- home

- Reference

- Experience

Due to constant changes in pension legislation, Russian citizens increasingly began to think about what kind of pension awaits them in the future. At the same time, most of them have little or no understanding of the intricacies of the ongoing reforms, and therefore cannot fully assess the scope of their pension rights and prepare for retirement properly.

Citizens have questions even at the level of basic terminology; for example, many do not see the difference, say, between work experience and insurance experience. However, this question is the most important one for assessing your future retirement security.

Differences between work and insurance experience

Many working citizens have heard about two types of length of service: labor and insurance. But not every person understands the difference between them, much less knows what specific role they play. Labor is the total duration of a person’s working activity, starting from the first entry in the work book and ending with the moment of retirement.

This includes not only the time that the employee devoted directly to work, but also:

- Serving in the Armed Forces of the Russian Federation, as well as in a number of paramilitary units - the Ministry of Emergency Situations, the Ministry of Internal Affairs, the FSB, the Federal Penitentiary Service.

- Period of sick leave.

- The time spent officially registered at the employment center as an unemployed person.

- Leave to care for a young child.

- Caring for a disabled person of the 1st group, a disabled child, an elderly person over 80 years old.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

In addition to the general one, there is a special work experience. It is counted for workers working in enterprises with hazardous conditions, in the far north, and in a number of paramilitary units.

Special experience gives the right to early retirement based on length of service (for the Armed Forces, Ministry of Internal Affairs, FSB) or “hot net” (for workers in hazardous industries). Before the introduction of a new procedure for calculating pensions in 2002, length of service played the main role in calculating the amount of pension payments: the more a person worked during his life, the larger the pension he was entitled to.

After adoption in December 2001 new Federal Law No. 167, seniority gradually began to become a thing of the past, giving way to an increasingly important role to insurance.

It remains relevant only for people who began their working career before 2002.

The insurance period dates back to 1996, when such a concept first appeared in Russian pension legislation. This term refers to the period for workers to make contributions to the insurance part of the pension fund. Since January 1, 2002 Contributions to the Pension Fund have become mandatory for all employers with hired employees. For each citizen of the Russian Federation of working age, an individual account is opened in the pension fund, into which insurance contributions are received.

The base rate of contributions to the mandatory pension fund in 2021, according to Federal Law No. 306, is 22% of wages. A person's insurance experience was initially measured in calendar months, and later a point accounting system was introduced. Along with the funded part, insurance has been the main criterion influencing the amount of pension payments since 2002. The insurance period includes the following periods in the life of an able-bodied person:

- Working as a hired worker or employee.

- State or municipal service.

- Private enterprise, if at the same time contributions were paid under compulsory pension insurance.

- Work as a deputy in parliaments at various levels - from the State Duma to the municipal assembly.

- Serving in the army, police and other law enforcement agencies.

- Staying in places of detention, subject to employment there.

- Caring for a baby until he is one and a half years old.

- Being registered with the employment service and receiving benefits.

As you can see, unlike the length of service, the insurance period does not include the period of a citizen’s education at a university.

At the same time, individual entrepreneurship and farming, which are not included in the length of service, are included in the insurance (if the individual entrepreneur made the appropriate payments).

What is insurance experience?

The insurance period is a set of periods of activity during which payments were made to the Pension Fund of the Russian Federation.

The first day of calculating the insurance period is the person’s first official working day.

The first official working day can take place not only with an official appointment, but also in a number of life situations when a person brings public benefit in isolation from his main professional activity.

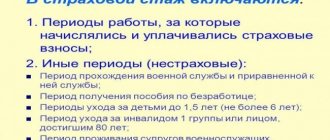

Insurance experience includes:

- compulsory service in the armed forces;

- maternity leave;

- maternity leave for a child up to one and a half years old;

- the period of stay in a pre-trial detention center, if, as a result of a criminal case, a person was found innocent;

- temporary totality of all periods of incapacity. This category also includes unemployed citizens being on sick leave;

- care for elderly relatives and disabled people;

- being registered with the Labor and Employment Service, subject to monthly pension payments in the Russian Federation;

- staying abroad during a period of professional necessity;

- the status of a serviceman's wife who is with her husband in an area where there is no possibility of officially finding employment.

These periods will be classified as insurance length only on the condition that after them there will be official employment, accompanied by payments to the pension fund by the employer company.

