Home » Debit cards MIR

Pensioners can apply for a MIR card for free at any major Russian bank. They are accepted for payment in any store, and you can withdraw money from any ATM. Therefore, when choosing, you should pay attention to how much you can save thanks to cashback and interest on the balance.

In 2021, all major banks are issuing free MIR cards for pensioners.

- Sberbank Customer reviews about the Sberbank card

- Reviews from VTB clients

- Reviews from Post Bank cardholders

- Reviews from Rosselkhozbank cardholders

- Reviews from Promsvyazbank cardholders

- Feedback from Ak Bars Bank clients

- Reviews from URALSIB Bank clients

- Reviews from Moscow Industrial Bank cardholders

- Customer reviews about the Rosbank card

- Reviews from UniCredit Bank cardholders

Sberbank

The country's largest bank was one of the first to issue a MIR social card for pensioners. Among its advantages are the following:

- free service;

- 3.5% per annum on any amount in the account;

- cashback with “Thank you” bonuses up to 30%

- free cash withdrawal up to 100 thousand per day.

Judging by the reviews of the owners, this card really has quite a lot of advantages, and it does not have any particular disadvantages. The card cannot be used abroad - however, this is a feature of any MIR payment system account. However, already in 2021 they are accepted at some payment points in Belarus, South Ossetia, Armenia, Kazakhstan, Kyrgyzstan, Turkey and Abkhazia.

Fig.2. The MIR card from Sberbank is serviced free of charge during its entire validity period.

Note! Cash without commission can be withdrawn in the following order: 50 thousand at an ATM and 50 thousand at a bank branch. If a larger amount is required, 1% will be charged (minimum RUB 100).

Customer reviews about the Sberbank card

“I’ve been using the MIR card for a long time – right after I transferred my pension. There are no comments - it is accepted at all ATMs and stores, like any other. Plus interest on the balance, plus small bonuses. I didn’t find any cons.”

Anatoly, 64 years old, Krasnoyarsk

“I recommend the Sberbank Mir card to all pensioners - it is serviced completely free of charge and also gives a small interest on the balance of 3.5%. It turns out that you always have a small bank account with you.”

Natalya, 55 years old, Vladivostok

How to apply for a pension on a MIR card?

You can make a transfer in your region of registration. With your passport and SNILS, go to a branch of Sberbank, MFC or Pension Fund to submit an application. It can be filled out on the spot or in advance by printing a form from the Sberbank website.

Pros and cons of the card

A pension card has its pros and cons. The advantages outweigh the disadvantages:

- release and maintenance are free;

- the ability to connect additional paid services at a reduced rate;

- opportunity to use throughout the country, including Crimea; for comparison, international payment systems do not work in Crimea due to sanctions;

- the operation of the MIR payment system does not depend on foreign policy.

There are disadvantages:

- restrictions on use outside of Russia;

- not all online stores are ready to accept the WORLD.

Problems with payment acceptance are being actively resolved.

VTB

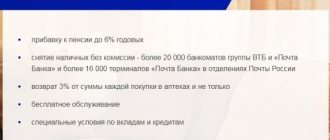

VTB issues one of the most profitable pension cards, which has great advantages:

- Free service.

- Interest on balance up to 8.5%.

- Cashback up to 10%.

- Possibility to choose a cashback category once a month.

- Increasing the deposit rate or reducing the loan rate is your choice.

The card is very convenient to use, which is confirmed by reviews from holders. You can withdraw cash for free both from VTB and from our partner Post Bank. There are no specific disadvantages to this product.

Fig.3. A multicard from VTB allows you not only to store money securely, but also to save it thanks to a high interest rate on the balance of up to 8.5%.

Important! The client has 7 options to choose from, including increased cashback in certain categories, an increase in the deposit rate or a reduction in interest on the loan. You can change the option free of charge once a month.

Reviews from VTB clients

“I recommend the multicard from VTB to all pensioners - it has everything they need. The service is free, regular interest is accrued on the balance and I get discounts in stores - although this is rare, because my pension doesn’t really allow it. Nevertheless, the benefits are obvious.”

Anna, 67 years old, Khabarovsk

“A very convenient product - all in one: deposit, cashback and bank account. I recently opened a deposit at VTB, activated the option, and the rate increased by 1%. Very profitable."

