Retirement age for municipal employees

According to Federal Law No. 143 of May 23, 2016, starting from 2021, the retirement age of MS will increase annually by 6 months. Thus, in 2021, older people who held positions in the municipal structure will be able to apply for a pension upon reaching 55.5 years (women), 60.5 years (men).

These innovations will affect more than one million elderly citizens.

The changes will not affect persons who had already received a pension before the introduction of the new bill. In addition, employees who held government positions before January 1, 2021 and had at least 20 years of service, as well as employees who have accumulated 15 years of service and have received the right to a pension, are entitled to receive a pension at 55 and 60 years of age (women and men, respectively). until January 1 of the New Year.

As a result of the changes, the state will save more than 600 million rubles in 2021. Every year the amount of budget funds will increase due to the gradual increase in the retirement age of MS.

Municipal employee pension

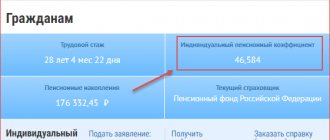

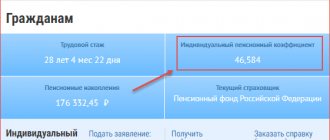

The amount of pension payments consists of the citizen’s actual work experience, average monthly income for the previous year of service, and corresponding allowances (if any).

In addition, you need to collect a sufficient number of individual points (coefficients).

Last year, the government of the Russian Federation carried out a reform regarding the procedure for retiring municipal workers. Thus, starting in 2021, the retirement age was to be increased gradually every year by six months.

The ultimate goal of the reform is to raise the age for a municipal pension to 63 years for female employees and up to 65 years inclusive for men.

The transition period will continue until 2032. The age limit is increased in stages.

Thus, in order to retire, it is necessary to take into account the employee’s length of service and the date of the right to receive the corresponding pension payments. For example, if you were supposed to retire in 2021, you will only have this opportunity a year later.

Interesting material : teacher retirement.

How much experience is needed?

Changes to the pension reform made in July 2021 affected the MS experience, which is necessary to assign a pension. From 2017, the length of service will increase by six months until it reaches 20 years. Although in 2021, a total length of service of 15 years was required to grant a pension.

Therefore, to apply for a pension in 2021, MS must have at least 15.5 years of experience, and in 2021 - 16 years, and so on until the 20-year period.

If a former MS gets a government job after pension payments have been assigned, then the amount of the pension is not reduced or cancelled!

Municipal length of service is used as the basis for determining the pension percentage as follows:

- 15 years - 45% of the monthly salary;

- 16 — 48%;

- 17 — 51%;

It is important to know! How to calculate a military pension

That is, for every year worked over 15 years, MS receive a pension bonus of 3%. Maximum pension rates are 75% of the average salary.

When assigning a disability pension, the MS experience does not affect the amount of the pension. If there are groups 1 or 2, the pension is equal to 75% of the salary, and if group 3 is assigned, it is 50%.

The pension size should not be lower than the subsistence level!

Retirement age for employees

The unlucky categories, which will now qualify for an old-age pension, include all persons working in municipal positions permanently, those in the civil service in the constituent entities of the Russian Federation or at the federal level of the country, as well as ordinary civil servants.

A complete list of positions and professions can be found on the regional websites of the constituent entities of the Federation, or on central government resources. The increase will occur by eight years for women and five years for men (63 and 65, respectively).

Read more: Is it profitable to invest in real estate now?

But, those who are approaching date “X” should not be upset - it will happen gradually - from 2021 to 2032, and in each of them no more than six months will be added to the pension threshold. In 2019, which is logical, women will retire at municipal pensions at 56.5 years old and men at 61.5 years old.

Changes have also been made to the long-service pension, which will be relevant, according to the long-term program, starting in 2021. They similarly provide for semi-annual increments annually, directly from the mentioned date.

Therefore, in 2021, the length of service for the service pension will be 16.5 years. But this program also has a number of its own features - it is designed for a shorter period of supplements (from 2017 to 2026), and after 2026 the length of service for calculating this type of pension will be 20 years.

Long service pension

To assign a long-service pension, the MS must fulfill a number of conditions, namely:

- having a total length of service of 15 years or more (depending on the year in which the citizen applies for a pension);

- reaching retirement age.

To apply for a long-service pension, you must do the following:

- Submit an application to the HR department or the Pension Fund.

