Pensioners are a category of the population that needs additional income, but many financial companies avoid permanent cooperation with them. This organization is an exception to this rule. He considers pensioners not only as his main and honorable clients, but also opens deposits for pensioners at 12 percent. Sovcombank: what are the deposit conditions for pensioners?

Deposits for today for pensioners

Sovcombank has not yet developed separate interest rates for pensioners and disability pensioners, but has significantly increased their interest rates - at least 0.5% when opening each deposit. They also have access to minimal initial deposits, termination of the contract during the deposit period, free replenishment of the personal account and withdrawal of funds at any time.

Available deposits for pensioners for 2021:

- Maximum income;

- Interest on interest;

- Conscious decision;

- Golden time;

- On demand.

There is also a “Car” deposit for other categories of citizens, but it is not available for pensioners. For a clear understanding of each tariff, we will consider them separately.

Deposit programs for pensioners at Sovcombank

Sovcombank offers a wide range of programs for both persons over 14 years of age and pensioners. There is no special program for citizens of retirement age. They can choose to contribute under general conditions.

Attention! Investments in Sovcombank are kept in rubles.

The highest rates with an increase of 1% are intended for owners of the Halva card. The installment card will be automatically linked to the deposit account. It is needed to perform various operations. As soon as a pensioner starts using it, he automatically receives a 1% rate increase.

“Maximum income” deposit for pensioners

Issued for a period of one month to 1096 days. While other categories of citizens cannot have an interest rate higher than 8%, pensioners and pensioners have a minimum rate of 8.5%. An increase of up to 10.3% is possible.

The minimum amount of funds for the first payment is 30 thousand. rub. Key characteristics should include:

- Possibility of depositing funds during the deposit period (minimum amount - 1000 rubles);

- Interest is transferred at the end of the deposit term, after the maturity date;

- Some funds cannot be withdrawn;

- After at least one year of existence of the deposit, it is possible to terminate the agreement without losing part of the interest;

- If you deposit remotely online, the rate will increase by 0.5%.

Current deposit offers of Sovcombank

As it turned out, the financial organization has 6 types of deposits, but among them there are no offers for pensioners. They can enter into an agreement with the bank on a general basis.

What deposits can pensioners open at Sovcombank

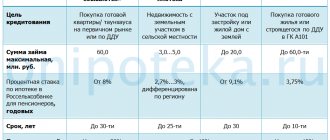

| Name of contribution | Minimum amount | Deadlines | Interest | Currency | Peculiarities | Who is it suitable for? |

| "Record percentage" | 50 thousand rubles | From 60 to 365 days | 7,3-7,8 % | rubles | Possibility of replenishing the deposit within 10 days, no partial withdrawals, interest payment at the end of the term. | Designed for those who want to receive the greatest income and are not interested in the ability to manage their deposits. |

| "Free" | 1 million rubles | From 91 to 365 days | 6-6.2% 1.6-2.7% in dollars 0.3-08% in euros | Rubles, dollars and euros. | Additional deposits and withdrawals are possible up to the established balance. Interest payments every month. | It will be of interest to pensioners who have the opportunity to make a contribution in the amount of more than one million rubles. Suitable for those who plan to withdraw interest monthly and partially withdraw money during the deposit period. |

| "Fixed income" | 30,000 rub. | From 31 to 1095 days | 5,8-6,7 % 1-3% in dollars 0.1-1.2% in euros | Rubles, dollars, euros | Possibility of replenishing the deposit. There is no partial withdrawal. Interest is paid every month. | For those interested in monthly interest payments. |

| "Maximum Income" | 50 thousand rubles | From 31 to 1095 days. | 6.1 – 7.65% in rubles, 1.2 – 3.5% in dollars, 0.2-1.4% in euros | Rubles, dollars, Euro | Additional contributions are accepted within 10 days. There is no possibility of using funds. Interest is paid upon expiration of the deposit term. | For those who are interested in receiving a high interest rate on their deposit and for whom the choice of term ranges is important. |

