Sberbank, like many other banks in Russia today, has profitable deposits with increased rates for both all individuals and pensioners in particular.

The information presented on this page will help you choose and open the most profitable pension deposit at the moment. Let's figure out whether it is necessary to make a deposit online today in order to get the maximum interest.

Features of individual deposits for pensioners in Sberbank

In 2021, Sberbank of Russia is offering pensioners basic deposits for individuals, but with the highest rates. Moreover, their size does not depend on the amount decided to place on deposit.

For example, with the “Save” deposit, a pensioner can receive the highest possible interest rate for this deposit even if he invests only 1,000 rubles. And another individual who does not belong to the category of pensioners will receive the same interest only if he opens a “Save” deposit, depositing 400 thousand rubles at once! Sberbank calculates interest rates on other pension deposits in a similar way.

However, we must remember the following.

For deposits opened in Sberbank Online, the maximum rate for the selected period is set only for age pensioners - women over 55 years old and men over 60 years old.

Special benefits are also provided for pre-retirees. In particular, if you have reached retirement age after opening a deposit, then its extension is automatically carried out at the maximum interest rate depending on the selected period.

What deposits for pensioners are there in Sberbank today

So, in Sberbank you can open the following pension products on special conditions:

1. “Save”; 2. “Replenish”; 3. “Pension-plus of Sberbank of Russia”; 4. MIR debit pension card.

Deposits with the ability to replenish and partially withdraw money without loss of profitability “Manage”, as well as the charitable deposit “Gift of Life” for pensioners in Sberbank are opened under general conditions.

See what deposits for pensioners are available in other banks today: more details >>

How to make a deposit with a high interest rate

You can open a deposit during a personal visit to the nearest bank branch. The deposit does not require registration through online banking services. This is done on the basis that pensioners are mostly older people and do not use gadgets.

To open you need to follow these steps:

- When visiting a bank branch, present identification documents and a pensioner's ID card.

- Write an application to open an account.

- Sign the contract.

- Deposit money in any convenient way.

A bank employee will perform all necessary procedures for opening a deposit. He is obliged to competently answer questions that a pensioner may have, for example, what characterizes the Pension Plus deposit in Sberbank, what it is and what its conditions are.

He will tell you in detail about the advantages and features of the deposit. It will help you choose a convenient and comfortable time mode and calculate the amount of interest. The pensioner does not need to do anything on his own; the necessary package of documents is prepared by a bank employee, and he will also help deposit the first contribution into the account.

What seasonal deposits are there in Sberbank in July-August 2021

In addition to offers from the basic line, Sberbank several times a year offers seasonal deposits with higher interest rates or more favorable terms and conditions. Today it's...

! Deposit “Additional interest”. It can be issued until August 31.

“SberBank is improving the conditions for the “Additional Interest” deposit so that our clients have more opportunities to increase their savings,” says Sergei Shirokov, director of the “Borrow and Save” division of Sberbank.

The maximum return on the “Additional Interest” deposit reaches 5.5% per annum in rubles - more about it >>>

Conditions and advantages over other deposits

A Sberbank deposit not only preserves a pensioner’s income, like a savings book, but increases it due to high interest rates. Flexible conditions and advantages of the deposit over other bank products make it an alternative source of additional income for the preferential category of depositors.

Despite the fact that Sberbank’s line of deposits focuses on pensioners, this deposit has a number of advantages over them:

- The minimum deposit is 1 rub. In all others, the minimum amount starts from 1000 rubles.

- Top up your account as many times as needed.

- The ability to withdraw money at any time without closing the account and losing interest.

Sberbank's pension deposits, Replenish and Save, are also aimed at servicing pensioners. They have higher interest rates and have the option of remote servicing. The Pension Plus investment does not provide such a function.

But these benefits are undermined by the following stringent investment conditions:

- Top up deposit conditions allow the depositor to increase the account, but also without the possibility of early withdrawal.

- There is no option to top up your account on the Save deposit. A high rate of 4.5% is charged on the amount of the first installment (from 1000 rubles), and accumulation is carried out through interest. Withdrawals are not available until the end of the contract term.