- Prepare a complete package of documents:

- passport;

- a certificate from the place of employment about the amount of salary for the last year of work;

- a certificate from the personnel service indicating the total length of service;

- a copy of the dismissal order; a document confirming the fact of assignment of a long-service pension;

- a copy of the work book.

- Review of documentation by employees of the Pension Fund (hereinafter referred to as the Pension Fund) - based on the results of reviewing the papers, the relevant authorities make a decision to assign the former MS a long-service pension.

You may also be interested in Different ways to find out your pension savings.

The pension is paid from the date of submission of the application, but not earlier than from the date of actual dismissal from public office.

The size of the pension depends on such indicators as:

- size of the casing;

- additional payments for the position;

- long service accruals;

- money paid for special working conditions;

- increases for academic degrees and titles;

- awards.

Every year the state indexes pension payments in accordance with inflation rates.

Registration of a municipal pension

The procedure for applying for a municipal pension is somewhat different from applying for insurance coverage.

List of documents

To accrue financial support, the following documents should be prepared:

- passport;

- work book;

- certificate of income for the last year;

- pension certificate or other document confirming the fact of retirement in old age;

- SNILS (if available);

- military ID (if available).

This list is not exhaustive, since the procedure for registering municipal pensions is established by local authorities independently and, accordingly, there are different requirements for the documents provided.

Where and when to contact

The municipal pension, unlike the insurance pension, is paid from the local budget. To formalize it, a municipal employee must contact the personnel department of the organization where he works, providing the relevant documents.

An official has the right to apply for it at any time after he has this right.

In accordance with current legislation, persons employed in municipal service are entitled not only to an old-age insurance pension, but also to an additional one based on length of service. Only those officials who have been employed in local government bodies for a long time - at least 16.5 years in 2021 - can count on receiving it

Amount of pension payments

The size of the MS pension with 15 years of experience is equal to 45% of the average salary. For each year worked over 15 years, the MS receives a bonus of 3% of the salary.

The maximum criteria for pension payments are equal to 75% of the cash payments of the MS. The size of the pension is directly related to the salary of a municipality employee, as well as to the size, bonuses, and benefits throughout the entire working life.

It is important to know! Benefits for military pensioners

In addition, the amount of the long-service pension should not be lower than the minimum wage in a particular region.

The long-service pension is paid to disabled people in the following percentage: group 1.2 - 75% of the salary; Group 3 – 50%.

The amount of pension payments for length of service is compensated for the last 3 years if the documentation was submitted after the standard deadlines.

The pension consists not only of a percentage of the salary part, but also of a fixed payment, bonuses for position, annual indexation, a funded part and other types of additional payments.

Types of pensions

Rights and benefits for municipal employees are established by federal and local legislation. The state support defined by him contains:

- Long service pension. It is financed from the regional budget. In addition to officials, representatives of professions associated with risk to life - military personnel, rescuers, test pilots, etc. - have a similar benefit for length of service.

- Insurance payment for disability or old age. This subsidy has federal funding and is assigned on a general basis.

- Various surcharges. It is necessary to have the right to receive them, so they are not paid to all pensioners.

The municipal long-service pension supplements the state old-age or disability benefit up to a certain limit. In general, the total amount of the two payments should not exceed 75% of the average monthly salary for the last year worked. In this form, it is fair to consider municipal payments not as an independent state benefit, but as an additional payment to the existing one (insurance or disability).

- Russia changes entry rules into the country

- Payments upon dismissal due to employee reduction - amount of compensation

- How to cook pasta the navy way

Calculation of pensions for municipal employees

In order for the MS to be able to independently calculate the size of the future long-service pension, it is necessary to use the following formula:

Average salary* coefficient* percentage of length of service=pension.

To determine the average salary, you need to multiply the salary amount by 2.8 (the maximum salary limit for the position).

Municipal experience is used in the form of percentages, namely:

- 15 years - 45% of salary;

- 16 — 48%;

- 17 — 51%;

That is, for every year worked over 15 years, MS receive a pension bonus of 3%. The maximum indicators are 75% of the average salary.

Benefits for municipal employees

In addition to pension payments, MS are entitled to the following benefits:

- Medical care for medical workers and the employee’s family after the assignment of pension payments.

- Payments of pensions for length of service or disability, as well as the assignment of a pension to the family of the MS in the event of death while performing an official assignment.

