How is alimony calculated from unemployment benefits?

When the alimony payer is officially fired from work, the accountant of the relevant organization must submit a court order to assign alimony to the FSSP, since it is impossible to withhold it from the salary of a former employee of this organization.

Further, the job of government officials is to determine another source of income for the alimony payer. To do this, a special request is submitted to the Pension Fund of the Russian Federation and the Employment Center. If during such a check it turns out that the alimony payer is on the labor exchange, then the writ of execution is sent to the Employment Center.

Funds can be recovered from an unemployed parent if certain documents are available. If the agreement on payment of alimony was drawn up voluntarily, then in order to carry out the procedure for collecting alimony, you will need to present the original notarized alimony agreement. If payments were ordered in court, then the original of the relevant writ of execution is required.

Employees of the Employment Center do not have information about whether an individual is obligated to pay alimony. In order to confirm this information, they need to present documents that will indicate the official award of the obligation to pay alimony.

Next, the accounting department of the central bank has the right to transfer the required amount of alimony to the claimant.

What to do if child support is not paid?

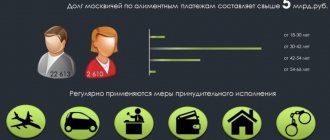

The debtor cannot justify the lack of payments for children by his financial situation, including the fact that he is not employed and does not have a stable income. The powers of bailiffs have now been significantly expanded, so for failure to pay alimony such a person can be brought to both administrative and criminal liability. In addition, if there is a debt, a penalty is charged on it, which must also be paid in favor of the alimony recipient.

The law makes it possible to foreclose (by seizing) the debtor’s property and subsequently sell it to pay off the debt, block funds in bank accounts and deposits, prohibit the alimony payer from traveling abroad until the debt is repaid, etc. Thus, modern legislation makes it possible to collect alimony even from an officially unemployed father and at the same time provides a number of effective measures that help fight unscrupulous parents, forcing them to pay off the resulting debt in payments for the maintenance of their own children.

Moreover, even in the event of the death of the debtor, the claimant has the right to receive payment against the debt that was incurred for alimony during the life of the payer. To do this, you need to obtain a certificate from the bailiff about the amount of such debt, and then go to court with a claim to recover this amount from the heirs of the deceased debtor who accepted his inheritance. At the same time, regular payments (monthly) cease with the death of the debtor, including if his children have not yet reached the age of majority.

Statement of claim for collection of alimony debt (sample)

How much child support must be paid in 2020?

According to Article 81 of the Family Code of the Russian Federation, the parties have the right to independently agree on monthly payments for the child. If both guardians of the child could not come to a common decision on the amount of child support, they must use the established minimum:

- For one minor, a quarter of the income is paid - 25%.

- For two children, a third of the income is paid - 33%.

- For three or more children, half the income is paid - 50%.

Examples of alimony calculations

In order to understand the system of deducting alimony from unemployment benefits, it is necessary to consider a specific example.

It is worth considering that its size is set based on the average level of official earnings over the last 3 months. According to Government Decree No. 1375 dated November 15, 2018, in 2020 the minimum amount of alimony was established in the amount of 1.5 thousand rubles, and the maximum amount was 8 thousand rubles. (for pensioners – 1280 rub.)

For example, citizen Petrov registered and receives 1.5 thousand rubles. He has one minor child for whom child support must be paid. The following calculation will be carried out at the employment center:

1.5 thousand rubles. * 25% = 375 rub. – amount of payments per child.

Petrov should receive 1125 rubles. (1500-375 rub.). But in fact, he will receive less. This will happen due to the fact that the cost of sending money will be deducted from the calculated amount. But even for such penalties there are also restrictions. A maximum of 70% of the unemployment benefit payment amount can be recovered. In this case, citizen Petrov can receive at least 450 rubles. And if you take into account delivery and money transfer services, this amount will be about 350 rubles.

Next, it is worth considering the situation when alimony is paid in the amount of more than a monetary amount. A father on unemployment benefits with such a child benefit system can find himself in serious financial difficulties.

For example, citizen Ivanov pays monthly alimony for a minor child in the amount of 6 thousand rubles. But, after some time, he lost his main job, and his official income is 3 thousand rubles. (size of minimum unemployment benefit).

Taking into account the minimum collection percentage, the amount of alimony from this level of income will be about 2.1 thousand rubles. Since according to the exaction sheet the amount of alimony was initially 6 thousand rubles, with monthly payments of 2.1 thousand rubles, Ivanov will still owe his child 3.9 thousand rubles.

