Author of the article: Anastasia Ivanova Last modified: January 2020 2680

Alimony is the obligation of one of the parents to support the child, expressed in monetary terms. Payments can be ordered in court or by voluntary agreement of the parents. The legislation clearly regulates this process, protecting the interests of the minor. When imposing child support obligations on a parent, the claimant wants to know from what point child support is accrued.

Law and its power

The law is on the side of minor citizens to provide them with everything they need. According to the RF IC, their rights and interests are given priority and protected by legislators. The most important legislative act defining the obligations of parents towards children, as well as the procedure for withholding and transferring child support payments, is the Family Code. But there are also other laws that can be referred to and to which you can turn for information about the amount and procedure for paying alimony:

- civil legislation of the country;

- Labor Code;

- Decree of the Government of the Russian Federation of July 18, 1996 No. 841;

- Resolution of the Plenum of the Armed Forces of the Russian Federation No. 9 of October 25, 1996;

- Federal Law of the Russian Federation No. 229 of October 2, 2007;

- Order of the FSSP of the Russian Federation No. 318 on the rules for implementing enforcement proceedings in cases concerning the withholding and transfer of alimony.

But it is worth noting that the relevance of certain sources must be checked; they tend to change.

Important nuances to take note

Legislative acts of the Russian Federation in force in 2019 regulate the procedure and rules for collecting funds. We will list the main points that you need to understand, when you can collect funds and after how many days the payment begins.

So:

- The first thing to remember is that collection must be carried out on the day the claim is submitted to court. It’s not worth waiting for the consideration of your application, much less a decision on its implementation. Collection will not be made from the date of the decision; it will be established from the date of receipt of documents.

- evasion of payments for past periods will be considered under certain conditions. In order to state that child support was not paid for the past period, given the lack of income in the account over the past 36 months, significant evidence is required. They can be various letters, recordings of conversations, correspondence, testimony of witnesses attempting to collect funds from the debtor. The systematic nature of the second’s deviation from fulfilling his duties is recognized as a violation of the law.

- The period for which restrictions on filing claims are established applies exclusively to those situations when the petition is being considered for the first time. If the authority previously made a decision, and the alimony provider evaded payments, then the collection is made for the entire time when the applicant had the legal right to do so.

- Divorce of parents does not affect the period of retention of funds in favor of children. Collections are made both during the marriage and after its dissolution, so the timing of applying for alimony does not depend on the presence/absence of marriage. A claim can be filed at any time, taking into account individual characteristics in the relationship between a man and a woman.

This is also important to know:

Up to what age alimony is paid: changing the amount and order of payments

If we have figured out the payment procedure, then there is another question that needs to be addressed: up to what age is alimony paid?

So, we answer: until the child reaches adulthood (18 years old). There are also cases when a person who has already reached the age of eighteen can himself demand money from a parent who failed to fulfill his duties before reaching adulthood. In this case, the debt must be repaid when the young person reaches 21 years of age.

Periods and amount of alimony payments

When filing a claim for alimony payments for the past period, the maximum collection period is three years.

In order for the court to make a positive decision, the plaintiff must provide documented evidence that the defendant evaded alimony payments during this period, and the claimant demanded their payment. Evidence may include a recording of a conversation, emails and mails, correspondence on social networks, witness statements, audio and video recordings. Expert commentary

Kireev Maxim

Lawyer

If the claimant's demands are satisfied, alimony payments are calculated for the past three years. It does not matter whether the parents were married. The three-year period is established only for the first application for alimony. In case of repeated applications, when the payer evaded payments, payments may be collected over a much longer period.

Child support payments are withheld until the child reaches adulthood. Article 81 of the Family Code determines the amount of deductions in the absence of an alimony agreement:

- for one child – 1/4 of income;

- for two – 1/3 of earnings;

- for three or more – 1/2 of the income.

In cases where collection in shares is impossible, for example, if the payer’s income is irregular or unconfirmed, or may violate the rights of a minor, the amount of payments is determined by the court in a fixed amount.

Who has the right to receive financial support?

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

We have determined from what point alimony is paid, but who can sue them? Persons entitled to such security can make a claim for the collection of funds. Alimony is assigned:

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

- Children under 18 years of age;

- Children who are recognized as disabled, even after reaching adulthood, who also have a disability;

- Disabled parents;

- For former spouses if there are legal grounds;

- Other family members who need financial assistance. The necessary conditions for going to court are the following points: the plaintiff’s incapacity for work and the defendant’s availability of the necessary funds. They may be high wages, bank accounts, or the property of the defendant.

