The time a woman takes care of her newborn is quite a long period. It can legally last up to 1.5 or until the baby’s third birthday. It all depends on the wishes of the employee herself. Some go to work before the child turns 1.5, while others go from one maternity leave to another.

Many people are concerned about the question of whether this period is included in the total length of service, which determines whether a woman will receive an old-age pension. After all, some women give birth to two children almost in a row and for them the period of being at home with the newborn is prolonged. At the same time, new changes appear in pension legislation every day.

What is insurance and work experience?

The concepts of labor and insurance experience are used with different meanings in different branches of legislation. To calculate vacation pay, you need work experience, to calculate social children's benefits and sick pay, you need insurance experience, and to calculate pensions, you also need insurance experience, but this is a pension one.

At the same time, the total length of service in pension legislation is the total number of years of work and other socially useful activities that were carried out before January 1, 2001.

The term now used is insurance experience. It includes not only the working time when the employee worked in a particular place, but also other periods, including part of the parental leave.

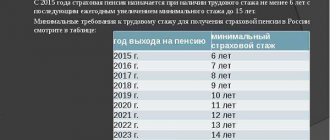

According to Art. 8 of the Federal Law “On Insurance Pensions”, taking into account the transitional norms enshrined in Appendix No. 3, in 2021, in order to assign an old-age insurance pension, you need at least 11 years of insurance experience. By 2024, this value will reach 15 years. There are cases when you can retire early; for this purpose, preferential insurance period is considered (Article 30 of the Federal Law “On Insurance Pensions”).

If you have an insurance record, a person has the right to apply for an old-age or long-service pension. At the same time, how large the pension will be depends on the length of service. The more contributions were paid, the longer the insurance period, the greater the pension will be.

We talked in more detail about whether vacation time is included in the length of service and insurance coverage in this article.

Periods counted towards insurance and total length of service

09.11.: 2704

Insurance experience is the total duration of periods of work and (or) other activities taken into account when determining the right to a labor pension, during which insurance contributions were paid to the Pension Fund of the Russian Federation (PFR), as well as other periods counted in the insurance period.

Total length of service is the total duration of labor and other socially useful activities before January 1, 2002, taken into account when assessing the pension rights of insured persons as of January 1, 2002.

The insurance period includes periods of work and (or) other activities that were performed on the territory of the Russian Federation, provided that during these periods insurance contributions were paid to the Pension Fund. Periods of work outside Russia are included in the insurance period in cases provided for by Russian legislation or international treaties, or in the case of payment of insurance contributions to the Pension Fund. Along with the specified period of insurance, the following non-insurance periods are counted:

— completion of military service (other service equivalent to it);

— receiving compulsory social insurance benefits during a period of temporary disability;

- care of one of the parents for each child until they reach the age of one and a half years, but not more than three years in total;

receiving unemployment benefits;

participation in paid public works and the period of moving in the direction of the state employment service to another area for employment;

— detention of persons unjustifiably brought to criminal liability, repressed and rehabilitated,

and the period of serving the sentence by these persons in places of imprisonment and exile;

- care provided by an able-bodied person for a disabled person of group I, a disabled child or a person who has reached the age of 80 years;

- residence of spouses of military personnel performing military service under a contract, together with their spouses, in areas where they could not work due to lack of employment opportunities, but not more than five years in total;

- residence abroad of spouses of employees of diplomatic missions, consular offices of the Russian Federation, trade missions of the Russian Federation, etc., but not more than five years in total.

The assessment of the pension rights of insured persons as of January 1, 2002 is carried out by converting them into calculated pension capital (regulated by Article 30 of the Federal Law of December 17, 2001 No. 173-F3 “On Labor Pensions in the Russian Federation”). The estimated size of the labor pension when assessing the pension rights of a citizen can be determined at his choice in the manner established by Art. 30 of this Federal Law: clause 3 or clause 4. The assessment option is used that allows the citizen to be given the largest pension based on the length of his total work experience, which includes periods of work and (or) other activities before January 1, 2002.

