Private management company

Pension savings can be transferred to a private management company. Provided that an agreement on trust management of pension savings funds has been concluded between it and the Pension Fund of the Russian Federation. This agreement is concluded only with companies that have won a special competition.

This procedure is established by subparagraph 1 of paragraph 1 of Article 31 and paragraph 1 of Article 19 of the Law of July 24, 2002 No. 111-FZ.

When moving to a private management company, you can also choose the investment portfolio that, in the person’s opinion, is capable of ensuring the safety of pension savings and increasing them. This can be done provided that the management company offers more than one investment portfolio to choose from. This follows from subparagraph 1 of paragraph 1 of Article 31 of the Law of July 24, 2002 No. 111-FZ.

Situation: is it possible to transfer part of pension savings to one management company, and part to another?

Answer: no, you can't.

The Pension Fund of the Russian Federation transfers all pension savings to the organization chosen by the person (i.e., all funds accounted for in a special part of the individual personal account). This procedure follows from paragraph 2 of paragraph 2 of Article 34 of the Law of July 24, 2002 No. 111-FZ.

This is confirmed by the application form for choosing an investment portfolio (management company), approved by Resolution of the Pension Fund Board of January 21, 2015 No. 9p. It states that all pension savings are transferred to the management company.

Thus, pension savings can be transferred to only one management company.

How to manage pension savings?

What to choose – a management company or a non-state pension fund?

If a citizen has never applied to the Pension Fund to change an insurer or choose a management company, he will automatically form his pension savings through the Pension Fund.

In this case, they are invested by the state-owned management company Vnesheconombank, with which the Pension Fund has entered into a trust management agreement for pension savings. The difference between management companies and non-state pension funds is that if pension savings are in the trust management of the former, then the accounting of pension savings and the results of their investment, the assignment and payment of a funded pension is carried out by the Pension Fund; in the second case, a non-state pension fund chosen by the citizen.

Approximate criteria for choosing a management company, if the savings of the insured person are placed in the Pension Fund of the Russian Federation, may include the size of its authorized capital, the duration of the company’s operation, the management profitability indicator, as well as the total amount of pension savings of citizens under management. When choosing a non-state pension fund, in addition to the proposed criteria, you should pay attention to the number of fund founders and the availability of information provided to them.

Information on the main performance indicators of non-state pension funds can be obtained on the official website of the Central Bank of Russia, and you can familiarize yourself with the Register of licenses of non-state pension funds on the website of the Pension Fund. The official website of the Federal Tax Service of Russia may also be useful in providing information contained in the Unified State Register of Legal Entities about the insurer. Responsibility for the pension savings of citizens, depending on the choice of the insurer, lies with the Pension Fund or non-state pension fund.

To increase the total volume of pension savings of citizens, NPFs, as a rule, offer more favorable conditions than the Pension Fund. However, having chosen a non-state pension fund as an insurer, the insured person must be aware of the risks, for example, that such a fund is primarily a “private company”, whose license may be revoked if violations are committed, which will lead to the impossibility of further activities.

Investment of money by the Pension Fund of the Russian Federation

If a person has never transferred pension savings either to a private management company or to a non-state pension fund (NPF), or has not submitted an application to select an investment portfolio in a state management company, then the Pension Fund of the Russian Federation invested them by default:

- into the investment portfolio of government securities of a state management company (for those who began forming pension savings before August 2, 2009);

- into the expanded investment portfolio of a state management company (for those who began forming pension savings after August 2, 2009).

This procedure follows from paragraph 4 of Article 14 and paragraph 1 of Article 34 of the Law of July 24, 2002 No. 111-FZ, parts 4–5 of Article 4 of the Law of July 18, 2009 No. 182-FZ.

State management company

as of 01/01/2020

Information about the state management company

- Full name: State Development Corporation "VEB.RF"

- Short name: VEB.RF, VEB

- State registration number: 1077711000102

- Registration date: 06/08/2007

- The body that carried out the registration: Department of the Federal Tax Service for Moscow

- Address (location): Akademika Sakharov Ave., 9, Moscow, 107078, Russia

- Taxpayer Identification Number (TIN): 7750004150

- Date and number of the license to carry out activities for managing investment funds, mutual funds and non-state pension funds: -

- Duration of activity (years): —

- Telephone and fax numbers: +7,

- E-mail address

- Website address on the Internet: https://www.veb.ru/

- Availability of branches indicating their actual addresses and telephone numbers: —

