Calculation of pensions for women born in 1964 - formula, points, IPC and calculator

It was initially planned that the retirement age for women would begin to increase gradually - one year each year from 2021. This provision was included in the bill adopted by the State Duma in the first reading. President Vladimir Putin has proposed softening the terms of the pension reform, thereby lowering the retirement age for women from the original 63 to 60 years.

- Fixed payment. The size is determined by law and reviewed annually.

- Individual. The amount depends on the number of accumulated pension points and the cost of the IPC, the amount of which is established by law.

How to correctly calculate your old age pension in 2021

It is important to remember that when making calculations, points for all calendar years must be taken into account. At the same time, the coefficient indicator valid at a specific point in time of calculation is applied.

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

Pension calculation year of birth 1964

Possible options for periods of work for which salary certificates must be submitted to assign a pension are determined by current legislation. There are only two of them: For 2000 - 2001. This option is possible provided that the employee during this period was already insured in the personal accounting system of the Pension Fund and the company provided information for him - individual information about accrued insurance premiums. You can see these amounts in the statement from your individual personal account. You can request and receive it once a year at your territorial PF office. For any 60 months for the period of work before 2002, according to a certificate from the organization or an archival one. Possibly from different enterprises, but the periods must be consecutive according to the entries in the work book, and breaks in work between entries do not matter - partial months may not be taken into account when applying for a job or upon dismissal at will. Salary amounts for the period of work from 2002 onwards are important for the size of the labor pension, but only as the basis for calculating insurance contributions. Therefore, an extract from an individual personal account for periods of work before 2002 indicates the amount of accrued wages, and since 2002, the amount of insurance contributions, which are also taken into account when calculating the amount of the pension.

Hello. For now, the calculation is based on 2000-2001. You can provide a certificate for any 60 consecutive months until 2000. But you will only retire in 2 years, what will happen then is unknown. Before you do anything, be sure to consult a specialist. This will save you from many problems in the future. All the best. Thank you for choosing our site.

Examples and formulas for calculating an old-age pension in 2021 for a woman born in 1962

- SP - the amount of the insurance part of the pension assigned for the period - we divide the pension capital by the expected period of payments in months, starting from January 1, 1994 - the moment of the start of the state called “Russia”, in its new form, of course, not from Tsar Gorokh, by others in words for 19 years or 228 months.

- SIPC - the cost of the pension coefficient as of January 1, 2020, it was 64.1 rubles.

- Average salary - let it be 20 thousand rubles for the entire length of service; This, we note, is still a simplification.

- Work experience - 13 partial years, including 5 months of 2020 (thus, until 2020 - 10 full years, counting from January 1, 2005). If you don’t have enough work experience, what to do?

This is interesting: Application to a Notary for Entry into an Inheritance 2020

How is pension calculated for those born before 1967?

- Basic. This indicator is most strongly influenced by the age of the pensioner. If an elderly person is over eighty years old, then the pension will be high, since the basic part for this age is calculated based on the rate of 19 years.

- Cumulative. This part of the pension is only available to citizens born before 1967 and is defined by law, but it ceased to apply in 2005. The employer contributed 6% of wages to the Pension Fund of the Russian Federation monthly. The savings part is formed from this money. The total amount used to offset the funded part should not exceed 463,000 rubles per year.

- Insurance. This part is calculated based on the length of service accumulated by 2002, the average salary and a special coefficient.

Every year a bill to increase the retirement age is introduced into the State Duma, but such an innovation has not yet received approval. The retirement age currently determined for women is 55 years, and for the stronger half of humanity - 60 years. Following the example of many countries in the world, as well as neighboring CIS countries, the retirement age in our country will be increased, but according to analysts, this will not happen soon.

This is interesting: Payment for the birth of a second child in 2021 in the Volgograd region

How to Calculate Old Age Pension for a Woman Born in 1964

It must be taken into account that from 2002 to 2014, the estimated pension capital was indexed annually, and each year its own increase coefficient was approved. As a result, by December 31, 2014, when the new pension rules came into force, the indexation coefficient was 5.6148166.

Average monthly salary in the country for assessment according to clause 3 of Art. 30 of the Federal Law of December 17, 2001 No. 173-FZ was approved by the Government of the Russian Federation. For the period from January 1987 to December 1991, the average salary in the country was 314.09 rubles. (18845.2 / 60 = 314.087).