| "Automotive" | 30 thousand rubles | 365 days | 6,6 % 7.6% - subject to purchasing a car from bank partners with funds received from the deposit | Rubles | The deposit is opened if the citizen has a driver’s license. The possibility of replenishment is provided. You can spend funds after 180 days from the date of opening to purchase a car. The interest on the deposit increases if the car is purchased from partner banks. Interest is paid at the end of the term. | For pensioners who have a driver's license and intend to purchase a new car. |

| "Comfortable" | 50 thousand rubles | From 31 to 1095 days | 6-7.55% in rubles, 1.1-3.4% in dollars, 0.1-1.4% in euros | Rubles, dollars, euros | Additional fees may apply. Partial withdrawal is not provided. Interest is paid at the end. | For those who want to replenish the deposit throughout the entire term, as well as for those who value a wide range of terms. |

| "Always at hand" | 5 thousand dollars or euros. | From 365 to 730 days | 0,5 % | Dollars, euros | Partial withdrawal of the deposit is possible. Replenishment throughout the entire validity period; Interest is paid every month. | For those who want to invest savings in foreign currency and receive income from them. |

Each of the presented deposits has its own parameters. When choosing the most profitable one, a pensioner must take into account his own goals and capabilities.

What deposits can pensioners roll over?

Compared to 2015, the line of Sovcombank deposits has changed.

In particular, the bank stopped accepting the following types of deposits:

- Rublevy “Always at hand”;

- "Golden time";

- "Interest on interest."

Pensioners who have any of the specified deposits can increase its validity period, that is, prolong it.

Extension conditions:

| Contribution | Conditions |

| Always at hand | The minimum deposit amount must be 30 thousand rubles; it is possible to replenish the deposit within 10 days; rate - 5%; interest is paid every month. |

| Golden time | The minimum amount is 1 ruble; rate - 5.3%; interest is paid at the end of the deposit term; The deposit is intended for transferring pensions and salaries. |

| Interest on interest | The minimum deposit amount must be 30 thousand rubles; it is possible to replenish the deposit within 10 days; rate - 5.1-6.5%; capitalization; It is possible to spend accrued interest. |

“Interest on Interest” deposit for pensioners

The deposit period varies from one month to three and a half years. The interest rate varies from 8 to 9.3%. The minimum amount of funds for the first deposit is PLN 30,000. rub.

It is important to pay attention to the following deposit parameters:

- The minimum deposit amount is PLN 1 thousand. rubles;

- The interest rate is paid into the pensioner's account at the end of each month of maintenance, i.e. regularly;

- After at least 365 days of deposit storage, it is possible to terminate the contract without losing the ruble at the end.

Additional Information

Do you want to have additional income? To do this, you can transfer your pension from the Pension Fund to Sovcombank to the “My Income” account. At the same time, you will receive the following privileges as an “Honorary Client”:

- On the balance of your own funds when transferring pensions/salaries, 5.3% per annum is charged. The rate of 5.3% is valid for 1 month from the date of the last pension payment.

- Free SMS notification.

- Free card service.

Remote opening of deposits will be available for existing bank clients. Now you can open and replenish deposits without leaving your home using the Internet bank sovcombank.ru. In this case, you will receive increased interest.

It is noteworthy that interest is paid into a secondary account. A “Halva” installment card is issued to a bank account for payments to individuals; this condition is mandatory. Its design and maintenance are free, and you can order it delivered directly to your home or office.

“Informed Choice” deposit for pensioners

The minimum amount of the initial deposit of funds is 5000 rubles. The interest rate ranges from 10.5% to 10.9%. Due to the very high interest rate, this deposit is only available to pensioners. The deposit period is from one to three years.

- An account is opened only when a plastic card is issued;

- The interest rate is charged only at the end of the deposit term;

- You may not deposit additional cash into your personal account during the deposit period;

- Withdrawal of funds during the deposit period is prohibited;

- The Client has the right to terminate the Agreement with the Financial Company early without risking his personal money.

Advantages of Sovcombank deposits for pensioners

Sovcombank offers the following opportunities for pensioners:

- wide deposit range;

- deposit insurance;

- high interest rates;

- reliable bank.

Sovcombank is one of the best organizations for opening deposits. Clients are attracted by competitive interest rates and the opportunity to increase income on deposits. The disadvantages of Sovcombank include the lack of special conditions for pensioners and the need to use the Halva card to increase interest on deposits.

