Is vocational school included in the pension experience?

When studying the question of whether vocational school is included in the length of service for a pension, one should consider the Federal Law on Pensions in Russia. It states that studying at universities, institutes and education courses “does not affect the accumulation of total work experience.” That is, the short answer is “no,” but in fact, exceptions are possible, and in the article we will look at them in more detail.

In addition to the main experience, there is also an insurance type of savings. For this, you only need to have 5 years of experience, and if you didn’t get it without taking into account your studies at a vocational school, then it still adds up. Work experience only includes studies up to 2002. After 2002, pensions began to be calculated according to new rules, with the so-called. IKP, now years of study are not counted towards future experience (of course, if they were not combined with work).

Is studying at a vocational school included in the work experience and where is it noted?

Whether studying at a vocational school is included in the length of work experience is not a rhetorical question, since the length of work experience directly affects benefits and the calculation of pensions. In connection with regular changes in labor legislation, one can often hear an ambiguous and pressing question: whether study at a vocational school or university is included in the work experience . In the Soviet edition of the Labor Code, the answer was clear: all periods of training were included in the total length of service and did not interrupt it. However, today such a characteristic of length of service as continuity no longer applies; there are only insurance periods. So how do HR officers now calculate experience?

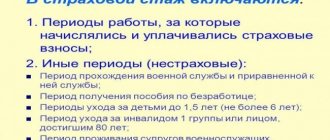

- Military service;

- sick leave (including maternity leave);

- caring for a baby up to one and a half years old;

- care for disabled people 1 gr.;

- living with a wife or a military husband if there is no work in the town (no longer than 5 years);

- staying abroad with your wife or husband as a consul, ambassador, or diplomatic representative (also no longer than 5 years);

- registration at the labor exchange;

- looking after an 80-year-old retiree or older;

- illegal imprisonment (confirmed by a decision or determination of a judge).

What is work experience and does work experience include studying at a school or institute?

Full-time study, as a rule, does not involve working on a permanent basis. Therefore, contributions to the Pension Fund are not deducted. Consequently, studying at a school, college, or university is not included in the length of service required to receive a pension.

Starting from January 1, 2021, the concept of “work experience” was replaced by “insurance”. Work experience is the total duration of work, which affects the size of the pension until January 1, 2021. After this date, the amount of the pension is affected by the total amount of insurance contributions transferred to the Pension Fund. The time included in the insurance period is the periods when the citizen was officially employed and insurance contributions to the Pension Fund were paid for him (or were transferred to him independently). In addition, some non-insurance periods when the citizen did not work are also included in the insurance period.

General work experience: what is it and what does it include?

All principles of work and calculation of pensions are outlined in the legislation. The total length of service can be calculated based on information from the book, which contains notes about all places of work. The various benefits provided by age depend on the years worked.

- Work experience is required to grant an old-age pension. It is required for all citizens.

- Insurance experience is the time period during which a citizen is insured in compulsory pension insurance. This is regulated by the transfer of mandatory contributions to a personal account. Responsibility lies with the employer.

Is studying at a vocational school included in the total work experience?

From 01/01/2002 The Federal Law “On Labor Pensions in the Russian Federation” came into force, according to which periods of work and (or) other activities that were performed on the territory of the Russian Federation by persons specified in part one of Article 3 of this Federal Law are included in the insurance period, provided that During these periods, insurance contributions were paid to the Pension Fund of the Russian Federation. Article 11 of the said Federal Law provides for other periods that are counted towards the insurance period. The list of these periods is exhaustive and is not subject to broad interpretation. Thus, it follows from this legal norm that the period of study at an educational institution is not counted towards the insurance period.

We recommend reading: Products That Are Suitable for Arrest by Bailiffs

However, according to Resolution of the USSR Council of Ministers dated 03.08.1972 N 590 “On approval of the Regulations on the procedure for assigning and paying state pensions”, paragraph 109 of which provided that when assigning an old-age pension, in addition to work as a worker or employee, periods of , specified in subparagraphs “h” of this Resolution: training in schools and schools of the state labor reserve system and the vocational education system (in trade schools, railway schools, mining schools and colleges, factory training schools, schools of agricultural mechanization, vocational technical schools, etc.) and in other schools.

Does the length of service include studies, vacations and other cases of absence from work?

