Conditions for assigning alimony

Content

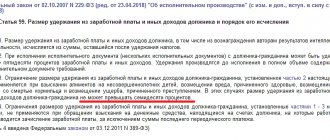

The main legislative act regulating the amount, conditions and features of alimony for four children is the RF IC. In Art. 81 of the RF IC states that when collecting funds in court, no more than 50% of wages or other income - benefits, pensions, earnings from renting out housing, fees - are withheld from the alimony payer.

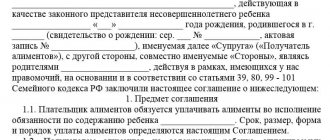

Former spouses can enter into a voluntary agreement, which indicates when and in what amount alimony is transferred. The document is certified by a notary and is equal in legal force to a writ of execution. The woman can present it at the payer’s place of work.

In the absence of official income, alimony is assigned in a fixed amount. Payments are calculated taking into account the minimum wage in the region.

How many are they?

In accordance with Art. 81 of the Family Code, for three or more children, up to half of the earnings are collected from the parent. If there are special circumstances, the amount of deducted earnings can be changed either up or down. These changes can only be corrected in court.

In a fixed amount of money

In some circumstances specified in the law, the court may determine the amount of alimony in a fixed monetary amount for a parent who has been awarded child support obligations. This is a fixed amount, a multiple of the subsistence minimum (Article 83 of the RF IC). When setting the size, the following are taken into account:

- the needs of each child;

- financial and marital status of each party.

The fixed amount will be greater than or equal to the children's subsistence minimum accepted in the region of residence of the child.

This type of alimony obligation will be established by the court in the case when:

- the percentage of alimony violates the interests of one of the parties;

- the alimony payer has the status of an individual entrepreneur;

- the income received by the alimony payer is partially or fully received in foreign currency or in kind;

- the alimony payer does not have regular income, or he works under a GPC agreement;

- no notarial agreement on child support was concluded between the parents;

- There are other circumstances that prevent the payment of child support as a percentage of income.

One of the cornerstones when assigning alimony payments in a fixed monetary amount is the calculation and evidence of the need for this amount. According to Part 2 of Art. 117 of the RF IC, a fixed sum of money must be a multiple of the subsistence minimum per child in the recipient’s region of residence, and in the absence of such, the subsistence minimum in the Russian Federation.

As a percentage of earnings or total income

The most common way to pay child support in accordance with the Family Code of the Russian Federation is to collect a percentage of the parent’s earnings:

- 1/4 of income (25%) - for one child;

- 1/3 of income (33.3%) is for two;

- 1/2 (50%) - for three or more dependents.

In hybrid form

Art. 83 of the RF IC, in addition to the percentage of recovery and a fixed monetary amount, provides for a hybrid form of payment of alimony.

This form is recorded by a notary (voluntary form) or in court. The parent undertakes to make payments in favor of his children simultaneously in shares of income and in a fixed amount of money, if there are legal grounds for this in the form of the sufficiency and characteristics of the payer’s income.

Before collecting alimony, the recipient has the right to determine, with explanation, which method will be most convenient for him. Then he has the right at any time to change the method of collecting alimony to a mixed one.

Payments in mixed form are possible in accordance with Article 83 of the RF IC if:

- the parent has several types of income (salary and income from rental housing, royalties for creative activities);

- Along with official income, there is unofficial income;

- payment of wages to the alimony payer occurs in foreign currency or natural products;

- another form of collecting alimony goes against the interests of one of the parties.

Amount of child support for 4 children

As mentioned earlier, for 4 children a man will have to pay 50% of his income monthly if payments are assigned in a shared ratio. Judges also adhere to this rule in the case when the payer does not have an official job - no more than half of the average earnings in the country are transferred, but in a fixed amount per minor.

You can read more about the average salary for calculating alimony here.

The number of marriages does not matter.

The interests of children are usually put first, and here the law also protects payers. If alimony for three children is set at 50% and a man is required to pay money for the fourth, the amount to be withheld will remain the same. Payments received by mothers for the maintenance of minors will be reduced to 12.5% for each.

To understand the calculation procedure in detail, it is enough to familiarize yourself with practical examples.

Alimony in a fixed amount

Payments in a fixed amount are prescribed if the court is unable to establish the exact level of income of the defendant.

Agapov O.N. has two children from his first marriage, and two more were born in his second. He divorced his wife, she filed a claim for alimony. Previously, the amount of payments was 33% of the minimum wage, since the payer was not employed.

According to the court decision, Agapov is obliged to pay another 33%, which amounts to 66% in total. This is a violation of his rights, so he filed a lawsuit to reduce the amount of alimony.

At the time of the appointment of payments, the minimum wage was 11,163 rubles.

11163 x 50% = 5,581.5 rubles. - total payable.

5,581.5/4 = 1,395.75 rubles. per child in a fixed amount.

