Division of property in a mortgage

The Civil Code of the Russian Federation, namely Article No. 256, paragraph 2, as well as the Family Code, states that the common acquired property of spouses is considered joint property. Even an apartment purchased on credit will be the common property of the husband and wife.

By agreement of the parties, it is possible to divide the joint property of the spouses into equal shares, unless the spouses independently decide to do so otherwise. Article No. 38, paragraph 2 of the RF IC allows a husband and wife to dispose of their own property at their own discretion, drawing up an agreement between the parties. The same applies to the debts of the spouses, which are also divided between the parties in half, unless a different proportion is agreed between them.

In Art. No. 7 of the Federal Law “On Mortgage” states that a mortgage loan can be established on property that is jointly owned by a husband and wife, if there is a written consent of the property owners. It follows from this that if the apartment is divided into a mortgage during a divorce, the division will occur in equal proportions. The shares of each person from a divorcing couple in joint property are equal (see paragraph 3 of article “39 IC of the Russian Federation”).

The bank's consent to the division of the mortgage

Sometimes during a divorce, people agree that they will draw up an agreement, but they will not coordinate this with the bank. After this, both contribute their shares to pay the obligatory payments, and formally the creditor cannot have any claims. But according to the law, he has the right to challenge the agreement.

The second option is not to enter into an agreement, but to verbally distribute who will repay the mortgage and in what amount. Everything here is legally clear: the deal has not been concluded, which means that the interests of the bank have not been violated. But for one of the spouses, this is fraught with the fact that the other will sooner or later refuse to pay, and will still have to return to resolving this issue officially.

Difficulties of divorce with a mortgage loan

Practice shows that it is not so easy to divide an apartment purchased with a mortgage during a divorce, since not only property is divided, but also debt. In the process of divorce with the presence of mortgage obligations, there is the interest of a third party - this is the bank.

The division of a mortgaged apartment in the event of a divorce, its sale after the dissolution of the marriage, the transfer of debt obligations from one spouse to another, the division of the monthly payment is carried out with the permission of the bank.

According to the provisions of the Code of Civil Procedure of the Russian Federation, Art. No. 391 clause 2, it is impossible to transfer debt obligations from one person to another without the permission of the creditors. In practice, if spouses want to make changes to the loan agreement, they contact the bank with an application. However, 90 out of 100 applications most often receive a negative response.

Attached documents

In order to share a mortgaged apartment, you must first confirm your rights to it; for this you will need to submit a package of documents:

- Mortgage agreements concluded with a credit institution.

- Papers from the bank confirming that the ex-spouses are repaying the loan, indicating the extent of its repayment.

Also, the application must be accompanied by photocopies of all documents that are mentioned in the claim itself and supporting all the evidence specified in it. In each case, the package of documents may be different; an approximate list is as follows:

- copies of claims by the number of parties to the process;

- photocopies of documents confirming the identity of opponents; at the court hearing itself, their originals will need to be presented;

- copies of marriage and divorce certificates, these documents confirm that co-borrowers have received a new status; ;

- if there are minor children, their birth certificates;

- title documents for the disputed real estate;

- receipt of payment of state duty.

Depending on additional circumstances, the court may require the following documents:

- certificates about the place of registration and residence of the parties;

- a certificate in form 2-NDFL (about the plaintiff’s income), it will be required to prove the possibility (or impossibility) of the plaintiff repaying the balance of the loan;

- if, in addition to the mortgaged apartment, other jointly acquired property is divided - title documents for this property.

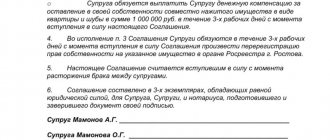

Agreement between spouses on the division of property

If spouses have property that the parties do not want to classify as community property, they must enter into a written agreement - draw up a legal document (nuptial agreement) that determines the fate of the jointly purchased property. This can be done during marriage. Then the question of how to divide a mortgaged apartment after a divorce will not be on the agenda.

When starting a family, no one thinks about divorce. But people who understand that it is impossible to predict everything in life draw up a marriage contract, which spells out all the important aspects regarding the division of common property in the event of a divorce. Also, some citizens have already come to the conclusion that it is easier to discuss all the nuances of dividing the mortgage and paying off the debt while being married and having drawn up a written agreement in advance, than to deal with the division in court.