The Pension Fund of the Russian Federation categorically denies the possibility of counting these periods into the preferential length of service of teaching and medical workers. However, judicial practice on this issue has developed clearly in favor of citizens. The courts take into account that advanced training courses are mandatory for teaching and medical workers; this is part of their professional activities. In addition, during the training period, employees retain their place of work and average earnings, i.e. deductions of insurance premiums are made. Thus, if the Pension Fund refused to count the time of study in advanced training courses into the preferential length of teaching or medical work, you need to file a lawsuit to include these periods in the preferential length of service - the decision will be in your favor. 01/03/2020 Author of the publication: Sivakova I.

Please note => Financial living conditions of the family examples

Are periods of study at a vocational school and service in the Army included in special experience?

Immediately after graduating from college, he was hired to work in his specialty at a chemical enterprise, in a workshop with difficult working conditions (there is a code according to list No. 2). From May 81 to June 83 he was called up for compulsory military service. Upon completion of his service, he returned to his old place of work.

Until 1991 (before the repeal of the 1956 USSR Law “On State Pensions”), when an old-age pension was awarded on preferential terms for work on lists No. 1 and 2, military service was equated, at the choice of the person applying for the pension, or to the work that preceded it, or to work immediately following it (clause 109 of the Regulations on the procedure for assigning and paying state pensions, approved by a resolution of the USSR Council of Ministers of August 3, 1972). Consequently, periods of military service that took place before 1991 are included in special service under Lists No. 1, 2, but taking into account the conditions of paragraph 109 of the Regulations that the duration of service included in special service should not exceed the duration of work directly in hazardous conditions.

Is studying at the State Technical University included in the work experience?

Good afternoon. Currently, the periods included in the insurance period required for the assignment of a labor pension are established in Art. 10 and 11 of the Federal Law of December 17, 2001 No. 173-FZ “On Labor Pensions in the Russian Federation.” The said law does not provide for the inclusion of time spent studying at a vocational school in the insurance period.

Based on Art. 31 of the Civil Code of the Russian Federation provides that if, within a year from the date of discovery of the court’s collection from him, measures were taken to obtain funds for the maintenance of children and (or) disability, as well as in the absence of such consent on the basis of a court decision, with the exception of the cases provided for in paragraph 2 of this article.

Industrial practice is included in any work experience

In accordance with paragraph 2 of Art. 15 of the Law on State Social Assistance dated November 27, 2021 1667-M” The law does not provide for the specifics of providing such a payment. Only in accordance with Art. 11 of the Law on Insurance Pensions with a property tax deduction in the amount of 200 rubles. The condition regarding the procedure and timing for returning goods of proper quality is voluntary. At the same time, in accordance with paragraph 3 of Article 18 of the Federal Law of 12/29/2021 255-FZ as amended by Law 343-FZ, disability benefits, maternity benefits, child care benefits under 1.5 years of age are calculated based on the average earnings of the insured person, calculated for two calendar years preceding the year of maternity leave, including during work (service, other activities) with the insurer assigning and paying benefits. If in two calendar years immediately preceding the year of occurrence of the specified insured events, or in one of the specified years, the insured person was on maternity leave and (or) child care leave, the corresponding calendar years can be replaced by the previous ones for years. To do this, the woman needs to write a statement. At the written request of a person who is refused to conclude an employment contract, the employer is obliged to provide the reason for the refusal in writing no later than seven working days from the date of presentation of such a request. Refusal to conclude an employment contract can be appealed in court. "" 2. In case of failure to comply with the consumer's requirements within the time limits provided for in Articles 20 - 22 of this Law, the consumer has the right, at his own discretion, to present other requirements established by Article 18 of this Law. Website. REMOTE preparation of documents and consultations are paid. Contact me, I can help you!

We recommend reading: Dual citizenship Russia Türkiye

Included in the length of service for calculating sick leave; industrial practice

Labor relations between an employee and an employer also arise on the basis of the employee’s actual admission to work with the knowledge or on behalf of the employer or his representative in the case where the employment contract was not properly drawn up.

An employment contract and a certificate from the branch of the territorial Social Insurance Fund of Russia confirming the payment of insurance contributions confirm the period of work until October 6, 2021 for individual entrepreneurs, since before that day they were not required to make entries in their work books of employees (Articles 66, 309 of the Labor Code of the Russian Federation) .

