A survivor's pension is a measure of state assistance to persons who find themselves without the support of a loved one after his death. The benefit is aimed at compensating loved ones for the income that they could have received during the life of the deceased. A survivor's pension after 18 years of age is possible in cases determined by the current legislation of the Russian Federation. Confirmation of these conditions allows you to extend the payment when the child reaches adulthood. Read more about this in our article.

Survivor's pension after 18 years: size and documents

Types of pensions and survivor benefits

The list of support measures provided by the state in case of loss of a breadwinner includes:

- pension payments;

- benefits and compensation for paying for housing services, public transport, child nutrition in educational institutions;

- free participation in cultural events;

- benefits for admission to educational institutions, camp vouchers, sanatorium and resort treatment, and so on.

Receiving state support is carried out through the Pension Fund, MFC, and social protection authorities.

In 2021, citizens are provided with three types of survivor's pension. The grounds and procedure for their appointment are determined by the regulatory framework: Federal Law No. 400 of December 28, 2013 (as amended on December 27, 2018), Federal Law No. 166 of December 15, 2001 (as amended on December 27, 2018).

Table 1. Types of pension benefits for the loss of a breadwinner

| View | Reasons for appointment |

| Insurance | If the deceased has an insurance record, reflected in the personal account in the Pension Fund. Duration of work activity and cause of death are not taken into account |

| State | Paid to the family of a deceased military man or astronaut in case of death due to disasters |

| Social | Required if the person did not have insurance coverage or committed a crime. The appointment is possible if the deceased was a pensioner, disabled or was killed by his own dependent |

The main recipients of benefits are the children of the deceased who are under 18 years of age. But dependents can also be elderly parents, grandparents of the deceased, an adopted child, or a disabled person. After reaching 18 years of age, children have the opportunity to extend benefits in cases determined by the legislation of the Russian Federation.

Grounds for receiving a pension after 18 years of age

After reaching the age of majority, the payment of benefits ceases. The main reason for continuing to accrue survivor benefits to children is their full-time education in educational institutions. This takes into account institutions of any type: colleges, universities, graduate schools, and so on. Training is also available at international institutions. If previously it was possible to enroll only in those places with which the Russian Federation had an agreement, then according to the latest changes in legislation (from November 2021), the educational center can be any.

IMPORTANT! Part-time or distance learning is considered insufficient to receive benefits.

Full-time study in educational institutions - the basis for extending the payment of a survivor's pension after 18 years

An exception to extending a pension after 18 years is studying in:

- Police Higher School;

- fire schools of the Ministry of Internal Affairs;

- Customs Academy;

- military schools.

This is due to the cadets’ credit for years of service and army experience during the period of training. The pension is granted until graduation from an educational institution or until the citizen reaches the age of 23. Also, the conditions for payment of benefits after 18 years are:

- Disability assigned before reaching adulthood. Pension accrual for this category of persons continues even after 23 years.

- Relatives of the deceased (brother, sister, son, daughter), who are unemployed and caring for his children under 14 years of age, are entitled to receive payments.

If a dependent was responsible for the death of the breadwinner, and this is proven in court, he is entitled only to a social pension.

Conditions and documents required for calculating payments

The main requirement for persons applying for a survivor's pension after the age of 18 is the status of a full-time student.

At the same time, this condition has limitations. Upon reaching 23 years of age, regardless of whether the person continues studying, funding stops. The reason for extending the payment period can only be the presence of disability since childhood.

The level of educational institution does not affect the possibility of receiving pension payments. The recipient may be a student at a university, college or technical school. At the same time, if a student is studying part-time or evening, he has no grounds for calculating a pension.

Citizens not included in the list of recipients of financial support:

- persons studying in military schools;

- undergoing training at the institutes of the Ministry of Emergency Situations and the Ministry of Internal Affairs;

- cadets of higher police schools;

- students of the Customs Academy.

Read more: Is it possible to receive a parcel using a driver’s license?

These categories of students do not have the right to apply for payments under the SPC, since while studying at the above-mentioned educational institutions they are on state support, and their length of service is included in their future pension.

Those students who receive education at foreign universities are also entitled to pension support, but only on the condition that admission took place through distribution or a special direction. To process payments, they need to provide supporting documentation to the Pension Fund.

You can get an education both on a budgetary basis and on a commercial one. This fact does not matter for calculating benefits.

Making payments

To assign benefits, the future pensioner or his representative contacts:

- territorial branch of the Pension Fund of the Russian Federation;

- MFC (multifunctional center).

A citizen must submit an application, and it can be delivered in person, by mail (registered mail with an inventory) or electronically through the Pension Fund portal.

