Categories of pensioners receiving a mortgage

Some categories of elderly people can apply to the institution for money. Before making a deposit, the representative determines the chances of getting the money back. This is necessary to assess the chances of debt repayment.

Categories of pensioners who have a chance to receive money:

- Married applicants. More often, such couples are considered wealthy and reliable.

- Elderly citizens who have permanent or temporary work. If you receive systematic income once a month, there is a chance to receive a deposit.

- Clients who own a property. If the loan is not repaid, the apartment or car is repossessed.

- The pensioner must have a positive credit history. At the same time, have a pension card from Rosselkhozbank.

An important condition is that the applicant invites guarantors. This increases the chances. They must also be solvent.

Divorced citizens are often refused. Or those involved in litigation. In addition, the application is rejected if the applicant has dependents.

Categories of pensioners who can get a mortgage

Rosselkhozbank identifies certain categories of people of the older generation, the agreement with which is characterized by a reduced degree of risk. It is easier and faster for them to obtain a mortgage, and they may be offered better conditions. Priority is given to pensioners who are employed under an official contract and have a high monthly income.

Married couples are highly rated by Rosselkhozbank due to their financial security and social security. The more close relatives or friends who are ready to become a guarantor, the faster the mortgage is issued.

Please note: the level of income and capacity of third parties are factors that are carefully checked by the bank.

Mortgage for pensioners at Rosselkhozbank - conditions in 2021

Mortgages for pensioners from Rosselkhozbank are an advantageous offer in 2021. The money company offers optimal conditions for Russian citizens. Primary requirements:

- The client is not older than 75 years.

- Bank amounts are paid in Russian currency – rubles.

- When registering, you need to pay an amount that corresponds to approximately 15% of the value of the property.

- Interest varies depending on the loan period and the amount of the down payment.

- Loans are given to citizens for a period of 25 years.

- Make a minimum monthly payment.

- Clients are given 10-200 thousand Russian rubles.

- Auto payment option available. Pension payments are automatically transferred to the repayment account.

- The terms and conditions remain the same during the refund period. There are no additional payments.

- The main goal of the campaign is to help citizens buy housing.

What does the bank offer?

Before we consider in detail the programs under which pensioners will be able to obtain a mortgage from Rosselkhozbank in 2021, we note the advantages of lending from the bank:

- the decision to issue a loan or apply for a mortgage is made within 5 working days;

- provided the opportunity to submit an application online;

- the future borrower will need a relatively small package of documents, and the bank is loyal to participants in salary projects and recipients of pension payments;

- the ability to choose a loan repayment method - differentiated or annuity;

- preferential interest rates were provided for the purchase/construction of housing in rural areas;

- there are no hidden fees when making payments or early repayment of the loan, a repayment schedule convenient for the borrower is developed;

- the need for insurance of the purchased property or personal insurance of the borrower is determined by agreement of the parties.

Recommended article: How to apply for a Sberbank mortgage online without a down payment in 2021

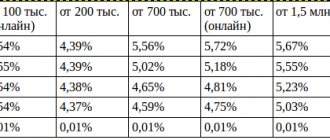

The table below shows the conditions for Rosselkhozbank mortgages for pensioners in 2021 according to the programs currently in effect.

Mortgage calculator

A mortgage calculator is a standard program that is needed to assess the status of cash payments. The service helps you independently determine the profitability and feasibility of lending. A citizen will understand how beneficial a loan is in this situation. In addition, it will assess all financial risks. The following information is used to determine data:

- the full amount of the property being purchased;

- duration of the loan agreement;

- possible additional interest and commissions;

- debt elimination plan.

Please fill out all fields to get accurate information. Now, the system will provide a payment schedule.

Requirements for borrowers

To obtain a mortgage loan from the Russian Agricultural Bank, a pensioner must meet the established requirements:

- Citizenship of the Russian Federation.

- Registration in Russia.

- Positive credit history.

- Applicant's legal capacity.

A pensioner under the age of 75 can become a client of the Russian Agricultural Bank. This is possible if the pensioner attracts a solvent co-borrower and after half the loan term, the main debtor will be no more than 65 years old. If these two conditions are not met, then the pensioner will be able to get a mortgage only if he is no more than 65 years old at the time of repayment of the debt.

Most often, clients of retirement age are given a mortgage loan for a period of no more than 10 years. Concluding a mortgage agreement for a longer period involves additional risks, which the lender is reluctant to take.

