Author of the article: Lina Smirnova Last modified: January 2020 9912

Alimony can be calculated in different ways. When paying benefits, disputes often arise about whether alimony should be calculated as a tax deduction. Let's consider what a tax deduction is, when it can be assigned and in what order it is carried out, and also when, when paying alimony, it becomes necessary to take into account the tax deduction when calculating the amount of alimony.

Alimony and personal income tax: before or after?

Usually, the employer receives a writ of execution, according to which the accountant must deduct money for the child from the employee’s salary, namely:

- performance list;

- court order;

- agreement, with notarization, on child benefits;

- resolution of the bailiffs ( Parts 1, 3, Article 12 of the Federal Law of the Russian Federation No. 229 ).

If the writ of execution does not indicate a fixed amount, then they will be charged exactly like this ( Article No. 81 of the RF IC ):

| №/№ | Number of children | How much to pay |

| 1. | One | 1/2 of earnings |

| 2. | Two | 1/3 of earnings |

| 3. | Three or more | 1/4 of earnings |

Helpful information! Alimony and personal income tax collected from the employee from the monthly salary are regulated by Art. No. 99 Federal Law of the Russian Federation .

Many payers are interested in: “How is alimony deducted from the accrual or minus personal income tax?” They are interested in when children's money is withheld: before or after the duty is withheld? A comprehensive answer to this question is contained in the text of Federal Law No. 223, which regulates the topic “Tax deduction for alimony.” The law states that all amounts of child benefits can be withheld only after income taxes have been withheld.

Note! Regarding alimony and income tax: when calculating wages, the accountant must first subtract the tax duty from the employee’s salary, and only then, from the remaining salary money, calculate the amount of child support.

Let's give a clear example of the calculation:

A certain Ivanov is obliged to pay his son money in the amount of ¼ of his salary. His salary is twenty thousand rubles. Personal income tax – 2,600 rub. Thus, Ivanov will receive 17,400 rubles. Let's calculate the alimony amount:

| 17.400 rub.: 4 = 4.350 rub. Amount of money for my son: 4,350 rubles . |

Remember! Children's money paid in a lump sum is not taxed. Accordingly, if payments are made in a fixed figure, then they are not affected by the amount of salary and tax.

Here is a list of steps for calculating alimony:

- When the payer receives a salary, in accordance with the terms of labor legislation.

- When the standard duty is withheld from a salary 13%.

- When child support is calculated from the remaining income.

- When payments are transferred to the recipient's bank account.

In general, the mechanism for calculating the above payments is very simple, but it becomes very complicated if there are several writs of execution. Citizens receive compensation for the provision of minors, property and material benefits from using the loan.

Is alimony taxable?

Alimony is the money that a parent allocates for the maintenance of his minor child who does not live with him.

Let's consider the procedure for calculating payments for a child from the payer's salary:

- First, the total monthly earnings are determined, taking into account allowances and bonuses.

- Total income is taxed. All tax breaks are included in the calculation here.

- The child transfer specified in the writ of execution is withdrawn from the net income.

- The costs of transferring money to the recipient are borne by the payer.

Thus, it is clear that income tax on alimony is not allowed by law. And this amount is determined after all state duties and fees are withdrawn from the total income of the alimony payer.

Russian legislation does not provide for taxation of alimony. Since they do not relate to income. These funds go to the second spouse to support the joint child, that is, a redistribution of funds occurs.

An analogue of this redistribution can be an example in a family when a wife receives money from her husband to buy food. They do not become her personal, she does not get rich from them and, accordingly, there is no reason to charge a tax on them. Payments for a child, if considered conditionally, are part of the family budget, even in cases where the family has actually broken up.

When answering the question whether alimony is subject to income tax, the answer should be unequivocally negative. All contributions to the state budget were previously taken from this category of payments, so the recipient can safely spend them.

Calculation of personal income tax when withholding alimony from material benefits

A material benefit is the money that the person paying the tax receives as a saving on something.

Most often, material benefits occur when receiving an interest-free loan: in this case, money is saved due to unpaid interest.

