Where to go if you think your pension is calculated incorrectly

If a pensioner has doubts about the correctness of the calculation of the amount of his pension, he can initiate a check of the pension calculation and, based on the results of this check, he will be convinced of the correctness or incorrectness of the calculation.

This is very easy to do, just take your documents and go to the territorial branch of the Pension Fund of the Russian Federation closest to your place of residence. Contact any operator to submit a written request to the head of the department with a request to check the calculation of your pension. It is not uncommon for citizens who have received their first pension payment to have doubts about the fairness of its size. And of course, in this case, the pensioner wants to make sure that no error occurred when calculating the pension. Which, in his opinion, led to the accrual of such a small pension to him. You will learn where to turn if you are in doubt about the correct calculation of the amount of your pension from this article.

Where to check

First of all, you should figure out where to check the correctness of pension calculation. If a pensioner has any doubts whether he is receiving the correctly calculated amount, he will have to contact the Russian Pension Fund directly. The application should indicate a request to re-check the correctness of the calculations made for the amount of pension payments and submit it to the Pension Fund branch, in accordance with the pensioner’s registered address.

https://www.youtube.com/watch?v=ytcreators

Within five days from the date on which the application was accepted, where a citizen asks to check the correctness of the calculation of the old-age pension, Pension Fund employees are obliged to clarify whether the pension was calculated correctly and notify the applicant about the results of the check. If it turns out that the amount of payments was indeed calculated with errors, then, in accordance with current legislation, it will be adjusted automatically.

What to do if the accrued pension is below the subsistence level in 2021

Are you receiving less than the standard in your region? But why is the pension lower than the subsistence level? Can such a situation arise in the legal field at all? Let's consider how the insurance part of payments is formed. The formula looks like this:

It is important to note that older citizens who have completed their working career have the highest chances of receiving a pension supplement from the state up to the subsistence level. The decision is made by territorial authorities, which assess the level of financial security of the pensioner. The main means of income that social security authorities pay attention to are:

Should pensions be paid up to the subsistence level?

Only non-working pensioners have the right to a social supplement to their pension if the total amount of their material support is lower than the pensioner’s subsistence level established in the specific region at their place of residence.

In general, if the amount of financial support for a pensioner is lower than the living wage for a pensioner established in your region, which, in turn, is lower than the living wage for a pensioner in the Russian Federation as a whole, then you will be given a federal social supplement (FSD).

https://www.youtube.com/watch?v=ytadvertise

If the total amount of your material support is below the regional subsistence level of a pensioner, which exceeds the subsistence level of a pensioner in the Russian Federation as a whole, then the pensioner is entitled to a regional social supplement (RSD).

Also see “Social pension supplements: table by region.”

The activities of the Government of the Russian Federation are aimed at improving the quality of life of Russians, increasing trust in government and maintaining a stable situation in the social sphere. The state guarantees citizens of the Russian Federation the receipt of a minimum cash income subject to certain conditions. A unique measure for comparing the level of income of Russians, including pension payments, is the cost of living.

This indicator is established per capita for three categories of citizens:

- working age;

- pensioners;

- children.

The cost of living is a subject of constant debate in society, as it does not fully reflect the real life and needs of a person. However, its significance is great and is intended:

- to assess the standard of living of citizens;

- to establish the amount of social benefits at a minimum level;

- for budget formation.

The estimated size of many pension payments established in our country sometimes does not even reach the minimum. In this regard, it is simply necessary to pay extra to pensioners so that they can provide themselves with what they need.

The value of this indicator is not constant and depends on the cost:

- food set necessary for normal human life support;

- a minimum set of non-food products;

- a set of services necessary to meet the social and cultural needs of a person;

- expenses for mandatory payments and fees.

The PMP indicator is calculated once a quarter, and data on this is then published in official publications. However, to establish social benefits, the cost of living is established once a year: for the regions by separate resolutions, at the federal level - by the budget law.

The value of PMP is determined at two levels: federal and regional. The procedure for establishing this indicator is also different:

- in the first case, it is regulated by the Government of the Russian Federation as a whole for the country;

- in the second case, it is determined on the basis of local laws for a specific subject of the Russian Federation.