Igor, 65 years old, Irkutsk

Post Bank

The bank offers to receive a free card, immediately on the day of application. The main advantages of this offer:

- free service;

- the ability to withdraw cash without commission from both Post Bank and VTB;

- interest on balance up to 6%.

But this card does not provide cashback. At the same time, customers can receive additional interest when making purchases in partner stores of the MIR payment system. These include supermarkets OKEY, Panasonic, Daughters and Sons and many others.

Fig.4. The Post Bank card allows you to increase your savings at a rate of up to 6% per annum.

Reviews from Post Bank cardholders

“Very convenient MIR card from Pochta Bank. Service is free, cash can be withdrawn almost everywhere - there are a lot of VTB ATMs. In addition, interest is charged on the balance - i.e. you don’t pay at all and still save money.”

Vladimir, 61 years old, Moscow

“I recommend a card from the Post Bank to everyone - it is free, issued immediately (you can get it directly from your social security office or at the post office, where there is a Post Bank branch). Interest is actually accrued on the balance, and you will receive a maximum of 6% if the account balance is 50 thousand or more.”

Galina, 57 years old, Omsk

Pension card Mir

When receiving a plastic card, its owner, first of all, pays attention to the bank that issued it, as well as its validity period. However, on its front side there is no less important information in the form of the payment system logo. The latter is, in fact, a special electronic system through which electronic payments are made.

Today, there are several global payment systems in the world, the cards of which are accepted almost anywhere on the planet. First of all, these are Visa and Master Card.

Reference! The American Express non-cash payment system is no less used, but it is practically unknown in Russia and is used by our compatriots, mainly outside the country.

It should be noted that the leading payment systems are registered abroad, and therefore it is practically impossible to regulate their activities using the instruments provided for by Russian legislation. In addition, as practice has shown, this circumstance allows some states to exert economic pressure on individual organizations and individuals.

The need to create its own national payment system arose in the Russian Federation in 2014 and is associated with events surrounding the contestation of the status of the Crimean Peninsula. It was at this time that there was a threat of stopping the service of plastic cards of Western payment systems in Russia, which would cause significant damage to the domestic economy.

After the actual entry of Crimea and Sevastopol into the Russian Federation, the Visa and Master Card payment systems stopped servicing on the territory of the peninsula. In this regard, the only possibility of using non-cash payments on the territory of these subjects is their implementation within the framework of the national payment system.

The Mir payment system, which received its name as a result of a popular vote, was launched in accelerated mode already in 2015. And two years later, all retail outlets that work with non-cash payments became required to accept card data for payment. At that time, an active transfer of state employees and recipients of various government payments, including pensions, to cards of the Mir payment system began.

Today, “Mir” is accepted throughout the country, as well as in Armenia. The Russian Foreign Ministry, as well as representatives of financial institutions, are actively working to ensure that cards of the domestic payment system are accepted in those countries where Russians travel most often, including the CIS countries, Turkey, Egypt, and so on.

Rosselkhozbank

In this bank, the pension card is also serviced free of charge, and the client receives:

- up to 6% on balance;

- 5% cashback for purchases in pharmacies.

Despite the small ATM network, you can also get money for free from partners:

- Alfa Bank;

- ROSBANK;

- Raiffeisenbank;

- Promsvyazbank.

Fig.5. Thanks to the offer from Rosbank, you can receive a stable income of up to 6% and cashback of 5% in pharmacies.

Reviews from Rosselkhozbank cardholders

“I really like this card because I get 5% cashback at pharmacies, i.e. essentially a permanent discount. I have already recommended it to all my friends and colleagues.”

Tamara, 63 years old, St. Petersburg

“A very convenient product from Rosselkhozbank - both interest on the balance and a discount in pharmacies. True, there are not many ATMs. But there are partners – Alfa-Bank, for example.”

Igor, 60 years old, Yaroslavl

Promsvyazbank

This bank offers a free card, but if you do not use it for a year, a service fee will be charged (up to the account balance, but not more than 1000 rubles). At the same time, it also has its own advantages:

- interest on the balance is one of the highest 5%;

- discounts for purchases from partners are also quite large - up to 40%;

- cashback for purchases in pharmacies and gas stations – 3%.

Fig.6. With this card you can receive a guaranteed interest on the balance of 5% and discounts of up to 40%.

Important! Interest on the balance of 5% is accrued only if there is constantly more than 3,000 rubles in the account.

