Who is entitled to the benefit: basis

The benefit is assigned to residents of any region of Russia with a low income. To receive social assistance, the family's total monthly income must be below the subsistence level.

Material payments are due:

- single or divorced parents receiving the minimum wage;

- a low-income couple with several children;

- a family where one of the parents works and the other takes care of the children.

Payments are also given to persons raising a disabled child under 18 years of age.

Who can apply for benefits

Monthly payment

In order to receive payments before the child reaches adulthood, parents must take care of collecting documents confirming that they have grounds for transferring these funds.

Regional authorities must transfer money monthly; failure to comply with this requirement is a violation of the law.

Disability payment

Until a child with a disability reaches the age of majority, one of his parents has the right to contact the social security authorities to apply for benefits. To confirm the right to receive funds, the applicant must provide the following package of documents:

- Certificate confirming disability.

- An expert opinion confirming that due to his illness the child cannot attend a regular school.

If the child has a disability, the amount of the monthly benefit provided can be increased several times.

Payment for single mothers

The assignment of a monthly payment for a mother raising a child alone depends on the presence of several factors:

- Availability of employment.

- Number of children in care.

- Family income.

That is, the status of a single mother alone cannot be the basis for receiving child benefits and increasing such payments. Accordingly, no special documents are required to obtain this status.

Benefit amounts

Payments for a child: features of the accrual scheme

Benefits are calculated according to the total income of family members and a number of other factors. You can determine the amount yourself using the tips below.

- Add up the official income of the spouses.

- Find out your local PM.

- The amount of income received is compared with the subsistence level.

When a family's monthly income is below the subsistence minimum level, they may qualify for government assistance.

Average monthly income of parents

When calculating the amount of monthly payments, the monthly income of each parent is taken into account. Not only the official salary is taken into account, but also interest from the deposit account, funds received for renting out real estate, unofficial earnings, and alimony. A calculation period of 3 calendar months is taken before submitting an application for financial assistance for a child.

Regional cost of living

The municipal cost of living is periodically announced by local authorities on websites or in the media. When a standard for a region is not established, the federal standard is taken as the basis for calculating the amount of payments.

Instructions for applying for benefits through the government services website

Financial assistance for children until they reach adulthood - regional benefit. It can be received by certain categories of citizens. The State Services portal does not have a single service for receiving payments throughout Russia.

To find out whether the service is provided electronically in the selected region in 2020, you need to:

- enter the portal;

- activate your personal account;

- enter the query “allowance for a child under 18 years of age” into the search bar.

In the results display, you need to select the desired page and follow the link. It is important to pay attention to how the service is provided - during a personal visit, by mail and through the MFC. In this case, it is impossible to submit an application for child benefits under 18 years of age through the State Services portal on the website.

If the portal in the selected region provides a service for processing payments, step-by-step instructions will tell you how to do this:

- Enter your login and password and go to your personal account on the portal. If there is no login information, register.

- Go to section.

- Click on the line “Child benefits” to apply for child benefits.

- Enter your place of residence to view the list of services available for a specific region. There is a possibility that some type of benefit is not available in a certain area.

- Select the appropriate type of payment if the service is provided in the selected region.

- Go to the registration stage, click on the “Get service” button.

- Indicate by tick who is filling out the application - the applicant or the representative. In each case, you will need to provide data from additional documents confirming the existence of such rights.

- Select the locality where money for minors will be transferred.

- In the window that appears, select the appropriate category of the applicant.

- Check whether the fields are filled in correctly in accordance with the actual data. If the application is submitted by a direct applicant, the information is entered automatically. Fill in empty windows if any remain.

- At the next stage, check whether the passport data is entered correctly.

- Enter the required data in the applicant's registration address form. Check the box next to your place of residence. Housing can be anything (temporary, actual), and does not necessarily have to coincide with the official one.

- Check the convenient way to receive benefits. Payments can be made to a card or via mail. Provide bank details or post office number.

- Attach to the application electronic duplicates of the documents required by the system. Each document must bear the electronic signature of the applicant. If there is no mark in the form of a red star on the statements and certificates, the portal will not let them through. And, accordingly, will not send the application to the authorized bodies.

- Finally, you need to agree with the processing of personal data and study the criteria for providing benefits. Select the communication option where you will receive notification of your payment request.

- The last step is to click on the “Submit Application” button.

