Tariff "Pension" in RSHB

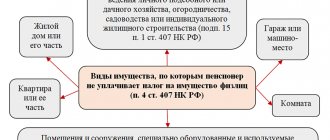

The Mir card is intended for social payments.

Adult citizens of the Russian Federation who have the right to receive social benefits (old-age or disability pensions, benefits, subsidies) can join the program. The tariff plan applies to 6 payment instruments, 3 of which are connected to the Mir system.

Until 2021, it was possible to issue international MasterCard cards. The pension tariff for them is switched off after expiration.

Terms of service for Rosselkhozbank debit pension cards

The Rosselkhozbank pension card is convenient for receiving pensions and social benefits. If you are a pensioner, you can order this bank card for free and make the necessary payments using it.

Plastic is issued only in the MIR payment system, which is accepted by all Russian stores and ATMs.

Categories of the Mir card for pensioners

The bank offers 3 types of payment instruments that can be used for:

- obtaining privileges;

- managing pension accounts through an online service;

- cashless payment for purchases;

- receiving and transferring money.

Classical

The card can be used not only in Russia, but also in Turkey or Armenia. The leaders of the payment system plan to expand the territory of Mir.

The card can be used in Turkey and Armenia.

The design of the card resembles that of MasterCard. The front side indicates the number, owner details, and validity period (equal to 3 years).

On the reverse side there is a CVC code used when making payment transactions via the Internet.

Instant

Ready cards are stored in bank branches. Like classic ones, they are valid for 3 years. As storage progresses, the period decreases. At the time of issue it must not be less than 2 years old. During registration, an account is opened for each client to which the card is linked. When paying for purchases online, you must indicate the owner's name in Latin. Its spelling can be clarified by calling 8-(800)-100-01-10 . The instant card has the same functions as the classic one, but the cash withdrawal limit has been reduced.

Co-branding

The card is issued with the participation of the UnionPay payment system. On the territory of Russia it works as a standard “Mir”. When the client travels abroad, the national payment system does not function. The card starts working as UnionPay. It can be used for cashless payment.

Characteristics of the Mir pension card from Rosselkhozbank

The payment instrument can be connected to programs that imply the calculation of interest on the balance or the return of part of the amount spent. Account servicing is also considered profitable.

Conditions for calculating interest

Profit is calculated daily. For balances exceeding 100 rubles, 4% per annum is charged. Already calculated interest does not expire when you change your debit card balance in the next month. The total amount of income is credited to the account at the end of the month.

Interest is charged on the account balance.

Restrictions on interest accrual

There is no limit on the balance used to calculate income. However, when calculating interest, the lowest value recorded for the month is taken.

Service cost

There is no charge for maintaining the main account. Servicing an additional card costs 200 rubles. in a year. If the account balance does not exceed 3,000 rubles, and transactions are not carried out for a year or more, a commission of 100 rubles is deducted monthly.

Alert services

You will have to pay 59 rubles for notifications about transactions. per month. SMS notifications about replenishment are sent free of charge.

You will have to pay for notifications from the bank about transactions.

Possibility of increasing interest on the balance

When storing more than 50 thousand rubles on the account. the client can receive additional income.

Interest is calculated according to the following scheme:

| Balance amount, thousand rubles. | Supplement to base rate |

| 50-100 | 0,5% |

| 100-500 | 1% |

| Over 500 | 2% |

Transfers between cards

You can perform an operation using the payment instrument or account number. There are no fees for intrabank transfers. When sending money to card accounts opened in other financial institutions, 1.5% of the transfer amount (at least 50 rubles) is debited.

Depositing and withdrawing cash to a card

There are no fees for replenishing your balance through cash registers or ATMs.

Cash withdrawal takes place at an ATM.

You can withdraw money using:

- RSHB branded terminals;

- partner ATMs (Rosbank, Raiffeisenbank, Promsvyazbank, Alfa-Bank).

- cash desks of any financial institutions.

