How do Norwegian pensioners live?

The political system in the state in question was built on the basis of socialism, with many citizens belonging to the middle class. Medical services are provided at an affordable price, including support for vulnerable segments of the population. These include students and retirees. In addition, the state has a low level of corruption.

The country also attracts with its nature and ecology. It is necessary to highlight in a separate block the amount of taxes paid by citizens. The more a person receives in salary, the more taxes he will need to pay. The population is also subject to tax payments on real estate and movable property classified as movable.

Norway is the country in which the highest level of earnings has been established. The average salary is 240 thousand crowns, after conversion to euros this amount is 80,000. The living wage for the population is no more than 210 thousand crowns.

This value is set for pensioners for an annual period. If we consider the average life expectancy, this mark is at the level of 90 years. For this reason, it becomes possible to raise the retirement age even after 70 years.

It is also useful to read: Retirement age in France

Latest data on Retirement Age for men in Norway ()

Most likely, the reader will have to go through several more such cycles before aging to retirement age. Therefore, keeping up with the latest news and changes in pension legislation is very useful.

If the pension recipient has dependents, then he can count on a 50% increase in the amount of basic pension payments.

The pension increase is calculated based on the “best” 20 years. For now. This situation will soon change. The calculation will be based on the last 20 years of work. If you have worked for less than 20 years, the increase is calculated as the average of all years of work.

Chinese men can leave the service at 60, and women at 50-55, depending on their occupation. The Chinese authorities have repeatedly said that they are going to increase the pension qualification by 5 years. The last time they promised to do this was in 2021, but it didn’t work out. The reform was postponed until 2045.

It is worth paying attention to the fact that the indicated value applies to both male and female representatives.

Pension points can also be earned for working at home, i.e. for unpaid work if you are caring for helpless old people, small children or disabled people. This kind of work gives you up to 3 points per year, which are called omsorgspoeng.

If you want to return to your homeland and at the same time retain the right to receive your minimum pension from the Norwegian state there, you must first live in Norway for 20 years.

Thanks to such a good pension system in Norway, people who have retired are starting a new life. A lot of time is freed up, thanks to which older people move freely around Europe, not constrained by time constraints. There are often cases when they go to Spain or Italy during the cold weather, where they buy housing and enjoy sunbathing.

Everyone chooses for themselves how much to work, and it depends on how much the citizen would like to receive in old age. For most, it is profitable to retire at 67, so we will take this figure as a basis.

Due to the discovery of gas and oil fields in the sixties, life in Norway became almost fabulous. Street in the center of Oslo According to many people who want to leave Russia or Ukraine for “fairytale” Norway, they “fell in love” with this country as children, looking at the magnificent illustrations of the great Kittelsen.

The most important thing in the article on the topic: “The Norwegian pension system” with professional explanations. If you have any questions while reading, you can contact the duty lawyer.

In the sixties, oil and gas fields were discovered in this country, due to which the social security of citizens increased. In particular, decent conditions are created for older people when they receive government support. You will learn about how a pension is formed in Norway in 2021 and the average size of payments in this article.

Norwegian pensions! The laws defining them used to be Chinese literacy for foreigners living in Norway, and now even more so! There are about to be too many old people. A huge army of sixties, the entire military and post-war generation, are preparing to retire. And an ever smaller part of the population will work for the pension fund.

The retirement age established by the legislator is 67 years for both men and women, but if you work in hazardous work, you can, by agreement with your employer, retire earlier - at 62 years.

It should be taken into account that it is quite difficult for a foreign applicant to find a job in the country. Only a highly qualified specialist with a narrow focus can count on good earnings and career prospects.

The lowest salary in Norway is approximately NOK 215 thousand per year. This amount is considered almost beggarly.

Then the question arises of how such a small state has such capabilities. The reason is that the country has large pension funds, which are formed by using profits received from gas and oil exports.

Norway is one of the most prosperous European countries. Due to the discovery of gas and oil fields in the sixties, life in Norway became almost fabulous.

