When faced with a situation where a loved one dies, many people experience great stress. However, having sorted it out and pacified the storm of emotions, familiarity with the inheritance procedure is inevitable. When taking steps to inherit an apartment, it is important to know the specifics of this procedure.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

Right to inherit an apartment

The categories of persons who have the right to inherit an apartment are established by the current Civil Code. It contains a number of grounds preceding inheritance and determines the parties to legal relations, so inheritance of real estate is possible using several methods.

There are only two of them:

- by will

- and according to the law.

Let's consider each of them separately.

By will

This method involves changing the owner of real estate from the deceased owner to the heirs according to a unilateral agreement. It contains the testator's "final decision".

The agreement is to formalize the rights in the future to the disposal of real estate and/or movable property and the property rights of the former owner in the event of death. The testator determines any circle of persons to whom he wishes to transfer his real estate.

Property may be bequeathed:

- Individuals.

- For legal entities.

- Local government body (municipality).

- To the state.

Good to know! As for individuals, it is worth emphasizing that the testator has the right to name absolutely any person, even if he is not a relative. Any agreement, including this one, can be challenged if any participant becomes dissatisfied.

In law

In the absence of any order, the legislator has provided for the protection and protection of the right to receive property. In this case, family ties will be very important.

Taking into account who the person wishing to inherit is in relation to the testator, they can be assigned to a certain group.

There are 7 categories of inheritance:

- The first category includes immediate family members and relatives, such as children, surviving husband/wife, parents.

- The participants in the second are siblings and step-brothers, along with surviving grandparents.

- The third group includes relatives and uncles.

- According to the fourth, great-grandfathers and great-grandmothers belong to it.

- The legislator classified relatives of the fourth degree of kinship as the fifth stage.

- Great-great-grandchildren, nephews, uncles and aunts were legally assigned to the sixth stage.

- The last line, established by law, includes the stepsons, stepdaughters, stepfather and stepmother of the deceased person.

Inheritance after parents by law

Article 1141 of the Civil Code of the Russian Federation contains the basic rules of inheritance by law. According to them, the children of the deceased are primarily heirs at law. If for one reason or another they do not accept the inheritance, in the absence of other heirs of this line, the rights to the inheritance will pass to relatives as part of other lines. Children, like other heirs, may be considered unworthy on the basis of the rules of Art. 1117 of the Civil Code of the Russian Federation. There are the following reasons for recognizing a child as an unworthy heir:

- if these citizens committed illegal actions against the testator or other heirs in order to change the size of the inheritance share or the decisions of the testator;

- if the children of the deceased shied away from fulfilling the duties assigned to them to support the deceased. The court may decide on this after the interested parties submit a corresponding application.

If a child is found unworthy, he is deprived not only of the right to inherit by law or will, but also of the right to receive a compulsory share.

In cases where children have been designated as heirs after being found unworthy, they have rights to inherit the property specified for them in the will of one of the parents. Recognizing an heir as unworthy deprives his descendants of the opportunity to receive the said inheritance by right of representation.

Based on Art. 1146 of the Civil Code of the Russian Federation, if the children of the testator do not enter into the inheritance due to their death, the rights to it will pass to their own descendants. Clause 2 of Art. 1142 of the Civil Code of the Russian Federation specifies that the grandchildren of the deceased and their descendants can inherit property. Thus, the heirs of the first stage are all direct descendants of the deceased , regardless of how many generations separate them.

Inheritance from blood parents

Children inherit movable and immovable property with associated obligations by law and by will. A disabled child , in addition, has the right to a mandatory share in the inheritance. Inheritance by law and by will is carried out in accordance with the rules of this Code (Article 1118 of the Civil Code of the Russian Federation and Article 1141 of the Civil Code of the Russian Federation).

Inheritance from adoptive parents

Article 1147 of the Civil Code of the Russian Federation establishes the rules for inheritance by adopted children from adoptive parents . These include:

- adopted children are treated as blood relatives of the adoptive parent. After his death, they inherit in the same order as their own children. The adoptive parent, in turn, receives all the rights of the child’s natural parents;

- the adoptive parent receives rights to the child's inheritance after his death.

By receiving the right to inheritance after the death of the adoptive parent, the child can retain rights to the property of blood relatives. This is permissible if the adoptive parent is one citizen . If the adoptive parent is a woman, the father of the child can leave him the rights and obligations associated with the property. When a man becomes the sole adoptive parent, the decision to retain the rights and obligations associated with the inheritance is made by the mother of the adopted person.

Ways to get an apartment

When considering the issue of obtaining the right to real estate after the death of a loved one, it is necessary to establish the moment when the rights of use arise.

Such a right arises in several ways:

- Legal.