All non-working pensioners whose total amount of material support does not reach the pensioner’s subsistence level (PLS) in the region of his residence are provided with a federal or regional social supplement to their pension up to the amount of the PMS established in the region of residence of the pensioner.

The federal social supplement is paid by Pension Fund institutions and is established if the total amount of cash payments to a non-working pensioner does not reach the pensioner’s subsistence level established in the region of residence, which, in turn, does not reach the pensioner’s subsistence level as a whole in the Russian Federation.

A regional social supplement is paid by regional social protection authorities if the cost of living of a pensioner in a constituent entity of the Russian Federation is higher than the same figure in the Russian Federation, and the total amount of cash payments to a non-working pensioner is lower than the regional subsistence minimum.

When calculating the total amount of material support for a non-working pensioner, the amounts of the following cash payments are taken into account:

- pensions (parts of a pension);

- additional material (social) support;

- monthly cash payment (including the cost of a set of social services);

- other social support measures established by the legislation of the constituent entities of the Russian Federation in monetary terms (with the exception of social support measures provided at a time).

In addition, when calculating the total amount of material support for a pensioner, the cash equivalents of the social support measures provided to him for paying for the use of a telephone, residential premises and utilities, travel on all types of passenger transport, as well as monetary compensation for the costs of paying for these services are taken into account.

How can you check whether your old-age pension is calculated correctly?

Unfortunately, such a complicated (albeit fairer) system sometimes fails. As a rule, the cause of such problems is the human factor - one or another employee may get confused in the testimony of various documents provided by the pensioner, or incorrectly calculate the amount using the formula. One way or another, incidents happen that lead to incorrect pension calculations (usually downward).

As you know, the new concept for calculating pension payments has caused a wide resonance in Russian society. And it is not surprising - the updated system is so strikingly different from the previous one that still not every Russian citizen understands how it functions. Well, in this article we will analyze both the procedure for calculating the old-age pension and those force majeure cases when a pensioner receives an incorrectly calculated amount.

We recommend reading: An individual entrepreneur is

Was it possible to live on a Soviet pension?

Ex-director of the Research Institute of Statistics of the Federal State Statistics Service Vasily Simchera - about pensions in the USSR.

— In the pre-perestroika Soviet Union, living on a pension was twice as easy as it is today. One Soviet ruble is equal to approximately 100 current rubles. But the circle of pensioners was limited then: pensions were not given to everyone (almost like in today’s China, where 2% of the population receive pensions today).

In 1940, there were only 4 million pensioners in the USSR, in 1960 - 21.9 million, in 1970 - 41.3 million, in 1980 - 50.2 million (today - 41 million). At the end of the history of the Soviet Union, there were 60 million pensioners, of which 12 million were collective farmer pensioners. They need to be separated into a separate group, because collective farmers began to receive pensions in 1956. The initiator of this was the reformer Alexei Kosygin, then deputy chairman of the USSR Council of Ministers. The pension of a collective farmer in 1970 was 15 rubles, and in the late 1980s - 50 rubles.

The average salary in 1970 was 122 rubles, and the pension was 34.5 rubles. In 1990, the pension was 80 rubles. with an average salary of workers and employees of 200 rubles. In addition to cash payments, one pensioner also received over 85 rubles. non-monetary benefits - free medicine, free trips to sanatoriums and resorts, free boarding houses for the elderly and disabled, and other benefits.

Question answer

Retirement age in Russia and the USSR. Information Old-age pensions were assigned to men, as now, upon reaching 60 years of age, and to women at 55 years of age. Workers and employees employed in underground work, in hot shops, as well as in other jobs with difficult working conditions, retired 5-10 years earlier. This norm is enshrined in current labor legislation.

But pensions were formed completely differently than they are now. Today, if the state did not undertake the obligation to pay you a pension, then every month the part of the money that is withdrawn from it today and sent to the Pension Fund would not be deducted from your salary. This is called the joint pension system. In the USSR, there was a different system - your salary was given in full, and your pension was calculated from state or collective farm funds. The difference is fundamental: today a pension is not the state’s, but your money, which the state is obliged to return to you in full, like any savings. The current pension system, which was borrowed from the West, was previously described as one of the “ulcers of capitalism.”