Reviews from Promsvyazbank cardholders

“I am satisfied with the Prosmvyazbank card because there is a constant cashback for gas stations and medicines. In addition, there is interest on the remaining 5% - I think this is one of the most profitable offers for pensioners.”

Alexander, 64 years old, Moscow

“With the Promsvyazbank card everything is fine, but there are not enough ATMs. True, now there are already partners where money is withdrawn without cash - these are Alfa-Bank and Rosselkhozbank. Otherwise there are only positives.”

Marina, 55 years old, St. Petersburg

AK Bars

This bank issues a MIR social card for pensioners, called “Longevity”. Among its advantages:

- free service;

- cashback 5% per annum on the amount of all purchases;

- 5% per annum on balance.

However, this bank is not represented in all regions; moreover, it does not have many ATMs and there are no partners where you can withdraw money without a commission.

Fig.7. Ak Bars awards cashback for everything in the amount of 5% per annum.

Feedback from Ak Bars Bank clients

“I really like the pension card of this bank - cashback is awarded for everything, which rarely happens - maybe even this is the only case. But there are not enough ATMs. It’s just that in our city there is one in the very center, where I often go - it’s convenient for me. It could be worse for the rest.”

Yuri, 68 years old, Omsk

“I can highly recommend the free Longevity card. A large percentage on the balance and cashback for everything - indeed, this is almost the only offer. As for receiving cash, I do these operations once a month; as soon as I receive my pension, I withdraw it immediately. So you can adapt and you won’t feel any inconvenience.”

Antonina, 59 years old, Kazan

Rosselkhozbank pension card 2021: favorable interest on pension

The MIR pension card of Rosselkhozbank is not available to all applicants. First of all, the applicant must have Russian citizenship.

The pension card from Rosselkhozbank in 2021 works according to the following rules:

- There is no charge for activating the SMS notification service about incoming transactions;

- notifications for any other transactions are paid at the rate of 49 rubles every month;

- the maximum amount for cashing out per day is 300 thousand rubles;

- The limit for cash withdrawals per month is 1 million rubles.

Important : when receiving funds through third-party self-service devices, a commission of 1% of the withdrawal amount is charged, but the minimum is 100 rubles.

To successfully obtain a pension card, the applicant will only need to collect the necessary documents and submit a request to the nearest branch of the financial institution. The application can be filled out directly at the bank.

Additionally, you will have to take care of organizing the transfer of your pension to a special account at Rosselkhozbank.

To do this, you need to contact the branch of the Pension Fund of the Russian Federation with a statement of intention to receive funds using new details.

Despite the general convenience of the card’s functionality for pensioners, information about the account status can only be obtained if certain nuances are observed.

It is worth considering that you can check your balance without charging an additional commission only through Rosselkhozbank devices.

If the request is sent through the equipment of third-party organizations, the amount of 45 rubles will be debited from the account for the implementation of the service.

Rosselkhozbank provides three types of pension cards:

- Classic. This is a standard option, for which the terms of use were defined above;

- Instant. Issued on the day of application, but does not contain the holder's name on the plastic. The main disadvantage is the reduced daily cash withdrawal limit. Otherwise, it fully corresponds to the classic version;

- Co-bending. A special feature is that it is issued in conjunction with the UnionPay payment system, which allows the plastic to be used in other countries where Russian cards are accepted. When visiting countries where MIR is not recognized, the card functions using UnionPay. With its help you can pay non-cash.

The basic functionality of each option is identical. The differences are only in the indicated positions.

URALSIB

At this bank you can also get a MIR social card, which is serviced free of charge. However, in some cases a commission is charged:

- if there were no operations from 1 to 2 years - 199 rubles. per month;

- if there have been no operations for more than 2 years - 250 rubles. per month (but if there is more than 10 thousand on the account, the interest is not withheld).

Also, a pensioner can activate any program of his choice - receiving 0.5 bonuses from the amount of purchases (automatically transferred to the mobile balance) or 1.5 bonuses for every 25 rubles spent on the card. These bonuses can be used to pay for purchases at partner stores. In this case, interest is not charged on the balance.

Fig.8. Thanks to URALSIB's offer, a pensioner receives 1.5 bonuses for every 25 rubles spent.

Reviews from URALSIB Bank clients

“The Uralsib card is quite good. Suitable for those who spend a lot. Then you can either send money to your phone or receive points and save for future purchases.”

