Service cost

The card is not completely free. Additional fees apply for some bank services:

- SMS banking – 50 rubles per month (starting from 3 months of use),

- 1% commission for withdrawals from third-party banks (minimum 100 rubles),

- transfers between cards at the rates of another bank (from 15 to 1000 rubles),

- 300 rubles for registration.

Other services are free:

- “linking” the card to the account,

- transfer of money to government accounts and funds,

- receiving a report on accruals and checking the balance on the balance sheet.

Reliability rating of NPF Lukoil-Garant

Non-state pension funds are an alternative option for forming a pension. Citizens enter into appropriate agreements with them. According to current legislation, everyone can once a year change the NPF or management company with which the corresponding agreement was drawn up. Choosing a pension fund is a voluntary decision to which every working citizen has the right during the formation of a future pension. Post Bank and NPF Lukoil-Garant offer their services to everyone who wants to receive decent payments in old age.

It should be noted that trust in a particular non-state pension fund is based on several factors. One of them is reputation and reviews. Also, for many banks, recommendations are important when choosing a non-state pension fund. Structures in the creation of which, in one way or another, the state participates in, usually enjoy greater trust.

Post Bank was formed as a joint project of Russian Post and VTB Bank, that is, in a certain way the state participates in the work of Post Bank. It is quite natural that the NPF chosen by Post Bank has passed certain checks and has a fairly high trust rating.

Evaluate the rating and performance of NPF Post Bank - Lukoil-Garant, to place the funded part of your pension in it

The advantages of this non-state pension fund include:

- duration of operation: the fund has been operating on the Russian market for 21 years, which indicates extensive experience in the field of investing funds entrusted to management;

- reliability rating: in 2021, leading rating agencies rated it as AAA, confirming the rating received in 2015;

- volume of investments and number of clients: these data indicate successful activity, especially if there is a stable trend towards an increase in these indicators;

- guarantees: Lukoil-Garant is a participant in the system of guaranteeing the rights of insured persons.

As you can see, Pochta Bank and NPF Lukoil-Garant are assessed as reliable companies that can be trusted to manage their own funds and future pension savings.

Advantages of a pension card from Post Bank

The client receives advantageous offers, including:

- 3% cashback when paying in stores,

- + 0.25% to the base rate on deposits,

- 2,500 bonuses on the Pyaterochka card, which can be spent on paying for goods,

- partial or complete deferment of a pension to savings with an increase in interest on the balance.

In addition, the advantages of the card are:

- simplicity of design,

- the ability to pay for utilities, mobile communications and the Internet from a card,

- it is accepted in all retail outlets, pharmacies, cafes and so on, but only in Russia,

- free release and virtually free maintenance.

"Care Line"

Automatically activated. With her, by calling the number free of charge, you can get professional psychological, legal, and medical advice. There is no additional charge for the service.

“13th pension” program

This is a kind of affiliate program. The client can bring 5 people to the bank who will transfer their pension to Post Bank and receive a reward in the amount of 8,700 rubles. The amount is paid for every 5 people. There is no invitation limit. Depending on his activity, a person earns additional money.

"Seasonal" deposit

Among the bank's offers, there are also non-standard options. These include the “Seasonal” deposit, which consumers will be able to open until June 30, 2021. Its conditions provide for a minimum investment amount of 50,000 rubles, which are placed for a year. The interest rate of the deposit is fixed and amounts to 8.25% per annum.

All income received is added to the deposit amount at the end of its validity period. You can deposit additional funds into your account within 10 days, however, early withdrawal is not provided. If the consumer wishes to extend the contract, it will be extended in accordance with the terms of the Capital program.

Registration of a pension card

To receive a debit card, the client must provide copies of his passport, TIN, pension certificate, SNILS, and also fill out an application. The card can only be issued in person at a bank branch.

Next comes the endorsement of the contract. Please read it carefully before signing!

