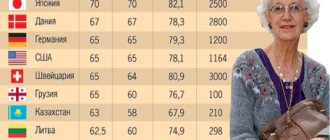

Retirement age in Kazakhstan for women and men

The minimum amount of benefits is guaranteed by the Constitution of the Republic, and it is paid in accordance with the law “On pensions...”. The age for applying for accruals for men is still higher than for women, but by 2027 it will be equal and will be 63 years old, regardless of gender.

How to retire early

Citizens who have lived for 5 years or more in regions at environmental risk have the opportunity to receive benefits ahead of schedule: men - 50; woman - 45.

These include areas near the Semipalatinsk test site in the period from 08/29/1949 to 07/05/1963.

Important from BBQcash: you need experience before 1998—25 and 20 years, respectively.

For mothers of large families with 5 or more children, the age to receive a pension is 53 years.

Important from BBQcash: a woman can give birth to them herself or adopt them.

Mandatory compliance with the conditions:

- at the time of applying for benefits, the fifth child must be over 8 years old;

- children were adopted before they turned 8;

- work experience - 20 years.

Citizens of Kazakhstan - participants in the savings system can take advantage of a pension annuity - an agreement that stops working activity before the established age - at 50, if their work for at least 5 years was associated with harmful conditions. For other categories: man - at 55 years old; woman - at 51.5 years old (from 2020).

Important from BBQcash: they must have enough funds in the UAPF: 9.6 and 13.5 million tenge, respectively.

Pension reform in Kazakhstan

In Kazakhstan, pension reform began in 1998. It was based on the principle that a citizen should be responsible for his future pension. Due to the need to modernize the current system and prevent a reduction in the amount of payments, changes are now being carried out, consisting of two stages:

- creation of a Unified Savings Fund with preservation of all savings obligations;

- approval of the concept until 2030, which provides for strengthening sustainability and increasing benefits.

These steps include the following:

- subsidies for OPF for working women caring for children under 1 year of age;

- lifting the moratorium on increasing the retirement age;

- the obligation of the employer to transfer 5% of his funds for employees working in hazardous conditions;

- change in basic benefit from 07/01/2018

The age increase affected only women. From 2021, six months will be added for each calendar year. In 2027, they will retire at 63 and buy an annuity at 55, like men. This change is associated with an increase in life expectancy, which is slightly higher for women.

Important from BBQcash: Early retirement remains unchanged.

As part of the reforms, a bill has been prepared to reduce the retirement age for teachers with 30 years of teaching experience upon receipt of a number of additional payments. Issues about pensions for miners and doctors who have psycho-emotional stress during work are being considered.

Pension contributions

The employer must transfer 10% of his employee’s income to the UAPF. The amount with which they are withheld should not be lower than the minimum wage and 50 times higher than it. The employer transfers 5% of his own funds to professional contributions.

Part-time workers, freelancers and employees under civil contracts are exempt from paying 10%. Contributions are made for them by those to whom the citizen provides services.

Important from BBQcash: the voluntary nature of transferring amounts for each person remains.

How is a pension calculated?

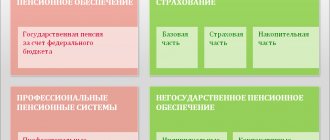

Kazakhstan has a multi-level pension system consisting of:

- Basic: until 2021, one size fits all.

- Mandatory or joint: the amount of contributions (10% of salary) and length of service before 1998 are affected.

- Voluntary: a citizen’s desire to receive additional income.

On the official website of the UAPF there is a forecast electronic calculator that allows you to calculate the amount of your pension. They offer the opportunity to calculate benefits for military personnel and employees of the Ministry of Internal Affairs, the Prosecutor's Office, etc.

What is a basic pension

State assistance for persons who have reached a certain age is called basic. It does not depend on other types of pensions. Until July 1, 2018, it was equal to 0.54 PM and was the same for everyone. Then the calculation procedure was changed. Now it takes into account the length of service and the amount of PM:

- 54% of the monthly salary, if a citizen worked for 10 years or less: in 2021 - 16,037 tenge or 2,651 rubles or 41 dollars, in 2021 - 16,839 tenge (2,770 rubles or 43 dollars);

- every year over 10 adds 2%.

A citizen who has worked for 19 years will receive 72%, 30 - 94%, more than 33 - PM. In 2021 it is 22,452, 29,312, 31,183 tenge, respectively. Work experience is calculated in accordance with current legislation. The changes affected everyone. Those who already received a pension were recalculated. In 2021, the basic benefit was increased by 5%, in 2021 it will increase by another 5%, but this will not significantly increase the pension. From January 1, 2020, the basic allowance for guardians raising a disabled child will be equal to the minimum wage - 43,567 tenge.