“Golden Time” deposit for pensioners

The minimum deposit amount is 1 ruble. Issued for a period of one semester - twelve months. The interest rate varies from 7 to 8%.

Main features of this deposit:

- It is possible to deposit additional funds during the deposit period both in cash and non-cash;

- It is possible to withdraw part of the funds;

- It is possible to pay interest every month;

- Interest can be added to the final cash balance.

Bank deposits in foreign currency

There are also deposits that are opened in US dollars (Euros are not opened). Currency deposits are not opened in all branches and offices, so please call 8-800-200-66-96 about a specific office in your city.

“Maximum income” in currency

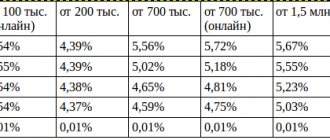

Rates for deposits in US dollars (% per annum): Conditions are valid from 06/01/2021.

| Minimum amount | Deposit terms up to one year | Duration – 2 years | Duration – 3 years | |||

| 3 months/91 days | 6 months/181 days | 9 months/271 days | 12 months/365 days | 24 months/730 days | 36 months/1095 days | |

| 500 | 0,3 | 0,3 | 0,3 | 0,5 | 0,5 | 0,6 |

Conditions:

- The minimum deposit amount is $500.

- Additional contributions are not accepted.

- Spending of funds is not provided.

- Interest accrual – interest accrual begins from the day following the day the corresponding deposit amount was made until the day it is returned

- Payment of interest – interest is paid upon expiration of the deposit term to a separate bank account for individuals

- Early closing rate – 0.01% per annum

- Renewal – automatic renewal

“Convenient” in currency

Convenient choice of term with an excellent rate and spending options. Currency – US dollars.

- Minimum deposit amount – 500 US dollars

- The minimum deposit amount is 100 US dollars.

Rates for deposits in US dollars (% per annum): Rates are valid from 06/01/2021.

| Minimum amount | Deposit terms up to one year | Duration – 2 years | Duration – 3 years | |||

| 1-3 months (31-90 days) | 3-6 months (91-180 days) | 6-9 months (181-270 days) | 9-12 months (271-365 days) | 24 months/730 days | 36 months/1095 days | |

| 500 | 0,1 | 0,1 | 0,1 | 0,2 | 0,3 | 0,4 |

Conditions:

- Additional contributions are accepted in cash and non-cash, in an amount not exceeding the initial deposit amount (from $100).

- Spending funds – possibly up to the minimum balance

- Payment of interest – interest is paid upon expiration of the deposit term to a bank account for individuals

- Early closing rate – 0.01% per annum

- Renewal – automatic renewal

Now you have complete information on foreign currency and ruble deposits and their conditions with interest rates.

Demand deposit for pensioners

This deposit does not set clear minimum donation limits. Interest rate 0.01%. The payment period is not limited, it is indefinite.

Key features of the deposit:

- Interest is transferred to the user's account daily;

- Dividends are transferred one year after the start of the deposit;

- The interest rate may be increased;

- It is possible to deposit additional funds during the deposit period;

- It is possible to withdraw money during the deposit period.

Deposits that can no longer be opened. Available only for renewal (for those who opened before)

More details

Maximum income

A deposit for those who want to receive maximum income on funds placed in the bank by a certain date.

Rate for deposits in Russian rubles (when opening a deposit in the office or independently via Internet banking):

| Deposit term (in days) | Interest rate (% per annum), rubles | The rate is subject to the conditions of regular turnover on the Halva card | |

| 1 month | 31 days | 3,6 | 3,6 |

| 3 months | 91 days | 3,8 | 3,8 |

| 6 months | 181 days | 3,8 | 4,8 |

| 9 months | 271 days | 3,8 | 4,8 |

| 12 months | 365 days | 3,8 | 4,8 |

| 24 months | 730 days | 4,3 | 5,3 |

| 36 months | 1095 days | 4,3 | 5,3 |

It does not provide for expense or income transactions, and interest is accrued after the expiration of the contract.

Additional replenishment is possible within 10 days, but not more than the amount of the initial payment.

- The minimum deposit amount is 50,000 rubles (funds can be deposited within 10 days)

- Payment of interest – Interest is paid upon expiration of the deposit term to a bank account for settlements of individuals. A “Halva” card is issued for a bank account for payments to individuals.

