One-time payment to pensioners: who is entitled to it and how to receive it

Recently, the Government of the Russian Federation has been developing a Law according to which every citizen has the opportunity not only to receive a labor pension for life from pension savings, but also to count on a one-time social benefit. In addition, each pensioner is given the right to receive urgent SPN pension payments, which were formed from voluntary insurance contributions.

- Citizens applying for pension payments due to the loss of a breadwinner.

- Persons receiving a disability pension and pensioners unable to work due to illness.

- Citizens who do not have rights to pensions due to lack of work experience, but are covered by state pension provision in the form of a social pension.

How to receive lump sum payments

The accumulated funds can be received one-time or no more than once every 5 years. Payments are available subject to the following conditions:

- The insured person born in 1967 and later did not refuse the opportunity to form a funded pension, and the employer made contributions.

- The pensioner continued to independently pay insurance premiums for the funded portion of his income.

Conditions of receipt

Based on Art. 4 of Law No. 360-FZ, the following insured persons can apply for security:

- receiving pensions for old age (age, including those assigned early), disability, and loss of a breadwinner;

- those receiving a social pension provided due to insufficient insurance coverage or pension points;

- who have accumulated contributions of 5 percent or less of the amount of the old-age insurance pension component.

- 5 best clinics for joint treatment

- Ceiling made of plastic panels

- How to lower cholesterol without drugs

What payments are due to pensioners born in 1957?

Currently, the Pension Fund is waiting for applications for payment of pension savings primarily from pensioners: men younger than 1953 and women younger than 1957, for whom from 2021 to 2021 employers paid insurance premiums for the funded part of their labor pension at a rate of 2%. The average amount of pension savings of these citizens is 5-6 thousand rubles, so the law provides for them the opportunity to receive these funds in the form of a lump sum payment. That is, if a citizen’s pension savings amount to 5 percent or less in relation to the total amount of his labor pension, then he will receive a lump sum payment.

What are the main innovations regarding the payment of pension savings established by the Law? (briefly) For the first time in the history of the Russian pension system, the law gives citizens the opportunity to receive pension savings as part of their labor pension, not only for life, as part of monthly payments (pension capital divided by the expected period of payment of the labor pension), but also (if eligible) as a lump sum payment. Citizens are also given the right to receive pension savings funds generated from their own additional contributions as an urgent pension payment. The law also expands the possibilities of succession of pension savings. Previously, legal successors could receive the pension savings of the insured person only if he died BEFORE he was assigned a labor pension. According to the Law, in the event of the death of an insured person who has been assigned a fixed-term pension payment, the remaining unpaid portion is payable to his successors. The Law also defines issues of legal succession of pension savings in the event that a mother sends funds from maternity (family) capital to an NPP (see below).

One-time payments to pensioners born before 1966: amount, news

Recent years have been full of events concerning pensioners. As soon as we got used to raising the retirement age, we started talking about the EDV again.

Let's find out what lump sum payments are to pensioners born before 1966: the amount, what news awaits us.

Types of lump sum payments to pensioners born before 1966

A one-time payment is not a monthly indexation of the pension, but a one-time payment, which is taken from the pension savings accumulated by the citizen in the Pension Fund account.

- Urgent. These are benefits that are paid monthly and are designed for a certain period of validity.

- Cumulative. They are appointed after loss of ability to work and are paid from the fund to which the employer transferred the money.

- For legal successors. The money is transferred to the relatives of pensioners who have died but managed to accumulate savings.

- Lifetime. This type of payment assumes that the funds will be received regularly throughout the citizen’s life.

Types of lump sum payments

A cumulative lump sum payment can be received if certain conditions are met. Anyone born before the specified date will be denied this payment if applying for an open-ended or fixed-term pension option.

Exceptions are possible to every rule. One of them works if, when forming this kind of savings, the monthly payment is less than 5% of the amount of the old-age pension payment.

In a number of cases specified in Russian laws, early processing of such payments is possible.

Types of payments

Who can count on EDV

In 2021, one-time payments to pensioners born before 1966 can be provided to women born in 1957, and for men born in 1953.

The law lists all the grounds for receiving them and the categories of citizens entitled to this compensation. These include:

- Those who worked in 2002, 2003, 2004. The administration of their enterprises transferred funds for accumulation.

- Those who have taken out pension insurance, which is indicated in the personal account of the PRF, that is, who have previously written an application to divide the pension into funded and insurance.

- Participants in the co-financing program who donated money to the pension fund voluntarily. Also, if the difference between the insurance and savings part is more than 5%.

- Women who have invested maternity capital in the Pension Fund.