Matrimonial property agreements are an ideal way to decide who can claim property and in what form after a divorce. Both prenuptial agreements and marital property agreements can specify how marital property and separate property will be transferred to the other spouse.

What is a property division agreement

According to Art. 38 of the RF IC, common property can be divided between spouses by agreement. Any real estate acquired during marriage, including a mortgaged apartment, is considered common property.

But there are several features:

- If the down payment was transferred before marriage, this amount is not divided.

- If you bought an apartment in a new building and the ownership was registered before the divorce, everything will be divided between the spouses.

- If the parties have entered into a marriage contract, common property is divided according to its terms. There is no need to enter into an agreement. If the conditions change, an additional agreement to the contract is drawn up.

- The division agreement must be certified by a notary.

Note! By agreement, the property can be divided as desired. But when it comes to a mortgaged apartment, you will need the bank’s permission, since its interests are affected. The procedure must be agreed upon with him.

Section of a mortgage loan in court

If the spouses did not draw up an agreement between the parties and were unable to agree on how to divide the apartment in the mortgage during a divorce, then the court will assume the responsibility for dividing the real estate in cooperation with the bank.

Either spouse has the right to apply to a court with a claim for division of the mortgaged apartment. The motion is based on a desire to veto the right of co-ownership. In this case, the judge must satisfy or not satisfy the plaintiff’s demand (clause 3 of Article No. 196 of the Code of Civil Procedure of the Russian Federation).

To make such a decision, the court should not ask the consent of the bank or credit institution, since the above requirement does not infringe on the interests of the creditor and does not ask to change the terms of the loan agreement.

Division of a mortgaged apartment by agreement

In reality, dividing real estate is difficult, and in cases of dividing a mortgaged apartment, the problems increase many times over.

There are several options for dividing such real estate:

- The ownership right is re-registered in favor of one of the spouses. At the same time, an additional agreement is concluded to the mortgage agreement, according to which the spouse who received the apartment becomes the borrower. The second party, by agreement, can receive monetary compensation for its share.

- The parties pay off the balance of the debt on their own, then sell the apartment and divide the proceeds according to the terms of the agreement.

- The couple finds a buyer willing to make an advance payment equal to the balance of the debt. The encumbrance is removed, the property is sold, and the money is divided between the parties.

- Shares in the property rights are allocated for each person, and the mortgage is divided in proportion to the allocated shares. This is unlikely, and not all banks agree to this. In addition, the allocation of shares implies the possibility of living together, and both spouses become borrowers.

It is important to consider that not every bank will agree to divide the mortgage between former spouses. To do this, you will have to renegotiate the mortgage agreement. In addition, the second spouse must meet all the lender’s requirements in terms of credit history, workload, and salary level. If these requirements are not met, the chance of allocating shares and subsequently concluding two mortgage agreements is very small.

Spouses are co-borrowers: how a mortgage loan is divided in court

When the judicial division of property procedure is completed, the married couple should contact the creditor with a request to transfer the debt. To do this, you need to provide a court order on the division of the apartment purchased with a mortgage. If the lender considers it necessary or, rather, beneficial, he will agree to make changes to the loan document. Alternatively, the following adjustments may follow:

- re-registration of a loan agreement for a husband or wife;

- re-registration of the mortgage document into 2 separate agreements.

Arbitrage practice

Judicial practice in cases of division of mortgaged property is ambiguous. In most cases, claims are satisfied in full or in part, but it all depends on the specific circumstances of the purchase of real estate and the current situation with the loan.

Here are some examples of real solutions:

- Decision No. 2-1112/2020 2-1112/2020(2-4493/2019;)~M-3831/2019 2-4493/2019 M-3831/2019 dated January 27, 2020 in case No. 2-1112/2020 .

- Decision No. 2-1229/2019 2-1229/2019~M-938/2019 M-938/2019 dated December 4, 2020 in case No. 2-1229/2019.

- Decision No. 2-4735/2019 2-4735/2019~M-3977/2019 M-3977/2019 dated December 3, 2020 in case No. 2-4735/2019.

The bank refused to renew the loan agreement

Credit organizations and banks try to avoid situations where it is necessary to re-register a mortgage document. It is easier for them for several people to be obligated to repay one loan than for there to be several loans where there is only one debtor.