- Deposit prolongation – Provided on the terms and at the interest rate in force at the Bank on the date of prolongation. The extension of the deposit is terminated after the Bank makes a corresponding decision. In this case, the deposit amount is transferred to a bank account for settlements of individuals.

Deposit “Record percentage”

In this deposit, Sovcombank offers increased rates and terms.

- The minimum deposit amount is 50,000 rubles (you can deposit funds within 10 days from 1,000 rubles in cash and by bank transfer).

- Additional contributions – Not accepted after 10 calendar days from the date of opening or prolongation of the contract.

- Interest accrual – Interest accrual begins from the day following the day the corresponding deposit amount was made until the day it is returned, if the debit from the account was made for other reasons, then up to and including the day of debit.

Rate for deposits in Russian rubles (when opened in a branch or independently in Internet banking):

| No possibility of early termination with interest retained | |||

| Duration (in days) | 2 months (60 days) | 6 months (181 days) | 1 year (365 days) |

| Interest rate (% per annum) | 4,5% | 4,25% | 4,25% |

| Interest rate for payments with Halva card | 4,5% | 5,25% | 5,25% |

- Payment of interest - interest is paid upon expiration of the deposit term on the Halva card.

- Payment of interest upon early withdrawal of a deposit (in full or in part) - interest is paid based on the interest rate established by the Bank for demand deposits at the time of withdrawal of the deposit.

- Spending of funds - no.

- Deposit extension . If the deposit is not claimed on the day of its expiration, the deposit is considered accepted again on the terms and at the interest rate in force at the Bank for this type of deposit on the date of extension. The extension of the deposit is terminated after the Bank makes a corresponding decision. In this case, the deposit amount is transferred to a bank account for payments to individuals.

Deposit “Free”

Deposit with monthly interest capitalization and the possibility of early termination at ½ rate!

Conditions:

| Minimum deposit amount | 1,000,000 rubles (funds must be deposited on the day the deposit agreement is opened). |

| Maximum deposit amount | No limit. |

| Additional fees | From 5,000 rubles. Accepted in cash and non-cash. Acceptance of additional contributions stops 30 calendar days before the end of the deposit period. |

| Spending funds | It is possible to withdraw funds up to the minimum balance. |

| Interest accrual | Interest accrual begins from the day following the day the corresponding deposit amount is made until the day it is returned. |

| Interest payment | Interest is paid during the term of the deposit agreement: monthly on the date corresponding to the date (date) of opening the account from which the extension period begins, as well as on the expiration date of the deposit term. |

| Adding interest to the deposit amount | The accrued interest is added monthly to the deposit amount (increases the deposit amount), on which interest is calculated. |

Terms and rates of the “Free” deposit

In rubles

| Duration in months (in days) | Rate, % per annum | |

| minimum amount, minimum balance | ||

| 1 000 000 | 10 000 000 | |

| 3 months (91 days) | 3,1% | 3,3% |

| 6 months (181 days) | 3,7% | 3,9% |

| 12 months (365 days) | 3,8% | 4% |

Rates for deposits in US dollars (% per annum)

The minimum deposit amount is $25,000 (funds must be deposited on the day the deposit agreement is opened).

The maximum deposit amount is $5,000,000.

Additional contributions – from 100 US dollars. Accepted in cash and non-cash. Acceptance of additional contributions stops 30 calendar days before the end of the deposit period.

| Duration in months (in days) | Rate, % per annum | ||

| minimum amount, minimum balance | |||

| 25 000 | 200 000 | 500 000 | |

| 3 months (91 days) | 0,3% | 0,4% | 0,5% |

| 6 months (181 days) | 0,3% | 0,4% | 0,5% |

| 9 months (271 days) | 0,3% | 0,4% | 0,5% |

| 12 months (365 days) | 0,3% | 0,4% | 0,5% |

Maximum income with Halva

An increase in the rate by 1% on all ruble deposits for owners of the Halva card.