- Foreigners who live on the territory of Russia and meet all the requirements of the situation.

- Such one-time payments can be received by disabled pensioners of groups 1-3, residents of the Russian Federation receiving a survivor's pension and having social cash benefits for old age in the absence of the necessary length of service or accumulated individual pension points to receive a state insurance pension.

Who is entitled to lump sum payments?

Conditions of receipt

For one-time payments to pensioners born before 1966 and who have grounds for receiving them, you need to come to your pension fund branch or multifunctional center where you write an application for compensation. This can be done not only in 2021, but also later.

The steps for registration are as follows:

- Collect the necessary package of documents.

- Go to the MFC or Pension Fund branch.

- Submit your application and documents.

- Receive a receipt indicating that the application has been registered.

- Wait for a decision.

- If the answer is positive, receive compensation.

Lump-sum payments to pensioners born before 1966 are calculated depending on savings. The amount may vary for different citizens.

Application methods

In addition to visiting the PRF, there are other ways to process payments. Let's look at them.

- Personal appeal to representatives of the pension fund or MFC.

- Through your personal account on the State Services portal.

- Log in using your username and password to the pension fund website.

If it is not possible to contact the authority yourself, this is done through a proxy who, in addition to his passport, provides a notarized power of attorney. List of documents

In order to receive compensation, you must collect and provide a package of documents or notarized copies. The law has been amended accordingly regarding who is entitled to compensation and the list of documents to receive:

- Passport of a citizen of the Russian Federation.

- For foreign citizens, a document confirming work and residence in Russia, an identity card.

- Statement of the established form.

- Work record book or documents confirming work experience and payment of insurance contributions to the state or non-state pension fund.

- Pensioner's ID.

- SNILS.

- Certificate of pension savings.

- If available, proof of disability.

To calculate the amount of payments, the application must contain the following data:

- Last name, first name, patronymic of the applicant.

- Registration and residence address.

- Passport details with date and place of birth.

- Insurance ID details.

- Contacts: email address, phone numbers.

- Savings account number

Preferred method of receiving money. If non-cash, then current account or card number.

- Date and signature.

- Payment terms

One-time payments to pensioners born before 1966 are made on time.

Documents are initially verified within 1-2 days. If the information is incorrect or there is no basis for calculating payments, then within 5 days a refusal is received in which the citizen is warned about the reasons.

If the documents have passed the initial check, then after 30 days the registration itself takes place, during which specialists collect certificates from the relevant authorities and calculate how much needs to be paid. The money is then transferred to the account or the applicant is invited to receive it.

Sometimes the process takes longer, but not more than 2 months.

The latest news for 2021 suggests that accruals are already being issued from February 1st. If you meet the criteria mentioned above, feel free to go to a pension fund.

Source: https://pokemongogid.ru/pensioneram/edinovremennye-vyplaty-pensioneram-rodivshimsja-do.html

One-time payments to pensioners born before 1966 - grounds for receiving

- survivor's pension;

- the right to social benefits in old age in the absence of the necessary length of service or accumulated individual pension points to receive a state insurance pension.

- voluntary participants in the state co-financing program who entered it before the end of 2021;

- who allocated maternity capital to form a pension.

We recommend reading: How to register an apartment yourself through government services

Who is eligible for one-time savings payments?

The law determines that payments can only be received upon reaching retirement age.

Accumulated funds, investment income, and amounts received as a result of the co-financing program are taken into account for calculation. A one-time payment to pensioners from the funded part of the pension is subject to the following conditions:

- work in the period from 2002 to 2004;

- birth dates for women were from 1957 to 1966, for men – 1953-1966.

Non-working pensioners insured by the Pension Fund of the Russian Federation (PFR) or a non-state structure can apply for a one-time type of financial support. The employer deducted contributions from their earnings at a rate of 22%: 16% - insurance, 6% - solidarity tariff. The following persons have the opportunity to receive payments:

- voluntary participants in the state co-financing program who entered it before the end of 2014;

- who allocated maternity capital to form a pension.

- Free excursions around Moscow - list of the most interesting, duration and schedule

- How will the assessment of the poverty level in Russia change?

- 5 problems that swollen lymph nodes may indicate

Is a lump sum payment available to pensioners born in 1957?

But even in this case, it is provided from the state not just to pensioners born in 1957, but to those who entrusted their funds to the Pension Fund. Those who have chosen NPFs for this need to contact these organizations if they still exist.

The payment is not due to all pensioners who have reached 60 years of age; it does not have a fixed amount and can be paid not only to those born in 1957. And unsubstantiated rumors that only women can apply for a one-time payment are also untrue.

