The Republic of Latvia is a Baltic state with a population of slightly less than 2 million people. It is located in northern Europe between Estonia and Lithuania. The country's economic potential is concentrated in the capital, Riga, where more than 50% of GDP is produced. About 60% of enterprises of Latvian manufacturers operate in the capital region. The standard of living in Latvia is somewhat lower than in most EU member countries. Let's look at who and how pensions are calculated in Latvia, and what benefits older people living in the republic can count on.

Latvian pension system

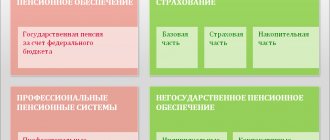

The pension system of the Republic of Latvia includes 3 levels:

- The first provides for the payment of pension benefits, the source of which is the total amount of money contributed by the working population of the country.

- The second level is a pension accumulated by the state for a specific elderly person. All residents of Latvia born after 07/01/1971 fall under this level.

- The third level is formed through voluntary accumulation: a person of working age contributes a certain amount in addition to the mandatory insurance contribution; when retirement occurs, it will return as a supplement to the basic pension.

Calculation of pensions and structure of the pension system

In order to understand how to correctly calculate a pension in the Republic of Latvia, you must first learn about the pension system of this state itself.

The Latvian pension system consists of 3 levels. The first 2 levels are a state system that provides pensions to all people over 62 years of age with 15 years of work experience. The pension is paid based on previously deducted social monthly payments. Social tax in 2021 is 34%, but most of the tax contribution is paid directly by the employer. Only 10.5% of the monthly salary is withheld from a person’s salary.

- The first level represents the payment of pensions from the total funds contributed by the working population of Latvia.

- The second level is a pension that the state accumulates specifically for a specific pensioner. This should not be confused with voluntary pension insurance. All residents of the Republic of Latvia who were born after July 1, 1971 fall under the 2nd pension pillar.

Pension system of Latvia

- The third level is the voluntary accumulation of funds. In other words, a person, while still of working age, can contribute a certain amount to the pension fund (separate from the mandatory insurance contribution), which will be returned to him upon retirement as an addition to the basic pension payments.

Table: pension amount depending on length of service

| Work experience (expressed in years) | Amount of pension benefits (expressed in euros) |

| Up to 20 | 70,43 |

| From 21 to 30 | 83,24 |

| From 31 to 40 | 96,05 |

| From 41 | 108,85 |

Where to get information about pension capital:

- Initially, a person needs to go to the portal https://www.latvija.lv/ and open the section called “Informācija par prognozējamo vecuma pensijas apmēru (information about the predicted old-age pension.”

The portal of public services of Latvia can also be viewed in Russian - Then you should go to the “pension capital” section and open the “together” tab. To the amount that appears on the screen, you must add the pension capital for your work experience before 1996, which can be found in the “starting pension capital” section. To display the data, you will need to enter the person's personal information.

- The system then adds these two values. The resulting amount is entered into the calculator.

To understand how pensions are calculated, it is important to learn about the current pension system. It includes 3 levels at which payments are formed differently. The first two are state-owned. They take care of providing for every person who has 15 years of experience and has reached the age of 62 years.

Payments are made on the basis of deductions made by employees during their working career. The last level is formed thanks to the contribution of the citizens themselves.

Social tax in 2021 is 34%. In this case, the main part is contributed by the employer, and only 10.5% is withheld from the citizen’s income. The following types of payments are distinguished:

- Pension provision from general funds that come from the population from wages.

- A pension that was accumulated from insurance payments of every citizen born after July 1, 1971.

- Voluntary savings of citizens. These are the amounts that are deducted to the pension fund in the process of working independently.

Latvian pension size

The number of pensioners in Latvia is increasing year by year: the increase over the last 10 years has been approximately 2-3%. Thus, as of the beginning of 2021, 320 thousand elderly people live in the country. This is approximately 20% of the total population.

The minimum pension in the Republic of Latvia fluctuates around 100 euros. Approximately 5.1% of the state’s residents receive such social benefits. It is enough for food only if there is serious savings. The insufficient level of government assistance for older people is especially noticeable given the fact that the minimum wage in the country is 4.3 times higher - 430 euros.

