As a rule, the loss of a breadwinner is considered not only the death of a person, but also the official recognition of him as missing. This situation not only causes moral damage to relatives, friends and dependents, but also deprives relatives of the main financial income in the family.

In the event of the loss of a breadwinner, a dependent family member has the right to financial compensation from the state in the form of a survivor's pension.

Survivor's pension for the wife of the deceased

Regulations

A more detailed description of the rights, registration system, and transfer of funds in the form of a pension is prescribed in the legislative framework of the Russian Federation. Regulatory acts related to this issue:

- Federal Law No. 4458-1 “On pensions for military personnel and members of their families”;

- Federal Law No. 166 “On state pension provision in Russia”;

- Federal Law No. 400 “On insurance pensions”.

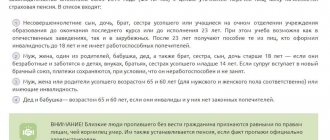

Federal Law No. 400 “On Insurance Pensions” states that in the event of the death of a Russian citizen, who, in turn, was one breadwinner in a family with persons who have lost their ability to work, or with persons who are officially unable to personally provide for their accommodation and were supported In the first case, the state pays cash benefits based on the regulatory framework.

Excerpt from Article 10 of Federal Law No. 400

Important! Monetary allowances are not necessarily transferred to blood relatives. The state can also pay money to individuals who are not related, but live together with the breadwinner.

So, for example, a mother-in-law has the right to receive benefits if she lived with her son-in-law on the same square meters and there is official confirmation of this.

There are exceptions to every rule. Thus, according to Article 10 of Federal Law No. 400, social compensation is not accrued even if there are family ties and residence in the family of the deceased, if the death occurred in the context of illegal actions of third parties, and within the framework of the pre-trial investigation it is proven that this person is a dependent or other beneficiary .

Pension in case of loss of a breadwinner by a pensioner: who has the right and documents for registration

- Content

Pension in case of loss of a breadwinner by a pensioner: who has the right and documents for registration

Elderly people who are supported by a family member, in the event of his death, are deprived not only of a loved one, but also of their means of livelihood.

Depending on the status of the deceased relative, they can count on insurance, social or government support.

In general, a pension for the loss of a breadwinner can be assigned to a pensioner in the absence of his own income, caring for minor children or disabled people.

Legal basis and conditions of receipt

The insurance payment is calculated in accordance with Federal Law No. 400 of December 28, 2013, and social and state - with the earlier Federal Law No. 166 of December 15, 2001 “On State Pension Security”.

The second legal act also lists cases in which it is possible to receive two types of pensions at once.

Possible payments

| View | Conditions of appointment |

| Social (minimum size) | The work experience of the deceased is less than six months |

| Insurance | The deceased’s length of service was more than 6 months, the sum of the fixed part and the pension coefficient was greater than the social benefit |

| State, military | Spouses or parents of deceased military personnel, astronauts, victims of man-made and radiation disasters have the right to receive |

In the latter case, the recipient is assigned two types of payments: for old age and for the loss of a breadwinner.

In other cases, he can choose only one type of financial support.

Dependents are entitled to financial support under the following conditions:

- the deceased has at least 1 day of work experience;

- death occurred due to a cause beyond his control.

Relatives of people who die due to self-harm or criminal offenses are unable to receive compensation.

Writing an application for a survivor's pension

If the deceased was a pensioner and received a large insurance amount, then the widowed spouse can increase his own pension by the amount of the difference.

He receives the right to payment for the loss of a breadwinner only if he is incapacitated and has no source of income.

Who can apply for a pension:

- parents and spouse who were not dependents at the time of death, but subsequently lost their source of income;

- adoptive parents (along with parents);

- grandparents, if they do not have able-bodied children;

- family members who were fully supported by the deceased and had no other income.

The main condition for financial support is the recipient's disability.

An exception is the case when an able-bodied parent, grandparent, brother or sister is caring for a family member who is under 14 years of age or is disabled.

A survivor's pension is not provided to working pensioners. Guilt in the death of the owner is also grounds for refusal.

Registration procedure

To receive financial support you need:

- take a death certificate;

- collect a package of documents;

- write an application to the Pension Fund;

- wait for the application to be reviewed (no more than 10 days).

Depending on the type of payment, a pensioner can receive a survivor's pension from the moment of death or from the first month following the application.

