age.