The average pension in Latvia at the beginning of 2021 is 320.27 euros:

- About 6.6% of the republic’s residents receive social benefits ranging from $100 to $200;

- for the majority of pensioners (48.2%), payments range from 200-300 euros;

- benefits in the range of 300-400 euros are paid to 24.4% of Latvian pensioners;

- only 7.4% have pensions from 400 to 500 euros;

- 8.3% of pensioners receive from 500 to 1,500 euros, and only 1,836 people have a pension of more than 1,500 euros.

The poverty rate among older people in Latvia on average exceeds 50% - the highest figure in the European Union.

Agreement between Russia and Latvia on pensions

The agreement was signed in 2011. It ensures the implementation of pensions in Latvia for Russian citizens, financial assistance for disability and loss of a breadwinner. Work experience is divided into two periods: accumulated before 1991 and after. In accordance with current legislation, Russian citizens living in the Republic of Latvia have the right to cash payments. If you have sufficient experience, it will be calculated according to Latvian conditions. Otherwise, the period before 1991 will be taken into account and confirmation from Russia will be required.

It will be possible to ask for help in the same way in Russia. Then they can take into account the period of work before 1991 in Latvia. The payment is calculated once and is not subject to indexation. Latvian citizens can receive a pension from their country.

Disability pension

How much a person will receive depends on their length of service. A person with 15-20 years of experience will receive a minimum of 88 euros, and in case of disability - 135 euros. Work experience from 21 to 30 years guarantees a minimum pension in 2021 in Latvia in the amount of 104 euros, for a disabled person - 160. With 31-40 years of experience they receive 120 euros, disabled people - 184. With work experience of more than 41 years, banks will pay 136 euros, and for a disabled person – 209.

Unemployment benefit

Unemployment benefits are calculated as a percentage of the average official salary. With up to 9 years of experience, a person will receive 50% of his average earnings, for 10-19 years - 55%, for 20-29 years - 60%, from 30 years - 65%.

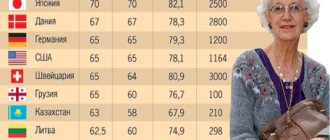

Retirement age

If in 2021 Latvians who have crossed the age limit of 63 years and 3 months could retire, then in 2021 this can be done by citizens who have at least 15 years of insurance experience and whose 63rd birthday has passed six months. This is due to the fact that the retirement age in Latvia, starting from 2021, increases annually by 3 months.

You can also retire early. People with at least 30 years of insurance experience can receive an old-age pension two years earlier than the generally established period.

Also, the privilege of early receipt of pension rights, if possible, extends to:

- parent or person in the status of guardian:

- having at least 25 years of experience;

- raised 5 children or a disabled child for at least 8 years;

- persons who took part in eliminating the consequences of the man-made disaster at the Chernobyl nuclear power plant. If the length of their work experience is at least 15 years, they can become pensioners 5 years earlier than the period that was established on a general basis.

In addition, early pension in Latvia is available:

- disabled women;

- persons who have lost their sight;

- dwarfs;

- persons who worked before 1996 at industrial enterprises with working conditions harmful to health.

The Latvian government plans to stop raising the retirement age every year only in 2021. It is not difficult to find out the goals pursued by the country's executive branch. Simple arithmetic calculations show that the answer to the question at what age do people retire in Latvia will then sound like this: after the 65th birthday.

How are pensions calculated?

The source of pension payments is payments made every month during the citizen’s working life. The fee charged for these purposes is 35%, but most contributions are payable directly by the employer. Only 10.5% of his monthly salary is withheld from the employee's salary.

To find out what pension an individual citizen is entitled to in Latvia, you need to apply the following formula:

RP = SPK/PKL:12, where

RP – monthly pension amount;

SPK is the amount of pension capital. What part of these indicators is taken into account will be discussed below;

PKL – the planned number of years of pension payment.

