Survivor's insurance pension in 2021

Disabled citizens who are dependent on a deceased relative can receive an insurance pension. If we are talking about minor children, there is no need to prove that they had no other source of income. If the dependent is another person, proof of disability will be required.

Persons caring for children under 14 years of age have the right to receive the insurance part of the pension. This could be: spouse, parents, grandparents. But only if the citizen is not officially employed.

The insurance pension is not paid to relatives if:

- the deceased had no accumulated experience;

- the death occurred due to a person who, in the event of the death of a relative, has the right to payments.

In the event of the death of both parents, the pension is assigned:

- double the amount if both mother and father had work experience;

- if the child has guardianship or is kept in an orphanage;

- if the deceased parents had a funded part of the pension, the child has the right to receive it by contacting the Pension Fund with the help of a legal representative.

In order for the children of the deceased to have the right to an insurance pension, the parents did not have to be officially married. It could have been a civil marriage or a finalized divorce. The main condition is that the deceased parent is indicated on the child’s birth certificate.

The exact amount of payments depends on the insurance savings of the deceased, as well as annual indexation. But it cannot be less than the subsistence level in the region of residence. Last year, the indexation of insurance pensions was 4%.

Recipients of a survivor's pension are exempt from property taxes. Who are these people?

Persons belonging to the category of “pensioners receiving pensions assigned in the manner established by pension legislation” are entitled to benefits on property tax for individuals.

Do such persons include children - recipients of survivor's pensions and their legal representatives who receive this pension instead of the child?

The Ministry of Finance provided clarifications on these issues in letter dated August 15, 2018 No. 03-05-04-01/57921 in response to a request from the Federal Tax Service.

Children of the deceased breadwinner and family members of the deceased breadwinner caring for the young children of the deceased breadwinner are independent categories of persons entitled to receive an insurance pension. If an insurance pension is established for them, they are recognized as recipients of the insurance pension (pensioners).

At the same time, Part 18 of Article 21 of the Federal Law of December 28, 2013 No. 400-FZ provides that if the recipient of the insurance pension is a child under the age of 18, the delivery of his pension is carried out to one of his parents (adoptive parents) or guardians (trustees).

Taking into account the above, pensioners (pension recipients) are citizens for whom a pension is established. At the same time, the delivery of pensions, i.e. the transfer of the pension amount accrued to the pensioner can be carried out either directly to the pensioner or to his legal (authorized) representative.

Consequently, citizens who are recipients of pensions, including insurance pensions in the event of the loss of a breadwinner, are exempt from paying property taxes on individuals, regardless of who receives such pensions.

The Ministry of Finance supported its conclusions with the position of the Ministry of Labor, set out in letter No. 21-1/B-649 dated 08/03/2018.

The Ministry of Labor clarified who is a pensioner in the event of the loss of a breadwinner by a child under the age of 14 and the care of such a child by his other parent.

In accordance with Part 1 of Article 10 of Federal Law No. 400-FZ, disabled members of the family of the deceased breadwinner who were dependent on him have the right to an insurance pension in the event of the loss of a breadwinner.

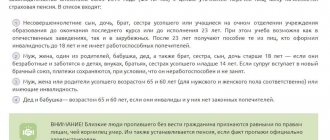

The following are recognized as disabled family members of the deceased breadwinner:

- children, brothers, sisters and grandchildren of the deceased breadwinner who have not reached the age of 18, as well as children, brothers, sisters and grandchildren of the deceased breadwinner studying full-time, but no longer than until they reach the age of 23 or children, brothers, sisters and grandchildren of the deceased breadwinner over this age, if they became disabled upon reaching the age of 18;

- one of the parents or spouse or grandfather or grandmother, brother or sister of the deceased breadwinner, regardless of age and ability to work, if he (she) is busy caring for children, brothers or sisters of the deceased breadwinner who have not reached the age 14 years old and doesn't work.

Thus, the recipients of the survivor's insurance pension will be those persons who meet the specified conditions for the appointment of a survivor's insurance pension and are entitled to receive it and to whom, accordingly, this pension is assigned - that is, it can be the child himself, and the above-mentioned relatives of the deceased breadwinner.

At the same time, it should be especially noted the peculiarity of the delivery of pensions to minor pensioners, which is that the minor citizen himself has the right to a pension, but at the same time, the delivery of this pension can be made both in the name of the minor citizen himself and in the name of his legal representative.

