In the process of living together, spouses become owners of various movable and immovable property: housing, cars, furniture and household items - all these items become jointly acquired property. However, part of the funds belongs to each person personally, and part belongs to their joint ownership. Accordingly, the order of inheritance of types of property is different.

We will explain in the article what a spousal share in an inheritance is by law after the death of a spouse, how the spousal share is allocated after the death of a former spouse, and what is included in the concept of “mandatory share in a spouse’s inheritance.”

Allocation of spousal share

Those items of property that were acquired by spouses during marriage are their jointly acquired property. The exception is situations where there is a prenuptial agreement or a separate agreement that defines the specifics of property relations. Under standard circumstances, this category of objects includes:

- spouses' income;

- pension and social payments for non-target purposes;

- real estate;

- movable property;

- securities;

- deposits;

- other objects that were acquired by husband and wife.

Reference! Property is recognized as joint property regardless of the fact who exactly acquired the object and to whom it is registered. The only thing that matters is the presence of a marriage, which is officially registered by the registry office.

What is joint property

The Family Code (Article 34) establishes a list according to which property can be classified as jointly acquired:

- movable and immovable items acquired by spouses upon marriage (houses, apartments, cars, etc.);

- income received as a result of work or business;

- finances received in the form of various social payments (pension, scholarship, etc.);

- securities related to securities, deposits, shares in the authorized capital, regardless of the name of which of the legal halves they are recorded.

Personal property is property acquired before marriage or as a gift or inheritance during marriage.

Common property does not include:

- personal items (except jewelry);

- payments received under copyright and patent agreements;

- payments received as insurance and compensation.

How is the spousal share in the inheritance allocated?

If the husband or wife died, then the second spouse can count on the allocation of his part of the property acquired during the marriage. In general, the marital share of the inheritance by law is 50% of the total estate. Therefore, only those objects that belong to the deceased belong to the inheritance.

As an example: a spouse owns a residential house, which was purchased under the DCT during the marriage. If the wife dies, then the heirs can only claim half of the property. The remaining 50% is assigned to the surviving husband. At the same time, he still retains the right to claim objects from the hereditary mass.

Procedure for the heir

First of all, it is necessary to pay a visit to the notary to open inheritance proceedings. The spouse must draw up an application for the allocation of half of the jointly acquired property and submit it along with a list of the property itself and documents confirming this right.

The notary must check the validity of the spouse's claims, then notify the remaining heirs that the applicant will be allocated half. He then issues a Certificate of Title, which is registered with the government agency. A notary can refuse to issue a document only if the applicant claims the personal belongings of the deceased.

Good to know: the consent of the remaining heirs to allocate a share is not required. The certificate is issued in any case, and notification is necessary only if the heirs decide to challenge it in court.

If the couple has drawn up a marriage contract, the ratio of shares may be different.

Mandatory share

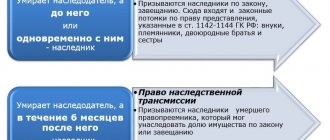

The procedure for entering into an inheritance can be carried out either by will or on the basis of the provisions of the current legislation. If a spouse, by his will, deprives his wife of an inheritance, then she can count on an obligatory share. The deceased cannot influence this.

Separately, we should highlight the situation in which the deceased indicated in the will part of the property of a surviving relative. Under these circumstances, it will be necessary to challenge the written will of the citizen by contacting the judicial department or adding a compromise with the heirs.

Rights and obligations of the testator

The testator has the right to accept the inheritance and submit an application to the notary to enter into legal succession.

A sample document is presented here.

The heir can also participate in the agreement on determining shares in the inheritance and allow other legal successors to inherit. The testator can represent his interests through a proxy.

An example of a power of attorney can be seen here.

If property is transferred by will, then the heir may know its contents, including in the case when a closed envelope with a written expression of will is opened, and the heir is included in the circle of possible legal successors.

The responsibility of the testator is to be a conscientious successor and not to try to increase his part of the inheritance in an illegal way.

The heir is obliged to pay the debts of the testator's creditors - in the case when, knowing about the debts of the deceased, he still assumed his rights.

Payment of the debt is limited to the value of the property passed on by inheritance.

To calculate the state duty, the heir is obliged to provide the notary with reliable information about the value of the property.

Stages of registration and receipt of a share

To successfully accept an inheritance, you will have to take into account a lot of nuances and subtleties that will allow you to avoid the consequences of pitfalls in the procedure. To do this, first of all, you need to decide on a step-by-step sequence of mandatory actions:

- After the death of a spouse, clarify on what basis the property from the inheritance will be distributed: in accordance with the will of the deceased or within the framework of the law. The spousal share in the inheritance in the presence of a will is determined taking into account the contents of the document. An exception is the exercise of the right to a compulsory share, which a disabled spouse can count on. In the absence of a will, the marital share in inheritance is approved by the current civil legislation. The primary legal successors include the children of the deceased, parents and spouses. The husband or wife can receive all the property of the deceased if there are no other heirs from priority order.