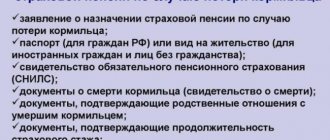

Documents for receiving a survivor's pension

For example, if the recipient applied on November 15, then the first amount will be credited from December 1 of the same year. Documents must be submitted to the Pension Fund or the relevant department of the military registration and enlistment office.

Required information

The following documents are required for registration:

- applicant’s passport, certificate of residence of a citizen of the Russian Federation;

- certificate of death or unknown absence of the breadwinner;

- certificate of insurance experience and average monthly earnings of the deceased;

- documents certifying family ties (certificates from local authorities, marriage certificates, adoption certificates, etc.);

- information about other recipients (dependents);

- a copy of the work book (to confirm the lack of income);

- income certificates and other documents confirming that the applicant was dependent on the deceased citizen;

- statement.

If documents are submitted through a representative, then a power of attorney will be required for the person who will handle the registration.

Calculation of the amount

A pensioner's survivor's pension is calculated on a general basis. The amount of social benefits is established by law and is indexed annually.

The calculation of the sum insured depends on the status of the deceased breadwinner of the family. If he was of working age and had work experience of more than 6 months, then the following formula applies:

P = IPC * PB + PV, where IPC is the amount of accumulated pension points, PB is the price of the point, and PV is the fixed part, which in 2019 is equal to 2,667.09 rubles.

The cost of each pension point is 87.24 rubles.

If at the time of death the citizen was a pensioner, then the insurance part (IPK * PB) is divided by the number of dependents.

Payment of survivor's pension

Monthly compensation for family members of an astronaut is up to 40% of his salary. State support for relatives of victims of man-made disasters ranges from 125% of the social pension.

For residents of the Far North, increasing regional coefficients have been established.

Conclusion

Upon the death of citizens, disabled members of their families have the right to monthly financial support.

If the breadwinner has sufficient work experience, the amount of compensation will depend on the number of accumulated pension points.

Some categories of pensioners will be able to receive several types of payments at once.

Video: How to transfer to a deceased spouse's pension

Basic data

In the event of the death of the breadwinner or his official declaration as missing, family members under eighteen years of age and dependents who were supported by the above-mentioned person, as a rule, are in dire need of financial assistance for further decent existence. Parents and persons with disabilities who are supported can also apply for cash subsidies. At the same time, the blood connection between parents and children does not play a role. Compensation is due even if the child was adopted. This situation is resolved and prescribed at the legislative level.

Close relatives, adopted children, etc. can receive a survivor's pension.

To obtain monetary compensation, you must provide the relevant authorities with a complete package of documents and fulfill all the necessary requirements.

The government body responsible for this situation is the Pension Fund. You can contact the Pension Fund of the Russian Federation for advice, submission of documents, etc.

To save personal and public time, experts advise carefully studying the legislation on the issue of interest.

Necessary concepts

A pension is a state monetary allowance that is established for state support of socially vulnerable segments of the population in the form of monthly funding. When calculating a pension, the following factors are taken into account:

- average income over working years;

- length of service (for the entire period).

Social benefits are calculated based on a combination of all of the above factors. If the pension is assigned for the loss of a breadwinner, in this case only the insurance period is taken into account.

When calculating a survivor's pension, the insurance period of the deceased is taken into account

Dependents are citizens who are financially supported by other able-bodied citizens for a long time. The legislation of the Russian Federation provides for the designation by the term “disabled” of a person who has an appropriate document confirming the disability group. An unemployed person may not necessarily be disabled.

How to apply

The procedure for registration of the PPC is regulated by Federal Law No. 173. If the deceased belonged to the civilian population, an application for the PPC is submitted to the Pension Fund office at the applicant’s registered address. Disabled relatives of deceased conscripts also apply for a pension from the Pension Fund. Read more in our material “How to apply for a survivor’s pension.”

The PPC of military personnel and law enforcement officers is registered with the pension authorities of the Ministry of Defense and the Ministry of Internal Affairs. Before submitting an application, a relative must first contact the military commissariat at the place of service or the military registration and enlistment office at the registration address to obtain a certificate of service and death of the breadwinner.

Who is entitled to a cash grant in case of loss of a breadwinner?

