The pension system of the Russian Federation allows for the possibility of placing deposits of the working population in various pension funds. All of them, except for the only state-owned one, are private. Officially, such organizations are called non-governmental pension funds.

As a rule, NPFs provide more favorable conditions for deposits, but are considered less reliable. There are many different NPFs. Some of them attract customers with the reliability of their deposits, while others pay high interest rates.

Labor legislation recognizes the right of a citizen to change the fund at will. In this case, funds already accumulated can be transferred to a new trust. The need to change funds arises under many circumstances:

- When finding a more profitable Non-State Fund.

- When changing your pension accumulation strategy.

- If there is a threat of bankruptcy of a non-state trust.

- Other.

Remember that it is advisable to withdraw money from a non-governmental trust during the end of the financial year. Otherwise, the investor risks losing part of the accrued interest. It is also worth knowing that when withdrawing money from the pension system, you will have to pay income tax on the accrued interest. Therefore, it is advisable to directly transfer money to another non-governmental or government fund. In this case, you will not have to pay 13% on deposit payments received.

Funded pension in 2021

Submit an application to your non-state pension fund (if you have an agreement) or to the Pension Fund branch in person, through a legal representative or on the official website of the pension fund.

For NPFs, you must provide a passport and a certificate from the Pension Fund of the Russian Federation on the assignment of an old-age insurance pension. All documents can be sent to a non-state pension fund by mail, but they must be certified by a notary. This is quite expensive, over a thousand rubles for each document. In addition to your passport and certificate, you need bank details to transfer money.

The application along with the documents must be reviewed within ten days. The citizen will be officially notified of the decision made. If it is positive, then the payment will be made within two months.

The funded pension in the coming new year is indexed, as before, by the percentage of inflation. The age of survival has increased, and therefore monthly payments will decrease. The moratorium (freezing) of the funded part is extended .

If you find an error

Please select a piece of text and press Ctrl + Enter

CTRL + ENTER

The moratorium on the formation of the funded part of the pension has been extended until the beginning of 2022. The amendments entered into force on January 1, 2021. This means that the amount of insurance premiums goes to the formation of the insurance pension in full. The rule is mandatory for everyone, and the wishes of the insured person are not taken into account.

An increase in the funded part before the moratorium is lifted is possible thanks to the activities of the Non-State Pension Fund, which, through management companies, invests this money in investment projects. Everything that is transferred by the employer or individual entrepreneur (for himself) goes towards the formation of an insurance pension. At the same time, it will not be possible to leave the NPF without joining another NPF, or without returning the savings to the Pension Fund. The transition is made in several steps.

An agreement must be concluded with the selected non-state pension fund. Officially, the document is called a compulsory pension insurance agreement. The contract form is standard (simple written form). You must have a passport of a citizen of the Russian Federation and SNILS with you.

The agreement does not come into force immediately. The document acquires legal force after the funds of the funded part of the pension are transferred to the previous NPF. If the regulator does not impose a restriction on the fund, then it cannot refuse the insured person to enter into an agreement (Article 36.4 75-FZ).

Yield factor

What exactly do fund investors like, apart from service? If we analyze opinions regarding the factors that predetermine trust, NPF (reviews of many analysts correlate with this) attracts clients with its reliability. That is, the fund does not promise investors incredible returns, but makes it clear that the indicators achieved within the framework of the current investment strategy did not arise by chance. Therefore, as evidenced by the reviews addressed to NPF “Doverie”, clients are attracted by transparency in the organization’s relations with investors. NPF specialists who interact with citizens explain in detail the advantages of concluding an agreement with the fund, focusing on the balance of the organization’s investment model.

There is also a healthy degree of doubt among citizens regarding the activities of the fund. They are mainly associated with precedents reflecting visits by representatives of non-state pension funds to the apartments of potential clients and intrusive offers to conclude an agreement. However, there is no reliable public information that this practice of NPFs is systemic in nature, as well as facts that indisputably confirm that it is Doveri employees who make the visits. An agent can be an intermediary offering to enter into agreements with different non-state pension funds.

How to exit NPF (Non-State Pension Fund)

Especially if you want to switch to another pension fund or withdraw money altogether. The most interesting thing is that many clients have no idea that they are part of the organization. Such cases are becoming more and more common every day.