Children from different men

The mother has four children from four different men. They have no other children.

The first ex-husband earns 50 thousand rubles, the second – 35 thousand rubles, the third – 15 thousand rubles, the fourth – 30 thousand rubles. Each of them contributes 25% for their child.

50,000 x 25% = 12,500 rubles.

35,000 x 25% = 8,750 rub.

15,000 x 25% = 3,750 rub.

30,000 x 25% = 7,500 rub.

12,500 + 8,750 + 3,750 + 7,500 = 32,500 rub. - a total of four children to receive.

Children from different women

Let's look at the opposite example. The man has four children from different women, and for all of them he pays alimony in the amount of 50% of a salary of 70 thousand rubles.

70,000 x 50% = 35,000 rub. – total to be paid in total.

35,000/4 = 8,750 rub. every child.

Four children and alimony being sought for the maintenance of his ex-wife

When transferring payments for four children, the total amount may be increased if the ex-spouse decides to collect alimony for herself.

The alimony payer earns 50 thousand rubles, of which 25 thousand rubles. monthly transfers to his wife for the maintenance of their common four children.

The woman decides to collect payments for her maintenance, because she is on leave to care for her youngest child. The court satisfies the claim and orders payments in the amount of 3,000 rubles. monthly.

50,000 x 50% = 25,000 rub. is due to children, an additional 3,000 rubles are paid. ex-wife.

In total, the man transfers 28,000 rubles monthly.

Child support for 5 or more children

The payer has four children from a previous marriage. Subsequently, a daughter was born, but after living with his wife for 5 years, the man decided to divorce. All children are minors.

For the first four children, he paid 50% of the salary of 100 thousand rubles, which in total amounted to 50 thousand rubles, or 12,500 rubles. for everyone. Child support was collected from him for his fifth child, and payments for the rest were reduced. The mother of the last child filed a lawsuit, 25% of the salary was assigned, which ultimately amounted to 75% of the income, and the man filed a lawsuit to reduce the amount of payments.

100,000 x 50% = 50,000 rub.

50,000/5 = 10,000 rub. for a minor, or 10% of the salary.

For children from different marriages, the amount to be paid does not change.

At the legislative level, the minimum and maximum amounts of payments are not established.

How does division occur between dependents from different marriages?

Alimony for four children: how much percentage can be assigned? Since a man has equal obligations to all children, the amounts of payments should be the same. If we assume that according to the law, three, four or more offspring are supposed to deduct half of the income, therefore, each person should share 1/8. If any of the dependents do not have a disability that requires increased material investments, the amounts will most likely be equalized. As practice shows, even if ex-wives express objections to the reduction of alimony paid to them before the birth of a man’s fourth child in a new marriage, the judge still takes the side of the defendant.

In what cases is 70% of income assigned?

The maximum amount of alimony that can be collected for child support is 50% of all types of income. But the maximum amount that can be withheld from wages is 70%.

It is withheld in the following cases:

- the man also has dependents for whose support he transfers funds (parents, spouse, ex-wife);

- The alimony provider has arrears of alimony (70% of the salary will be withheld until the debt is repaid).

However, withholding 70% has a negative impact on the payer’s standard of living. Therefore, he can go to court to reduce the amount of payments.

Decor

Registration of alimony is possible in two ways provided for in the Insurance Code:

Voluntarily - when the parents (the recipient and the payer, if the children are raised by a guardian) agree on their own. In this case, they need to draw up an agreement (a simple written form) and have it certified by a notary.

Judicially . In this case, a claim for alimony can be filed against all children at once (a simplified form is possible - issuing a court order by a magistrate), or against each child individually. This usually happens in cases where the mother already receives child support for previously born children, but the father refuses to pay for the newly born child. For example, from another marriage, or a child born outside of marriage.

To collect alimony, it is enough to provide the court with a package of documents:

- Passport (copy);

- Child's birth certificate (copy);

- Marriage certificate (divorce) (copy);

- Certificate from the defendant’s place of residence.

Increasing or decreasing the amount of child support for 4 children

An increase in the amount of alimony is usually made at the initiative of the recipient or voluntarily by the payer. A woman may qualify for additional payments if the child is seriously ill, injured and requires expensive treatment.

How to proceed:

- Collect certificates indicating an urgent need for finance.

- Try to reach an agreement with the payer or immediately file a claim in court.

- Wait for a court decision.

Men who find themselves in any of the following situations can apply for a reduction in child support payments:

- deterioration of financial situation due to layoffs at work, the birth of another child;

- financial need due to illness.

To reduce the amount of alimony, a statement of claim is submitted to the court, accompanied by documents confirming good reasons. If the payer quit on his own initiative, the claim will be denied. In other cases, the decision is made individually and may be influenced by the financial situation of both parties.

How is alimony collection carried out?