How much child benefit is paid for a child under 18 years of age: table

You can familiarize yourself with the amounts of payments for children by age and category of beneficiaries using the table below.

| Title of the manual | Amount in ruble currency for 2020 | Amount in ruble currency for 2020 |

| One-time payment when placing a child under guardianship or adoption | 16.350.33 when adopting a disabled person or several children at once - 124.929.83 | 16.759.09 when adopting a disabled person or several children at once - 128.053.08 |

| Maternal capital | 453.026 (the amount of the one-time payment is fixed until January 1, 2020 inclusive) | |

| Monthly payments | ||

| Caring for an infant under 1.5 years old | 40% of average monthly earnings. There is a minimum prescribed by law, beyond which benefits cannot go. | |

| Child care for a military personnel (not under contract) | 11.096.76 | 11.374.18 |

| Survivor's benefit (father died in military action) | 2.231.85 | 2.287.65 |

| Caring for a descendant living in the Chernobyl zone | 3.162 – child up to 1.5 years old 6.324 – child up to 3 years old | 3.241.05 – child up to 1.5 years old 6.482.10 – child up to 3 years old |

| Monthly payment for large families after the birth of the third child until he reaches 3 years of age | Living wage per child, established by regional legislation | |

| Help for low-income families with a minor | The amount is calculated by the Social Protection Fund. The payment is individual for each region and family. The amount of the benefit depends on the information about the family budget that was submitted to the fund. | |

In areas for which regional salary coefficients are used in accordance with the established procedure, the indicated amounts of payments are determined in multiples of

How to apply for a monthly childcare benefit for a child up to 1.5 years old

Any family with a newborn child can receive benefits. This right appears after the end of maternity leave, which is 70 days after childbirth (86 days for childbirth with complications or 110 for multiple pregnancies). You can submit an application for another six months after the child turns 1.5 years old, in which case the benefit for the entire period will be paid in one payment.

To find out whether the required service is provided at the nearest MFC, you need to call the contact numbers of the center, consult with a specialist, make an appointment, choosing a convenient time and date. On the appointed day, you need to come to the registrar window and hand over the necessary papers. After verification, authorized structures will begin to transfer funds to the mother.

What documents are needed

The list of papers for processing child benefits up to 1.5 years old at the MFC office will depend on who will care for the baby - the father or mother, and whether the parents are employed. If you work officially, then the center’s services will not be needed: just collect documents and submit an application for parental leave and a monthly allowance to your employer. The following papers will be required:

- copy of ID;

- statement ();

- certificate of birth of the baby;

- a certificate of non-realization of the right to leave and child care benefits by the second parent.

Unemployed citizens submit papers to social services. protection or MFC. You will need another kit:

- identification;

- work book;

- birth certificate;

- certificate on the number of family members;

- statement.

To receive benefits, you will need to register the child at your place of residence. Remember that you can register a newborn at the place of registration of the mother or father without the permission of the property owner.

Amount of child benefit up to 1.5 years

The amount received will be 40% of the average monthly earnings for the last 24 months. You can calculate it using the formula: add up wages for two years, divide by 730 days and multiply by 30.4 (the average number of days in a month). The benefit will be 40% of this amount, with a minimum amount of 4,852 rubles, and a maximum of 27,985 rubles. In 2020, the unemployed will be able to count on 3,277.45 rubles for the birth of their first child and 6,554.89 rubles for subsequent children.

What is the amount for children under 18 years of age in different regions

The size of government payments varies depending on the regional subsistence level, since the amount is calculated relative to its value.

This is due to the fact that Russian cities have different standards of living and monthly salaries. Prices for food, gasoline, and utilities vary. Below are the basic rates for cities without taking into account additional factors. The actual calculation is carried out by social service workers on an individual basis.

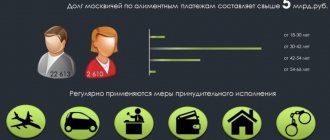

Moscow

Moscow families are considered the most affluent in the country.

Low-income spouses are paid 4,000 rubles as a base rate, 6,000 rubles for single parents, military families and in the absence of assistance in the form of alimony.

St. Petersburg

In St. Petersburg, the standard benefit is 723 rubles. Children of military personnel or from single-parent families are entitled to 1,045 rubles.

Krasnodar region

The Krasnodar Territory has the lowest benefits. Poor two-parent families receive 170 rubles for each offspring. A single parent is entitled to 333 rubles, and a descendant of a military serviceman is entitled to 246 rubles.

Penza

In the Penza region, families are entitled to an average of 290 rubles of financial assistance per month. For military personnel in fixed-term uniform - 435 rubles, and for children of single parents 580 rubles are paid.

Federal payments

Each new parent is entitled to federal payments , distributed throughout all regions of the country.

The one-time benefit for the birth of a child was again indexed. From February 1, 2020, payment amounts = 18,143.96 rubles.

The childcare benefit for children under 1.5 years of age directly depends on the amount of official income. If a parent on maternity leave did not work or his income was low, then he will receive payments calculated based on the minimum subsistence level.

