How to transfer to a deceased spouse's pension?

These appeals are widespread, since there is an opinion that the surviving spouse, having renounced his pension, can receive the pension of the deceased, but this opinion is not entirely correct. The law provides for the possibility of switching from an old-age (disability) pension to a survivor's pension, but the amount of a survivor's pension is always less than the amount of the old-age or disability pension that the deceased himself received, therefore, when applying to the pension authorities, recipients of an old-age pension with with an application to transfer them to a survivor's pension, the feasibility of such a transfer is checked in each specific case on the basis of the submitted documents on the insurance period and salary of the deceased, that is, the estimated pension is calculated.

Due to the introduction of pension reform, the age limits for incapacity for work have changed

Now it is established at the legislative level that a deceased spouse can only transfer to the pension upon reaching 60-65 years of age, for men and women respectively. However, we must not forget about the transition period, during which the age limits will increase.

In 2021, the retirement age was increased only by six months, so women can refuse their pension and receive survivor benefits from 55.5 years old, and men from 60.5 years old.

Categories of Russians who will retire according to the old rules - at 55 and 60 years old

In cases where the surviving spouse has a disability, the age limit does not matter for security due to the loss of a breadwinner (regardless of the assigned disability group).

Is it possible to receive my husband's pension after his death?

Moreover, as part of the procedure, the widow is required to formalize a refusal of her own pension and choose a pension for the loss of a breadwinner - in accordance with the provisions of Art. 4, art. 9 Federal Law No. 173 “On Labor Pensions” dated December 17, 2001. It is possible to switch from one type of pension to another several times.

Upon reaching retirement age, the spouse has the right to count on one type of security. She cannot receive her own pension plus benefits for the loss of a breadwinner, with the exception of the wives of military personnel or astronauts, as well as citizens affected by radiation, provided that she does not enter into a new marriage. The concept of “transfer to the husband’s pension” is inherently incorrect, since state support is assigned to the wife of the deceased, which is related to the husband’s pension - due to the presence of a link to the amount of the deceased’s pension.

We arrange the transition to my husband's pension after his death

The insurance benefit is paid if the husband has a certain length of service. At the same time, his work activity must be of an official nature, that is, employment occurs in strict accordance with the norms of the Labor Code of the Russian Federation. At the same time, there are no strict requirements for the duration of the insurance period itself.

The concept of “transition to the husband’s pension” is also fundamentally incorrect in this regard, in that it mistakenly means that the widow will be able to receive her husband’s payments in full. Actually this is not true. The payments due to the widow will be less than what her deceased husband received.

Can a widow count on her deceased husband's pension?

New pension legislation, which came into force on January 1 of this year, allows a woman to receive pension payments for her deceased spouse if she refuses her own pension. But there are a lot of nuances here. One of them is related to the calculation of pensions for working pensioners.

How is the payout amount calculated? The correct name is not “husband’s pension” or “husband’s pension”, but a survivor’s pension. Because if the husband’s pension was a serious addition to the family budget, losing it will hurt the widow’s wallet and significantly worsen the financial situation.

You must apply for this type of pension at the branch of the Pension Fund of the Russian Federation at your place of residence. The calculation formulas are given in Article 16 of Federal Law No. 173. They are based on the amount of the breadwinner’s pension capital distributed over 228 months, plus fixed payments.

In this case, it is assumed that the spouse had an old-age or disability pension.

Transfer to the deceased spouse's pension; rules, procedure, deadlines and documents

In our country it is prohibited to receive several pensions at the same time, but there are exceptions for certain categories of citizens. For example, widows of: - military personnel who died from injuries while on duty can claim two pensions; – astronauts who died; – liquidators of the accident at the Chernobyl nuclear power plant.

You may be interested in:: Is it possible to contact a Pensoner at the MFC to avoid paying Apartment Tax

These categories of wives have the right to receive both a survivor's pension and their own labor pension. In order to apply for a military pension, you must contact the Commissariat by preparing documents: your own passport, the file of your deceased spouse, a serviceman’s ticket and an order.