The funded capital is added to the SPK. And the value of the desired parameter is a value derived from a number of conditions.

To clarify the above formula, it should be said that, in particular, the old-age pension depends on:

- the volume of pension capital accumulated from 01/01/1996 to the month from which the benefit will be paid;

- average insurance premiums for the period from 1996 to 1999;

- total insurance period until December 31, 1995;

- planned time interval for pension payment.

On September 27, 2021, the Seimas of the Republic of Latvia adopted in the final reading important amendments to the law on social benefits for the elderly. They provide that not only the pension itself is subject to indexation, but also additional payments for length of service.

Those persons whose value of the latter indicator is greater are provided with preferences. They are as follows: the indexation of pensions in Latvia in 2021 for citizens with a work experience of 45 years or more will be carried out using 80% of the actual percentage increase in salaries, on the basis of which social insurance contributions are determined. Let us recall that until now the figure of 70% appeared in the calculations.

Also on this day, the Seimas adopted in its final reading amendments to the law regulating the collection of personal income tax. Their action is also aimed at improving the well-being of older people.

In particular, taxes on pensions in Latvia will be charged only if its monthly value exceeds:

- in 2021 – 270 euros;

- in 2021 – 300 euros;

- starting from 2021 – 330 euros.

The Ministry of Finance of the Republic of Latvia has published forecasts for the state of the country's economy after increasing the tax-free minimum for pensioners to 3,960 euros/year: this will lead to a negative fiscal effect on the budget of 11.8 million euros. And this phenomenon is not the only one that can cause a decrease in trust in the government on the part of people receiving government benefits.

Thus, disability pensions are now paid in Latvia to almost 35 thousand people with disabilities. They are provided with additional payments for length of service of an average of 12.34 euros/month.

Experts have calculated that the income of citizens in this category, with the indexation of surcharges in 2021, will increase before paying income tax by an average of 2.32 euros/month. Naturally, such a slight increase does not arouse enthusiasm among disabled people.

The amount of pensions in Latvia for persons in this category is shown in the table.

| Disability group | Pension amount, euro | Pension amount, rubles |

| Group I | 102.45 | 7592.57 |

| Group II | 89.64 | 6643.22 |

| III group | 64.03 | 4745.26 |

Average payments to pensioners in the Republic of Latvia

What is the average pension in Latvia in 2021? It is equal to 304.30 euros in the country. This level exceeded last year's figures by 8.15 euros. But more than half of pensioners receive 200-300 euros monthly. 12.2% of pensioners receive less than 200 euros. And only 7.3% have payments over 27.4%.

Most pensioners have support from the state at the level of 300-500 euros monthly. This income is acceptable for most large cities, allowing you to live comfortably and pay for current expenses.

Pension indexation is carried out annually. After it, the average size increases by 18.27 euros. A maximum of 27.5 euros is added to monthly income. Only income up to 382 euros is indexed. If the amount is larger, the increase is carried out only from the amount of 382 euros.

The state takes special care of vulnerable segments of the population. A disability pension is provided depending on the group received and some other factors:

- 1 group - 102.45 euros;

- Group 2 - 89.64 euros;

- Group 3 - 64.03 euros.

Thus, it becomes clear at what age people retire in Latvia. It is important to work the required number of years and make regular contributions in order to receive good security in old age.

Peculiarities of registration of a Russian pension in Latvia

The Russian pension in Latvia is paid to persons living in the territory of the Baltic country if:

- they have reached the retirement age established in the Russian Federation;

- they have the right to a pension for: loss of a breadwinner;

- length of service;

- obtaining a disability group.

In this case, insurance premiums paid on the territory of Russia are taken into account.

How is the Russian pension paid?

To resolve the issue of assigning a pension benefit for periods of employment after 01/01/1991, you must contact the department of the State Social Insurance Agency of Latvia (hereinafter referred to as SSIA). You will need to provide the following documents:

- application for a pension;

- papers confirming work activity and equivalent time of stay on the territory of both states - Russia and Latvia;

- package of documentation corresponding to the intended type of pension.