For applicants who are on state pensions, there are no requirements regarding work experience. However, employed pensioners have a better chance of having their application approved, unlike non-working clients.

Required documents

To formalize the contract, you will need to provide a list of documents. Without them, the credit institution will not consider the request of an elderly person. Before visiting the office, collect all necessary originals or copies. Check with a representative in advance. Call support and find out detailed information. Main list:

- passport (original and copy);

- official application for obtaining a mortgage;

- statement of current income, according to form 2-NDLF;

- a certificate from the pension fund indicating the money;

- documents on living space as collateral. The deposit is determined depending on the type of property;

- real estate insurance.

In addition, in rare cases, Rosselkhozbank requires additional information and certificates. Most often this is:

- marriage certificate and documents of the husband or wife;

- statement of income of the client and his spouse;

- documents confirming the absence of criminal records and litigation.

Who can get a mortgage from Rosselkhozbank

Citizens of retirement and pre-retirement age look like reliable borrowers in the eyes of the bank. The institution believes that this category of people takes their obligations seriously and does not allow late loan payments.

Despite this, the bank is more willing to issue housing loans to the following categories of pensioners:

- Working citizens. Pensioners who, in addition to a pension, receive a stable salary, have a better chance of having their application approved.

- Married couple. Pensioners in a registered relationship are considered the most affluent clients, since the combined income of both spouses allows them to fulfill their obligations in a timely manner and in full.

- Pensioners with a positive credit history.

- Applicants who have registered real estate that can be used as collateral for a loan.

- Citizens who can attract a co-borrower. This can be not only a relative, but also any other person who is capable and solvent.

- Military pensioners participating in the savings-mortgage system.

Rosselkhozbank has not developed mortgage lending programs specifically for pensioners. This category of applicants can receive a loan on general terms.

Requirements

Rosselkhozbank provides a list of requirements to all clients. Special attention is paid to elderly people. The bank faces many risks when issuing funds to such applicants. Main conditions:

- At the time of full repayment of the debt, the client’s age must not exceed 75 years.

- The applicant must be a permanent resident of Russia.

- At the same time, have citizenship of the Russian Federation.

- The client must have additional income in addition to the pension.

- Adding guarantors. This person is not necessarily a close relative. The main thing is that he is solvent. Certificates are required for confirmation.

- The Applicant does not have any negative credit experience. The last few decades are taken into account.

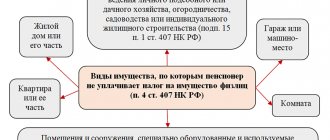

In addition, special conditions apply to real estate. In particular:

- living space is not an element of any collateral;

- the apartment was owned by the previous owner for about 3 years;

- there are no debts to utility services;

- the property is not subject to court cases and is not seized;

- The block is sold with the consent of all owners.

Mortgage terms

Rosselkhozbank offers quite favorable conditions for mortgages for pensioners.

The main ones include:

- The borrower's age cannot exceed 75 years.

- Mortgages from Rosselkhozbank are provided in Russian rubles.

- Mandatory down payment of at least 15% of the cost of housing.

- Depending on the type of housing purchased, as well as the duration of the loan transaction and the amount of the down payment, the interest rate changes.

- Rosselkhozbank issues mortgages to pensioners for a period of up to 25 years .

- The loan amount can range from 100,000 to 20,000,000 Russian rubles.

- Loan payments are made monthly.

- You can use the auto payment service. In this case, the loan is repaid at the time pension payments are credited to the client’s account at Rosselkhozbank.

- The mortgage agreement does not establish a moratorium on early repayment.

- There are no additional or hidden fees when issuing a loan from Rosselkhozbank.

- The purpose of lending is any residential property on the primary or secondary market.

Video on the topic:

Failure Cases

A credit institution refuses an applicant in several cases:

- the borrower does not meet the parameters;

- the applicant has no relatives or family;

- the citizen refuses to draw up an insurance policy;

- has a criminal record;

- the client has no income and does not receive a pension from the company;

- borrower without real estate as collateral.

Thus, any pensioner can become a client of Rosselkhozbank. To obtain a positive result, a person must meet the requirements of the company. You can repay the loan at your discretion. If you make a payment ahead of time, the fees do not increase. A mandatory requirement is to issue an insurance policy.

The most favorable conditions

The interest rate offered to pensioners at Rosselkhozbank is determined taking into account the contribution paid by the client at the very beginning and the selected period.