When cashing out an account at third-party cash desks and ATMs, 1% of the transaction amount is debited (minimum 100 rubles). When withdrawing cash, take into account the restrictions presented in the table:

| Type of transaction | Classic or co-branded | Instant |

| Cash withdrawals at branded ATMs, thousand rubles. per day | 150 | 75 |

| Withdrawal of money from the Russian Agricultural Bank or third-party banks, thousand rubles. per day | 300 | |

| Cashing out an account by any means, million rubles. per month | 1 | |

Accounts for pensioners: current offers from Rosselkhozbank

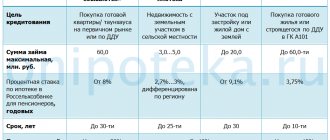

If you study the conditions offered by Rosselkhozbank, interest rates on deposits for pensioners often turn out to be very attractive. Elderly clients can take advantage of both standard deposit offers available to any depositor and special products aimed at pensioners. Cash accounts can be opened by citizens in both Russian rubles (RUR) and American dollars (USD). Deposits opened through Rosselkhozbank may differ in the following significant parameters:

- investment period;

- level of annual interest rate;

- the amount of the deposit being formed;

- list of preferences used;

- possibility of additional balance replenishment;

- option for partial withdrawal (withdrawal) of money from a bank account.

What interest is accrued on the pension deposit? What are the terms of a typical bank account agreement for a retiree client? All these issues should be considered in more detail by carefully reading the current deposit programs of Rosselkhozbank.

Rosselkhozbank offers several profitable deposits for pensioners

Pension Income: main contribution parameters

This deposit is opened upon presentation by the client of a pension certificate or any other document that can replace it. The deposit can be made in the name of any entity, including a minor citizen. If the applicant has already reached retirement age, the paper (certificate) confirming receipt of the pension may not be provided.

The Rosselkhozbank Pension Deposit is opened to a citizen on the following conditions:

- The minimum amount (starting deposit fee) is 500 rubles.

- The maximum allowable amount of the deposit to be formed is 2 (two) million rubles.

- The depositor can place funds for 395 days, 540 days or 730 days.

- The annual deposit interest rate is 5.90%.

- Monthly interest payment to the investor. Interest income is accrued on the last working day of each month and at the end of the deposit period. The amount of accrued interest can be reinvested by adding it to the amount of the existing deposit or transferred to a separate client account at the bank.

It is allowed to replenish the deposit balance with additional contributions accepted during the entire period of validity of the deposit. An additional contribution to increase the initial deposit amount can be at least 1 ruble.

It is not allowed to make debit transactions on the account while maintaining the established profitability. If funds are withdrawn by the client ahead of schedule, interest is paid in accordance with the rate stipulated by the terms of the demand deposit. The deposit is automatically extended for a similar period with the parameters and rate current at the time of extension.

Pension Plus: terms of the deposit agreement

An interesting opportunity for an elderly investor is to take advantage of the Pension Plus deposit offer. The conditions and grounds for opening this deposit are in many ways similar to the Pension Income package, but have their own specifics.

Key parameters of the Pension Plus deposit:

- Can be issued to a minor citizen.

- The minimum deposit amount (primary payment) is 500 rubles.

- The maximum size of an account to be opened is 10 (ten) million rubles.

- The percentage of annual return on the deposit is 5.90%.

- The minimum period is 395 days.

- The maximum deposit period is 730 days.

- Interest accrued to the depositor is capitalized monthly.

- It is allowed to replenish the account balance with additional contributions (minimum 1 RUR).

It is allowed to carry out expense transactions to ensure the designated profitability, provided that the depositor maintains the established amount of the minimum balance (500 RUR).

The extension of this deposit is carried out by analogy with the Pension Income deposit on the terms of the day following the end of the previous period.

Pensioners can open a deposit not only in rubles, but also in other currencies

European Deposit – deposit for a wide range of depositors

This deposit product can be issued by any citizen remotely or directly through the office of a financial institution. The European deposit is opened by Rosselkhozbank on the following conditions:

- If a deposit is placed by a client for 730 days, the annual rate of return for him will be 0.15% for remote registration. When opening through a bank office – 0.10%.

- When placing a deposit for 1095 days, the annual accrued income will be 0.35% if the registration is done remotely. If a deposit is opened directly at a bank branch – 0.30%.

- The deposit is opened in euro currency (EUR).

- The minimum deposit amount (starting fee) is 1000 EUR.

- The maximum size of the deposit is without restrictions.

Accrued interest is paid to the client upon completion of the deposit period or upon early withdrawal of the deposited funds by the depositor. Such payment is made by transferring the required amount to the citizen’s separate bank account.

It is not allowed to replenish an open deposit with additional contributions. It is not allowed to carry out expenditure transactions to ensure the assigned profitability.

There is no automatic extension of the deposit. Early withdrawal of the deposit by the depositor results in the payment of interest income on the terms provided for by the bank's demand deposit.

Opened exclusively in the name of the investor himself. Making such a deposit in favor of third parties is not permitted.