The insurance period is used when calculating payments for certificates of incapacity for work, when calculating a social pension, and when calculating child benefits.

Types of insurance experience and what it includes

Russian legislation defines four types of insurance experience:

- General experience. It includes all periods of official employment of a citizen, as well as the period of other actions that are included in the concept of insurance experience. In fact, the total length of service is the length of service that is taken into account when calculating the labor pension.

- Professional (special) – experience that is awarded for harmful working conditions. The fundamental principle for accruing special experience is that the working conditions comply with code 3.3 or more.

- The minimum is the age pension criterion, that is, the presence of insurance coverage upon reaching retirement age. This length of service allows citizens who do not have Russian citizenship but have been officially residing in the country for more than 15 years to receive minimum pension payments.

- Mixed – a one-time combination of work experience with a working specialty. For example, service in the armed forces of the Russian Federation under a contract.

Minimum length of service for assigning an insurance pension in 2020

In 2021, in order to receive a cash payment, 10 or more years of work, that is, work experience, is required. However, other periods can also be added up, for example, military service or maternity leave.

Do not forget that the duration of work, during which contributions are made by the employer, is not the only condition for retirement. Requirements also include reaching the age limit and a specific number of individual points.

Functions

The length of the insurance period has a direct impact on the calculation of pensions and sick leave benefits. Until 2015 The unit of calculation was the calendar month, and after that a point system was introduced. This was done to unify and simplify the calculations of mixed length of service, when a citizen worked part of the time until 2002, before the introduction of compulsory pension insurance.

Insurance period during sick leave

The length of the insurance period when calculating hospital benefits also plays a decisive role. This dependence is presented below:

- Does not exceed six months - the amount of hospital payments is equal to 1 minimum wage.

- From six months to five years – 60% of salary.

- From five years – 80% of salary

The exceptions are maternity benefits and benefits for work injuries.

In these cases, regardless of the insurance period, the employee is provided with benefits in the full amount of his monthly salary. Leave to care for small children is also fixed at 40% of wages.

Insurance experience and military service

Service in the armed forces differs from ordinary hired work in that no taxes or payments to state funds are collected from military personnel. Military personnel receive full pay. The question arises, since their employer (in this case, the RF Armed Forces) does not make any contributions to the PRF for soldiers and officers, does the insurance period not apply to them? This is by no means true: according to the provisions of Federal Law No. 400, army service is included here, however, falling under the definition of a non-insured event.

Other situations

Since 2015, persons who have worked for at least 6 years have the right to receive a minimum pension. From this moment on, the amount of insurance experience required for calculating pensions is increased by a year every year. This growth will stop only in 2024, reaching 15 years.

Thus, it is the length of the insurance period that will become the main criterion for determining the time of early retirement.

What is the difference between work experience and insurance?

The difference between general experience and insurance experience is formal. Labor is understood as the total duration of activity (social, professional) until the beginning of 2002. After this date, the calculation of insurance begins, which means the total duration of working periods during which payments of contributions to the Russian Pension Fund were made for a specific worker, employee, or manager of an enterprise.

The differences between the internships lie in the fact of transferring contributions. The concept of labor includes any professional work and social activity, regardless of the transfer of contributions to the Pension Fund. To calculate the insurance, only periods during which contributions were paid for the employee are taken into account. There are no other significant differences or distinctions between the concepts.

There is also no difference between “general” and “labor”. In Russian legislation these are identical concepts. In a number of legislative and regulatory acts, length of service is referred to as “general labor experience”.

Classification of species

The need for a person to have work experience is enshrined in the legislative acts of the Russian Federation on labor activity.

In order for seniority to accrue, an employment agreement is concluded between the employer and employee. There are several types of work experience:

| Labor | The total period of labor or social activity, during which the citizen made timely and regular contributions to the Pension Fund |

| Civil service experience | Duration of activity in state institutions. At the same time, employees are awarded bonuses for length of service and additional leave |

| Special vehicle | Labor activity associated with hazardous work. Retirement will be early |

Continuous work experience is considered to be a period of work without changing employers. Since 2007, this concept has lost its meaning.

It is not taken into account either when calculating sick leave or when calculating disability payments.

The continuous period remains if:

- the workplace changed and the break was less than 30 days;

- the employee quit of his own free will and the break was less than 3 weeks;

- the employee quit due to his wife’s transfer to another city;

- the employee is pregnant;

- a woman has children under 14 years of age or a disabled child under 16 years of age.