One-time payment to working pensioners in January 2021

True, it is worth making a small clarification about pensioners who do not give up their work duties during their well-deserved retirement. So, if their profit is above 1 million rubles, then there will be no one-time payment to working pensioners in January 2021. Moreover, in this case, even a standard benefit is not eligible for accrual.

You can receive the assistance required by law at the Pension Fund branch located in the region where Russian citizens live. At the moment it is known that 5 thousand rubles. will be equal to a one-time payment to pensioners in January 2021. Dmitry Medvedev states that this amount will cover the rise in food prices, despite its small size.

We recommend reading: What is a house cadastral passport and why is it needed?

One-time payments to those born before 1966: payment amount and receipt procedure

- A one-time payment is provided for pensioners born before 1966 (women since 1957, and men since 1953);

- Those for whom the difference between the insurance and funded pension is 5%;

- Individuals who participated in the state co-financing program;

- Persons who have pension insurance, which is reflected in a special individual personal account;

- People who worked in the period 2021-2021;

- Persons who transferred funds from family capital for a future pension;

- Foreigners who meet all the above requirements and reside in Russia on a permanent basis.

- Direct statement;

- Passport or other identification document;

- Labor and pension book;

- SNILS;

- Certificate on the amount of pension savings;

- Confirmation of receipt of assistance from the state for disability;

One-time payments to pensioners born before 1966 as of today, 02/28/19″

One-time payment to those born from 1953 to 1966: how to receive

It turns out there is a payment for men and women born from 1953 to 1966. And not only does it exist, but it also functions successfully.

However, not everyone has an idea: what the payment is, what it is for, and who exactly has the right to receive it.

The one-time payment (LAP) that I am talking about is available to both men and women.

But there are several aspects that are important to know before contacting the Pension Fund for its provision. The fact is that the state has set certain obstacles that are important to comply with. And many people simply don’t know about them.

The Internet is replete with information on this issue, but not all sources are replete with truthfulness. Therefore, you should not take everything for granted.

Information taken from official sources (PFR and State Services) states that the payment exists and has no time frame. It can be obtained at any time of the year. And next year it will also operate.

With the documents for registration, you should contact the Pension Fund at your place of residence, write an application, and in about a month the money will arrive in your bank account.

Payments to those born between 1953 and 1966 can be received by:

- men born from 1953 to 1966;

- women born from 1957 to 1966.

And the main condition for receiving EDV: a person had to contribute money to the funded part of the pension from 2002 to 2004. In essence, this EDV is the same money that was allocated by a person to the savings portion.

If you don’t know or don’t remember whether you made contributions or not, you can find out about this from the Pension Fund. Its staff will provide all the necessary information.

Federal Law No. 360 of November 30, 2011 provides for the following types of social payments:

- Urgent - performed every month for a set period;

- Savings - paid monthly as compensation for loss of ability to work after the amount in a special account where the money was transferred by the employee or his employer;

- For legal successors - the funds are received by the relatives of the deceased insured citizen, as well as other persons who can legally inherit the unpaid portion of the money;

- Lifetime – a citizen regularly receives government assistance for the rest of his life;

Poroshenko announced the US refusal to negotiate with Russia

Biletsky told how he was “infected” with Russophobia while still at school » News from Russia and the world today

Payment to pensioners born in 1953-1966 is made at a time from the following sources:

- Security in case of loss of a breadwinner;

- Fixed subsidies - from an annually indexed base payment, the amount of which is affected by length of service, place of residence, age, presence of supported family members and disability;

- From old age insurance benefits - consists of insurance contributions stored in the Pension Fund of Russia. The amount of contributions directly depends on the official salary;

- Disability benefits;

- For final calculations of wages and vacation pay upon the worker’s retirement;

- Funds received from the co-financing program;

- From accumulative savings, which consist of social contributions (subject to their investment in 2002-2004).

Who is eligible for one-time compensation?

Art. 4 of the Law “On Funded Pension” and the rules of the compulsory insurance system list a number of persons who have the right to one-time payments from the Pension Fund:

- A one-time payment is provided for pensioners born before 1966 (women since 1957, and men since 1953);

- Those for whom the difference between the insurance and funded pension is 5%;

- Individuals who participated in the state co-financing program;

- Persons who have pension insurance, which is reflected in a special individual personal account;

- People who worked in the period 2002-2004;

- Persons who transferred funds from family capital for a future pension;

- Foreigners who meet all the above requirements and reside in Russia on a permanent basis. When paying a lump sum benefit, pensioners born in 1957-1966. do not give the right to choose the option of forming future security, while such an opportunity is provided for younger fellow citizens. But it is precisely this category of persons that meets the requirements for simultaneous compensation. From 2002 to 2005, employers of such citizens were required to make payments for a funded pension.