Important from BBQcash: this methodology is designed to establish social justice for citizens with extensive experience and give an incentive to young people to work.

Solidarity or labor pension

They pay to everyone who worked for at least 6 months before 1998. For the calculation, they take the average income for any 3 years starting from 1995. The size of the joint portion is equal to 60% of the average earnings. Those who have the necessary experience receive the full amount: 20 years - women; 25 years old - men. If it is greater, then each year the benefit amount increases by 1%. Maximum - 75% of the income from which the calculation is made. In 2021, the minimum labor pension is 36,108 tenge, and the maximum is 46 MCI or 116,150 tenge.

Important from BBQcash: generational change will lead to the disappearance of this part.

Pension calculator Online

Important! Before you start calculating your future pension, please read the following information carefully:

- The results of pension calculations are purely conditional and are intended only to familiarize yourself with the amount of your future pension. For a more accurate calculation, we recommend contacting the pension fund.

- All calculation data: coefficients, point value, fixed payment amount, which are used in the calculator, are given as of January 1, 2021 . This means that for the entire period of work experience that you indicate in the calculations, the values of the coefficients, fixed payments, your salary, etc. will apply. taking into account 2021 indexation.

- The calculator will be more useful to those users who are just starting their work experience.

- When calculating, it is conditionally assumed that in 2021 you have the right to receive a pension with the data you entered.

- If you need to pre-calculate the GIPC, you can do so on this page.

Amount of insurance pension (SP)*

: Your work experience is less than 9 years The number of accumulated PCs is less than 13.8 Your work experience is less than 9 years and the number of pension savings PC is less than 13.8: You are entitled to a minimum pension: 8703 rubles

Number of individual pension coefficients (PC)

:

Clear and recalculate

* Your pension calculations are approximate. To obtain more accurate results, we recommend contacting the Pension Fund of the Russian Federation. When calculating the conditional amount of the insurance pension, the following indicators for 2021 are used: Fixed payment - 5,334 rubles; The cost of 1 pension coefficient is 87.24 rubles;

The maximum salary before personal income tax, subject to insurance contributions, is 85,083 rubles per month.

Examples of calculations for those retiring in 2021

Victoria Sergeevna is retiring in April of this year at the age of 65. Until 2021, the woman had created pension savings, thanks to which she could receive a pension of 9,000 rubles.

She also has two children, and she spent 1 year on leave for each of them. For the last 2 years, Victoria Sergeevna has been caring for her father at the age of 84.

At the moment she receives a salary of 25,000 rubles.

To calculate the insurance pension, you need to know the amount of IPC = SCH (the insurance part of the labor pension as of January 31, 2014) / C (the cost of one point).

In this case, her IPC = (9000-5334.19)/87.24 = 42 points.

Now you need to find out how many pension points a woman will receive for 2021: (0.22 (22% - the rate of insurance contribution when calculating an insurance pension) × 4 (the serial number of the month of retirement in 2021) × 25000/212360 (the maximum possible annual contribution in 2021))x10=1.04 points.

For leave to care for the first and second child, included in the non-insurance period, she receives 1.8 and 3.6 points, respectively.

For caring for a citizen over 80 years of age, she receives 1.8 points for each year. In this case, 2 years.

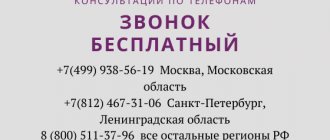

Attention! If you have any questions, you can consult with a lawyer for free by phone throughout Russia. Calls are accepted 24 hours a day. Call and solve your problem right now. It's fast and convenient!

The sum of all pension coefficients of Victoria Sergeevna = 42 + 1.04 + 1.8 + 3.6 + 1.8 + 1.8 = 52.04.

Since a woman retires 9 years later than the established period, she is entitled to bonus coefficients for a fixed payment and for an insurance pension of 2.11 and 2.32, respectively.

The size of the insurance pension is calculated according to the following formula: SP = FV (fixed payment) × K (premium coefficient) + PC (sum of all annual IPC) × S × K.

According to the formula, the insurance pension will be: 5334.19 × 2.11 + 52.04 × 87.24 × 2.32 = 21787.87 rubles .