Boris, 68 years old, Magnitogorsk

“Uralsib offers a good pension card, one might even say it’s profitable. But there are not enough ATMs - so keep that in mind.”

Marina, 56 years old, Novorossiysk

Pros and cons of the Mir card from Sberbank for pensioners

Political and financial sanctions sent a message about the need to quickly develop and implement our own independent payment currency. In 2015, the World project was presented, the primary implementation of which was undertaken by Sberbank. The use of exclusively national currency for settlements and state support led to the release of several new bills, forcing all budget organizations to switch to using a domestic solution.

The innovation also affected pensioners; the issuance of new cards began on July 1, 2021. Find out more about the Mir card from Sberbank.

The government program is designed until 2021, when all budget organizations and pensioners will use the solution from Mir. Support for the project will not stop. Over the course of 2 years, more than 300 banks managed to join the program, many of which became issuers and received the right to issue similar solutions. The state strictly regulates the conditions for using this type of card, limiting third-party interference.

The main advantages for state employees and pensioners include:

- a unique four-stage protection system that prevents the possibility of hacking and data theft using software. The developers were able to achieve this level of protection by using the latest world developments in this area in the security system;

- no interest on withdrawals, deposits and transfers of funds within Russia. Sberbank and issuing banks are required to provide such conditions;

- guarantee of high speed of processing requests received by the bank. Any operations occur instantly. All money transfers are carried out exclusively through Russian centers;

- favorable conditions and constant discounts help attract new customers to the system.

Thus, this program not only improves the quality of storing financial assets and offers new conditions, but also ensures the financial sovereignty of Russia, which has a positive effect on the overall economy.

A new project cannot be without temporary disadvantages; the following problems are relevant for 2021:

- low level of integration with international payment services, which can cause inconvenience when purchasing goods and paying for services abroad. Integration is available with JCB and Maestro. It is planned to sign an agreement with Visa, which will be a new stage in the development of this solution;

- the high cost of producing such cards for banks, which is influenced by the technologies used. If you purchase such a card separately without using the replacement program, the first payment for annual service will be higher than that of foreign analogues;

- Many online stores and other services have not yet connected the option to use the Mir payment system; this problem is being actively solved, as a large flow of customers began to demand the opportunity to use this particular payment option.

Moscow Industrial Bank

At this bank you get a MIR card for free, and it is valid for 5 years. But at the end of this period, a monthly commission of 200 rubles begins to be charged. Among the advantages are the following:

- up to 6% on balance;

- 5% for purchases in pharmacies and supermarkets.

Fig.9. Thanks to this offer, pensioners can save on purchases in pharmacies and supermarkets - a permanent 5% discount is provided

Reviews from Moscow Industrial Bank cardholders

“It’s a very good card, although maintenance costs 1,200 rubles a year. However, keep in mind that you receive a permanent 5% discount in supermarkets and pharmacies - this is a very significant amount, which is certainly more than 1,200 rubles.”

Yulia, 55 years old, Moscow

“I really like this card. The service is free for now, plus constant discounts in pharmacies and even grocery stores - I believe that this is the only offer on the market.”

Olga, 59 years old, Moscow

Rosbank

Rosbank does not have special social cards for pensioners. However, you can order a classic debit card, which is serviced free of charge if any one of the conditions is met:

- The client has 100 thousand or more in his Rosbank accounts (in total).

- He makes transactions in the amount of 15,000 rubles per month. (non-cash only, receiving money from an ATM does not count).

If this condition is not met, a service fee of 199 rubles begins to be charged. per month. Among the benefits of this offer:

- receiving cashback up to 20% for purchases from partners;

- receiving interest on the balance at 8% per annum.

Among the shortcomings, clients sometimes cite an insufficient number of Rosbank ATMs. However, he has many partners in terminals where money can be withdrawn without commission:

- VTB;

- Alfa Bank;

- URALSIB;

- AK Bars;

- Gazprombank;

- Rosselkhozbank;

- Raiffeisenbank.

Fig. 10. You can withdraw cash not only at Rosbank, but also at an extensive network of partner ATMs.

Customer reviews about the Rosbank card

“I personally really like the Rosbank card, because it is both an account and a bank deposit - 2 in one. But it is only profitable if you spend at least 15 thousand on it every month. If the pension is less, it is better to order another card - from the same Sberbank, for example.”