Payments to pensioners born in 1953-1967

The Pension Fund of Russia, after a flurry of posts about receiving payments, gave citizens clarification regarding receiving a one-time payment. It turned out that there are much more categories of people entitled to it, and the age criterion is not necessary. So, citizens can count on payment if one of the following criteria is met:

The latter category specifically includes women born from 1957 to 1966, and men born from 1953 to 1966. They found a time when part of the funds went to the funded part of the pension. However, they can only receive payments if they have a balance in their pension savings.

One-time payments to pensioners born in 1953-1967

A one-time payment is made from pension savings. With the documents for registration, you should contact the Pension Fund at your place of residence (if you have chosen a non-state fund, then to it), write an application and in about a month the money will arrive in your bank account. There is no urgency in filing such an application; it can be submitted indefinitely. There are no time limits set.

“The main condition for receiving a lump sum payment is that the citizen reaches retirement age, i.e. assignment of an old-age insurance pension, including early. Citizens born in 1967 and younger can receive a lump sum payment from pension savings once, or no more often than once every five years, if they have not refused to form a funded pension, or for pensioners who continue to pay insurance premiums for a funded pension on their own,” they explain. to the Pension Fund of Russia.

Cumulative pension for citizens born in 1953-1967

Persons in this age group can form pension savings. These funds were formed from insurance transfers from employers made in the period 2002-2004. Previously, until 2014, the insurance premium for Russians younger than 1967 was distributed in fixed proportions:

- 6% – joint and several part (not reflected in the individual account of the insured);

- 10% – insurance part (on an individual account);

- 6% – funded part.

The funded component (6 percent) is not used to pay current pensioners; it is invested and can be transferred to legal successors. The following can receive the funded part of the pension at a time:

- Persons born in 1967 and younger when they are assigned an early insurance pension upon reaching age (old age).

- Citizens in whose favor in 2002-2004. insurance premiums have been paid for the funded part of pension deposits. Since 2005, deductions have ceased due to legislative changes. This condition applies to citizens born in 1953-1966. (male) and born 1957-1966 (female).

- Russians who participated in the state co-financing program when forming a pension. The program was open for entry during the period 01.10.2008–31.12.2014. Citizens who paid the first installment before January 31, 2015 are considered participants.

- Persons who have allocated maternity capital to form a future pension (only for women).

What payments are due?

If a Russian has savings in a pension fund, state or non-state, they can be obtained in several ways. According to Law No. 360-FZ of November 30, 2011, 3 types of payments are provided:

- unlimited (performed every month throughout the life of the pensioner);

- urgent (during the period established by the pensioner themselves);

- one-time (one-time payment).

After the death of a pensioner, his heirs can claim the funded pension of the deceased. Important: a lump sum payment is established under conditions strictly defined by legal norms. Pensioners, real and potential, born before 1967, unlike the younger generation, were deprived of the right to choose the type of pension formation.

- 9 working schemes for leaving less money in grocery supermarkets

- How to find a person by phone number

- Law on silence in new buildings in Russia

In 2002-2005 their employers paid contributions to the funded component of the pension in accordance with the established mandatory procedure. In this category, such savings that have been accumulated for a short time are insignificant, and with a value of less than 5 percent, citizens born in 1953-1967 can receive savings provision in lump sum payments (based on Article 4 of Law No. 360-FZ of November 30, 2011).

Amount of pension savings

It is necessary to clarify the size of possible payments depending on the place of their formation. If the funds were transferred to the management of any non-state pension fund (abbreviated as NPF), then the pensioner should apply for receipt to a specific NPF.

If contributions were made to the Russian Pension Fund, this authority pays the funds. With this option, the MFC also considers the request for payment. If a pensioner does not know where the funds are located, this can be clarified at the territorial branch of the Pension Fund, through the State Services portal or the MFC.

What payments are pensioners entitled to in addition to the monthly pension?

If a pensioner receives EDV, he is also entitled to take advantage of a range of free services; this right does not need to be proven; it arises automatically upon confirmation of preferential status. So, an individual has the right to hope for:

- Receiving medications from a state pharmacy. Unfortunately, in 2021, not all medications appear on the free list, and state pharmacies are only available in large cities.

- Participation in the queue for free vouchers to a sanatorium is based on disability confirmed by documents. If a disabled person has the 1st group of disability or has been disabled since childhood, then exactly the same free accompanying voucher is issued for another 1 family member.

- Free travel to the place of treatment and home by train.