In a situation where the mortgage was issued with a down payment of more than 30%

No. Deadline (years) Minimum interest 1 2 3 1 5 14.5 2 10 15 3 20 15.5 4 30 16

In a situation where the mortgage was issued with a down payment of more than 50%

No. Deadline (years) Minimum interest 1 2 3 1 5 13.5 2 10 14 3 20 14.5 4 30 15

When applying for a mortgage loan, it is more profitable for pensioners to deposit as much as possible at once. The optimal period is 10 years. With this choice, the value of regular payments and the interest rate allow you to minimize overpayments.

Rosselkhozbank offers pensioners a consumer loan of up to half a million, which does NOT require guarantors or transfer of collateral. The maximum period is 7 years. The rate under the agreement is from 16%.

Basic requirements for the applicant

The issuance of a loan under the “Mortgage for Pensioners” program is provided only to those citizens who retired at the age of 55-60 years, depending on gender.

It is important to pay attention to the following rules:

- If for some reason the applicant retired earlier than the standard period (policeman or military, disabled person, etc.), then he is provided with a longer housing loan period;

- Work experience is of great importance - the borrower must have worked for at least a year for the last 5 years (and six months must have been at the last place of work);

- Additional sources of income are also important for a banking organization (private pension funds, the presence of deposits or any investments, real estate or owned transport, etc.).

Requirements for a pensioner-borrower:

- The potential borrower should not be older than 75 years at the expected expiration date of the loan agreement;

- Permanent registration of the applicant on the territory of Russia;

- Status of a citizen of the Russian Federation;

- Income level (this includes additional earnings and income of the spouse);

- No negative credit history for previous years.

- Possibility for the applicant to attract co-borrowers.

Requirements for real estate from Rosselkhozbank:

- The housing property that the pensioner plans to purchase must be owned by the seller for at least 3 years (this will need to be proven to bank employees by providing them with the relevant documents);

- The property should not be subject to collateral;

- It is necessary to provide a certificate stating that all utility bills at this address have been paid off (there is no debt);

- The desired apartment/house should not be subject to arrests and other burdens in favor of third parties;

- Consent to the purchase and sale transaction from all home owners is required.

Conditions of the “Mortgage for Pensioners” program at Rosselkhozbank:

- Amount - from 100 thousand to 60 million rubles;

- The borrower's down payment is at least 15% of the cost of the property;

- Loan term - from 1 year to 10 years.

Mortgage for pensioners under 75 years old without guarantors at Rosselkhozbank

The established requirements for pensioners wishing to buy housing are standard. One of the important ones is the age of the borrower at the time of full repayment of the loan; it is 75 years. It is equally important to collect the necessary papers and documents, as well as prepare them properly.

The age category is quite flexible, but it is allowed in the complete absence of various encumbrances.

These are things like:

- Pledge;

- Litigation;

- Dependents;

- The likelihood of other threats occurring.

To obtain a mortgage loan, it is very important to have a completely understandable scheme for purchasing real estate, which is clear from a legal point of view. If everything is clear with the documents and legal justification, it is permissible to take out a mortgage on a house, apartment, completed or unfinished construction projects. The purity of the transaction is important, starting from the previous owner and ending with the transfer of the property to the official borrower.

Rosselkhozbank terms and conditions

Since pensioners are mostly elderly, Rosselkhozbank, in order to minimize its own risks, reduces the maximum loan period to 5-7 years on average.

However, if a pensioner works or retired on preferential terms for some citizens (military, ballerinas, teachers), then his age may be a much lower figure, and accordingly the loan term also increases.

Rosselkhozbank offers mortgages to pensioners subject to the following conditions:

- Availability of state registration on the territory of Russia and Russian citizenship;

- Compliance with the maximum permissible lending age;

- Providing the necessary documents;

- Stable solvency and own income, in addition to pension.

Requirements for borrowers

Pensioners acting as borrowers or co-borrowers are checked by Rosselkhozbank more carefully due to high risks.

To apply for a mortgage at Rosselkhozbank, a pensioner must meet the following requirements:

- The age at the time of full repayment of the debt is no more than 75 years (on average it even drops to 65 years, but there are cases of mortgages being granted up to 80 years);

- Availability of citizenship and state registration;

- Availability of documented stable income, in addition to pension payments;

- If a married couple wants to get a mortgage, then the income of the family as a whole is assessed, and this is a plus, since it is easier for two people to allocate money to repay the necessary amounts;

- The presence of other property is taken into account and the possibility of transferring it to the collateral object in parallel with the acquired property is considered. In this case, the bank is more willing to issue a mortgage and on much more favorable terms;

- Possibility of participation in the mortgage program by other co-borrowers, who may not necessarily be relatives;

- Good credit history with Rosselkhozbank and other banks in previous years.

