For twenty-four years now, the non-state pension organization “Heritage” has been operating, which was renamed twice before it was given this name. It all started with the Interros-Dostinostvo organization, to which NPF Norilsk Nickel was added in 1996. Actually, the pension fund is best known under the name “Norilsk Nickel”. Four years ago, a decision was made to rename Norilsk Nickel to Heritage.

But the merger process did not end there, and in the period from 2014 to 2016, Heritage, that is, the former Norilsk Nickel, was included in Gazfond along with Kit-Finance and Promagrofond. Starting from 2021, all clients of the listed organizations are serviced by the Gazfond institution. More details about the activities of this fund, as well as its services and rating will be discussed below.

Changes taking place in the fund

Today, the Heritage pension fund (Norilsk Nickel) announces the completion of the reorganization process in the form of a merger with the Gazfond pension savings company, which is the largest in its field in terms of the scale of simultaneously combined assets.

NPF Gazfond acquired the KIT-Finance institution, which added two million people to its client base. In turn, Heritage added another eight hundred thousand clients to the newly created Gazfond. And thanks to Promagrofond, more than two million more people were added. As a result, the total number of clients within the association already exceeds six million clients, and the volume of pension savings amounts to 425 billion rubles. The pension reserve of the united organization "Gazfond" is equal to 16 million rubles.

Heritage Fund Rating

In accordance with 2015 data, NPFs were assigned the “A++” by the NRA (National Rating Agency). The indicators reflect the high efficiency of pension activities in relation to insured persons.

This rating is based on the following results:

- high performance in the compulsory insurance market;

- effective implementation of business projects;

- profitable placement of pension assets;

- stable corporate governance.

After the merger with NPF Gazfond, Heritage does not participate in the rating assessment from NRA.

What benefits did clients receive as a result of the merger?

The merger took place under a strong brand, which guaranteed investors additional confidence and reliability, confirming the correct choice of the fund for the formation of future pension capital. The status, as well as the voice of the created fund, has become much stronger.

The combined structure today consolidates the experience, knowledge, skills and best practices in running the business of all four funds. Currently, the fund’s experts are conducting explanatory work among potential clients, developing and increasing the financial literacy of the population. In addition, the new organization operates and develops within the framework of long-term financial planning and cooperation.

As a result of the merger, the infrastructure of the four funds expanded geographical access to provide services and ensured the operation of services aimed at remote servicing.

It should be emphasized that the effectiveness of this pension organization is largely determined by the assembled dynamic, creatively thinking and diversified team of professionals, who are united by the desire for one goal - increasing entrusted funds. In addition, the activities of this pension fund are aimed at improving the quality of life of clients in the long term.

Reliability indicators of the Gazfond organization

Today this fund is represented in most Russian districts. Gazfond, which includes the Norilsk Nickel pension fund, has opened 55 offices throughout the country. Through the joint efforts of the team, a monetary fund was created that amounts to almost 500 billion rubles. Pension savings (as well as reserves) also amount to quite impressive amounts, which once again confirm the reliability of the formed structure.

According to last year’s data, the return on investment of pension savings reaches 13%. In turn, the profitability of accounts of clients of this organization for compulsory insurance is 11%. As for the profitability of pension reserves, in this case we are talking about 10%. The rate of non-state pension provision is 10% per annum, which is several times higher than inflation.

Customer reviews about Norilsk Nickel

Based on the feedback from clients of NPF Heritage, the fund has both positive and negative sides. The advantages include:

- Many representative offices;

- Long-term work in this market;

- Transparent activities, openness;

- Possibility of conducting transactions online.

Among the shortcomings, clients note excessive pressure of a psychological nature, a relatively low rate based on the results of the year, and the provision of reporting solely at the client’s request. The story of fraud also causes a negative attitude.

In general, NPF Heritage has a reputation as a stable fund that can be trusted with pension savings.

(

7 ratings, average: 2.57 out of 5)

Fund ratings

It is worth noting that the ratings of the Norilsk Nickel pension fund are the highest in terms of reliability, which is confirmed by leading national agencies:

- According to the ruAAA rating, the highest level of financial reliability is assigned.

- The forecast "Stable" was assigned by Expert RA.

- The AAA rating, which means maximum reliability, was given by the National Rating Agency.

The pension institution "Gazfond" was awarded an award called "Financial Elite of Russia" in the category "Project of the Year in the field of consolidation of pension funds" in 2021.

General information about the fund

The pension fund in question was formed in 1995. Until 2013, it was called “Norilsk Nickel”.

During the time this organization carried out its activities, it was given the following awards:

- Financial elite of Russia;

- Pension Oscar.

In 2015, a non-governmental organization joined the Gas Fund, which has a significant presence in the pension sector. After the organizations merged and became one, a number of changes occurred. Citizens who invested in Heritage were given the opportunity to choose the organization where their funds would be stored in the future.

Gazfond, which includes the Norilsk Nickel pension fund, operates in the financial market in the most promising area, and their activities are aimed exclusively at providing pensions to citizens.

The following areas of activity can be distinguished:

- Implementation of non-state pension provision.