We recommend reading: Benefits for the poor in Perm

What additional payments are due to pensioners?

- For work in the Far North . The amount of payment depends on the time of work. For 10 years, an additional 1,300 rubles are charged, for 15 - about 2,200.

- Agricultural workers . The introduction of such a premium is only in the future. In theory, it should be 1100 rubles.

- For postponing retirement . This payment accumulates during work and is accrued upon completion of work. The amount of the premium depends on the specific enterprise.

- Regional (if income is equal to the regional subsistence level): Civil servants for government experience . If a pensioner has worked in government service beyond the norm, for each extra year he must receive an additional 3% of the pension payment.

- To the military for injuries during service . The amount of the supplement depends on medical indicators and is set individually.

- For the loss of a military breadwinner. A certain percentage of the total amount of the social pension is assigned.

Elderly residents of Moscow and St. Petersburg are entitled to a number of additional payments, because living in these cities is more expensive than in other Russian cities. The minimum established pension for Muscovites is 12,000 rubles.

Explanations from the Pension Fund: what payments are due to pensioners

Types of payments of pension savings funds According to Federal Law dated November 30, 2021 N 360-FZ (as amended on October 3, 2021) “On the procedure for financing payments from pension savings funds,” the following types are made from pension savings funds formed in favor of the insured person payments:

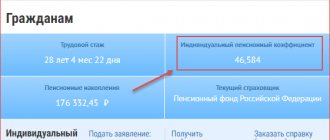

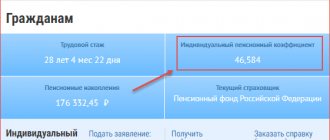

To obtain information about the amount of pension savings, you must request a notification about the status of your individual personal account. Today this can be done in several ways. The most convenient and fastest is in your personal account on the Pension Fund website, on the government services portal, as well as using the mobile application “PFR Electronic Services”.

How to get a funded portion for a pensioner born in 1956

- What is a payment from a funded pension, and what amount are we talking about?

- Conditions for payment from the funded part of pensions to disabled people

- How to receive a lump sum payment - instructions

Who is entitled to a lump sum payment from the funded portion in 2021?

- Photocopies of the main pages of the applicant’s identity document.

- SNILS.

- A document issued by the pension fund department stating that you are receiving a pension.

- Power of attorney, if the principal applies.

- Photocopies of important pages of the principal's passport.

One-time payment to pensioners born before 1957

Information about payments to pensioners born in 1953-1967 has been appearing on the Internet from time to time for several years now. Moreover, many citizens panic about the urgency of receiving monetary compensation, believing that it needs to be processed as soon as possible, otherwise the right to it will be lost.

How to receive the funded part of a pension for a pensioner born in 1955

In addition to the lump sum payment, the law provides for two more types of pension savings payments: fixed-term pension payment and the funded part of the old-age labor pension. An urgent pension payment may only include payments from additional contributions within the framework of the state co-financing program for pensions and maternity capital funds, if the woman - the owner of the maternity capital certificate - has allocated its funds or part of the funds to form her pension and has already received the right to receive labor pensions.

I am a pensioner, born in 1955. There is a lot of talk now about the payment of pension savings. My employer also paid insurance contributions for me from 2002 to 2004 for the funded part of my labor pension. Explain it simply, and not as it is written in the law. There's nothing to understand there. Nina Nikolaevna, Irkutsk

We recommend reading: Rating of notaries for inheritance matters in Moscow

Social Payments in 2021 to Pensioners Born in 1957

To receive a cash benefit, there is no need to apply anywhere - the Pension Fund will calculate all payments and make accruals automatically, throughout December of this year - January of the new one. Accordingly, there is no need to write applications, draw up any other papers and documents, or take any active actions.

The period for consideration and decision making is 1 month. Payment is made within 2 months after receiving a positive response from the Pension Fund. In case of a negative result, the applicant is sent a written notification within 5 working days.

A one-time payment to pensioners born before 1966 has no time restrictions

In order to register, you should first prepare the necessary package of documents and then contact the Pension Fund at the place of registration with them. Pension Fund employees on the spot will offer to write a personal application and after a month the funds will be transferred to the specified bank account.

But due to the fact that some people who have reached the retirement age barrier and left work practice do not have sufficient information on this topic, they have to remain in the dark. In this article we will try to explain why a lump sum payment is paid to pensioners born before 1966, as well as who exactly is entitled to receive it.

Receipt conditions for those born before 1966

A one-time accumulative payment to pensioners is made subject to a number of conditions. Citizens born before 1966 are not entitled to receive it if they have applied for a fixed-term or open-ended type of pension contributions. There is an exception when, when establishing such savings, the monthly payment is less than 5% of the old-age insurance pension. Early registration is possible in cases stipulated by the laws of the Russian Federation.