After activating the card, it is “linked” to a phone number. This is necessary to receive secret codes, as well as information about deposits and withdrawals of money. The bank employee tells the client the PIN code for the card. If desired, the owner can independently change it at an ATM.

How to apply for and receive a pension card

Cards of the MIR system and Visa Classic "Pyaterochka" are issued at the request of the client, after opening a savings account, to which the pension is credited. Non-registered MIR and Visa Classic cards are issued immediately upon application; you only need to have your passport with you.

Activation of the cards is not required - upon receipt, the bank employee will ask you to create a PIN code, which is entered at the terminal. Afterwards, the cards can be immediately used to pay for goods and services in online or offline stores.

READ All ways to change the PIN code on a Pochta Bank card

Delivery of “plastic” to the recipient is also provided, but this service costs 100 rubles. Moreover, in this way you can order the design of a personalized card.

Important! If the client wishes to receive a personalized MIR or Visa card, the account maintenance fee will be 700 rubles per year. Foreign citizens can apply for Visa Platinum, the cost of account servicing is similar - 700 rubles per year.

Online services for pension cards

You can monitor your account status and the movement of funds in several ways.

Working with a map on the Internet:

- register on the bank's website,

- log in to your personal account using your login and password,

- enter your mobile number,

- send information to the operator,

- receive a secret code on your phone, enter it in the required field and send it for verification.

After this, the client can:

- control your account,

- learn about promotional offers,

- make transfers.

Transfer of pension to Post Bank from another bank

Transfer of pension accruals to Post Bank is carried out in two stages:

- filling out an application for opening a savings account at Pochta Bank;

- drawing up an application for pension transfer.

The best option is to immediately contact Post Bank. During one visit, employees will help you draw up all applications and give detailed advice on the procedure and deadlines for processing documents. You must have with you:

- passport and work book, plus copies thereof;

- certificates - about the amount of work experience, wages for any 5 years;

- marriage certificate, if the surname has changed several times - documents about each change.

There is no need to contact the Pension Fund branch.

The procedure can be carried out independently, through the State Services portal. First you need to create an account on the website www.gosuslugi.ru and confirm it. For verification, a request is made in your personal account to generate a confirmation code; it arrives by mail within a few days. Later, the code is entered into a special field, and the profile is considered verified.

Next, in the “Pension Delivery” section, you must indicate the place of receipt – post office address, card number. In the “Organization” menu item, Post Bank is indicated.

Re-registration takes about 10-15 days. It is recommended to transfer your pension immediately after receiving the next payment - applications will be processed within a month, and the next pension will arrive without delay.

Transfers from other accounts

When transferring money from another card, you must carefully enter all the data.

Expert opinion

Kochetov Vladimir Viktorovich

Leading specialist in finance. 23 years of experience in a large bank in Moscow. Specialization: loans, mortgages, refinancing.

Ask a Question

- If the funds are not withdrawn from the account and not transferred to another card, then there is not enough amount on the balance.

- If money was transferred via telephone or Internet, debited from the account, but there was no receipt, then an error was made in the recipient’s card number. In this case, you need to contact the bank, provide a receipt and return the money back.

- If it is impossible to either deposit or withdraw money from the card, then it is blocked. You need to go to a bank branch with your passport.

Disadvantages of service at Post Bank

Post Bank is part of the VTB Group and is a reliable financial institution. At the end of 2021, the network of service points already included about 12.5 thousand POS terminals; by the end of 2021, the bank plans to increase the figure to 18 thousand. This indicates that using cards is convenient.

There are no disadvantages of contacting Post Bank as such. Funds from the card are issued not only at post offices, but also at all ATMs of the VTB Group (VTB24, VTB Bank of Moscow, Leto-Bank and others).

The disadvantages include:

- Relatively small network of representative offices. While Sberbank's operational branches are common, Pochta Bank's are mainly service points. It is not always convenient to visit crowded post offices to deposit or withdraw money or resolve any organizational issue.