State assistance in the form of a survivor's pension is awarded to persons who need this financial security and personally do not have the opportunity to work.

Accrual occurs for disabled categories of citizens.

- Persons who have not reached the age of majority and do not have the opportunity for official employment due to age.

- Relatives whose age has reached retirement age. Such citizens receive an old-age pension, but also need financial support from the breadwinner due to difficult life circumstances.

- Persons who have a document confirming their disability. Such citizens have the right to receive a disability pension subsidy, only at the minimum established by the state. This minimum does not provide an opportunity for an adequate standard of living and requires additional financial payments.

Certain categories of citizens may apply for payments

All accruals are transferred only to the above categories of persons if all conditions required by law are met. In the Russian Federation, such a system of payments is accrued upon the loss of a breadwinner or upon official recognition of a citizen as missing, who had dependent or full support relatives of a certain category. When applying for a pension, family ties must be documented.

Category of persons (relatives) eligible to apply for a pension:

- Children or relatives who have reached the age of majority, but not older than twenty-three years, studying full-time at universities and other educational institutions. It is important to remember that such a person must not have a second able-bodied parent.

- Any close relative who has not reached the age of majority (brother, sister, grandson, child).

- Any of the spouses, grandparents, if there are close relatives of the deceased minor (under fourteen years of age). This category can include both children and brothers and sisters.

- Spouse, parents who are of retirement age and have lost their main income. In such situations, the Pension Fund does not take into account the time of registration of death or declaration of missing persons.

- Persons who have registered an adoption for a child, or the child who has been adopted, have the right to claim payments on the same terms as the parents. To apply for a pension, it is enough to present a document confirming the legal fact.

- Persons who have reached retirement age or have a disability, but if they lived on monetary allowance from a deceased or missing person.

The wife of the deceased, if she does not work, has the right to receive a survivor's pension

When can you receive a deceased spouse's pension?

In accordance with pension legislation, the spouse of a deceased pensioner, his children or other relatives

have the right to the pension of the deceased. It is not very easy to transfer to the pension of a deceased person; for this you need to meet some conditions.

There is only one exception to these rules - the right to receive the deceased’s pension in the current month. Then you can receive one monthly pension regardless of additional conditions.

Pension of the deceased for the current month

The legislation assumes that the pension for the month in which the person died is payable in the same month

. If a pensioner received a pension before death (for example, it was transferred to a card), then this amount will not have to be returned.

If a person died, and only after that the pension for the current month was received, then you should contact the Pension Fund with an application to receive the payment. The law states that relatives of the deceased are prohibited from receiving payments from the month following the month of death of the pensioner.

A pension for the current month can be received upon application from any relative who lived with the deceased. However, there is no explanation anywhere whether it is possible, for example, to withdraw a pension for the current month from a relative’s card, provided that the PIN code of the card is known

.

But if the pension arrived the next month after the death of the deceased

, then this amount should no longer be withdrawn - this money will be returned to the state. And if they are withdrawn, the Pension Fund will require the payment to be returned in full.

Benefits when switching to a husband's/wife's pension

In Russian legislation there is no term “pension provision for the deceased”. In Russia, the type of payment is called a survivor's pension.

To transfer to the pension provision of a deceased spouse, you must:

- prove the fact of being a dependent;

- get benefits.

The second condition follows from the first

. If in a family the pension of one spouse was much larger than that of the other, then after the death of the first, the family budget is significantly reduced. And this fact can already be considered confirmation of dependence.

A survivor's pension can only be received with an officially registered marriage.

. If the spouses lived in a civil marriage, then the Pension Fund and the court will refuse to transfer to the pension of the deceased.

If the difference in the size of the pension payment was approximately 2 times or more, then the spouse can apply to the Pension Fund with an application. If the difference in pension amounts was 1-2 thousand rubles, then the spouse of the deceased should not apply

for changes in pension provision, since the amount of payment for the loss of a survivor will be less in amount than the pension of the deceased.

note

, when transferring to the pension provision of the deceased, the husband or wife must give up their own pension. Therefore, before submitting an application, it is better to consult with a Pension Fund employee.

Contributory pension of the deceased spouse

If a person died before the date of assignment of a funded pension, then his relatives can apply for payment. Pension savings are distributed in equal parts among all heirs

, that is, the spouse, children of the deceased and his parents.

