About the fund

NPF Neftegarant appeared on the market of non-state pension services in 2000. Initially, the emphasis was on employees of OJSC NK Rosneft (at that time it was the main shareholder - 99.5%).

Interesting movie: the management of OJSC NK Rosneft establishes JSC NPF specifically for the company’s employees. Considering that the fund’s income is at least 15% of all cash receipts, this is a goldmine for enrichment.

In the period until 2007, Insurance and Pension Rules come into force, NPF Neftegarant opens several branches.

In 2014, after integration with TNK-BP, there was a rapid expansion of the client base. An additional flow of clients is provided by branches of the Irkutsk region, Krasnoyarsk Territory, etc. At this time, NPF Neftegarant becomes one of the largest funds in the Russian Federation and is part of the NAPF Council. Rating agencies increase the fund's reliability level to AA+.

Over the next 3 years:

- new insurance rules were developed and introduced;

- non-state pensions begin to be paid;

- a personal account was opened on the website of NPF “Neftegarant”;

- synchronization with the State Services portal was carried out, electronic signature confirmation was introduced.

Despite the dubious beginning (use of official position), NPF Neftegarant is mastering the market and developing:

- several branches have been opened over 18 years;

- in December 2021, a reorganization took place (with an increase in assets): JSC NPF Neftegarant-NPO and JSC NPF Soglasie-OPS joined (who followed the news: there were publications on the network that Neftegarant would rise at the expense of Soglasie) .

August 2021 brought the fund a new name - JSC NPF Evolution. On November 11, 2021, an announcement was posted on the official website that NPF Neftegarant (under the new name NPF Evolution) had absorbed:

- NPF "Soglasie";

- NPF "Education";

- NPF "Social Development".

In this connection, a decision was made on a new reorganization. The fulfillment of contracts with NPF Neftegarant remains in force (no re-conclusion is required).

Information

| Full title | Joint Stock Company "Non-State Pension Fund "Neftegarant", from August 22, 2019 - JSC "NPF "Evolution" | ||

| License number | No. 344/2 dated April 26, 2004 | ||

| Foundation head office | 115054, Moscow, Kosmodamianskaya embankment, 52, building 5 | ||

| Official site | https://www.evonpf.ru, the website www.neftegarant.ru no longer works | ||

| Contacts | Hotline number 8-800-700-65-54 | ||

| Founders | OJSC NK Rosneft, LLC SK Neftepolis | ||

| Shareholders |

| ||

| Legal entity | Pension savings | REGION Trust LLC | |

| Pension reserves | REGION Trust LLC | ||

| Depository | CJSC "VTB Specialized Depository" | ||

| Managers | |||

| Branches and regional offices | Buzuluk, 1st microdistrict, 21g, premises No. 11 and No. 12, tel. Angarsk, 29th microdistrict, no. 1, office. 306, tel. +7 (3955) 56-04-14 Krasnodar, Western District, st. Krasnaya, 155/2, office. 508, tel. Samara, Moskovskoe shosse, 17, office. 804, tel. Nefteyugansk, 2nd microdistrict, 24, office. 509, tel. +7 Izhevsk, st. Pushkinskaya, 165, office. 409, tel. +7 (3412) 905-913 Krasnoyarsk, st. Molokova, 37a, off. 1208, tel. Nizhnevartovsk, st. Lenina, 17/P, off. 101, tel. Ufa, st. Kirova, 1, office. 323, tel. +7 (347) 272-87-88 Vladivostok, st. Pervaya Morskaya, 9, office. 505, tel. Temporarily does not serve clients: Orenburg, st. Chkalova, 43a, office. 16, tel. +7 (3532) 911-007 | ||

| What services do they provide? |

| ||

Statistics (for Q2 2021)

| Volume of pension savings and reserves | Savings – 123,075,014.75113 rubles. Reserves – 80,361,119.14046 rubles. |

| Amount of pensions paid | RUR 137,840.1382 |

| Number of clients | 1 470 936 |

| Profitability | 11.74% (after payments to the manager, depository and fund) (for Q2 2021) |

| Reliability rating | According to the Expert RA rating agency, the reliability rating is ruAAA (maximum level of reliability), date of assignment - Q2. 2021 |

| Awards | Awards are not presented on the official website of NPF Neftegarant |

Terms and service

| Foundation programs |

|

| Conditions of entry | There are no special requirements for the degree of relationship or age, you only need an agreement with NPF "Neftegarant" |

| Types of payments |

|

| User's personal account on the official website | Transition from the main page of the site or directly via the link https://lk.evonpf.ru/login.php |

| Mobile app | No |

How to enter into and formalize an agreement with the fund: application form

All employees of Rosneft are automatically clients of NPF Neftegarant. Beginners will need to contact a specialist in charge of this issue.

For everyone else, the contract is concluded in person:

- in Moscow (main office);

- in branches.

An application form will also be provided there. There is no contract available through the official website yet.

How to transfer pension

This is a standard procedure for all NPFs:

- an agreement is concluded with Neftegarant;

- an application is written to the pension fund at the place of residence.

Additionally, you may need to contact the fund from which you plan to leave.

How to find out your savings

I recommend monitoring the accruals of NPF Neftegarant on the State Services website. A one-time registration will be required (in my opinion, tedious), but this is an opportunity to track the movement of funds. I warn you, because this is the only way many of our compatriots unexpectedly find themselves in another fund.

The second option is to use your personal account on the website of NPF Neftegarant.