The insurance period is:

| General | These are periods of labor or other activity within the Russian Federation, military service and other situations when contributions were deducted, regardless of breaks |

| Special | A period of working under difficult working conditions. Contributions are paid according to special rules |

| Continuous | The period of work of a citizen without interruptions for 1 or several employers |

| Mixed | Consists of work experience and length of service. Applicable to those retiring from service. Military personnel are allowed to retire at age 45. If the length of service (20 years) is not enough, mixed experience is used - 12.5 years of service must be included in 25 years of work experience |

Where exactly are they used?

Currently, the term “work experience” is almost never used. In order for the Pension Fund to accrue a pension to a citizen, the insurance period is used.

Labor is rarely used, only in accordance with special rules for calculating pensions from the state.

Converting periods to full years and months

Addition of periods is carried out in several ways. The first is the summation of time periods.

This option is used when an employee has several periods, including years, months and days.

In this case, it is necessary to select the entire part. For example, the first period is 3 years, 5 months and 22 days. The second is 1 year, 7 months and 2 days.

It turns out – 3 years + 1 = 4. Months – 5+7=12, days – 22+2=24. Isolating the whole, it comes out to 5 years and 24 days. This will reflect approximately 80%.

The next way to calculate insurance experience is to allocate entire periods. For example:

| First period | 18 months and 24 days (whole days are calculated as follows - 18*30+24=564) |

| Second | 28 months and 13 days (28*30+13=853) |

| Third | 22 months and 23 days (22*30+23=683) |

The total comes out to 853 + 564 + 683 = (2100)/30 = 70, divided by 12 and the result is 5.83. That is, the approximate length of service is 5 years and 8 months. This method is imprecise, so the common method is addition.

What are the differences between them

Labor and insurance experience are different concepts from a legal point of view. The main difference is their intended purpose.

The length of service is calculated for the purpose of pension provision. It was taken into account only until 2002. Starting from this date, the insurance period was calculated.

The insurance period includes the working time of citizens, during which insurance premiums were paid to the Pension Fund for the employee.

It is calculated when establishing rights to receive a labor pension. This also takes into account non-insurance periods - military service, maternity leave.

Work experience is the total number of days of work or other activity before 2002. The size of the pension until January 1, 2002 depends on its duration.

Current standards and legislative framework

All aspects of calculating the insurance period are regulated by relevant regulations.

- Federal Law No. 27 (1996) – on the personal accounting of each worker in the pension system. The first legislative act that provides basic concepts about the insurance pension system.

- Federal Law No. 165 (1999) – amended definition of the concept of “insurance period”.

- Federal Law No. 167 (2001) – on compulsory pension insurance of citizens. It is the fundamental bill in accordance with which insurance deductions are made for compulsory health insurance.

There are also a number of additional laws regulating some special cases - Federal Law No. 400, which spells out the provisions on military personnel. Federal Law No. 255 (2006) on the procedure for calculating temporary disability payments to employees.

Where is experience accounting applied?

Both types of length of service are taken into account by employees of the Russian pension fund when calculating pension payments to a person entering a well-deserved retirement. The new pension reform, which unfolded in 2015, uses points as the main unit for calculating pension payments, not months or rubles of savings. The number of points accumulated directly depends on the time during which insurance premiums were paid.

The later a citizen applies for a pension, the more points will accumulate in his account, and, accordingly, the larger the pension.

Addition of periods of labor and insurance experience

If part of a person’s work activity occurred before 2002, then the periods of labor and insurance experience are added together. According to Decree of the Government of the Russian Federation No. 1015, a citizen in such a situation must present to the pension fund a work book that contains records of the entire duration of his work activity. Pension Fund employees calculate labor points based on the total length of work experience up to 2002, after which they index them. The indexed points are added to the pension points that the employee accumulated after the entry into force of Law No. 167.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

If a person has lost his work record, and he was unable to prove the fact of working before 2002, then he can only count on a minimum old-age pension.

What is work experience?

Work experience is labor or socially useful activity, which is reflected in the work book.

Types of work experience:

- Continuous – the duration of a citizen’s work at one workplace in one company, without a break in the labor relationship or transfer to another organization within three months from the date of last employment. The main condition for continuous work experience is three months from dismissal to employment. If this rule is violated even for 1 day, the service will be considered interrupted.