- 40% of the deceased spouse’s allowance if the accident leading to disability occurred outside of service;

- The widow receives 50% of the allowance if the deceased husband became disabled due to illness or injury during service.

- 150% of the social pension if death occurred due to an illness contracted during the “term” period;

- 200% of the social pension if the husband died while performing his duty from injuries incompatible with life.

You can apply for such a pension in accordance with Article 28 of the Law under number 4468-1 if: Employees who control the registration of the pension may require evidence of the cause of death, the presence of a fatal disease that was acquired during service.

New pension legislation, which came into force on January 1 of this year, allows a woman to receive pension payments for her deceased spouse if she refuses her own pension. But there are a lot of nuances here. One of them is related to the calculation of pensions for working pensioners. Such payments are disproportionately less than those received by persons who have retired.

Keep in mind that if a woman is a veteran, has a disability or another category of benefits, then all her benefits remain, even when she switches to a survivor's pension. The law provides for the possibility of switching from an old-age (disability) pension to a survivor's pension, but the amount of a survivor's pension is always less than the amount of the old-age or disability pension that the deceased himself received, therefore, when applying to the pension authorities, recipients of an old-age pension with with an application to transfer them to a survivor's pension, the feasibility of such a transfer is checked in each specific case on the basis of the submitted documents on the insurance period and salary of the deceased, that is, the estimated pension is calculated. If, when calculated on a new basis, its size does not reach the amount of the old-age pension received, then, accordingly, transferring to a survivor’s pension is not practical.

Let's figure out whether in Russia a wife can receive her husband's pension after his death

This must be done because only in this case will you be able to receive a survivor’s pension from the state, which is often mistakenly mistaken for the pension of a deceased husband. Even if you were not dependent on your spouse, but over time you lost your source of income, or it remained in a meager amount, then the pension fund will not be able to refuse you.

Immediately prepare for the fact that the state will not pay you two types of pensions. Therefore, if you decide to receive money for the loss of a breadwinner, then:

- give up your pension;

- ask to assign you another type of pension “for the loss of a breadwinner”.

For detailed explanations on these issues, read Article 4, as well as 9 of Federal Law No. 173 of December 17, 2001 “On Labor Pensions in the Russian Federation”.

Recalculation of pensions for pensioners in the event of the death of a spouse

This must be done because only in this case will you be able to receive a survivor’s pension from the state, which is often mistakenly mistaken for the pension of a deceased husband.

Even if you were not dependent on your spouse, but over time you lost your source of income, or it remained in a meager amount, then the pension fund will not be able to refuse you. Immediately prepare for the fact that the state will not pay you two types of pensions.

Therefore, if you decide to receive money for the loss of a breadwinner, then:

- give up your pension;

- ask to assign you another type of pension “for the loss of a breadwinner”.

For detailed explanations on these issues, read Article 4, as well as 9 of Federal Law No. 173 of December 17, 2001 “On Labor Pensions in the Russian Federation”. The pension of the deceased husband passes to the wife in the following cases:

- refusal of one’s own pension, taking into account that in accordance with Article 5 of Federal Law No. 400, one can receive only one pension from the list of established payments determined by the Russian Federation;

The procedure and list of necessary documents for transferring to the husband’s pension after his death

→ → → Current article Contents If the deceased’s pension exceeded that of the spouse, she has the right to apply for a survivor’s pension.

At the same time, she will have to give up her own benefits, since receiving two types of pensions is not provided for by law. It should be taken into account that payments under the SPC (in case of loss of a breadwinner) do not amount to 100% of the deceased’s pension.

We recommend reading: Labor standards subject to agreement with the trade union

They depend on the amount of insurance premiums paid by the deceased during work, that is, on the length of service and the amount of wages. If the widow’s own pension is higher than the expected benefit under the SPC, there is naturally no point in switching to it.

