Many pensioners have land plots, which are an interesting hobby for them, a source of additional income and an opportunity to provide themselves and their families with food grown independently. Having a plot of land can make life much easier for retirees. Those who have it or dream of purchasing a plot of land need to know whether any benefits are provided for this type of local taxation in 2017.

The Land Code of the Russian Federation regulates all land use regulations. In 2017, in accordance with Article 15 of the Tax Code of the Russian Federation “Local taxes and fees”, this tax should, as before, be collected in all territories of municipalities. It must be paid not only by various companies and enterprises, but also by citizens who own their own privatized plots of land provided to them on the basis of perpetual use rights. Land is the property of a citizen if it was acquired legally.

Are pensioners entitled to land tax benefits? What categories of pensioners are eligible? Where should I go to receive them and what documents should I provide? We will answer these questions in this article.

Land tax benefits

Based on the cadastral value of the land, the amount of land tax is calculated, the rate of which is set at 0.3-1.5% of this figure. It depends on who is the owner of each specific site - an enterprise, a partnership, a private owner, etc. Municipalities have the right to set their own rates, but only within the limits specified in the law. The legislation defines land taxes as a mandatory payment that replenishes the local budget. All land owners must pay them.

The Land Code specifies the categories of citizens who are entitled to benefits. The law provides detailed information regarding land taxation of enterprises. In accordance with the Tax Code of the Russian Federation (Chapter 31), everyone who owns land plots (companies and individuals, including pensioners) on the right of perpetual use are obligatory payers. Citizens who own land as tenants and have the right to use the land for a certain time free of charge are not taxed.

The Tax Code of the Russian Federation (Article 395) contains a short list of categories that have the right to preferential taxation, or are completely exempt from paying it:

- indigenous peoples, small in number, living in the North, Far East, and Siberia;

- northern peoples, for whom the land serves as a means of preserving their characteristic way of life and conducting their folk crafts.

The legislation does not provide for other preferential categories to which preferential taxation could be applied. This also applies to pensioners, who must also pay for land on a general basis without fail.

The essence of land tax

Paying taxes is a mandatory part of owning property. This directly applies to the owners of plots of land, as well as to persons who own them on the basis of the right of perpetual use. This is regulated by the norm of the Tax Code, Article 388.

It also applies to those who inherit property during their lifetime.

The taxation procedure is approved at several levels. If we talk about regions, this is done by elected municipal bodies. Taxation in cities of federal significance is formed by the legislative body of these structures. All these provisions are clearly stated in Article 387 of the Tax Code.

Reducing the amount of land tax

The Tax Code (clause 5 of Article 391) provides for categories of citizens for whom the amount of land tax can be reduced by 10 thousand rubles depending on the value of the land according to the cadastre. This rule of law applies to:

- Heroes of the Soviet Union, Heroes of the Russian Federation, full holders of the Order of Glory;

- disabled people of groups I and II;

- disabled since childhood;

- veterans and disabled people of the Great Patriotic War, military operations;

- citizens exposed to man-made disasters;

- persons who participated in nuclear weapons tests, liquidators of nuclear accidents;

- citizens who have suffered or received radiation sickness, disabled people whose disability is a consequence of nuclear exercises or tests. There are no pensioners in this category of persons.

Return of land tax

When paying land tax, pensioners can return part of the money spent only in the form of benefits

who are appointed by local authorities. Subjects of the country set different conditions for receiving benefits, so to clarify this information, you should contact your local tax office.

To receive the appropriate benefits, you must fulfill a number of requirements, such as:

- submit applications;

- provide the tax authority with a list of documents, namely: passport;

- pensioner's ID;

- title documents for the land plot;

- employment history.

Rights of local municipalities

Municipalities have the right (clause 2 of Article 387 of the Tax Code of the Russian Federation) to introduce their own tax benefits, determine the grounds for their provision and the procedure for their provision. They can also determine the amount of tax-free land tax for certain categories of tax payers.

Many municipalities take advantage of this tax law provision. Thus, in Moscow, on the basis of clause 13 of Article 3.2 of the Law “On Land Tax”, pensioners living alone are provided with benefits for gardening.

St. Petersburg has its own law “On Land Tax” No. 617-105 dated November 23, 2012, in paragraph 10 of clause 1 of Art. 5 of which it is indicated which categories of citizens should not pay this tax. These include taxpayers who have:

- owns one plot of land in the city;

- having the right to unlimited use of a land plot;

- having the right to lifelong inheritable ownership of a plot with dimensions of no more than 2500 sq.m. (including individual pensioners who have issued a pension in accordance with the legislation of the Russian Federation).

Accordingly, land tax benefits for pensioners and the list of documents that must be provided to receive them are established by the legislation of a particular municipality. You can find out whether a pensioner is entitled to a benefit in 2021 by contacting the municipality or tax office where the pensioner’s land plot is located. This was stated in the letter of the Ministry of Finance of the Russian Federation dated February 19, 2013 No. 03-05-06-02/24.

