Deduction amount

If the parents have not agreed on the amount of child support, then it is collected in court in the amount of:

- quarters of income - per child;

- thirds of income - for two children;

- half of earnings - on three or more.

If a citizen does not comply with the court’s demand voluntarily, then the writ of execution is sent to his place of work. The employer must fulfill it unconditionally.

According to the writ of execution, in addition to current alimony, the resulting debt is collected. The total percentage of such deduction can reach 70% of the employee’s earnings.

Example

Payment order for alimony, sample 2020

When submitting a payment order, you must indicate your full name. recipient, as well as his bank details. They are either indicated in the writ of execution, or the employee must indicate them in the application (when paying maintenance for minors by agreement).

This is important to know: How to transfer alimony according to a writ of execution

Payment of maintenance for children is debited from the account first (Article 855 of the Civil Code of the Russian Federation), therefore, in field 21 of the payment order you must indicate “1”.

When transferring by agreement between the child’s parents, the details of this document should be indicated in the purpose of payment.

Transfer of alimony: sample payment order for payment at the request of an employee

If maintenance is paid for a minor by court decision, then the purpose of payment must indicate the number and date of the writ of execution.

Sample payment order: alimony under a writ of execution

From what income is alimony withheld?

Maintenance for minors is paid from all employee income not only during work, but also during absence from work:

- wages;

- bonuses, allowances, and other remuneration for performing job duties;

- vacation pay;

- temporary disability benefits.

The full list is given in Government Decree No. 841 of July 18, 1996.

IMPORTANT!

The deduction should be made from the salary after personal income tax has been deducted.

The types of payments from which child support is not withheld include (Article 101 229-FZ):

- travel expenses and other accountable amounts;

- compensation payments in connection with the use of the employee’s personal property in the interests of the organization. The government list clarifies that we are talking about the use of tools, transport, equipment, other technical means and materials, reimbursement of expenses associated with their use (RF Government Decree No. 388 of 04/01/2019);

- compulsory social insurance benefits, with the exception of sick leave payments;

- financial assistance in connection with an emergency or the death of a family member.

Transfer to the account of bailiffs

Sometimes the decree on the execution of a court decision does not indicate the second parent as the recipient, but the Office of the Federal Bailiff Service. This situation may arise, for example, when debt is collected, the applicant or child is unable to receive funds either in cash or in non-cash form (no bank card or account), and also if the children are supported by the state. In this case, the recipient of the payment will be the Federal Bailiff Service. But despite the fact that the funds are transferred to a government agency, the payment order when transferring alimony should not be filled in the fields intended for payments to the budget. This is explained by the fact that, in essence, such a payment is not a transfer to the budget (tax, fee), but is simply accumulated by the bailiff service in a special account for further payment to the recipient.

Payment methods for a minor

The former spouses determine the method of calculation independently, regardless of the basis for alimony. If the father for some reason avoids making the obligatory payment, the bailiff has the right to forcibly withhold the money using a writ of execution. Payment options are as follows.

Let's consider the last payment option - by filling out a payment document. This method, although it looks complicated for a person who does not have an economic education, is actually very convenient. The accountant of every organization needs to know how to fill out payment orders for alimony.

Alimony in favor of bailiffs

Usually, alimony is transferred in favor of the claimant - the ex-wife (husband), parents, etc. That is, the employer draws up a regular payment order and transfers the money to the current account of, for example, the ex-wife of his employee.

However, it happens that the money must first be redirected to the bailiffs, and not directly to the collector. There can be many reasons for this. For example:

- if there is no information about bank accounts, electronic cards opened in the name of the child or the creditor;

- if the debtor evades payment of alimony when savings accounts or cards are discovered in banks;

- in case of forced receipt of money - when selling the debtor’s property to cover the alimony debt.

Thus, transferring alimony in favor of bailiffs is a procedure that an employer may rarely encounter. After all, he always knows from what amount to withhold them, who is the debtor and to which account the salary is transferred. It would seem difficult to imagine that if there is a claimant, alimony must first be sent to the bailiffs. This “scheme” is, to put it mildly, very strange. However, in 2020, in practice, there are cases when a legal entity (for example, a bank) needs to transfer alimony in favor of bailiffs.

This is important to know: Criminal liability for failure to comply with a writ of execution

We also note that if the address of the person in whose favor alimony is being collected is unknown, the FSSP of Russia recommends transferring alimony by payment order to the settlement account of a structural unit of the relevant territorial body of this service (subclause 9, clause II of Appendix No. 1 to the Methodological Recommendations FSSP of Russia dated June 19, 2012 No. 01-16).

In such a situation, you need to know how to issue a payment order for withheld alimony. Here is a sample that is relevant in 2020 (can be downloaded from the link below):

If you find an error, please select a piece of text and press Ctrl+Enter.

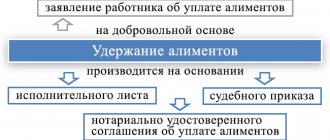

Withholding of alimony from earnings

After the employer has received a writ of execution from the claimant or a copy thereof from the bailiff, in which his employee is indicated as a debtor, the amounts specified in the writ of execution should be withheld from wages (including advance payments) and other income paid to the employee, regardless of his desire (Part 3 of Article 98 of the Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings”).

The employer may receive a writ of execution from a bailiff or from the claimant himself (for example, from the employee’s ex-wife). It is imperative to inform the employee about the receipt of the writ of execution and obtain his signature stating that he knows about the receipt of such an order (letter of Rostrud dated December 19, 2007 No. 5204-6-0).

