According to Article 1162 of the Civil Code of the Russian Federation (Civil Code of the Russian Federation), a certificate of receipt of the right to the property of the testator can be obtained at the place of residence of the deceased or the location of his real estate. To receive a document six months after the opening of the inheritance, you need to submit an application . The document is issued personally to each heir, or one for all.

Clause 2 of Art. 1162 of the Civil Code of the Russian Federation states that the certificate can be canceled if information appears about new heirs or the property of the testator that is not included in the issued documents. In this case, the notary issues an additional certificate of the right to the inherited property and the obligations associated with it. Issue is made only after payment of the state duty in the amount established by Article 333.24 of the Tax Code of the Russian Federation (TC RF).

Why do you need a certificate?

This document is the basis for...

- registration of ownership of inherited property and receipt of relevant documentation - extracts from the Unified State Register of Real Estate;

- requirements for third parties to provide inherited property to the legal owner - the heir;

- realization of the rights of the owner - to own, use, dispose of inherited property.

The absence of a certificate is not a basis for the loss of legal inheritance rights. However, to confirm these rights, this document is still necessary.

What to do when inheriting a plot of land

The procedure for registering ownership of a land plot differs to some extent from the rules for taking ownership of an apartment or house, although land is also real estate.

The algorithm for registering inheritance and registering ownership of a land plot is as follows:

- the potential heir applies to the city or district archive, which issues a resolution stating that the given land plot was previously transferred to the ownership of the deceased;

- contacting the administration of the gardening partnership (if the land is part of such a society) in order to obtain a special extract;

- ordering and production of a cadastral passport for land in Rosnedvizhimost;

- obtaining a certificate of absence of land tax debt from the Federal Tax Service. Before this, you must pay a special state fee;

- contacting a notary to fill out an application for acceptance of inheritance;

- registration of property rights in Rosreestr.

Issuance procedure

To obtain a Certificate, heirs must adhere to the procedure established by law, consisting of the following steps:

Filing an application for acceptance of inheritance

The certificate can be issued only to those heirs who have expressed a desire to enter into the inheritance. This is done by submitting an appropriate application to the notary's office.

The application can be submitted...

- In person (you must have your passport with you);

- By mail (the applicant's signature must be notarized);

- Through a proxy (the right to represent the interests of the heir must be indicated in a properly executed power of attorney);

The application must include the following information:

- Information about the applicant, that is, the heir (full name, date of birth, place of residence);

- Information about the testator (full name, date of birth and death, last place of residence);

- Information about other heirs;

- Intention to inherit;

- Grounds for inheritance (family relationship, will);

- Composition and location of inherited property;

- Date of application;

- Signature.

You can read more about this in the article “Application for inheritance.” There you will also find a sample application.

Preparation of documentation confirming the right of inheritance

The documents that are submitted to the notary for the issuance of a Certificate can be divided into groups:

- confirming the death of the testator (death certificate issued by the civil registry office, court decision);

- confirming the basis for inheritance (will or documents on family ties: marriage, divorce, birth and other documents);

- confirming the testator's ownership of the inherited property (extracts from the Unified State Register of Real Estate, registration documents for the vehicle);

- confirming the value of the inherited property as of the date of death (appraisal report, cadastral information, technical documentation).

A detailed list of documents can be found in the article “What documents are needed to enter into an inheritance.”

Payment of state duty

The certificate will be issued only if the state fee is paid. This will be confirmed by a payment receipt.

Read more about calculating the amount of state duty below.

Receipt

If all the conditions of inheritance are met (terms, documents, grounds for inheritance), the notary appoints a day for issuing the Certificate to the heirs.

How to get

Receipt of the certificate must be preceded by acceptance of the inheritance. As mentioned above, this can be done both virtually and notarially.

In case of actual inheritance

For actual inheritance, the successor needs to do something that can express his interest in receiving the property, namely:

- Own or manage it, for example, live in the house or use the things of the testator, move them, transfer them for storage, etc.

- Implement measures to protect the inheritance from attacks by third parties (installed additional locks, an alarm system, a video surveillance system, entered into an agreement with a security company, informed the notary about the need to take measures to protect the inherited property).