In the event that a survivor's insurance pension is established only for a child under the age of 14, then he will be the recipient of the specified pension, while his legal representative (including one of the parents to whom such a pension is not assigned) in fact, will be the person who fulfills the obligations to receive funds (in this case, the pension assigned to the child) due to the incapacity of the child himself.

The above-mentioned letter from the Ministry of Finance and the attached letter from the Ministry of Labor were brought to the attention of the Federal Tax Service letter No. PA-4-21 / [email protected] dated 08/21/2018.

Upcoming free webinars

- 10.08.2021

What to do if you are summoned to the Federal Tax Service's commission on problem counterparties? - 13.08.2021

Working with foreign counterparties: what is important to know - 17.08.2021

Criminal legal and tax risks when participating in state tenders

State survivor's pension in 2021

The state pension for the loss of a breadwinner is paid to close relatives of deceased military personnel, combat veterans, WWII, and astronauts who suffered from radiation disasters that directly depended on the income of the deceased.

Close relatives include:

- children under 18 years of age;

- children studying full-time in higher institutions up to 23 years of age;

- children with disabilities, congenital or acquired before the age of 18;

- spouses caring for children under 14 years of age;

- parents of retirement age, as well as if there is a disability;

- spouses, if they have reached retirement age.

Relatives of employees of the Ministry of Internal Affairs are entitled to receive a state pension. This right is given to the employee’s children and widows. If the deceased did not have a family, then the right to subsidies arises from the parents.

Children can count on support until they reach adulthood and are able to work. The widow receives cash payments until she enters into a new marriage.

If the recipient of a state pension in the event of the loss of a breadwinner is assigned other payments, such as insurance upon reaching retirement age, social benefits for disability, or employees for long service, the right to accrue two types of subsidies arises.

The right to receive two pensions simultaneously arises for the following categories of citizens:

- parents of a serviceman who died in the line of duty;

- military wife, unless remarried.

What privileges do children who have lost their breadwinner have?

Children left without one breadwinner can count, by and large, on a pension and one-time privileges associated with education and transportation costs.

Children recognized as orphans or left without parental care, before reaching adulthood, receive full state support and receive preferences in almost all areas of life.

For children who find themselves in a difficult life situation associated with the loss of one or both breadwinners, much depends on the legal literacy of their representatives and the desire of the latter to defend the rights of children.

The set of benefits varies in different regions, and their provision is of a declarative nature, so some privileges remain unclaimed due to citizens’ basic ignorance of their existence and their rights to receive them.

Social pension for loss of a breadwinner in 2021

A social pension for the loss of a breadwinner is assigned regardless of the length of service of the deceased.

Children of the deceased can receive it only in the following situations:

- have not reached the age of majority;

- are studying full-time at a university and have not yet turned 23 years old.

Other relatives cannot apply for a social pension. They may be assigned an insurance or government subsidy.

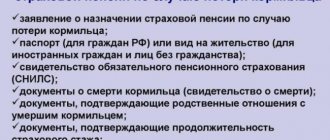

You can apply for pension payments in one of the following ways:

- in person or on the Pension Fund website;

- in person at the MFC;

- send documents by Russian Post.

Documents that need to be collected to receive a pension:

- statement;

- passport, birth certificate of children;

- death certificate of the breadwinner;

- confirmation of the fact of dependency.

They may also be additionally asked to collect certificates. It all depends on the specific situation, the type of pension benefit.

The amount of social benefits for a child in the event of the loss of one parent should be 50% of the income on which the family previously lived. If there is more than one child in the family, then the subsidy should be 100% of the income of the deceased.

Important! If the deceased father or mother was not officially employed, the amount of the monthly benefit will be 4959 rubles, if the child is an orphan, the amount of the benefit will be 9919 rubles.

Important! In a situation where a child, before reaching adulthood, gets married or the opportunity for official employment arises, payments stop.

State and social pensions begin to be paid on the first day of the month following the month of application.

The insurance pension is formed from the date of death of the breadwinner. The period for applying for this type of benefit is 12 months. If the application to the Fund is received after the established deadlines, the payment is accrued from the day the application is received.

You can receive pension payments in several ways:

- by mail (upon receipt, the day on which the postman will bring the benefit to your home will be determined);

- through a bank (it is possible to receive it through a bank cash desk, as well as by transfer to a bank card).