HR outsourcing

Ivan - alimony is paid as a percentage of all types of earnings. (all those that the Wife can prove). the question is how you want to pay alimony - if you have high earnings, then draw up an alimony agreement with your wife - it’s more profitable for you, negotiate the monthly amount and it will not change. If she applies for alimony, she must prove your earnings - that is, the personal income tax is yours. And since you don’t work, you’ll have to pay Mrot!

We recommend reading: Tax refund when buying a car on credit

How can a child support payer reduce the amount of payments?

To request a reduction in the amount of alimony, the alimony payer must submit a corresponding application to the magistrate's court. In this letter it is necessary to clarify the details of the plaintiff and defendant. Such information is indicated in the header of the application.

The body of the application must clearly explain the circumstances associated with receiving unemployment benefits. It is also worth arguing for a request for a temporary reduction in the amount of alimony payments. To do this, the plaintiff must collect a package of the following documents:

- A copy of the alimony payer’s passport.

- A copy of the child's birth certificate.

- A document that officially confirms the reasons for collecting alimony in a certain amount.

- Certificate of dismissal of the alimony payer from the previous place of work.

- A document from the Employment Center, which will confirm the established amount for alimony payments.

There are many factors that can significantly influence the court's decision to reduce the amount of alimony payments. You can add documents to your application that will confirm a responsible approach to the alimony payment procedure. For example, you can provide monthly checks and bank statements that record the fact of payment of alimony.

Should an unemployed person pay child support?

Offer - yes, force - definitely no. In some regions, employment authorities cooperate closely with bailiffs, while in others they do not. no, there was no such thing in the powers of the bailiff, bailiff...

Very often a situation arises when a person wants to support his child after a divorce, but he simply does not know how to do it correctly. The lack of official work complicates understanding. Today a young man came to see me with a simple question about how to pay child support if I am not officially employed.

The method for determining the amount of alimony obligations by a judge, including for a person who finds himself unemployed or without an official income, is to take into account the specified principles.

This is due to the fact that both parents are required to participate in these expenses. In this case, it is necessary to prepare a calculation of alimony based on actual receipts from stores, as well as for a certain period of time in advance.

What do you need to do to join the labor exchange?

To join the labor exchange, you must fulfill a number of conditions:

- An individual must be 16 years of age.

- The individual must have the desire and readiness for a new job search.

- An individual must be ready to take up the vacancies offered to him.

In order to register with the Employment Center at your place of residence, you must provide the following documents:

- Work book.

- Passport of a temporarily unemployed person.

- Document confirming qualifications and education.

- Salary certificate from the previous place of work for the last three months.

The maximum amount of unemployment benefits can be received by people who have lost their jobs due to dismissal or layoff. Also, the work experience must not be less than 26 weeks. Registration with the labor exchange was carried out no later than a year after the loss of work.

What to do if the postal order is returned to the employment center

There are cases that the claimant for a number of reasons (changed address, etc.) did not receive a postal transfer and the transfer is returned to the employment center. For the return of postal orders (unreceived alimony), postal offices require a fee.

Thus, in accordance with clause 35 of the Decree of the Government of the Russian Federation of April 15, 2005 N 221 “On approval of the Rules for the provision of postal services,” the addressee (his legal representative), and in the case of return, the sender may be charged a fee for storing the registered postal item for a period of more than one working day after delivery of the secondary notice with an invitation to the postal facility to receive the postal item (not counting the day of delivery). The amount of storage fees is determined in accordance with the tariffs established by postal operators.

In this case, it must be borne in mind that, as a general rule, there is no basis for classifying such a tariff as an employment center expense. Transfer and transfer of funds in the form of alimony are made at the expense of the debtor (Article 109 of the RF IC).

According to paragraph 16 of Directive N P-7-10-307, in cases where the address of the person in whose favor alimony is being collected is unknown, the withheld amounts are transferred to the deposit account of the district, city (district in the city) court at the location of the employment center .

The main requirement is that parents must support their children who have not reached the age of majority, regardless of their current financial capabilities (Article. If the alimony payer currently has no income that can be levied, he accumulates debt, which is repaid when he earns money.

There are several ways to set the amount of regular payments for alimony obligations: In the first case, interested parties need to discuss the needs and capabilities of each of them, find a compromise solution and fix it in a bilateral agreement.