On the conditions for granting pensions to women born in 1963

Often citizens who contact the Pension Fund Branch for the Vladimir Region are interested in what conditions exist for assigning a pension. For example, they ask: “I was born in February 1963, I am going to retire in 2021, since I will be 55 years old. I just don’t understand how much experience I should have - 9 years or 15?”

The value of the individual coefficient at which the right to an insurance pension arises, starting from January 1, 2021, is 6.6, with a subsequent annual increase of 2.4 until the value of the individual pension coefficient is reached 30, established by Article 8 of the Federal Law of December 28, 2013. No. 400-FZ.

How to find out from what year of birth and how much a funded pension is calculated

Its duration is set by the citizen himself, but it cannot be less than 10 years. It is assigned and paid upon the emergence of the right to an old-age insurance pension to persons who have formed pension savings through contributions within the framework of the State Co-financing of Pensions Program, including employer contributions, state contributions on income from their investment, and, in addition, from the mother’s money (family) capital.

- Citizens whose funded pension is 5% or less in relation to the amount of the old-age insurance pension, including taking into account the fixed payment, and the size of the funded pension, calculated as of the day the funded pension was assigned.

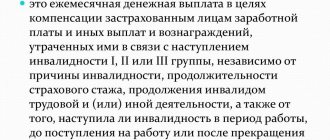

- Citizens counting on an insurance pension for disability or in the event of the loss of a breadwinner or under state pension provision, who, upon reaching the generally established retirement age, did not receive the right to an old-age insurance pension due to lack of the required insurance period or a sufficient number of pension points (taking into account transitional provisions pension formula).

We recommend reading: Is detention required if you have two small children?

New formula for calculating old-age labor pension for women born in 1964

Errors in determining the amount of the pension due are not uncommon. Therefore, if a citizen doubts that his pension is calculated correctly, he can submit a corresponding application to the Pension Fund. After five days, Pension Fund employees must check the calculation for errors and, if found, correct them.

This is interesting: If the Furniture is Decorated Not in My Name, the Bailiffs Can Describe

This value is subject to annual indexation relative to the inflation rate. The adjustment is made on February 1 of each year. In 2021, the cost of a point was set at 78.28 rubles, but after additional indexation in April it was increased to 78.58 rubles.

What is the minimum pension that women born in 1966 can expect?

The pension reform, which was planned for 2020-2020, was frozen indefinitely. Therefore, pension calculations are currently carried out according to the old version. Namely, the person himself chooses the length of his experience over five years. From there the minimum pension is calculated. So, at a minimum, a woman born in 1966 can count on 6,500 rubles, unless of course she lives in Moscow, where payments are significantly higher

There is a Pension calculator on the site, but it works strangely. I currently have only 10 years of confirmed experience and therefore the system cannot calculate the amount of my pension. It says that your experience is less than 15 years. Although this experience will be mandatory only from 2025. And at the time of my retirement, I will need 12 years.

How to calculate the size of a pension in 2021 for a woman born in 1964

The procedure for calculating pensions is the same for everyone. Pension payments are assigned from the date of application for accrual, but not before the right to receive them arises. To do this, women born in 1964 need to contact the Pension Fund, the Multifunctional Center, through the State Services portal or directly to the employer, providing:

Fixed payment. The size is determined by law and revised annually. Individual. The amount depends on the number of accumulated pension points and the cost of the IPC, the amount of which is established by law.

Formula for determining the insurance part

Taking into account the above criteria and relying on the provisions of Law No. 400-FZ (December 28, 2013), the insurance pension formula for women born in 1964 can be expressed as follows:

RSP = FV + SPB × KPIK, where:

- RSP – amount of insurance pension;

- FV is a fixed (basic) component, the size of which for 2019 is set at 4,982.90 rubles;

- SPB - the cost of a pension point (in 2021 - 81.49 rubles)

Please note that in addition to the insurance pension, women born in 1964 can also receive a funded pension, but only if it is formed. The size of the payment depends on several factors:

- the amount of contributions to be deducted;

- the number of years during which contributions were made;

- in which fund the savings were placed (each company has its own interest rates).