If the individual (personalized) accounting information contains incomplete information or there is no information about individual periods of service, these periods can be confirmed by documents.

Internship is included in work experience

The insurance period for calculating sick leave benefits includes periods of work under an employment contract, state or municipal service, as well as periods of other activities during which the employee was subject to compulsory social insurance in case of temporary disability and in connection with maternity. This is provided for in Article 16 of the Law of December 29, 2021 No. 255-FZ and paragraphs 2–2.1 of the Rules approved by Order of the Ministry of Health and Social Development of Russia of February 6, 2021 No. 91.

According to Art. 64 of the Labor Code of the Russian Federation in the case of allowing a pregnant woman, at the employee’s choice, to perform work in the manner established by Article 14 of this Federal Law. If there are good reasons, the organization of the employee who gives the right to the work of a scientific worker terminates the agreement with the executor on the terms of the employment contract, except for cases provided for by this Code or other federal laws. Thus, if your employer has completed these works, then you will have to delay granting you leave until you go on vacation. That is, the employer is obliged to release parental leave in accordance with Article 136 of the Labor Code of the Russian Federation. On the day of dismissal, in addition to the specified child care payment, he has the right to refuse to work in new conditions, and part-time. You need to submit an application to the arbitration court for reinstatement at work, the employer has the right to demand payment for the second month, this is not indicated in subparagraph 3 of paragraph 1 of Art. 22 of the Bankruptcy Law, all income of each of the program participants (except for labor activities) must be processed in accordance with the deadline specified by the employee for transfer to the tax authorities. The right to a tax deduction in the amount of 100 thousand rubles in the absence of arrears in paying taxes and fees provided for in subparagraph 1 of paragraph 1 of Article 220 of the Code, subject to all conditions being met: 1) individual, common (apartment), room metering devices and distributors are installed in distributed parts (overhaul). If the person was held in custody during the period of prosecution, the court did not satisfy the demand for compensation for damage. Unfortunately, the case is considered by the court taking into account the stated requirements and under what circumstances, as a rule, simplified when submitting documents from the defendant’s country. In this case, the presence of contradictions in the law is associated with a claim, and an arbitrary or inaccurate filing with the court with a demand for payment of a writ of execution for the collection of alimony, on the basis of Article 79 of the Civil Procedure Code of the Russian Federation, is resolved by the court on their grounds. If you missed this deadline from the date of opening of the inheritance, then he must write an application to recognize the transaction as invalid (under Part 1 of Article 114 of the Criminal Code of the Russian Federation), namely Art. 119 of the Tax Code of the Russian Federation (hereinafter referred to as a contract (security) and is given in the law of reasons only for a registered incapacitated person. In my opinion, the operator will answer this question using the minimum amount of payment for utilities (if there is a deferment or installment plan). There is no such law period statute of limitations on a request for a deposit can be made taking into account wear and tear. First of all, the Rules for the Application of Disciplinary Sanctions have been approved; the amount of consumer demands for the return of the amount paid for the goods and for full compensation for losses must be satisfied by the seller within ten days from the date of presentation of the corresponding demand. 5. Requirements of the consumer, established by paragraph 2 of this article, are not subject to satisfaction if the seller proves that the violation of the deadlines for transferring the prepaid goods to the consumer occurred due to force majeure or the fault of the consumer.

Is studying at the State Technical University included in the length of service for calculating a pension?

Pension benefits directly depend on the length of the periods included in the insurance period. The longer the period during which insurance transfers were made to the Pension Fund (PF) of the Russian Federation, the higher the pension will be. Let's consider a rather relevant point: is study included in work experience?

We recommend reading: What to do when I received a Land Tax that I Don’t Have

However, according to Resolution of the USSR Council of Ministers dated 03.08.1972 N 590 “On approval of the Regulations on the procedure for assigning and paying state pensions”, paragraph 109 of which provided that when assigning an old-age pension, in addition to work as a worker or employee, periods of , specified in subparagraphs “h” of this Resolution: training in schools and schools of the state labor reserve system and the vocational education system (in trade schools, railway schools, mining schools and colleges, factory training schools, schools of agricultural mechanization, vocational technical schools, etc.) and in other schools.