- Actual.

Legal

The legal path consists of going through all the necessary legally significant procedures, the requirement for which is established by the legislation of the Russian Federation or other legal acts. Specifically, this means drawing up and submitting an appropriate application.

Actual

If the chosen path is actual, then the heir must perform certain actions that are undeniable and are interpreted as a desire to accept the property as an inheritance.

These actions could be:

- Moving into residential premises, as well as living in it.

- Installation of additional security systems at the property.

- Changing lock cylinders on the entrance doors to a house or apartment.

- Voluntary self-payment of utilities.

- Absorption by the heir of debt for utilities supplied to the testator.

How can a daughter enter into inheritance rights?

» Deadline for entering into inheritance is October 18, 2020

How can a daughter inherit an inheritance?

Alexander (03/27/2014 at 11:33:40)

As the heir of the first priority, she has the right to inheritance. You, as the legal representative of your daughter, contact the notary within the prescribed period (6 months) with an application to accept the inheritance or issue a certificate of inheritance. Check with the notary for the package of necessary documents. Don’t forget that in addition to property, your daughter will inherit her father’s debts, if he had any.

Article 1142 of the Civil Code of the Russian Federation. Heirs of the first stage

1. The heirs of the first priority according to the law are children. spouse and parents of the testator.

Article 1153 of the Civil Code of the Russian Federation. Ways to accept an inheritance

1. Acceptance of an inheritance is carried out by submitting, at the place of opening of the inheritance, to a notary or an official authorized in accordance with the law to issue certificates of the right to inheritance, an application from the heir for acceptance of the inheritance or an application from the heir for the issuance of a certificate of the right to inheritance.

If the heir's application is handed over to the notary by another person or sent by mail, the heir's signature on the application must be certified by a notary, an official authorized to perform notarial acts (clause 7 of Article 1125), or a person authorized to certify powers of attorney in accordance with clause 3 of Article 185.1 of this Code .

Acceptance of an inheritance through a representative is possible if the power of attorney specifically provides for the authority to accept the inheritance. A power of attorney is not required to accept an inheritance by a legal representative.

2. It is recognized, until otherwise proven, that the heir has accepted the inheritance if he has performed actions indicating the actual acceptance of the inheritance. in particular if the heir:

took possession or management of inherited property

took measures to preserve the inherited property, protect it from encroachments or claims of third parties

made at his own expense expenses for the maintenance of the inherited property

paid at his own expense the debts of the testator or received funds due to the testator from third parties.

Article 1154. Time limit for accepting an inheritance

1. An inheritance can be accepted within six months from the date of opening of the inheritance.

I HOPE YOUR POSITIVE FEEDBACK.

How can a daughter inherit an inheritance?

Question: Good afternoon. My wife’s father died, my father and mother were divorced. For the last 15 years, my father lived in a civil marriage with a woman. The apartment and car are registered in my father's name. Can my spouse claim an inheritance? How can I format it correctly now?

Good afternoon Your wife can claim the inheritance as the heir of the first priority of inheritance by law, provided that her father did not make a will in favor of another person. If there is a will and the heir under the will accepts the inheritance, then your wife will only be able to claim an obligatory share in the inheritance, provided that she is disabled (disabled person of any group or an old-age pensioner).

If you liked the answer, we would be grateful for a “like” of the topic page below related to your question

More consultations on the topic:

Payment of inheritance tax

Question: How will the tax on inherited property be calculated if there are several heirs? Everyone pays tax on their own.

If a tax arises, then each of the heirs is the taxpayer for the share due to him in the inherited property.

Tell me about the inheritance

Question: This is the situation: his father died, he had a car and a house. My son submitted the paper to...

The notary is not obliged to conduct a search for inherited property. Provide the notary with documents confirming ownership.

Inheritance tax

Question: Hello! In 2020, she entered into an inheritance under a will, from grandmother to granddaughter, until August 2020.

Good afternoon Cancellation of tax for relatives of the second degree (i.e., including for.

State register of speech certificates.

Question: Hello, a problem arose when registering an inheritance. The street was renamed from Byla Poznańska to Staro.

Good afternoon Indeed, the State Register of Property Rights does not contain the name of Staro Ozeryanka street. In it up to.

Denial of inheritance

Question: Hello, please tell me whether it is necessary to write a refusal to inherit a daughter’s (monetary) inheritance from her father if the father does not claim it.

No. Good afternoon! Your situation is unclear. Who will inherit after whom? Daughter after father.

part of a privatized apartment

Question: was the application for acceptance of the inheritance submitted on time at the place of last residence of the deceased, is there a deadline.

According to the law, if the inherited property includes real estate, then the heirs are required to obtain a certificate of ownership.