One-time savings can be received by disabled pensioners of groups 1-3, citizens who have:

- survivor's pension;

- the right to social benefits in old age in the absence of the necessary length of service or accumulated individual pension points to receive a state insurance pension.

- How to remove paint from clothes at home

- Hairstyles for kindergarten graduation

- How to sew jeans

One-time payment to pensioners born from 1956 to 1966

The average amount of pension savings of these citizens is 5-6 thousand rubles, so the law provides for them the opportunity to receive these funds in the form of a lump sum payment. That is, if a citizen’s pension savings amount to 5 percent or less in relation to the total amount of his labor pension, then he will receive a lump sum payment. Citizens receiving a social pension or labor pension for disability or loss of a breadwinner who have not acquired the right to an old-age labor pension due to lack of the required insurance experience (at least five years), but have reached the generally established retirement age, can also count on a one-time payment (men – 60 years old, women – 55 years old). At the same time, they must have pension savings.

If the result is positive, a lump sum payment to pensioners is made within a period not exceeding 2 months from the date of the decision. In case of refusal to assign payments, the Pension Fund notifies the citizen in writing of the decision made, indicating the reason.

One-time payment to pensioners

At the same time, money can be issued only to those persons who have reached retirement age. The peculiarity of receiving compensation is that citizens who were born before 1966 cannot independently determine the method of forming pension provision. But those who were born since the beginning of 1967 have this opportunity. Pensioners born before 1966 can receive state assistance, since from 2002 to 2005, employers paid contributions to the funded part of the pension for all their employees.

Dear Lyudmila, this age limit is established by Article 4 of Federal Law No. 360. The peculiarity of providing compensation is that citizens who were born before 1966 cannot independently determine the method of forming a pension. And people born since the beginning of 1967 have this opportunity. Receipt of state assistance is provided for pensioners born before 1966, since from 2002 to 2005, employers paid contributions to the funded part of the pension for all their employees.

If you cannot personally apply for payments, another citizen may represent your interests. In this case, he must have a notarized power of attorney. You do not need to bring original documents; the law allows for the possibility of providing notarized photocopies.

If erroneous information is accidentally provided, or based on the results of an audit, Pension Fund employees reveal that the applicant cannot receive a one-time benefit, he will be notified of this. Information will be received within 5 days from the moment the decision to refuse was made.

Over the past decade, the system for calculating payments to older people has changed significantly. In 2012, a funded pension appeared. And in 2015, payments began to be calculated based on the amount of insurance premiums. They are paid by the employer for each employee. After this, the number of pension points accumulated is calculated and the final payment amount is assigned.

- Men born 1953 - 1966 and women born 1957 - 1966. From 2 to 6% of their salary went to the funded part in the period from 2002 to 2004. Since 2005, deductions for them have stopped.

- Citizens born in 1967 and later. From the very beginning of the reform, 6% of the salary was deducted for them. Contributions stopped at the end of 2013. Then the savings system was frozen.

The insurance pension also includes a fixed part - this is the minimum that a pensioner is guaranteed to receive. Its size is set annually by the state. From January 1, 2021 it is 6044.48 rubles. If certain conditions are met, for example, upon reaching 80 years of age or having dependents, the fixed portion is paid in an increased amount.

– The law gives the right to withdraw a funded pension in a lump sum at the age of 55 for women and at the age of 60 for men. To do this, one of the conditions must be met: there is not enough experience or points to assign an insurance pension, or if the funded part of the pension is less than 5% of the amount of old-age payments. An application for payment must be submitted to the Pension Fund of Russia or to a non-state pension fund if savings are accumulating there,” said Irina Leonchuk, a specialist at the Kemerovo Center for the Protection of Citizens’ Rights.

You can find out the size of the funded part of your pension in the Pension Fund or on the State Services portal. You can get a statement about the status of your pension account in the Sberbank Online application - in the “catalog” tab (at the bottom of the application) you need to find the “State” section.

IMPORTANT! Since 2014, the Government has frozen the funded part of pensions. This means that all 22% of insurance premiums go to forming only the insurance part. This money is used to pay current retirees. The moratorium is valid until 2024. The funded part continues to increase for those who make additional contributions, participate in the State Co-financing Program or have allocated maternity capital to the funded part.

When paying a one-time benefit, pensioners born in 1957-1966. do not give the right to choose the option of forming future security, while such an opportunity is provided for junior citizens. But this same category of persons meets the requirements for simultaneous compensation. From 2002 to 2005, employers of such people were required to make payments towards a funded pension.