If the claim is satisfied and the judge makes an appropriate decision, re-applying to the court with similar demands is not allowed.

The principle of calculating the amount of payments

Before applying for alimony, you must calculate the amount. To determine the amount to be paid, a percentage of the parent's income is usually calculated. However, there is such a thing as a fixed amount of money. It applies in the following cases if the payer:

- has no official income;

- receives income in kind or in foreign currency;

- has irregular or fluctuating income;

- determining income is difficult;

- assigning payments in the form of a share of income will violate the interests of the minor.

The court is also authorized to appoint a mixed system, which will be the method of calculating funds.

If the money is accrued to the plaintiff or to an adult child with a disability, then its amount is determined only in hard monetary terms.

Defendant's share of income

So, as mentioned above, the main way to determine the amount of funds is to calculate the share of earnings. Article 81 of the RF IC specifies the amount of cash payments in shares of the parent’s income:

- alimony for one child - up to 25%;

- alimony for two children - up to 33.33%;

- Child support for three or more children - up to 50%.

But one should take into account the fact that the court may also award a smaller amount of payments due to the special circumstances of the case.

First payment

From what date is alimony collected? Although the law determines the moment of accrual, this does not mean that the first payment will occur on the same day. The timing of cash accruals depends on a number of reasons:

- Efficiency of the Federal Bailiff Service (FSSP) It is not uncommon for cases when, for organizational reasons, a case stands still. If the bailiff service has not provided the recipient and payer with confirmation that the proceedings have been opened, the inaction of the service should be appealed in court.

- Irregular payment to the payer. If the defendant receives an official salary, but his employer is withholding wages, then the timing of the first money transfer will depend on the date the defendant receives payment for his work. But if the delays in wages exceed all possible deadlines, and it is proven that this is not the fault of the payer, but the fault of the employer, then the former may be exempt from fines and penalties imposed for late payment of alimony. It is not possible to take any action under these circumstances, which means it becomes useless to complain about whether child support is calculated correctly on time.

- The nature of the payer’s employment. The way the defendant earns income largely determines when alimony is paid. Official employment greatly simplifies the matter, because... When working officially, funds are transferred to the claimant from the next salary. If the defendant works unofficially, then the situation becomes ambiguous: the moment from which money will be accrued can be determined only after the bailiffs discover the payer’s sources of income and his property, which can be sold to repay the debt. In this case, it may take more than one month until the money is received.

Procedure for calculating alimony

In accordance with Article 211 of the Code of Civil Procedure of the Russian Federation, a court decision to collect alimony funds must be executed immediately, regardless of the presentation of the writ of execution to the bailiff service.

After actually receiving the writ of execution in hand, it should be transferred to the FSSP authorities to initiate enforcement proceedings, subsequent actions will be carried out by them.

The FSSP action algorithm is limited to a short timeframe:

- making a decision to open production – 1 day from the provision of documentation;

- sending a copy of the resolution to the claimant and the payer – 1 day from the issuance of the order.

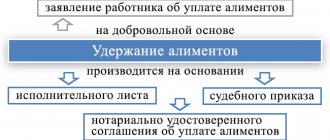

Withholding of alimony from the salary is carried out by the employer of the alimony obligee on the basis of documents:

- writ of execution;

- court order;

- notarial alimony agreement.

The transfer of documentation can be carried out by the FSSP, the recipient or the payer. In order for the recipient to initiate the deduction of alimony from the payer's salary, it is necessary to submit an application.

The accountant at the place of employment withholds alimony from the salary

:

- after paying taxes;

- within 3 days from the moment the money is credited to the account.

If the payer does not have a fixed date for receipt of earnings, alimony can be transferred monthly at any time.

When the amount of alimony is not received within the specified period, you should contact the employer to determine the reason:

- postponement of the payment date;

- dismissal of the alimony obligee;

- failure in cooperation between accounting and the bank.

Late payment of alimony

When alimony obligations established by a court decision are not fulfilled, a payment debt is formed. Collection of alimony debt has no statute of limitations; the amount is calculated for the time elapsed after the application to the judicial authority (Article 107 of the RF IC). The three-year rule does not apply in this case.

In accordance with the provisions of Article 115 of the RF IC, the claimant may exercise the right to demand a penalty for late alimony payments. The payment debt is included in the estate of the defaulter. This clarification was provided by the Presidium of the RF Armed Forces.

Statute of limitations

We looked at the moment at which alimony is collected, but the timing of applying for alimony also becomes an important issue. Alimony is awarded from the moment the claim was filed with the court; it is from this day that payments should begin to accrue.