In general options, the following periods are included in the total length of service:

- work as a worker, employee (including abroad), member of a collective farm or other cooperative organization; other work in which the employee was subject to compulsory pension insurance; work (service) in paramilitary security, special communications agencies or in a mine rescue unit; periods of individual labor activity (including in agriculture);

- creative activity of members of creative unions - writers, artists, composers, filmmakers, theater workers, as well as writers and artists who are not members of the relevant creative unions;

— temporary disability that began during the period of work, and being on disability of groups I and II due to an injury at work or an occupational disease;

- stay in places of detention beyond the period prescribed during the review of the case;

- military service;

- receiving unemployment benefits, participating in paid public works, moving in the direction of the employment service to another area for employment.

Does this include time spent on maternity leave from 1.5 to 3 years?

Maternity leave is a period of rest that is given to the mother so that she can be with her newborn. At this time, the woman is under special protection of the state; she cannot perform her work for valid reasons and enjoys social support measures.

Therefore, as a general rule, parental leave is included in various types of length of service - labor and insurance. However, there are some peculiarities: leave related to caring for a child under 3 years of age is not always taken into account.

What period is counted towards the length of service?

In Russia, parental leave is divided into 2 segments:

- care up to 1.5;

- vacation from 1.5 to 3 years.

To calculate the pension, only the first period of vacation is taken into account, to calculate sick leave payments and child benefits - both, and to calculate vacation pay, neither of these periods is taken.

In order for the time spent on parental leave for up to 1.5 years to be included in the pension period, you must either work before taking the leave or immediately go back to work after caring for the child.

So, the answer to the question of how many years of parental leave are included in the length of service will be as follows: the total length of service includes this entire time period, including after the extension of leave until the child’s third birthday.

Periods for calculating the insurance period

The insurance period includes periods of work and other activities on the territory of the Russian Federation, provided that during these periods insurance contributions were paid to the Pension Fund of the Russian Federation. These are the so-called periods included in the insurance period. Insurance premiums for a citizen are paid by his employer. Therefore, the main feature of these periods included in the insurance period is that the citizen worked officially during these periods. It does not matter whether the citizen worked under an employment contract, provided services or performed work under service contracts or contract agreements. The main thing is that during these periods his employer or customer pays insurance contributions to the Pension Fund.

However, there are other periods when a citizen did not work and insurance contributions to the Pension Fund were not paid for him. Such periods can be counted towards the insurance period. These are the so-called “non-insurance periods” that are counted towards the insurance period. Those. When assigning an insurance pension, these non-insurance periods are also taken into account. Examples of non-insurance periods (counted into the insurance period) are periods of conscription in the army and being on maternity leave.

Which one will it be included in?

Parental leave from 1.5 to 3 years is included in the total length of service; during this time, the employee - woman or man - retains a job. Time spent on vacation is included in the insurance period for calculating sick leave and child benefits. However, the second part of parental leave, when benefits are no longer paid, is not included in the pension period.

Let's take a closer look at what type of experience includes parental leave from 1.5 to 3 years.

Will it be included in the worker?

According to Art. 256 of the Labor Code of the Russian Federation, parental leave is a social guarantee provided by the employer. is mandatory until the child reaches 3 years of age if the woman applies for it. You can go on vacation only until the child’s one and a half birthday or extend this time to three years.

The period when the child is 1.5 years old, but not yet 3 years old, is not paid by the employer. Therefore, it refers to types of leave without pay.

According to the law, caring for a child until his third birthday is included in the continuous, general labor account of years worked. The period under consideration is also included in the calculation of work in the specialty. This is the period when the employee performed work that was necessary to obtain a certain qualification.

The only exception, when care time up to three years is not included in the length of service, concerns early retirement.

Time spent caring for a child is not counted towards vacation time. This means that no standard leave will be provided for this period.

Check out other helpful articles on maternity leave. Find out how vacation is granted, whether it is possible to arrange an extension and early exit from vacation, and whether it is possible to work on maternity leave and how to apply for part-time work.

Does it go to the insurance company to calculate the pension?

The insurance pension, which is used to calculate the pension, does not take into account the period of parental leave from 1.5 years to 3 years.

They do not pay insurance premiums. This is why most mothers try to go to work after their child is 1.5 years old. In some cases, employees are trying to return to their workplace earlier.

The insurance period for retirement includes periods of child care for up to 1.5 years, in total - up to 6 years, that is, for four children in total.

The calculation of pensions according to the latest reform depends on the number of pension points. For vacation with children under 1.5 years old in Part 12 of Art. 15 Federal Law “On Insurance Pensions” the following points are given:

- for the first child – 1.8;

- for the second – 3.6;

- for the third and fourth – 5.4 points.