Why is the purpose of the alimony payment indicated?

Purpose of payment is information containing information about why the money is being transferred. In this case, it is alimony. In addition, various documents require information about the number of enforcement proceedings (IP), the period and date of initiation of the IP.

If the person obligated for alimony transfers money by non-cash payment from a bank card for a long time after the initiation of enforcement proceedings, without indicating the purpose, the recipient has the opportunity to collect a penalty, despite the actual receipt of money. The reason is the lack of evidence of payment. If the receipt contains the phrase “for alimony,” it is impossible to claim the debt.

Advantages of payment through Sberbank

Why do clients often choose Sberbank?

Firstly, this is the most widespread bank in Russia. It has a larger number of ATMs, terminals and branches throughout our country. The Sberbank Online Internet banking system is also a reliable and convenient way to pay for any services, including alimony payments.

Bank transfers of alimony through Sberbank:

- Convenient and affordable if you live in different cities.

- Simple - you don’t even have to leave your home.

- Completely free within the bank. The commission for transfers to cards of other banks is less than when paying by post.

- They are easily recorded and serve as unconditional confirmation of the completed payment, for example, in court.

- You can arrange it as an automatic payment to eliminate the need to re-enter your details.

- Mobile and arrive very quickly.

Alimony is transferred personally by the payer

Collection of alimony is carried out in two ways:

- According to the alimony agreement. The document is certified by a notary, the payer transfers the money voluntarily. The contract specifies the amounts and terms agreed upon by the parties.

- According to the writ of execution. It is issued to the claimant based on the results of legal proceedings. The amount of payments is determined by the judge. The claims are satisfied in full or in part. The writ of execution is subsequently provided to the bailiffs or to the organization at the place of work. Voluntary fulfillment of IL requirements by those obligated for alimony is also possible.

If the writ of execution is handed over to the employer, deductions are made by the company's accountant. The payer's consent is not required for this.

Personal transfer of money

You can transfer finances personally by agreement or writ of execution. If the parties manage to reach an agreement, women may not have to go to a notary or court and receive money by verbal agreement.

To protect themselves, payers are advised to require a receipt from recipients each time they transfer money, stating:

- Full names of both parties, passport details;

- date, time and place of payment;

- purpose – alimony;

- the amount and period for which it is paid;

- Full name, date of birth of the child;

- basis - IL or agreement.

This is important to know: Contents of the writ of execution under the Code of Civil Procedure of the Russian Federation

Transfer to bank account

Most often, citizens use online services where the “payment purpose” field is absent, but instead there are “comments”. It is in this section that you must indicate what and for whom the money is being transferred.

Transfer through a bank branch

When contacting a financial institution in person, you will need to fill out a payment order, and the purpose must be indicated here. The document must also include the child’s full name, period and number of the writ of execution.

Features of transferring alimony from card to card (between accounts)

Always save receipts and receipts.

Receiving and sending alimony through Sberbank is profitable and convenient.

Advantages of transferring from account to account:

- Minimum commission or no commission.

- The waiting time for a transfer is up to three hours.

- Specify the purpose of the transfer, indicate your full name “To pay alimony for the maintenance of a minor.”

- Try to pay child support on the same date every month.

Alimony is paid by the employer

The most common way of paying money for minors is a transfer by an accountant at the place of work of the child support obligee. This is done on the basis of a writ of execution - a court order or an alimony agreement - the claimant presents it independently upon receipt. It is possible to transfer the ID to bailiffs.

Payment order

A payment order (PP) is a mandatory document when transferring finances through a bank. It is filled out by an accountant. When registering, please provide the following information:

- payment order – 1;

- PP number;

- Date of preparation;

- Suma in cuirsive;

- INN and KPP of the enterprise;

- names of payer and recipient banks;

- account numbers of both parties, TIN;

- purpose – alimony according to IL No. (...) for the period from (month) to (month);

- total amount of alimony;

- signature of the payer (accountant).

The bank marks are placed at the bottom - the signature of the employee who accepted the document and the seal. The order is drawn up in 4 copies: three remain for storage in different bank archives, the fourth is returned to the payer with a note of acceptance.

Postal transfer

The payers themselves or accountants at their places of work can transfer alimony by postal order. To do this, fill out a payment document containing information:

- amount in numbers;

- Recipient's name and address;

- Full name and address of the sender;

- message – child support (full name) for (period). This is the purpose;

- sender's passport details;

- payer's signature.

If the money is transferred by the employer, additional information is indicated on the payment slip:

- information about the number of days worked per month, salary received, personal income tax withheld, alimony payments;

- number and date of the IL or agreement;

- purpose – payment of alimony for a certain period.

To send such a transfer, the organization issues a power of attorney to an authorized employee, therefore this method of paying alimony is used in exceptional cases.

What does the form look like?

A certificate of alimony received (or paid) is drawn up in a free format: the law does not provide a special form for a certificate of alimony collection.

The certificate must contain:

- Corner stamp or seal with serial number and corresponding date.

- Name of the institution issuing the certificate.

- Full name of the recipient of the form.

- The employee’s income, the amount of taxes and alimony paid.

- The total amount of funds paid.

- Date of registration.

- Signature of the official issuing the certificate and his initials.

- The signature of the manager, certified by a seal.

Child support certificates have legal force and remain valid regardless of the statute of limitations.