So today officials, by freezing the funded parts of pensions, delaying their indexation, returning barely half of the funds set aside in trust for retirement, are stealing not state money, but ours. They also steal from me - I am a pensioner. Every month they took 40 thousand rubles from me, in terms of today’s money, and they only paid 20 thousand of it! They stole our pension money, just like they stole people's savings in the past. Pensions are the same as labor savings, for which everyone should have an individual pension account. And then everything was poured into a common pot and now go figure it out...

Year of the pensioner. What is behind the authorities’ decision to increase pension indexation Read more

Where to go if you have a small pension

You will learn where to turn if you are in doubt about the correct calculation of the amount of your pension from this article. Errors can arise for various reasons: due to the incompetence of a pension fund specialist, errors (inaccuracies) in the documents submitted when applying for a pension.

If the pension was calculated in an underestimated amount due to your fault (for example, you did not indicate that you have a dependent child or that you are entitled to any additional payments), then according to paragraph 1 of Art. 20 of the Federal Law “On Labor Pensions in the Russian Federation”, recalculation is made from the 1st day of the month following the month in which the Pension Fund accepted your application for recalculation of the pension upward.

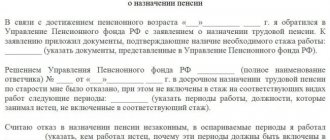

What is not counted towards length of service when calculating pensions?

Of course, periods of study, military service, and parental leave will not be included in the length of service when calculating a pension. But that's not what we're talking about here.

First of all, periods of work that are not confirmed by an entry in the work book will not be included in the length of service. Before people began receiving SNILS from the Pension Fund, all work experience was taken into account solely according to documents, and the main one was the work record book. At the same time, personnel department employees often made and continue to make mistakes when preparing records, and these errors can create many problems in the further registration of pensions.

For example, when applying for a pension, Pension Fund employees may not count periods of work into their total length of service if errors were made in the work book, in particular when writing their full name. owner. If the seal imprints are not readable, the period of service may also not be counted, as is the case if the book does not contain information that the enterprise where the person worked was renamed. And there are many similar reasons for refusal to count certain periods of service.

All controversial work periods will have to be confirmed by documents, certificates from employers, certificates obtained in the archives, or through the court.

Also, periods of a person’s work during which no insurance contributions were paid to the Pension Fund will not be counted towards the length of service. There is Law No. 173-FZ “On Labor Pensions”, according to which, since 2002, one of the main conditions for counting working periods into retirement experience has been introduced - payment of insurance contributions. That is, if a person worked unofficially for several years or under an agreement under which the employer did not make transfers to the Pension Fund, then this period of work will not be counted when applying for a pension.

For this reason, many problems are currently arising due to the fact that employers did not fulfill their duties and did not make the necessary contributions to the Pension Fund for their employees.

However, here there are two important points at once: 1. Until 2002, according to the law, in order to include working periods in the pension period, no insurance contributions were required to be paid. Therefore, the exclusion of seniority due to their absence for working periods before 2002 is considered illegal, according to the decision of the Supreme Court of the Russian Federation in case No. 83-KG 13-13. 2. Also, the Constitutional Court of the Russian Federation adopted Resolution No. 9-P of July 10, 2007, according to which if the employer did not pay insurance premiums for the employee, this is not a basis for excluding the working period from the pension period.

However, there is a problem here. If the employer did not submit information about accrued contributions to its employees to the Pension Fund, then the period of employment will be included in the total length of service, but the specified period will not be taken into account when calculating the pension, since the amount of contributions for the specified period is unknown.

A small pension has been awarded where to apply

Mom is disabled 3 gr. Receives a 50% discount on utilities. When adding up to a pension, they say that an increase to the minimum pension and subsistence level is not allowed. Is it so? Please tell me how we can achieve a revision of pension accruals, where to go, and what to do for this?

Good afternoon My mother, when she retired in 2005, received a pension below the subsistence level. Total continuous work experience is 33 years. Because the archive of the labor department of the Regional Executive Committee was lost, where she worked for 13 years (my mother worked there as an economist), then the accounting department of the Regional Executive Committee, according to its own considerations, issued a certificate of minimum earnings. Now my mother receives 5,600 rubles as of June 1, 2013. When I contacted the Regional Pension Fund, I received an answer that my mother should take a certificate for other years.

What to do if your pension is small

A situation often arises when, during the calculations, a pensioner was assigned a pension below the subsistence level.