What are the survivor benefits?

In addition to pensions, there are a number of benefits that make life easier for the relatives of the deceased.

Benefits are provided to the following citizens:

- children under 18 years of age or students under 23 years of age who are studying full-time at universities and do not have another source of income;

- spouses or retired parents with disabilities;

- dependents.

The legislation provides benefits for the loss of a breadwinner both at the federal level and at the regional and municipal levels. Local authorities have the right to independently regulate the list, as well as the amount of benefits, depending on the economic capabilities of the region.

List of benefits provided to relatives of a deceased breadwinner:

- additional payment up to the subsistence level;

- free travel on public transport (bus, trolleybus, tram);

- dental prosthetics, including repair and manufacturing (except for precious metals);

- medicines from the approved list;

- discounts on the use of utilities;

- vouchers to sanatoriums (with payment of travel to the place of treatment).

There are also benefits for children in case of loss of a breadwinner. Thus, the following may be provided:

- free dairy kitchen for up to two years;

- free or discounted meals at school;

- free or discounted textbooks;

- advantage when entering college, technical school, university;

- visiting cultural institutions such as theaters, cinemas, exhibitions and museums - at the expense of the state.

Other benefits

In addition to receiving a social pension, social services in kind and cash can also be provided. This is regulated by the Federal Law “On State Social Assistance” dated July 17, 1999 N 178-FZ. This social service is necessary in order to support the livelihoods of citizens. In some regions of the Russian Federation, different types of assistance provided, as well as the amount of this assistance, may be established. Social assistance and payments may differ slightly from each other, depending on the region.

At the time when the minor receives a pension, a cash payment is established that will be made every month. This payment will be paid by social security authorities. Its size may vary depending on the region, however, additional payments cannot be less than the minimum subsistence level established in the region.

The benefit, which is paid every month, is due to persons under sixteen years of age. If the child is studying, the age increases to eighteen years. In addition to the monthly payment, the student can count on compensation, which is due every year. This compensation is issued by educational authorities. A minor can count on the following assistance and benefits:

- receiving dairy products and formulas until he reaches two years of age, and in case of a chronic illness - until he reaches fifteen years of age;

- receiving free medications until he reaches three years of age;

- preferential travel on public transport while he receives a pension payment;

- free entry to zoos, theaters, museums, parks run by the municipality until he reaches seven years of age;

- preferential visits to zoos, theaters, museums, parks, from seven to eighteen years old;

- two meals a day and textbooks while he is in school;

- free food while he receives vocational education.

Executive authorities in each region can independently expand the types of assistance and benefits provided to this category of children.

What benefits do children have for losing a breadwinner if they are raised by a single mother?

If a child is being raised by a woman who has the status of a single mother, but the birth certificate confirms paternity, then the state provides a full package of survivor benefits for this child. The child also has the right to receive pensions and a number of benefits in the field of housing and communal services, use of public transport (trolleybus, bus, train), free medicines, and medical care.

The Russian government supports children who have lost a parent, and the required subsidies are paid until the child has the opportunity to earn a living on his own.

Important! Adopted children have the same rights to receive subsidies. In addition, they may qualify for the following benefits:

- travel on public transport at the expense of the state;

- preferential two meals a day in schools, free textbooks;

- free visits to cultural sites;

- survivor's pension, including all necessary additional payments, for example, for students under 23 years of age, or additional payments up to the subsistence level.

What benefits are provided for children in the event of the loss of a breadwinner?

What happens in this case if the child becomes an orphan?

Children who are left without a mother and father have the right to a survivor's pension. If the pension is social, a supplement of 15,000 rubles is calculated.

In addition, the following benefits are provided:

- Budget-funded places are mandatory allocated for vocational education (not exempt from entrance exams);

- free treatment in medical institutions;

- housing up to 18 years of age on the basis of a rental agreement (after five years of residence, you can submit documents for privatization).

If a citizen who had a dependent child with a disability died, the widow or widower has the right to:

- additional payments in the amount of 5,500 rubles (if employed);

- early retirement (five years earlier than the statutory period);

- if you have a job, you can take 4 days off at any time (the employer must pay for these days);

- use public transport (except taxis) free of charge with an accompanying person;

- obtaining housing if diagnosed.