- Insurance of an employee in case of loss of ability to work during the period of work activity or after its completion, but related to the performance of job duties.

- Preferential dental prosthetics (not in all regions).

- Compensation for funeral expenses of MS (introduced at the discretion of local authorities).

Additional social benefits are provided by local authorities in different regions of the country.

Municipal employee status

The defining features of this type of professional activity of citizens are set out in legislation. The differences between municipal service and other types of employment are:

- work on a permanent basis in positions in local government structures;

- financing from the local budget.

Like civil servants, local government employees have the opportunity to receive an additional pension. At the same time, municipal employees do not include persons who ensure the work of local administrations using various technical means (for example, cleaners, security guards, electricians, etc.). Subjects of the Russian Federation independently establish lists of positions that serve as the basis for drawing up staffing schedules. The table shows options for classifying workers in accordance with the following registers:

| Subdivision principle | Examples |

| Scope of powers available | Head of municipal administration, head of a territorial structural unit, head (manager) of a department. |

| Level of education received and skills by profession | Chief specialist, leading specialist, category 2 specialist. |

| Qualification category | Acting municipal councilor 1st class, senior assistant of the municipal service 2nd class. |

Supplement to pension

MS have the right to receive the following types of additional payments:

- increase in pension in the amount of one salary;

- social additional payments when assigning a pension that is below the minimum subsistence level;

- additional payments from 50 – 80% of the salary;

- preservation of state guarantees;

- monetary compensation for unused vouchers;

- payments to relatives for the funeral of MS.

It is important to know! Pension for widows of former military personnel

The full list of surcharges is fixed individually by region of the country. Consequently, the list of additional payments may vary between different regions of the Russian Federation.

Additional payments are due in cases where the MS, in addition to government activities, worked in an official position in another field!

Latest news this year

Increasing the retirement age

From January 1, 2021, the age of MS pensioners will increase by 6 months annually. So, in 2021, a pension can be issued upon reaching 55.5 years and 60.5 years (men and women, respectively). The retirement age will continue to increase up to 65 and 63 years (men and women).

Increased experience

In addition to age parameters, the period of work experience will also increase to 20 years instead of 15. The increase will occur annually by 6 months.

Canceling indexing for working MS

In the next two years, municipal service employees who decide to continue working once the required parameters are achieved will not be able to see the annual recalculation until they leave the workplace. At the same time, you are allowed to work until you reach 70 years of age, no more.

Reducing the coefficient

From 2021, the coefficient for length of service will be reduced to 1% (in 2016 it was equal to 2.8% of the salary).

Getting a raise

To assign an additional payment in the amount of 75% of the salary, you must work for 10 years, not 3 years. As a result, the economic crisis had a negative impact on MS pension payments. Even the February indexation of the MS pension remains a big question.

Features of calculating pensions for municipal employees in 2019

First of all, about terminology. Who are municipal employees?

As follows from Article 10 of Law No. 25-F3, a municipal employee is a person who was hired for a vacant full-time position in an institution that has the status of “municipal” and receives monetary remuneration for the performance of his official duties from budgetary funds.

The positions that these workers can occupy are divided into five categories:

The right to receive pension benefits for municipal employees is regulated by federal laws No. 166-F3 and No. 25-F3. According to these laws, pensions for civil servants are calculated not according to old age, but according to length of service.

The assignment of a pension to a municipal employee in 2021 is made if the applicant has worked in the municipal service for the minimum calendar period possible for retirement and has reached retirement age.

Long service pension for municipal employees

Length of service is the time period during which a person working in a municipal institution held a certain position in the status of a civil servant.

If a civil servant decides to retire in 2021 due to length of service, then he should be aware that the length of service of a municipal employee for a long-service pension must be equal to or greater than 15 years. Work experience in the civil service can be confirmed by a certificate issued by the personnel department.

A similar certificate confirming work experience in the municipal service can be issued by other departments that have the appropriate right and authority to do so.

Read more: How to fill out a passenger customs declaration

The long-service pension itself for municipal employees is a type of compensation assigned ahead of schedule.

If the retirement of a municipal employee is not tied solely and exclusively to the development of the length of service necessary to obtain seniority, and he is going to retire due to old age, then such an employee receives additional bonuses.