A pension below the subsistence level is subject to compensation to the minimum level if the pensioner meets the following conditions:

- the citizen is recognized as low-income, that is, the calculated pension provision, as well as other transfers from the state, are below the minimum that is established for a pensioner in the region;

- the citizen is not officially employed and does not receive wages, that is, he is unemployed.

The cost of living is set by each region independently, at its own discretion and depending on the cost of living and inflation. In addition, the minimum income is set separately for the categories of children, adults and pensioners.

Thus, the maximum value is set in Chukotka - 19,000 rubles, and the minimum in the Tambov region - 7,811 rubles. In Moscow, the value is set at 12,115 rubles, in the Moscow region - 9,908 rubles, and in St. Petersburg - 8,846 rubles.

The amount is subject to regular review by regional authorities and may be adjusted depending on changes in the price level and the cost of the food basket.

It must be borne in mind that in order to determine whether a pension should be paid up to the subsistence level, it is necessary to take into account all the income and cash receipts of the recipient of the payment. The following transfers are taken into account:

- all types of pensions;

- social subsidies;

- monthly cash transfers assigned to individual categories, as well as the monetary equivalent of the provided set of social services, which includes medicines, vouchers to a sanatorium and travel on intercity transport;

- benefits recalculated in monetary form in the form of free travel on public transport, discounts on utilities, etc.

Who will have their pension increased to the subsistence level? Compensation is provided to all citizens, but depending on the situation, it is made from the federal or regional budget.

If the authorities set a cost of living that is higher than the average for Russia, then compensation is made by the local social security department at the expense of the regional budget.

If the average value for Russia is higher than the minimum level established by regional authorities, then the pension fund pays compensation from the federal budget.

The possibility of receiving compensation disappears if a citizen has entered into an employment relationship with an employer. The additional payment can be renewed upon dismissal and termination of a working career.

Decor

Where to go if your pension is below the subsistence level? It depends on who makes the payment - the local social security department or the Pension Fund. The order of circulation in both cases is presented in the table.

| Order | Social protection | Pension Fund |

| Cases of appeal | If the authorities have set a cost of living that is higher than the average for Russia. | If the average value for Russia is higher than the minimum level established by regional authorities. |

| Methods of circulation |

|

|

| How to apply through State Services | A confirmed individual account record is required, which after registration can be obtained by sending a request and confirming your identity at any Multifunctional or Raiffeisen Bank for account holders, at the Russian Post office by clicking the “Send letter” button. | |

| How to apply through the MFC | You just need to come to any office (a map with addresses and work schedules is on the portal), get a coupon and wait to see a specialist. | |

| How to apply in person | You can find addresses on the website of the authorities of the constituent entity of the Russian Federation. | You can find out the location of the nearest branch of the Pension Fund on the official portal in the “Contacts” tab. |

| How to apply through an individual account on the Pension Fund website | No possibility | To register, you will need an account on the Government Services website. After authorization, you need to go to the “Pensions” tab and there click on “Submit an application for pension recalculation.” |

In both cases, the application indicates the following information:

- Which state is the applicant a citizen of?

- Full Name;

- a man or woman submits an application;

- date of birth;

- SNILS number;

- contact details (phone and email, if available);

- information from the identity document (series, number, by whom and when issued, department code);

- place of birth;

- state of permanent residence;

- registration address;

- residential address;

- whether the citizen is employed or not;

- reasons for revising the amount of payments;

- confirmation of your consent to the processing of personal data, as well as consent to notify the Pension Fund of any changes that may lead to a revision of payments.

If the pension payment was assigned before 2010, then filing a notification is not required. Recalculation is done automatically.

When appearing in person, as well as when applying through Multifunctional Centers, the applicant will need to have an identification document with him.

Transfer deadlines

The amount to be transferred will be recalculated starting from the next month after submitting the application by any of the methods.

Any pensioner whose income level does not reach the level established by the regional authorities is given an increase to this level by the federal or regional authorities. To obtain it, you must contact the Pension Fund with a corresponding application.

An additional payment to the pension can be made if the total income of the pensioner, which also takes into account the benefits provided in cash equivalent, is less than the level established by the subject of the Russian Federation in which the recipient permanently resides. To recalculate the payment, you must contact the Pension Fund or the local social protection department with an identification document and an application.