Boris Ivanovich decided to retire in April 2021 at the age of 63. The man worked in the village for 35 years and subsequently remained to live there. In his youth, he served in the army.

At the end of 2021, he already had savings that allowed him to receive a monthly pension in the amount of 14,000 rubles.

At the moment, the man receives an official salary of 40,000 rubles.

To calculate the insurance pension, you need to know the amount of IPC = SCH (insurance pension as of January 31, 2014) / C (the cost of one point). In this case, his IPC = (14000-5334.19)/87.24 = 99.33 points.

Now you need to find out how many pension points a man will receive for 2021: (0.22 (22% - the insurance premium rate when calculating only the insurance pension) × 4 (the serial number of the month of retirement in 2021) × 40000/212360 (the maximum possible annual contribution in 2021)) x 10 = 1.66 points.

Also, for military service in the army, which is included in the non-insurance period, he is entitled to another 1.8 points.

Sum of all pension coefficients for a man = 99.33+1.66+1.8 = 102.79

Let us recall that Boris Ivanovich worked in the countryside for more than 30 years and remained to live there, so he is entitled to a 25% bonus to the fixed payment, that is, its value will be equal to: 5334.19 x 1.25 = 6667.73 rubles.

It is worth noting that a man retires 2 years later than the established period, so he is entitled to bonus coefficients for a fixed payment and for an insurance pension - 1.19 and 1.24, respectively.

The size of the insurance pension is calculated using the following formula: SP = FV (fixed payment) ×K (premium coefficient) + PC (sum of all annual IPC) ×S×K.

According to the formula, the insurance pension will be: 6667.73 × 1.19 + 102.79 × 87.24 × 1.24 = 19054.17 rubles .

Calculating your pension using the pension fund calculator

The change was the increase in the retirement period. By 2024, this level is planned to be increased to 15 years. At the same time, its increase will occur gradually, per year - in 2015 it will take six years, in 2021 already 10.

If a citizen does not have enough length of service, he will still be able to retire, but five years later than the period established by law.

Therefore, those who want to understand how the old-age pension is calculated in 2021 need to know what age limit is set in a particular year.

Such a system will definitely suit citizens who want to increase their work experience and plan to work after reaching retirement age, however, it raises a large number of questions among current pensioners, as well as among those who have the right to use preferential length of service, for example, if a citizen is a teacher or health worker or an employee of the Ministry of Internal Affairs.

The main questions are how the funds will be distributed between the funded and insurance parts of the pension and how to calculate a preferential pension, for example, for disability? As far as is known, the state takes responsibility only for the second part. That is, the citizen is faced with a contradiction: will the funded part or is it better to completely rely on the state?

Considering that the required length of service has increased, relying on the state is quite risky. This system has also been severely criticized by experts because the labor pension will be calculated in points. Experts express the opinion that older people, who are much more comfortable with fixed payments, simply will not be able to understand how to calculate their future pension .

Procedure for calculating pensions Online

How to calculate your pension in 2021? The insurance pension is calculated using the same formula as in previous years:

SP = FV * K + PC * S * K

The formula for calculating pensions in 2021 includes the following:

- SP is the amount of pension for a specific year.

- PV is a fixed part of the pension.

- The bonus K coefficient depends mainly on the retirement age. For example, if a citizen retired 3 years later than the established period, then the coefficient takes the value 1.19.

The second part of the formula consists of the following indicators:

- PC – the sum of the citizen’s annual individual pension coefficients.

- C reflects the value of one pension point for the year for which the calculation is being made.

- K – premium coefficient.

In some cases, the pension may be calculated differently. For example, in order to calculate a military man's pension , you need to know his military rank - this is important for determining the military pension salary.

Calculation example for pensioners retiring in 2019

Anna Andreevna turns 55 in February 2021, but she has not been working since the beginning of January.

Using online calculators, the woman calculated that the amount of her IPC during her work was 75 , an additional 1.8 was accrued to her for the birth and care of a child.

She does not have any special (harmful, northern or rural) experience; she lives in the Oryol region, so she will not be assigned a regional coefficient.

The calculation of the pension amount in 2021 will look like this:

(75+1,8)*87,24 + 5334,19 = 12034.22 rubles.

More accurate calculations can only be made by Pension Fund employees who have the pensioner’s personal pension file.

How to calculate your pension using a pension calculator?