The State Insurance Agency sends the received documents to the Pension Fund of the Russian Federation. There a decision is made regarding the assignment of a pension to a person living in Latvia.

The length of work experience in Russia may not be enough to receive pension payments. Then the period of official work in Latvia is also taken into account. But pension calculations are based only on Russian work experience.

The pension is paid through the State Social Insurance Agency once a quarter. They receive funds from one of the banks of the Republic of Latvia or at the post office. In the first case, the account number of the credit institution is indicated, which can be found out from the agreement concluded with the bank.

Benefits in Latvia for pensioners

On the territory of the Republic of Latvia, benefits are available at the national and local levels for citizens of retirement age. In the first case, the following subsidies are provided:

- former juvenile prisoners of concentration camps receive financial assistance for: compensation for the so-called patient fee;

- purchase of medicines and medicines;

- Dental prosthetics.

For people whose only income is a state pension and who do not have health insurance, benefits are provided:

- Those who survived the siege of Leningrad can count on financial assistance for the purchase of medicines, dental prosthetics, and the purchase of a coffin and cross. If they are classified as low-income, they are entitled to free food for 2 months a year.

- Pensioners who have the status of politically repressed persons have the right to free travel on municipal transport and dental prosthetics. Financial assistance is provided for them when purchasing a coffin and cross.

- Single pensioners living in premises without amenities have the right to visit the baths for free twice a month.

Let us briefly consider what benefits are provided to pensioners in Latvia by local authorities. The widest package of social benefits is offered in Riga. Let's name just a few positions:

- the amount of assistance from the municipality to cover the above-mentioned patient fee is 71 euros;

- pensioners with low-income status whose monthly income is less than 127 euros are entitled to a subsidy;

- elderly people with any disability group receive assistance of up to 2,134 euros for housing arrangement;

- those who have reached 100 years of age are given a one-time payment of 150 euros.

Benefits are also provided in other Latvian cities. For example, in Daugavpils, pensioners can ride public transport for free.

From January 1, 2021, after the death of a pensioner, his widowed spouse will be able to receive half of the deceased’s pension. Only recipients of an old-age, disability or long-service pension will be able to take advantage of this right.

The benefit will be paid only to widowers; divorced spouses or couples living in unregistered relationships are not eligible for payment.

Military pensioners in Latvia

Employees of the Latvian State Audit Office recorded in 2021 the fact that Russian retired military personnel received cash payments from two states at once. The reason for this situation was the coincidence of the base periods used for settlements and cash payments.

To correct it, the Latvian executive branch decided to stop payments for periods paid by the Russian Federation. They mean:

- time of completion of urgent military duty;

- period of extended stay under the banners of the USSR Armed Forces;

- service in structural divisions of internal affairs;

- time of study in higher educational institutions.

Currently, military pensions in Latvia are paid to Russian former military pensioners solely on the basis of length of service. But only if the value of this indicator meets the requirements of current legislation.

The average long-service pension of a Russian citizen with the status of a military pensioner will fluctuate in the Republic of Latvia in the range of 550-560 euros by 2021.

Pension for military personnel

Military personnel with Russian citizenship, thanks to their service in Latvia, received a pension in a foreign country. This situation has developed for a very long time. Many people know that during the existence of the USSR, military personnel were sent to serve in various regions of the Soviet Union. After the collapse of the USSR, Latvia decided to reward the military (not Latvian citizens, but Russian residents) for their past service and awarded them a pension.

Military pensioners in Latvia have long received pensions from two states: Latvia and the Russian Federation. But in 2011 the situation changed. The State Control of the Republic of Latvia established this fact, therefore Latvia stopped payments for the following periods that were previously paid by Russia:

- Duration of compulsory military service.

- Carrying out overtime service in the armed forces of the Union of Soviet Socialist Republics.

- Serving in the Ministry of Internal Affairs and its structural divisions.

The fight for the rights of Russians in Latvia. More details in the next video.

Retired Russian military personnel receive pension payments from Latvia only for length of service. On average, a military pensioner with Russian citizenship receives benefits in the amount of 550 euros per month.