How to terminate an agreement with a non-state pension fund

To terminate the contract with NPF Neftegarant, a written application will be required. If you decide to transfer money to another fund, check the details in advance. They will also need to be indicated in the application.

Please note that you can terminate the contract with Neftegarant:

- before the start of non-state pension payments (if the contract is for life);

- at any time (if urgent).

For details, please visit https://www.evonpf.ru/for— clients/ipo/rastorg.php.

Personal income tax refund

You can return part of the funds transferred to Neftegarant, based on the rate of 120 thousand rubles. Contact the tax office to clarify the list of documents, fill out the application correctly and bring all the necessary certificates.

Early retirement

Payments upon early retirement can be made if provided for in the contract (depending on savings schemes). Or you can terminate the contract, then NPF Neftegarant will pay the transfers and accumulated income (be prepared to pay tax).

Payment of fees

The fee payment schedule is specified in the contract. Regular monthly contributions to NPF Neftegarant will be made by:

- accounting (an application will be required);

- bank, if automatic monthly payments are configured.

NPF Neftegarant will not mind if the client begins to transfer additional funds at any time.

Customer reviews about NPF Atomgarant

On the official website of the non-state pension fund, clients and employees can leave their reviews, talk about the quality of service, and express their wishes and preferences.

Fund employees have the right to report the requirements that the organization places on them. You can also write questions that interest clients, they will definitely receive answers from experienced specialists.

Despite the fund’s high financial performance and excellent reliability, clients often agree to write positive reviews.

They express dissatisfaction, claim that their pension savings have not been returned to them, and do not plan to return them.

However, statistics say completely the opposite. It is unknown whether to believe ordinary citizens or the documented indicators of the fund.

Non-state pension organizations (NPFs) are created with the aim of placing the funded part of the pension of working citizens in the most profitable manner. A stable private company provides a chance to receive additional income upon retirement.

Advantages and disadvantages

I will note the pros and cons of NPF Neftegarant.

In my opinion, the advantages:

- a fund large in terms of assets and population coverage;

- professional management company VTB;

- programs with private clients in Neftegarant provide for the withdrawal of funds (this is written on the website);

- the necessary information (reporting and news) is available and published on time;

- There is a personal account and a working hotline telephone.

Disadvantages of Neftegarant:

- there is a risk of absorption by VTB Group;

- the fund has attracted defrauded investors of the acquired funds (legal proceedings and payments may begin, which will affect clients’ accounts).

Personal Area

To gain access to your account, you must do the following:

- Fill out a request for access by taking a form from an NPF employee or printing it from the website. Addresses of NPF branches can be found on the organization’s portal.

- Give the request to the employee along with a copy of the passport or send it by mail to the address: 109147, Moscow, st. B. Andronevskaya, 23, building 1

- Access will be provided within 20 days, about which an SMS will be sent to the specified phone number (if the information in the request is provided correctly).

- After receiving the SMS, you need to go to the account tab on the website page and click the button to receive a password.

- After receiving the password on your phone, you need to enter the phone number and the received password into the login form.

- After logging into your account, it is recommended to replace the temporary password with your own.

The password is valid for the entire duration of cooperation with the Foundation; it does not need to be disclosed to third parties. If you lose your password, repeat step 4. When you finish working in your account, you need to press the exit button.

Possibilities

The following information is available to the participant in the account:

- the amount of savings;

- the amount of interest received;

- cash flow history.

The participant can also find current news from the Foundation.

How to find out your savings?

Data on savings is available in the corresponding section of the participant’s account. It provides information about payments from the employer and the fund.

Complaints and reviews

My review of NPF Neftegarant will be supplemented by quotes from the financial forum.

Official website of NPF "NEFTEGARANT"

If you are still tormented by doubts regarding the pension fund and whether to invest and whether to trust them with your money or not, you can read all the detailed information provided on the official website and learn a lot of interesting things about them. It should be noted that the most important criteria in the choice are two main characteristics - profitability and reliability rating.

Having learned the statistics of these two criteria, you can judge by it and determine what the percentage of risk and the percentage of future earnings are. We want to provide data on the specified pension fund so that you can familiarize yourself with it and draw conclusions regarding the Neftegarant fund.

Profitability

Profitability – the most important and responsible role in making a decision regarding a particular fund is played by this point. It provides information not only in percentage terms, but also provides information regarding what are your chances of profit if you invest in this fund. For example, 6.43%, which safely guarantees that your income, payments, and the funded part will be worthy.

Reliability rating

Reliability rating – A++. Another important point that is also not recommended to be ignored when making a decision. The reliability rating also provides a guarantee that the fund is economically stable and reliable, and that you can invest in it without fear for your investment.

Good to know. When making a final decision, you should make sure that the information provided to you is correct in order to avoid problems and misunderstandings with the company in the future.

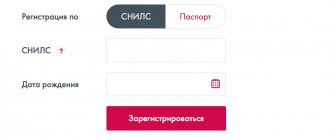

How to register a personal account

You can register in your personal account yourself remotely. There is no need to visit the organization's office. Registration will not take more than 10 minutes.

You can register in the system as follows:

- Open the official website.

- Go to the personal account section.

- Enter personal data.

- Provide contact details.

- Create a password.

- Confirm your access code by email or SMS.

After completing all the steps, you can authorize your account.

It is recommended to enter into an agreement with the organization. To do this, you need to have SNILS and a passport with you, as well as a photocopy of it.

Important! The first registration is carried out at the Neftegarant office in any division.

Login to your personal account