Receipt for the division of money after the sale of a house

Question: After the death of my husband’s father, according to his will, the house was registered in my husband’s name. With his 2 brothers.

Legally, the house belongs only to your husband, and the transfer to his brothers of any part of the money proceeds from.

Entering into inheritance in the ATO zone

Question: Hello. With the beginning of the war, my parents and brother moved from Donetsk to Belarus (all of them are citizens of Ukraine). Ya.

Good afternoon The answer to your question today lies not so much in legal, but in.

inheritance of an apartment

Question: My mother died. My brother and his family live in her apartment. The apartment is privatized for my mother and brother. My mother and brother are registered.

If six months have not passed since the death of your mother, then you can submit an application to a notary.

Registration of immovable property

Question: Mother died. and my father is deprived of parental rights, I am his daughter living with my grandmother. Father.

When an apartment is privatized, all family members who will be present at that time will participate in it.

Can a daughter inherit instead of her father?

At the end of 2011, my ex-mother-in-law died. She left behind a private house in which she lived herself, with a small plot of land next to it. In a month and a half, the period for entering into inheritance ends. And her only son, my ex-husband, refuses to deal with this issue. He suffers from alcoholism and spends most of his time drunk. He and I have a daughter together. He has no more children from anyone. Tell me, is it possible to register an inheritance for the house in the name of our daughter, that is, the grandson of the mother-in-law. She didn’t draw up a will for anyone, at least that’s what she told us.

April 17, 2012, 12:41 User, Ufa

Lawyers' answers (5)

According to the Civil Code of the Russian Federation, the heirs of the first priority according to the law are the children, spouse and parents of the testator. The grandchildren of the testator inherit by right of representation (the share of an heir by law who died before the opening of the inheritance or at the same time as the testator passes by right of representation to his respective descendants).

If your ex-husband does not want to deal with the registration of inheritance, then he can declare his right to inheritance from a notary and issue a notarized power of attorney for the registration of his inheritance rights, for the one who will deal with the registration, i.e. receive the necessary documents, submit applications, etc. (for example, this could be your daughter). BUT! She will register the inheritance not for herself, but for her father. After receiving a certificate of ownership, the father can draw up a gift deed for his daughter.

17 April 2012, 12:56

Have a question for a lawyer?

City not specified

According to the law, there is a priority order for entering into inheritance. The beneficiaries of the estate include the decedent's children, surviving spouse and parents. If there are other first-degree relatives, grandchildren will have the right to inherit only by right of representation, i.e. in the event of the death of their parents. At the same time, they inherit that part of the inheritance that would have legally belonged to their mother or father if they were alive at the time the inheritance was opened. If your ex-mother-in-law has no other relatives, and your ex-husband does not want to enter into an inheritance, then your daughter has the right to submit an application to the state notary office at the place where the inheritance was opened within six months from the date of her grandmother’s death. To enter into an inheritance, your daughter must have the following documents: a death certificate of the testator, originals of title documents for the house, a registration certificate, certificates from the place of residence of the testator about the composition of the family at the time of his death, identification documents of the heir - passport, identification code, and also documents confirming relationship with the testator - father’s birth certificate, daughter’s birth certificate, etc.

17 April 2012, 13:06

After the death of the testator (the day of opening of the inheritance), the heir, as a general rule, is given 6 months to assume the rights of the heir. As follows from the letter, you are familiar with this deadline. It also follows from the letter that the will will take place according to the law, since your ex-mother-in-law (ex-husband’s mother) did not leave a will. Taking into account the priority according to the law (in this case, the first priority), the following will inherit: the children, spouse and parents of the testator. From your letter it follows that the only legal heir will be your ex-husband (son of your mother-in-law). I offer you the following option for solving (resolving) the problem indicated in the letter and not reflected in the answers of my colleagues. Your ex-husband can directly refuse the inheritance in favor of the deceased’s granddaughter (your daughter together with your ex-husband). To renounce the inheritance, your husband (you have to try) needs to go to a notary and submit an application for renunciation of the inheritance. This option seems to be the most effective and simple. After this, your daughter needs to take steps to enter into an inheritance (payment for land, electricity, etc.) and then she will receive a certificate of the right to inherit the relevant property. With respect and good luck, A. Denis.

17 April 2012, 13:46

Maybe, under such circumstances, you should think about notarizing your husband’s refusal of inheritance from a notary (Article 1159 of the Civil Code of the Russian Federation)?

17 April 2012, 13:47

Client clarification

The thing is, my husband doesn't care. He doesn't want to go anywhere. How can we manage without his help?

17 April 2012, 14:02

Denis Andreichenko really indicated the simplest option.