As you can see, it is very difficult to correctly calculate your pension independently , given the large number of indicators. Therefore, it is more convenient to calculate your pension using the 2021 calculator online . To calculate your pension, you must enter the following information:

- gender and age (women retire 5 years earlier than men);

- length of service (the length of service coefficient for each year of work increases by 0.01);

- average salary (if a citizen’s salary is higher than the national average, a coefficient is also applied, the upper limit of which is 1.2);

- pension tariff (namely the ratio between the funded and insurance parts).

You need to fill in this data and click the “Calculate” button, after which the system will give you the result.

Attention! If you have any questions, you can consult with a lawyer for free by phone throughout Russia. Calls are accepted 24 hours a day. Call and solve your problem right now. It's fast and convenient!

Source: https://pensia-expert.ru/trudovye-pensii/pensiya-v-2015-godu/pensionnyj-kalkulyator/

How to calculate work experience

When calculating length of service, all working periods are taken into account:

- contract;

- entrepreneurial or other activities;

- law enforcement agencies.

Includes care time:

- disabled person of group 1 or 2;

- a non-working pensioner;

- elderly people over 80;

- a disabled child under 16;

- children under 3, no more than 12 years old.

Life time:

- military;

- state and courier;

- VOHR, police, special communications and rescue units in mountainous areas.

Period of residence or stay:

- in custody for those repressed who were subsequently rehabilitated;

- on occupied territory during the Great Patriotic War, if no crimes were committed;

- abroad, but not more than 10 years;

- in areas that do not provide employment opportunities for spouses of military personnel (except for urgent work), employees of special agencies, up to 10 years.

Important from BBQcash: the period of study in all educational institutions is also taken into account.

When calculating preferential length of service, having reached a certain age, some periods are multiplied by a coefficient.

Two:

- labor during the Great Patriotic War (including civilian workers);

- accommodation in besieged Leningrad (ages 12 and older);

- staying forcibly on the territory of other countries (concentration camp, ghetto, etc.), if they did not commit crimes;

- treatment and care of persons infected or sick with AIDS in special institutions.

Three:

- labor in besieged Leningrad;

- being in custody due to repression, subsequently rehabilitated;

- areas of environmental risk from 08/29/1948 to 07/05/1963.

One and a half:

- regions near the Semipalatinsk test site from 07/06/1963 to 01/01/1992;

- organizations conducting forensic diagnostics when performing work from the approved list.

Important from BBQcash: staying in the active army during hostilities, in partisan detachments, in a hospital while treating a military injury provides for a long service bonus for military personnel.

Participation in seasonal work for the period is counted as a year:

- navigation on water transport;

- industrial organizations from the approved list.

Everything about funded pensions in Kazakhstan

With the introduction of the savings system, each employer is obliged to transfer contributions to an individual PF account. The amounts can be viewed in your personal account on the UAPF. The following persons may apply for payments from this fund:

- who have reached retirement age;

- having sufficient funds for an annuity in the amount of the minimum pension;

- those who received disability of groups 1 and 2 indefinitely;

- those who moved outside the Republic of Kazakhstan for permanent residence.

Until 2021, a citizen himself could set the frequency of receiving amounts; after that, only monthly. To calculate the amount of payments, there are special formulas and a minimum (54% of the minimum wage). If the collected amount in an individual account does not exceed 12 minimum pensions, then it can be received at a time.

Payments are made until all savings are fully used and there are guarantees from the state for safety, taking into account the level of inflation. The remaining amount in the event of death is inherited by law.

If the accumulated amount allows you to buy a pension annuity, then it is transferred to the insurance company and payments are received. An annual indexation of 5% is provided, which is not included in the Pension Fund. If there are insufficient funds, you can deposit them in any way and then enter into an agreement with the insurance company. The Pension Fund must check it and only then transfer the required amounts.

If there are enough funds, then those who exceed the annuity leave it in the UAPF and receive benefits from there. The contract with the insurance company is concluded for a certain period or for life. After the time expires, payments stop. In case of death before the end of the established period, the heir receives the amount.

Interesting from BBQcash: the insurance company can pay a certain percentage of the amount one time.

The payment schedule is established in the contract.

Voluntary pension

This is a type of funded pension, but voluntary. It is received by citizens who have made additional contributions to the UAPF or another fund from their own funds. The concluded agreement determines the frequency and duration of payments.

Pension calculator in 2021 online calculator calculation of the PRF

When calculating the conditional amount of the insurance pension, the following indicators relevant for 2021 are used:

- Fixed payment – 5,686.25 rubles.

; - Cost of 1 pension coefficient – 93,00

; - The maximum salary before personal income tax, subject to insurance contributions, is 95,833 rubles per month.