Composition and structure of shareholders (participants) of the management company

State Development Corporation "VEB.RF"

| No. | — |

| Full name of the shareholder (participant) (for an individual - full name) | — |

| Address (place of location of the legal entity) | — |

| Date and number of the certificate of state registration of a legal entity | — |

| Main state registration number of a legal entity | — |

| Taxpayer identification number | — |

| Data on the latest changes in the name, organizational and legal form of a legal entity | — |

| Shareholder's (participant's) share in the authorized capital. At nominal value | — |

| Shareholder's (participant's) share in the authorized capital. As a percentage of the authorized capital | — |

VEB.RF is a state corporation, a non-membership non-profit organization established by the Russian Federation on the basis of a property contribution and created to carry out social, managerial or other publicly beneficial functions. The property transferred to VEB.RF is the property of VEB.RF.

Investment declarations

Expanded investment portfolio

Decree of the Government of the Russian Federation dated September 1, 2003 No. “On approval of the investment declaration of the expanded investment portfolio of the state management company”

Investment portfolio of government securities

Decree of the Government of the Russian Federation dated October 24, 2009 No. “On improving the procedure for investing funds to finance the funded part of the labor pension in the Russian Federation”

Investment portfolio of the payment reserve and investment portfolio of pension savings of insured persons for whom a fixed-term pension payment has been established

Change of management company

Management companies and investment portfolios can be changed annually (clause 1, article 32, clause 2, article 34 of the Law of July 24, 2002 No. 111-FZ).

Your choice between investors for the next year must be made before December 31 of the current year (submit an application to the Pension Fund of the Russian Federation). For example, before December 31, 2015, you need to decide who to entrust pension savings for 2021. This follows from paragraph 4 of Article 32 of the Law of July 24, 2002 No. 111-FZ.

An exception is provided for citizens who decide to pay additional pension contributions, but do not have pension savings or they are not invested. Such citizens have the right to decide on an investor at the stage of submitting an application for payment of additional pension contributions. This procedure is established in Article 11 of the Law of April 30, 2008 No. 56-FZ. For more information about paying additional pension contributions, see How to start making additional contributions to a funded pension.

Application for choosing a management company

Submit an application for choosing an investment portfolio (management company) to your branch of the Pension Fund of the Russian Federation. For information about which branch of the Pension Fund of the Russian Federation residents of Moscow and the Moscow region should apply to, see the table.

To transfer pension savings to a private management company, Vnesheconombank, or change the investment portfolio, an application can be submitted:

- on paper in the form approved by Resolution of the Pension Fund Board of January 21, 2015 No. 9p;

- electronic.

This is established in paragraphs 2 and 4 of Article 32 of the Law of July 24, 2002 No. 111-FZ.

Fill out the application in accordance with the Instructions approved by the Resolution of the Board of the Pension Fund of Russia dated May 12, 2015 No. 157p.

The paper application for the selection of an investment portfolio (management company), in particular, indicates:

- applicant's details (full name, date of birth, insurance certificate number);

- data of the management company where pension savings are transferred;

- name of the investment portfolio (if the company offers more than one option).

The Pension Fund of the Russian Federation places the application form and instructions for filling it out no later than September 1 of the current year on information stands in its territorial branches, as well as on the Internet. For example, on a single portal of state and municipal services. At a citizen’s request sent to the Pension Fund of the Russian Federation via the Internet, the application form and instructions for filling out will be sent in the form of an electronic document.

This procedure follows from paragraph 3 of Article 32 of Law No. 111-FZ of July 24, 2002, paragraphs 2–3 of the Procedure approved by Order of the Ministry of Finance of Russia of August 30, 2005 No. 109n, Instructions approved by the Resolution of the Board of the Pension Fund of Russia of May 12, 2015 city No. 157p.

Situation: is it necessary to submit an application for choosing an investment portfolio (management company) if a person wants to leave pension savings in the same management company for subsequent years under the same conditions?

Answer: no, it is not necessary.

Last year's statement will be valid for all subsequent years until the person wants to make changes. All newly received amounts of pension savings will be transferred to the selected management company. This follows from paragraph 1 of Article 32 of the Law of July 24, 2002 No. 111-FZ.

Situation: what should a person do who has submitted an application to choose a management company for pension savings, but later decided to change his decision? The deadline for submitting applications to the Pension Fund has not yet expired.

Submit another application to your branch of the Russian Pension Fund.