At the same time, the period of caring for a disabled child is included in the pension insurance period. This refers to the time that a person did not work while caring for a child. You can formalize this and receive payments from the Pension Fund. If you do not formalize such care, you will need to submit an application to the Pension Fund. The Pension Fund publishes clarifications on this matter.

In any case, this guarantee does not apply to officially employed persons on parental leave under 3 years of age.

For some professions, there is a preferential length of service, the presence of which gives the right to an earlier retirement. In Soviet times, the period of child care up to the third birthday was included in the length of service for early retirement.

However, on October 6, 1992, Law No. 3543-1 “On Amendments and Additions to the Labor Code of the Russian Federation” was issued (currently no longer in force), which excluded child care time from the preferential calculation.

Thus, in the preferential period for early registration of a pension, parental leave from 1.5 to 3 years will be considered only if the mother went on maternity leave before October 5, 1992 inclusive.

Is it taken into account by insurance for sick pay?

To calculate payments when paying for a certificate of incapacity for work or calculating maternity benefits, you need to know the duration of the insurance period. The percentage that will be paid to the employee or the amount of maternity benefits depends on this.

In Art. 16 of the Law of December 29, 2006 N 255-FZ specifies that the period of time taken into account when calculating sick leave must also include parental leave. In this case, both a period of up to 1.5 years and up to 3 years are taken into account.

Do they count towards the internship period?

All employees have the right to vacation. The working period, which gives the right to rest, includes both working time and non-working time (holidays and weekends, sick leave and vacation periods). The length of service used for leave does not include the time when the employee was absent from work without good reason, as well as when the employee was suspended from his work duties in the event of a crime or misdemeanor.

Reference! When taking into account length of service for subsequent leave, the entire period of time when the employee was absent from work is taken as a basis. When taking into account the period for calculating a pension, only the time period when the insurance amounts were paid for the employee is taken into account.

Another paid one

Annual leave must be provided to employees for at least 28 days. Since during the main and additional vacation the employee retains his place and his salary, then the “vacation pay” is subject to insurance deductions in the Pension Fund of the Russian Federation . Thus, paid leave is included in the working period, which is taken into account when calculating a future pension.

Planned vacation time could be time spent caring for a child or taking exams. That is, the time that is agreed upon in advance by the employer and employee. Unlike the planned one, the next one has vacation time at your own expense without providing a salary.

Days at your own expense

Russian legislation provides for vacation days without pay. An employee has the right to go on “vacation” without pay for both good and bad reasons. However, if the reason is not valid, the employer may not agree on vacation time. The duration of such time is agreed upon in advance with management.

In accordance with Article 121 of the Labor Code of the Russian Federation, the total length of service includes leave without pay, but only if its duration is no more than fourteen days per year .

Important! Days spent on leave without pay are not taken into account in the insurance period, since during this time period the employer does not pay insurance premiums for the employee.

It should be noted that an employee on vacation without pay can return to work at any time and begin performing his duties. An employer cannot send an employee on vacation without pay by order. Although such situations occur in practice, they are illegal and a direct violation of workers’ rights.

From what year is maternity leave not included?

Until January 1, 2002 Art. 167 of the Labor Code prescribed that the time period while the mother was with the child should be included in the length of service on which the future pension depended. Since 2002, in connection with the pension reform, pensions began to be calculated according to other parameters.

The Federal Law “On Labor Pensions in the Russian Federation” was adopted, and for the calculation of pensions, the period when insurance contributions are received from the employer for a person became important. Other periods included in the insurance period were prescribed separately in the law. The period of a person being on parental leave from 1.5 to 3 years was not included in this list.

The birth of a child and its subsequent care is an important stage in a woman’s life. During this period, she is completely occupied with her child and is forced to interrupt her work activity. Therefore, many mothers are interested in how parental leave will affect their future pension.

Up to 1.5 years of vacation is paid and this period is counted, including in the insurance period. The time period when a woman sits with a child from 1.5 to 3 is included only in the accounting of general work experience, experience in the specialty and is taken into account when paying sick leave and calculating child benefits.

Before going back to work after 1.5 years, we recommend consulting with an accountant: he will tell you how much money you will lose with such a decision now and in the future. And on this basis, you can already decide how best to organize the rest of the maternity leave.