How is alimony calculated as a percentage of wages?

Calculation of alimony by percentage or, as it is also called, by the share method is a widespread method, regulated by Article 81 of the Family Code of the Russian Federation. To begin calculating alimony payments, you need official confirmation of the payer’s place of work, as well as the amount he receives as wages or other income.

During a divorce, parents of minors enter into alimony legal relations. In most cases, the mother is the recipient of child support since she is the one raising the children. The father in this case acts as the payer of payments.

IMPORTANT! Using the percentage method for calculating alimony is possible only if the payer has a stable financial income.

To determine the amount of alimony payments, it is necessary to take into account several facts that affect its volume:

- the number of children born in marriage or officially adopted;

- wages and definition of types of income received by the payer;

- possible debt of the person obligated to make payments.

How to correctly calculate alimony as a percentage of salary?

The most difficult moment when calculating alimony is confirming the base from which interest will be calculated. This base is wages, pensions, stipends, funds from the rental of personal property and other income.

REFERENCE! Article 81 of the RF IC obliges the payment of alimony only to those children who need it, and not to all. Based on this, the amount of mandatory payments is calculated.

When the income is indicated, you can begin to determine the share to provide for children. It is equal to:

- 25% if there is one minor child;

- 33% provided that two children are supported;

- 50% in favor of three children who need it.

IMPORTANT! If the number of children is more than three, then the amount of child support payments will be at least 50%. However, according to paragraph 3 of Article 99 of Federal Law No. 229, its maximum amount cannot exceed 70% of the total income.

For example, if the payer’s salary is equal to 50,000 rubles, then alimony payments for one child will be a quarter of the amount - 12,500 rubles; accordingly, the maintenance of two children will take a third of the amount - 16,667 rudds; to provide for three children - half the amount of 25 thousand rubles. But, if there are more than four children, then you can claim no more than 35,000 rubles, which is 70% of the money earned.

ATTENTION! The example is given taking into account the deduction of personal income tax. According to the first paragraph 99 of Article 229 of the Federal Law, in order to distribute alimony from earnings, it is necessary to take into account the amount already subject to personal income tax in the amount of 13% for 2020.

Despite the fact that the minimum amount of alimony is not provided for by Russian legislation, it can be calculated based on the size of the minimum wage - the minimum wage.

For 2020, the minimum wage is 12,130 rubles. Therefore, the minimum monthly payment, taking into account the deduction of personal income tax, will be:

- 2638 rubles per child;

- 3517 rubles to provide for two children;

- 5276 rubles for the maintenance of three children;

- no more than 7387 rubles in exceptional cases.

What income is subject to alimony withholding?

Each party to alimony legal relations must know what income constitutes the basis for collecting monthly payments to provide for children. There is a certain list of income, which is established in accordance with Government Decree No. 841 of July 18, 1996.

The list includes all types of earnings:

- salary from the main workplace;

- income from part-time work (including wages of convicted persons);

- maintenance in the form of funds for state and municipal employees;

- fees, allowances, additional payments to the basic salary (including for difficult, stressful working conditions, additional hours of work or irregular hours, going to work on holidays and other conditions);

- all types of bonus payments, etc.

In addition to earnings, alimony is also accrued for other income, or periodic:

- scholarships;

- sick leave benefits payments;

- unemployment benefits;

- pensions;

- payments for unused vacation;

- income if the person is an entrepreneur;

- funds received from renting out property;

- funds for the provision of services and performance of work;

- scientific grants and payments;

- compensation from the federal or local budget;

- allowances for employees of the Ministry of Internal Affairs, military personnel, drug control authorities, fire and customs services.

If the person obligated to pay alimony has more than one source of income, then the collection is carried out from all of them in the appropriate percentage amount.

From what income is child support not withheld?

Collection of alimony may not apply to all types of income. In accordance with Article 101 of Federal Law No. 229 “On Enforcement Proceedings,” the collection of alimony is illegal from the following points:

- compensation received for damages to health;

- allowance for funeral rites;

- means of compensation for harm received at work;

- alimony payer;

- social benefits paid for a child or for the loss of a breadwinner;

- maternity capital provided at the birth of a child;

- travel expenses;

- funds intended for depreciation of equipment;

- financial assistance for newlyweds and new parents;

- funds received from the employer intended for health purposes.