I did not take this option into account in my answer. But you still cannot do without renouncing the inheritance in favor of your daughter or registering a power of attorney. If he “doesn’t want to go,” invite a notary to his home.

17 April 2012, 14:11

Looking for an answer? It's easier to ask a lawyer!

to our lawyers - it’s much faster than looking for a solution.

The procedure for entering into an inheritance without a will

Entering into inheritance is an important stage after the death of a relative. The law clearly regulates all cases of inheritance, even without a will. Before contacting a notary and declaring your rights, it is advisable to understand how such issues are resolved, what documents are needed, and within what time frame the registration takes place.

How property is inherited: all possible options

The issue of inheritance of property is worked out in detail in the law and in legal practice. The documents clearly define all procedures, required documents, deadlines for registration and other important points related to the transfer of property from a deceased person to the heirs.

There are 2 possible situations related to the sale of property that remains after the death of its owner:

- Inheritance by will - in this case, everything is obvious: the property of the deceased goes to the persons specified in the will. A will is the result of good will, to which every citizen has the right. It is always registered with a notary and can only be changed by the will of the person who compiled it at any moment in his life.

- Inheritance by law is applied in situations where, for some reason, the deceased did not have time or did not want to draw up a testamentary document. Accordingly, in this case, the transfer of things, real estate, cars, securities and other property is carried out on the basis of instructions given by civil law.

If a will is drawn up, any person (private citizen or company, as well as the state) to whom the property is transferred in full is recognized as an heir. However, there are a number of persons whom the law (Article 1149 of the Civil Code) guarantees to receive a certain share from the property of the deceased:

- all children of the deceased who are under 18 years of age (including adopted and guardianship children)

- all children of the deceased of any age, if they are recognized as incapacitated for health reasons (disability)

- parents of the deceased (including his adoptive parents) who are retired due to age or serious health problems (disability)

- spouse of the deceased, who is also an old-age or disability pensioner).

Inheritance without a will: order of heirs

In the legal sense, a deceased person is called a testator, regardless of whether he managed to execute a will or not.

The law (Chapter 63 of the Civil Code, Part 3) contains clear instructions regarding who inherits the property of a deceased person and in what order if there is no will. To clearly describe the procedure, the concept of queue is used. Accordingly, there are heirs of the 1st stage, 2nd stage and so on.

- First of all, persons who are the closest relatives of the deceased person are included:

- The entry of the next group of heirs into rights is possible if the deceased does not have any of the heirs of the 1st stage. Then the property goes to the following persons:

- If there are no relatives of both of the described groups, then the heirs will be:

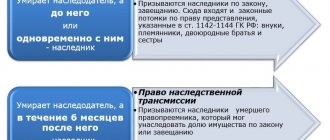

- In the absence of all the described persons, the property is distributed among relatives of the 4th and 5th generations. The entire scheme is clearly reflected in the figure.

- A citizen dies and no will has been made. He is survived by a nephew, an adopted son and a wife. Accordingly, first of all, the inheritance will go to the adopted son, then to the wife, then to the nephew by right of inheritance.

- After her death, the citizen was left with two adult able-bodied daughters, one of whom was adopted, a husband and a cousin. During his lifetime, no will was drawn up. Then all the things will first go to the daughters (in equal parts adopted and natural), then to the husband, and lastly to the cousin with the right of representation.

- During his lifetime, the citizen drew up a will stating that all property should go to the son of his friend. At the same time, he has 2 adult sons, 2 grandchildren and 1 disabled daughter (with a disability), who is already 18 years old. In this case, the property will be transferred to the will, but the obligatory share will go to the daughter (despite the fact that she is an adult and has a disability). The sons and grandsons will not get anything.

If there are no heirs of all queues

In rare cases, it is impossible to find the heirs of all the described queues. Then the property of the deceased person is distributed among persons by right of representation, who replace the deceased heirs in the following order:

- Grandsons and granddaughters of the deceased.

- Nephews and nieces of the deceased.

- Cousins and cousins.

It is extremely rare for a situation to arise in which there are no heirs at all. Then all property becomes the property of the state.

Entering into an inheritance without a will: step-by-step instructions and list of documents

Notaries deal with issues of registration of all documentation related to inheritance, as well as the actual registration procedure for a citizen entering into inheritance under the law and under a will. If it becomes known that a relative to whom you are becoming an heir has died, it is important to immediately go to a notary. The registration procedure is as follows:

- You should ask a notary whether a will was drawn up by the deceased, if this cannot be done in any other way. You can familiarize yourself with the text of the will, if any, and assess your chances of accepting the property.

- Writing an application in the prescribed form (the notary will suggest it), which expresses in writing the intention to accept the inheritance.