To avoid any problems with the law, it is advisable for the payer to voluntarily transfer the amount of alimony established by a court decision. If the father works officially, this responsibility will be assigned to the accounting department of the enterprise. In this case, the funds are transferred almost automatically, and the payer receives the rest of his salary minus alimony obligations.

If the father ignores the need to voluntarily transfer funds for the maintenance of the children, the process will move to the stage of mandatory collection of alimony, at which the bailiff service will come into play. It has all the necessary powers to collect both current and previously incurred debts. In this case, the payer will incur quite considerable additional costs to pay for the actions that will be taken by the bailiffs.

If alimony is paid by voluntary agreement of the parties, then bailiffs can be contacted to collect it only after the recipient files a statement of claim in court and receives an appropriate decision.

Procedure for applying for child support for 4 children

If four children were born in one marriage, the spouses have two options:

- enter into an alimony agreement;

- establish payments through the court.

If there are a large number of children from different marriages, a man can draw up agreements with his ex-spouses, but in practice this is quite rare, and alimony is collected in court.

Claim procedure

Procedure:

- Collect documents and submit, along with a statement of claim, to the court at the place of registration or at the defendant’s registered address.

- Wait for the court hearing to be scheduled.

- Appear for the hearing on the appointed date.

- Based on the results of the proceedings, obtain a court decision and IL.

Then the claimant can transfer the IL to the bailiffs at the payer’s registered address or provide it at his place of work. In the latter case, funds are automatically withheld by the accountant from the man’s salary without his consent.

Order order

Another way to collect alimony is to issue a court order. A woman needs:

- prepare an application and necessary documents;

- apply to the magistrate's court to issue an order;

- wait 5 days and receive a document to use it instead of IL.

The advantages of a writ (PO) over a claim are that the time frame for considering the application is minimal, there is no need to summon the other party to court, the judge considers the case on the basis of the documents provided by the applicant. The disadvantage of the PP is that it is easy to cancel a court order by filing a counter-statement of disagreement; this is somewhat more difficult to do within the framework of a lawsuit.

If the payer disagrees with the amount of payments prescribed in the court order, he has 10 days to challenge. He needs to submit an application to cancel the document, and then collection is carried out in the manner of a claim, and not a writ.

Is there a maximum amount of deductions?

With an average Russian salary of 40 thousand rubles. a woman who receives only 13,050 rubles to support three children cannot feel financially protected. Naturally, she has a question about whether it is possible to oblige the negligent dad to pay more.

The above-mentioned law No. 229-FZ states that the total amount of deductions from an employee’s salary should not exceed 70%. A similar requirement also contains. How to reconcile the norms of the RF IC, the RF Labor Code and the law on enforcement proceedings?

Let's figure out how much percent of his earnings a father who left his family is obliged to allocate for the maintenance of his children. It turns out that sometimes you can force a man to give his ex-wife up to 70% of his income. This situation is possible if the “other half” has the right to demand alimony from the defendant for their maintenance.

According to the norms, a woman is entitled to alimony if she:

- pregnant;

- is raising a child under three years of age;

- disabled;

- low-income (this is documented), while caring for a disabled child.

Example 3. Galushkin R.N., a mother of many children, files a lawsuit against her ex-husband. In the statement, she demands to collect alimony for herself and her three children from the father who left the family. Since her youngest child was only six months old, the claim was granted. Based on the court verdict, T.S. Galushkin is now obliged to pay alimony:

- ex-wife – 20% of earnings;

- three children – 50% of earnings.

Procedure for alimony payments

When drawing up an alimony agreement, the order of payments is governed by its provisions. The only rule that should be followed is indicated in Art. 103 of the RF IC - the amount of alimony paid by agreement cannot be less than the amount that could be established through the court.

- If the payer is officially employed, when paying funds under a court decision, he may not transfer the money himself - an accountant will do this for him. It is also possible to force deduction at the initiative of bailiffs who have received IL if the man refuses to make payments voluntarily.

- If the person obligated for alimony does not work anywhere, the money is collected from unemployment benefits, pensions and other deductions. He undertakes to independently fulfill his alimony obligations, otherwise he will begin to accrue a penalty in the amount of 0.1% of the amount owed for the day of delay.

Important! When handing over money personally, a woman is recommended to take a receipt for alimony. If finances are transferred through a bank, you must indicate in the comments “for alimony” and write the period for which the payment is made.

Responsibility for evasion of alimony payment

If there is no receipt of alimony in the account within six months, it is considered that the defendant is maliciously evading alimony obligations. The mother or persons who are involved in raising children (guardians, educators) can report this violation of the law to law enforcement agencies. According to Article 69 of the RF IC, the defendant may be deprived of parental rights. Article 157 of the Criminal Code of the Russian Federation provides for other forms of punishment for non-payment of alimony, up to and including imprisonment. If the location of the defendant is unknown, he will be put on the wanted list, and state guardianship and trusteeship authorities will have to resolve the issue of financial support for minors.