Retirement of women born in 1964 under the new law

In 2021, a law raising the retirement age came into force, which primarily affected women born in 1964 . They will be the first to retire under the new law. According to the standards of the old legislation, they were supposed to retire at the age of 55, that is, already in 2021. But taking into account the transitional provisions of the reform, the age value for them increases by 1 year (see Appendix No. 6 to Federal Law No. 400 of December 28 .2013).

However, women born in 1964 are eligible for a benefit that allows them to receive pension payments six months ahead of schedule. This right is granted in accordance with Part 3 of Art. 10 of Law No. 350-FZ of October 3, 2018. This means that their retirement is postponed only for six months .

Thus, women born in 1964 will retire at the age of 55 years 6 months . This will take place according to the following scheme (depending on the month in which they were born):

| Date of Birth | When will they retire |

| January 1964 | July 2019 |

| February 1964 | August 2019 |

| March 1964 | September 2019 |

| April 1964 | October 2019 |

| May 1964 | November 2019 |

| June 1964 | December 2019 |

| July 1964 | January 2020 |

| August 1964 | February 2020 |

| September 1964 | March 2020 |

| October 1964 | April 2020 |

| November 1964 | May 2020 |

| December 1964 | June 2020 |

The pension legislation provides for various benefits, as a result of which the retirement age can be reduced (that is, it will be possible to retire earlier than the period specified in the table).

How to calculate old age pension correctly

The calculation uses the so-called increase in length of service during Soviet times and in the new Russia. Soviet periods increase by 1%, periods of employment according to the Labor Code of the Russian Federation from the moment of collapse to 2002 by 10%.

These contributions increase over the years under an agreement concluded with the Pension Fund or Non-State Pension Fund, and upon retirement, a person has the opportunity to receive the invested funds and increased by interest as a pension.

This is interesting: Additional payment to the Pension of the Ministry of Labor Veterans

Retirement of a mother of many children born in 1964

Simultaneously with the law on retirement age, new benefits came into force in 2021. One of these benefits is early pension for mothers with many children - with 3 and 4 children (for mothers with five children such a benefit was provided previously).

According to the new law (clauses 1.1 and 1.2, part 1, article 32 of law No. 400-FZ):

- mothers with three children retire at 57;

- and with four - at 56.

Since the law provided for a fixed age, mothers with 3 and 4 children born in 1964 will not be able to take advantage of this benefit. It is more profitable for them to arrange payments according to generally established standards, since they are much lower than those provided for on a preferential basis (at 55 years 6 months). Therefore, the deadlines for processing payments will correspond to the generally established ones (see table).

Let us remind you that for a preferential appointment it is not enough just to reach the established age:

- Children must be raised until their 8th birthday ;

- A woman must have at least 15 years of insurance experience and an IPC of at least 30 points.

In addition, when determining the right to benefits, children in respect of whom the mother was deprived of parental rights or whose adoption was canceled are not taken into account.

Early exit based on length of service (37 years)

If you have a long work history (37 years for women), you can apply for a pension before reaching retirement age. Having developed the required length of service, a woman can become a pensioner 24 months before the statutory period, but not earlier than 55 years .

Since the law sets the retirement age at 55.5 for women born in 1964, the length of service benefit for them will not be provided in full . The reduction will be only six months instead of two, since the law limits the lower age limit. Therefore, women born in 1964 with 37 years of experience they retire at 55 .

Let us remind you that the duration of this length of service includes only periods of working activity and paid sick leave. That is, the time a woman is on maternity leave for up to 1.5 years is not included in it.

How is pension calculated for those born before 1967?

- Basic. This indicator is most strongly influenced by the age of the pensioner. If an elderly person is over eighty years old, then the pension will be high, since the basic part for this age is calculated based on the rate of 19 years.

- Cumulative. This part of the pension is only available to citizens born before 1967 and is defined by law, but it ceased to apply in 2005. The employer contributed 6% of wages to the Pension Fund of the Russian Federation monthly. The savings part is formed from this money. The total amount used to offset the funded part should not exceed 463,000 rubles per year.

- Insurance. This part is calculated based on the length of service accumulated by 2002, the average salary and a special coefficient.

Every year a bill to increase the retirement age is introduced into the State Duma, but such an innovation has not yet received approval. The retirement age currently determined for women is 55 years, and for the stronger half of humanity - 60 years. Following the example of many countries in the world, as well as neighboring CIS countries, the retirement age in our country will be increased, but according to analysts, this will not happen soon.

This is interesting: Is it possible to sell an apartment with temporarily registered persons

How to calculate a pension for a woman born in 1964

The calculation of the insurance pension (SP), regardless of the citizen’s date of birth, is carried out according to the formula:

SP = PV + ∑IPK × SIPC

Where

- PV – basic part of the pension (fixed payment);

- ∑IPK – total IPC on a citizen’s personal account (SNILS);

- SIPC is the cost of one IPK (or so-called pension point).

The total IPC depends only on the citizen - on the duration of his work, “non-insurance” periods, for which points are also awarded (caring for a child under 1.5 years old, military service), etc. And the values of the fixed payment and the cost of the pension coefficient are established by law and change annually.

Since women born in 1964 retire in 2019 and 2021, the calculation of the payment assigned to them will be different.

- When calculating pensions in 2021, the following values will be used: PV = 5334.19 rubles, SIPC = 87.24 rubles. This applies to women born from January to the end of June 1964.