It is not for nothing that Norway consistently ranks at the top of the list of countries where the most favorable living conditions have been created for retirees.

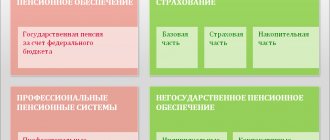

The structure of the pension system

Norway is a country that has a fairly transparent and liberal system, for this reason it attracts people from other countries to resettle. However, the question arises at the moment when people find out the age at which they will be able to obtain a pension status. This figure is one of the highest in the world and is 67 years.

It is worth paying attention to the fact that the indicated value applies to both male and female representatives. There are a certain number of companies whose employees have the opportunity, by agreement with management, to take a well-deserved retirement upon reaching the age of 62 years. In some cases, citizens prefer to work until they are 70 or more years old.

Initially, the age at which retirement becomes possible seems quite high. But it must be pointed out that indicators of the standard of living in this state are better expressed in comparison with other countries. In addition, the average life expectancy in the state is 90 years

Pay attention to the fact that in the state in question, people of retirement age live well. The main merit in this direction relates to the actions of government authorities. In particular, various social programs have been developed; it is possible to work after obtaining pension status. Pensioners also receive a fairly high level of income.

Then the question arises of how such a small state has such capabilities. The reason is that the country has large pension funds, which are formed by using profits received from gas and oil exports.

Reference! Also, the pension fund is fed by using tax deductions from working persons. Information suggests that in Norway there are companies that make a profit after selling oil.

The pension is formed through the following parts:

- Basic. It is calculated regardless of what total accruals are made and is based on the length of service inherent in the former employee. Citizens who are single and have accumulated 40 years of experience can count on the full amount of payments. In this case, this value must be continuous. When citizens of retirement age are married, they are entitled to a payment in the amount of 85 percent of the total value. It can also be applied for by residents of other countries who have or do not have a residence permit. In addition, these are persons who arrived from outside the EU and have been working in Norway for at least three years. Then the citizen can count on a reduced amount of payments. If a person supports dependents, then the additional payment is about 60 percent.

- Special part. It depends on the exact amount of income of a particular person, and points are taken into account. An increased pension is granted to persons who receive income in the amount of no more than six average monthly earnings. When a citizen exceeds the specified limit 12 times, no special pension is accrued. In this case, the state indicates that the citizen could independently accumulate funds for a future pension.

- Payment package . This part is accrued to persons who receive a minimum pension.

Also, the latter type of pension is also available to those who receive payments in the amount of no more than the average salary for the annual period.

Pension in Norway - 152 thousand rubles in Russian money

Russia turned out to be one of the worst countries for retirees. Business FM found out how they live in Norway, Australia, and New Zealand

Photo: YAY/TASS

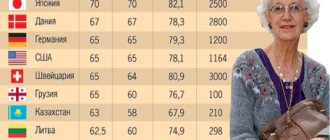

Russia was recognized as one of the worst countries for retirees. The country ranked 40th out of 43 possible in the annual global pension index. Russia ranks last in terms of indicators such as health care insurance costs and health care costs per capita. Over the course of the year, the country managed to improve its average score in the “finance” category; Russia still ranks last in the corresponding ranking. Norway takes first place in the pensions top.

The director of communications for the Norwegian Pensioners' Association, Kristin Ryth, says that on average a retired citizen receives almost NOK 21,000 per month. This is approximately 152 thousand rubles.

Kristin Ryth Director of Communications, Norwegian Pensioners Association “Pensioners have a good life in Norway. That's how it is with us. The average pension is approximately NOK 250 thousand per year. The pension system in Norway consists of two parts: one is public, which is formed through taxes, the other is private. Working citizens must make contributions to non-state pension funds. If you work for a government agency, your pension will be 66% of your salary when you retire. In the private sector, this will depend on how much you have paid into your pension fund. You pay part of it from your salary, and the employer contributes another part to this fund. If you have a very low pension, healthcare will be free for you.”