This entire list of income is not subject to the collection of alimony payments, so if the recipient claims payment, the payer has the right to demand cancellation of payments and reimbursement of money through the court.

How is alimony withheld from wages?

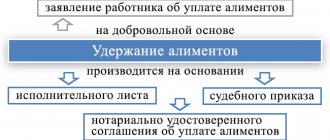

Collection of alimony can occur in two ways: voluntary and forced.

The first is a voluntary agreement of the payer with his obligations and requirements on the part of the recipient. If the child’s parents have reached a mutual agreement and want to calmly resolve the situation, then they draw up a special agreement that specifies all the conditions.

The second option involves disagreements between the child’s parents, which they cannot resolve on their own. Since financial assistance to a child is the responsibility of a parent, he can be forced to do so through a court order.

Voluntary payment of alimony as a percentage of salary (by agreement)

If it was possible to reach a common decision between the parties to the alimony legal relationship, and the payer wants to take care of his offspring, a notarial agreement should be drawn up. According to Articles 99 and 100 of the RF IC, it must contain the following information:

- the amount of future payments;

- their frequency, i.e. frequency of payments;

- method of transfer by the payer to the recipient;

- the period during which they will be implemented.

Alimony can be paid until adulthood, or after each child reaches 18 years of age.

The convenience of the agreement is manifested in the possibility of choosing certain points that cannot be implemented in court. Thus, parents have the right to agree not on monthly payments, but on rarer ones. But the amount will be larger, or the payment period will be longer, exceeding the age of the children. At the same time, the amount of payments should not be less than the amount to which the child would be entitled if the case was heard in court (Article 103 of the RF IC).

For 2020, the cost of concluding this agreement on alimony payments with a notary is 5,250 rubles. According to Article 80 of the RF IC, if the payer violates the terms of the contract, the recipient has the right to go to court to force the collection of payments.

Registration of alimony as a percentage through the court

In the event that the parties to alimony legal relations have not reached a voluntary agreement, or the obligated person refuses to pay, there is an option for forced collection of funds through the courts.

There are two ways to unilaterally go to court.

Filing an application to the Magistrates' Court with a request to issue a court order

In this option, the application is submitted to the defendant, who has no other obligations to pay alimony. No court proceedings are required, and the order is issued no later than five days from the date of filing the application. Alimony payments are assigned only as a percentage of the payer’s income, that is, it is impossible to collect a fixed amount of payments, only as a share of the salary.

If the potential payer does not agree, he can appeal the order within ten days from the date of its adoption. The parent is not required to explain the reasons for disagreement; they can be any. In this case, the plaintiff must re-apply to the magistrates' court, but with a statement of claim.

Filing a claim for alimony

This option of appealing to the magistrate’s court differs from a simplified court order in that:

- the presence of other alimony obligations of the payer does not play a role;

- the method of collection can be either percentage or mixed, or indicated for a fixed amount of payments;

- even if the defendant does not have a permanent job or is completely unemployed, he will still make payments;

- a full court hearing is required.

When choosing the method of going to court, the recipient of payments in any case does not pay the state duty (Clause 2, Part 1, Article 336.36 of the Tax Code of the Russian Federation).

As a result, the plaintiff receives a court order or writ of execution, which contains information about the payer’s obligation to pay a monthly share of his income until his child reaches adulthood. Next, the document should be submitted to the bailiff service, where they are required to study it and initiate enforcement proceedings in order to ensure the start of receipts for alimony payments.

Advantages and disadvantages of this type of accrual

For the obligated person, you can find several positive characteristics when assigning alimony in shared terms:

- If your earnings decrease, the amount of alimony will also decrease. If a fixed amount is assigned, the payment may become unaffordable for a person with a low-paying job.

- A citizen can find an informal part-time job and improve his financial situation. Bailiffs will not carefully monitor this, since money is transferred according to the writ of execution.

The main disadvantage of this method for the recipient of alimony is that the obligated person can come to an agreement with an unscrupulous employer who will pay the salary “in an envelope”. Among the disadvantages are the following points:

- an increase in total income will affect the citizen’s well-being to a lesser extent. Because the percentage of alimony payments will increase.

- The payer should take into account that large cash receipts can be seriously reduced. For example, receiving royalties for an author's work or dividends on shares.