You can find out more about the list of banks that provide mortgages with a bad credit history by following the link.

Video on the topic:

Requirements for real estate objects

A mortgage provides for the issuance of funds secured by purchased or existing real estate, that is, in fact, the client is the owner, but in order to guarantee repayment of the loan, Rosselkhozbank has the right to apply sanctions regarding these objects in the event of late mortgage payments.

Rosselkhozbank, when issuing a mortgage, puts forward certain requirements to the collateral:

- The property must be assessed by a professional appraiser and be recognized as liquid if put up for public auction;

- If existing property acts as additional collateral, then ownership must also be confirmed by established documents;

- If a plot of land is purchased, then a check is made on climatic and geographical conditions, as well as the lack of protection by environmental funds;

- The property must be located within the bank branch location.

Mortgage conditions at Rosselkhozbank and requirements for borrowers

PJSC Rosselkhozbank is one of the largest banks in Russia (along with Sberbank, VTB, Gazprombank). RSHB ranks second in the number of branches, and all voting shares of the company belong to the state. Therefore, potential borrowers can be confident in the company’s reliability, which is important in modern conditions.

You can take out a mortgage from Rosselkhozbank both for the purchase of an apartment, apartments in new houses (new buildings) or the secondary market, and for the purchase of a finished house (townhouse, cottage) or land for construction. Moreover, the client can also choose a mortgage loan for the purchase of housing under a shared construction agreement. It is worth noting that under some programs it is possible to obtain a mortgage at Rosselkhozbank without a down payment and with only 2 documents.

In order to obtain a mortgage from the Russian Agricultural Bank, the borrower must meet the following criteria:

- Be a citizen of the Russian Federation (have a passport).

- Have registration at your place of residence or stay.

- For individuals, the work experience at the last job must be more than 6 months and at least one year of total work experience over the last five years.

- If a mortgage loan is taken out by a client with a positive credit history and who receives wages into an account opened with the Russian Agricultural Bank, then the length of service at the last job may be more than 3 months. Borrowers receiving a pension into an account with this bank are not subject to requirements for total work experience.

- For those who run a personal subsidiary plot (LPH), it is necessary to have an entry in the household book about the citizen’s management of this same private plot for more than 1 year before the date of filing an application for a mortgage loan.

- The borrower must be over 21 years of age. However, the loan will not be issued if the client is over 65 years old at the time of closing the debt obligations.

To apply for a mortgage at Rosselkhozbank, a potential client must provide the following package of documents:

- completed borrower questionnaire and loan application;

- passport of a Russian citizen;

- men under 27 years of age must present a military ID;

- documents confirming marriage or divorce;

- children's birth certificates;

- papers confirming the required level of income and work experience of the borrower;

- documents on the loaned property, as well as collateral (if the program provides for collateral).

In order to take out a mortgage for a secondary home at Rosselkhozbank or for an apartment in a new building, individuals will have to provide a certificate in form 2-NDFL or in the bank form to confirm their income level. You can download a certificate on the bank form on the company’s official website. It should also be taken into account that when considering an application, the bank has the right to request any other additional information and documents (work book certified by the employer, education diploma), so you need to be prepared for this.

Mortgage interest rates at Rosselkhozbank and lending conditions depend on the chosen program, the term of borrowing funds, and the status of the borrower. If a person has a positive credit history, is a salary client of the bank, receives a pension into an account at the Russian Agricultural Bank, or uses maternity capital when purchasing real estate, then he can count on preferential conditions and a reduction in the interest rate on a mortgage at Rosselkhozbank.

Now let's take a closer look at each mortgage program in this credit institution.

Requirements for the purchased object

The bank imposes certain requirements not only on the borrower, but also on the real estate on which the mortgage is issued. Housing must be located in the region where the branch of the financial institution is located. If the house is built of wood, then it will not be possible to get a mortgage on it.

Requirements for the purchased object:

- No illegal redevelopment.

- No encumbrances or arrests.

- Wear percentage is not less than 70.

- The technical condition of the house must be up to standard.

Housing should not be subject to demolition, and also be in emergency fund. If the real estate is state or municipal property, then it will not be possible to obtain a mortgage on it.