- receiving pensions for old age (age, including those assigned early), disability, and loss of a breadwinner;

- those receiving a social pension provided due to insufficient insurance coverage or pension points;

- who have accumulated contributions of 5 percent or less of the amount of the old-age insurance pension component.

- Security in case of loss of a breadwinner;

- Fixed subsidies - from an annually indexed base payment, the size of which is affected by length of service, place of residence, age, presence of supported family members and disability;

- From old age insurance benefits - consists of insurance contributions stored in the Pension Fund of Russia. The amount of contributions directly depends on the official salary;

- Disability benefits;

- For final calculations of wages and vacation pay upon the worker’s retirement;

- Funds received from the co-financing program;

- From accumulative savings, which consist of social contributions (subject to their investment in 2002-2004).

We recommend reading: Does a child need citizenship?

Upon retirement, the cumulative share of transfers does not go towards the old-age pension, the amount accumulates, and it can be transferred to legal successors (heirs). It is from this part that pensioners born in 1953-1967 will be able to receive a lump sum payment.

- Persons born in 1967 and younger when they are assigned an early insurance pension upon reaching age (old age).

- Citizens in whose favor in 2002-2004. insurance premiums have been paid for the funded part of pension deposits. Since 2005, deductions have ceased due to legislative changes. This condition applies to citizens born in 1953-1966. (male) and born 1957-1966 (female).

- Russians who participated in the state co-financing program when forming a pension. The program was open for entry during the period 01.10.2008–31.12.2014. Citizens who paid the first installment before January 31, 2015 are considered participants.

- Persons who have allocated maternity capital to form a future pension (only for women).

Please note : if the size of the funded pension is less than 5% of the funded and insurance amount, it will be paid only in a lump sum; it will not be possible to “stretch” it. The opposite is also true: if it is more than 5%, then you will not be able to get it at once. That is, there is no choice here as such.

A one-time payment is assigned if the estimated amount of the funded pension is 5% or less in relation to the sum of the insurance pension and the amount of the funded pension. To understand whether you are entitled to a lump sum payment of savings, you need to add up the monthly insurance and savings pensions and divide the total amount by 20 (to get a threshold value of 5%). Example for retirement in 2021 (note: calculation may change based on individual parameters):

- Your insurance pension (X) is 13,500 . per month.

- Your pension savings are 103,200 rubles.

- Estimated amount of monthly funded pension (Y) = 103,200 rubles. / 258 months (the so-called “survival period”) = 400 rubles. per month.

The size of the monthly “accumulative” increase in pension will be equal to the entire amount of savings (of course, together with the income from their investment), divided by the number of months in which you will receive it. To estimate the size of your lifetime payments, you need to do some simple calculations. The monthly amount will be equal to the amount of savings divided by the so-called “survival period”. The “survival period” in Russia is adjusted every year and is gradually growing. In 2021 it was equal to 258 months (21.5 years), and in 2021 it is estimated at 264 months (22 years). The increase in this indicator is due to an increase in average life expectancy.

Currently, about 90% of all payments in the compulsory pension insurance system (MPI) are one-time payments. There are several reasons. Some received a small or “gray” salary, others constantly lost investment income by changing insurers, and so on. Today, the size of the average lump sum payment varies depending on the region and is 13-14 thousand rubles.

- name of the authority;

- individual data about the insured applicant;

- SNILS of a pensioner;

- savings account number (filled out by a fund specialist);

- information about already assigned pension benefits;

- method of receiving payments;

- date of registration;

- pensioner's signature.

- to the territorial branch of the Pension Fund or MFC at the place of residence - upon a personal visit to the pensioner;

- via the Internet on the website of the Pension Fund of Russia or in the system on the State Services portal - electronically, by registering there and opening a personal user account;

- by registered mail.

Some citizens of retirement and pre-retirement age mistakenly count on a one-time receipt of funds from the insurance component of their pension. The Pension Fund was given an explanation that a one-time payment is possible from pension savings, first of all, when a Russian reaches retirement age.

- receiving pensions for old age (age, including those assigned early), disability, and loss of a breadwinner;

- those receiving a social pension provided due to insufficient insurance coverage or pension points;

- who have accumulated contributions of 5 percent or less of the amount of the old-age insurance pension component.

It is necessary to clarify the size of possible payments depending on the place of their formation. If the funds were transferred to the management of any non-state pension fund (abbreviated as NPF), then the pensioner should apply for receipt to a specific NPF.

