How are pension points calculated?

Points are calculated based on the amount of insurance premiums accrued and paid for the employee. The higher your salary, the more contributions your employer makes to the Pension Fund for you, and the more points you can earn. A person who officially receives the minimum wage gains less than 1 point per year, i.e. He can earn 30 points not in 15, but in 30 years. For retirement in 2021 - 21 points and then the number of points will increase annually by 2.4 until it reaches 30 by 2024.

How can you increase your work experience?

You can buy points that count towards your pension! This right is spelled out in the law “On compulsory pension insurance in the Russian Federation” . This means that any person who works unofficially can buy the points needed to receive a pension. That is, make the necessary insurance contributions yourself.

Depending on the region in which you live, pension fund specialists can calculate the cost of one point. If you buy points, the cost of one pension point can be 10 or 15 thousand.

This applies to all pensioners: A law has been passed to prevent working pensioners from indexing their pensions

The maximum number of points a person can buy in a year is 10. However, there are some restrictions that can be called minor. In total, a person who independently pays insurance premiums from earned money can buy no more than 7.5 years of work experience. This constitutes half of the work experience. But there are no restrictions on purchasing points. That is, the more points you acquire, the higher your pension will be.

You should know that in order for an old-age insurance pension to be assigned, three conditions are necessary:

- The woman must be 55 years old, the man 50 (however, the years in which the retirement age increases should be taken into account)

- The total amount of work experience must be at least 15 years. If you buy points, then in fact you only need to work for 7.5 years.

- The number of points must be at least 30.

If we count approximately, then in order to purchase half the points, that is, 15, you need to pay about 150,000 rubles. However, as a rule, the lack of work experience may be only a few years, which, in principle, can be compensated by purchasing points.

By the way, if you are single, then you can find a good friend on a dating site for seniors: Best Dating Sites for Seniors

Therefore, if you still have time before retirement, but you do not have enough work experience points, contact your pension fund office for clarification. You will be provided with all the detailed information on your region in which you live, they will explain how much money you need to earn this year and pay insurance premiums.

Why do citizens have difficulty getting a pension?

Today, with only 21 points required, many are faced with a problem. Most likely, these citizens worked without formalizing labor relations, which means that their pension rights were not formed.

Employees who agree to receive a salary in an envelope are also at risk. They can receive a decent amount in their hands, but they are officially registered for a small salary, and it is from this that taxes and contributions to the Pension Fund are paid. And when the time comes to apply for a well-deserved rest, there may not be enough points, or there may not be enough of them to receive a decent pension.

When should you start earning your pension?

It’s a big mistake to think that retirement is still far away. In old age, you will have to see how important every year of experience, every point earned is. In addition, we should not forget that insurance pensions are available not only for old age, but also for disability and in the event of the loss of a breadwinner. None of us is immune from troubles and illnesses, and what kind of pension a disabled person will receive - insurance or social - makes a significant difference. And the family simply will not receive an insurance pension in the event of the loss of a breadwinner if the deceased family member did not formalize an employment relationship and his pension rights were not formed.

What to do if you don’t have enough insurance coverage to retire in Russia

Firstly, this is beneficial for individuals who are currently working outside of Russia, but are planning their permanent place of residence and future retirement in the Russian Federation. Thus, the subject, even while working, takes care of the upcoming insurance pension and makes all the necessary contributions. When the time comes for retirement, the Pension Fund of the Russian Federation will accrue to him the amount of the insurance pension that corresponds to the length of service and accumulated points.

This is also beneficial for citizens who currently live in the Russian Federation, but do not have the legal right to receive a pension. By paying contributions to the Pension Fund, they will thus earn this opportunity and by the time they go on vacation, they will be able to submit documents for registration of benefits.

Well, and thirdly, this is beneficial for those who want to pay volunteer contributions for other individuals (for a spouse, parents, other relatives or loved ones).

Citizen Nikonova A.A. She applied to the Pension Fund to calculate her pension, and it turned out that she was only missing 2 points.

According to the Law, she cannot now claim benefits, and the state will begin paying them only after 5 years.

There is a way out - to buy the missing 2 points, but a citizen can pay the entire amount only in a year. Thus, during the calendar year she cannot claim benefits in any case.

You don’t have to do this and wait 5 years. Even with a minimum pension of 9 thousand rubles, for 4 years citizen Nikonova A.A. will lose 432 thousand rubles.

Now let's calculate the purchase of the missing 2 points.

The new pension reform has forced us to take a different look at calculating length of service. It allows you to independently form your own fund by paying contributions. If you do not have a certain number of points to go on holiday, you can compensate for this in several ways: by making a contribution for yourself (or another person) or by waiting for a state pension for 5 years.

The first option is preferable, because even when calculating the minimum pension, its non-payment for 5 years will compensate for the amount of insurance contributions.

Pension coefficients are converted into rubles when a citizen receives an insurance pension. In 2021, each point “costs” 93 rubles, in 2021 it will already be 98.86 rubles. For everyone who is already receiving a pension, the value of their points will be recalculated automatically from January 1 (except for working pensioners - they will only do this if they are fired).

In addition, a fixed payment is added to the cost of points; in 2021 it will be 6,044.48 rubles.

Accordingly, the general formula will look like:

Against the backdrop of the fact that the price of pension points is steadily growing, people of retirement age have begun to think about getting a job after officially retiring. This will allow them to stay afloat, receiving a more or less normal amount of money every month.