- Provide the specialist with all the necessary documents:

- Pay the fee, complete all the documents and expect your actual entry in six months.

At the end of the registration procedure, a corresponding certificate is issued, certified by a handwritten signature and a blue seal of a notary.

Registration fee

The amount of the fee does not depend on how the inheritance is transferred - in accordance with the will or by law. It is determined by only two factors:

- The heir's turn.

- The amount of the inheritance.

The fees are clearly presented in the table.

Preferential categories

The law establishes that some citizens do not pay the full amount of the duty or are exempt from it altogether. In this case, they need to provide original documents that certify their right to the benefit:

- Disabled people of groups 1 and 2, regardless of which queue they belong to, pay half of the fee, as well as all other costs associated with paperwork. Relevant medical documents must be provided.

- The following categories of citizens do not pay the fee:

Payment of the fee is a mandatory condition when registering an inheritance; it is provided for by law. In this case, each heir who has presented his rights pays this fee.

Deadlines for exercising the right

After the death of a citizen, if there is no will, you cannot inherit his property immediately, but only after 6 months. The countdown of this period begins on the day that is next in relation to the official day of death indicated in the certificate.

For example, a citizen died on February 26. Accordingly, things are transferred to the heirs no earlier than August 27. Moreover, if August 27 falls on a Saturday or Sunday, then the day of inheritance is the next Monday.

EXAMPLE. The citizen died on November 8. Heirs have the right to join after 6 months, i.e. formally May 9. But since this is a public holiday, the day on which their rights will begin to legally apply from the next working day.

In a legal sense, this period is not provided in order to be able to complete all the documents - such processes are generally completed much faster than six months. The fact is that 6 months are necessary for all the heirs to show up and confirm their consent to accept the inheritance.

Any of them has the right to refuse property. If this happens, as well as in cases where within 6 months some heirs have not declared their intention, then the property is distributed among the next heirs.

Along with the existing rule on the entry period, there are several exceptions:

- If some heir did not have an objective opportunity to find out about the death of the testator, then even after the expiration of the period, his right can be restored. However, such a decision can only be made by a court - accordingly, the heir needs to prove with documents why he was unable to declare his rights in time.

- If, after 6 months, none of the heirs of the 1st line have notified their intentions, then the heirs of all subsequent lines have less time to do this - 3 months.

Disinheritance

Some heirs may be officially recognized as unworthy during the life of the testator or after his death. Such a decision is made only in court. An unworthy heir completely loses his right to inheritance.

Such persons include the following:

- Citizens who have committed criminal acts against the testator, as well as any of his heirs: murder or attempted murder, rape or attempted rape, causing grievous harm.

- Citizens who tried to illegally influence the will of the testator at the time of drawing up his will - threats, use of physical force.

- Citizens who were obliged to support and care for their heirs, but did not do so without good reason.

The responsibility for collecting evidence that the heir is unworthy lies with other heirs or interested parties.

You can learn more about disinheritance here.

A detailed consultation with a practicing notary who has experience in registering inheritance without drawing up a will can be found here.

Entering into inheritance after death

Entering into inheritance after the death of a relative is accompanied by a number of formal procedures. The entry into rights may be hindered by claims made by third parties, the lack of some of the mandatory documents, or basic ignorance of the basic laws governing this area of relationships between people.

Inheritance of property means the transfer of rights to it to other persons who have legal grounds for it. Who has more rights to inheritance after the death of her husband? His spouse, children or parents? To whom does the inheritance go after the death of your father? Knowledge of the laws helps answer these questions.

There are two modes of inheritance: by will and by law. The latter regime is valid if it is not changed by a will drawn up in advance.

According to the Civil Code of the Russian Federation, strict deadlines are established during which everyone can exercise their right to receive an inheritance, must submit a notarized application or perform actions specified in the law, regarded as actual entry into the inheritance. The period is 6 months from the date of registration of death.

Entry into inheritance after death according to the law is carried out in the following order. First of all, children, spouses and parents of the testator have the right to inherit. Only then come the grandchildren and their descendants, who receive the right of inheritance based on the principle of representation.

Entering into an inheritance after death under a will is possible subject to compliance with all the conditions for its legal registration. The will must be executed in writing personally by the person drawing up his will. In this case, the person making the will must be fully capable. The existing will must be certified by a notary or persons who have the legal right to do so (chief doctors of hospitals, captains of ships, heads of expeditions or places of detention).

Entering into inheritance after death: registration rules

You can enter into rights in two ways: by submitting an application to a notary and actually accepting the inheritance.

When submitting an application, this must be done at the place of residence of the testator. This can be done in person or through postal services (subject to a notarized application). A number of general and additional documents are attached to the application. Common documents include the passport of the person entering into the inheritance, a document confirming the death of the testator, a certificate from the place of residence and a document indicating kinship are required.