- Providing early non-state pension provision.

- Carrying out compulsory pension insurance.

In addition to compulsory pension insurance, Gazfond (that is, the Norilsk Nickel pension fund too) provides its clients with individual cash savings plans. The proposed programs give people an additional opportunity to independently build their savings through tax breaks and personal funds in order to maintain a high standard of living not only for themselves, but also for their loved ones in the future.

Advantages of an individual pension plan at Gazfond

The following advantages can be identified as part of this service:

- Clients of the non-state pension fund "Norilsk Nickel" as part of Gazfond can independently form target capital for the implementation of their long-term (both personal and family) plans on fairly flexible terms.

- State support, which makes it possible to increase the profitability of savings with the help of social tax deductions, returns 13% of the amount of pension contributions, which do not exceed 120,000 rubles per year.

- Funds in the account of the non-state pension fund "Norilsk Nickel" as part of the Gazfond, along with investment income, are inherited in full both at the accumulation stage and during planned payments.

- Clients are guaranteed legal protection, within the framework of which the pension account funds cannot be levied on the claims of third parties, and moreover, they cannot be seized - the savings are completely protected.

Customer Reviews

Reviews about the Norilsk Nickel pension fund as part of Gazfond that come from clients are different. For example, many note as an advantage that Gazprom is one of the founders of this organization. Agree, quite a serious company?

In addition, many clients in their comments call this fund reliable and report that it provides good interest on contributions. Many people like the opportunity to receive free consultations over the phone.

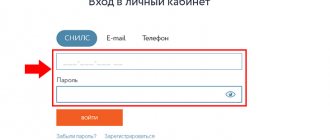

The most advanced ones talk about the convenience of the interface of the official website of the fund: it is simple and understandable, so it is not difficult to manage your personal account of the Norilsk Nickel pension fund. In addition, customers appreciate the attentiveness and responsiveness of the employees.

History of the organization

In 1993, NPF Interros-Dostinostvo was registered. In 2006, it received the name “Norilsk Nickel”. In 2013, NPF Norilsk Nickel changed its name and became Heritage. In 2014, as a result of reorganization, a closed joint stock company appeared. The next significant stage in the work of the structure was the merger with Gazfond.

At the same time, Promagrofond and Kit-Finance became part of Gazfond. Since 2021, clients of all three organizations have been served here. Thus, NPF “Heritage” turns 24 years old. As a result of the merger, a systemically important fund emerged, accumulating over 400 billion rubles.

What's not to like

Among the reviews of dissatisfied investors there is information that representatives of this organization walk through the entrances of residential buildings in order to draw up false documents on the transfer of a person’s personal pension account to their fund. In addition, the excessive persistence of employees in trying to attract clients also does not suit many.

In general, people are satisfied with the activities of the Norilsk Nickel pension fund and often say that any problematic situation is resolved quickly by employees, and clients receive competent answers to all questions. In addition, depositors constantly receive new information about the status of their accounts. It is also worth noting that often people in reviews of the non-state pension fund Norilsk Nickel positively evaluate the corporate ethics and high level of services of this fund.

The “Personal Account” service is available for clients of the fund

New regional offices of the non-state pension fund “Heritage” in Volgograd and Krasnodar began their work in March 2014.

We will teach you all the tricks and tell you about the procedure for error-free actions. By going to the PFR website www pfrp ru to the personal account of the insured person, you can quickly, clearly and competently arrange the service you are interested in. Read the instructions carefully, go to pfrf ru citizen’s personal account and take advantage of the prospects that open to you.

It is worth noting that KIT-Finance and Promagrofond also participated in the merger with him. Starting in 2021, all clients of these institutions switched to services from Gazfond. The total amount of receivables by users of the services of the Kuzbass branch of Mechel-Energo LLC exceeded 89 million rubles...

Pension savings in the compulsory pension system are insured by the state. Whatever happens to the fund, the entire amount of contributions made will be returned to your individual pension account at the Pension Fund.

Working in difficult conditions requires increased attention to providing these categories of workers with social guarantees. TO…

The pension insurance system is designed to realize the citizen’s right to receive income after cessation of active work. Unfortunately, not all future...

LLC KIT Finance Pension Administrator, the sole shareholder of CJSC KIT Finance NPF, CJSC NPF Heritage, CJSC NPF Promagrofond and OJSC NPF Gazfond Pension Savings, decided to merge these funds.

When a difficult life situation arises associated with the death of a breadwinner, citizens who were financially dependent on him... Using information from the Pension Fund of Russia database, fraudsters forged citizen applications and agreements on the transfer of funds. “At the moment, it has already been established that in a similar way, 137 million rubles were withdrawn from state control to the NPF Norilsk Nickel,” investigator Andrei Starov told Kommersant yesterday.

At the end of last year, the market leader in compulsory pension insurance, NPF Lukoil-Garant, was sold. Recently, the pension business has been losing investment attractiveness due to uncertainty with pension reform and plans to tighten government regulation of the pension market, so many owners of NPFs are ready to sell them, admits a source close to NPF Norilsk Nickel.