- Special - this length of service includes not only work activities, but also socially useful ones, which are distinguished from work experience by the conditions in which it is carried out or by the content of work activities. Depending on the conditions there are:

- working conditions that allow a person to retire early. This case includes working with harmful substances, in areas with an extremely unfavorable climate, heavy physical work;

- working conditions that give the right to payment of compensation. This category includes employees whose work involves risk to life, harmful working conditions, work in which a non-disclosure document is signed;

- public service employees;

- high productivity for more than 5 years;

Work experience in a specialty is the total working time that an employee has worked in a profession, corresponding to his qualification certificate.

How is it calculated

The insurance period is calculated by adding up the periods when insurance premiums were paid for a person. For the most part, this is the time of direct work or entrepreneurial activity.

However, we should separately highlight the so-called insurance periods, the correct calculation of which is of great importance for the corresponding calculation.

In accordance with the law, these must include:

- being on sick leave;

- caring for a child up to 1.5 years old;

- maternity leave;

- time to care for an elderly person.

This list is not complete or exhaustive.

Many older citizens are concerned about how their insurance coverage will be calculated for periods of work before 2002. This is due to the fact that such a thing as “insurance premiums” simply did not exist until that time.

However, these individuals need not worry as all these periods are taken into account by the pension fund. Payments under UTII and Unified Social Tax in the period from 1991 to 2002, as well as social insurance contributions before 1991, are equal to insurance contributions.

Changes in pension legislation, carried out as part of the corresponding reform, imply stricter requirements for recipients of insurance pensions. One of them is having a sufficient number of years of insurance experience. So, in 2021, the minimum number is 10.

If a citizen has worked for less time, then an insurance pension cannot be assigned to him.

The insurance period is not the only criterion for assigning an insurance pension. In this case, such a parameter as the individual pension coefficient (IPC), expressed in points, is also of great importance. In 2021 there should be at least 16.2.

The IPC parameter affects not only the very fact of the possible assignment of a pension, but also the amount of future security.

The Russian Pension Fund strives to reduce the level of paper document flow, including when interacting with insured persons, to a minimum. In this regard, since 2015, pensions are calculated based on information from an individual insurance account. They are contained in a single database of the Pension Fund.

A citizen has the right to access the relevant information by ordering an extract from the Pension Fund. In addition, you can find out about the account status in your personal account on the fund’s website.

However, in some cases, information about length of service in the Pension Fund database may be incomplete. In this case, entries in the work book are taken into account.

The right to a pension is an inalienable right of every citizen, but its specific size and purpose are different for everyone.

This is explained by the fact that the main parameter is the length of service of an individual employee.

In addition, it is of no small importance for receiving other payments and benefits: additional leave, bonuses or compensation. More details about the role and types of work experience below.

The main document by which this period is determined is the work book. It first appeared in 1918, and a year later it became a mandatory document for all persons over 16 years of age. It was necessary precisely to record the place and duration of a citizen’s work, and subsequently to determine his work experience.

As part of the reform of the pension system, which began in 2015, the importance of work experience began to recede increasingly into the background.

General labor

The periods included in this length of service are calculated using a calendar method based on their actual duration. That is, they are determined from the date of commencement of work until the date of dismissal, including, but not limited to, days off, holidays and various vacations.

Special work experience includes the total periods of work of a citizen in certain sectors of the economy, areas of activity or professions. The list of these periods is very limited and is established by special legislative acts.

Continuous

It is defined as the duration of continuous (that is, without interruptions in work) activity of an employee at a specific enterprise or in one area. If, when moving from one institution to another, the break is less than a month, then this period is also considered continuous.

Conversion of periods of labor and insurance experience into full years and months

To convert different types of experience into full years and months, different methods are used. For length of service, a scheme is used for adding up the entire time of work, starting from the date of hiring to the date of dismissal, inclusive. The insurance amount is calculated slightly differently, since the amount of payments covers the entire month, and not a single day. To do this, the specialist must perform several actions:

- Set the number of full years and months of insurance experience. Days in partial months are taken separately.

- Complete years and months are added separately, and partial days - separately.

- Partial months are rounded up - every 30 days, converted into a full month, and 12 months - into an insurance year.

This rule was established in the official letter of the FSS No. 15.03.09 of 2012.