Additional documents are the following for individual cases:

Based on the totality of the necessary documents, the notary opens an inheritance case, finds out the circle of all heirs, and calculates their shares. After six months, a certificate of right to inheritance must be issued. This document should then be submitted to the federal registration service office in order to receive a document on state registration of the right to the transferred real estate.

The actual acceptance of an inheritance is considered to be the heir’s entry into management or ownership of the property, the incurrence of expenses for the maintenance of the property, and the adoption by him of measures aimed at preserving the property and protecting it from damage and paying the testator’s debts. In this case, the right of ownership of the inheritance must be recognized by the court.

On December 16, 1992, my husband’s father died (the only survivors were his mother, sister, and he); in January 1993, my sister and husband renounced their share of the inheritance in favor of their mother. On July 20, 2013, the mother died, in the hope of receiving 1/2 of the house, the husband filed an application with a notary. After 60 months, the notary explained that the mother bequeathed all the property to her sister and showed the will dated May 15, 1993, that is, before the expiration of 6 months for the mother to enter into the inheritance, the will had already been drawn up and notarized. Can I get clarification on whether the husband should challenge such a will and where to turn in this case?

How to look younger: the best haircuts for those over 30, 40, 50, 60 Girls in their 20s don’t worry about the shape and length of their hair. It seems that youth is created for experiments with appearance and daring curls. However, already last.

What does your nose shape say about your personality? Many experts believe that you can tell a lot about a person's personality by looking at their nose. Therefore, when you first meet, pay attention to the stranger’s nose.

10 charming celebrity children who look completely different today Time flies, and one day little celebrities become adults who are no longer recognizable. Pretty boys and girls turn into...

7 Body Parts You Shouldn't Touch with Your Hands Think of your body as a temple: you can use it, but there are some sacred places that you shouldn't touch with your hands. Research showing.

11 Weird Signs That You're Good in Bed Do you also want to believe that you please your romantic partner in bed? At least you don't want to blush and apologize.

Why do you need a tiny pocket on jeans? Everyone knows that there is a tiny pocket on jeans, but few have thought about why it might be needed. Interestingly, it was originally a place for storage.

Sources: www.yurist-online.net, www.notary.kh.ua, m.pravoved.ru, 2ann.ru, fb.ru

Next

No comments yet!

Share your opinion

You might be interested in

How to register a car as an inheritance at the traffic police if there are two heirs

Cancellation of a certificate of inheritance by a notary

Refusal of inheritance is a one-sided transaction

Tax on the sale of an apartment by inheritance of consanguinity

Popular

We received a certificate of inheritance for an apartment, what next (Read 185)

Inheritance after the death of a divorced spouse (Read 168)

Address certificate of the Federal Migration Service for inheritance (Read 164)

Can bailiffs take away an inheritance (Read 130)

How to inherit an apartment after the death of your mother?

The first priority is to contact a notary office with an application. Next, he will check the authority of the applicant and the basis for succession by including him in the circle of heirs.

Place and deadline

The opening of an inheritance is carried out either at the place where the person died, or at the location of a larger volume of property. Registration of the main inheritance document (certificate of the right to inheritance) is carried out by a notary of the corresponding notarial district. Further, if the inherited property is real estate, it must be re-registered with Rosreestr.

Registration procedure

After establishing the recorded fact of a person’s death, the relevant notary opens an inheritance case and, accordingly, an inheritance. Further, he calls on all persons who are possible heirs to inherit.

Let's celebrate! The procedure for obtaining a document confirming the right to inheritance takes half a year. At this time, the notary carries out actions to clarify the volume of inherited property, persons entitled to receive the inheritance, checking the documents that were provided to him by the heirs and other actions provided for by law.

Required documents

To register an apartment received by inheritance, different sets of documents will be needed at different stages.

So for the direct inheritance stage you will need:

- The applicant's passport and its copy.

- A document from the civil registry office confirming the death of the testator.

- Documents for real estate previously issued to the testator.

- Statement of desire to accept inheritance.

At the next stage you will need:

- Certificate of right to inheritance.

- The heir's passport and its copy.

- Application to Rosreestr for the transfer of ownership of real estate from the testator to the heir.

Price

The service for transferring ownership of real estate includes the following paid services:

- Opening of an inheritance case by a notary.

- Carrying out by a notary legally significant actions related to registration of inheritance.

- Issuance of a document confirming the right to inheritance.

- Carrying out registration activities.

A specific indicator is the fixed amounts of state duties established by the Tax Code. So, for persons who are heirs of the first and second stages, it will be 0.3%. For heirs of other queues it is 0.6%.