In 2021, about 1.5-2 million citizens will retire. However, younger people should not delay and become interested in future old-age benefits now. The pension calculator calculates how much a person will receive if he retires this year, given his current salary and other parameters. It shows the approximate result.

The exact amount will be known after submitting your application for retirement and calculating all rights and benefits; you can always view it in your personal account of the Pension Fund. An analysis done in advance helps determine future financial support in old age and creates motivation for honest, regular contributions to a retirement account.

Pension calculator on the website www.pfrf.ru

Influencing factors

After the reform, the IPC - Individual Pension Coefficient - was added to the influencing factors for calculating pensions. It is quite simple to calculate it by entering your salary before deduction of personal income tax into the form on the website.

In another way, IPCs are called pension points. They affect old-age insurance benefits, which are calculated by multiplying points by the price of one point in a given year and summing these values.

Conditions for receiving old age benefits:

- Availability of retirement age: from 55 years old for women and from 60 years old for men.

- A certain number of years of experience in paying insurance premiums. From 2024 this figure will reach 15 years.

- Minimum number of pension points: 30.

Important : the number of points per year is limited. In 2020 it is 9.13, and in 2021 it is 10 for citizens who do not have pension savings. Otherwise, other figures appear: up to 6.25% in 2021.

It is worth remembering : the state regularly indexes the insurance pension, while the funded one is in the NPF or Criminal Code, depending on the desire of the citizen, and is not subject to indexation.

Verified funds invest these funds in financially profitable projects, increasing the client’s income. If the programs turn out to be failures, then the client can only hope for the amount that he had already contributed earlier.

What else is the IPC charged for: individual cases

IPC can be accrued not only based on length of service, but also in some situations described in the law.

1.8 points are awarded for one year of care for the following category of citizens:

- disabled person of group I;

- disabled child;

- old people over 80 years old;

- child under 1.5 years old (both parents).

1.8 is also accrued for one year of conscription service in the army. If a parent takes a year off to care for a second child, he will be awarded 3.6 points, and for the third and fourth - already 5.4.

The Pension Fund encourages people to retire as late as possible by offering an increase in fixed payments and insurance cash benefits by 36% and 45% points, respectively, if a citizen applies 5 years after receiving the right to security in old age. After 10 years, the fixed payment will increase by 2.11, and the insurance payment will increase by 2.32.

Military pension

Military pension also has its own calculation formula:

- 50%. .

There are three types of military pension:

- by length of service;

- on disability;

- for the loss of a breadwinner - relatives receive if he goes missing or dies.

Important : if 20 years of service are not reached, the pension is calculated based on mixed length of service.

Fixed payment, its size in 2021

The fixed payment amount in 2021 is RUB 5,686.25. for persons who have reached retirement age. Depending on the category of pensioners, it may vary:

- 7,474.35 rubles for persons with more than 15 years of work experience in the Far North, with 25 years of experience for men and 20 for women.

- 9965.80 - for disabled people of group I.

- 4982.90 - for disabled people of group II.

- 2491.45 - for disabled people of group III.

- and some other categories, in accordance with the law of December 28, 2013 N 400-FZ.

Indexation of the fixed part occurs every year on February 1, taking into account the growth of inflation. From April 1 every year, the Government may consider increasing it based on the income of the Pension Fund.

How is the insurance pension calculated in 2021?

The insurance pension includes four periods of earned funds:

- until 2002;

- 2002-2014;

- after 2015;

- others non-insurance.

In 2021, the cost of one point is 93.00 . It grows from year to year, taking into account indexation and inflation. The formula for calculating a pension is: multiply the number of points by the cost of one and add a fixed payment. Let’s say you have 70 points in your account, then the insurance benefit will be 70 x 93.00 +4982 = your pension.

The number of points depends on the citizen’s work experience and his contributions, while the other two indicators are established by the state annually and indexed.

Funded pension: size, sources and conditions of receipt

Since 2015, the funded pension (CP) ceases to be part of the labor pension and becomes an independent type of old-age benefit. Its size depends on the length of the payment period.

Formula for calculation: the amount of pension savings is divided by the number of months of the expected payment period.

NP is formed in several ways:

- The funds are contributed by the employer during the entire working period of the employee: 22% of the salary - 16% to the insurance part and 6% to the funded part.

- Maternity capital can be invested partially or in full.

- Participation in the Co-financing Program.

An insured person of retirement age has the right to receive NP if his savings in the pension account are at least 5% in relation to the amount of the old-age insurance benefit.

