The collection of alimony from military personnel is carried out taking into account the current Russian Family Code, therefore the procedure and grounds for collection are practically no different from the general procedure for paying alimony payments.

Most often, writs of execution for withholding alimony from military personnel relate to the obligation to support minor children. Let us consider the basic procedure for such deductions from persons undergoing military service in the Russian army and contract service, taking into account current legislation.

Legal regulation

Collection of alimony from persons recognized as military personnel is carried out on the basis of a number of legal acts:

- Family Code of the Russian Federation. Establishes the fact that there is an obligation to support children on the part of parents;

- Federal Law “On Enforcement Proceedings”. Determines the procedure for collecting payments forcibly if the parent does not fulfill his obligation voluntarily;

- Decree of the Government of the Russian Federation No. 841 of 1996. This act establishes a list of sources of income from which alimony can be collected;

- Federal Law “On the status of military personnel.”

Resolution No. 841 determines that employees of the Ministry of Internal Affairs, employees of the Ministry of Emergency Situations, and customs workers are also equated to military personnel. From all citizens working in these structures, alimony is collected equally.

Income of military personnel

Pay for those serving in the military differs from other civilian employees. Instead of wages, military personnel receive monetary allowances. Payments are made from the budget of the Ministry of Defense of the Russian Federation.

A serviceman's salary consists of:

- payment for the position held;

- payment for military rank;

- various bonuses (for conditions of service, for class, for dangerous working conditions, for length of service, for maintaining state secrets, for awards).

The full salary is formed from payments for the position and assigned rank.

Expert commentary

Potapova Svetlana

Lawyer

In addition to basic payments, military personnel are entitled to financial assistance and bonuses. Bonuses are usually awarded before a vacation, at the end of the working year, or on the occasion of a holiday or other significant event.

Financial assistance is issued upon receipt of a report from a serviceman. It is accrued due to personal circumstances, such as:

- changing of the living place;

- official transfer to another region;

- birth of a child;

- graduation from a higher educational institution;

- marriage.

If an employee is assigned the duties of an absent military personnel, on the basis of the relevant order, an additional payment is made for combining positions.

How to collect alimony from a military personnel?

In order to receive payments from a serviceman, grounds for recovery are necessary, this could be:

- agreement on the payment of alimony concluded between the payer and the recipient. Must be certified by a notary;

- judicial act.

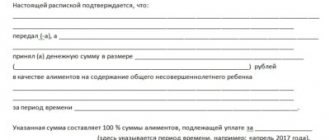

The agreement is concluded only voluntarily. The payer undertakes to pay the agreed amount, and if he does not do this, then the document can be used as a writ of execution, that is, submitted either at the place of work, to the accounting department of the relevant part, or to the bailiff service at the debtor’s place of residence.

The document may contain not only the amount, but also the frequency of payments, conditions for changing the amount, liability for non-payment and other points that do not contradict current legislation.

Judicial procedure is applied when the payer refuses to enter into an agreement. At the same time, you can go to court even when deductions are actually made, simply if you want to record the obligation in the form of a document.

Since a serviceman regularly receives wages (if he serves under a contract), the procedure is carried out through the issuance of a court order. The liability will be calculated as a share of income and will be:

- a quarter of income if there is one child;

- third if there are two children;

- half if there are three or more children.

The plaintiff submits an application for an order to the court and does not pay the state fee. The norms of the Tax Code directly speak about this.

The issue can be resolved in a court of general jurisdiction if the order is canceled by the payer or another issue that is subject to resolution in a lawsuit is considered at the same time, for example, divorce, division of property, and so on.

Alimony payments from military pension

Military personnel have the right to receive a long-service pension. Additionally, training in special institutions is considered part of the service, so a military man can officially become a pensioner at the age of 35.

To calculate length of service, many factors are taken into account - the duration of military operations and the elimination of the consequences of man-made disasters, the duration of work with nuclear weapons, the work of a pilot, and service in high mountain areas.

A serviceman can also receive a pension due to receiving a certain disability group.

The alimony provider will need to deduct child support for a minor child from pension payments.

The Pension Fund is responsible for calculating alimony. SSP employees can draw up a writ of execution at the initiative of the alimony recipient and send it to the Pension Fund. However, it may take about 60 days before the first child support transfers begin.

If a military retiree moved to a new place of residence, but did not inform the employees of the relevant services about his move, then specialists send the necessary documents to the court, which is located on the territory of the organization that withheld alimony from the serviceman’s income.

When a woman initiates the collection of alimony, she has the right to file an application with the SSP. The department employees will make a request to the military registration and enlistment office, after which the mother of the minor must visit the Pension Fund and provide the employees of this body with a writ of execution. Alimony will be collected from the serviceman's pension on the basis of this document, even if the man's current address differs from his registered address.