Indexation of payments for 2020 and 2020

| 2018 | 2019 | |

| Payment for the first child does not work | RUB 3,163.79 | 4852.00 rub. |

| Payment for the second and subsequent child | 6284.65 rub. | 6803.98 rub. |

Absolutely anyone can count on general government payments, regardless of the type of employment, marital status, place of registration and amount of income.

How to make a payment

The process of processing payments for a child under 18 years of age takes place in several stages:

- collection of necessary documentation;

- presentation of papers to the required authority;

- waiting for a response from services.

Low-income families are extremely rarely refused. Usually, if their income still exceeds the subsistence level in the region.

List of documents

You should first prepare the necessary papers. Their list is as follows:

- income certificate in form 2-NDFL for 3 months for a working parent or both spouses, if officially employed;

- copies of children's birth certificates;

- photocopies of parents' passports;

- social card details or account of any Russian bank.

Upon arrival at the social service, find an application for accrual of child benefits at the stand, ask the employee for a form, and fill it out.

Where to contact

The package of papers should be submitted to the regional branch of the Social Security Authorities. The location of the service can be found on the website.

When the child turns over 16 years old, he must provide a certificate from the school that he is continuing his education. If you don't do this, your payments will end.

Submission of documents

When the list of papers has been prepared, it should be sent to the social security service department. This is done in several ways:

- personally carry the documentation;

- send them via Russian Post by registered mail with notification;

- send scanned papers through the government services portal.

Within 10 days from the date of receipt of the papers, social services must make a decision on the assignment of child benefits.

If the decision is made in favor of the applicant, after 2 or 3 months, the first payments are awarded.

Deadlines and procedure for obtaining financial assistance

The question of how to receive child benefits until the age of 18 is resolved quite simply. The legislation establishes that it is necessary to collect a package of documentation, after which the application will be considered within ten days. Documentation is submitted to the local social security department; the review period can be extended to 30 days if an income verification is required.

In the event that the applicant is refused, the relevant authorities send a message with a package of documents provided earlier.

Attention: the benefit is paid upon reaching eighteen years of age only if the teenager continues to study after graduation, which is documented. In other cases, payments stop when the child reaches 16 years of age.

How to apply for child benefits under 18 years of age correctly? It should be remembered that such assistance is usually assigned for a year, after which you must re-submit an application with documents to the local social security department. You must first clarify the amount of payments and collect a full package of documents, especially certificates confirming the low income for each family member.

What documents are required for registration?

The following documents for child benefits up to 18 years of age are provided with the application:

- an application indicating the bank account number (issued in the name of one of the parents);

- copies of passports of both parents;

- a certificate indicating that the child lives together with his parents (guardians, adoptive parents);

- a copy of the birth certificate for a teenager;

- a copy of the marriage certificate for the parents;

- a certificate confirming income for the last three months or copies of work records, a certificate stating that both parents or one of them are registered with the labor exchange;

- for a teenager over fourteen, you must provide a copy of your passport; for children over sixteen, a certificate of continued education, if such a fact exists.

Documents must be submitted to local PF authorities; certificates of disability and the presence of only one parent are added to the already specified package (issued at the local social security department). Additionally, a medical examination is required for a child or parent with a disability.

You can receive cash benefits for children under 18 years of age by submitting the appropriate documents and an application to the regional social protection authorities. But such payments are assigned only to low-income groups of the population with certificates confirming income below the minimum.

What to do in case of refusal

Social assistance for children is rarely denied.

Employees will formalize the refusal in writing, stating the reason. Why they may refuse:

- the child is fully supported by the state;

- the firstborn appeared on the account before January 1, 2020;

- applicants do not have parental rights;

- family income exceeds the subsistence standard;

- the applicant has not provided the necessary documents or their authenticity is questionable.

Parents can appeal the decision to higher authorities. In the latter situation, you can deliver documents or prove their authenticity in court with the help of lawyers.

When is maternal assistance prescribed?

Who is entitled to child benefits under 18 years of age? The conditions of the program are:

- The income of a family with a child under eighteen years of age is less than the average per capita minimum in the region of residence.

- A child who has not yet turned eighteen years of age lives permanently with his or her parents.

- Financial assistance is paid to only one parent after submitting a full package of legally required documentation.

If all conditions are met, then one of the parents has the right to submit a package of documentation to the local social security authorities. Child benefit under 18 years of age in 2020 may be canceled in the following situations:

- the child is/was transferred to full state support;

- parents have been deprived of parental rights by the court for various reasons;

- if the guardians have other paid “children’s” funds.

If the decision on financial assistance is positive, then the first amount is credited to the applicant’s account the very next month after submitting the documentation. This type of benefit is regional and is paid from local budgets.