Read more on our website

Widow transitioning to her husband's pension

Puk = PK / (T x K) / KN + 1281, where Puk is the required amount of the survivor’s pension; PC - the amount of the deceased husband's estimated pension capital, established for the deceased spouse as of the date of his death; T – 228 (months of expected receipt of a pension, calculated on the basis of 19 years: 19 x12 = 228 months); K – 1 (the ratio of the insurance period to 180 months, in the case under consideration 180/180 = 1); KN - the number of disabled family members of the deceased breadwinner; 1281 rub. - fixed basic size of labor pension in case of loss of a breadwinner for a spouse. Roughly speaking, if only his wife applies for a survivor’s pension, then the amount of her provision will not be bad at all if the deceased’s earnings were substantial. In addition, there is a constant increase in pension payments due to their indexation.

This is interesting: What taxes are old-age pensioners exempt from?

Can a spouse receive a deceased spouse's pension in 2021?

After the death of a spouse who received a higher pension, life for his family may become much more difficult. However, any citizen of the Russian Federation has the legislative right to transfer the pension of a deceased spouse to himself. In this article we will look at how to transfer to the pension of a deceased retired spouse, and what features this process has.

Is the pension of the deceased inherited?

Transferring to the pension of a deceased life partner is the right of a spouse, which is legally enshrined in the regulations of the Russian Federation. The transition to payment of a deceased pensioner can occur at the request of the widow or widower. However, this procedure is not as transparent and simple as it might seem at first glance.

Can a spouse receive the deceased spouse’s pension instead of his own?

The law does not limit the right of pensioners to receive a pension for a deceased spouse after his death, and in the event of an increase in their own accrued benefit, this process can be canceled. But to implement the receipt procedure, you must meet certain requirements. Thus, in order to switch to her husband’s benefit, the wife needs to contact the Pension Fund no later than six months after his death. If there were circumstances that prevented the documents from being completed on time, then in order to restore the right to receive benefits for the deceased, a court decision is required, which will determine how objective the reason for the delay was.

After the death of the citizen receiving it, the pension is divided into two parts, while the funded one is equated to an inheritance, which means it will be distributed among his heirs - given to them in cash or transferred to specified accounts. The size of such a payment is on average 30-35% of the amount of accrued funds to the deceased citizen. The coefficients used in the calculation are quite complex; it is often impossible to calculate the amount of money paid with your own hands, so it is better for the wife of the deceased to contact the Pension Fund to make preliminary calculations. The procedure for inheriting the insurance part is not carried out under current legislation.

Consideration of the calculation of payments is made in accordance with the papers on the insurance period and wages of the deceased. If the amount of new calculations is less than the amount of payments already accrued, then the transition to the spouse’s pension will not be rational.

It should be noted that, according to current legislation, a widow has the right to choose from two options - to continue receiving her labor pension or to switch to the deceased’s benefit. She cannot arrange two collaterals at the same time.

How to transfer to a deceased husband's pension?

A widow can personally contact the Pension Fund to transfer the deceased spouse’s pension into her own account or use the services of a representative. In any case, you must have a package of necessary documents and a completed application in the prescribed form.

Where to contact?

An application for transfer and assignment of security is submitted to the Pension Fund at the place of residence, stay or actual residence. You can submit an application through a direct visit to the territorial department of the Pension Fund, by sending a letter by mail, or by submitting an application on the official portal of the Fund or through the MFC.

What documents are needed?

The list of necessary documents, without which it will be impossible to transfer to the pension of a deceased spouse, is specified in the regulations of Order of the Ministry of Labor and Social Protection No. 14 of January 19, 2016. The papers include:

- documents confirming the citizen’s identity (citizen’s passport or birth certificate);

- and documents confirming the death of the spouse and relationship with the deceased;

- papers indicating that the deceased has insurance coverage.

All documents must have a number, date of issue, and signature of the employee who issued them. If the necessary documents are not available, the applicant is given 3 months to provide them.