Features of calculating alimony from military personnel

Child support from a military personnel, as a general rule, is calculated in accordance with the general procedure, however, the procedure still has some peculiarities:

- If a serviceman is undergoing military service, then alimony may not be accrued at all for the duration of his service. To do this, the soldier needs to submit a corresponding application to the bailiff service. If such a document is not submitted to the FSSP, then payments will be accrued in the form of debt.

- If a citizen is a military pensioner, then collections are made from the military pension, as well as separately from wages if, after going on vacation, he works in a civilian profession.

- Contract workers pay alimony in the general manner, as they receive wages. Their income is treated the same as any other source of funds.

Alimony payments do not apply to income directly related to the person. For example, a bonus associated with the heroic performance of military duty is not included in the amount for calculating payments in favor of a minor child.

General information

According to family law, a parent is required to pay child support from almost all types of income. The law also establishes the amount of payments:

- one child receives no more than 25%;

- two children – 33%;

- three or more children – 50%;

- a fixed amount of money (set individually).

Alimony in the form of a fixed amount is used quite often, as this allows you to quickly calculate the required amount. But it is important for the recipient to correctly take into account all the needs of the child, expenses for him, the cost of living in the region, as well as the financial capabilities of the payer.

Usually, to calculate payments in a fixed amount, all expenses for the child for the month are counted (not only food and the purchase of necessary things are taken into account, but all expenses). The amount received is divided in half, since both parents have equal responsibilities in supporting children. If there are several children, then the calculation is carried out for each of them separately.

There are several ways to provide alimony - voluntary and forced. The voluntary method involves the parties drawing up an agreement, on the basis of which payments are made. The forced method includes going to court and receiving alimony based on a writ of execution.

When does a military member's alimony payments stop?

Termination of alimony obligations is carried out in the general manner:

- when children reach adulthood;

- if full legal capacity arises as a result of the emancipation of the child;

- the child was adopted by another person;

- at the time of death of a serviceman;

- upon reaching the reason for termination of payments specified in the agreement;

- when a decision is made to challenge paternity (previously paid amounts are not returned, but subsequent ones are terminated).

A serviceman may have an obligation to pay alimony not only for a child, but also for a spouse who is raising a child up to three years old (see alimony for a wife up to 3 years old) or is pregnant. Alimony will terminate at the end of the three-year period.

A disabled spouse or ex-spouse can also seek alimony from a military member. He loses his right at the moment of restoration of his ability to work.

Cancellation of alimony payments

According to general rules, military personnel pay child support until the child reaches adulthood or for life if he is disabled. In some cases, alimony may not be provided for the following reasons:

- death of one of the parties;

- the alimony agreement has expired;

- the circumstances specified in the contract have occurred (for example, the child has entered a university);

- the minor has acquired legal capacity (married, found a job, etc.);

- the child was adopted;

- the adult child has regained his ability to work.

The appearance of other dependents, disability or financial difficulties on the part of the payer does not give the right to stop payments. The amount may be temporarily reduced by agreement or court decision.

Reducing alimony payments

Complete termination of alimony payments is possible only when certain situations occur. The military man also has the opportunity to reduce the amount of payments by filing a corresponding claim in court. The reason may be:

- the emergence of obligations in relation to other persons, for example, another child is born to him or payments begin to accrue in relation to disabled parents;

- the second parent with whom the child lives gets married or receives a new source of income;

- the serviceman’s financial situation has deteriorated significantly, for example, long-term additional expenses have arisen;

- the military man received a disability and, accordingly, lost his ability to work and a significant part of his income;

- other reasons.

Each situation will be considered by the court on an individual basis. The list of reasons, in this case, is open, that is, the applicant can indicate another reason for reducing the amount of payments.

Procedure: features

If the court makes a positive decision in the case of collection of alimony payments, the plaintiff receives a writ of execution. After this, the alimony recipient has a question: how will the financial assistance be calculated?

The parent who is the child support recipient may choose, at his discretion, one of the options for transferring payments:

- By bank transfer to a savings book, personal account or card.

- By postal transfer.

- Receive funds independently from the accounting department or cash desk of the enterprise.

Important! Since military units are closed security facilities, receiving funds from the cash desk of the relevant institution is not always possible.

Having chosen one of the above options, the parent must submit an application to the accounting department with a note on the method of accrual of money. The application must also be accompanied by a writ of execution.

The application must contain information:

- personal information about the recipient;

- contact details of the alimony recipient;

- details of the writ of execution;

- method of receiving and holding funds.