By agreement of the parties or by a court order, it may be decided to divide an apartment purchased with a mortgage between husband and wife into unequal shares if there are minor children who will live with one of the parents. It may also be decided to completely transfer the ownership of the apartment to one of the spouses. However, if a banking institution refuses to rewrite the loan agreement, then both husband and wife will be considered joint and several debtors.

There are several options for getting out of this situation:

- continue to make loan payments;

- borrow from reliable persons the necessary amount to repay the mortgage ahead of schedule or sell other expensive property for the purpose of further selling the property and dividing the amount received from the sale;

- draw up an appeal to a judicial authority against the refusal received from the bank.

Without agreeing among themselves regarding the division of the mortgaged apartment, the former spouses will have to continue paying off the loan debt after the divorce. Otherwise, it will be possible to lose not only the right to own the apartment, but also the amounts of money with which loan payments were previously made.

Statement of claim for division of mortgage after divorce (sample)

18

According to current legislation, everything acquired by spouses while in a marital relationship is their common property.

As a result of this provision, any jointly acquired property and funds are subject to division in equal shares, unless otherwise agreed by the husband and wife in the marriage contract or there are no grounds provided by law (for example, the presence of minor children remaining with one of the spouses) for increasing the share in the common property of the spouses.

However, as stated in the provisions of the Family Code, not only all jointly acquired property is subject to division, but also joint debts, which include a mortgage loan for the purchase of any residential real estate - an apartment, a house, etc.

If it was not possible to reach an agreement on the division of a mortgaged apartment or house, the spouses have only one option - to go to court with a demand for the division of both the property and the remaining debt.

For more information about the features and procedure for dividing an apartment purchased using a mortgage, read the separate publication “How to divide an apartment with a mortgage during a divorce.”

Where is it served?

Taking into account the specifics of the division of both debt arising from a mortgage loan agreement and real estate acquired with loan funds, a claim for division of a mortgage after a divorce should be filed exclusively in the district court.

Magistrates have jurisdiction over cases of division of the common property of spouses, the cost of the claim for which does not exceed 50 thousand rubles. The occurrence of such a circumstance when dividing a mortgage is practically impossible.

When determining territorial jurisdiction, the following conditions should be followed:

Features of the claimWhere to file

| If the subject of the dispute is only the debt under the loan agreement | The claim is filed in the district court at the place of residence of the defendant |

| If the claim states a demand for recognition of ownership of real estate | The claim is filed with the district court at the location of the real estate |

claim

When drawing up a statement of claim, it is necessary to take into account the requirements of Art. 131 of the Code of Civil Procedure of the Russian Federation, which sets out in detail the specifics of the content of the claim and the documents attached to it.

So, in a claim for division of a mortgage after a divorce, the following must be indicated:

- The name of the court in which the documents are submitted and its address.

- Full names of the parties to the case, their addresses and contact numbers.

- The third party is the bank that issued the loan and is the mortgagee of the disputed property.

- Circumstances of the dispute: date of marriage, date of divorce, reasons for the lack of consent of the spouses on the voluntary division of property.

- Information about the circumstances in which the debt arose, including details of the loan agreement, information about the bank, the pledged property, the terms of the loan, the procedure for repaying the debt, the status of each spouse (borrower, co-borrower, etc.).

- References to legislation and other evidence on which the plaintiff bases his demands and the proposed option for dividing property (if the plaintiff asks for a larger share than required by law, this demand must be justified and supported by evidence).

- A request to divide the debt, indicating the payment procedure, the amount of compensation, the fate of the mortgaged apartment (if any are stated and relevant for a specific situation).

- List of attachments to the claim, signature, date.

The claim is signed by the plaintiff personally or by his representative (having a formalized power of attorney) and submitted to the court either in person, through the reception desk, or by sending a registered letter through the postal service.

If the document is drawn up correctly and the annexes are sufficient, the court accepts the claim for proceedings, conducts preparations for the case and schedules a court hearing.

During the preparation, additional documents or evidence may be requested if the court considers the submitted documents to be insufficient. It is better to present them to the court in advance.

State duty

The amount of state duty when dividing a mortgage or a mortgaged apartment is determined based on the provisions of Art. 333.19 part 1 of the Tax Code of the Russian Federation, establishing the procedure for calculating state duty for claims of a property nature.