For residents of the capital, the amounts are significantly higher. For example, in 2020, low-income Muscovites can rely on the following amounts of financial assistance for children under 18 years of age:

- up to 3 years - 10 thousand rubles, and for children of single mothers/fathers, military personnel, a parent evading payment of child support - 15 thousand rubles;

- from 3 to 18 years old - 4 thousand rubles, and for children of single mothers/fathers, military personnel, a parent evading payment of alimony - 6 thousand rubles;

- for a disabled child living with his parents, as well as for a child whose parents are disabled (or one of them) - 12 thousand rubles.

Are there additional subsidies for a child under 18 years of age?

Additional benefits for raising a minor include payments to single mothers with disabled children in their care.

The base rate is 6,000 rubles per month. The application is submitted to the Pension Fund along with the mother’s work record and medical examination certificates. Russian legislation helps parents with low incomes raise their children with the help of cash benefits. It is not difficult to obtain them, the main thing is to collect the necessary documents.

Refusals are rare; usually the decision is made by social workers in favor of low-income spouses. If your application for state assistance is rejected, you must go to court. It is realistic to win the case only if the parents are completely right, the documents are true, and their income is below the subsistence level.

Who is entitled to benefits until adulthood?

In accordance with the law of May 19, 1995 No. 81-FZ, the following payments are provided:

- for pregnancy;

- caring for a baby up to one and a half years old;

- child benefit regardless of age.

In accordance with paragraph 1 of Article 21 of the Civil Code of the Russian Federation, children are persons who have not reached the age of majority and do not have full civil capacity. Any citizen under 16 years of age is considered a child.

Expert opinion

Gusev Vladislav Semenovich

Lawyer with 10 years of experience. Specializes in criminal law. Member of the Bar Association.

In the period from 16 to 18 years, he can remain a child or become fully capable and lose his child status if certain circumstances arise:

- official marriage;

- self-employment from the age of 16. In the event that the court or guardianship authority recognizes full legal capacity.

In accordance with Federal Law No. 81-FZ, payments must be provided at least once a quarter. Children under 18 years of age can receive benefits on a monthly basis. In some regions, they can be issued through the State Services portal in accordance with step-by-step instructions.

Benefits for families with disabled children

| 2017 (RUB) | 2018 (RUB) | |

| Monthly compensation for the parent of a child under 23 years of age | 6000 | 12000 |

| Monthly compensation to the parent of a disabled child of groups 1 and 2, if he does not work | 6000 | 12000 |

From 02/01/2020, the payment for Muscovites will be increased exactly twice

In addition, new material assistance will appear: an annual compensation for the purchase of clothes for attending school, its amount will be 10,000 rubles.

To apply for benefits, you must contact the social protection department. A mandatory condition is a certificate from a pediatrician confirming the disability status.

Additional Information

- What payments and benefits are entitled to a disabled child?

- Read about benefits for caring for a disabled child in this article.

- Details about pension payments to disabled children are described on this page.

Federal payments

Each new parent is entitled to federal payments , distributed throughout all regions of the country.

The one-time benefit for the birth of a child was again indexed. From February 1, 2020, payment amounts = 18,143.96 rubles.

The childcare benefit for children under 1.5 years of age directly depends on the amount of official income. If a parent on maternity leave did not work or his income was low, then he will receive payments calculated based on the minimum subsistence level.

Indexation of payments for 2020 and 2020

| Amount (rub.) | |

| 1 | 75460 |

| 2 | 105644 |

| 3 | 150920 |

| All subsequent | 150920 |

| 2018 | 2019 | |

| Payment for the first child does not work | RUB 3,163.79 | 4852.00 rub. |

| Payment for the second and subsequent child | 6284.65 rub. | 6803.98 rub. |

Absolutely anyone can count on general government payments, regardless of the type of employment, marital status, place of registration and amount of income.

List of documents

Security can be assigned only after the parent has submitted all the required documents:

- Completed application. It must indicate the basis for the purpose, account number or bank details for transferring funds;

- Passports of both parents;

- A document confirming the marriage between the parents;

- Document on the birth of the child, if he reaches 14 years old, his passport;

- A certificate stating that the parents live together with the child;

- A document confirming the income received for the three months preceding the application (based on this document, the average per capita income in the family is calculated). As a rule, this is a document in Form 2 Personal Income Tax.

How long does it take to make payments?

The term for accrual of security is one year. After this period, the family has the opportunity to once again contact the authority where the initial application was made, providing new information about the income received. If the grounds for receiving security have not disappeared, the transfer is resumed.

Extension of payments is carried out in the same territorial body to which the application for assignment of payments was previously submitted.

Remember that the payment is not processed, and the paid funds are stopped being transferred in the following cases:

- The child has reached the age specified by law.

- The parent is deprived of parental rights.

- The minor does not live with his parents.

- Guardianship was established over the child.