An application for payment of pension savings must be submitted to the Pension Fund or a non-state pension fund, depending on where the deceased’s savings are located.

State pensions

State pensions paying to certain categories of employees are inherited upon death. For example, upon the death of a military spouse who was the main breadwinner of the family, his relatives, including the spouse, may receive a survivor's pension, which includes the state pension.

When applying for payment of state pensions, you need to go to the institution responsible for establishing preferential security

and the purpose of this payment (for example, for military pensions - to the military registration and enlistment office).

Other payments

It is very important to know that when applying for similar social benefits, various nuances occur. There are different types of pension benefits.

| Pay | Description |

| Insurance pension | Payment of cash benefits is carried out from the funds of the Pension Fund of the Russian Federation. Such payments are due only to those persons who previously regularly paid the insurance premium. |

| Military pension | A cash payment that is available only to family members of a military personnel. |

| Social pension | Relates only to those persons who did not make insurance payments. Payments in such a situation will be much less. |

| State pension | A citizen who suffered during the liquidation of man-made and radiation disasters has the right to apply for this kind of monetary payment. |

There are other social benefits

This is a complete list of the pensions that the heir of the deceased can count on.

Specifics of accrual of monetary allowances

In the process of calculating the size of the survivor's pension, different formulas are used. There is one constant formula and auxiliary ones, which constantly change depending on many factors. For example, there are differences if a citizen received a salary, pension or other payments.

Important! Do not forget about such an indicator as a fixed coefficient. It is established by law. Every year, the legislative body calculates a fixed coefficient in accordance with the norms of the economic situation in the Russian Federation. However, such a calculation is not the full amount, but only a share of insurance transfers.

In this regard, even with a small pension rate for the deceased (or missing person), you can qualify for the subsistence minimum or the established minimum wage.

When calculating payments, a fixed coefficient is taken into account

Minimum size

The size of the social survivor pension for children in 2019 is:

- 5180 rubles if one parent died;

- 10,360 rubles if both died.

For family members of fallen military personnel, the pension is 5,180 rubles.

The state pension in the event of the death of a serviceman or through the Ministry of Internal Affairs is 7,770 rubles or 10,360 rubles, depending on whether he was in service at the time of death or not.

From April 1, 2021, planned indexation of social, state and Ministry of Internal Affairs pensions for the loss of a breadwinner is expected.

Pension payments to the wife of the deceased (missing person) in the presence of official employment

Social security in the form of a pension is accrued to the wife of the breadwinner only if she lived as a dependent of her husband.

Otherwise, the state will accrue funds to the dependents, children and parents of the deceased (missing person), officially recognized as disabled.

The wife has the right to receive monetary allowance for the minor (under fourteen years old) children of the deceased, if any. However, it does not matter whether she is employed or not. After the child turns fourteen years of age, he himself has the right to receive funds.

Important! If the spouse applies for social benefits personally, then this option is possible only in a situation where she is officially disabled.

If the wife of the deceased breadwinner works, she can only receive payments for children under 14 years of age

This category of citizens initially draws up all the necessary documents confirming the fact of incapacity for work. Due to the fact that the breadwinner’s wife was completely financially dependent on her husband, this payment is processed and paid by the state without any problems.

In what situations do pension payments stop accruing?

Social payments and subsidies provided by the state are not accrued in cases where:

- the person receives a disability pension payment from the state, but has not proven his disabled status at a scheduled expert examination;

- the spouse gets a job on an official basis in accordance with the Labor Code of the Russian Federation. An exception to the rule are relatives of military personnel called up as ordinary soldiers, sergeants, foremen, and sailors. Only under such conditions, relatives of the deceased (missing person) have the right to apply for a pension subsidy even in the case of official employment;

- children or close relatives (sisters, brothers, grandchildren) are eighteen years old or, if they are studying full-time at higher educational institutions, they are twenty-three years old;

- the dependent person is fourteen years old and is supported by citizens receiving a pension payment from the state.

In some cases, the survivor's pension may no longer be paid.

Pensioners of the Ministry of Internal Affairs

If the deceased was a pensioner of the Ministry of Internal Affairs, pension subsidies are provided only to the dependents of the deceased (missing person). At the same time, the subsidy will be calculated and accrued both in the complete absence of financial income and when transferring other own payments. Do not forget that a disabled relative also has the right to claim payment for the loss of a breadwinner. Such a person will receive funds related to pension payments from a pensioner of the Ministry of Internal Affairs. Some funds provide such financial subsidies:

- Ministry of Internal Affairs;

- Pension Fund.