What will happen to benefits?

At the legislative level, there is a special category of widows who have the right to claim benefits even after the death of their spouses. For women who did not work in connection with the move to the place of service of their military husbands and were not able to accumulate work experience for the calculation of benefits, monetary support is considered separately.

Pension accruals for military personnel and their spouses also differ from standard labor accruals. If in general cases the spouse of the deceased does not have the right to receive benefits for her deceased husband, widows of military personnel who died in service, participants in combat operations in “hot spots” or veterans of the Great Patriotic War have similar privileges.

Detailed information about the process of transferring to a deceased spouse's benefit can be found here:

Thus, the state allows spouses to receive pension payments for their deceased husbands in cases where they refuse their own benefits. However, the re-registration process involves a lot of nuances associated with the calculation of pension payments and the preparation of the required documents.

Dear readers ! If you need specialist advice on pensions and state benefits, we recommend that you immediately contact qualified practicing lawyers on social issues:

Dear readers ! If you need specialist advice on pensions and state benefits, we recommend that you immediately contact qualified practicing lawyers on social issues:

Is it possible to receive money for a deceased spouse - response from the Pension Fund

If the deceased worked in military service under a contract or was equal in status to a law enforcement officer , then the spouse may be awarded a pension if he was declared incapacitated. At the same time, there is no need to prove that he was a dependent.

You can receive a pension upon reaching retirement age. You will have to prove that the spouse applying for a pension was dependent on the second - his income is less than what the deceased received. Now the pension due to death in service is a little more than 10 thousand rubles, and due to illness in service that led to death - 7.5 thousand rubles.

Now it is established at the legislative level that a deceased spouse can only transfer to the pension upon reaching 60-65 years of age, for men and women respectively. However, we must not forget about the transition period, during which the age limits will increase.

You may be interested in:: Young family program in rural areas 2021

The thing is that a dependent is entitled to pension benefits not from the moment he applies to the Pension Fund, but from the day the breadwinner dies. If death occurred within 1 year from the date of application, then all funds for the previous time will be paid. When more than 12 months, the pension is paid for 1 year ago.

If the insured did not live to see his pension, his legal successors can receive money from the funded part. This is not done by the notary, but by the Pension Fund. Successors may be by application or by law. The pension fund must notify both of them of the right to payments from the funded part of the deceased’s pension. But it is better not to wait for a letter, but within six months after the death of the insured person, go to any branch of the Pension Fund of the Russian Federation with the original documents. Here's what you'll need:

The pension fund refused her because she missed the deadline set for applying for payments. But in fact, it was the pension fund that should have told this woman that she could receive pension savings. This is his legal obligation. The Pension Fund was required to send notices to legal successors within 10 days from the date of receipt of the document on the death of the insured person.

The legal successor can be any person indicated by the citizen in his application. If the citizen does not take advantage of this right, the payment of pension savings will be made to the legal successors of the first priority: parents, children, spouse, and if there are no such relatives, then the payment is made to the legal successors of the second priority - grandparents, grandchildren, brothers (sisters).

The estate includes not only the movable and immovable property of the deceased, but also some savings. They also include the funded pension of a deceased relative, which the heirs have the right to receive within six months from the date of death of the testator. We'll talk about how to get it further.

When a widow has switched to a survivor's pension and enters into a new relationship, that is, gets married, the security continues to be paid to the woman - provided that she does not choose a different type of security - in accordance with Art. 10 Federal Law No. 400 “On insurance pensions”. But when the widow gets married again and, after registering the marriage, applies for “receipt of the deceased husband’s pension” (that is, for payments in connection with the loss of a breadwinner), the woman receives a negative answer. From the point of view of legislation, the widow in this case does not need pension provision for the loss of a breadwinner, since the new husband can fulfill his role and provide for the woman’s needs.