Read (1 answer) Tags: 1 Evgeniy Russia, Irkutsk · 09.17.2021 I applied to the HR department of Russian Railways about leaving the NPF “Blagosostoyaniye”, which was refused, they did not give me a form for leaving and the application to the station manager was ignored. What to do? As I understand it, the only way out is through the prosecutor's office.

- inheritance of pension funds. savings formed only from personal contributions, or from all contributions, or do not provide for inheritance at all;

- minimum, optimal or maximum amount of contributions;

- limitation on the number of heirs or the absence of such a condition.

The level of trust among clients of NPF Blastostoyanie is very high. What is the number of clients of the fund - more than 1.2 million people. Of these, about 350 thousand already receive a non-state pension, formed through personal contributions and employer contributions.

In addition, you can get a tax refund of 13 percent, and it does not matter how much compensation was transferred to you. You receive corporate contributions in connection with retirement age after leaving Russian Railways only if the length of service during which the payments were made is at least five years. In order for the pension to be preserved if there is a case of dismissal from the organization before the appointed payment period, the length of service must be at least five years, and the redemption amount must not be touched. Moreover, after you have retired from , you can continue to increase your additional part of the pension with independent contributions as an individual by entering into an NGO agreement.

In fact, it's just a hoax. This is how they lure gullible and naive clients. Remember one important point if you decide to open a future pension account. You can deposit funds into the non-state pension fund "Blagosostoyanie", but you will not see them in the form of cash.

Then, without your participation, the new NPF will make a request and transfer all savings from Blagostostoyanie. An unpleasant surprise for fund participants is the expectation of payments. Moreover, both for pensioners and in case of transfer to another organization.

The fund you named may mean any fund that operates exclusively in your organization. Joining such funds, as well as leaving them, is a voluntary matter for each employee and can be done at any time on the basis of submitting a written application to the management of the specified fund.

text in the previous edition)6. Providing measures of social support for large families of internal affairs bodies at the place of residence of the federal executive body in the field of migration and enforcement within the prescribed period in accordance with parts 4, 4 and 5 of Article 24 of this Federal Law.

Moreover, in accordance with Part 5 of Article 19 of this Federal Law, it follows that in the case of applying for protection of legitimate interests, the production of communications depends on the severity of harm to the life or health of a citizen or a person replacing him. According to paragraph 1 of Art. 7 of the Federal Law of April 15, 1998 66-FZ (ed.

But some are interested in how to withdraw money from the NPF Blagosostoyanie. This will have to be looked into thoroughly. Otherwise, you may be left without a livelihood at all. Initially, of course, you will be lured by all means into our current organization.

High profitability, simple and favorable conditions, the ability to terminate the contract with the company at any time without any serious consequences. In general, as clients assure, they will lure you here with all their might.

What will you need? Again, a statement. Only here you will also have to add information about your registration. That is, to prove belonging to one or another branch of the Pension Fund of the Russian Federation. The application is then considered for some time. And a notification with a response is sent to you. If all is well, you can transfer funds from your account in Blagostostoyanie to the state. This is done by the organization itself; you will not see these operations. Exactly the same as cash.

The state wants us to choose who will manage our pension savings. Therefore, we choose the insurer under compulsory pension insurance ourselves - this is called “disposing of a funded pension.”

Whatever insurer you choose, one or more management companies - management companies - will directly conduct investment activities. The Pension Fund and Non-State Pension Funds receive money, and then insurers send it to their management companies.

As already noted, management companies are engaged in investing pension savings. Between them and the future pensioner stands the insurer - the Pension Fund or Non-State Pension Fund.

The insurer is a layer that acts as a guarantor, forms and then pays a funded pension. To form means to accept contributions, take into account and transfer pension savings to the management of the management company.

Profitability. No one knows in advance how a non-state pension fund will work - they do not guarantee a certain percentage of profit from investments. What kind of profitability the NPF gave will become known only by April of next year. For example, funds will report for 2021 by April 2021.

If a fund gave 10% for ten years in a row, this does not mean that it will not go into the red next year. Therefore, after switching to another PF that has historically shown better results, you can either win money or lose money.

Proximity. If you switch to a fund whose branch is located in your city, this may be an advantage. For example, you will want to come there to write a statement or make a scandal.