Conditions for increasing the rate when paying with the Halva card:

The rate increases by 1% at the end of the deposit period if the following conditions are simultaneously met:

- made at least 5 purchases during the reporting period;

- the total amount of purchases from 10,000 rubles for the reporting month (own or borrowed funds);

- Transactions in any stores, including those not included in the list of partners, are taken into account;

- there is no overdue debt on the Halva card;

- deposit period over 3 months.

An increased interest rate applies for deposit amounts up to RUB 1,500,000 . Interest at the additional rate is accrued only on amounts up to RUB 1,500,000. If the deposit amount is higher, interest is accrued only on 1,500,000; the additional rate does not apply to the rest of the deposit.

- If the conditions for increasing the rate are not met in at least one reporting period, the deposit rate does not increase.

- The reporting period is considered to be the elapsed month from the date (day) of opening the deposit account.

How is the interest rate calculated?

The method of transferring money in the form of interest depends solely on the type of tariff plan previously selected by the client. There are only two options: either the money is transferred at the end of each month, that is, regularly, or only at the end of the deposit period.

Opening deposits is popular due to the possibility of receiving additional income simply by storing money in the client’s personal account. There is also capitalization, the essence of which is to increase the level of income and increase dividends.

The most popular types of investments:

| № | View | Average income |

| 1 | Bank deposits small percentage | 4-6% per annum Amount ~ 1 million rubles. |

| 2 | Real estate secure | 6-8% per annum Amount ~ 3-5 million rubles. |

| 3 | Bonds, bills, currency experience required | 5% -15% per annum From 100,000 rub. |

| 5 | You need an idea for your own business | Up to 300% but, of course, not immediately |

Are there any special conditions for making a deposit for people of retirement age? Unfortunately no. There are no special programs for this category of depositors; if they want to open a deposit here, they do so on a general basis.

Please note that the bank is a participant in the deposit insurance system. This means that if Sovcombank’s license is revoked, you are guaranteed to be able to get your money back in the form of compensation. Its maximum size can be up to 1.4 million rubles; more details can be found here.

How to open deposits online?

To open a personal account with Sovcombank remotely, you need to go to the bank’s official website with your personal password and login. Next, click on the “Open Deposit” column and then select the necessary options to quickly find the best option.

With the help of an individual data selection system, the customer can significantly reduce the time it takes to receive payment. Before completing the application, you must familiarize yourself with the conditions for opening a cash account.

Opening a deposit online only takes a few minutes because you need to enter a short list of personal details and then select “I want to invest”. Here you must indicate the total amount that the client wants to transfer to the bank. If a credit institution user needs to transfer funds from one account to another, select the “Withdraw from account” option.

The last step is to confirm the operation. To do this, you need to receive a code to your phone number or email address. Once confirmed by the bank, the client's payment officially begins to work.

How to open a deposit at Sovcombank?

It is not at all difficult for pensioners to open a deposit with Sovcombank. To do this, there is one most convenient and easiest way - to open an account at a branch with the help of a bank consultant. The algorithm of actions will be as follows:

- Select the nearest Sovcombank branch and find out its opening hours.

- Come to the department with your passport and other documents, if necessary (PTS or driver’s license).

- Consult with a bank employee about all deposit programs and choose the most suitable one.

- Write an application to open a deposit.

- Fill out the contract and agree to its terms, but only after reading it in detail - there is no rush.

- Transfer money to the deposit account within 10 days from the date of its opening. You can make several payments during this period, all of which will be counted as a down payment. Details for replenishment will be indicated in the contract.

All actions are performed very quickly and opening a deposit does not take much time. If difficulties arise with replenishing your account, consultants will also help resolve the issue, be it a transfer through a terminal or replenishment through a cash desk.

The pensioner just needs to choose the most optimal payment method and transfer the money within the specified time frame, after which the deposit will be activated and begin to generate income according to the terms of the selected program.

Residents of different cities can open a deposit with Sovcombank:

- Kaliningrad.

- Moscow.

- Kostroma.

- Ivanovo.

- Tolyatti.

- Samara.

- Yaroslavl.

- Tomsk.

- Voronezh.

- Krasnoyarsk.

- Podolsk.

- Chelyabinsk.

Residents of other localities should simply select the nearest city from the list, or call the hotline to find out the most optimal way to open a deposit.