Relatives of a deceased Ministry of Internal Affairs pensioner have the right to benefit payments

Much depends on who exactly accrued pension payments. This could be a military pension payment, or maybe a standard pension accrued by the Pension Fund of the Russian Federation. In such cases, having a funded pension comes in handy. If there was one, then the relatives of the breadwinner have the right to receive such a pension in full.

How to receive payments after the death of a relative

Families that lost their breadwinner as a result of the Chernobyl disaster or the accident at the Mayak production association (PO) in 1957 are entitled to receive a one-time monetary compensation for the loss of their breadwinner in the amount of 33,930.80 rubles; parents of the deceased - in the amount of 16,965.45 rubles.

In addition, for the loss of a breadwinner who participated in the liquidation of the consequences of the disaster at the Chernobyl Nuclear Power Plant or at the Mayak Production Association, his children, as well as other disabled family members who were dependent on him, are awarded a monthly compensation in the amount of 257.48 rubles for each disabled member families.

Children who lost their breadwinner who participated in the liquidation of the consequences of the disaster at the Chernobyl nuclear power plant or at the Mayak Production Association are paid an annual compensation of 339.32 rubles each.

Citizens who have received or have suffered radiation sickness and other diseases associated with radiation exposure or with work to eliminate the consequences of the disaster at the Chernobyl nuclear power plant, as well as disabled people as a result of the Chernobyl disaster, have the right to monthly monetary compensation for them and their children living with them for the purchase of food products. The right to this benefit remains until the child reaches 14 years of age, regardless of whether the victim is alive.

On the territory of Moscow, one-time financial assistance is also paid annually to pensioners and disabled people - family members who lost their breadwinner as a result of the Chernobyl disaster or the accident at the Mayak production facility in 1957. The payment amount is 5,000 rubles.

To process payments you will need:

- a certified copy of the certificate of a deceased participant in the liquidation of the consequences of the accident at the Chernobyl nuclear power plant (accident at Mayak PA);

- a certified copy of the breadwinner's death certificate;

- a certified copy of the conclusion of the interdepartmental expert council (military medical commission) on establishing the causal connection between the death of the breadwinner and the consequences of the Chernobyl disaster;

- a certified copy of the marriage (birth) certificate;

- documents containing information confirming the fact that disabled family members are dependent on the deceased breadwinner;

- a certificate of disability and (or) pension certificate or other document confirming the fact of receiving a pension (if you are a pensioner or disabled person registered at your place of residence in Moscow and are applying for one-time financial assistance);

- a certificate confirming the fact of leaving the exclusion zone or resettlement zone.

You must submit documents to the state center]“My Documents”[/anchor] regardless of your place of residence in Moscow.

To a military man

If a serviceman dies, benefits are issued in two types - on standard terms, according to the state model, and on a preferential basis. This is due to the fact that military service is somehow associated with increased danger. If a serviceman dies while performing his duty, his spouse has a legal right to a pension subsidy.

For many, it is unknown at what time and under what circumstances a survivor’s pension is awarded. This subsidy will be valid after the spouse reaches retirement age.

An exception is the situation when the wife is either on maternity leave or is forced to stay at home to care for the child due to illness.

Excerpt from Article 29 of the Law of the Russian Federation No. 4468-1

The calculation of pension payments itself is based on accounting documents on the declared income of a military man in accordance with his position.

To a combat veteran

According to the legislation of the Russian Federation, there is a certain form of processing payment for the loss of a breadwinner when he was injured while defending his homeland or fulfilling his duty. Such injuries include:

- wound;

- contusions;

- bodily injuries resulting in injury or illness.

In such situations, the state calls veterans those who served behind the cordon - in countries where military conflicts occur that entail military action.

Combat veterans, as well as their relatives, have the right to payments from the state

In this case, it is necessary not to forget that the spouse will be able to receive a financial subsidy only after reaching retirement age - such a subsidy will be accrued as a kind of increase in pension.

The children of the deceased are also entitled to such financial subsidies, provided they are not of legal age. And until the age of fourteen, while the child is considered a minor, all subsidies and payments can be received and administered by an officially recognized guardian.