If you choose a non-state pension fund without a representative office in your region, you will have to resolve all issues remotely or travel far.

Pension from different sources. If you have entrusted your pension savings to a non-state pension fund, it will pay you a funded pension. You will receive insurance from the Pension Fund of Russia. You will have to apply for pensions to NPFs and Pension Funds.

For convenience, you can return to the Pension Fund of the Russian Federation before reaching retirement age - there you will apply for both pensions and will receive them from one source.

To change the pension fund, you need two documents: an agreement and an application. They can be issued during the year no later than December 1. The agreement is concluded with or without the help of representatives of the selected fund, and the application in any case is submitted to the Pension Fund. These documents are not necessarily issued at the same time and in one place.

Where to conclude an agreement. If there is a branch of the selected non-state pension fund in the city, you can come there with your passport and SNILS. Our specialists will help you prepare the necessary documents and submit your application. You can also submit an application through the fund's website.

Why? NPF "Future" ("Welfare") is a non-state pension fund. It was renamed into NPF “Future” in June 2015. He is engaged in collecting, preserving and increasing your money. But only if we are talking about the funded part of the pension. That is, it helps in ensuring your old age. There is nothing suspicious about this. Therefore, reviews regarding the corporation’s activities are more encouraging. No deception, everything is transparent and understandable. But some are interested in how to withdraw money from the NPF Blagosostoyanie. This will have to be looked into thoroughly. Otherwise, you may be left without any means of subsistence at all. You can also return to the generally accepted pension savings scheme. That is, to state co-financing. Not the most common occurrence, but it does happen. Do you want to take money from “Welfare” and transfer it to the state account? According to reviews, this process will also not take much of your time.

Today, people can be content with a large number of proposals to transfer the funded portion to a non-state pension fund. Agents of these funds know how to convince people who are happy to sign a transfer agreement.

True, some later realize that they should not have done this. Let's look at the situation about how such people can return back to the Pension Fund, and what is required for this. Where can you form a funded pension? A funded pension today can be formed for people younger than 1967.

both in the non-state pension fund and in the good old Pension Fund. Many believe that it would be better to leave this amount in the State Pension Fund, since in this case nothing will happen to it.

“My pension was sold to a non-state person for 1000 rubles” In April - May, citizens who have savings receive letters with information about the status of their account. Many are surprised to learn that their funds were transferred from one non-state pension fund (NPF) that they chose to another.

How to exit a non-state pension fund? After the pension reform, many chose one of the non-state pension funds. But what to do if you made the wrong choice on how to leave the NPF?

Acceptable terms for termination of the contract

In accordance with the law, termination of a contract with a non-state pension fund is possible at any time. All a citizen needs to do is send an application to the appropriate type of organization. It is also necessary to sign documents, according to which the amount placed on the accounts of the NPF will be transferred to another fund or transferred to the citizen’s bank details.

At the same time, the payment procedure established by NPF “Doverie” may differ from the standards adopted in other organizations of a similar profile. But, as a rule, the payment of amounts is carried out by using accumulated funds in the formula for calculating it, as well as added amounts of income. Those payments that have already been made are deducted.

It does not matter exactly when the person decided to terminate relations with the Trust Fund - at the stage when funds are being accumulated, or in the process of making payments. The entire amount payable to the client must be transferred within the established procedures.

They want to completely eliminate funded pensions. What will happen to the NPF then?

Despite the fact that the obligation to transfer their pension savings arose for every citizen of the Russian Federation back in 2015, some people are in no hurry to make such a decision. It is customary to secretly call these people “silent people.”

There is also a separate category of citizens who, having transferred their savings to a non-state pension fund, suddenly changed their minds and decided to return their funds to the Russian Pension Fund. In this case, the money in the account will be used to invest in government programs.

The completed application, as well as all accompanying documents, must be submitted to the territorial office of the Pension Fund. You can do this in several ways:

- In person or through your representative.

- By post.

- In the form of an electronic document on the State Services portal.

Review of received documents is carried out within 3 months. After this period, the money is transferred from the NPF account to the State Pension Fund.

We describe typical ways to resolve legal issues, but each case is unique and requires individual legal assistance.

To quickly resolve your problem, we recommend contacting qualified lawyers on our website.