Important information! The Tax Code of the Russian Federation states that alimony cannot be collected from material benefits due to the fact that this money does not exist in reality: it is “theoretical” and exists only on paper. But, when calculating the tax duty, this illusory money is taken into account, and due to it the tax payment increases.

Let's give a clear example:

A certain Petrov, in 2020, received a cash loan from the organization, without interest. The material benefit is in percentage savings . The amount of benefit is determined at 2/3 of the refinancing rate. In Art. No. 224 of the Tax Code of the Russian Federation states that such income should be subject to a tax duty of 35% .

Do not forget that money for a child should be calculated without taking into account personal income tax for material benefits.

Personal income tax when withholding alimony if the debtor uses a tax deduction

For employees of organizations that have children (or a dependent under 24 years of age), the Tax Code of the Russian Federation provides for a monthly tax discount for them. This discount directly depends on the number of minors ( clause 4, clause 1, article No. 218 of the Tax Code of the Russian Federation ):

| №/№ | Number of children | Tax compensation amount |

| 1. | one two | 1,400 rub. |

| 2. | three or more | 3,000 rub. |

An important argument for obtaining a tax deduction for personal income tax is the condition under which the payer’s children will be provided for.

Do not forget! Receiving a tax deduction helps to increase the income “basket” of the alimony payer, and accordingly it increases the amount of child payments.

Standard deduction for alimony worker

An employee from whose income alimony is withheld has the right to receive a standard “children’s” personal income tax deduction for the child for whom he pays alimony (we are talking about income subject to personal income tax at a rate of 13%). The deduction is:

- 1400 rub. – for the first and second child;

This deduction is provided to the employee until the month in which his total income from the beginning of the year exceeded 280 thousand rubles.

Personal income tax is a tax that is levied on the income of individuals. It is 13% of the income and is withheld from the taxpayer’s official income.

Recipients of alimony often ask the question: is the alimony they receive income?

Income deduction for children

Let's consider the topic of alimony collected from property tax deductions.

The calculation of alimony benefits, when making a property deduction and withholding income duty from it, is of interest not only to accounting workers, but also to the payers themselves. For example, it is well known that such money can be quite large and helps to increase the income of the payer.

In case of receiving a property return of funds, the recovery of maintenance for a minor occurs in two ways:

- A person paying maintenance to his child receives a property deduction directly from the employer. Thus, his “basket” of income becomes larger. It is based on the amount received that the children's money is calculated.

- At the end of the year, the father, the alimony payer, provides the tax authorities with an income declaration and, at the same time, fills out an application for the return of the excess withheld money. In this case, the ex-husband is obliged to calculate the amount of the child support fee himself and transfer the money to his ex-wife.

Note! If the children's money was never transferred, then the child's mother has the right to file a lawsuit to receive it.

Why are taxes not collected on alimony payments?

Analyzing the absence of income tax on alimony, experts pay attention to the principle of receiving these funds. Income refers to the profit received for work or activities performed. Alimony is calculated specifically as support for the incapacity of a child, wife or parent.

To fully understand the situation, an analogy is drawn with the cohabitation of the payer and the recipient within the same family. If one of them transfers funds to the other for personal needs from his income, then such transfers are not considered the recipient’s profit and are not taxed - they are only redistributed between citizens.

A similar situation is observed with the calculation of alimony, the only difference being that the funds are transferred with a certain regularity by agreement or by court decision. Separate living is not mandatory.

Personal income tax is not withheld from alimony payments, since the redistribution of funds is based on already calculated income and does not allow double taxation.

Even if the payer is not officially employed and his wages are not taxed, it is assumed that he himself fills out an income declaration and pays the required interest.

Calculation of alimony, in the presence of writs of execution

In the text of Federal Law No. 229, in Art. 111 , talks about the approved procedure for the execution of penalties.

When answering the question: “Alimony by law is withheld before or after personal income tax?”, the following algorithm of actions should be taken into account. First, personal income tax must be deducted from the employee’s salary, and after that, collection can be carried out in a strictly established manner:

- collection of alimony;

- compensation for the amount of damage to a third party (these are fines and other taxes);

- deduction of the amount of refundable funds for causing moral damage.

You should know! All first-priority enforcement payments cannot amount to more than 70% of the income of the alimony. In relation to penalties of the second and third degrees of importance, the amount of payments that can be taken should not exceed 50% of the income.