- Pay bills for the maintenance and servicing of the property - utilities, cleaning services, repairs, restoration (payments must be made from the personal funds of the heir).

- To pay off the debts of the testator or to receive what was due to him from third parties.

Completion of one of the specified actions will be sufficient for the inheritance property to be considered accepted. But before receiving a certificate of title, the actual successor will need to officially confirm this circumstance.

Judicially

If he missed the deadline for inheritance, the fact of acceptance of the inheritance is established in court: the heir submits a corresponding application to the district court and attaches to it evidence of the actions he performed within the framework of the inheritance. And based on the judge’s positive decision, he applies for a certificate.

A certificate of inheritance may be replaced by a court decision if its operative part recognizes the heir's right of ownership of the accepted property. He must separately ask for this in the application to establish the fact of inheritance. In this case, the successor performs all further actions in relation to the inherited property on the basis of a judicial act.

At the notary

If the deadline established for the succession process has not yet expired, you can confirm the acquisition of property directly from the notary. To do this, the applicant will need a document reliably indicating the fact of inheritance, for example:

- certificate of place of residence;

- receipts for payment of utility bills, taxes, fees, etc.;

- contracts for the provision of services for repair or protection of property;

- a copy of the statement of claim against the persons who illegally took possession of the inherited property.

If the outcome is successful, the notary notes the fact of acceptance of the inheritance and invites the successor to begin the procedure for issuing a certificate.

When notarizing an inheritance

Formal acceptance of the inheritance is carried out as follows:

- From among the notaries assigned to the last place of residence of the testator, the most suitable one is selected (only the territorial attribute is a mandatory criterion, otherwise the heir is given freedom of choice). If the place of residence of the deceased is not determined or is located abroad, you should look for a notary at the location of the inherited property - first immovable, and in its absence - movable.

- Together with a will or documentary confirmation of inheritance rights by law, a death certificate of the testator, a certificate from his last place of residence, his passport, title documents for property and an appraisal act, the successor goes to the notary. Some documents can be delivered later - the main thing is to get to the authorized specialist on time.

- At the notary, the heir writes an application for acceptance of the inheritance. This document becomes official confirmation of his desire to accept the property due. Without this, the inherited share may go to other, more interested applicants. In addition to your personal data, the application should indicate the basis on which the inheritance rights were transferred to the applicant, the date of death of the testator and a brief description of the property being accepted.

After checking the documents, application and powers of the applicant, the notary registers his application, and the process of accepting the inherited property is considered completed.

If you wish to receive a certificate of title in the near future (after six months from the date of death of the testator), the heir declares this to the notary. This request is included in the application for acceptance of the inheritance.

After this, the successor pays all the necessary expenses and on the appointed day comes to the notary to receive the document. But he can also write an application to transfer the certificate by mail to the address specified by him. If the request is not made at an appointment with a notary, but is submitted by post or through a courier, the signature on it must be certified by a notary.

Procedure

If a certificate of the right to inheritance was not issued during the process of accepting the inherited property, an additional one is required, or the actual successor applied to receive it, the procedure will proceed as follows:

- The heir draws up and submits in writing an application requesting the issuance of a certificate, and then submits it to the notary at the place where the inheritance was opened. This can be done in person, by mail (with proof of signature on the application) or through a representative (based on a power of attorney or a document confirming the authority of the legal representative - parent or guardian).

- If the applicant applies to the notary's office in person, the notary checks his passport or other identification document and notes the details on the application.

- The notary finds out whether there are other heirs besides the one who applied and starts paperwork (in the case when this is the first visit of the heir, and no one else has previously applied within the framework of this inheritance case).

- The application is registered, and the successor who submitted it is informed of the list of documents necessary to confirm inheritance rights. If some of them are already contained in the inheritance file, only the missing ones need to be conveyed.

- The notary explains the obligation to pay state fees, notary fees and legal and technical services, and gives the applicant the details by which he makes the payment.

- After carefully checking the documents and analyzing the information received, the notary begins to issue the certificate. If the inheritance was carried out on two grounds at once - by law and by will, the applicant is issued separate certificates. And each of them is executed in two copies, one of which is received by the heir, and the second remains with the notary.