We have calculated a small pension, where to apply?

Perhaps our experts will advise her to take other periods for the calculation, another five years, this will be the basis for recalculation. You can also go to our website, select the “St. Petersburg” section, there, in the left column, the last item is the column “send an application to the Pension Fund of the Russian Federation.”

Despite all the advantages, some pensioners refuse to use this useful banking tool because they have heard about the problems associated with transferring money to cards. Indeed, sometimes problems arise due to delays in transfers.

WHAT IS IMPORTANT TO KNOW ABOUT THE NEW PENSIONS BILL

Today, Omsk residents are leaving for a well-deserved rest, part of their working experience was in Soviet times, part in the difficult nineties and 2000s, when not everyone managed to maintain guaranteed jobs - some had to be a “shuttle worker”, work without official registration, which means - without contributions to the Pension Fund... Someone had a short or even minimal work experience, had a small salary... All these parameters directly affect the size of the pension. And if in Soviet times the pension legislation was uniform for the entire period of a person’s working activity, because the country’s economic policy was uniform, each period was clearly taken into account and reflected in the work book, then today the pension amount is calculated based on different time periods and different pension legislation - Soviet , post-Soviet and modern. That is why in Soviet times, every pensioner could easily and simply independently calculate his future pension, and today this requires knowledge and practice of applying several federal laws of two countries - the Soviet Union and the Russian Federation.

We recommend reading: Rules for entering into inheritance without a will

It should be noted that in accordance with the current pension legislation, the assignment, recalculation and payment of pensions is carried out by the territorial office of the Pension Fund on the basis of documents on length of service, wages and other documents submitted by the applicant. There are situations when the pension is calculated at an underestimated amount due to the citizen’s own oversight - for example, if he did not indicate that he has a dependent child or is entitled to some additional payments. If the missing documents are provided, from the 1st day of the next month the pension will be recalculated upward.

Retirement age

Russian pensioners acquire the right to take a well-deserved retirement in old age at a younger age than in other countries. It is this factor that economic experts refer to when explaining the reasons for Russian pensions being too low. Residents of other countries, by the time they reach retirement age, manage to accumulate sufficient capital for a decent benefit.

The life expectancy of Russians is no less important. For the European population, this figure is much higher than for our citizens. That is why they are quite capable of retiring at a later age. The new pension reform is designed to raise the retirement age of Russians. It is being carried out in stages and by 2025 all citizens will have the right to retire at 60 and 65 years old, i.e. 5 years later.

Compared to other countries, Europeans on average retire at 65-70 years of age. Therefore, even after the reform, the retirement age of Russians remains lower. This means that there will be fewer contributions to the future pension, which also explains the reasons for the small pension benefit in the Russian Federation.

If you haven’t transferred your pension to your Sberbank card: what to do and where to go

Indeed, sometimes problems arise due to delays in transfers. These troubles appear due to various reasons: from the usual sluggishness of employees of social and banking organizations, bank transaction errors, to incorrect connection of the issued card.

- the social card does NOT require payment for service;

- Sberbank charges additional interest on the card;

- You can find out about the receipt of your pension without leaving your home by using a special notification service via SMS;

- A social card allows you to make utility and other types of payments with great convenience.

My pension is small, but I’ll last another year! “- Alla Pugacheva made a shocking statement

Even at the beginning of her career, Pugacheva was more than in demand, but she received mere pennies for her performances. The singer started with a fee of 7 rubles, and later, already in 1978, they began to pay her 16 rubles 50 kopecks for each performance. There was also a period under Stefanovich when the star’s fee was 47 rubles 50 kopecks. It is from these amounts that the pension of the honored singer is now formed.

We recommend reading: How to Conduct a Purchase and Sale Transaction of a Land Plot Independently

And indeed, as we found out, the legendary performer’s pension does not exceed 17 thousand rubles. And this is with an additional payment for the title “People’s Artist of the USSR”, as well as with the payments that are due to her as the liquidator of the Chernobyl nuclear power plant accident... Not at all a lot by today’s standards, the Diva has something to worry about and it’s not in vain that she tries to stay in the ranks and look good and young. The environment demands it.