It is advisable to contact the MFC if an agreement on interdepartmental interaction has been concluded between it and the territorial department of the Pension Fund, that is, if the center can provide such a service to the population.

The date of registration is considered to be:

- the day the application was accepted by the Pension Fund or MFC;

- date of mailing;

- day of transmission via the Internet.

Citizens staying for permanent residence in another country send a list of documents to the central branch of the Pension Fund in Moscow.

State and social benefits are accrued from the 1st day of the month of application, insurance - from the date of death. In the latter case, it is recommended not to exceed the annual application period, otherwise the pension will be accrued 12 months before the date of registration. For example, the breadwinner died on February 10, 2021. If registration occurred in the next 12 months, then the payment is calculated from the date of death (from February 10, 2017). But if the application is submitted later than the established period, for example, May 11, 2021, then payments are due from May 11, 2017.

Primary purpose

When you first apply for payment, an application is provided in any convenient way.

Sample application for survivor benefits

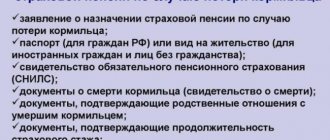

List of documents for assigning payments:

- passport, SNILS;

- confirmation of the death of the breadwinner;

- papers indicating the degree of relationship with the deceased;

- certificate of income, length of service (not always required);

Certificate of insurance experience

- a document confirming the basis for the payment (medical certificate of disability, certificate from an educational institution, etc.).

Certificate of study at a university Medical certificate of disability

Additionally, a citizen may need the following documents:

- confirmation of residence in the Far North (for calculating increasing coefficients);

- a document confirming the death of the second parent or granting the deceased the status of a single mother (certificate in form No. 25);

Help on form No. 25

- confirmation of residence of the child of the deceased with the future pensioner.

To apply for a social pension, the list of documents is the same, but a certificate of length of service and income of the deceased is not provided. When assigning a state benefit, it is important to provide information:

- about the cause of death (pathology or combat injury);

- about the period of service;

- confirmation that the widow is not married.

Even more information about applying for a survivor's pension can be found on our website.

Extension

To extend the payment assigned by the state, a citizen goes through a standard registration procedure. You must fill out an application indicating the list of attached documents.

Sample application for renewal of survivor's pension

The package of documents includes:

- passport (original and copy);

- confirmation of death of the breadwinner (original and copy);

- certificate of full-time study;

- confirmation of the degree of relationship with the deceased.

Depending on the circumstances, additional documents may be required to assign payments:

- confirmation of place of residence;

- a certificate from social security confirming the breadwinner’s status as a guardian;

- confirmation of the recipient’s lack of employment if he is caring for the children of the deceased under 14 years of age;

- certificate of income of the deceased.

Resumption of payments is made from the 1st day of the month following the one in which the application was submitted.

all about the survivor's pension for military personnel in the article on our website.

Video - Extension of survivor's pension for students

How to compose?

Depending on what type of pension provision a citizen is applying for, a notification must be submitted either to local units of the Pension Fund of the Russian Federation or to military pension authorities (authorized branches of law enforcement agencies).

A sample application for a survivor's pension can be obtained from any division of the Pension Fund. Citizens are also given the opportunity to familiarize themselves with this document on the official website of the Pension Fund.

Basic rules for filling out the form:

- in the very first empty line you need to enter the name of the local PFR authority to which the application and other documents necessary for the assignment of benefits are submitted;

- in paragraph 1 you need to indicate the information and contact details of the applicant (full name, place of registration, telephone number, etc.). In cases where a citizen entitled to receive a pension benefit is represented by another person, it is necessary to indicate in paragraph 2 not only his personal data, but also the legal grounds for such representation. If a citizen applies to government agencies in person, the second section should be left blank;

- indicate the type of benefit required and information about receiving other cash payments in paragraph 3 of the form;

- in the next section you need to familiarize yourself with the basic rights and obligations of the recipient of the pension benefit;

- in the last, fifth paragraph, you need to indicate the list of documents to be submitted. Then put the date of completion and signature with a transcript.

Read more: Is it possible to sell a mortgaged apartment during a divorce

? A claim for a survivor’s pension can be found on the official website of the Pension Fund of the Russian Federation in the section on forms and forms .

Calculation and amount of pension

The amount payable depends on the type of benefit received, cause of death, profession and other circumstances.