- The document is issued to the successor on the appointed day upon his personal appearance before the notary or, if requested, sent by mail. In this case, the applicant does not have to wait for the certificate to be issued to other heirs, but their share must be taken into account.

- The guardianship and trusteeship authorities (if among the heirs there are minors and not fully capable citizens) and the tax authority are notified about the issuance of the certificate.

The applicant’s responsibilities can be transferred to his representative - legal (parent, guardian, trustee) or voluntary.

The legal representative is responsible for registering the inheritance of a minor, incapacitated and partially capable successor. He confirms his authority by presenting a birth certificate of the person represented or a decision of the guardianship and trusteeship authority to appoint him as a guardian/trustee.

A voluntary representative can only be appointed by an adult and fully capable person. To provide him with the necessary scope of powers, the heir issues a notarized power of attorney with a clear list of assigned tasks.

Required documents

To obtain a certificate of inheritance, the following documents are required:

- Certificate of death of the testator or a judicial act declaring him dead.

- Certificate about the last place of residence of the deceased or the location of his property.

- A will or a document confirming the basis for inheritance by law (birth, marriage, adoption certificate, judicial act establishing dependency).

- Acts and extracts from government registers establishing the deceased's ownership of property.

- Technical plan of the inheritance object.

- Valuation act.

- A document confirming the presence or absence of an encumbrance on the property being registered.

Some of the submitted papers may already be kept in the estate file if the applicant or any of the other successors have contacted the notary before.

Deadlines

The time for filing an application for the issuance of a certificate of title is not regulated by law. The main thing is that it is received by a notary after the death of the testator.

But this does not apply to the procedure for accepting an inheritance. It must begin no later than six months after the death of the testator. In some cases, the established period begins to run from the moment when the priority successor renounced the inheritance rights. And, if the opportunity to enter into inheritance arose as a result of non-acceptance of the property by other applicants, the period will be three months from the day when the six months allotted to them expired.

The time for issuing a certificate is regulated by Art. 1163 of the Civil Code of the Russian Federation, according to which the document must be ready after six months from the date of death of the testator. But these time frames may be shifted in the following cases:

- the birth of an heir is expected;

- the court is considering a case challenging the applicant’s inheritance rights;

- The submitted documents are insufficient or they raise doubts in the notary’s mind (time is required for examination).

You can receive a document earlier if the notary has indisputable evidence that there are no other applicants for the inheritance besides the persons who applied.

Expenses

For issuing a certificate, the applicant is charged a state fee or notary fee and a fee for legal and technical services.

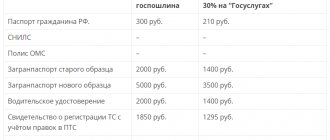

State duty is a monetary fee withheld for receiving a government service (issuing a document). If the inheritance case is handled by a private notary office, the state fee is replaced by the notary fee, but the amount of payment remains the same.

The state duty is charged in the amount of:

- 0.3% of the estimated value of the inherited property for heirs from among close relatives and family members of the deceased (parents, children, spouse, brothers and sisters);

- 0.6% for all other successors.

In accordance with Art. 333.38 of the Tax Code of the Russian Federation, the following are exempt from this payment:

- recipients of a certificate of title to inherited living space (if they lived on it at the time of the death of the testator) or a bank deposit;

- minors and incompetent heirs;

- disabled people of groups I and II (by 50%);

- heirs of property of persons who died while performing official, public or civic duty.

Fees for legal and technical services are additional costs that the applicant will have to bear when preparing the document. It is charged according to the tariff established by the notary chamber of the constituent entity of the Russian Federation. For Moscow, prices will be as follows:

- certificate of title to real estate - 5,000 rubles/object;

- for movable property - 3,000 rubles/object;

- for unreceived pensions and income - 500 rubles;*

- for cash deposits and bank accounts - 1,000 rubles. (for funds up to 100,000 rubles), 2,500 rubles. (deposits from RUB 100,000).*

* - the fee is charged not for issuing a certificate (in these cases it is issued free of charge), but for submitting requests to credit institutions, and if there are more than three requests, each subsequent one will cost 100 rubles. (within 1,000 rubles).