- The need to notify the bailiff in the event of a change of place of work.

- Ambiguous attitude towards obligated persons in society. Alimony payers have a reputation as people who try their best to avoid this obligation. That is, such a circumstance can negatively affect relationships in the work team.

Our experts have prepared other useful materials about the different types of alimony. From them you can find out how alimony is paid to individual entrepreneurs, how assignments occur within marriage and outside marriage, whether you need to pay your wife on maternity leave, and how to formalize voluntary payment of alimony.

Change in percentage of number of children

The amount of alimony that the payer is obliged to pay to the other party to the alimony relationship directly depends on the number of minor children. The more there are, the higher the percentage charged on income.

For one child

The amount of alimony as a percentage for an only child who needs financial support from parents is equal to a quarter of income. That is, the payer must monthly transfer 25% of wages or other income provided for by Government Decree No. 841 of July 18, 1996.

For two children

Alimony payments to provide for two children amount to a third of income or 33%. Payments are mandatory until each child reaches full adulthood, unless otherwise provided by law.

For three children

Situations involving provision of child support payments for three children at once do not occur as often as for one child. If this happens, try to come to an agreement with your partner and draw up a voluntary alimony agreement. If the potential payer refuses or does not want to pay the full amount, then go to court. The amount of alimony payments is exactly 50% of the income of the obligated person.

For four or more

Few families accept the responsibility of having four children. This is a heavy burden, especially if the partners decide to divorce. In this case, the percentage relative to the income of the person who will make the payments, as a general rule, should not exceed 50%. However, the share can be increased, since it takes a lot of money to support so many children. According to the third article of Federal Law No. 99, the maximum share of alimony payments does not exceed 70%. This is the maximum amount that can be distributed among all children in equal amounts.

Who calculates alimony from an employee's salary?

The employer of the payer of alimony payments is responsible for their calculation. At the same time, according to paragraph 16 of Article 64 of the Federal Law “On Enforcement Proceedings,” representatives of the executive branch, by virtue of their powers, check the accounting records related to the workplace of the obligated person.

The organization is obliged to fulfill all the requirements of the bailiffs and submit its accounting records for inspection in accordance with Articles 12 and 14 of Federal Law No. 118. If the official request is ignored, the company faces a fine of 100,000 rubles, and the director personally - 20,000 rubles (Part 3 of Article 17.14 of the Administrative Code RF).

Collection of alimony as a percentage at the place of work

If the plaintiff, who is the recipient of alimony, decides to do without the intervention of the bailiff service, then he has the right to independently contact the administration of the organization at the payer’s place of work.

IMPORTANT! If the payer has several places of work, the recipient has the right to demand the required number of copies of court documents. This is necessary to withhold alimony payments from each source of income of the payer.

According to Article 109 of the RF IC, the employer has the right to withhold the amount of alimony from the employee’s wages if a writ of execution, a court order or a notarized tax payment agreement with an additional copy is provided.

Only in this option is the administration obliged to make monthly payments from the wages or other income of the employee who is the alimony payer. The transfer to the recipient of the payment must be made within three days from the date of payment of the salary. All costs incurred during the transfer are paid by the payer.

REFERENCE! The payer is not required to write and provide a statement about the need to deduct alimony.

The recipient of alimony has the right to choose the method of receiving funds to provide for children:

- from the cash desk of the enterprise where the payer is registered as an employee;

- receive funds into your personal bank account;

- use postal services and receive the transfer at the nearest branch.

He expresses his decision in a statement, which he submits to the accounting department of the organization responsible for withholding alimony payments from the payer’s wages. The application must contain not only information about the desired method of receiving payments, but also the address and details if necessary if it is decided to receive a transfer to a bank account.

If payments are received in cash from the organization’s cash desk, then the cashier must make a note about the details of the recipient’s personal passport, which contains:

- number,

- date of receipt,

- place of issue,

- registration information.

Collection of alimony as a percentage through the FSSP (bailiff service)

The recipient can use another method of collecting alimony from the payer. To do this, the writ of execution can be transferred to the Federal Bailiff Service (FSSP), where the relevant official will be obliged to initiate enforcement proceedings against the future payer and ensure that alimony payments begin to arrive to the claimant.