Table 2. Amount of survivor's pensions

| View | Recipient | Cause or circumstances of death | Payment amount |

| State | Relatives of petty officers, sergeants, sailors, soldiers | Combat injury | 200% of social pension (SotsP) or 10068.5 rubles |

| Disease | 150% of Social Security or 7551 rubles | ||

| Relatives of a serviceman | Disease | 40% of DD - at least 150% of Social Security | |

| Combat injury | 50% of cash allowance (DS) - at least 200% of Social Security | ||

| Children | Disaster at a technical facility (death of father and mother or single parent) | 250% of Social Security or 12,585 rubles | |

| Other family members | Disaster at a technical facility | 125% of Social Security or 6292 rubles | |

| Dependents of astronauts | 40% of salary | ||

| Social | Each recipient | 5034.25 rubles | |

| When both parents die | 10068.53 rubles |

The required amount of the insurance pension (StrP) is established on the basis of the individual pension coefficient (IPC) and the cost of one point (SPK).

Calculation formula: StrP = IPK*SPK

However, when determining the insurance pension, increasing coefficients and a fixed base part are also taken into account. The latter is 2667 rubles, for orphans - 5334 rubles.

Important! It happens that a dependent may qualify for several types of pensions, but according to the law he is entitled to only one benefit. He has the right to choose it, assessing it from the standpoint of his own benefit. Pension Fund employees can independently designate a pension option, choosing the most profitable one for the recipient.

The last time the social pension was increased was in 2021 to the amount of 5,034 rubles. In 2021, its increase is planned on April 1 by approximately 2%. However, in 2021, the size of the insurance pension increased due to the increase in the SPK (the cost of 1 pension point) to 87.24 rubles and the indexation of the fixed payment to 5,334 rubles.

Are payments available to working students?

Part-time work for students in their free time is common. However, it should be taken into account that the main condition for payment of survivor benefits is the recipient’s disability. If the work is carried out without official registration and is not recorded anywhere, the pension is paid as usual. If a citizen enters into a contract for work activity (even for 2-3 summer months), this becomes the basis for stopping the accrual of benefits. It is believed that from this moment a person has a source of his own income, which means he is removed from state support.

Important! Working students are deprived of their statutory pension rights.

Working students can receive a survivor's pension if they are employed unofficially

Until what age is the pension paid and can it be extended?

According to the general rules established in the Russian Federation, social benefits in the form of pension payments to dependents who are left without parental support are established until the age of eighteen, that is, the age of majority. At the same time, in the event of the loss of a breadwinner, students will receive funding until the age of 23.

Read more: Dimensions of parking spaces for cars

The reason for this extension is that a full-time student is required to attend lectures every day, which physically prevents him from working.

Then the question arises, how to extend your pension? Renewal or extension of financing under the SPPK occurs in the same manner as the initial registration. Within six months after the termination of financial support, you must contact the UPFR with a package of papers and a request (application) to extend the payment period.

Working students are deprived of the opportunity to receive benefits, since labor activity involves the receipt of material income, which means that the citizen does not need additional support.

Starting from 2012, it is possible to receive survivor pension payments for students not only during the academic year, but also during the main summer holidays. That is, they do not stop during the holiday period.

A separate category of recipients are persons with disabilities registered before adulthood. Citizens with disabilities are not subject to the age limit for receiving a survivor's pension after 18 years of age. Benefits for children with disabilities are accrued and funded for life.

Is the pension paid during holidays?

Until 2012, the practice was to exclude the holiday period from the annual benefit amount. However, according to the current legislation of the Russian Federation, payments are retained by the student for the entire duration of his studies. The only exception is when a citizen turns 23 years old. This age causes the cancellation of further payments.

Important! Vacations do not serve as grounds for cancellation or suspension of pension accrual, regardless of their duration. Payments are made as usual and in volume.

Are benefits accrued during academic leave?

An official break from studies is possible if the student has compelling reasons: illness, pregnancy, childbirth, and so on. With the consent of the administration of the educational institution, an order is prepared to grant the student administrative leave. The student must provide a copy of the document to the PF department, where a temporary break in studies is recorded. However, it does not affect pension payments - they remain the same and do not stop. The status of a person undergoing training is assigned to the person for the entire period of administrative leave. The break affects the extension of the study period. But, if the benefit recipient turns 23 years old before the end of the last course, benefit payments are canceled.

Termination of payments

Payments are canceled automatically when the child reaches the age of 18. If a person applies for an extension of benefits on the grounds established by law, then it is renewed until he turns 23 years old or ends his studies. For people disabled since childhood, pension rights are assumed for life.

Important! If the recipient of the benefit gets married, all payments remain in the same amount.