The fixed payment and the amount of the funded pension, which is calculated as of the day of its appointment, are also taken into account.

Otherwise, when the ratio is less than 5%, the citizen has the right to request a lump sum payment, when the accumulated amount is paid at a time without monthly division.

In addition, a citizen receives NP regardless of receiving other cash benefits.

How to check the amount of pension savings?

Previously, information about pension savings was reported by the Pension Fund, but now a citizen himself can familiarize himself with them at any time:

- online on the websites gosuslugi.ru and pfrf.ru, you only need your SNILS number;

- in the branches of the Fund;

- from employees in bank branches or ATMs: VTB, Sberbank, etc.

Important: to create an account on the State Services portal, you will need your passport number and series, as well as SNILS. After gaining access to sections of the site, open the “Russian Pension Fund” tab for further information. If difficulties arise, the Hotline will provide options for solving the problem. Number: 8 800 100-70-10.

The cost of a pension point for working pensioners in 2020

About 10 million citizens are working pensioners, and in 2020 the Government may leave this category without pensions. These include persons receiving wages and making contributions to the fund, as well as self-employed people. Pension payments have increased by 3.7% since the beginning of 2021. Accrual of points for work experience is possible in an amount of no more than 3 and in total it is 244.47 rubles.

How to calculate your pension using the new pension calculator?

The PFR pension calculator allows you to calculate your future pension online and form your opinion on how to ensure your old age with dignity. It is not suitable for military personnel and law enforcement officers who do not have employment experience in civilian areas.

All calculations are approximate, the exact figure will be obtained after applying for cash benefits, when all pension rights and benefits will be calculated in each case. To simplify the calculations, some factors are assumed to be constant, taking into account that the person retiring will receive it in the current year.

Persons who worked in the Far North, caring for certain categories of citizens, have the right to increased coefficients for calculating benefits.

Self-employed citizens must annually transfer 1% of the amount of at least 300,000 rubles to compulsory pension insurance.

A small questionnaire is presented on the official website of the Pension Fund. You must specify:

- floor;

- year of birth;

- number of years of conscription service;

- number of planned children;

- duration of care for certain categories of citizens;

- the period after reaching retirement age during which a person refuses to pay cash benefits;

- official salary;

- type of work: self-employed or hired worker;

- seniority.

After entering all the data, you need to click the “Calculate” button.

On the page with the calculator there is also a column where you can calculate the number of pension points that can be received in 2020, taking into account wages before deduction of personal income tax (NDFL).

Let's sum it up

The main task of the online calculator from the Pension Fund for calculating pensions is to inform the population about the criteria that influence the provision of old age, and to motivate them to increase their readings by increasing social and labor activity. The flat salary, regular contributions, insurance period and retirement age determine its size.

It is quite difficult to manually calculate all the benefits and entitlements over a lifetime. Special algorithms will do this on their own, taking into account various criteria, but their numbers are not accurate due to some constant coefficients. It will be possible to find out the specific amounts after submitting an application for retirement, where Pension Fund specialists will calculate all the nuances in accordance with the law.

Source: https://pfrf-kabinet.ru/kalkulyator-pensii

Moving

On the territory of Russia there is an agreement on guaranteeing the rights of citizens of the CIS countries in the field of pension accrual.

Citizens of Kazakhstan working under an employment contract in Russia apply for SNILS. This is necessary to take into account the length of service when applying for a pension, to receive benefits in your state or in the Russian Federation.

Migrants are paid a pension according to the laws of the state where they live. When calculating, all length of service earned in the CIS is taken into account. Moving to permanent residence and obtaining Russian citizenship will entail the termination of payments in Kazakhstan. It is necessary to complete the transfer: they receive a pension file and submit all the required documents to the Pension Fund of the Russian Federation.

Staying on the territory of Russia with a temporary residence permit allows you to receive a Kazakhstani pension on a bank card and withdraw it in the Russian Federation.

Calculate pension Online

By 2021, the amount of points accumulated was 61; the pensioner does not have any bonus conditions. The exception is deferment of pension for 4 years. This gives the right to increase the fixed part by a factor of 1.27. Let's calculate using the formula:

When calculating the conditional amount of the insurance pension, the following indicators for 2021 are used: Fixed payment - 5,334 rubles; The cost of 1 pension coefficient is 87.24 rubles; The maximum salary before personal income tax, subject to insurance contributions, is 85,083 rubles per month.

We recommend that you read: 2 personal income tax new form 2021