Please note that the cost of the claim will include both the value of the property and the amount of debt to be divided. Contrary to the common practice of excluding the amount of debt from the price of the claim and thereby underestimating the amount of state duty, the share of each spouse in joint obligations is also subject to state duty.

This position is confirmed by Letter of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of the Russian Federation dated January 25, 2012 No. 03-05-06-03 and a number of examples of judicial practice.

Example of calculating state duty

The plaintiff filed a claim for the division of a vehicle worth RUB 1,000,000. the balance of mortgage debt in the amount of RUB 400,000. and non-residential premises worth 2,000,000 rubles. The issue of division of property purchased with a mortgage has not been raised.

The total value of the property is 3,000,000 rubles + the amount of debt is 400,000 rubles.

The total cost of the claim, subject to payment of state duty, will be:

3,400,000 / 2 = 1,700,000 rubles, i.e. ½ share of the plaintiff in the common property and liabilities.

The amount of the state duty will be (clause 1, part 1, article 333.19 of the Tax Code of the Russian Federation): 13,200 rubles. + 0.5% of the amount exceeding RUB 1,000,000. (700,000 * 0.5%=3500) = 16,700 rub.

In total, when filing a claim, you will need to pay state fees totaling 16,700 rubles .

Applications

The statement of claim must be accompanied by copies of all documents mentioned in the claim itself and confirming the arguments specified in the document.

A standard set will look something like this:

- A copy of the claim for the defendant and the third party.

- Copy of the passport.

- A copy of marriage and divorce certificates.

- Copies of documents about children.

- Loan agreement (copy).

- On the right about the amount of debt.

- Documents for property purchased on credit (certificate of registration of ownership).

- Receipt for payment of state duty.

Additionally, depending on the circumstances of a particular case, the following documents may be submitted:

- certificate of place of residence of children and spouses;

- information about the plaintiff’s income (to justify the possibility or impossibility of repaying the loan);

- marriage contract (if any);

- documents on other property subject to division.

Sample statement of claim

The sample presented below describes only one of the options for dividing property purchased with a mortgage and the debt itself.

claim for editing

In addition to the method of dividing the mortgage indicated in the example, the plaintiff may ask the court to completely transfer the debt to the defendant, asking him to pay him compensation, or demand that the apartment be put up for sale, followed by division of the proceeds. In addition, the debt and apartment can be offset against shares in other property. In any case, only an experienced lawyer can understand all the intricacies of the division of a mortgage and real estate purchased using it.

- Due to constant changes in legislation, regulations and judicial practice, sometimes we do not have time to update the information on the site

- In 90% of cases, your legal problem is individual, so independent protection of rights and basic options for resolving the situation may often not be suitable and will only lead to a more complicated process!

Therefore, contact our lawyer for a FREE consultation right now and get rid of problems in the future!

Save the link or share with friends

Source: https://allo-urist.com/iskovoe-zayavlenie-o-razdele-ipoteki-posle-razvoda/

Mortgage before marriage: divided or not

A mortgage taken out before marriage belongs to the person executing the credit relationship; responsibility for debts also lies with the person who made the transaction. During the marriage, the loan debt will be repaid and the second spouse will have the right to file a claim in case of divorce to claim a certain share. If the mortgage was taken out before marriage, then lawyers recommend drawing up an agreement with the spouse, which advises stipulating the rights of each in the possible division of the apartment purchased on credit.

Who will pay the loan taken out during marriage?

If the mortgage was taken out before marriage:

- The owner of the mortgaged property is one of the spouses for whom the monetary obligation was issued. A claim is filed against this person for monetary recovery in favor of the other spouse in the amount of 50% of the amount paid on the loan during the marriage.

- The ex-husband and wife pay the mortgage jointly and receive shares of the mortgaged property after the debt is fully repaid.

- The monetary obligation is re-registered for each spouse separately. Accordingly, the property is divided into shares.

If a mortgage was taken out during a marriage without a contract, the spouses are obliged to repay the debt in full on time, regardless of who paid off the loan earlier and made the down payment when registering the mortgage transaction. The creditor has the right to demand fulfillment of obligations from both spouses-co-borrowers.