- To accept an inheritance, you need to send a corresponding application to the notary office where the inheritance case has been opened. The contents must indicate your intention to receive the property of the deceased. Usually you need to contact a notary at the last address of residence of the deceased. It is important to comply with the deadline for submitting the application - it is six months from the date of death of the relative. If the allotted time has been missed, it is possible to restore the possibility of appeal through the court if there are grounds or by reaching an agreement with other heirs.

- Collection of documents necessary to confirm your right to inheritance and obtain a certificate. Depending on the circumstances, the list may vary, but the general list is as follows:

- death certificate of a spouse or a court decision declaring a citizen dead;

- confirmation of the right to claim an inheritance - either a will or a certificate of registration of relations;

- confirmation of the deceased's ownership of the property;

- conclusion of an independent expert on property valuation.

- When submitting papers, you also need to pay a state fee. The fee for immediate relatives is 0.3% of the value of the testator's property. Maximum – 100 thousand rubles.

- All that remains is to obtain a certificate confirming the spouse’s right to the inheritance received. The document is provided after 6 months from the date of death of the testator. You can receive a certificate before six months have passed, if there is evidence of the absence of other heirs.

Reference! After receiving the certificate, you need to register ownership in the proper manner. So, if real estate was acquired by inheritance, you will have to contact the state register.

How to highlight?

- First of all, you need to contact a notary who can identify the marital share of the living spouse in jointly acquired and personal property;

You must contact a notary at the place of permanent registration of the deceased spouse.

- At the notary's office, the spouse must fill out a special application, after which the notary will issue him a certificate confirming fifty percent ownership of the joint property;

If the spouses drew up a marriage contract during their lifetime, then obtaining a certificate from a notary will be even faster.

- After this, the notary specialist will notify other heirs of the need to declare their intention to enter into an inheritance;

Other heirs do not have a challenge to the living spouse's 50 percent share.

Solutions in case of controversial situations

It is not uncommon for disputes to arise between relatives during the distribution of inheritance. Among the conflict cases involving a spouse, it is worth highlighting the problem of determining whether property belongs to the category of jointly acquired property. As an example: a husband gave a vehicle to his wife, but the process of transferring the object was not properly formalized - there is no deed of gift. As a result, after the death of her husband, the wife can only claim half of the car, although she considers the property entirely her own for obvious reasons.

To resolve disputes, the assignee can use one of two provided methods. The first is to reach a compromise with dissatisfied relatives and draw up an agreement in writing, indicating the conditions for the division of property. The second is more relevant, since in practice it is used much more often. Its essence is to resolve the dispute by going to court.

Each of the current options is worth examining in more detail.

Concluding an agreement with relatives

The provisions of the Civil Code do not limit the right of citizens to freely conclude contracts between individuals. The key condition is that the provisions of the agreement do not contradict the provisions of the law. Therefore, the heirs can take advantage of the provided opportunity and set their own conditions for the division of the inheritance mass.

The agreement must be drawn up in writing. In this case, you will have to obtain certification from a notary. In the absence of a specialist’s signature, the document will not have legal force. Using this option, the marital share can also be determined. The content and form of such an agreement are not specified by law.

Peaceful resolution of the conflict is the least expensive method and the most effective. However, in practice it is rarely implemented due to the reluctance of relatives to meet other heirs halfway to resolve controversial issues.

Trial

Litigation is the most common and most expensive option. To initiate legal proceedings, you will have to file a claim in the prescribed form. If you neglect the need to comply with regulatory requirements, the request will not even be accepted for consideration. Therefore, it is important to take into account the provisions that are reflected in the content of the application:

- the name of the judicial institution where the claim is sent;

- personal information about the participants in the proceedings (plaintiff and defendant): full name, address where the citizen lives and is registered, contact information;

- cost of claims - the price of the property established by an independent expert is indicated;

- the descriptive part includes the circumstances of the conflict situation. Thus, you will need to indicate the date when the spouse died, a list of disputed property and the claims of dissenting persons;

- claim. They are formulated as: the allocation of the marital share from the inheritance mass and the assignment of the plaintiff’s right to this property;

- a list of documents attached to the application to confirm the content of the claim;

- date of application;

- applicant's signature.

When filing, you will need to pay a state fee, the amount of which is determined by the value of the claim.