Following Norway in the Global Pension Index is Switzerland. The minimum pension here is 1,250 Swiss francs per month (about 77 thousand rubles), says Zurich journalist Lukas Stocker:

Lukas Stocker is a journalist from Zurich “On average, retirees have a little less money than when they worked, most can enjoy life. The mandatory state pension is between 15 thousand francs and 30 thousand, and this is considered the minimum that needs to be invested. And if this is not enough, then the region, the canton, pays something extra. Then there is the professional pension itself, where it depends on the job, on the company... basically, it’s flexible - how much you pay during your working life, then you get more when you’re retired.”

Following Norway in the Global Pension Index are Switzerland, Iceland, and Sweden. New Zealand rounds out the top five. Here, regardless of work experience, every pensioner can count on payments from 400 New Zealand dollars (about 69 thousand rubles), says a private guide in the New Zealand city of Dunedin Sergei Gumenyuk:

Sergey Gumenyuk private guide “There is no pension here like in Russia, that is, there is no income, no matter how many years you work, the retirement age is 65 years, and you receive about 400 New Zealand dollars a week, this is already in your hands. Here the tax is paid, and then the tax is directly deducted. You may not have worked at all your entire life, perhaps you were on social security, but the amount after 65 is the same. This is socialism. No matter what happens to you, there is full social service here. If something suddenly hurts you, you have an accident, or something else happens to you, they will repair it for you free of charge. If your home where you live does not have a mortgage, you have paid it off, it is yours, $400 a week is enough for you. Buy food in a supermarket, eat in a cafe - even 100 dollars a week is enough for you, no problem, plus you can also go for a drive, travel, see your grandchildren, children, fly to Australia.”

Following New Zealand in the pension rankings is its neighbor Australia. The country is attractive and comfortable for retirees, but it still has its drawbacks, says Sydney resident, editor and publisher of the anthology “Australian Mosaic” Tatyana Torlina. She receives 1,800 Australian dollars per month (almost 85 thousand rubles):

Tatyana Torlina editor and publisher of the anthology “Australian Mosaic” “If a person needs help, he is put on a waiting list for social housing, and only 25% of this pension is paid. The rest is enough for services, I mean water and electricity. The pension here is paid by different departments, since my husband was a war veteran, the Ministry of Veterans Affairs pays him. Pensioners have a very large discount on medicine. My husband was very seriously ill, he had cancer, he was injected with medicine every month, it cost about 1 thousand dollars, we paid 5 dollars for it. He also had such a discount, because he was a veteran, but the same discount, maybe a little less - not 5 dollars, but 10 dollars - was paid by those who were simply pensioners. With the most basic medical care, ultrasound, x-rays, it’s all free. There is a fee for serious dental research. Therefore, everything related to dentistry in our country is terrible. I can’t remember all these benefits at once, there are many of them. Australia is an ideal country in this sense; it is very good for old people and children here. But for people of working age who have to work hard, it’s very difficult here.”

The top 10 most attractive countries for retirees also included Germany, Denmark, the Netherlands and Luxembourg. Below Russia in the pension ranking are Brazil, Greece and India. They occupy places from 41 to 43 respectively.

Add BFM.ru to your news sources?

Retirement age in Norway

Before you begin to analyze the amount of a pension in the country in question, you need to indicate the age group at which a citizen becomes entitled to a pension. For representatives of both sexes, this value is represented by 67 years.

If there is an agreement drawn up with the employer, then you will be able to retire at the age of 62. It is also permissible to work until the age of seventy.

It is also useful to read: Retirement age in Switzerland

The situation with pensions in Norway

The retirement age in Norway is 67 for men and women. You can stop working under an agreement signed with your employer at age 62. Employees of hazardous production or people working in extreme conditions can receive pension accruals early. The average life expectancy is 83 years, so the government plans to increase the pension qualification to 70 years. Perhaps in the near future residents will face changes in this matter.