It is this law that establishes the specific procedure according to which the funded portion is paid. If a citizen has concluded a corresponding agreement, then he can send the first demands for payment of his funds after two months, but not earlier. Pensioners can submit the same request after the second

Here, as the participants assure, a very interesting and simple scheme is used: you are simply refused to terminate the contract for one reason or another. Either the application was written incorrectly, or the conditions for transferring to another pension fund were not met.

- The ability to choose inheritance: it is either absent or applies to personal or state savings.

- Contribution amount: minimum, maximum, optimal.

- Limitation on the number of heirs. Or the absence of such conditions.

Your Personal Account allows you to find out all the information related to your personal savings for the current period. To obtain such information, you can also send a request via Russian Post. The main thing is to accurately indicate the address to which the response should arrive.

We recommend reading: How to find out whose land it is

And all this despite the promises of the fund. Why does this happen? And how to carry out this process correctly? Voluntary To understand this fully, you need to consider the position of the company's management. The whole problem is that a very interesting scheme is used here: the pension savings that the client makes are his money, his voluntary contributions. That is, in fact, you will be the owner of the account.

In fact, you are obliged to make pension contributions. If you want to change your pension fund, get ready for a lot of problems. They are often kept silent about them. But if everything were that simple, no one would ask: “I want to withdraw money from the NPF Blagosostoyanie.” How to do it?" It doesn't matter how you found out that you became a member of the organization. Now you will have to try hard to get your money back. Cash Many believe that resolving this issue will not be difficult.

About activities

The non-state pension fund "Doverie" has its own focus in its activities. Reviews about it are already encouraging. After all, there are no cunning schemes here, the activities are transparent and understandable. Just by the name alone you can tell that the company is engaged in collecting and preserving citizens’ pensions.

More precisely, its cumulative part. Moreover, you will be promised a certain return from participation. That is, you can not only save, but also increase your future pensions without any problems. With all this, you will not need to do anything special - just be a client of the company. That's all. For these opportunities, the non-state pension fund “Doverie” receives positive reviews. It turns out that you can quickly secure a comfortable old age on favorable terms! Is this really true? After all, these are the loud words spoken by the organization’s administrators. What do customers and employees think about this?

How to exit a non-state pension fund

You can receive a funded pension if you have the right to receive an old-age insurance pension, including early, if the amount of the funded pension is more than 5% in relation to the sum of the old-age insurance pension, increases in the fixed payment to the insurance pension, and the amount of the funded pension , calculated on the day of assignment of a funded pension.

The funded pension is paid for life .

Application forms for applying for a funded pension:

Application for the assignment of a funded pension Sample Application for the assignment of a funded pension

Application for payment method Sample Application for payment method

You can apply for an urgent pension payment if you have accumulated pension savings formed within the framework of the State Pension Co-financing Program or at the expense of maternal (family) capital.

You determine the duration of the urgent pension payment yourself, but it cannot be less than 10 years (120 months).

Urgent pension payments are made monthly .

Application forms for applying for urgent pension payment:

Application for an urgent pension payment Sample Application for an urgent pension payment

Application for payment method Sample Application for payment method

- Application(s) in the prescribed form depending on the type of payment (see above).

- Consent to the processing of personal data. Consent to the processing of personal data. Sample Consent to the processing of personal data

- Passport (or other document proving identity, age and place of residence).

- Insurance certificate of compulsory pension insurance (SNILS).

- Pension certificate or other document confirming the existence of pension grounds (certificate from the Pension Fund of the Russian Federation).

- Bank details for transferring pension payments.

- If your personal data has changed since the conclusion of the agreement, you must provide the Fund with documents confirming such changes.

If a set of documents is submitted by a representative, then you must additionally provide:

- Representative's passport (or other document proving identity, age and place of residence);

- A document confirming the authority of the representative (for example, a notarized power of attorney, a court decision, an act of the guardianship and trusteeship authority on the appointment of a guardian, etc.).

- personally contact a branch of the Fund or partner bank URALSIB. Find out the address of the nearest branch in the Office Addresses section;

- send the documents to the Fund by Russian Post at the address: 162614, Cherepovets, Lunacharskogo Ave., 53A, JSC NPF FUTURE.