Video

Insurance of deposits of individuals

Deposit insurance assures clients that their money is safe even if the financial institution suffers a fatal failure. The entire amount will be returned, but you need to remember - no more than 1,400,000 rubles. Therefore, it is better for users to open several small deposits with Sovcombank to ensure their security throughout the entire service period.

However, the credit institution does not insure all deposits; there are exceptions:

- Fiduciary deposit management;

- Separate deposit specialization (for professional purposes);

- Deposits of foreign companies;

- Bearer deposits;

- Electronic invoices;

- Metal deposits.

Conclusions: what is the most profitable Sovcombank deposit today?

In this review, Top-RF.ru correspondents examined in detail all of Sovcombank's current deposit programs. Now we can draw some conclusions. Let's compare the profitability of deposits, bringing them to a common denominator. Let's say we want to invest 100,000 rubles for 1 year. Which deposit will have the highest interest rate?

Comparative table of profitability of Sovcombank deposits

(based on the amount of 100,000 rubles and a period of 1 year)

| Contribution | Bid* |

| Spring percentage | 6,6% |

| Comfortable | 6,4% |

| Fixed income | 5,6% |

| – | – |

*) without taking into account the increase when paying with the Halva card

As you can see, the most profitable deposit today is the “Spring Interest” deposit.

However, it should be noted that the conditions for setting interest rates at Sovcombank are quite confusing. Therefore, before you make a deposit, be sure to carefully read the agreement and check all the details with a bank employee, says Top-RF.ru expert on deposit programs Viktor Davidenko.

Question answer

?Is it possible to open several deposits at once?

Yes. The client can make any number of deposits.

?Can I withdraw money before the deadline?

Yes. You can do this at any time. But interest will be accrued based on the interest rate of the “Demand Deposit” deposit, which currently amounts to 0.01% in rubles.

?What happens if you don’t withdraw the money at the end of the deposit period?

In this case, the deposit will be extended on the terms and at the interest rate in force at the bank on that date. The extension of the deposit is terminated after the bank makes a corresponding decision. In this case, the money is transferred to a bank account for payments to individuals.

?Are there deposits for pensioners at Sovcombank today?

Unfortunately no. For example, at Sberbank, pensioners will receive maximum interest on deposits, regardless of the amount. Rosselkhozbank has special deposits for people of retirement age. But Sovcombank does not provide for anything like this today. Senior citizens will receive the same percentage as ordinary individuals. However, this does not make the bank's offer any less attractive.

Professional advice

What determines the interest rate on a deposit?

“Banks offer the highest profitability on classic deposits, that is, without the possibility of replenishing and withdrawing funds during the entire term of the deposit (for example, Spring interest - editor's note).

Bank offers with interest payments to another account, that is, without capitalization (For example, Permanent income - editor's note), are interesting to those who want to use deposit income to finance their current expenses.

Replenishable-revocable deposits (For example, Convenient - editor's note) are suitable for those who are not confident in their savings abilities or are only at the very beginning of forming savings

Despite the lower profitability, these deposits have important advantages - they allow you to manage funds and at the same time receive additional income,” says Anastasia Gileva, a banking professional who manages the Absolut-Bank operational office in Ufa

Deposit Regular income (up to 5.20%)

Deposit conditions Regular income

- Deposit currency – Russian rubles;

- Deposit term – from 31 to 1095 days;

- The minimum opening amount is 30,000 rubles;

- Deposit replenishment is provided (from 1,000 rubles). The amount of all additional contributions should not exceed an amount equal to the amount of funds on the deposit 10 calendar days after its opening (or extension);

- Partial withdrawal is not provided for by the terms of the contract;

- Payment of interest – interest is paid monthly (on the date of opening the deposit) or at the end of the placement period to a separate account;

- The rate for early closure of a deposit is 0.01% per annum;

- Prolongation is automatic;

- Delayed replenishment - you can open a deposit at any convenient time and replenish it within 10 days.

| Deposit term | Bid | Bet with Halva |

| 31 – 90 days | 3,40 | 3,40 |

| 91 – 180 days | 3,90 | 4,90 |

| 181 – 270 days | 4,00 | 5,00 |

| 271 – 365 days | 4,10 | 5,10 |

| 730 days | 4,20 | 5,20 |

| 1095 days | 4,20 | 5,20 |