Disabled people and veterans of the Great Patriotic War, prisoners of fascist camps and, 50% of the time, disabled people of group I will not have to pay for legal and technical services.

When is canceled

An already issued certificate, as well as legally significant actions carried out on its basis, can be canceled in the event that:

- its recipient was recognized as an unworthy heir;

- the priority successor, who had not previously submitted an application to the notary, restored the period of inheritance;

- the right confirmed by this certificate was challenged in court.

If this happens, the heir is obliged to return the property for which the document was issued, or compensate for its value in cash.

Place of issue

The certificate is issued at the place where the inheritance was opened. This could be...

- the last place of residence of the testator (in his own, rented or rented residential premises);

If the testator permanently resided abroad, the inheritance will be opened in the country where he lived. In this case, the certificate will be issued by a consulate or other authority of that country.

- if the last place of residence of the testator is not established, the address for opening the inheritance and receiving the Certificate will be the location of the inherited property (all or most of it).

The place of opening of the inheritance must be documented , for example...

- a certificate of last place of residence issued by a housing organization (HOE) or a migration authority (UVM);

- if the last place of residence has not been established, documents confirming the location of the inherited property (for example, a title document, an extract from the Unified State Register of Real Estate).

If the heirs do not have any of the specified documents, the place of opening of the inheritance can be established by a court decision.

Issue date

The certificate can be issued only after the deadline for accepting the inheritance has expired. As a rule, this period is 6 months . This 6-month period applies to cases of inheritance by law and by will.

The starting date for calculating the 6-month period is the date of opening of the inheritance - that is, the date of death of the testator. If only the month or year of death is known, the inheritance opens on the last day of the known month or year.

If the date of death is unknown, it is determined by the date of entry into force of the court decision declaring the missing testator dead. However, for a notary it is not enough just a court decision to declare the testator dead. The fact of the death of the testator recognized by the court must be registered in the civil registry office. A death certificate issued by the civil registry office on the basis of a court decision is the basis for opening an inheritance.

After the expiration of six months, the notary issues a certificate to those heirs who submitted the application, provided the necessary documents, and paid the fee. The notary has no right to delay the issuance of the certificate if other heirs have not completed the specified actions within the prescribed period.

What to do if the 6 month period has already expired? Read the article “How to enter into an inheritance after 6 months.”

Terms of issue

Inheritance by law

Legal heirs receive a certificate of right to inheritance if the following conditions are met:

- The death of the testator has been established;

- The place and time of opening of the inheritance have been determined;

- Inherited property is determined;

- The absence of a will has been established;

- The circle of heirs by law has been determined (in order of priority);

- There are statements from heirs;

- All supporting documents are available;

- The heirs paid the state duty;

- The 6-month period for inheritance has expired.

You can read more about inheritance by law in the article “How to enter into an inheritance without a will” and “The order of inheritance by law.”

Inheritance by will

If the notary establishes the existence of a will, inheritance will not occur according to the law (in order of priority), but in accordance with the will of the testator. Otherwise, the conditions for obtaining a certificate correspond to those listed above.

However, there are some nuances here. First of all, the notary will find out whether the will has been canceled or changed. A corresponding note is made about this. If necessary, the notary makes a corresponding request to the notary office at the last place of residence of the testator.

The notary also finds out whether there are heirs entitled to an obligatory share by law . These are minor children, disabled parents and the spouse of the testator, who are entitled to half of their legal share, regardless of the contents of the will. The rest of the property is distributed among the heirs according to the will.

Sometimes the will does not indicate all inherited property . The property that is listed in the will is inherited by will, and the part of the property not mentioned by the testator is inherited by law. In this case, the heir under the will can also be an heir under the law - in this case he will receive both shares.

You can read more about this in the article “How to inherit under a will.”

What is a certificate of inheritance

This is a supporting document, the owner of which can argue his position in inheritance proceedings. It must contain information about the successor, testator, notary and property. The information contained in the certificate must correspond to the actual state of affairs.