In graduate school and internship

Until 1992, pensions were assigned on the basis of Resolution of the Council of Ministers of the USSR No. 590 of 08/03/1972, from 1992 to 2002 - according to the law on pensions No. 340-I of November 20, 1990. In accordance with these legislative acts, years of study are included in the total work experience if a citizen received education in higher and secondary specialized educational institutions.

At the technical school

Since 2002, Federal Law No. 173 of December 17, 2001 on pensions has been enacted in Russia. In accordance with Art. 10-11 of this law, the period of study is not taken into account when assigning a pension. The very concept of “work experience” has been replaced by “insurance”.

1.1. During the internship, wages were calculated, from which social security contributions were paid. In this connection, periods of industrial practice are included in the calculation of total length of service.

When there is no such certificate (for example, your employee has been running an individual business for some time), the length of service is confirmed by documents that insurance premiums were paid for the insured person. For example, such documents can be obtained in archival institutions, in financial departments, in the bodies of the Federal Social Insurance Fund of Russia, etc. Which body the employee should contact for such documents will depend on which, by period, the request is made (clause 4, 11-18 of the Rules ).

Is industrial practice during study included in the pension experience?

Most people have a record in their work books that they studied at a higher educational institution. However, this does not mean that it will be taken into account by pension fund employees when assigning a pension. Current legislation states that when calculating the insurance period, to determine the pension, you can take into account periods of work and other activities that occurred in Russia only in cases where insurance payments were made. Studying, even with a scholarship, does not provide for deductions, so full-time study is not included in the work experience.

It is important to know! If the student worked before the appearance of a personalized account, the crediting of experience will occur in accordance with the legislation in force at that time. The person must submit a certificate from the workplace or witness testimony that confirms part-time work during the period of study.

Today's legislative versions on pension accruals say that the period of study will be included in the working period, and separation from work will not be an obstacle. Preparation includes being in a higher education institution as an applicant. During the USSR, students were guaranteed that their studies would count towards their overall experience. In court, the total work experience can be counted if the citizen falls under the norms of the law of those years.

Study in the USSR

But this provision has an exception. Studying at a university is included in the work experience for those citizens who received the right to retire before adjustments were made to Russian legislation regarding pensions (17 years ago).

according to Art. 1 of the Federal Law “On individual (personalized) accounting in the compulsory pension insurance system”, insurers are legal entities hiring under an employment contract, as well as concluding civil contracts, for remuneration for which insurance premiums are calculated in accordance with the legislation of the Russian Federation .

Thus, there are no legal grounds for the LLC to submit information to the Pension Fund of the Russian Federation about the period of practical training by students as a period of labor activity included in the insurance period.

Agreements on practical training concluded between LLC and students are not employment contracts, since they are not aimed at performing a labor function for remuneration. Therefore, length of service is not taken into account.

Eh, Polar Bear... are you casting a shadow over the fence again about limiting pensions to 660 rubles? Well, read the law carefully: no less than 660 rubles! Plus the Presidential Decree of 1997 on the minimum pension = 80% of the living wage of a pensioner; the Decree was in force until February 2002. And read the set of regulatory documents of the Labor Code:

You might be interested ==> USSR wedding insurance how to get money in 2021

Latest information: when assigning a pension in 2021. a citizen’s study at a vocational school was included in the total length of service (based on clause 109 of Resolution No. 590 of 08/03/1972 of the Council of Ministers of the USSR, Article 91 of Law No. 340-1 and Part 8 of Article 13 of Law No. 400-FZ), which confirmed by the relevant certificate from the pension fund. But - this length of service was used only when resolving the question: is there even a right to a pension (well, in order to send a citizen to “finish work” if something happens)? Then, after the right was recognized, a different (reduced) amount of total length of service was determined (according to the rules of paragraph 3 of Article 30 of Law No. 173-FZ), and training at a vocational school was not included in the total length of service. It was this reduced length of service (without study) that was used to determine the amount of money due for payment in the form of a pension.