For early withdrawal of funds on other deposits, the depositor faces penalties in the form of a reduction in the interest rate or loss of part of the income as a percentage. There are also more stringent conditions under which early withdrawal is strictly prohibited.

Elderly people may need money at any time, and the prospect of using their savings when the need arises is one of the most important factors in choosing a Pension Plus deposit.

Which Sberbank deposits for pensioners today have high interest rates and favorable conditions?

Deposits with preferential terms for persons of retirement age

Under special conditions, pensioners today can open replenishable deposits at Sberbank, as well as time deposits without the ability to manage their money, but with the highest return.

01.

Sberbank deposit for pensioners “Save”: conditions and interest

This deposit is designed to receive a guaranteed maximum income. Its advantages are:

√ maximum interest rate for the selected period, regardless of the deposit amount; √ automatic transfer to the best possible rates at Sberbank upon reaching retirement age and prolongation of the deposit.

Among the disadvantages, it should be noted that there is no possibility of replenishing and partially withdrawing money without losing interest.

Conditions

• Duration: from 1 month to 3 years; • Replenishment: no; • Partial withdrawal: no; • Amount: from 1,000 rubles / 100 US dollars;

Conditions for calculating interest

• Interest is calculated monthly; • Accrued interest is added to the deposit amount, increasing income in the following periods; • Accrued interest can be withdrawn and also transferred to the card account;

Interest rates

In Russian rubles

Today, the profitability of a deposit in rubles depends on the method of registration.

Registration at the bank office

Without capitalization / With capitalization

| Term | Interest rate |

| 1-2 months | 1,90 / 1,90 |

| 2-3 months | 2,20 / 2,20 |

| 3-6 months | 2,70 / 2,71 |

| 6-12 months | 3,20 / 3,22 |

| 1-2 years | 3,35 / 3,40 |

| 2-3 years | 3,20 / 3,30 |

| 3 years | 3,05 / 3,19 |

But if you make the same Save deposit remotely - for example, in Internet banking, then the interest in rubles will be slightly higher!

Registration in Sberbank Online

Without capitalization / With capitalization

| Term | Interest rate |

| 1-2 months | 2,05 / 2,05 |

| 2-3 months | 2,35 / 2,35 |

| 3-6 months | 2,85 / 2,86 |

| 6-12 months | 3,35 / 3,37 |

| 1-2 years | 3,50 / 3,56 |

| 2-3 years | 3,35 / 3,46 |

| 3 years | 3,20 / 3,350 |

But the method of registration now does not affect the profitability in dollars. Both in the branch and on the Internet the rates will be the same.

In US dollars

Registration at a bank branch and Sberbank Online

| Term | Interest rate |

| 1-2 months | — |

| 2-3 months | — |

| 3-6 months | — |

| 6-12 months | 0.05 |

| 1-2 years | 0.35 |

| 2-3 years | 0.35 |

| 3 years | 0.35 |

For a detailed overview of the Save contribution, see here >>

Deposit calculator: calculate your income!

The Sberbank online deposit calculator for individuals will help you calculate income depending on the interest rate and term. It allows you to find out the profitability taking into account capitalization, replenishment and withdrawal of funds from the account.

02.

Deposit for pensioners in Sberbank “Replenish”: conditions and interest

This is a typical replenishable deposit for those clients who prefer to save and regularly set aside money for a rainy day. Its advantages are:

√ possibility of replenishment; √ maximum interest rate for the selected period, regardless of the deposit amount; √ automatic transfer to the best rates possible at the Bank upon reaching retirement age and prolongation of the deposit.

Conditions

• Duration: from 3 months to 3 years; • Amount: from 1,000 rubles / 100 US dollars; • Replenishment: provided for the following contribution amounts: - cash - from 1,000 rubles / 100 US dollars; - non-cash - unlimited. • Partial withdrawal: no.