Important! If a set of documents is sent to the Fund by mail, it is necessary to certify by a notary (or in a manner equivalent to a notary): the authenticity of the signature on the application for payment; A copy of SNILS; a copy of the certificate from the Pension Fund of Russia (instead of a copy, you can provide the original); copies of documents confirming changes in personal data; copies of passports of the client and his representative; a copy of the document confirming the authority of the representative.

Bank details can be certified by the bank or independently by the client. To do this, you need to write “Copy is correct” on them, your full last name, first name and patronymic, put your signature and date of certification of the copy.

After reviewing the set of documents, the Fund will send you a copy of the decision on payment or refusal to pay by Russian Post.

The law regulating the activities of NPFs indicates that part of the savings of citizens who have expressed a desire to leave the NPF early may remain on the organization’s balance sheet if its profitability is negative at the end of the year. This can be avoided if you draw up an application in advance not for an early transition, but for a regular one, however, the document will begin to be valid 5 years after writing.

Also, in order to reduce potential losses from changing NPFs or transferring back to the Pension Fund, you need to familiarize yourself with the procedure for calculating investment interest and select the period when the amount will actually be increased. Most often, increases in amounts occur at the end of the year.

Performance results and ratings

In 2012, the organization entered the top 10 funds in terms of the number of signed agreements on the participation of citizens in the compulsory pension insurance program. In the same year, several banks operating in the Russian Federation became partners of NPFs. The fund's marketing strategy includes a wide range of activities: the use of advertising channels and online resources.

NPF carries out 2 main areas of activity: work in the field of non-state provision, as well as interaction with citizens within the framework of compulsory pension insurance programs. Both areas of the organization’s work are assessed by experts as successful. For example, in the first quarter of 2013, more than 339 thousand people placed their trust in the fund in terms of interaction under compulsory pension insurance programs. The NPF, reviews of which began to actively spread online, was characterized by clients as a structure staffed by qualified and responsive specialists. In the 1st quarter of 2013, the volume of savings in the fund amounted to 7.8 billion rubles, which is approximately 20 times more than the figure for the same period in 2012.

Don't lose income by moving from fund to fund!

Payments are assigned upon reaching retirement age or the fulfillment of the conditions specified in the contract. The procedure for issuing funds begins after submitting an application in the prescribed form to the fund. If you need to find out how to receive the funded part of your pension from NPF Future, consult the organization’s specialists. To do this, call the hotline, use the feedback form on the website or visit the company’s office.

Low investment returns, unclear investment strategy, and the presence of negative information about the fund’s development prospects gave rise to many negative reviews from clients of NPF Future. There are more and more people wishing to terminate the contract every day. And investors are experiencing the loss of part of their pension savings very hard. You can read more about this on public review sites.

As of 2021, NPF “Future” received a reliability rating of “A” (this rating indicates a high level of reliability, but this is not the maximum possible rating). The new agency RAEX confirmed these statistics and assigned a “stable” forecast. This pension organization does not participate in the NRA rating system.

Currently, NPF “Future” is included in the list of the five best non-state funds in Russia in all respects.

Statistics as of 2021:

- The total volume of pension reserves is 4,100,000 thousand rubles.

- The total amount of all pensions paid is 25,000.

- The total number of depositors is 100 thousand people.

- The current amount of all accumulated funds is 230 million rubles.

- The number of insured participants is 4 million people.

You can obtain detailed data on current savings in three ways:

- On the organization's website in the user account. To do this, you need to log in to the site and go to your account. After that, select the “Pension Savings” tab. Here you can request information about your current savings. To do this, you will need to indicate the date of the last operation performed.

- In any branch of the organization. First, you need to find out the address of the organization’s nearest office; you can do this on the website.

It is recommended to call this office in advance and find out when you can come. You must take your passport and SNILS with you. In the office, an employee of the organization will explain all further actions to provide information about current savings.

- You can also get information about savings at the branch. This organization directly cooperates with NPF “Future” and provides assistance to program participants. To obtain information, you will also need to take your passport and SNILS with you.

Profitability is the main component necessary for choosing a suitable pension fund in which it is recommended to invest your money. Since the more the organization earns, the higher the participant’s pension level will be in the future. So when choosing a fund, always check detailed profitability statistics over several years of the organization’s existence.