If an employee has special services to the state, he may receive additional benefits when a pension is assigned.

Early retirement of a municipal employee

Recent changes in pension legislation affected primarily civil servants.

These changes concern age standards and work experience requirements for applicants. For municipal employees, the retirement age and age limit began to increase in 2021.

Since all the latest changes in pension legislation are absolutely unpopular and are perceived extremely painfully by most people, the implementation of pension reform is being carried out in stages.

The bar for raising the retirement age moves up gradually, at intervals of six months annually. Ultimately, the retirement age should be 63 for women in 2032 and 65 for men in 2026.

Documents for registration of early pension for municipal employees

In 2021, women employees of municipal bodies can apply for a well-deserved retirement at the age of 56 years, and men - at the age of 61 years.

An age limit for municipal service has been established. It is 65 years old, regardless of the gender of the employee. Based on this, the concept of a “fixed-term contract” has lost its meaning.

All previously concluded “fixed-term” employment contracts from January 1, 2021 become “unlimited-term”.

The length of service in a municipal institution, which allows you to apply for early retirement based on length of service, will be twenty years in 2026, increasing by six months annually. According to this, in 2019, seniority must be at least 16 years in government positions.

How pensions are calculated for municipal employees in 2021

The calculation of pensions for municipal employees is made taking into account two factors:

- work experience;

- the amount (as a percentage of accrued salary) of deductions of insurance premiums.

This principle is also applied when calculating pension benefits for employees of municipal institutions. Law No. 166-F3 clearly states how to calculate pensions for municipal employees.

The minimum value of compensation payment for them should not be less than 45% of the average salary for the last calendar year.

The amount of old-age compensation calculated in proportion to the applicant’s IPC is subtracted from this value.

The maximum value of compensation payment is 75%. This value is calculated using the following algorithm: for the first 15 years of work experience, 45% is automatically taken.

Calculation of length of service for municipal employees for retirement

Then, for each subsequent year, an increase to the pension of municipal employees in 2019 in the amount of three percent is added to this minimum, but in such a way that the total amount received does not exceed 75%.

In accordance with the provisions of the law, the procedure for paying pensions to municipal employees is established. This category of persons is given the right to simultaneously receive two pensions - for length of service and part of the amount for old age.

In this case, the first is calculated based on the length of service in the civil service, and the second - from the remainder of the total length of service. An employee can refuse payments based on length of service and apply for a pension payment only for old age.

Indexation of pensions for municipal employees in 2021 is carried out through indexation of the insurance part of the pension in the approved manner.

What documents are needed to apply for a pension?

The long-service pension differs from the usual one, since this payment is made from federal budget funds. Therefore, the law specifies the conditions for its appointment, a list of necessary documents and the procedure for studying them.

Payment of pensions to municipal employees

To apply for compensation for length of service, a municipal employee must submit a package of documents consisting of:

- a petition signed by the head of administration for a long-service pension;

- a list of positions held in municipal institutions, indicating the period of work in each position;

- a certificate of all income for the last calendar year;

- passport, TIN;

- work record book and its copy (notarized);

- military ID (if available);

- dismissal order.

Conclusion

Pension compensation for municipal employees is calculated for each current month.

Delivery of funds to the pensioner is carried out in the manner that he indicates in the application.

The pension payment can be transferred to an account, to a card, or delivered by mail.

So, starting in 2021, municipal employees lost their status as government favorites in the country, and received not only an increase in the retirement age, but also an increase in the length of service so that this same pension would be accrued based on length of service.

Today we will talk about the specific numbers in which this will be expressed, and how it will affect the lives of our fellow citizens.

Pension law

Issues regarding the assignment of MS pensions are regulated by such bills as:

- Federal Law-8 dated 01/08/1998;

- Federal Law-25 dated March 2, 2007;

- Federal Law-143 dated May 23, 2016;

- Federal Law-134 dated October 24, 1997;

- Federal Law-166 dated December 15, 2001;

- Federal Law-178 dated July 17, 1999;

- Federal Law-385 dated November 22, 2016;

On the same topic, news, we suggest looking at the new bill in the state.

Duma. At the end of this material, I would like to note that the assignment of the MS pension is undergoing a number of global changes, so every civil servant must know his own rights and responsibilities prescribed in the new legislation. This material touched on all the important aspects of the pension reform, which is related to the calculation of the MS pension in 2021.