If the child is under 14 years old, his guardian can receive payments

Important! It should be noted that such a payment can be added to the basic pension subsidy for disabled citizens.

Close relatives of which employees of the Ministry of Internal Affairs receive cash payments?

Financial assistance for the loss of a breadwinner is available to relatives of the following groups of employees:

- persons who have entered and are serving in the Ministry of Internal Affairs;

- persons who completed conscription service with the rank of officer, warrant officer, midshipman, as well as contract soldiers, sailors, sergeants and foremen;

- persons serving in fire defense;

- persons serving in the drug control department;

- persons serving in the penitentiary service.

The subsidy, paid monthly, is provided to relatives of employees who:

- are currently serving;

- died within three months after leaving service at their own request;

- at any time when leaving service due to illness, injury, in any situations related to injury, concussion.

Relatives of deceased employees of the Ministry of Internal Affairs can receive payments

A clear example of calculating pension benefits for employees of the Ministry of Internal Affairs.

Serov A.A. worked in the law enforcement agencies of the Russian Federation for twenty-five years and received the rank of colonel. In this status, a citizen dies as a result of an accident that is not related to his service in the authorities. After the death of Serov A.A. There was a family left consisting of a wife (disabled) and two young children. Consequently, the wife, and subsequently the children, will receive certain payments.

The pension will be provided:

- the wife of a deceased person who served in the Ministry of Internal Affairs, until the child is eight years old, regardless of the woman’s age and her official place of work;

- to the wife of the deceased with a child over eight years old in the absence of official employment - such payments will be transferred monthly until the child turns 14 years old.

Social benefits are accrued if, at the time the child turns fourteen, the wife of the deceased turns 55 years old (retirement age). In such a situation, the pension benefit for the loss of a breadwinner will be paid for life, regardless of the presence of an officially registered marriage.

If the widow of a serviceman is already 55, she will receive benefits for life

Important! Payments will be accrued to all children until they reach the age of majority or twenty-three years of age (provided that the citizen receives higher education on a full-time basis).

Through the Ministry of Internal Affairs

Paid to families of breadwinners:

- served in the internal affairs bodies;

- those who served under conscription as officers, warrant officers and midshipmen or served under contract as soldiers, sailors, sergeants and foremen;

- served in the State Fire Service;

- serving in the authorities for control over the circulation of narcotic drugs and psychotropic substances;

- serving in institutions and bodies of the penal system;

- served in the Federal Service of the National Guard of the Russian Federation.

A survivor's pension through the Ministry of Internal Affairs is paid to the family of an employee in the internal affairs bodies (OVD) if he died:

- during the period of service;

- no later than three months after dismissal from service;

- at any time after dismissal due to injuries received in service: wounds, contusions, injuries, or other diseases;

- during the period of receiving a pension or no later than five years after the termination of payment.

Who is entitled to

A pension for the loss of a breadwinner who served in the internal affairs department is paid to disabled members of his family who were dependent on him.

A child, brother, sister, or grandson of a deceased person who served in the police department is considered disabled:

- until they turn 18 years old;

- until they turn 23 years old if they are full-time students at an educational institution;

- all their lives, as long as there is a “disabled” category, and they received it before the age of 18.

The brother, sister and grandson of a deceased employee in the Department of Internal Affairs will be paid a pension if they do not have able-bodied parents who are legally obligated to support them.

The parents and spouse of a deceased employee in the internal affairs department are considered disabled if:

- reached the ages of 55 and 60 years (women and men, respectively), and the death of the breadwinner occurred due to a military injury;

- reached 60 and 65 years of age (women and men, respectively);

- are disabled.

Grandparents of a deceased grandson who served in the police department are considered disabled, but they will be entitled to a survivor's pension if they do not have able-bodied children who are legally obligated to support them.

The pension will be assigned to parents, spouses, grandparents, brothers or sisters if they do not work but are caring for a child, brother or sister of the deceased who is under 14 years of age. In this case, the fact of being dependent on the deceased is not important.

Being a dependent is also not required for:

- disabled children;

- disabled parents and spouse if they have lost their livelihood;

- disabled parents and spouse, if the death of the breadwinner was due to a military injury.

If a police officer who died due to a military injury left behind a child under eight years of age, then the spouse caring for him is entitled to a survivor’s pension, regardless of:

- how old is the spouse;

- whether it works or not.