Good to know! However, the law provides for limits on the amount in some cases. So for the first and second categories the limit is 100,000 rubles. In the second case, the amount of the duty cannot exceed 1 million rubles.

The price can also include:

- Notary fee.

- Fee for technical and legal services provided by a notary.

- Additional expenses incurred by the notary.

- Costs of state duty in connection with registration of the transfer of ownership by Rosreestr.

Collection of documents for registration of a share of an apartment by inheritance

A man died. The funeral took place. We need to pull ourselves together and start preparing to inherit a share of the apartment.

Opening an inheritance is possible only after the death of the apartment owner.

It is impossible to accept it during the owner’s lifetime under any circumstances.

It will be necessary to prepare a set of papers for notarization within six months from the date of death of the apartment owner.

The following algorithm is proposed:

- visit to the registry office: the medical certificate of death and the passport of the deceased are exchanged for a death certificate issued on stamp paper;

- visit to the photo center: a copy is made of the death certificate;

- going to the passport office: the heir takes with him a passport, the death certificate of the apartment owner and a copy, removes the deceased from the registration register and requests Form 9 indicating the date of discharge.

Documents are being prepared for the initial visit to the notary:

- passport;

- death certificate of the apartment owner (and a copy);

- will (if available);

- Form 9 with the date of deregistration of the deceased;

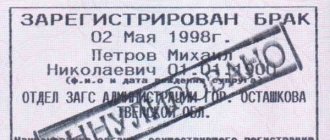

- birth certificate, marriage certificate (confirming relationship with the testator).

Having taken the necessary papers with them, interested people visit a notary's office, submit to the notary an application confirming in writing their intentions to inherit the share, and receive a list of documents that must be collected and submitted within six months from the date of departure of the apartment owner.

To formalize the inheritance of a share in a privatized apartment, you need to collect certain documents.

To inherit a share in an apartment, you will need:

- privatization agreement;

- certificate that the ownership of the housing has been registered by the state;

- cadastral passport;

- extract from the Unified State Register.

Since October 2020, the last two points are taken over by notaries. Now they have the right to request these papers in electronic form.

Many heirs may be interested in questions about whether it is possible to sell the inherited apartment, how much it costs to enter into an inheritance, as well as how the resulting living space is divided during a divorce and how the inheritance of a non-privatized apartment occurs. The answers to them can be found on our website.

Refusal of inheritance

All pretending heirs have the right to refuse to enter into inheritance rights. This is enshrined in current legislation. It was provided for as a result of the fact that inheritance implies the transfer of not only property rights, but also responsibilities.

Because of this, a situation may arise where it is not profitable to accept the inherited property, since in the future it will have to be transferred to pay off the debt.

There are several types of refusal:

- Refusal in favor of another candidate.

- Simple (unconditional).

- Silent.

Let's celebrate! Thus, the process of registering real estate is multi-stage. To register real estate, you must accept it as an inheritance and contact the registration authorities for re-registration. Completing these procedures is associated with the need to pay state duties and taxes provided for by Federal Law.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now: +7 (Moscow) +7 (812) 309-53-42 (St. Petersburg) It's fast and free!

Heirs after the death of a child

Inheritance after the death of a child, from a technical point of view, does not represent a difference from succession between other relatives. The potential owner of the estate must appear before the notary within six months after the death of the citizen.

If the specified period is missed, it can only be restored under certain circumstances. As follows from the rules of law, there is a procedure for inheritance by law and by will. The legal order is relevant when there is no will. At the same time, heirs can simultaneously accept property under two modes .

If part of the property is distributed according to the will, then the rest is distributed according to the general principles specified in the law . It is possible to accept property at the same time by law and will, as well as to choose one or completely refuse the inheritance. Upon entering into the rights of possession, use and disposal, the new owner may renounce them within 6 months, without giving reasons.

In law

In civil law, there are 8 lines of inheritance. In particular, when distributing property, it is necessary to take into account the obligatory share of the testator’s dependents.

In the event of the death of a child, the right to receive property first arises from the parents, children, and spouse . In equal shares to everyone, but do not forget that the marital share will be greater than the rest.

Example

Citizen Uvarov A.P. died, his wife was Uvarov R.O., and his parents were Uvarov P.L. and Uvarova A.A.. The property includes a house acquired during marriage. Consequently, since half belongs to Uvarova R.O, on the basis of marriage, only part of the house 1/2 is divided. The wife and parents each receive 1/3 of the remaining half. Uvarova R.O. also receives a share of half the house, but as an heiress. That is, 1/2 of the entire home was already hers originally, and 1/3 was acquired by inheritance.