You cannot simply take over your husband's pension after his death . If the spouse supported his household and relatives, helping them financially, if he can be called a breadwinner, then the widow has the opportunity to apply for a completely different type of pension - for the loss of a breadwinner .

LiveInternetLiveInternet

—Categories

- ASIAN CUISINE (236)

- ANIMATION (2)

- AIR GRILL (6)

- LIBRARY (45)

- VIDEO (40)

- EVERYTHING FOR YOUR DIARY (54)

- EVERYTHING FOR PC (500)

- EVERYTHING AT YOUR HANDS (81)

- KNITTING (2509)

- DESSERT (1482)

- DESIGN (11)

- HOME BEAUTY SALON (421)

- PREPARATIONS AND CANNED PRODUCTS (110)

- LAW AND ORDER (106)

- CASUAL GAMES (2)

- SEWING & CRAFTS IDEAS (221)

- ISOTERICA (297)

- LEARNING FOREIGN LANGUAGES (171)

- INTERESTING (216)

- INTERIOR (152)

- CINEMA (118)

- CINEMA HALL (66)

- BEAUTY AND HEALTH (1573)

- COOKING (4714)

- CUISINES OF THE WORLD (379)

- LANDSCAPE (4)

- MICROWAVE (106)

- MUSIC (117)

- NEED TO KNOW (292)

- DRINKS (76)

- EDUCATION (57)

- STEAMER (15)

- REmodel (80)

- UTILITIES (839)

- USEFUL AND INTERESTING LINKS (156)

- POLITICS (357)

- JOKES (82)

- PSYCHOLOGY (79)

- TRAVEL (85)

- PATCHWORK (6)

- REPAIR (111)

- HANDCRAFTS (448)

- GARDEN AND VEGETABLE VEGETABLE (55)

- WEDDING (6)

- SCRAPBOOKING (37)

- SOFT (88)

- STYLE AND FASHION (67)

- POEMS (103)

- KITCHEN APPLIANCES (42)

- PHOTO (1)

- PHOTO GALLERY (28)

- FLORICULTURE (122)

- SEWING (866)

This is interesting: Buying an apartment by proxy from the seller

-Music

—Search by diary

—Subscription by e-mail

—Interests

— Regular readers

-Statistics

How to transfer to a deceased spouse's pension

Saturday, September 15, 2021 13:35 + to quote book

What should a pensioner do if his life partner, who received a higher pension, dies? Is it possible to transfer his pension to himself?

If a pensioner's life partner dies, this is a huge grief. But when the first difficult days pass and the pain of loss recedes a little, the understanding comes that we must move on. And if the deceased spouse received a higher pension, life after his death may become much more difficult. What kind of financial support from the state can such a widowed pensioner count on?

As it turns out, to put it bluntly, any Russian pensioner has a legally enshrined right to transfer the pension of their deceased spouse to themselves. And if the deceased was not a pensioner, then receive a survivor’s pension. But let's deal with everything in order, and start with exactly how it happens

Is it possible for a wife to transfer to her deceased husband's pension?

It is impossible to transfer your late husband's pension to yourself based solely on personal desire. In such circumstances, if the death of a spouse entails the loss of basic financial support for his dependents, the relatives of the deceased have the right to apply for another type of pension - a survivor's pension.

At the same time, current legislation prohibits a spouse who has lost her sole breadwinner from claiming other types of pension payments, even if she has sufficient length of service to qualify for a pension.

In accordance with the provisions of Articles 5 and 9 of Federal Law No. 173-FZ of December 17, 2001, the wife of the deceased has the right to choose one of the types of labor pensions provided for by law. Therefore, in order to receive a survivor's pension, a woman must write a waiver of her own pension provision.

Thus, the common opinion about the possibility of transferring to the husband’s pension is fundamentally wrong. After the death of her husband, a woman can receive a pension, the amount of which will really depend on the size of her husband’s pension in accordance with his length of service and the amount of transferred insurance contributions.