If a person believes that his pension was calculated incorrectly, he can go to court

— There are two minimum pension levels in Ukraine. This is the minimum pension (since September 1999 - 24.9 UAH), on the basis of which pensions are calculated under the Law “On Pensions” and the minimum pension, which is accepted mainly for calculating bonuses and increases (16.62 UAH).

Citizens who have no work experience can only count on a social pension. Its amount is 50% of the minimum pension (24.9 UAH x 50% = 12.45 UAH) for persons who have not acquired the right to receive a pension for good reasons (for example, in connection with caring for a disabled person), and 30 % of the minimum pension (7.47 UAH) - for those who did not work without good reason.

How does a pension depend on length of service?

The size of the pension depends directly on the type of security assigned. The biggest one is old age insurance. The smallest one is social. The reason is that the amount of social pension has a fixed value, set annually. When appointing her, insurance or work experience is not taken into account. The main thing is to live in the Russian Federation.

The long-service pension is accrued to municipal and civil servants. Its size depends on how large the allowance was, since the amount of security is calculated based on the salary received. For each additional year over the required length of service, an additional 3% of the employee’s allowance is paid.

- Top 10 most dangerous things for children

- Adjika recipe for the winter

- Clafoutis with cherries

Increase in pension

Recently, rumors have been circulating on the Internet that pensioners with extensive experience can receive additional pension points. They even give specific numbers:

- 1 point – for women over 30 years old and men over 35 years old;

- 5 points – for women over 35 years old and men over 40 years old.

This information is false and representatives of the Pension Fund of Russia have spoken about this more than once. Extensive work experience in certain cases allows you to receive a pension supplement. This opportunity is provided only in some regions where citizens are awarded the title Veteran of Labor. The amount of the premium for each subject is determined by regional regulations.

Regardless of work experience, pension provision for non-working pensioners cannot be less than the subsistence level established in the region of residence of the elderly person. If the accrued security does not reach the value determined for the subject, the recipient is entitled to an additional payment.

A citizen can apply for recalculation of a pension for long service if there are unaccounted periods of work. To do this, it is necessary to provide the authorized employee of the Pension Fund with papers that can be used to determine the length of service and the amount of remuneration received (extracts from orders, employment contracts, archival certificates).

- Shellac kit at home

- 5 things doctors do to avoid getting sick

- Soon Russians will begin to receive pensions almost instantly

Additional PB can be obtained due to the inclusion of non-insurance periods in the total length of service. This includes the time when a person could not work or was unemployed for objective reasons:

- service in the army as a conscript soldier;

- caring for a newborn until he is one and a half years old;

- participation in community service;

- being on sick leave;

- caring for the elderly or disabled people of group 1;

- being in the status of unemployed registered with the Employment Service.

Important: study, regardless of the status and type of educational institution, is not included in either the work history or the insurance record! Off-the-job training, leave at your own expense, and maternity leave for a child from one and a half to 3 years are not counted as working periods.

An additional payment to the pension is also due in other circumstances:

- availability of the necessary work experience or length of service in difficult climatic conditions;

- reaching the age of 80;

- having 25 years of experience in the agro-industrial complex with permanent residence in a rural area;

- delayed retirement – an incentive factor is applied for each full year;

- living in the northern regions - payments will be higher due to the application of the regional coefficient;

- availability of a registered funded pension - the amount of the supplement depends on how large the amount of savings is.

To increase the amount of payments, the insured person must contact the Pension Fund at the place of residence and submit an application in the prescribed form. It must be accompanied by a passport, SNILS and documents confirming the right to recalculate pension payments upward. The appeal will be considered within 10 days, after which the applicant will receive a response.

Benefits for early retirement

In January 2021, another pension reform will start in Russia. It defines a new retirement age, which will be gradually raised from 55 to 60 years for women and from 60 to 65 years for men. At the same time, some innovations await future retirees:

- Women with 3 children will be able to retire 3 years earlier, with 4 - by 4 years, with 5 or more - by five years.

- The age limit for those employed in the Far North and similar territories will increase. Men - 60 years old, women - 55 years old.

- The duration of special service for all categories of beneficiaries will not change.

- State employees will be able to retire if they have a preferential length of service from 15 to 30 years, depending on their profession, but the right to receive pension payments will be shifted forward by 5 years.