- Limits on withdrawals – up to 50 thousand rubles. per month. All banks have such conditions - this is a feature of free social cards.

- If you withdraw money from a card through third-party ATMs, the commission will be 1% of the amount, but not less than 100 rubles.

From Sberbank

If you already have a pensioner account with Sberbank of Russia, then it is possible to transfer it to Post Bank.

But before you do this, think 3 times whether this is necessary. You must have obvious advantages and reasons for doing it. If there are none, then it will be a waste of time and effort.

Judge for yourself:

- Both Sberbank and Pochta Bank are state-owned systemically important banks in Russia with approximately the same service conditions.

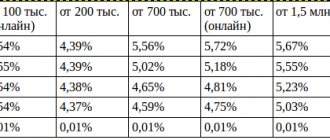

- The interest on the balance will vary - but not much, especially considering the economic situation in Russia, they will constantly change. For 2021, the interest on the balance in Post Bank is 4-6%, in Sberbank on a pension card - 3.5%. But the service is free for both. Both banks will issue a “MIR” card for pensioners free of charge.

- Both banks are reliable, their license will not be revoked, they can collapse and close only if the state itself collapses. The probability of this approaches zero.

- Both banks have tens of thousands of branches and ATMs throughout Russia. They are in both cities and villages. There will be no problems with withdrawing money.

Pension debit card MIR

According to Federal Law No. 161-FZ of June 27, 2011 “On the National Payment System”, social and pension payments are transferred exclusively to cards of the domestic payment system “MIR”, created on the initiative with the support of the state in accordance with strict international standards and ensuring absolute security of payments.

The card is issued and serviced free of charge. From the third month of use, a fee of 49 rubles is charged for SMS notifications. It can be turned off at any time. Information about each transaction will no longer be received, but SMS about pension enrollment will be received free of charge.

You can apply online or in the office; personal presence is required to receive it. You will have to pay 100 rubles for delivery to the selected branch. To receive, you only need a passport and SNILS.

All owners have access to commission-free intra-bank transfers and “withdrawal” of funds from cards of any banks for amounts over 3,000 rubles. VTB and its own ATMs provide commission-free replenishment.

You will receive an activated card with a basic tariff plan (all that remains is to install the mobile application and create a personal account). After receiving the first pension, it automatically changes to “Pension” or “Salary pensioner” (in case of receiving wages into a bank account for at least 3 months).

Terms of service for a card for pensioners

Available for pension card holders without commission:

- opening an account;

- annual maintenance;

- reissue;

- transfers within the bank;

- cash withdrawals from ATMs installed by the bank and its partners;

- replenishment of the card at the specified ATMs;

- replenish your account using Mobile Banking or Internet Banking.

The card is used to pay in stores, when receiving services, as well as for online purchases. The card is linked to a Savings Account, which accrues monthly interest of up to 7% per annum on the smallest balance. A savings account is used to save and accumulate money, but at the same time, using it, it is easy to use the money for your own purposes.

Interesting. A pension card issued by the Mir system has special benefits of the Mir card, which can be found on the website of the payment system.

The Mir Card and Savings Account provide pensioners with a convenient combination of deposit and card. With one card you can both spend and save money, the accrued interest is capitalized automatically and remains on the card, they can be withdrawn along with the rest of the money at any time. All accruals are tracked using the free Mobile Bank.

Where and how to withdraw money from Post Bank without commission

Care line. What is this?

The Care Line is a special service available to all pensioners who have switched to service at Pochta Bank.

This is a telephone support center for social, medical and legal issues. It works around the clock, you can call during the day, and at night, and in the evening, and in the morning.

They will advise you, give you competent answers, resolve legal problems, and help with social protection.

How to connect the Care Line? No action is required on the part of the pensioner; the connection will be automatic the first time the Pension is credited to the account. It is enough to transfer pension servicing to the bank.

However, the disadvantage of this service is that you can apply no more than 10 times in one calendar year.