The bank has the right to foreclose on the property pledged under the mortgage agreement if the ex-husband and wife cannot agree on payments and violate their terms more than 3 times in 12 months or do not pay at all.

If the mortgage was issued during the marriage to one of the spouses with the drawing up of a contract:

- one spouse will appear in the loan agreement and the equity participation (purchase and sale) agreement. Subsequent division of mortgage payments is not possible;

- the monetary obligation to the bank falls on the spouse for whom the agreement was drawn up.

Applications

The statement of claim must be accompanied by copies of all documents mentioned in the claim itself and confirming the arguments specified in the document.

A standard set will look something like this:

- A copy of the claim for the defendant and the third party.

- Copy of the passport.

- A copy of marriage and divorce certificates.

- Copies of documents about children.

- Loan agreement (copy).

- On the right about the amount of debt.

- Documents for property purchased on credit (certificate of registration of ownership).

- Receipt for payment of state duty.

Additionally, depending on the circumstances of a particular case, the following documents may be submitted:

- certificate of place of residence of children and spouses,

- information about the plaintiff’s income (to justify the possibility or impossibility of repaying the loan),

- marriage contract (if any),

- documents on other property subject to division.

How to divide an apartment with a mortgage taking into account the interests of children

After parents divorce, children usually remain living with one of them. Its share in shared housing will be increased taking into account the interests of children. It will not be possible to divide the apartment in which maternity capital is invested in half between the parents. In this case, most likely, the mortgage payment by court decision will be divided equally between both spouses, as those bearing joint responsibility for the maintenance of their common children.

To sell a mortgaged apartment in which children claim a share, you will need not only the consent of the bank, but also the consent of the guardianship authorities. And they give their consent only if the children are provided with residential premises equivalent in cost and living conditions to the property being sold.

Infringement of the interests of children during the division of common marital property can result in serious problems for parents, including deprivation of parental rights.

Filing a counterclaim for the division of mortgage debt and debt obligations

During a divorce, the defendant can file a counterclaim and put forward demands for the division of debt obligations on a loan, or for the division of a mortgage, or for the division of a mortgaged home.

In any case, you will have to file a counterclaim.

Let us note what data must be included in the counterclaim under the mortgage section:

- Name of the judicial authority, its address, precinct number.

- Information about the plaintiff.

- Defendant's details.

- Document title: “Counterclaim”.

- Information about the date of filing the main claim and the case number.

- Information about the subject of the dispute.

- Arguments about the need to file a counterclaim, about the relationship between the main (initial) and counterclaims. Point out that joint consideration of claims will contribute to a speedy resolution of the dispute between the parties.

- Evidence that confirms all the circumstances listed in the claim.

- Links to legislation.

- The plaintiff's claims on the counterclaim.

- List of attachments to the claim.

- Date of filing the claim, signature of the plaintiff.

Any important information, without which the court considers the demands against the defendant to be unfounded, must be stated in the counterclaim . This is the same equivalent claim as the main one, but it is only filed from the defendant to the plaintiff.

Complete list of documents for obtaining a building permit

Some people want to start building a country house, others are looking for information about obtaining permission to build an industrial facility. Whatever construction is planned, obtaining a permit is mandatory, otherwise problems with registering the object and putting it into operation are inevitable. All you need to do is obtain permission to build the desired type of building and comply with the plan during construction. Laws on obtaining permits have changed several times, so we have compiled the latest information for 2020 on how to obtain a building permit and what documents are required.

Execute a gift deed at the MFC in one window - execution and registration of the gift agreement

Donation procedures are one of the most common transactions in Russia, along with the purchase and sale of housing, cars or land. Giving a relative or other person an apartment, a house, a car or a plot of land is not difficult - this procedure has been established and has long been known. On the other hand, the process is not as easy as it seems, because certain mandatory conditions are required, without which the transaction will not take place, or later it may be declared illegal.

Damp wall in an apartment: what to do and where to go

Sometimes it happens that both in apartments of old buildings and in new buildings, the walls become damp, mold appears, freezing, etc. The reasons for this phenomenon may be different, but most of them relate to non-compliance with technical rules during construction or repair, the use of poor materials and defects in the execution of work. It happens that the residents themselves are to blame for the appearance of damp walls in their homes. How to find out who is to blame for this problem, and how to ensure that construction or repair deficiencies are eliminated by the company that caused them?