Conditions for calculating interest

• Interest is calculated monthly. • Accrued interest is added to the deposit amount, increasing income in subsequent periods. • Accrued interest can be withdrawn or transferred to the card account.

Interest rates

In Russian rubles

Today, the profitability of this deposit in rubles also depends on the method of registration.

Registration at the bank office

Without capitalization / With capitalization

| Term | Interest rate |

| 3-6 months | 2,45 / 2,46 |

| 6-12 months | 2,85 / 2,87 |

| 1-2 years | 2,90 / 2,94 |

| 2-3 years | 2,65 / 2,72 |

| 3 years | 2,40 / 2,49 |

But if you make the same deposit Replenish remotely - for example, in Internet banking, then the interest in rubles will be slightly higher!

Registration in Sberbank Online

Without capitalization / With capitalization

| Term | Interest rate |

| 3-6 months | 2,60 / 2,61 |

| 6-12 months | 3,00 / 3,02 |

| 1-2 years | 3,05 / 3,09 |

| 2-3 years | 2,80 / 2,88 |

| 3 years | 2,55 / 2,65 |

In US dollars

Today this deposit is not issued in foreign currency.

For a detailed overview of the Replenish deposit, see here >>

03.

Deposit "Pension-plus of Sberbank of Russia"

This is a deposit to receive income for retirement. It is intended for individuals receiving pensions from the Pension Fund of the Russian Federation, non-state pension funds, as well as ministries and departments providing pensions. Opens only in rubles. It will not be possible to open the Sberbank of Russia Pension Plus Deposit in dollars. Even those who in our country receive a pension in dollars, although we doubt that such exist.

Conditions

• Term: 3 years; • Minimum amount: 1 ruble; • Replenishment: unlimited; • Partial withdrawal without loss of interest: provided up to the level of the minimum balance; • Early termination: when the deposit is withdrawn, the rate established on the date of opening (prolongation) of the deposit does not change.

Conditions for calculating interest

• Interest is accrued every 3 months • Accrued interest is added to the deposit amount, increasing income in the following periods.

Interest rate

3.50% per annum without capitalization;

3.67% per annum with capitalization.

04.

Sberbank MIR pension cards

The Sberbank MIR “Social” debit card is intended for receiving a pension. It is beneficial in that the issuance and servicing of cards is free, and 3.5% per annum is charged on the money in the account.

Conditions

• Payment system: MIR; •Territory of use: Russian Federation; • Card account currency: rubles; • Card validity: 3 years; • Electronic chip protection: provided; • Cost of service: free; • Preferential mobile bank: the first 2 calendar months are free, then 30 rubles per month; • Bonus program “Thank you from Sberbank”: provided.

Interest on Sberbank MIR pension cards

3.5% per annum on the card balance.

More information about the conditions for issuing and using Sberbank bank cards for pensioners can be found here.

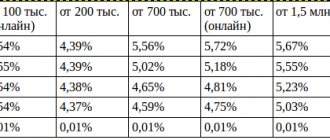

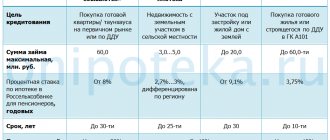

See the conditions of the pension card at Rosselkhozbank. Read more >>

Deposits without benefits for persons of retirement age

“Manage” deposit

This deposit allows partial withdrawal of funds, as well as replenishment of the account without loss of interest.

Conditions

• Duration: from 3 months to 3 years; • Min. amount: 30,000 rubles, 1000 dollars; • Replenishment: yes; • Partial withdrawal without loss of profitability: up to the minimum minimum balance. • Capitalization: yes.

Interest rate

in rubles

| in the department | online |

| up to 2.41% | up to 2.56% |

In US dollars

Today this deposit is not issued in foreign currency.

Read more >>

“Gift of Life” contribution

This is a ruble deposit for those who are ready not only to save money, but also to help those in need - children with oncological, hematological and other serious diseases. Every 3 months, Sberbank transfers to the Gift of Life charity fund an amount of 0.3% per annum of the deposit amount.