- Plum compote for the winter recipes for a 3 liter jar

- Bordeaux mixture

- How to find a lost phone by satellite

What factors influence the value of the IPC?

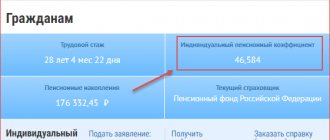

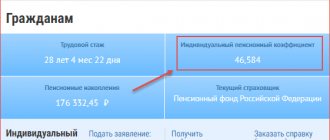

During their working career, women receive a salary, based on the amount of which the employer pays insurance contributions to the Pension Fund. Subsequently, they are converted into pension points, the number of which directly affects the size of the pension payment. For different periods of employment, the IPC is determined taking into account a number of features:

| Calculation time periods | Criteria taken into account when calculating | Peculiarities |

| Until 2002 |

| Due to the fact that the Pension Fund does not have enough information about the length of service and accruals made, the IPC may be reflected erroneously in each individual case. To avoid this, it is recommended to provide all possible evidence of employment at this time and confirm the amount of salary received. |

| 2002–2014 | Funds accumulated in accounts are converted into IPC using a special formula | You can calculate the number of IPCs yourself by using the calculator on the Pension Fund website |

| Since 2015 | Determined by the amount of insurance premiums | Calculation is carried out for each year worked |

| Other periods | The IPC is stipulated by law depending on the reason for lack of employment | The periods during which the woman did not work are taken into account. This includes:

|

The number of pension points can be calculated on the Pension Fund website, using a special calculator, or using the following formula:

IPC = Amount of insurance contributions of a citizen for a specific year / Standard amount of contributions for an insurance pension × 10

The procedure for calculating the old-age pension in 2021

Due to the fact that over the past 30 years there have been 3 pension reforms in our country, many citizens have difficulty understanding the principles of formation of pension payments and the procedure for calculations. Let’s look at how pensions are currently calculated and provide a number of examples for clarity.

After 2021, the funded part of the pension was allocated as a separate type, and citizens had the opportunity to form it or not. When forming the funded part, insurance contributions go to both parts of the pension:

Calculate pension Online

When calculating the conditional amount of the insurance pension, the following indicators for 2021 are used: Fixed payment - 5,334 rubles; The cost of 1 pension coefficient is 87.24 rubles; The maximum salary before personal income tax, subject to insurance contributions, is 85,083 rubles per month.

This is interesting: How to Remove a Lease Encumbrance If the Contract has Already Expired

Attention! If you have any questions, you can consult with a lawyer on social issues for free by phone: +7 in Moscow, St. Petersburg, +7 throughout Russia. Calls are accepted 24 hours a day. Call and solve your problem right now. It's fast and convenient!

How to calculate the size of a pension in 2021 for a woman born in 1964

It was initially planned that the retirement age for women would begin to increase gradually - one year each year from 2021. This provision was included in the bill adopted by the State Duma in the first reading. President Vladimir Putin has proposed softening the terms of the pension reform, thereby lowering the retirement age for women from the original 63 to 60 years.

The procedure for calculating pensions is the same for everyone. Pension payments are assigned from the date of application for accrual, but not before the right to receive them arises. To do this, women born in 1964 need to contact the Pension Fund, the Multifunctional Center, through the State Services portal or directly to the employer, providing:

This is interesting: Pension Law From May 2021 On Additional Payments to Pensioners for Children

What pension are those born in 1964 eligible for?

Pension reform was carried out, and the rules for calculating payments changed. Now each citizen independently forms his pension using points. However, those people who were born before 1967 did not have the opportunity to accumulate the required number of points. In this regard, the rules for calculating pensions for them are somewhat different from the general ones.

Possible nuances When planning to receive a pension, a citizen must take into account some nuances: Minimum insurance - work experience must be 15 years During this entire period, payments should have been made to the Pension Fund of the Russian Federation In addition to work activity, the length of service may include those time periods when the citizen could not work , but was busy raising a child, received an education at a higher educational institution, served in the army or received unemployment benefits. The pensioner has the right to continue working after retirement. In this case, the amount of the payment will be slightly reduced, but the additional insurance period will be taken into account when recalculating the pension in future Registration of a pension is not a complicated but lengthy procedure.