The judge's verdict largely depends on the plaintiff's preparedness to substantiate his position. To increase the likelihood of a positive decision, it is recommended to use legal support. You will have to spend extra money on the services of a specialist, but his work can significantly help in achieving the goal.

List of documents

Before going to the notary, the living spouse must take care of drawing up an application and collecting the required package of documents.

A sample application can be downloaded on the Internet, filled out and brought to the notary. Another option is to come to a notary’s office and fill out an application for the allocation of a marital share on the spot.

Download

Sample application for allocation of marital share.doc

The application for the allocation of the spousal share shall include the following information:

- Full name of the notary's office to which the spouse applies;

- Details of the living spouse: last name, first name, patronymic, actual residential address and place of permanent registration;

- Then the name of the document is written, namely “Application for the allocation of the marital share”;

- Details of the deceased spouse: last name, first name, patronymic, actual residence address, as well as place of permanent registration during life, date of death;

- Further, in the main part it is necessary to indicate what property the spouses acquired from the moment of marriage;

- In addition, it is necessary to indicate the presence/absence of a marriage contract;

- In the final part, the applicant must indicate the requirement, namely “allocation of the marital share in jointly acquired property”;

- At the very end, the date of filing the application is indicated, as well as the personal signature of the living spouse;

In addition to the application, the spouse needs to prepare the following list of documents:

- Death certificate of the deceased spouse;

- Marriage certificate;

- Documents for property that, according to the Law, is considered jointly owned (sale and purchase agreement for an apartment, registration documents for a vehicle, etc.);

- Marriage agreement (if any);

- If the deceased husband has a child under eighteen years of age, then written consent from their guardianship authority must be provided;

After providing all the necessary documents, the notary carefully examines them and then issues the living spouse the appropriate document confirming the right of inheritance to joint property.

Refusal of spousal share

A portion of the surviving spouse's property may also be included in the estate. However, such a situation is possible only if the husband/wife decides to formalize the renunciation of the marital share in the inheritance from the category of objects that are recognized as jointly acquired. This possibility of an heir is determined by Article 236 of the Civil Code of the Russian Federation. It is important to take into account that this statement also presupposes the relative’s renunciation of ownership of these objects.

At the same time, no one has the right to create obstacles for the surviving spouse to realize such an opportunity. The notary also cannot influence the decision. He is only obliged to explain the legal consequences of refusal.

The concept of “marital share” and types of property

According to the Family Code of the Russian Federation, “spousal share” is usually understood as the rights of spouses to property acquired jointly in an official marriage. Thus, each spouse has a property right equal to 50 percent.

During their life together, spouses acquire two types of property:

- Joint property. Those. acquired by spouses from the moment of official marriage;

Example: while married, the spouses took out a mortgage on a two-room apartment, which they paid off jointly for ten years. Thus, at the end of the mortgage payments, the spouses have equal rights to the apartment, and the real estate acquires the status of “jointly acquired property,” which means the spouses have an equal marital share in it.

- Personal property. Those. acquired by one of the spouses before official marriage. In addition, property gifted or inherited is considered personal property.

Personal property can be considered: copyrights, insurance payments, as well as other personal property (which only one of the spouses uses).

Information!

Despite the fact that precious jewelry is considered personal property, spouses have equal rights to it.

Changing the share size

Under standard circumstances, the joint property of the spouses is divided 50 to 50. At the same time, the provisions of the law define situations when the size of the share can be adjusted either downward or upward. Thus, Article 39 of the family law defines the following points as grounds for change:

- spouses have children together who have not reached the age of majority;

- the surviving spouse is declared disabled;

- intentional infliction of damage by the surviving spouse on family members, including the testator.

As an example of the last reason: excessive consumption of alcoholic beverages or taking drugs. Also, the court may decide to reduce the share if gambling addiction is confirmed, with an indifferent attitude towards family members.

Grounds and conditions

The basis for the division of property is considered to be a mutual agreement between the surviving spouse and other heirs.

If there is no such written agreement, then the spouse can go to court and demand that his share be allocated forcibly.

A list of property is compiled and the necessary assessment is carried out. The presence of encumbrances on property is not considered an obstacle to the inclusion of such items in the inheritance mass.

The marital share can be allocated during the marriage.

The ownership of property can be determined in a marriage contract, which must be registered with a notary.

The ownership of the property must be properly registered.

The condition for separation is the actual existence of property rights, the ability to own a thing, and confirm the presence of properly formalized rights to it.

Deprivation of share

A husband or wife who loses a spouse may be disqualified from claiming a spousal share. For such cases, the legislation provides the following grounds:

- an attempt on the health or life of the second spouse. This is especially true if such actions caused the death of a husband or wife;

- committing illegal actions in relation to the testator or other legal successors in order to increase the size of the due share;

- deliberate evasion of obligations to support needy family members.