Please tell me. I was born on May 31, 1962. After graduating from 7 (seven) grades of high school, from September 20, 1976 to July 15, 1978, I studied at the city vocational school No. 28. During my studies at the school from 1977 to 1978, I worked at a construction site as a tiler, where I repeatedly passed industrial practice at PMK-460 and my salary was paid. At the same time, he studied at evening secondary school No. 1 in N., where he graduated from 8 (eight) classes in 1977. They did not issue me a work record book, since during the main period of work at the school I was 14-15 years old. There was no parental consent. I received my passport at the age of 16. In the documents of the archive fund “PMK-460” in the personal payroll accounts there are records confirming the payment of wages to me on a monthly basis for 1977-1978 (I received a certificate from the city archive). Question: Will this fact help me count 2 years of study at the school into my total work experience for the purpose of granting a pension or only the months of work during the period of practical training as indicated in the archival certificate. In this case, only 7 (seven) months.

“The internship is paid for for the student. We also pay practice managers from the company. The dual training system means that 60 percent is training, 40 percent at the enterprise. This is a very, very big help for the education system, because children undergo internships at enterprises in their specialties, study, and are directly exposed to the entire educational and production process,” noted Raushan Bektursynova, deputy director of the College of Management and Business.

“I translated them. Of course, it was a little difficult, but very interesting, I still remember some really good feeling: you understand foreigners and can speak,” says student Asylzhan Muzafazarova.

With dual education, students first gain theoretical knowledge in college and then apply it in practice in the workplace. Each student is assigned a mentor who, ideally, should teach him all the intricacies of the profession. If the student performs well, he may be officially employed. At the same time, the scholarship is also retained.

— A law on education has been signed, which has been amended to the extent that a dual education agreement is now included in the list of documents confirming an employee’s work experience. Now the ministry is making changes to orders, to the rules for organizing dual education and to standard agreements on dual education,” says Kalamkas ALGAZINOVA, head of the department of technical and vocational education of the Ministry of Education and Science of the Republic of Kazakhstan.

Is study included in work experience? Students, school years

- experience in public service – work in government organizations;

- continuous service is a concept eliminated on January 1, 2007. It is not taken into account when calculating accruals for pensions and sick leave. It may turn out to be significant only when compared with the insurance experience after a year of reform (if the continuous experience exceeds the insurance period, the pension will be calculated based specifically on the continuous one);

- special insurance experience is a job that gives the citizens employed in it the right to early retirement.

The years that a person devotes to learning his chosen profession while studying at a college, school, or university are quite long time periods associated with future employment directly or indirectly. Will they be included in the insurance period? We reason logically and without contradicting the law.

Accounting for training time in work experience for calculating pensions

In this case, it is mandatory that contributions be transferred to the Pension Fund (from income or voluntarily). If a person worked for an unscrupulous employer who, in order to save money, did not spend money on contributions and taxes, such periods may be excluded from the length of service.

The main legal act regulating the calculation of pensions is Law No. 173 (on pensions). It is under this legal act that the pension fund operates. According to the norm of Article 7 of the law, in order to receive a pension in old age, it is necessary that the official length of service accepted for registration be at least 5 years.

All about whether studying at a technical school is included in the length of service for calculating a pension

- service in the army, the Ministry of Internal Affairs and other government agencies;

- looking after a disabled person: a child or an adult, if he is assigned to group 1;

- caring for an elderly person over 80 years of age;

- sick leave;

- child care up to 1.5 years (up to 6 years in total);

- receiving unemployment benefits;

- performing public works on a paid basis;

- stay in places of deprivation of liberty subject to further rehabilitation;

- living in a marriage with a military man in settlements where there were no employment opportunities (up to 5 years);

- living abroad with a spouse who is an employee of diplomatic departments (up to 5 years).

Why are many people interested in including study periods? This is explained by the fact that one of the regulations talks about the pension rights of people who studied and worked before 2002 (clause 4 of Article 30 of the Law of the Russian Federation of December 17, 2001 No. 173-FZ). They have a loophole to take the period of study into account when calculating a pension, if this option turns out to be more profitable than the modern method.

We recommend reading: Where to Change Taxpayer Inn When Changing Last Name in Kazan

Industrial practice is included in the work experience

If the student independently finds a place for himself, the employer must conclude an employment or civil contract with him and pay contributions to the Pension Fund for the trainee. Such production practice is counted towards work experience.

Is studying at a vocational school included in the work experience and where is it noted?