Profitability of the non-state pension fund "Future" from 2014 to 2021:

- As of 2014, the profitability of the non-state pension fund "Future" was 1.47%, which is 1.21% less than the profitability of the Pension Fund.

- In 2015, the profitability increased significantly and amounted to 5.58%. However, this profit is almost 3 times less than the profit of the Pension Fund for the same period.

- In 2021, the organization’s profitability decreased and amounted to 3.87%.

Not the fairest rules

However, as already mentioned, the non-state pension fund “Doverie” does not earn the best reviews. At least as an employer. Yes, you will indeed be offered official registration with a work book with a corresponding contract, comfortable working conditions and a full social package. But in practice, a slightly different picture will turn out.

What can you expect? As many people claim, they will simply conclude an employment contract with you. But the level of wages and the provision of a social package are a lie. Low salary, virtual impossibility of going on maternity leave or sick leave (official earnings are lower), as well as constant overtime work. This is what turns many people off. Yes, a similar situation occurs for many employers, and you can somehow come to terms with it. But the employees are outraged by something else.

What exactly? The non-state pension fund "Doverie" (Tver) earns reviews as an employer that are not the best. Exactly the same as in all other regions of Russia. Attention is focused on the fact that when you are employed, you will be forced to make contributions (for retirement) specifically to the company’s accounts. That is, the organization’s goal is to get into the employee’s pocket and take possession of his savings. Moreover, everything is logical and official - few people will use one pension fund and work in another. This decision repels many - why lure new clients into the organization by hook or by crook? Especially if these are applicants who initially want to get a job and not invest? Most people don't like this arrangement.

How to switch to another pension fund

Terentyev Bogdan

Each citizen, when participating in programs from the NPF “Blagosostoyanie,” retains the right to receive a tax refund in the amount of 13 percent for serious expenses for the purchase of real estate, treatment, training, and so on.

The pension is retained even upon dismissal, if the insurance period is at least five years. And after dismissal, individuals have the right to increase their security. It’s just that contributions become individual rather than corporate.

NPF Blagostostoyanie is a reliable fund to which more than a million people have already entrusted their savings. They adhere to an integrated approach to investing funds. This ensures a high level of profitability for any investment. At the same time, the risks remain minimal.

The average industry pension for Russian Railways employees reaches 90 thousand rubles.

The application itself and the package of documents can be completed:

- at the bank office;

- at the central office of Sberbank NPF.

In the case of independently completing a package of papers and an application for payment, it is necessary to notarize the signature of the insured person. Documents are sent by mail. Application forms can be found in your personal account.

Attention When calculating the amount of the pension, the amount of investment income for the entire period of validity of the agreement between the bank and the insured person must be taken into account. You can get information about the accumulated amount:

- on the official website of NPF Sberbank;

- at a Sberbank branch;

- at the main office of the Pension Fund.

Regardless of the method of obtaining information, have a passport of a citizen of the Russian Federation and SNILS with you.

Methods for receiving savings There is more than one way to receive the savings portion. There are three of them:

Part of a person’s salary is transferred to the Pension Fund. The funds are kept in the accounts until you reach old age. Important But under some circumstances you can withdraw money from Sberbank NPF. Sberbank NPF is a reliable system that allows you to ensure a harmless old age.

- 1 How to withdraw the funded part of your pension?

- 2 When and how can you receive pension savings?

- 3 Ways to receive savings

- 4 Customer reviews

How to withdraw the funded part of your pension? The funds of the funded part are formed from contributions from employers. A personal account is opened for each person. Without citizen participation, money is invested in the stock market.

How to competently transfer from NPFs and Pension Funds? It is noteworthy that if your company, where you were previously a member, has a negative profitability at the end of the year, then part of your savings will remain in the non-state pension fund and will not be transferred.

To bypass this clause, and also not to lose previously accrued interest, it is necessary to fill out an application for transfer (works out 5 years from the date of writing), and not an application for early transfer.

Forum of our website I ask that the management of a separate division of the Gorky branch of the NPF "Blagosostoyanie", located in Cheboksary, be held accountable for illegally refusing to terminate my contract with the NPF "Blagosostoyanie" and return my contributions.