Conditions

• Term: 1 year; • Min. amount: 10,000 rubles. • Replenishment: no; • Partial withdrawal: no. • Capitalization: yes.

Interest rate

3.40% per annum without capitalization;

3.44% per annum with capitalization.

More information about the Pension Plus deposit

This interesting banking program allows clients to receive additional income from their pension. For some people, this is a great help, especially if they have no other sources of income.

- The deposit can be replenished at any time, as well as partially withdraw funds from it without losing interest.

- The minimum amount of the so-called minimum balance is only 1 rub.

- The annual rate in rubles is within 3.5%.

- The deposit period is up to 3 years.

Is it possible to withdraw money from the deposit early?

If the terms of the deposit indicate that partial withdrawal is not provided, this does not mean that the depositor cannot return his own money before the time established by the agreement!

In any unforeseen situation, if you need money before the end of the deposit, you can always get it. But, alas, almost no interest.

The Save, Give Life, Replenish and Manage deposits have the same conditions for early withdrawal of money:

✓ If you withdraw money within the first 6 months, interest will be charged at a rate of 0.01% per annum.

✓ And if you withdraw savings after 6 months, then income in most cases will be calculated based on 2/3 of the interest rate.

Other rules come into force only if your savings have increased 10 times during your stay in the bank. But this is only possible if you actively replenish the deposit yourself. So, if you are planning to open Replenish or Manage deposits, carefully study the conditions for early withdrawal of money.

And one more nuance.

!In case of early termination of the deposit, interest is recalculated without taking into account monthly capitalization!

Prolongation conditions

Automatic prolongation of deposits of individuals is carried out on the terms and at the interest rate in effect on the date of prolongation. The number of extensions is not limited.

See savings offers at Pochta Bank. Read more >>

How is interest calculated?

The profitability of the deposit does not depend on the amount deposited and the period of replenishment of the account.

Interest is credited once a quarter at the rate of 3.5% per annum. If you withdraw money from your account early, interest will be charged on the actual balance. Accrual of interest on the actual balance means that the greater the account balance as of the control date, the higher the amount of accrued interest will be. If funds are constantly replenished and not withdrawn for a long time, then the return on the deposit will be high.

Will interest rates rise in the near future?

The Bank of Russia has already raised the key rate to 6.5% per annum in 2021 and has no plans to lower it in the near future.

“According to our updated forecast, in 2022 the average key rate will be 6.0–7.0% per annum,” says the head of the Bank of Russia, Elvira Nabiullina.

According to the head of the Central Bank, to combat inflation in the country, “it is necessary to create conditions to increase the propensity to save, and this requires a higher level of interest rates.”

Thus, the yield on deposits should increase.

The head of Sberbank, German Gref, has previously stated that he allows rates on deposits and loans to increase in this regard.

The only question is how much interest rates can rise.

Yuri Yudenkov , professor at the Faculty of Finance and Banking at RANEPA . In his opinion, deposit rates will average 5.5–6% per annum.

The increase in deposit rates, observed since March, will continue following the increase in the key rate, but with some lag, says Mikhail Doronkin, managing director of the NKR rating agency. According to agency forecasts, by the end of 2021 the average deposit rate may increase by 0.5-0.7 percentage points. - until 6%.

Financial expert Ruslan Pichugin expressed a more optimistic opinion to AiF. According to him, interest on deposits may increase to 7% per annum.

“However, Sber depositors should hardly count on such an increase in the return on deposits. Green Bank is very conservative in this matter and keeps interest rates on deposits at minimum values. Growth is only possible during promotional periods,” says Top-RF.ru columnist Viktor Davidenko.

? Are Sberbank deposits insured for pensioners?

All deposits of Sberbank of Russia are insured in accordance with the Federal Law “On Insurance of Individual Deposits in Banks of the Russian Federation” No. 177-FZ dated December 23, 2003.

Reviews

Sergey, 68 years old, Krasnoyarsk: “After retiring, I immediately opened a Pension Plus deposit. I have been a client of Sberbank for a long time, I receive my salary on a bank card. Now I’m transferring my entire pension to a deposit. A salary is enough to live on, but it doesn’t hurt to save for old age. Moreover, it is possible to withdraw money at any time.”