Theoretically, it is not necessary to issue a certificate, but practice shows the opposite picture. If this document is available, its owner has the right to safely dispose of inherited real estate (part of it) and movable property. The issuance is made both to one successor and collectively, to the constituent elements of the inheritance or to its full volume.

State duty

The cost of issuing a certificate of inheritance depends on several factors:

Firstly, on the value of the inherited property (for this, the notary is required to provide documents on the value).

Secondly, from the family connection of the heirs with the testator - heirs of the first and second priority pay only 0.3% (but not more than 100,000), other relatives and non-relatives - 0.6% (but not more than 1,000,000) of the cost .

Some categories of heirs are exempt from paying state fees. For example, minors and incompetent heirs. They need to provide the notary with documents confirming their right to be exempt from payment.

Read more about this in the article “State duty when registering an inheritance.”

What to do next

Having entered into inheritance rights, most citizens do not know what to do next. Now the person can fully dispose of the received property. It can be used for its intended purpose, sold or donated.

It is very important to register ownership. This is done as follows:

- real estate is registered in Rosreestr;

- car - to the traffic police.

Let's take a closer look at what to do after receiving a certificate of the right to inheritance by law.

Real estate

If the heir received an apartment or house, then in order to fully dispose of the property he must make changes in the register. This requires:

- Collect the necessary documentation. It includes the applicant’s identity card, certificate of inheritance, receipt of payment of state duty, technical plan.

- Submit an application and documents for registration of ownership. This is done through a branch of the MFC or Rosreestr.

- Receive an extract from the Unified State Register of Real Estate.

Automobile

By law, the new owner of the vehicle is required to re-register documents within 10 days. Otherwise, he will be fined 2,000 rubles.

To re-register a vehicle you must:

- pay 850 rubles state duty;

- obtain MTPL insurance;

- draw up a diagnostic card;

- write an application to the traffic police and attach to it the documents listed above, the applicant’s passport and STS.

Bank deposit

To re-register a deposit or withdraw cash from an account, you need to visit a bank branch and submit an application. A certificate of inheritance is attached to it. No additional paperwork is required.

Business

If an enterprise is inherited, then in order to accept it the heir will have to re-register the property complex. It is possible to inherit both the entire business and its share.

The registration process is very similar to the transfer of real estate. To do this, the successor will have to contact Rosreestr. To conduct business activities, you will need to register as an individual entrepreneur or legal entity. If the successor plans to sell the business, re-registration with Rosreestr will be sufficient. To do this, you will need to pay a state duty in the amount of 0.1% of the estimated value of the enterprise.

Share in a business company

You can inherit a share in an LLC only with the consent of its other participants. In case of refusal, the successor is paid monetary compensation, and the share is distributed among members of the company. If consent is received, then the data of the new owner is entered into the Unified Register of Legal Entities.

Weapon

After the death of the testator, all his weapons are temporarily confiscated by the police. Then, if the assignee receives all the necessary permissions, he can return the property. In the absence of permits, the citizen will have a year to sell the inheritance. Otherwise, the weapon becomes state property, and the copyright holder is paid compensation. As a rule, it is significantly less than the market value of the property.

Debts

Any debts of the deceased are an integral part of his inheritance. Sometimes their size exceeds the value of the property, and therefore it would be more logical for the successor to formalize a waiver of the inheritance. It should be taken into account that refusal is possible before receiving the certificate. Otherwise, you will have to go through the courts.

The procedure for obtaining a certificate usually does not cause any particular difficulties. Having received this document, the successor must register the property of the deceased, after which he will be able to dispose of it at his own discretion.

Sample certificate

The certificate of inheritance looks like this:

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- Moscow and the Region

- St. Petersburg and region

- FREE for a lawyer!

By submitting data you agree to the Consent to PD Processing, PD Processing Policy and User Agreement.

Anonymously

Information about you will not be disclosed

Fast

Fill out the form and a lawyer will contact you within 5 minutes

Tell your friends

Rate ( 1 ratings, average: 5.00 out of 5)

Author of the article

Irina Garmash

Family law consultant.

Author's rating

Articles written

612