Tax benefits in 2015

In the Russian Federation, legislation provides for a number of tax benefits for individuals and legal entities, but almost all of them are provided only on an application basis, that is, until you apply, you will not receive them. Therefore, you need to know about them.

For pensioners for property, land, car

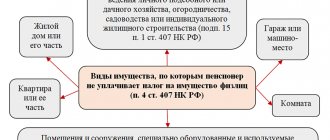

As the law indicates, namely the Tax Code (Article 401), a person who is entitled to a pension is exempt from paying property tax. These people are given a zero rate, which means they don’t have to pay for the following property:

- 1. Housing, including rooms, apartments, houses.

- 2. Garages, parking spaces (in a common garage).

- 3. Outbuildings with an area of no more than 50 square meters. m, and they should be located on plots for summer cottages, subsidiary plots, and individual housing construction.

- 4. Premises used as creative workshops, studios, galleries, non-state museums.

The benefit applies to one object of each type. For example, if a pensioner has an apartment, a garage, a dacha, then there is no need to pay him. When he has 2 apartments, he will have to pay extra for one of them, since each category of property provides the right to benefits for only 1 object.

The car (transport) tax is not federal, it is determined independently by the constituent entities of the Russian Federation, so the provision of discounts varies throughout the country, but in most regions significant benefits are provided for pensioners, they also depend on the number of cars and their power. Typically 1 vehicle is exempt. For these property issues, contact the nearest tax office, where they will explain in the most meaningful way about the right to this benefit, and tell you the procedure for receiving it.

The most confusing situation is with benefits for a land plot - they can be established by both the subject (for example, Moscow, Moscow region) and any local municipal government authority, so they are very different, and in many regions they are not even going to provide for them.

An example of a situation could be land tax benefits for pensioners in the Moscow region. This subject does not mention this issue in its laws, and local authorities treat discounts for pensioners on land differently - the city of Ivanteevka exempted single low-income pensioners from paying, for the rest the tax amount was reduced by half, they also pay in Korolev, in Lotoshino there is a preferential the payment is 25% less than for the rest of the population, but the Shakhovsky district did not provide discounts and this is not the only territory that has abolished the preferential pension tax.

You can receive all property preferences by writing an application to the tax authority at your place of residence.

Procedure for applying for benefits

If, when contacting the municipality or the Tax Service, it is confirmed that a pensioner has a land tax benefit, you need to write an application for exemption from paying it and submit it to the tax office at the place of residence or location of the plot of land falling under preferential taxation.

Basic list of documents submitted along with the application:

- passport;

- certificate or certificate confirming disability, illness, injury, awards;

- documents for land as a taxable object.

The municipality may require additional certificates from the pensioner to receive benefits. All these documents (not certified copies) can be sent by mail or delivered in person. After reviewing the submitted papers, service employees must notify the applicant of their results as soon as possible.

Land tax benefits for pensioners

All tax benefits are divided into 3 types:

- Exemption of citizens from paying land tax.

- Reduction by 10,000 rubles. tax base (the amount from which the tax is calculated).

- Benefits that are established by municipal authorities.

Only persons related to:

- Small peoples of the North, Far East and Siberia.

- Peoples who use lands to preserve and develop traditional lifestyles, farming and crafts.

The tax base may be reduced for persons who, in accordance with Part 5 of Art. 391 of the Tax Code of the Russian Federation are:

- Heroes of the Soviet Union.

- Heroes of the Russian Federation.

- Full Knights of the Order of Glory.

- Veterans and disabled people of the Second World War.

- Veterans and disabled combat veterans.

- Disabled children.

- Disabled people of group 1.

- Disabled people of group 2, and disability of this group must be awarded to them before the beginning of 2004.

Documents for registration of benefits

A person can apply for benefits by submitting an appropriate application to the tax office at the location of the land plot (Clause 10 of Article 396 of the Tax Code of the Russian Federation).

Along with an application for a reduction in the amount of land tax, a citizen of retirement age will need to submit:

- passport;

- title documents for a land plot acting as an object of taxation.

To clarify the specific list of documentation required to apply for benefits, a citizen will need to contact the tax office at the location of the land plot.

Fringe benefits

The Tax Code of the Russian Federation does not contain specific norms that exempt pensioners from paying taxes or give them the right to pay tax at a reduced rate, however, legislative acts of municipal authorities often provide in their norms a number of additional social benefits addressed to persons of retirement age.

For example, some municipal authorities provide pensioners with discounts on land tax if these citizens have permanent registration in the municipal area.

A number of government bodies guarantee benefits to those citizens of retirement age who do not have a place of employment or are registered in residential premises built on the territory for which the pensioner pays a mandatory tax.

Registration of benefits

After a citizen of retirement age has provided the authorized tax inspector with a complete package of documents for obtaining a tax benefit, the official checks the received documentation.

If the information recorded in the documents is true, and the documents are recognized as authentic, then the land tax is recalculated.

Such recalculation should cover the time period starting from the moment the citizen’s rights to benefits arise. If a citizen submits an application and additional documents to the tax office for registration of benefits untimely, then the recalculation period is limited to 3 years.