Marina, 47 years old, Voronezh: “I thought that the Pension contribution was only for old-age pensioners. It turned out that we, beneficiaries, can also open a deposit. I am transferring my pension and have activated the Piggy Bank service. The interest on the deposit is lower, but it is not lost upon urgent withdrawal. Even if there is 1 ruble left on the deposit, 3.5% is charged on it.”

Ekaterina, 34 years old, Novosibirsk: “The deposit was opened for my mother. She had long wanted to save money, but could not make a choice. And here it is very convenient - the pension is immediately credited to the deposit account, there is no need to go anywhere or stand in queues. This is important for an elderly person.”

What is the most profitable Sberbank deposit for pensioners today?

Let's figure out what kind of deposit you need to make in order to get maximum income. Let's consider several criteria that can affect the profitability of a deposit.

1. Design method. Today, a higher interest rate on a deposit can be obtained if you open a deposit not in a bank office, but through your Sberbank Online personal account.

Conclusion: this means that in order to get the maximum interest, you need to make a deposit at Sberbank Online or an ATM, and not at a bank branch.

2. Amount. The deposit rate for pensioners does not depend on how much you want to deposit in the bank.

Conclusion: you can invest 1,000 or 400,000 rubles, but the profitability will be the same.

3. Deadline. For pensioners, the profitability of deposits depends only on this parameter.

Conclusion: judging by the rate tables, the maximum profitability today can be obtained if you invest money for a period of 1-2 years.

Now let's choose the most profitable deposit using a specific example. Let's say a pensioner wants to invest 100,000 rubles for 1 year. Which investment will be better?

Comparative table of Sberbank deposits for a period of 1 year

| Deposit / Rate | in rubles | in dollars |

| Save Online | 3,56 % | 0.35 |

| Top up Online | 3.09 % | — |

| Pension Plus | 3.67% (3yrs) | — |

| MIR map | 3,50 % | — |

| Manage Online | 2,38 % | — |

| gift a life | 3,44 % | — |

| Additional percentage | 4,85 % | — |

| — | — | — |

As you can see, the most profitable today for a period of 1 year is the “Additional Interest” deposit, and for other terms – “Save Online”.

How to open this deposit in Sberbank. What is needed for this

Opening a pension deposit is quite simple. If you already have a Sberbank card to which your pension is received, you can do this at any ATM, online via the Internet or using a mobile application. The last two methods are valid only if connected from the date the option was activated. You can also personally visit any of the bank offices.

If you do not have a card, then you can draw up an agreement only during a personal visit. Here are the step-by-step instructions:

- Choose the Sberbank branch most conveniently located to you.

- Be sure to take two documents with you: a passport and a pension certificate, present them to the bank consultant. He will tell you in detail about the conditions and print out the agreement in two copies (the first will remain with you, the second will be kept in the bank).

- You will be offered a plastic card to accompany your deposit, don’t refuse, it’s very convenient. If desired, a savings book can also be issued; some pensioners prefer this option.

- The last step is to deposit the required amount of funds into the account. This can be done at the cash register, through an ATM, or transferred in another way.

Sberbank NPF rating

The non-state pension fund of Sberbank of Russia has managed to earn a good rating throughout its operation. He was never listed lower than number 8. If we talk about his assets, then in the 2013 annual period alone they doubled in their amount and amounted to 80 billion rubles. There was also an increase in available pension savings by 78%.

At the very beginning of the 2014 annual period, the organization’s client base was 2,000,000 people. The average parameters for the size of a pension account are 54,000 rubles. exclusively within the framework of the insurance program. Due to these indicators, the bank reached a leading position and took an honorable second place in the ranking of identical fund structures operating in the Russian Federation.