But even with this approach, which Russian citizens take not for fun, but to survive, there are many other pitfalls.

The point is that, unlike most representatives of the pension environment, pension indexation for working pensioners was frozen almost three years ago and the situation has not budged. And while payments to other categories of recipients are being increased (another group of those whom the state has ignored for years are former military personnel), working people of retirement age are forced to receive payments according to the old standards.

Many consider this approach to be unfair simply because people do not work out of a good life. They are not even warmed by the thought that in this way they receive the accumulation of pension points, which are recalculated annually and form the basis for increasing their pension.

One of the serious disadvantages of insurance pensions, for which their appearance was called a return to social security, is that the level of a person’s income does not affect the amount of a future pension so much. During one year you can earn no more than a certain number of pension coefficients.

If in 2021, to obtain the right to an insurance pension, it was necessary to have at least 11 years of experience and 18.6 pension points, then in 2021 - at least 12 years of experience and 21 pension points. Every year the number of points and experience will increase until it reaches 30 and 15, respectively. The maximum number of pension points that can be “earned” in 2021 is 9.57.

Unfortunately, more and more often people are faced with this problem: the Pension Fund refuses to assign an old-age insurance pension to a person, even if he has reached the required retirement age, but does not have enough length of service or pension points.

In 2021, this bar is raised: for an old-age insurance pension, you will need to confirm at least 12 years of experience and 21 points. This applies to everyone who reaches retirement age next year.

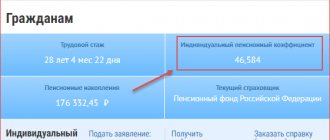

By the end of this year, they should look at their statement from the Pension Fund to see how much individual pension coefficients (this is the official name of pension points) have accumulated in their personal account.

If they are not enough before the 21st, you can pay voluntary insurance contributions to the Pension Fund by the end of the year - then next year the missing points will be credited to your account and denial of your pension will be avoided.

Otherwise, you will have to wait for your pension for at least another year (since voluntary contributions are taken into account only in the next year - see more details here).

The draft budget of the Pension Fund of the Russian Federation for 2021 was adopted by the State Duma in the 1st reading. According to this document, the indexation of insurance pensions from January is planned at 6.3%.

This means that one pension point will cost 98.86 rubles. And the fixed payment (which is added to the insurance pension) will be 6,044.48 rubles. Thus, knowing the amount of points, you can easily calculate the size of your pension after indexation.

However, for those who work, it will be more difficult to receive at least the same amount of pension points into their personal account next year as this year.

The fact is that the value on the basis of which pension points are calculated is increasing (it is called the “limiting value of the base for calculating insurance contributions”).

According to the project presented by the Ministry of Finance of the Russian Federation, in 2021 this value will be 1,465,000 rubles (which is almost 13% more than in 2020).

The amount of insurance contributions received to the employee’s personal account for a calendar year is divided by 16% of the maximum base value for the same year and multiplied by 10. We obtain the amount of pension points earned in one year.

Since the base limit is used as a divisor in the formula, increasing it leads to a decrease in the final result.

In other words, with the same earnings in 2021, the employee will be awarded fewer pension points than in the current year 2021 - that is, earning points will become more difficult.

It must be taken into account that in 2021 the age will increase not only for the appointment of an old-age pension, but also for switching to other types of pensions.

In particular, disabled people are automatically transferred to an old-age insurance pension from the moment they reach retirement age.

But the age has also increased for them: in 2021, a disabled person will be transferred to an old-age insurance pension if he turns 61.5 years old (man) or 56.5 years old (woman), provided that he has 12 years of experience and 21 points .

Otherwise, he will remain on a disability pension. This is especially disadvantageous for disabled people of the 3rd group, since their pension lags behind the old-age insurance pension by at least 3,000 rubles (due to the difference in the fixed payment - Article 16 of Law 400-FZ).

Unfortunately, women under 56 and men under 61 will not be able to switch to their spouse's pension in 2021. The reason is still the same - increasing the retirement age.

To transfer to a pension for the loss of a breadwinner (i.e., a spouse), the retirement age in 2021 increased by 2 years, and in 2021 it is raised by 3 years.

To estimate the size of the retirement age, points accrued over the entire period should be converted into rubles. This is done by multiplying them by the current cost. The value of PB is a variable value that grows every year. Initially, the increase in cost was tied to inflation, but starting in 2021, this indicator changes under the influence of the minimum wage. As of 2021, the cost of a point is 93 rubles, and indexation is 6.6%. In 2021, thanks to indexing at 6.3% , the price will rise to 98.86 rubles .

The ongoing annual indexation is already part of the pension reform, and the indexation increase is pre-determined for each year. From 2025, indexation will take place on 1.02. to the inflation rate over the past year.

It is quite difficult to predict down to the penny the price of a pension point in subsequent years, since the change in the minimum wage is also unknown. However, based on dynamics and certain calculations, experts have compiled an approximate cost of the pension coefficient until 2024.

| Year | Point cost |

| 2019 | 87.24 rub. |

| 2020 | 98.86 rub. |

| 2021 | 98.86 rub. |

| 2022 | 104.69 rub. |

| 2023 | 110.55 rub. |

| from 2024 | RUB 116.63 |