Irina, 62 years old, Novosibirsk

“The Rosbank Mir card is an interesting offer. And even though there are few ATMs, it is still convenient to use. You can withdraw cash from the same VTB or Alfa Bank, of which there are many in any city. But if you spend less than 15 thousand, you will be charged 200 rubles for a month of service - keep this in mind right away.”

Vladimir, 65 years old, Samara

How to cancel the “MIR” card?

Pensioners have the right to refuse to receive pension payments on the Mir card. In this case, the funds will need to be collected at a post office or bank office. To refuse, you will need to visit a Sberbank branch and write an application. The plastic is destroyed immediately before the client.

Many banks force pensioners to issue a Mir Pension Card, citing the fact that they can only receive pensions through the national payment system. However, the ban exists only regarding international cards. Receiving your pension through the Post Office or a bank branch remains unchanged.

UniCredit Bank

This bank also does not issue a MIR social card for pensioners, however, each client can order a classic card with an affordable annual service of 500 rubles/year. Its main advantage is receiving cash without commission:

- up to 200 thousand per day;

- up to 500 thousand per month.

In addition, the client participates in a special discount program when making purchases from partners. However, interest on the account balance is not provided. The network of partners is not very large - you can withdraw cash for free only in 3 banks:

- Raiffeisenbank;

- ICD;

- URALSIB.

Fig. 11. The MIR UniCredit Bank card makes it possible to receive large amounts of cash up to 200 thousand rubles. per day without commission.

Reviews from UniCredit Bank cardholders

“You can take a Unicredit card, although it is not free. It’s just that this card is ordinary, and not special for pensioners. Therefore, if it is not expensive for you, you can immediately transfer your pension to this bank.”

Irina, 56 years old, Ekaterinburg

“I like the Unicredit card because I often buy books and other goods on Ozon and for my grandchildren on the Daughters-Sons network. There are normal discounts - 5%, 10% and even more. Well, I don’t really need to withdraw cash, so I’m not interested in the 200 thousand limit.”

Lyubov, 59 years old, Khimki

New rules from July 1, 2021

In accordance with the Federal Law of May 1, 2017 No. 88-FZ “On Amendments to Article 16.1 of the Law of the Russian Federation “On the Protection of Consumer Rights” and the Federal Law “On the National Payment System”, from July 1, 2021, all social payments - scholarships, benefits and pensions — will only be transferred to the “World” card.

Until July 1, 2021, Russian citizens who receive pensions and other social benefits on cards of other payment systems (VISA, MasterCard) are required to issue themselves a MIR card. For pensioners whose pension will be assigned after July 1, 2021, the card will be issued automatically. If such payments are credited to other cards, not to the MIR card, it is assumed that the bank will be obliged to return the entire pension amount to the Pension Fund if a national payment card is not linked to the recipient’s account.

Pensioners who receive pensions by mail or at home do not need to issue cards. The new rules will not affect them.

If you changed a card from another payment system to a MIR card and your account has not changed, you do not need to report the card number to the Pension Fund of the Russian Federation, since the account remains the same. If the bank account number changes, the pensioner must submit a new application to the Pension Fund for pension delivery, including through the EPGU or through the citizen’s Personal Account on the Pension Fund’s website.

If desired, any pensioner can change the method of pension delivery at any time - receive the pension on a Mir card, either at the post office or at home.

For pension recipients permanently residing outside of Russia, the transition to Mir cards is not provided for by law.

Which bank is better to apply for a MIR card?

A review of banks shows that almost everywhere the MIR card is serviced free of charge. Therefore, when choosing a suitable bank, you should pay attention to the interest rate on the balance, cashback, as well as the presence/absence of ATMs nearby.

| Bank | Service, rub. | Interest on balance | Cashback |

| Sberbank | 0 | 3,5% | up to 30% |

| VTB | 0 | up to 8.5% | to 10% |

| Post Bank | 0 | until 6% | — |

| Rosselkhozbank | 0 | until 6% | 5% |

| Promsvyazbank | 0 | 5% | up to 40% |

| AK Bars | 0 | 5% | 5% per annum |

| URALSIB | 0 or 199-250 rub/month. | — | 1.5 bonuses for every 25 rubles. |

| Moscow Industrial Bank | 0, then 200 rub./month. | until 6% | 5% |

| Rosbank | 0 or 199 rub./month. | 8% | up to 20% |

| UniCredit Bank | 500 rub./year | — | up to 20% |