White salary

It is important to receive an official, or, as it is called, “white” salary. It is from the official salary that contributions (16%) to the Pension Fund are calculated and annual pension coefficients are calculated. The higher the official salary, the higher the size of the future pension will be.

Let’s say your salary is 50 thousand rubles, but according to your documents it’s only 10 thousand. After 20 years of such work, you will have accumulated 100 fewer pension points than you otherwise would have. This means you will miss out on your pension by more than 8,000 rubles.

Official work

It is very important to get a job with official registration. Today there are many pensioners who receive a minimum pension.

It can be assumed that some of them have such a low pension because they received income that was not reflected in any documents. That is, they worked unofficially: they received their salaries from hand to hand, and no one paid insurance premiums from them.

As a result, the result: people worked, but when applying for a pension, these periods are not taken into account. So it turns out that the employer, by issuing “black” wages, without being reflected in accounting and, accordingly, without paying taxes and insurance contributions, “steals” a significant part of the future pension.

Transfer of pension to NPF

If you haven't done it, just do it. Seriously.

Which NPF to choose? To be honest, I don't care. They all can't boast amazing returns. In addition, there are constantly some mergers, bankruptcies, and changes from hand to hand.

Just transfer money to any of the largest funds. For example, to the Future, Soglasie, RGS or Sberbank. In general, in any case. And don’t touch it for 5 years - according to the law, if you transfer the funded part of your pension more often than this period, the savings “burn out”.

I don’t know what will happen to our pension and NPF, so I wouldn’t count on this source. In any case, if you receive a pension, great. No - that's not it. We always have a backup plan (not a backup plan, as they say on the buses).

Official income

It is important to receive official income. In order to “earn” pension points, you need official income. And the higher it is, the more it is charged.

So, in a year a person can receive a maximum of 10 points (this is from 2021, now is a transition period: in 2021 the maximum is 8.70 points). To do this you need to receive about 75 thousand rubles. per month.

If the salary is half the maximum, then the person will now receive only a little more than 4 points. If three times - about 3 points and so on. When assigning a pension, each pension point is multiplied by the value of the pension coefficient. Now the cost of the coefficient is 81.49 rubles. It is indexed annually by the state.

Seniority

The longer the length of service, the greater the pension. A long insurance period is the basis for a high future pension. Not only the size of the “white” salary is important, but also the period during which you receive it. From 2024, the minimum insurance period for receiving an old-age insurance pension will reach 15 years.

Those who do not have enough working years will only be able to claim a social old-age pension. Firstly, it is prescribed 5 years later than the insurance one (for women - from 60 years old, for men - from 65). And secondly, much less and, in fact, equal to the subsistence level.

In addition, the longer you work officially, the more points you will accumulate. This is also important, because there is a minimum “threshold” for an insurance pension, not only based on length of service, but also based on points. From 2025 you will need to have at least 30 pension points in your account. Ideally, you need to earn as many points as possible.

How to get a big pension

When registering with the Pension Fund of Russia, each person is assigned an individual number consisting of 11 digits. It is never repeated and is assigned to the citizen for life. As confirmation of registration in the compulsory pension insurance system, a special document is issued - SNILS.

When applying for a job, having a card is mandatory. If it is not formalized, the employer will do it himself. The SNILS number is used to transfer insurance premiums.

- Free advanced training for working pensioners

- 6 Foods That Cause Inflammation in Your Body

- 6 Best Hair Removal Methods

It is important to constantly monitor the amount of transfers through your personal account or by contacting the Pension Fund, since not all employers are conscientious and may not pay contributions in full.

Official employment

A high salary level is a guarantee that you will receive an increased pension in the future. This is due to the fact that insurance premiums are calculated only from official earnings, and not from money received “in an envelope”. With this scheme, the number of PBs will be less than with a white salary.

For example, the official salary is 70 thousand rubles:

- For a year, a person will be credited with 7.30 PB.

- If you receive 40 thousand rubles through the accounting department, and the rest according to the gray “in an envelope” scheme, only 4.17 PB will be credited.

- The difference for one year will be 3.13 PB (7.30 – 4.17 = 3.13).

- Multiplying this number by the cost of the PB for 2021, we get 320 rubles (3.13 x 87.24 rubles).

- Every year the value of the pension point is indexed. This means that the amount will only increase. If we assume that a person works for 20 years, then the pension will be less by 6.4 thousand rubles. Taking into account annual indexations, the amount of the lost pension may increase even more.

Increase in pension for long service

Recently, news has been spreading on the Internet that citizens are entitled to an additional payment to their pension for long service. The Pension Fund refutes this information, since according to current legislation, only the insurance period is taken into account when assigning a pension - the time when the employer made insurance contributions to the Pension Fund.

The only exception is taking into account the duration of work during the USSR period, since this indicator is taken into account when calculating the length of service coefficient. It is then used to determine the number of PBs during this time.

High official income

With a high salary, a larger number of PB will be accrued. According to the law, in order to assign an insurance pension, two conditions must be met:

- Have a minimum insurance period, which in 2021 is 10 years. Each year it increases by a year until it reaches a final value of 15 years by 2024.

- Earn the minimum IPC. For 2021, the value is set at 16.2 with an annual increase of 2.4 points. From 2025, the minimum will be 30 PB.