Clause 3-8 of Article 10. Conditions for assigning an insurance pension in case of loss of a breadwinner (Federal Law No. 400)

Pension benefits are provided to disabled persons undergoing full-time training. If a citizen was expelled, dropped out of school, transferred to a correspondence course, or started working with a work record book, he is deprived of the right to receive benefits. The person is obliged to notify the Pension Fund about this by appearing with documents indicating the grounds for stopping payments and other benefits. The citizen fills out an application for waiver of charges. If the PF was not informed and payments were made illegally, the recipient will be required to reimburse the funds paid. In case of refusal, the collection case is resolved in court. To repay the debt to the state, bailiffs make an administrative decision to transfer money from the debtor’s accounts to the Pension Fund or seize his property. In this case, court costs and bailiffs' commission are added to the amount of collection. The death of the recipient is also grounds for termination of payments.

Pension payments and other state benefits provide support to families who find themselves in difficult situations. The measures are aimed at providing material assistance to citizens until they acquire the ability to work and financial independence.

Survivor's pension after 18 years of age: conditions for students to receive it

A survivor's pension is a type of financial assistance that is paid to individuals in connection with the death of the only able-bodied family member. The legislative basis for the calculation of this assistance is the Federal Law of December 28, 2013 N 400 “On Insurance Pensions”, Article No. 10 of which provides for the conditions and procedure for regular cash payments.

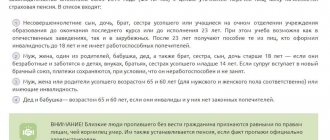

Thus, disabled dependents of a deceased citizen or a citizen recognized by the court as missing can apply for help from the state. Namely:

- family members who have reached retirement age ;

- minor brothers, sisters, children and grandchildren of the deceased. It is worth noting that this rule has some exceptions. Thus, for 18-year-old family members who are studying full-time in educational institutions, they have the right to extend the receipt of a survivor's pension until they turn 23 years old. A full-time student is officially recognized as disabled until graduation from a university, institute or other institution that provides the opportunity to receive secondary vocational education.

- relatives who care for disabled and young family members of the deceased.

In short, the main conditions for adults to receive survivor benefits are:

- recognition of the interested person as a dependent of the deceased. In accordance with the provisions of the law, this category includes: members of the family of the deceased who were fully supported by him and had no other sources of income;

- presence of disability or full-time study at an educational institution.

- the fact of caring for the minor relatives of the deceased.

Citizens over 18 years of age who have lost their breadwinner, in cases provided for by law, have the right to receive a social pension. Payment of this benefit is possible subject to certain conditions:

- permanent residence in the Russian Federation;

- establishing the fact of disability or training.

It is also worth noting that the law provides for cases when a student receiving a pension may study outside the state. Thus, Federal Law No. 400 dated December 28, 2013 indicates that a referral to study abroad must be drawn up in accordance with the current international treaties of the Russian Federation.

A person who studies at a military school, customs academy, educational institution under the Ministry of Internal Affairs, etc., is not entitled to receive a pension. This is due to the fact that cadets of these educational institutions earn experience and a future state pension during their studies.

Amount of survivor's pension after 18 years of age

A student's survivor's pension consists of the following parts:

- fixed - the minimum amount of payment, which is fixed by law (today the amount is 2491 rubles 45 kopecks);

- insurance - calculated individually for each person, depending on the work experience of the deceased.

The formula determining the amount of insurance payment for the loss of the sole breadwinner in a family is enshrined in the current legislation of the Russian Federation. It is calculated as follows: IR*SK+F , where:

- IC - the total score of a deceased citizen, which directly depends on the length of work experience and its duration;

- SK is a legally defined indicator of the significance of one point at the time of calculating the insurance payment for the loss of a breadwinner;

- F is the minimum payment amount established by law.

Minors and persons over 18 years of age (full-time students) who have lost one parent currently receive a social pension in the amount of 5,034.25 rubles per month. In cases where a student is an orphan, the social pension payment to students for the loss of a breadwinner doubles and amounts to 10,068.53 rubles.

Until what age is a survivor's pension paid to a student?

This type of pension benefit is paid to the student until he reaches the age of 23. Also, regular financial assistance from the state is terminated in the following cases:

- graduation or expulsion. The student needs to inform the branch of the local pension fund of the Russian Federation about this event and write an application for refusal of pension provision. Otherwise, for concealing the fact of expulsion from an educational institution, it will be necessary to reimburse illegally received funds in the period from the date of expulsion until the moment of disclosure of this information;

- transfer to part-time or evening classes. In this case, the student loses the right to receive benefits.

- official employment. survivor 's pension for a working student is prohibited by law. After all, this means that he has a source of income and, therefore, can do without state help.

It is worth noting that during the summer holidays, receiving a survivor's pension after 18 years of age continues, because the student status is not lost.