If the testator has only parents, then everything that the citizen owns is accepted by his parents. Taxation for parents is 0.3% but not more than 100,000 rubles. And in general, 0.6% but not more than 1,000,000 rubles. The spouse and children must also pay 0.3% of the amount received (market price).

By will

The testamentary order of inheritance is specific. The testator himself decides who will receive and how much, which greatly simplifies the inheritance procedure and eliminates possible conflicts on this issue. The citizen’s order must be drawn up independently. Representation in such cases is not permissible . The notary explains all the necessary nuances and helps the testator if questions arise.

The document must be drawn up only legally capable person, an adult . If, during the procedure, a notary doubts the adequacy of a person or has other reasonable suspicions that the person is not of sound mind, then he may refuse to certify the paper.

An adult child's will may include all or part of the estate. Persons who will accept the inheritance in the event of refusal or death of the main successor can also be designated. The description of the property may not be limited to what is already there, that is, the phrase “everything that will be my property at the time of death” will have legal force .

Information

The order can be drawn up as one or several (in relation to each subject of the will). If several documents contain the same property, then the implementation of entry into management rights will take place on the basis of the most recent one .

An obligatory share in the inheritance is also due in the case when the specified citizens from this category are not mentioned in the will or their share is less than the required one. Receipt of the obligatory part is based on the incapacity of a citizen who has lived with the testator for at least a year or who is dependent on him, but in different places. Children under 18 years of age, disabled people and pensioners are considered disabled persons.

If deadlines are missed

However, it often happens that it was not possible to accept the property on time. This does not mean at all that the heir loses the right to receive the inheritance bequeathed or transferred by law after the death of the parents. To receive an inheritance in this case, you must apply not to a notary, but to the court with an application. The text of the application must contain a request to restore the deadline. In addition, the heir will have to prove that the reason for missing the deadline is really compelling. This can only be done by presenting the relevant documents to the court, or with the help of witness testimony.

You must go to court to accept the inheritance after the expiration of the term no later than 3 years after eliminating the reasons that prevented you from doing this in a timely manner.

It follows that it is possible to enter into an inheritance many years after the death of the testator. If the heir, for example, did not know about his right, he can enter into inheritance within 3 years after he has this information. This means that you can enter into an inheritance either after 20 years or after a longer period.

After the death of parents, children have a priority right to inherit by law. To complete the application, you need to collect certain papers and, preferably, not miss the deadline. If this happens, it is only possible to restore what was lost through the courts.

Acceptance of inheritance by will

After the death of a son or daughter, the inheritance can be divided according to the conditions specified in the will. According to Article 1120 of the Civil Code of the Russian Federation, the testator has the right to bequeath any of his property to a circle of persons chosen by him.

The testator must make a will in person, in a state of legal capacity. It must be certified by a notary, otherwise such a document will not have any legal force. In the will itself, the testator may indicate the following information:

- conditions for receiving property;

- one or more receivers;

- a list of persons unworthy of his inheritance;

- additional heirs if the main heirs do not appear or refuse their share.

The testator has the opportunity to independently determine the size of the share of each heir. If he fails to do so, the property will be divided equally among all named recipients.

According to Article 1149 of the Civil Code of the Russian Federation, there are categories of citizens who have the right to an obligatory share of the inheritance:

- disabled parents and spouses;

- disabled minor children.

This circle of persons can claim the inheritance regardless of the will expressed by the testator. For example, a daughter can make a will in favor of her husband. If her parents are disabled citizens due to disability or age, they will claim a share of their daughter's inheritance in any case. The size of the obligatory share is 50% of the part that was due by law.

Registration of ownership of an apartment received as an inheritance

The powers to register property rights are vested in the management departments of the Federal Service for State Registration, Cadastre and Cartography.

To register your right, provide the following documentation to the government agency:

- A written request to register ownership;

- Certificate confirming inheritance rights;

- A document allowing to identify a citizen;

- A check confirming payment of the state duty;

- Technical documentation describing this property (technical passport or extract from it).

The law stipulates that registering ownership of an apartment should not take more than a month. Accordingly, after 30 days from the day the documents were submitted to the authorized body, the apartment becomes the property of the heir.

Was the Recording helpful? No 77 out of 96 readers found this post helpful.

Deadlines for registration of inheritance

Any legally significant action and process has deadlines that limit its implementation. Acceptance of property must be carried out within a period not exceeding six months from the date of death of the testator.

In order not to make a mistake with the beginning of the countdown, it is necessary to take into account that the day of death of the testator is considered:

- The date indicated on the death certificate;

- The date specified as the day recognized as the day of death of a person according to a court decision.

It is better not to miss the six-month period, since such a gap entails registration of the inheritance in a different, more complex manner.