This is also important to know:

The statute of limitations for alimony and the possibility of its extension

However, if the plaintiff made any attempts to resolve the issue with the defendant, but he evaded making payments, then the rules of law determine the statute of limitations for alimony debt. The plaintiff has the right to hold the defendant accountable, because this period is 3 years.

Please note that even if the child has reached the age of majority, the child support debt must still be repaid. In this case, there is no need to wait; the limitation period is calculated as three years from the age of 18.

Alimony when establishing paternity

During the procedure for establishing paternity, the procedure for calculating alimony does not change. The period is calculated from the moment of registration of the corresponding application in the court reception, if the claim contains a requirement for alimony. If nothing is specified about alimony, then payments are accrued from the moment the application for assignment of obligations to pay alimony is submitted.

Expert commentary

Potapova Svetlana

Lawyer

When establishing paternity in court, it is recommended to include in the claim a demand for the collection of alimony payments, which will save the time of the claimant.

The principles for calculating alimony after paternity is established are no different from the general procedure:

- alimony is calculated from the moment the claim to establish paternity is filed in court, provided that such a clause is provided in the application;

- if the clause on alimony is not included in the statement of claim, then payments are calculated from the date of application for the assignment of alimony obligations.

Collection procedure for workers and non-workers

At what point are alimony collected from unemployed citizens and does this circumstance somehow affect them? Decree of the Government of the Russian Federation of 1996 No. 841 regulates the list of income from which funds must be collected, and the procedure for calculating and the process of withholding money for a child is established by the Family Code of the Russian Federation. Now we will list the main list of where money for material maintenance comes from: salary, vacation pay, pensions, various funds of other origin. At the same time, financial support for the child should not be paid with the help of such income, which is called “payments upon dismissal, reduction of staff and liquidation of the organization.”

Funds for the maintenance of a child (or several children)

It must be borne in mind that there are certain restrictions, not only regarding the period from which alimony for minors will be calculated, but also regarding their size. Below you can see the percentage table. These data are taken from Article 81 of the Family Code of the Russian Federation:

| № | Number of children | Payout percentage |

| 1. | Only child | 25% of pension |

| 2. | Two children | 33% of pension |

| 3. | Three or more children | 50% of pension |

A fixed sum of money, unlike percentage deductions, is prescribed in a peace agreement on a voluntary basis. In addition, establishing a fixed amount of children's money occurs in the following situations:

- When the payer does not have a permanent job and income;

- When the income is foreign currency or the income is in kind.

From what moment is alimony calculated for a child or several children in large families? According to Government Order No. 841, first of all, a certain tax is withdrawn from the defendant’s income, and only after that alimony is collected. Therefore, based on the information described above, alimony is not the income of the recipient, and therefore it is not necessary to pay taxes on the funds.

Difficult situations are possible when the defendant behaves extremely irresponsibly because he does not consider it necessary to work and, as a result, have an official income. In this situation, the law protects the interests of the minor. In the absence of any income, a punishment may be imposed in the form of arrest and seizure of the debtor’s property, as a result of which its forced sale will be carried out by a court decision, but then it is decided in a separate manner from what point child support is calculated. There is an extreme measure in relation to careless and malicious defaulters, but it does not represent any practical benefit for a minor child. This measure is a criminal punishment for the crime.

End of cash payments

As a rule, collection of funds for maintenance is carried out until the child reaches adulthood, but there are certain additional circumstances that can extend this period:

- the child is a disabled person. This requires confirmation from the relevant health authorities;

- the child has been assigned the first or second disability group (even a third is possible);

- the child needs expensive treatment;

- voluntary consent between spouses.

This is also important to know:

Plenum of the Supreme Arbitration Court of the Russian Federation: bankruptcy procedure and payment of alimony to wife and child

It is important to note that the first three options above provide that alimony will be paid from the moment the claim is filed. While the latter option is based on independent and voluntary agreement on the amount and timing of receiving financial support for the child.

Once again, we draw your attention to the fact that all court decisions regarding alimony payments and their terms are subject to immediate execution.

By court order

The most common, albeit not the most convenient, way to collect child support from the second parent (and the gender of the parent is not specified in the law, because the child can live with both the mother and the father) is to apply for a court order. Previously, it was necessary to open a full-fledged case, attend its consideration and wait for the court’s decision, but since 2020 the system has been somewhat forgiven. Now alimony is collected from children only by order. And what is most important in our case is that they are collected from the moment the application is submitted. Not the receipt of the order and not the moment when this order nevertheless reaches the future payer, namely from the moment the application is submitted.