If the accounting department does not have the opportunity to find out the exact address of the alimony recipient, the financial support funds will be transferred to the FSSP account on the territory of which the military enterprise is located.

Also, when transferring the writ of execution to the bailiffs, the latter initiate the procedure for forced collection of alimony through enforcement proceedings. They are responsible for organizing the execution of the document; all that is required from the payer is cooperation and assistance.

Arbitrage practice

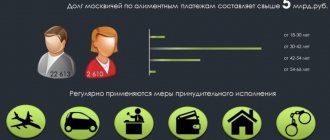

Due to the increased responsibility of payers, cases of collection of alimony from military personnel are rarely considered. The need to go to court arises for the following reasons:

- lack of mutual understanding on the issue of determining the amount of income from which alimony is collected;

- establishing paternity along with a request for child support.

Example. Citizen S. received alimony from her husband A. in accordance with the concluded agreement. By mutual agreement, deductions were set at 25% of income per child. In August 2020, the husband received a remuneration in the amount of 10 monthly salaries and he retired. From that moment on, the husband did not transfer the money, citing the fact that he was a pensioner and was not obliged to pay. S. appealed to the FSSP, but the bailiffs refused to engage in forced collection, since the document was not certified by a notary.

In the lawsuit, S. asked to recover alimony from A. from August 2018 in the amount of 25% of all types of income. According to Resolution No. 841, funds for children are withheld from cash receipts, including pensions and bonuses. As a result, the court decided to satisfy S.’s claims and collect from A. alimony in the amount of 25% of income from August 2020 until the child reaches 18 years of age.

Amount of alimony withholding

The size is kept as specified in the writ of execution. An accountant or even the head of a military unit cannot independently increase or decrease the amount of the monthly amount paid for child support. Only the court can make such decisions.

Since military personnel have a stable job and regular income, child support is always awarded in the form of interest.

For one child, 25% is deducted from the allowance, for two – 33%, for three or more – 50%. If payments are made in relation to spouses, former spouses or disabled adult children, then they can also be collected in the form of a fixed sum of money. In such cases, monthly deductions are equal to the fixed amount of money specified in the writ of execution.

As for delays and debts, there is no practice in such cases in relation to payers - military personnel. Alimony is always collected in full and strictly on time.

What payments are due upon dismissal?

Labor legislation establishes that upon dismissal, an employee is paid wages for time worked and compensation for unused vacations.

In addition, severance pay is paid as compensation. But it is paid only to those employees with whom the employer terminated the employment contract due to staff reduction or in connection with the liquidation of the enterprise. The amount of the benefit is equal to the average monthly earnings.

Moreover, an employee dismissed on this basis retains his average earnings for the period while he is looking for a new job (within 2-3 months). The management team of the organization (director, deputy, chief accountant), upon dismissal due to a change of owner, receives severance pay in the amount of not less than three months' average earnings.

Payment of severance pay in the amount of average earnings for half a month (2 weeks) is due in the following cases:

- The employee’s refusal to transfer to another position for medical reasons, or the lack of a suitable job for health reasons;

- Conscription into the armed forces;

- Reinstatement of a former employee (by decision of a court or competent authority);

- Refusal to transfer with the employer to another location;

- The employee can no longer carry out work activities due to health reasons, for example, he has become disabled (a special medical report is required);

- Refusal to work due to changes in working conditions (for example, working hours).

Thus, severance pay is a compensation payment in the event that dismissal occurs against his will. When hiring an employee, the employer may stipulate other circumstances for the payment of severance pay or payment of a larger benefit.

Procedure for calculating the amount

In accordance with Articles 81 and 83 of the Family Code, a military serviceman, like any other citizen, in the absence of a voluntary agreement concluded by the parties, will pay for maintenance:

- one minor - 0.25×D, where D is the payer’s income;

- two - 0.33×D;

- three, four and so on - 0.5×D.

If it is impossible to pay the specified amount as a percentage, the court, at the request of the alimony payer, may reduce the share of deductions - for example, from 1/4 to 1/5.

In some situations, when the size of a serviceman’s income fluctuates greatly from month to month, the court may order deductions not as a share of the income, but in a fixed amount - for example, 10 thousand rubles for each of the children.

In addition, recovery is possible using the formula A = (F + P), where A is the total amount of alimony payments per minor, F is the fixed part, P is the variable (percentage).

Important: ex-husband and wife, in accordance with the second paragraph of Part 1 of Article 80 of the Family Code, can, by mutual desire, enter into an agreement that will spell out both the method for calculating the amount of alimony and the regularity of their transfer, as well as other relevant details .