Deprivation of a share is carried out by court.

Legislation

- The general order of inheritance is determined by Section 5 of the Civil Code of the Russian Federation . Art. 1141-1148 determine the subjects of inheritance.

- The joint regime of property of spouses is indicated in the Civil Code of the Russian Federation - Art. 256 .

- The procedure for dividing the common valuables of a husband and wife is indicated in Chapter. 7 IC RF . It determines the legal regime of the marital property.

- Features of the division are indicated in Art. 38 IC RF .

- Disputes about inheritance are resolved in accordance with the recommendations specified in the Resolution of the Plenum of the RF Armed Forces on inheritance dated May 29, 2012 No. 9 .

- Procedural issues are resolved according to the rules of the Code of Civil Procedure of the Russian Federation.

Where should I contact?

A joint will can change the order of distribution. The joint will of the spouses provides for the transfer of the marital share to the second half for the duration of her life, without the possibility of alienation.

After the loss of the other half, the husband or wife must take a number of mandatory actions. The sequence of actions is as follows:

- Submit a written request to the notary office specialist responsible for the distribution of property;

- A specialist from a notary office is obliged to issue a certificate for half of the marital share, unless there is a marital agreement providing for a different procedure for the distribution of property;

- The notary notifies the other receivers about the allocation of the part.

The notification is made to provide for the possibility of challenging the share through the court.

The document is submitted in a strictly regulated form, which looks like this:

- Full name of the notary office, location address;

- Spouse details, contact phone number, address;

- Details of the deceased, date of death, residential address;

- List of joint ownership;

- Indicate the existence or absence of a marital agreement;

- Request for allocation of a part;

- The paper is certified with a signature and date.

The paper is issued upon availability of a package of documents, which we will consider in more detail.

What is the spouse's share in inheritance law?

During the time spent together, the couple acquires ownership of many things and objects. The latter usually include cars and real estate (land, houses, apartments, rooms). As already noted, all this becomes joint property. The only way to redistribute values otherwise is to draw up a bilateral agreement that reflects the requirements for the division of assets.

The following are recognized as joint benefits:

- partner income received in the form of salary;

- pensions, benefits of a non-target nature;

- financial assets placed in securities, companies, deposits;

- other things purchased during your stay in a union registered by the registry office.

The property is registered in the name of one of the family members. However, regardless of this and who earned the money, both the man and the woman will be considered owners. At the same time, values are not always recognized as shared. An example would be assets acquired by a citizen through a gratuitous transaction (inheritance, gift) or personal items used by only one member of the family. You can learn more about the classification of property in Art. 36 IC of Russia.

Resolving situations that give rise to disputes

Inheritance is a procedure in which many controversial situations arise. This is often due to the difficulty of determining the type of value that assets belong to: joint or private.

How to get out of the situation by concluding an agreement?

In accordance with Article 421 of the Civil Code of the Russian Federation in 2019, citizens have the right to enter into a written agreement, which must be based on the principle of the desire of both parties. According to the paper, the division of the inheritance will be carried out according to the provisions that are present in the text. The only thing is that the act must not contradict the requirements of the current legislation. The agreement is certified by a notary, whose signature and seal give the documentation legal force.

Resolving the issue through court

The drawn up claim must be aimed at protecting the property rights of the applicant. The fact is that the values accumulated during the marriage may go to other successors who did not participate in the couple’s life together. The petition is submitted taking into account all persons involved in the process. The defendants may be one or more persons. They are also the heirs of the citizen.

The claim must include information about:

- the authority in whose office the case was received;

- personal information of the plaintiff, defendants, interested parties;

- the cost of goods, according to an assessment carried out by experts;

- details of the death of the testator, as well as a list of assets that were owned by the latter

- the nuances of the controversial situation that has arisen;

- requirements;

- list of papers attached to the application;

- date of drawing up the requirements.

Question:

Is it possible to refuse the spousal share?

Answer:

Yes, the owner can refuse his part of the property based on an official statement. Then the benefits are redistributed among other successors. The procedure is carried out in accordance with Art. 9, 236 Civil Code. At the same time, a spouse who has deprived himself of a share of assets should remember that refusal is accompanied by the inevitable loss of any rights to the objects.

Is it possible to refuse

The surviving spouse may waive the right to a contribution or other joint property. To do this, he draws up a notarized application. The transfer of property to the heirs is then carried out in accordance with the general procedure.

Do you want to understand how to inherit property according to law? Read about this in the article: order of inheritance by law. Not sure if inheritance is taxable? Read about this in the article.

How to inherit a privatized apartment without a will is written here.