If the death of a serviceman occurred due to the commission of a crime, then only a social pension will be assigned and only to his children.

Benefit amounts

monetary allowance = (official salary salary for a special rank percentage bonus for length of service) × the amount of monetary allowance as a percentage for calculating the pension, established by law and changing every year. The ATS pension is paid in the amount of 50% of the amount of monetary allowance if:

- the breadwinner died as a result of war injury;

- the breadwinner died - a pensioner, who on the day of death was disabled due to a military injury;

- children of the breadwinner, if they are left without both parents;

- children if they were raised by a single mother.

Paid in the amount of 40% of the amount of monetary allowance if:

- the breadwinner died due to an illness acquired during the period of service, namely as a result of injury due to an accident or illness not related to the performance of official duties.

Amounts of monthly salaries in accordance with the position being filled for typical positions of employees of territorial bodies of the Ministry of Internal Affairs of the Russian Federation at the district level

| Job title | Salary (rubles) |

| Head of the territorial body (head of department) | 24 000 |

| Head of a territorial body (head of department), deputy head of a territorial body (deputy head of department) | 21 000 |

| Deputy head of the territorial body (deputy head of department), head of department in the department | 19 000 |

| Deputy Head of Department in Management | 17 500 |

| Department Director | 16 500 |

| Senior: investigator, detective, expert, specialist, inspector | 15 500 |

| Investigator, detective, expert, specialist, inspector | 15 000 |

Amounts of monthly salaries in accordance with the assigned special rank of employees of the Department of Internal Affairs of the Russian Federation

| Special rank | Salary (rubles) |

| General of Police of the Russian Federation | 27 000 |

| Colonel General: police, internal service, justice | 25 000 |

| Lieutenant General: police, internal service, justice | 22 000 |

| Major General: Police, Internal Service, Justice | 20 000 |

| Colonel: police, internal service, justice | 13 000 |

| Lieutenant Colonel: police, internal service, justice | 12 000 |

| Major: police, internal service, justice | 11 500 |

| Captain: police, internal service, justice | 11 000 |

| Senior Lieutenant: Police, Internal Service, Justice | 10 500 |

| Lieutenant: police, internal service, justice | 10 000 |

| Junior lieutenant: police, internal service, justice | 9500 |

| Senior warrant officer: police, internal service, justice | 8500 |

| Ensign: police, internal service, justice | 8000 |

| Foreman: police, internal service, justice | 7500 |

| Senior sergeant: police, internal service, justice | 7000 |

| Sergeant: police, internal service, justice | 6500 |

| Junior sergeant: police, internal service, justice | 6000 |

| Private: police, internal service, justice | 5000 |

Sergei Timofeevich served for 25 years and rose to the rank of department head at the district level and the rank of “Colonel” when he died from an accident not related to the performance of official duties. He is left with an unemployed wife who is raising his two children: three and twelve years old.

From the example we get:

- the official salary of the head of the department is 16,500 rubles;

- the salary for the special rank “Colonel” is 13,000 rubles

- The percentage bonus for 25 years of service is 30% and is calculated as: (official salary salary for a special rank) * 30%. For example, we get: (16500 13000) * 30% = 8850 rubles;

- the amount of cash allowance for calculating pensions from January 1, 2019 is 72.23%. From October 1, 2021, the amount changes and will be 73.68% based on Federal Law dated December 11, 2018 N 460-FZ.

- Since Sergei Timofeevich died due to an accident, his family members will receive a pension in the amount of 40% of their salary.

(16500 13000 8850) × 72.23% × 40% = 11044 rubles

The payment will be assigned:

- for two children, until they turn 18 or 23 years old, if they study full-time at an educational institution;

- the widow of a deceased employee in the internal affairs department until the youngest child turns eight years old, regardless of her age and availability of work;

- to the widow of the deceased, if after the child turns 8 years old the widow does not officially find a job, they will continue to be paid until the child turns 14 years old;

- if by the time the child reaches 14 years of age, the widow will have turned 55. In this case, the survivor's pension will be paid for life, regardless of whether she marries again.

We find that from January 1, 2021, a widow and two children will receive pensions in the amount of (11,044 rubles) × 3 family members = 33,132 rubles.