It is important to know! Application for a court order to collect child support

As for the moment when alimony begins to be calculated according to the law, this day can be considered the day of going to court (and not the day the decision comes into force). Moreover, in both cases. But there are additional nuances.

For example, if the writ of execution was not submitted by the plaintiff to the FSSP or the employer, then enforcement proceedings do not begin. And it will not be possible by law to collect the debt incurred due to the fault of the recipient during this period. It’s another matter when the debt arose through the fault of the payer. The debt can be collected even if the child has reached the age of majority. But the law gives only three years for this, no more.

If a peace agreement is concluded, the parties independently decide when the payer should start paying alimony. In other cases, the payer’s obligation to pay alimony arises upon the request of the recipient. This is taken into account both in oral agreements and when resolving the issue in court. In other words, the obligation to pay alimony does not arise by default, but is of a declarative nature.

Additionally

Having considered the basic information and ways to obtain money to support a child, we move on to points that raise no less questions. They do exist and we consider it necessary to touch upon them as well.

Child support for adult children

There is still some confusion about when the cash payment period ends. Misinformed people believe that a full-time basis of study at a university can help maintain payments and continue until the end of the study. Many payers and recipients of alimony are interested in whether there is some kind of extension of payments in connection with the child’s admission to full-time study at the university. Now we will examine this issue in detail. In accordance with the general rule, financial support due to a child is paid until he reaches the age of majority (that is, up to eighteen years of age). Despite existing rumors and myths, a child’s full-time education at a university does not in any way affect the continuation of financial support payments for an adult; accordingly, cash payments cannot be extended. Therefore, in this case, receiving alimony for adult children is not possible.

Free legal consultation We will answer your question in 5 minutes!

Call: 8 800 511-39-66

But if the question arises about the payer’s failure to fulfill his obligations and irresponsible attitude towards this issue, then the recipient has every right to hold the former accountable. Unpaid child support until adulthood can be recovered from the payer even after the child reaches the age of eighteen. Despite the temporary termination of obligations to pay maintenance, the debt for non-payment is subject to execution, which will also be subject to a penalty.

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

Alimony for the previous period

The statute of limitations has its own characteristics in the issue of monetary payments to a child: on the one hand, it applies, but on the other, it does not apply. So, let's clearly draw the boundaries and identify what the statute of limitations is:

- takes place when alimony actually began to accrue from the date of filing the application, but not for the previous period, no matter how long it was;

- does not apply when the amount of cash payments has already been assigned, and the payer does not pay them. In such a situation, he undertakes to compensate all accumulated debt for the entire period from the date of filing the application to the court, even if more than 10 years have passed.

Please note that in the first case there is a slight limitation. If the recipient of child support can prove in court that in the previous period all possible actions were taken to obtain alimony out of court, then the court may side with the recipient and take into account the previous period. The same is true in the case where the potential recipient did not have the opportunity to go to court earlier due to health reasons or any other valid reasons and circumstances that were beyond his control. Of course, everything will be carefully checked to find significant evidence.

Payments after 18 years

According to Article 107 of the Family Code of the Russian Federation, the court has the opportunity to extend the period to pay in a number of cases:

- it has been proven that the child is incompetent after reaching adulthood;

- the child has a disability of 1 or 2 groups;

- the child needs expensive treatment;

- existence of a peace agreement between parents.

Peaceful agreement

If the former spouses were able to mutually agree on child support payments on a voluntary basis, then they have the right to independently determine the date from which the funds will be accrued. The law does not establish any special restrictions on this. It is also peacefully regulated from what period alimony is calculated; in the document you can specify from what date payments will be made.

This is also important to know:

Withholding alimony from a pension: amount of collection and payment procedure

You should also know that the alimony agreement will gain legal force only after certification by a notary. The agreement is drawn up in writing. However, keep in mind that it is necessary to write a draft agreement in advance.

So, what rights does the payer have? In what ways can he provide for his child? The answers are waiting for you below. The payer has the right:

- pay money in a lump sum in an amount not lower than that required by law;

- pay child support not through cash, but by giving the child real estate, the amount of which covers maintenance costs;

- make payments in a fixed amount of money or give a share of the income, the amount of which is specified in the agreement.

Funds are accrued after the document is certified by a notary.

From the moment paternity is established

At what point is alimony awarded when proof of paternity is required? If such circumstances arise that you have to prove that the defendant is the father of your child, and you managed to prove this, then the necessary documents for collecting financial resources must be submitted immediately. In this case, the situation fits the general standard: the day of registration of the application is the moment the funds are accrued.