A person receiving alimony to provide for children may apply to the FSSP during the entire period covered by the alimony payments.

ATTENTION! The plaintiff can keep the writ of execution for 10 years from the date the court makes a decision to collect money from the defendant that is intended for the child. He has the right to contact the bailiff service even a few months before the child reaches adulthood, which means the termination of the payment period.

As in the case of applying to the administration of the organization for the purpose of work, it is necessary to submit an application, only to the bailiffs in order to consider the issue of collecting alimony from the payer. A parent living with a child who is the recipient of funds must personally contact the FSSP.

The application for recovery must contain:

- information about the claimant: passport details, telephone number, address at place of residence;

- data about the debtor similar to the data of the claimant;

- details of the issued writ of execution;

- details of the bank to whose account alimony payments will be credited.

REFERENCE! If you provide an alimony agreement certified by a notary, then you must write a statement, but indicating the details of the agreement.

After the bailiff receives the application, he is obliged to initiate enforcement proceedings within 24 hours, or refuse to collect the applicant. In case of refusal, you can challenge the decision through the court located at the place of work of the bailiff.

When opening a production case, the bailiff must contact the debtor to explain his obligations and rights. He must obtain information from the potential payer about:

- place of residence;

- personal contact for communication;

- workplace;

- all possible sources of income;

- personal property and its estimated value.

The bailiff must warn the debtor about criminal liability, which, in accordance with Article 157 of the Criminal Code of the Russian Federation, follows for evasion of alimony payments.

Conditions for paying child support for one child

The parties to alimony legal relations regarding the assignment of alimony for a minor child are his parents: mother and father. Moreover, in 80% of cases the payer is the father, and the recipient is the mother (less often, vice versa). Factors such as the official marriage of the parents or a civil marriage (the birth of a child out of wedlock) do not matter for the possibility of receiving child support, since payments can be safely collected in any case if the father is documented (otherwise, it will initially be necessary to go through the procedure for establishing paternity).

Of course, not every parent can become a recipient (as well as a payer) of child support. This requires the following legal grounds:

1) Documented relationship with the child - only an officially registered parent can be held accountable for participating in the financial support of the child; supporting documents in this case are:

- entry in the father column in the birth certificate (not from the words of the child’s mother); - certificate of paternity establishment (issued by the registry office if the parents did not register the marriage); - court decision to establish paternity; - court decision on adoption (or adoption) child.

2) The fact of evading voluntary participation in the maintenance of a son or daughter (or the absence of a notarial agreement on the payment of funds in their favor).

3) The child has not reached the age of majority (18 years old) or the lack of recognition of his early legal capacity (in connection, for example, with marriage).

4) The child has reached the age of majority, but has a disability.

The fact of joint or separate residence of the parent-deviator with the child is not significant - even if the mother and father are in the same living space, child support can be assigned if it is proven that there is no money for the family from the “negligent” defendant.

Judicial practice on the collection of alimony as a percentage

Let's look at a few real-life examples where court intervention was required to collect alimony payments from the payer.

Example 1

Citizen Anna K., who is the wife of Nikolai K., contacted a family lawyer with a desire to reduce the percentage of alimony payments to her daughter from her husband’s first marriage. Nikolai K. pays alimony in the amount of 25% of his earnings.

However, another child appeared in the clients’ family, which prompted them to want to reduce the mandatory payments to the first child. With the help of a lawyer, they drew up an application and submitted it to the court for consideration, attaching the birth certificate of the youngest child, a certificate confirming the father’s income and an estimate of expenses for the newborn.

The magistrate refused the citizen’s application, as he considered that the income of the children’s father allows him to maintain a decent standard of living and financially provide for the first child by paying alimony.

Thus, the birth of children is not a reason to reduce the percentage of alimony. The court will not approve of the infringement of the financial situation of one child in favor of another.

The maximum possible amount for alimony obligations

It is worth noting that the maximum amount of alimony is set either by the judge or by the alimony agreement.

Important: Russian legislation reflects the maximum possible amount of alimony: 50 percent of the salary of the alimony provider. And if the alimony payer is in arrears on his obligations, then the judge can set 70 percent of the salary in favor of the child.

Collection of alimony is made from wages or in a fixed amount of money. Let's consider the procedure for collecting each type.