- When calculated in 2021 : the fixed payment is equal to 5686.25 rubles, the cost of one coefficient is 93 rubles. This applies to women born from July to the end of 1964.

This does not mean that women born in 1964 who received a pension in 2019 will have lower payments than those who received a pension in 2020. From January 1, 2020, their collateral will be recalculated taking into account the current values of the PV and SIPC (traditional indexation will be carried out).

Calculation of pensions for those born before 1967

- work books:

- extracts from orders;

- employers' certificates;

- documents on service from the military registration and enlistment office;

- extracts from archival institutions;

- certificates of payment of taxes during periods of individual entrepreneurship;

- protocols for interviewing witnesses if it is impossible to provide other documents.

The pension capital as of January 1, 2002 (the start of a new pension accrual) should be calculated as follows::

09 Jun 2021 uristlaw 239

Share this post

- Related Posts

- Where is the Information on Demolition of Houses in Voronezh

- How to Register a School Card for State Services Nutrition

- How to Calculate Pension in 2021 for a Man Born in 1958

- Will there be an increase in pensions for non-working pensioners from October 1

Calculation example

Lyubov Ivanovna Smirnova was born on May 25, 1964. She plans to retire and wants to calculate when she will be able to do this, as well as calculate the amount of payment that will be assigned to her in the Pension Fund.

- According to the table, Lyubov Ivanovna will retire on November 25, 2019, when she turns 55.5 years old .

- When calculating her pension payment, the size of the fixed payment and the cost of one point will be used, established for 2019 - 5334.19 and 87.24 rubles, respectively.

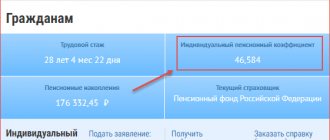

To find out how many pension points have accumulated on SNILS, Lyubov Ivanovna will use her personal account on the Pension Fund website (picture below) or contact the territorial office of the Pension Fund.

Smirnova has 46.584 points, which means the size of her future pension will be equal to: 46.584 × 87.24 + 5334.19 = 9398.18 rubles .

In addition, from January 1, 2021, indexation will take place for non-working pensioners, and this payment will be recalculated taking into account the new values of the PV and SIPC. The new security amount will be: 46.584 × 93 + 5686.25 = 10018.56 rubles .

Formula for determining the insurance part

Taking into account the above criteria and relying on the provisions of Law No. 400-FZ (December 28, 2013), the insurance pension formula for women born in 1964 can be expressed as follows:

RSP = FV + SPB × KPIK, where:

- RSP – amount of insurance pension;

- FV is a fixed (basic) component, the size of which for 2019 is set at 4,982.90 rubles;

- SPB - the cost of a pension point (in 2021 - 81.49 rubles)

Please note that in addition to the insurance pension, women born in 1964 can also receive a funded pension, but only if it is formed. The size of the payment depends on several factors:

- the amount of contributions to be deducted;

- the number of years during which contributions were made;

- in which fund the savings were placed (each company has its own interest rates).

- What may change in the passports of Russian citizens

- Why do cerebral vessels narrow in older people?

- How to cook pearl barley in water

What factors influence the value of the IPC?

During their working career, women receive a salary, based on the amount of which the employer pays insurance contributions to the Pension Fund. Subsequently, they are converted into pension points, the number of which directly affects the size of the pension payment. For different periods of employment, the IPC is determined taking into account a number of features:

| Calculation time periods | Criteria taken into account when calculating | Peculiarities |

| Until 2002 |

| Due to the fact that the Pension Fund does not have enough information about the length of service and accruals made, the IPC may be reflected erroneously in each individual case. To avoid this, it is recommended to provide all possible evidence of employment at this time and confirm the amount of salary received. |

| 2002–2014 | Funds accumulated in accounts are converted into IPC using a special formula | You can calculate the number of IPCs yourself by using the calculator on the Pension Fund website |

| Since 2015 | Determined by the amount of insurance premiums | Calculation is carried out for each year worked |

| Other periods | The IPC is stipulated by law depending on the reason for lack of employment | The periods during which the woman did not work are taken into account. This includes:

|

The number of pension points can be calculated on the Pension Fund website, using a special calculator, or using the following formula:

IPC = Amount of insurance contributions of a citizen for a specific year / Standard amount of contributions for an insurance pension × 10

Increased indexation of pensions

To gradually increase the retirement age, a long transition period of 10 years is provided (from 2021 to 2028). Adaptation to the new parameters of the retirement age in the first few years of the transition period is also ensured by a special benefit - the assignment of a pension six months earlier than the new retirement age. It is provided for those who were supposed to retire in 2021 and 2021 under the previous legislation. These are women born in 1964–1965 and men born in 1959–1960. Thanks to the benefit, pensions on new grounds will be assigned as early as 2021: for women aged 55.5 years and men at age 60.5 years.

What changes are provided for pensioners

● in difficult working conditions, as locomotive crew workers and workers directly organizing transportation and ensuring traffic safety on railway transport and the subway, as well as truck drivers in the technological process in mines, open-pit mines, mines or ore quarries - men and women;

May 04, 2021 uristgd 366

Share this post

- Related Posts

- Risks when buying a summer house in SNT 2021

- Experience for Labor Veterans in Perm

- Sample of filling out an Application for Insurance Payment in Alfa Insurance Accident

- Holidays at State Expense for Low-Income Families in 2021