The law establishes that the ATS pension cannot be less than 200% of the social pension if:

- the breadwinner died as a result of war injury;

- the breadwinner died - a pensioner, who on the day of death was disabled due to a military injury;

- it is prescribed to the children of the breadwinner who are left without both parents;

- it is prescribed to children when they were raised by a single mother.

A survivor's pension under the ATS line cannot be less than 150% of the social pension if:

- the breadwinner died due to an illness contracted during his service.

Complete list of documents that must be submitted to the relevant authorities

After the death of the breadwinner or his official recognition as missing, it is necessary to collect a complete package of documents and submit them to the relevant authorities. In any legal state, all civil relations are concluded with documentary evidence of a legal fact. Do not forget about the seriousness of this issue. It makes no sense to fraudulently receive subsidies from the state. Such behavior entails either administrative or criminal liability. Everything will depend on the amount of payments received through fraud.

Standard list of documents:

- passport of the person who writes the application for pension payment;

- a certificate of income received from the deceased’s wages for his entire career, or from a pension subsidy;

- death certificate of a citizen or official conclusion of the competent authorities declaring a person missing;

- a document confirming the relationship between the deceased person and the person claiming compensation (for example, a child’s birth certificate, marriage certificate, etc.);

- work book of the deceased citizen.

You need to provide certain documents to apply for a pension

What documents are needed

A detailed list of documents for appointing a SPUK can be found here.

But, as a rule, so much documentation is not required, since most of the papers are at the disposal of state or municipal authorities.

As a rule, the spouse will need to collect not so many papers:

- statement;

- passport;

- power of attorney (if it is not the spouse who is applying, but a proxy);

- work book of the deceased breadwinner and other documents confirming periods of work activity before registration in the OPS system (after registration in the OPS system, the length of service is confirmed based on personalized accounting information);

- a document serving as confirmation of the family relationship with the breadwinner (for the wife, this is a marriage certificate).

If a wife wishes to receive SPUK on the basis of reaching 55 years of age (or disability), she must prove that she is a dependent.

The following document would be suitable:

- certificate from housing authorities;

- certificate of income of all family members;

- court decision establishing dependency.

The process of applying for a survivor's pension

In order to claim financial assistance for the loss of a breadwinner, the wife of a deceased citizen must contact the Pension Fund of the Russian Federation at her place of residence. The pension payment itself is not formalized; to begin studying the documents and calculating compensation, the spouse must write a written application in accordance with the uniform template established by law. Such an application must be accompanied by the above-mentioned originals and photocopies of documents. Any disputes on this issue shall be resolved in court.

How to apply for pension payments to the widow of a breadwinner

Registration of benefits occurs on the application principle. This means that the applicant must independently apply for his appointment. The registration process consists of several steps:

- Prepare the documents necessary to assign allowances.

- Contact the Pension Fund or the Multifunctional Center (MFC).

- Submit an application, attaching the collected package of documents. This can be done in person, by mail or through a legal representative. It is possible to submit an application through your personal account on the Pension Fund portal.

- Wait for the decision to be made.

- Compensation of Soviet deposits for pensioners in 2021

- How can I return an item without a receipt?

- How will the self-isolation regime in Moscow be monitored?

State and social pensions due upon the death of a husband are assigned to the widow from the beginning of the month in which the woman applied for payments, but not earlier than the day on which the right to accrue pension benefits arose. The survivor's insurance pension is calculated:

- from the date of the husband’s death, if the widow applied for payment within 12 months from the date of the right to receive money;

- from the month of application, if the application and documents were submitted 12 months after the date of the citizen’s death.

The insurance pension consists of a fixed part, the amount of which is determined by law and revised annually, and a so-called surcharge, the calculation of which takes into account:

- insurance length of the deceased for his entire work activity;

- number of pension points;

- individual pension coefficient.

List of required documents

To assign a pension payment, the widow must provide:

- application in the prescribed form;

- passport or residence permit if the spouse does not have Russian citizenship;

- death certificate of the husband or a court order declaring him missing.

Please note that the above list is mandatory documentation. The specialist accepting the application may request additional certificates and documents to establish the circumstances or status, for example, confirmation that the woman is caring for relatives of the deceased under 14 years of age. If not all papers are submitted, the wife of the deceased is given three months to provide the missing documents. In this case, the pension payment will be assigned from the date of application.