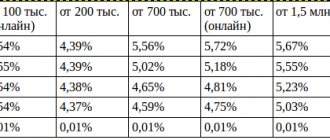

Deposit Profitable: high annual interest rate

The terms of this program provide for a differentiated approach to establishing the deposit annual interest rate.

The specific return on the deposit depends on the following parameters:

- Design method:

- remotely;

- through the office of a banking organization.

- The procedure for paying interest income to the client:

- upon completion of the deposit period;

- monthly payment through capitalization or transfer to a separate account.

Agreed duration of the deposit period:

- minimum 31 days;

- maximum 1460 days.

The amount of the deposit to be placed is at least 3000 RUR or 50 USD. The maximum size of the deposit formed is without specific restrictions (more than 1.5 million rubles or 25,000 USD).

Thus, the minimum annual rate of return on this deposit is 5.90% (RUR) or 0.05% (USD). The maximum annual deposit interest can reach 6.70% (RUR) or 2.45% (USD).

It is possible to open an account in the name of the investor himself or in favor of a third party. It is not allowed to replenish the deposit balance and conduct expense transactions that provide for maintaining a given profitability. Automatic extension of the contract is carried out in a limited manner for the same period with the parameters relevant at the time of extension.

An investment deposit involves the transfer of invested funds into trust management

Investment deposit: ample opportunities for passive income

This product allows pensioners and any other individuals to earn money in two ways:

- placing your own money directly on a bank deposit;

- investing on trust principles in special mutual funds.

The period for placing funds on a bank deposit can be either 180 (one hundred eighty) or 395 (three hundred ninety-five) days. The amount of the deposit cannot be less than 50,000 RUR or 1,000 USD. The maximum amount of such a deposit is not limited by the bank. If the deposit period is 180 days, then the highest annual rate of return will be 7.10% (RUR) or 1.70% (USD). For a period of 395 days, annual interest accrues at a maximum of 7.30% (RUR) or 2.50% (USD).

It is issued exclusively to the investor himself. Accrued interest is paid upon completion of the deposit period. It is prohibited to replenish this deposit and make expense transactions. There is no automatic extension of the deposit.

How to apply for a pension card at the Russian Agricultural Bank

To receive a payment instrument, you need to prepare the required documents, submit an application, and sign a service agreement.

Required documents

To obtain a card, you will need a passport of a citizen of the Russian Federation. You also need to provide a pension certificate or any other document confirming your right to receive social benefits.

Filing an application

You can apply for a payment instrument in person at the office or online. In the first case, contact an employee and fill out the provided forms.

You can apply for a card via the Internet.

The online application is submitted as follows:

- Go to the website rshb.ru. Open a section with debit products.

- Select the desired option. Click the “Complete” button.

- Indicate personal and contact information, information about the place of registration. Select a bank branch to receive a card.

After reviewing the application, the manager calls the client back and clarifies the details of signing the contract.

Methods for obtaining a card

You can only pick up a payment instrument at a bank office. Home delivery is not provided at the credit institution in question.

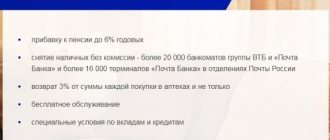

Pros and cons of a pension card

The positive qualities of a financial product include:

- free issue and maintenance;

- increased interest on the balance;

- expanded network of bank branches and terminals;

- the presence of a co-branding option that works abroad;

- possibility of receiving additional income.

The card has free service and an increased interest rate on the balance.

The disadvantages of the Pension TP include:

- small cashback;

- no home delivery of cards.

How to transfer a pension to Rosselkhozbank

A potential client needs:

- Contact the RSHB office with your passport and pension certificate. Fill out an application for transfer of payments.

- Submit the forms certified by the bank to the Pension Fund or social security authority.

- Close the account to which the pension was previously received. To do this, submit a corresponding application to the financial institution. Performing this action helps to avoid unnecessary expenses. If there are no transactions, maintaining a pension account in some banks becomes paid.

In what dates are pensions transferred to the Rosselkhozbank card?

Contents The pension payment schedule is a relevant topic for any citizen who is entitled to social transfers. Let us immediately note that the frequency of receipt is not tied to a specific date or day of the week, so it can be postponed to an earlier or later date.

The recipient is informed in advance about any changes in the procedure for transferring funds. For this purpose, the resources of regional media agencies, stands located in pension funds and other social institutions are used.

When a Russian citizen reaches a certain age that allows him to interrupt his career and retire, he must apply to the regional branch of the Pension Fund of the Russian Federation for the monetary compensation due to him.