Sberbank NPF has a high rating among similar organizations

More information about deposits for pensioners

Deposits in Sberbank for pensioners: “Replenish”, “Save”, “Pension-plus”. But each deposit has its own nuances:

- “Replenish” and “Save” can also be opened by non-pensioners, but for pensioners there are special promotions on these deposits at Sberbank (more on this below). Both deposits can be made via the Internet, but there is an important point - if you make a deposit through Sberbank Online, the promotions apply only to old-age pensioners; pensioners for other reasons will not be given bonuses. To get the maximum benefit, disability/survivor/… pensioners will have to go to the office and sign a paper contract.

- “Pension Plus” can only be opened by pensioners and only in the office. Pension - for any reason, its source (Russian Pension Fund or private pension funds) also does not matter.

At Sberbank, I heard about other types of “operation codes,” for example, code 3. What is this?

There are quite a lot of ciphers in the banking program, number 3 is one of them. It is not related to additional account replenishment, but is related to deposits. Code 3 on the account statement indicates a partial withdrawal from the Savings or Manage accounts. If the client had made a full withdrawal, a different code would appear on the account statement.

Together, these two codes - 2 and 3 - give the program the ability to fully track and display in the database all movements of funds within the account before it is closed. The lack of need for other codes is also illustrated by a story that happened in 2021: previously, in addition to the code “2”, the code “15” was sometimes displayed on the account statement. But this cipher contained practically no new information; all essential data was well represented by code 2. As a result, cipher 15 was abandoned.

Thus, the account statement contains everything that is needed to inform the client and his legal protection, so this document should be kept even if the deposit has already been closed and the deposit agreement has ceased to be valid.

Registration of an IPP - where to apply

To register a pension plan, you can use different options:

- Sberbank branch.

- One of the NPF offices.

- Possibilities of a personal account in Internet banking.

The easiest way to apply for an IPP is to do it online. To do this you need:

- Read about the conditions of the available IPP options and click on the “Apply” button.

- In the proposed form, enter personal passport information, as well as contacts and the amount that will be the first payment.

- Confirm the order using the password from SMS.

- The first payment is transferred from a bank card.

If it is not possible or desirable to apply for an IPP online, you can contact Sberbank with your passport in person. The service may not be provided in all branches, so it is worth checking the list of suitable addresses on the bank’s website.

About requirements and conditions

An Individual Pension Plan is a program for ordinary citizens who want to increase their retirement benefits as they age.

Based on this, the set of requirements for clients is minimal - you need to contact Sberbank with a passport and SNILS, and also be ready to make a down payment. After that, you just need to fulfill your part of the contract.

Closing an individual pension plan in Sberbank

Termination of the contract and refund of money is the client’s right. Any of the grounds specified in the agreement will be suitable for closing an account:

- early termination of the contract;

- fulfillment by the fund of its obligations;

- transfer of savings from Sberbank NPF to another fund;

- payment of funds to heirs if they apply for them within 3 years after the death of the client.

To obtain decent security in old age, you need to think about pension savings in advance. IPP users often choose this option for investing in their old age, since no outsiders can recover these funds in their favor.

I made an additional contribution at Sberbank and they told me “type of operation 2” - what is this?

Banking organizations in Russia use the special automated workplace program “Client” of the AS “Client-Sberbank” to manage all assets and liabilities in the company. Without such software, managing millions of transactions every day would simply be impossible.

And for ease of sorting, the program implements a code map. Each code or cipher is the same thing - it is responsible for displaying specific information about the progress of the operation. For example, when making a loan payment through Sberbank Online, the transaction is assigned one code, when paying in cash in the office - another code, when making a first deposit payment - a third, and so on.

So, “type of transaction 2” is the code assigned to the additional contribution to the replenished deposit made at the bank’s office. When depositing via Internet banking, the transaction is assigned a different code.

Information about the deposited funds, the duration of the agreement, the payment schedule, etc. is displayed in the account statement, which an employee of the organization is obliged to give to you upon your first request.

In addition, Sberbank regulations are such that, regardless of your wishes, with additional replenishment, the employee is obliged to issue you a statement. From this document you can not only glean useful information, but also receive protection from possible errors or claims from the bank.