The accountant is obliged to make a calculation of all money subject to recovery under writs of execution, taking into account their maximum permissible values. If fees of the second degree of importance are not fully repaid, then the balance must be charged to the next payment stage. All money withheld for alimony and duties must be reflected in the payslip ( Article No. 136 of the Labor Code of the Russian Federation ).

When, for certain reasons, a payment debt appears on a minor, it is transferred to the next payment payment, and a penalty cannot be charged.

From what income is alimony paid?

In accordance with the Government Decree of the Russian Federation No. 841 dated July 18, 1996, which states that alimony for child support is calculated from all the payer’s income specified in the list established by law.

It includes the following types of income:

- official wages, as well as bonuses and various allowances calculated by the enterprise’s accounting department;

- payments in connection with vacation and illness (based on sick leave);

- pensions and scholarships;

- amounts paid in the form of financial assistance;

- funds from rental housing;

- other income.

The returned amount of the tax deduction is not directly included in the legally adopted list of income from which alimony is required to be paid.

Tax benefits

To be eligible to receive a tax break when paying a monthly child benefit, the employee must officially confirm a decent level of support for his children.

The main reason for benefits is the conscientious and regular payment of children's money.

To receive benefits, you must provide the following documents to the Federal Tax Service:

- about divorce (divorce certificate);

- about the birth of a child (establishing paternity);

- alimony agreement, court order (copy), writ of execution along with a court order;

- a certificate from an accountant, payments and receipts (anything that can confirm the proper execution of payments for the baby).

Summary

We found out that money received for a baby is not considered the recipient’s earnings. Alimony payments are just a method of distributing children's money between ex-spouses and parents of the child for his maintenance year after year.

Neither in 2020 nor in 2020, child support is not subject to taxes and fees ( clause 5, article No. 217 of the Tax Code of the Russian Federation ). The question is: “Alimony is considered immediately before or after the deduction of personal income tax?” is clearly regulated by law.

First, the accountant, according to Resolution No. 841 , calculates the entire income “basket” of the payer (his salary, bonus and allowance). Then the personal income tax (NDFL) is subtracted from the received amount. After this, the children's money is withheld and only then is it transferred to the recipient. In this case, all payments for the money transfer must be borne by the payer.

Why don't you have to pay taxes on alimony?

Alimony payments are not the income of the recipient. Alimony is simply a way of distributing between parents the funds necessary for the full maintenance of their common child.

A comparison that comes to mind is how a non-working husband gives his non-working wife money for groceries or other family expenses. This money is not her personal income, therefore, she does not need to pay taxes on it. Moreover, the husband has already paid all taxes at the time he received his income.

How are income taxes and alimony payments withheld from paychecks?

The procedure for deducting these payments from your salary is as follows:

- The monthly salary of the payer is determined (taking into account the amount of salary, bonuses, allowances);

- Taxes, including personal income tax, are deducted from earnings;

- From the remaining amount of earnings, alimony is withheld in accordance with the writ of execution;

- Alimony is transferred to the recipient; all postal or bank expenses for transferring funds are borne by the defendant.

Thus, at the time the salary is calculated, all necessary deductions from it in favor of the state occur. And the amount of monthly alimony payments is withheld from earnings after taxes, including income tax, are withheld. But this does not mean that alimony is taxed - only the payer’s earnings are subject to income tax. Alimony payments are not subject to any additional taxes or fees.

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

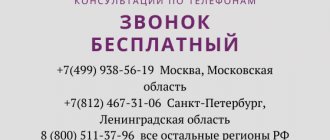

- Call the hotline:

This is important to know: The procedure for collecting alimony from an old-age pension

Taxation issues are always of interest to everyone. Parties to alimony legal relations are also interested in whether alimony is subject to income tax. It is clear that the recipient of the funds wants to know, for example, whether they will pay him 25% of the payer’s income in net form or 25% minus income tax. The payer also wants to know whether something additional, some kind of tax, will be withheld from him instead of the recipient of the funds. And it is important for the employer of the alimony provider to know what amounts to withhold from the employee in order to act within the framework of the law.