In addition, the legislation limits the maximum possible number of IPCs that a person can earn in 1 year:

- 2019 – 9,13;

- 2020 – 9,57;

- From 2021 – 10.

The IPC is calculated using a special formula, and each period (before 2002, from 2002 to 2015, after 2015) has its own methods. You can calculate the IPC for the current year based on the current salary on the Pension Fund website. A special calculator is used for this. There you can also determine the approximate amount of pension payments by filling out the necessary data.

- How to Naturally Get Rid of Parasites in Your Body

- Vascular diseases of the legs after 50

- Highlighting for short hair

Retiring after retirement age

Increasing your pension with extensive service is possible if you arrange a deferred retirement. This means that when the time for assigning payments is reached, the person refuses to receive pension benefits and continues to work.

For this, the state provides him with a bonus - an increasing coefficient. The value is established by law, differs for a fixed payment (FV) and IPC and depends on whether a citizen has the right to receive an early pension or not.

The highest pension accrual coefficient reaches ten years:

to PV without the right / with the right to early retirement

- 1 year – 1.056/1.036;

- 2 – 1,12/1,07;

- 3 – 1,19/1,12;

- 4 – 1,27/1,16;

- 5 – 1,36/1,21;

- 6 – 1,46/1,26;

- 7 -1,58/1,32;

- 8 – 1,73/1,38;

- 9 – 1,90/1,45;

- 10 and more – 2.11/1.53.

to IPC without the right / with the right to early retirement

- 1 year – 1.07/1.046;

- 2 – 1,15/1,10;

- 3 – 1,24/1,16;

- 4 – 1,34/1,22;

- 5 – 1,45/1,29;

- 6 – 1,59/1,37;

- 7 – 1,74/1,45;

- 8 – 1,90/1,52;

- 9 – 2,09/1,60;

- 10 and more – 2.32/1.68.

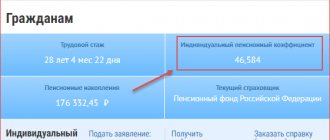

Monitoring the status of an individual pension account

There are 5 main ways that will help you monitor the status of your personal account and control the process of forming a future pension:

- through your Personal Account on the Pension Fund website;

- through the State Services portal;

- by downloading a mobile application running on devices running Android or iOS;

- by visiting the territorial office of the Pension Fund of Russia;

- through the Multifunctional Center (MFC).

Formation of a funded pension

You can increase your monthly income upon retirement by forming its savings part in non-state pension funds (NPF). You can do this yourself, and the size of contributions and their frequency are determined by the future pensioner at will. To form a funded pension, you must come to the company’s office with your passport and sign an agreement.

Some employers independently enter into agreements with non-state pension funds and form a funded pension for their employees. It will be possible to use the savings only after retirement, and the rule is valid if the employee has not moved to another company.

You can claim your earnings when men reach 60 years of age and women reach 55 years of age. The rule applies only to the duration of the transitional provisions of the pension reform.

There are several ways to receive the accumulated money. The pensioner chooses the option independently when concluding the contract:

- one-time entire amount;

- monthly for at least 10 years;

- for life every month;

- pass on by inheritance.

Monitor the condition of the HUD

Form a useful habit of monitoring the status of your personal account.

There are different employers, even unscrupulous ones. From time to time you need to check how many contributions to the future pension the employer has made and whether their amount corresponds to the salary. And also how many points and pension savings are already recorded in the personal account with the Pension Fund. There are several ways to get information about the status of your retirement account. The most convenient and fastest is in the citizen’s Personal Account on the official website of the Pension Fund of Russia www.pfrf.ru and on the portal of electronic government services www.gosuslugi.ru. The same information can be obtained through the Pension Fund client service. To do this, you need to go with your passport and SNILS to the nearest customer service at your place of registration and get qualified advice from specialists.

About pension payments

According to the latest data, the average pension throughout Russia is approximately 11,500 rubles. However, this value changes every year, so you cannot be sure that this is the money that will be paid to you every month. This is influenced by many factors: your work experience, the fixed pension rate for the year you need, and others. In order not to console yourself with hopes, you can go to the Pension Fund website and use a calculator to calculate your pension. It calculates your monthly pension payment based on your work experience (necessarily with “white” employment). Of course, the amount calculated using this program will not suit everyone, because everyone has their own “ideal” pension - an amount that will be enough for a comfortable life.

Important ! Therefore, if the result does not coincide with your expectations, there are several ways for you to increase your pension before it arrives.

Website of the Russian Pension Fund

At the moment, the pension consists of two parts:

- The first is insurance. It is formed on the basis of insurance premiums paid regularly. Due to the standardized rate, insurance payments do not depend on the amount of earnings and length of service. So in this case, pensioners who worked in a store as a cashier and administrator, for example, will receive the same amount for insurance payments.

- The second is cumulative. It is formed primarily on the basis of employer contributions, but may also include income received through the sale of securities on the financial market. A person is able to manage his savings as he sees fit. In addition, it is the accumulative part that is “regulated” - its value can be changed in advance.

The pension consists of several parts

There is also a state old age pension. It is paid to every citizen who has reached retirement age. However, to obtain it, you must have at least five years of experience - given that the minimum retirement age is 60 years, it will not be difficult to obtain such a relatively short experience.

Important ! Such payments directly depend on exchange rates and the country’s budget, so their sizes may often change.