The third condition is that a one-time payment can be assigned if a citizen’s pension savings amount to 5 percent or less of the currently received insurance pension. Otherwise, the funded part of the pension is assigned. Participants in the State Pension Co-financing Program are given the right to choose: to receive the funded part of the pension or a fixed-term pension payment, the period for receiving which can be determined independently, but it cannot be less than 10 years.

Recipients of a one-time payment are also citizens receiving a disability or survivors' insurance pension, or receiving a state pension, who, upon reaching the generally established retirement age, have not acquired the right to an old-age insurance pension due to the lack of the required insurance period or the required amount pension points.

In some cases, Pension Fund employees may require additional documents confirming special circumstances. So, if the applicant receives a social pension for old age, disability or loss of a breadwinner, then it is necessary to supplement the package with documents confirming work experience. If the application is submitted not by a pensioner, but by his representative, then his passport and a notarized power of attorney must also be attached. It should be noted that instead of original documents, the law allows the submission of notarized copies. If you submit your application by mail, you should only attach them - there is no need to include original documents.

The PFR Branch for North Ossetia has been accepting applications from pensioners for payment of pension savings for six years now. During this time, more than 14.4 thousand people applied to the territorial bodies of the Pension Fund of the Republic to request payments from pension savings.

- he did not receive his cash benefits for six months in a row;

- moved for permanent residence outside Russia to a country with which the Russian Federation does not have any agreement;

- did not arrive at the appointed time for a proper re-examination at the medical and social examination institution (this applies to disabled pensioners), etc.

Payments to pensioners born in 1953-1967, size and how to receive

// To receive a one-time benefit, two conditions must be met: the citizen must have the right to receive an old-age pension (or already be a pensioner) and have funds for pension savings. Then the Pension Fund of the Russian Federation will have no grounds for refusing to pay a one-time benefit.

March 1, 2021 » One-time payment to those born from 1953 to 1966: how to receive It turns out there is a payment for men and women born from 1953 to 1966. And not only does it exist, but it also functions successfully.

We recommend reading: Application for payment of the funded part of the pension to the Pension Fund of the deceased form

The Pension Fund told which pensioners will receive a lump sum payment of 12 thousand in April

Pensioners will receive a one-time payment in the amount of 12 thousand 100 rubles. RIA FAN reports this with reference to a message from the Russian Pension Fund. Not all people of retirement age will be able to receive the funds - this applies to those Russians who turned 80 in March 2021.

The information posted on the tvk6.ru resource is intended for personal use. Prohibited

copying and/or reproduction of information without an active link to this resource. The tvk6.ru site administrator has the right to delete a comment without giving reasons.

Media Network publication “TVK Krasnoyarsk”

.

Certificate of registration of mass media EL No. FS77 - 68730, issued on February 28, 2021 by Roskomnadzor. Founder Limited Liability Company “Novosti”

Editor-in-chief

Maria Vyacheslavovna Bukhtueva

Products of the Online publication contain information for age categories 12+

It should be taken into account that the additional payment is calculated from funds received by the Pension Fund from employers, so the amount of the additional payment varies depending on the funds received. Also, the criteria for the amount of additional payment are the person’s retirement experience and the current coefficients. The ratio of the total amount of contributions, penalties and fines to the Pension Fund of the Russian Federation received in the previous quarter from organizations where pensioners work to the amount of funds necessary to finance payments is also taken into account.

For now, only citizens of the Primorsky Territory can receive the additional payment, but other regions of the Russian Federation can follow their example. It should be taken into account that not all pensioners will receive money, but only those whose income does not exceed the average annual cost of living for a pensioner, calculated for the previous year. At the moment, this amount is 11,178 rubles. If a person's pension is less than this amount, then he will receive a payment from the state.

Some pensioners in the Russian Federation will receive an increase in their pension in the amount of 7,900 rubles from February 1, and for certain categories of elderly people the pension amount will be recalculated. This message was received from representatives of the Pension Fund. According to Pension Fund experts, pensioners who worked in civil aviation flight crews and coal industry workers may qualify for this additional payment.

We recommend reading: How long does it take for the Tax on the Purchase of an Apartment to be Refunded?

Pensioners will receive a new lump sum payment of 6,000 rubles in 2021. The regional government made this decision to reduce poverty in the region. In total, an amount of 450 million rubles has been allocated from the regional budget for the payment.

According to the Minister of Social Development of the Primorsky Territory, Svetlana Krasitskaya, almost all pensioners in the region are entitled to this payment, so they will not have to fill out any paperwork. However, some citizens will have to apply to the MFC or use the Social Portal of the Primorsky Territory. Primorye pensioners learned the news about receiving a new social benefit from representatives of the Pension Fund.