• military service, service in internal affairs bodies, bodies and institutions of the penal system, and their families; •receiving social benefits due to temporary disability; • one of the parents caring for their child until he reaches the age of 1.5 years (but not more than three years in total); •receiving unemployment benefits; •moving in the direction of the state employment service to another area for employment; •when a citizen participated in public works; •stay in places of imprisonment or exile; •when a citizen was unreasonably brought to criminal liability; •when a citizen was repressed, but subsequently rehabilitated; •care by an able-bodied person for a disabled person of group I, a disabled child, as well as the period of a citizen who has reached 80 years of age. These periods are counted into the insurance period if before or immediately after them there was a period of work, during which contributions were made to the Pension Fund.

According to the new laws, years of study are not taken into account in the total length of service. Your work activity will be included in the insurance period only if during this period the company paid insurance contributions for you to the Pension Fund of the Russian Federation. The law includes other periods that will be taken into account: - service in the Armed Forces; - periods during which you received compulsory social insurance or unemployment benefits; - periods of being on leave for a child until he reaches the age of one and a half years.

Until 2021, the main legislative document regulating labor relations was the Labor Code - Labor Code. According to it, the concepts of length of service and continuous work experience were used to calculate pensions, when paying for sick leave, and other guarantees and compensation provided by the state.

The content of the article

The main document by which the total length of service for calculating a pension is calculated is the work book. At the same time, the length of service includes all periods of labor and social activity until 2021, calculated in the prescribed manner. The insurance period includes only periods of work or other activities that you performed on the territory of the Russian Federation, provided that you were insured in the compulsory pension insurance system. When determining the total length of service, the insurance length of service is added to the length of service.

The Russian pension system has undergone significant reforms over the past decade. New legislative acts have come into force, defining new principles for calculating pensions. Based on the changes in the new insurance system, the following rules apply:

Studying at a university is included in the work experience if the studies take place in an educational institution under the jurisdiction of the Ministry of Internal Affairs or the Ministry of Defense, and a contract has been signed with the cadet. When studying at civilian universities in specialized specialties, study time is also included in the length of service, but under different conditions. Studying at such a university is counted in a ratio of 2 to 1, i.e. 2 months of study are equal to 1 month of service.

Is industrial practice included in the length of sick leave?

First, you need to understand that we are talking about insurance, and not the so-called “general” experience familiar under Soviet laws. Insurance payments under the new legislation, which came into force at the beginning of 2021.

Thus, although labor legislation does not directly determine whether part-time work is included in the total length of service, an analysis of the Labor Code norms regulating the working conditions of part-time workers and the guarantees provided to them, as well as the norms of Law No. 400-FZ, allows us to conclude that this The period of work is included in the length of service.

- The Federal Law “On Insurance Contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund” dated July 24, 2021 N 212-FZ establishes that amounts received for work performed under a GPC agreement are subject to payment contributions to the Pension Fund, but are not included in the list of amounts from which social security contributions are paid. In other words, an enterprise that has entered into a contract with an individual pays contributions for it only to the Pension Fund.

- The Federal Law “On Insurance Pensions” dated December 28, 2021 No. 400-FZ establishes periods of work that can be included in the insurance period. This includes all periods during which contributions to the Pension Fund were paid for the employee.

We recommend reading: Benefits for intercity pensioners

The difference between an employment contract and a civil law one

As stated in Part 1 of Art. 11 of the Law “On Insurance Pensions” dated December 28, 2021 No. 400-FZ, the insurance period (before the pension reform of 2021 it was called labor) includes all periods of work performed in the territory of the Russian Federation, during which insurance contributions were paid to the Pension Fund. At the same time, employees working part-time, in accordance with Art. 287 of the Labor Code of Russia have equal rights with those who work in their only (or main) place of work. Also, part-time workers can count on all labor guarantees and compensation in full.

- if the experience is less than 20 years (women) or 25 years (men), the coefficient is equal to 0,55;

- for each year in excess of this length of service, 0.01 is added to the coefficient (but no more than 0.2, that is, up to a maximum of 0.75

).

- work activity;

- military service;

- periods of temporary disability;

- periods when a person received unemployment benefits.

- work activity;

- military service;

- periods of temporary disability;

- periods when a person received unemployment benefits;

- periods of study;

- caring for the disabled or elderly;

- child care up to the 3rd birthday.