Spouse's retirement transition

The question of switching to another pension usually arises if the deceased spouse received a larger pension. In this case, the widowed pensioner, according to the current pension legislation, can prove that he was dependent on the deceased, then an insurance pension in the event of the loss of a breadwinner will be established for him in the amount of the pension that the spouse received.

In order for a spouse to be recognized as a dependent, he needs to confirm that he was fully supported by the deceased or received assistance from him, which was a constant and main source of livelihood. To do this, you need to collect and submit to the Pension Fund authority at your place of residence the following documents:

- certificates issued by housing maintenance organizations;

- certificates issued by local governments;

- documents on the income of all family members;

- other documents provided for by the legislation of the Russian Federation, in particular - a court decision.

The surviving spouse must be disabled (retired or disabled). If he does not receive a pension himself, one of the following conditions must be met:

- reaching retirement age (still 55 years old for women, 60 years old for men), but an insurance pension has not been assigned due to lack of length of service or pension points;

- the able-bodied spouse takes care of the minor children of the deceased, under the age of 14 years.

- the disabled spouse was dependent on the deceased spouse.

In these situations, the surviving spouse’s lack of own income does not play a role.

Moreover, if the fact of dependency cannot be proven in court, an application to the Pension Fund for transfer to the pension of the deceased spouse still needs to be submitted. Simply with the wording in it that a pension for the deceased spouse must be assigned “due to the loss of a source of livelihood.” This situation is provided for by law, so the Pension Fund should not refuse.

True, in this case, the pension will be assigned not from the date of death of the spouse, but from the first day of the month following the month of application to the Pension Fund. By the way, the deadline for contacting the Pension Fund on this matter is a whole year. The submitted documents and application must be reviewed within 10 days.

Transfer to the deceased spouse's pension

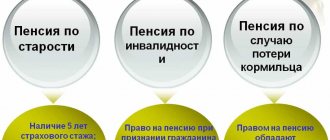

In accordance with Russian law, a surviving spouse may qualify for a survivor's pension if he has a disability:

- it is officially recognized that the pensioner is disabled;

- upon reaching retirement age with the emergence of the right to receive a pension.

To transfer to the pension of the deceased spouse, the remaining pensioner must document the fact of incapacity for work (disability or age) and submit a document indicating marriage.

Since pension changes in the country came into force in 2021, the transition process and its timing have been transformed.

Amount of pension for a spouse

The size of the pension in such a situation is calculated based on the insurance period, earnings and insurance contributions of the deceased spouse.

However, the widowed husband or wife will still not receive a full pension: the fixed payment is set in an amount equal to 50% of the amount provided for the old-age pension. Moreover, if the surviving spouse did receive a pension, then he will be paid the difference between the pension already paid and the new pension. Thus, the increased pension for the deceased depends on the number of pension points that were accrued to the deceased spouse when payments were assigned to him.

Survivor's pension

In some cases, a widowed spouse may not only transfer to the deceased’s pension, but also receive an additional survivor’s pension. This is possible in the following situation:

- when the spouse died during military service as a result of conscription or as a result of a military injury received in the service;

- when the deceased spouse took part in the liquidation of the disaster at the Chernobyl nuclear power plant and its consequences;

- when the deceased spouse worked on space tests.

In these situations, the surviving spouse has the right to receive two categories of payments: a survivor's pension, regardless of age and ability to work, as well as his own pension.

Grounds for receiving a husband's pension after his death

According to Russian law, the right to receive a pension in connection with the loss of a breadwinner is legal and is granted to the widow upon application.

The primary reason why a widow decides to receive her husband's pension instead of her own is the difference in the amount of payments if the woman has reached retirement age. In this case, a special commission will clarify all the information, in particular, the fact that the married couple lives together, and compare the amounts paid to each spouse.

This is interesting: Obtaining the status of a military veteran

If a woman does not have her own funds, then when submitting an application she will need to indicate that the widow was supported by her husband, and his pension was her only source of income.