We recommend reading: NPF yield 2021 Central Bank of the Russian Federation

Calculation of the year's pension for a woman born in 1964

The article discusses the procedure for the formation and calculation of insurance pensions for persons born in 1962 who retire in 2021 . They belong to the first category recipients. Accordingly, when calculating payments, generally established indicators (IPC and its cost) will be taken into account, taking into account the fact that contributions are deducted only for the formation of insurance payments .

Ease of use - at any time when working with the GARANT system, you can seek personal advice and get an answer to your question; the answers are stored in the GARANT system and contain hyperlinks to additional thematic materials contained in the system.

Is a funded pension born in 1964 accrued or not?

Features of receiving a funded pension A citizen can receive savings from a non-state pension fund or from the Pension Fund of the Russian Federation - this will depend on where they were formed. We hasten to remind you that the funded part of the pension appeared in 2021, and for three years it could be saved by men born in 1953 and older, as well as women born in 1957 and older. From 2021, contributions to the funded pension are made only from payments of citizens born in 1967 or later. If a person retired on January 1, 2021 or later, he can exercise the right to receive a funded pension. 1.

We recommend reading: What taxes are included in federal or regional insurance premiums?

Good afternoon For men, the funded pension begins in 1953. All the best! Sincerely, Olga Alpatova Personal consultation Thank you, you helped me a lot! Do you have an answer to this question? You can leave it by clicking on the Reply button There were deductions, where did they go? question number No. 12106570

LABOR CONSULTANT

In order to calculate the pension capital that was earned under the old laws, it must be considered as length of service and salary, which will correspond to the future payment period. 144 working months increases to 228 months. Calculation formula: the old format pension is multiplied by the expected period. The old-style formula according to the law: multiply the length of service coefficient by the salary, divide the resulting amount by the ratio of the actual salary and the average salary established in a given period of time in the country.

Each employee can score no more than 10 points per year. There are also established restrictions that will be valid until 2021 - 7.49 points per year. For women born in 1962, the amount of money they earned before 2002 is divided by the value of 1 point to arrive at an estimated total number of points.

Old-age pension in 2021 for a woman born in 1963: correct calculation procedure

2020 Here the calculation changes a little. If you retire at the beginning of February 2021 and simultaneously terminate your work experience, the IPC will be calculated for 1 month worked over the last year. In our case, a woman with a salary of 15,000 rubles. I worked only 1 month in 2020 and then retired. We calculate the points for this year as follows: Example: IPK2020 = (16% × 15,000 rubles × 1 month) / (16% × 1,021,000 rubles) × 10 = 2400 / 127,360 × 10 = 0.147 points.

Calculation and conversion of points until 2021. A woman born in 1963, with an average salary of 15 thousand rubles for 7 years until 2021 (she worked for 3 years after 2021), will have the following amount of insurance premiums: 15,000 rubles × 12 months × 7 years × 16% = 202,000 rub. The resulting figure is the pension capital, which also, according to the law, must be converted into points. In order to convert pension savings into an individual coefficient (points), it is necessary to calculate the insurance part (IP):

09 Jun 2021 uristlaw 271

Share this post

- Related Posts

- What Documents Are Needed for a 13 Percent Refund on a Dacha Purchase?

- Its Legal Status What is Cadastral Activities?

- Astrakhan List of Certificates of Honor for Awarding the Title Veteran of Labor

- If after the trial I don’t refuse to pay, they will describe the property

Calculation of pensions for those born before 1967

- work books:

- extracts from orders;

- employers' certificates;

- documents on service from the military registration and enlistment office;

- extracts from archival institutions;

- certificates of payment of taxes during periods of individual entrepreneurship;

- protocols for interviewing witnesses if it is impossible to provide other documents.

The pension capital as of January 1, 2002 (the start of a new pension accrual) should be calculated as follows::

09 Jun 2021 uristlaw 238

Share this post

- Related Posts

- When will the Law on Amendments to Article 228 of the Criminal Code of the Russian Federation be adopted in 2020?

- In what cases can a Young Family be removed from the Program?

- Buzuluk Payment of Housing and Utilities to Labor Veterans

- HOW TO OBTAIN A SUBSIDY FOR AN APARTMENT FROM THE STATE IN THE VLADIMIR REGION