It is definitely worth indicating in the application who the father of the child is, because this way the situation is simplified. If you do not do this and do not put forward a demand in the document, then the money will be accrued from the day the claim is filed in accordance with the general procedure.

No marriage or no divorce

According to the Family Code, parents are obliged to support their common children in equal shares, regardless of whether the children were born in marriage or not. The state protects them in any case.

To have the right to money from your ex-spouse, it is enough to prove in court, with the help of the necessary documentation, the paternity of the child. You can do this by presenting a birth certificate, a DNA test, and even statements from your neighbors.

Divorce of parents

When divorcing a marriage, the question of who the child will live with is one of the key ones. After all, the answer to it also depends on whose side the money for the child’s maintenance will be paid. To be able to collect alimony, you just need to submit an application and find out all the details through the court. Also, ex-spouses may not do this, which will make their lives easier. But situations, of course, are different. If parents are committed to cooperation and put the welfare of their child above their personal problems during such a difficult period for their family, then they can simply sign an agreement. For it to have legal force, you just need to have it certified by a notary.

The drawn up agreement will be the basis for the court’s decision.

From what date is alimony calculated?

Withholding alimony is an official measure carried out in accordance with the norms of family law and supported by documents. If the payer gives the child gifts, takes him to the seaside, or regularly gives certain amounts of money, they are not alimony and it can be difficult to prove this fact in court.

You can, of course, for each such action take a receipt from the mother stating that she has no claims regarding alimony and all donated items or transferred money went towards alimony, but such cases are mere minuscule in practice.

The basis for payments of salary in accordance with the norms of the RF IC are:

- Agreement between parents. Such an agreement specifies the amount of content, terms and procedure for payments. Such an agreement is concluded by the parents and certified by a notary.

- A court order or decision that is issued as a result of a court's consideration of a relevant application.

Important! The right to file a claim in court is granted to the parent with whom the children, guardians, trustees or representatives of government agencies remain living (if the parents abandon the child or are deprived of their parental rights).

Maintenance of children is the responsibility of parents, which remains with them even after deprivation of parental rights.

A claim for alimony is made:

- from the moment of going to court, i.e. from the date of application;

- for the three years preceding the application, if the plaintiff proves that he has repeatedly tried to obtain financial support for children from the defendant.

Child support from the moment paternity is established

In a situation where, before filing for alimony, paternity must first be established, the answer to the question from what moment alimony begins to be accrued for the child sounds similar: from the moment the application is submitted to the court office. The main thing is that the statement of claim contains a demand for the recovery of alimony payments from the defendant.

If this requirement is not included in the claim, filing an application for the collection of alimony payments is a separate procedure, and the accrual will begin from the date of filing this application. For this reason, it is advisable, in order to save time and effort, in a situation where it is necessary to recognize the defendant as the father, through the court, submit a request for the collection of alimony in the same application.

Alimony for adult (adult) children

As mentioned above, the period for paying child support payments is from the moment the application for collection is filed until the child reaches the age of majority. There are many rumors that it is possible to increase this period to 23-24 years if the child is studying full-time at a higher educational institution.

However, the law does not oblige parents to support adult children solely on the grounds that they are receiving vocational education, despite the fact that young people studying at a university really need financial support.

However, the law recognizes only adult children who are incapacitated for health reasons and who do not have sufficient material resources to meet their needs (who do not have their own source of income that covers all material needs) as needy. But at the same time, all alimony unpaid before the age of majority can be recovered upon the child reaching the age of majority and before the expiration of the three-year limitation period.

Important! If for some reason enforcement proceedings have not been initiated, payments must still be calculated from the moment of filing. This means that the spouse (or child upon reaching adulthood) has the right to demand full payments along with all fines, penalties and interest for non-payment.

conclusions

In conclusion of our brief presentation of this difficult and sensitive issue, we would like to note the main points that people who are about to or have already encountered this situation need to know. Thus, alimony is calculated from the moment the papers are registered in the office (court, notary, etc.). It is important that the date of the decision does not play any role in obtaining financial support for the child. If the parents conclude a peace agreement, the timing and amount of payments and other nuances are determined and established by the parents themselves in the text of this agreement.

Of course, the procedure for collecting alimony is not always an easy and peaceful process, but with effort, you can achieve the necessary result for your child, because his interests should be your priority. The state has all the necessary instruments of influence to help you with this. Do not be afraid of difficulties, they are completely solvable, especially when the well-being of children is at stake. We wish you good luck and hope that you took away the things you were looking for from the article.

Subscribe to the latest news