In 2021, the government adopted changes that the Pension Fund will no longer invest in shares with increased profit due to risks. Now investments will be directed only to the most reliable, but not so profitable companies. The reason for this statement was statistics: the number of 60-year-old people is growing rapidly. Norwegians stop working when they reach retirement age.

The Norwegian pension includes:

- basic payment;

- additional charges;

- special benefits.

Those who have worked for three years are entitled to a basic pension when they reach the statutory age. But there is a nuance: the right also remains for those who have received Norwegian citizenship, but have not moved from the EU countries. Those who moved from the countries of the European Union, having worked for 1 year, and the total amount of work experience from different places of work, regardless of the country, is sufficient, then the right to receive a pension is provided.

A full basic pension is awarded to those with 40 years of service. The basic pension does not take into account the salary of the future retiree, but takes into account family status. Single people receive much higher premiums than those with families. 50% of the supplement is added to pension payments if a person is assigned dependent status. Additional pension payments are accrued in accordance with wages and calculated as points. Then they are added to the basic pension.

The special pension is calculated according to the work experience over the last 20 years. Those who have an annual income above the average for at least 3 years can count on such a bonus. But if the indicator is more than 12 times the number, the person is deprived of the right to receive a special pension, since he belongs to the group of wealthy residents of Norway and must provide for himself through savings. If the pension accrual does not reach the average, the Norwegian receives a benefit, for example, the mandatory payment of income tax is removed from him.

What is the pension in Norway?

The authority to determine the amount of the payment in question is vested in the local parliament. The average pension value currently includes basic and special types of payments, as well as benefits that a citizen is entitled to. The functions of transferring money have been transferred to the Pension Fund.

Registration of a pension in full, including required additional payments, will only be possible if the citizen has 40 years of service. At the same time, all years must be worked out in the territory of the state in question. T

Attention! It is also necessary to take into account the marital status of the citizen and for this reason single persons will receive a smaller amount of support.

Pension for foreign citizens

Migrants can receive a pension legally, but this requires official status from the start of their working career. Otherwise it cannot be counted. At what age do foreigners retire in Norway? The same rules are established as for the rest - 67 years.

It is not necessary to have a residence permit or other documents for permanent residence. It is enough to work for at least 3 years officially on a work visa. In this case, a basic pension is assigned. If the foreigner has European Union citizenship, the minimum period of work is 1 year.

If you have a permanent residence permit, you can participate in the pension fund program. This allows you to make deductions to increase future payments. Those who have worked the required 40 years receive payments on the same basis as native residents. There is not much difference in origin. It is important that the work is carried out in Norway and is official.

We recommend these articles:

What is the minimum pension in Armenia?

What is the retirement age in Estonia?

Average and minimum benefits received by Norwegian pensioners

According to government data, the average value of payments is 250 thousand per year. For a month this amount is 21 thousand. At the same time, in accordance with the rate established by the National Bank, this figure is 161 thousand.

The minimum amount is 179 thousand crowns, while in rubles - 1.3 million per year . This amount is paid to a citizen who does not have enough work experience. Those with small earnings will also receive.

Pension in Norway for foreigners

If a citizen arrived from the territory of another state and did not receive a residence permit, then he has the right to receive a pension. For citizens of states that are no longer members of the European Union, they are allowed to work for a one-year period.

After this, they will be able to apply for pension status. Next, they are accrued basic payments. If the country has not previously been included in the European Union, then the service must be 3 years.

Thus, according to world data, pensions in Norway are one of the largest in the world. Pensioners live quite well in the territory of this state.

Features of the Norwegian pension system

Those who have worked in the country for 3 years are entitled to basic financial support. Visitors from the European Union can work in this country for a year, and then summarize their work experience in other countries. If a citizen has caregivers, he can receive an increase of 50 percent. Those whose wages have exceeded the average for at least 3 years can count on additional deductions.

Important! A prerequisite for obtaining a pension in Norway is having a residence permit.