An important reason for contacting the Pension Fund with a request of this kind may be the health problems of the widow. The presence of disability, lack of work, and caring for minor children serve as the basis for making a positive decision.

How to transfer to my husband's pension after his death

Submitting an application to the Pension Fund is the main action for a woman who wants to transfer to her husband’s pension. Moreover, this must be done no later than six months from the date of the death of the spouse. If the established period has expired, then the issue can be resolved in court.

Before changing your own pension to a survivor's pension, it is recommended to calculate the new pension provision in order to understand the feasibility of the transition. The full calculation formula is specified in Art.

16 Federal Law No. 173. To calculate the figure, the husband's total pension money is divided by 228 months and fixed payments are added.

On average, the amount obtained does not exceed 30% of the money that was accrued to the deceased. Accruals of old age pensions and in connection with receipt of disability are taken into account.

Expert opinion

Kozlov Andrey Kirillovich

Lawyer with 10 years of experience. Specialization: criminal law. More than 3 years of experience in developing legal documentation.

The coefficients used in the calculations are very complex, so fund employees should not try to make a preliminary calculation.

An application for calculation of compensation can be sent to:

— directly to the Pension Fund of the Russian Federation;

— use the services of the MFC;

— by registered mail to the address of the Pension Fund of the Russian Federation;

-in your personal account on the Pension Fund portal.

The procedure for receiving a deceased husband’s pension: where to apply and documents

In order to transfer to the pension of a deceased retired spouse, a woman must apply to the Pension Fund.

You must have with you:

- passport or identity card;

- death certificate;

- certificate from place of residence about family composition;

- marriage certificate;

- personal pension certificate.

However, additional documents may be required.

Receipt of the deceased husband's savings portion

The funded part of the deceased's pension falls into the category of open inheritance. The right to receive it belongs to all heirs of the first category, unless there is a special order of the deceased.

In order to receive the funded part, the widow must find out which pension fund this amount is in, and then apply there with an application for receipt, to which the necessary documents are attached.

Terms of payment of the spouse's savings portion after his death

The application must be submitted no later than 6 months from the date of death of the investor.

If time is missed, the application will need to be submitted to the judicial authorities.

The 100% amount will be transferred to the spouse’s account or sent by postal order only if it is determined that she is the sole heir. If other legal heirs are announced within six months after the death of the investor, the funded part will be divided among everyone.

Documents for registration of the husband's funded part for himself

When submitting an application for the issuance of the funded part of the husband’s pension after his death, it is necessary to collect a package of documents established by law.

You need to collect the following documents:

- passport or other identity document;

- marriage certificate;

- death certificate of the investor;

- document on compulsory pension insurance in the name of the deceased;

- bank account details of the widow for transferring the inherited amount;

- a copy of the court decision, if we are talking about restoring the application deadline due to delay;

- a notarized power of attorney, if the widow cannot be present at the pension fund herself.

Additional documents may be required on an individual basis.

Useful video

We invite you to watch an interesting video on the topic of the article:

After the death of a spouse who received a higher pension, life for his family may become much more difficult. However, any citizen of the Russian Federation has the legislative right to transfer the pension of a deceased spouse to himself. In this article we will look at how to transfer to the pension of a deceased retired spouse, and what features this process has.

Is the pension of the deceased inherited?

Transferring to the pension of a deceased life partner is the right of a spouse, which is legally enshrined in the regulations of the Russian Federation. The transition to payment of a deceased pensioner can occur at the request of the widow or widower.

However, this procedure is not as transparent and simple as it might seem at first glance.

Can a spouse receive the deceased spouse’s pension instead of his own?

The law does not limit the right of pensioners to receive a pension for a deceased spouse after his death, and in the event of an increase in their own accrued benefit, this process can be canceled. But to implement the receipt procedure, you must meet certain requirements.