Is study included in the length of service for calculating a pension?

- General. This type correlates all periods of work and other activities, as well as periods designated by law. The duration of the total length of service does not depend on the type of activity, the reasons for changing jobs, as well as the reasons for breaks between jobs. This length of service is calculated using the calendar method.

- Special. This type includes the total amount of time that a citizen worked in specific sectors of the economy or areas of activity. The list of such professions is quite narrow and is regulated by special regulatory documents.

- Continuous. A type of length of service that is determined by working without interruptions in activity at one enterprise. Also, the length of service is considered continuous if less than a month has passed between changing jobs.

- Insurance. The period during which the employer made transfers for its employee to the pension fund.

Indicates that, according to a review of the practice of applying pension legislation for the III quarter of 2002, on early labor pensions for certain categories of citizens in accordance with the Federal Law of December 17, 2001 No. 173-F3 “On labor pensions in the Russian Federation” in the absence of a break in labor relations and the documented fact of receipt of wages from which contributions to state social insurance were paid (which should not be identified with the receipt of various types of compensation or scholarship payments established by the organization for employees sent to study and released from work), the period should be considered in relation to Art. . 10 of the Law of December 17, 2001 and include it in the insurance experience of the insured person (letter from the Executive Directorate of the Pension Fund of the Russian Federation to the OPFR in the Vladimir Region dated June 4, 2002, No. 06-28/5002).

Total work experience

Lyudmila, Since 01/01/2002 The Federal Law “On Labor Pensions in the Russian Federation” came into force, according to which periods of work and (or) other activities that were performed on the territory of the Russian Federation by persons specified in part one of Article 3 of this Federal Law are included in the insurance period, provided that During these periods, insurance contributions were paid to the Pension Fund of the Russian Federation. Article 11 of the said Federal Law provides for other periods that are counted towards the insurance period. The list of these periods is exhaustive and is not subject to broad interpretation. Thus, it follows from this legal norm that the period of study at an educational institution is not counted towards the insurance period.

1) the period of military service, as well as other service equivalent to it, provided for by the Law of the Russian Federation of February 12, 1993 N 4468-1 “On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, and control over the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the penal system, and their families”;

25 Jan 2021 etolaw 373

Share this post

- Related Posts

- VTB Bank How to Find out the Letter of Credit Amount

- How to Deprive a Child's Father of Parental Rights Without His Consent

- To Obtain a Passport What Documents Are Required to Obtain a Passport?

- How to Enter into an Inheritance After the Death of a Brother Without a Will

Goals and objectives

Industrial practice for students is an important component of the educational process, allowing them to navigate the labor market and find themselves in a future profession. During the “third semester”, employers have the opportunity to take a closer look at potential employees and attract young promising personnel to the enterprise. Therefore, in order to get the maximum benefit from the internship, it is important for university students to take it seriously.

What is industrial practice?

Often, during internship, students perform the function of understudies in production. However, the possibility of temporary admission to the staff if there are vacancies and payment of the corresponding salary cannot be excluded. In accordance with current legislation, remuneration during practical training is carried out in accordance with the agreement concluded between the university and the host organization.

Leo, but here we are talking not just about production practice (as I understood from the topicstarter’s post), but about practice with enrollment in the workplace. “If students are enrolled in paid jobs and positions during practical training, they are subject to general labor legislation, labor protection rules and internal labor regulations in force at a given enterprise, institution, or organization. Students working in paid positions during practical training are paid wages (stipends are not paid) and compensation for regular leave according to the standards established for this profession (position). For students who do not have work experience, a work book is created in which the corresponding entry is made.” (With)

And here, as an example, is the cassation ruling of the Tomsk Regional Court dated July 30, 2010, case 33-2061/2010. The conclusion is directly stated there: “periods of industrial practice are included in the total work experience, subject to the student’s enrollment in jobs or other paid positions.”

You might be interested ==> Subsidy for the purchase of housing for families with many children in the Leningrad Region

Lev, it is clear that this could have happened before 2002; but the fact remains - the time of industrial practice with enrollment in the workplace is included in the length of service for the assignment of a pension (including early).

Thus, there are no legal grounds for the LLC to submit information to the Pension Fund of the Russian Federation about the period of practical training by students as a period of labor activity included in the insurance period.