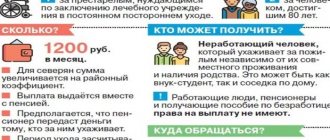

From January 1, 2021, insurance pensions of non-working pensioners have been indexed by 6.3%, which is higher than the forecast inflation rate for 2021. As a result of indexation, the old-age insurance pension of the majority of non-working pensioners increased by no less than a thousand rubles per month, and its average amount reached 17.5 thousand rubles.

The cost of one pension coefficient also increased, also by 6.3%, and a fixed payment. The cost of one coefficient in the new year has been increased from 93 rubles to 98.86 rubles, the size of the fixed payment - from 5,686.25 to 6,044.48 rubles.

From April 1, state pensions, including social pensions, will be indexed. The changes will be made in accordance with the increase in the cost of living of a pensioner for 2021.

From August 1, the Pension Fund of Russia and NPFs will carry out annual adjustments to the amount of funded pensions and fixed-term pension payments for compulsory pension insurance.

On January 1, 2021, a law came into force in Russia to increase the period of payment of funded pensions - or, as it is also called, the survival period. This is the expected period for payment of the funded pension. It is established by a special law in accordance with the average life expectancy of a citizen after retirement. It is used to calculate the funded pension (to do this, all savings must be divided by the period of survival). In 2020 it is 258 months, in 2021 - 264 months. Further changes in this indicator are unpredictable.

Starting this year, the minimum wage (minimum wage) and the cost of living are calculated based not on the consumer basket, as before, but on the median income of Russians. Median income means that half of workers earn more than this amount, half - less.

The minimum wage in 2021 is 42% of the median salary (12,792 rubles), and the cost of living in the Russian Federation as a whole is 11,653 rubles. The cost of living for the working-age population will be 109% of the cost of living per capita in the Russian Federation as a whole, the cost of living for pensioners - 86%, the cost of living for children - 97%.

The pensioner’s cost of living indicator is needed in order to calculate the amount of additional payments to pensions. If a non-working pensioner’s entire income - insurance or social pension, additional payments and benefits - does not reach the minimum in the region of his residence, then the state sets him a federal or social supplement.

- The retirement age, length of service and accumulated points requirements will increase slightly.

- Pension payments will be indexed and adjusted in 2021

- Citizens can now complain to the financial ombudsman about non-state pension funds

- Citizens protected from pension agents

- NPFs will be required to disclose the composition of their portfolios by issuer

- NPFs will invest voluntary pension savings of Russians according to new rules

- Life expectancy has changed in Russia

- The cost of living is being calculated in a new way for pensioners

I recommend everyone to submit a declaration, a certificate of payment of contributions, SNILS and a copy of your passport to the tax office at the beginning of the year in order to return part of the funds. Even if it’s a penny, but after 3 years in the bank with an additional investment you get a small starting capital.

It can be nested in:

- investment coins;

- Compulsory medical insurance;

- bonds.

Wangyu: in the end, the amount received will be more than the accumulated pension.

Pros and cons of the non-state pension fund "Future".

| + | — |

| Personal account, hotline, feedback form on the official website | Difficult to find the information you need |

| Merged 4 funds, increasing capital | Losses for 3 years in a row |

| Small reserve for repayment compared to liabilities |

Recoil

Often citizens join one or another pension fund for the sake of some kind of return, their own benefit. This is a completely logical and normal decision. Where it’s profitable, that’s where we’ll keep our money. In this area, the non-state pension fund "Doverie" receives average reviews (Moscow and other cities). That's not to say they're terrible. But they don’t provide any impetus for participation.

Why does this happen? At the moment, the return on your investment will be about 4-5%. That is, almost all of the profitability will be “eaten up” by inflation. Sometimes you may get nothing at all. Not the best thing, it turns off many people. You might as well save your pension in a bank! This is exactly the opinion that potential clients hold. But if stability is more important than the return on membership, Trust is ideal.

How to terminate the contract and take money from NPF future

Separately, they note the high level of service, even for specific branches located in small towns. There is only one drawback - forced entry into this fund for those who work for Russian Railways.

Either the application was written incorrectly, or the conditions for transferring to another pension fund were not met. In general, some people get tired of this situation, and they remain in the “Welfare” organization. If you really intend to leave the fund, you will have to prepare to do so with a fight. Several complaints, repeated applications and a long wait for the transfer of funds - and you will achieve your goal.