Thus, in order to switch to her husband’s benefit, the wife needs to contact the Pension Fund no later than six months after his death. If there were circumstances that prevented the documents from being completed on time, then in order to restore the right to receive benefits for the deceased, a court decision is required, which will determine how objective the reason for the delay was.

After the death of the citizen receiving it, the pension is divided into two parts, while the funded one is equated to an inheritance, which means it will be distributed among his heirs - given to them in cash or transferred to specified accounts. The size of such a payment is on average 30-35% of the amount of accrued funds to the deceased citizen.

The coefficients used in the calculation are quite complex; it is often impossible to calculate the amount of money paid with your own hands, so it is better for the wife of the deceased to contact the Pension Fund to make preliminary calculations. The procedure for inheriting the insurance part is not carried out under current legislation.

Consideration of the calculation of payments is made in accordance with the papers on the insurance period and wages of the deceased. If the amount of new calculations is less than the amount of payments already accrued, then the transition to the spouse’s pension will not be rational.

It should be noted that, according to current legislation, a widow has the right to choose from two options - to continue receiving her labor pension or to switch to the deceased’s benefit. She cannot arrange two collaterals at the same time.

How to transfer to a deceased husband's pension?

A widow can personally contact the Pension Fund to transfer the deceased spouse’s pension into her own account or use the services of a representative. In any case, you must have a package of necessary documents and a completed application in the prescribed form.

Where to contact?

An application for transfer and assignment of security is submitted to the Pension Fund at the place of residence, stay or actual residence. You can submit an application through a direct visit to the territorial department of the Pension Fund, by sending a letter by mail, or by submitting an application on the official portal of the Fund or through the MFC.

What documents are needed?

The list of necessary documents, without which it will be impossible to transfer to the pension of a deceased spouse, is specified in the regulations of Order of the Ministry of Labor and Social Protection No. 14 of January 19, 2016. The papers include:

- documents confirming the citizen’s identity (citizen’s passport or birth certificate);

- and documents confirming the death of the spouse and relationship with the deceased;

- papers indicating that the deceased has insurance coverage.

Expert opinion

Kozlov Andrey Kirillovich

Lawyer with 10 years of experience. Specialization: criminal law. More than 3 years of experience in developing legal documentation.

All documents must have a number, date of issue, and signature of the employee who issued them. If the necessary documents are not available, the applicant is given 3 months to provide them.

What will happen to benefits?

At the legislative level, there is a special category of widows who have the right to claim benefits even after the death of their spouses. For women who did not work in connection with the move to the place of service of their military husbands and were not able to accumulate work experience for the calculation of benefits, monetary support is considered separately.

Pension accruals for military personnel and their spouses also differ from standard labor accruals. If in general cases the spouse of the deceased does not have the right to receive benefits for her deceased husband, widows of military personnel who died in service, participants in combat operations in “hot spots” or veterans of the Great Patriotic War have similar privileges.

Detailed information about the process of transferring to a deceased spouse's benefit can be found here:

Thus, the state allows spouses to receive pension payments for their deceased husbands in cases where they refuse their own benefits. However, the re-registration process involves a lot of nuances associated with the calculation of pension payments and the preparation of the required documents.

Is it possible to transfer to the pension of a deceased person? Photo: pexels.com

Each person can count on a different pension size, since their income and work experience are taken into account. Most often, men receive a larger payment compared to women.

Therefore, after the death of their husbands, many women want to take advantage of their payments, although this is only possible if they have a lost pension. Most often, a survivor's pension is simply issued.

Features of receiving a military pension

If the deceased received military benefits, the spouse may also receive the deceased spouse's pension.

The widow of a military pensioner receives her spouse's pension in the following cases:

- the woman was dependent on her husband during his lifetime due to her own disability;

- if the wife has no other sources of income;

- the widow takes care of minor children, brothers or sisters of the deceased.

A military pension is assigned for the period of incapacity for work or on a permanent basis upon reaching retirement age. It cannot be canceled if the widow enters into a new marriage.