The Pension Fund of the Russian Federation will consider the application with the latest submission date. Provided that it is submitted before December 31 of the current year. The department will ignore the remaining applications (no matter how many there are).

This follows from paragraph 4 of Article 33 of the Law of July 24, 2002 No. 111-FZ.

Attention: the Russian Pension Fund will refuse to satisfy all applications received on the same day.

This rule applies if the following were received at the same time:

- several statements about the choice of investment portfolio (management company);

- application for choosing an investment portfolio (management company) and application for transfer to a non-state pension fund.

This follows from paragraph 7 of paragraph 3 of Article 33 of the Law of July 24, 2002 No. 111-FZ.

How to place the funded part of your pension at Vnesheconombank

Since when choosing the State Institution “Vnesheconombank” the insurer is the Pension Fund of Russia, you only need to submit the corresponding application to the territorial branch of the Pension Fund of the Russian Federation. This can be done either in person or by post (in this case, copies of documents must be notarized). In addition to the application to the pension fund, you must submit:

- insurance certificate (SNILS);

- identification document (usually a passport of a citizen of the Russian Federation).

It is also allowed to submit documents through an official representative (authorized person). In this case, you will additionally need a document certifying the identity of the authorized person and a corresponding document that confirms the right of the representative to act on behalf of the insured person (for example, a power of attorney).

Both those who are just planning to create a future funded pension and those who have already accumulated a certain amount in other companies can entrust their savings to Vnesheconombank. In the second case, the legislation of the Russian Federation allows at least a year to transfer savings under the management of the State Management Company.

This can also be done by insured persons who have chosen a non-state pension fund as their insurer. However, in this case, the insurer will be changed, that is, the citizen will transfer his funds from the NPF to the Pension Fund. And this can lead to loss of investment income. Therefore, it is necessary to switch from a non-state fund to a state fund no earlier than after five years.

When choosing the state management company Vnesheconombank, a citizen must also choose one of two investment portfolios offered by the company.

Selecting an investment portfolio and placing funds

The investment portfolio represents assets that were formed at the expense of funds transferred to the Pension Fund of the management company under one agreement. These funds are separated from other assets, and the portfolio is formed in accordance with the investment declaration.

State Management Company “Vnesheconombank” offers two investment portfolios for insured persons to invest their savings:

- Basic portfolio of government securities (GS);

- Expanded investment portfolio.

The government securities portfolio consists of government securities of the Russian Federation and bonds of domestic companies, as well as funds in rubles and foreign currency guaranteed by the Russian Federation. The expanded investment portfolio also includes mortgage-backed securities and bonds of international financial organizations. Remedies of the “silent”

were automatically transferred to the expanded GUK portfolio.

The management company separates investment portfolios, which are formed from pension savings, from other property (including its own), and opens separate accounts for each (with the Bank of Russia, credit institutions, etc.).

Application methods

An application can be submitted:

- personally;

- through a representative (legal or authorized);

- through a transfer agent;

- through an organization (employer);

- by mail;

- through the MFC;

- in electronic form, by filling out an interactive form on the Unified Portal of State and Municipal Services or in the Personal Account on the website of the Pension Fund of the Russian Federation.

This follows from paragraph 4 of Article 32 of the Law of July 24, 2002 No. 111-FZ and paragraph 3 of the Instruction approved by the Resolution of the Board of the Pension Fund of Russia of May 12, 2015 No. 157p.

Situation: is it possible to submit an application for choosing an investment portfolio (management company) for pension savings, handwritten, typed on a typewriter or computer?

Answer: yes, you can.

However, in this case it is necessary to proceed from the application form for the selection of an investment portfolio (management company), approved by Resolution of the Pension Fund of the Russian Federation Board of January 21, 2015 No. 9p. That is, list all the necessary details and take into account the location of this data in the original form.

This follows from paragraph 2 of the Instruction, approved by Resolution of the Board of the Pension Fund of Russia dated May 12, 2015 No. 157p.

Submitting an application through an organization

Only persons who have decided to pay voluntary pension contributions and submit an application in the form DSV-1 (approved by Decree of the Government of the Russian Federation of July 28, 2008 No. 225p) can submit an application for choosing an investment portfolio (management company) through an organization (employer).

This is established by paragraph 4 of Article 32 of the Law of July 24, 2002 No. 111-FZ, part 1 of Article 4 and part 2 of Article 11 of the Law of April 30, 2008 No. 56-FZ.

The receipt of the application must be confirmed.

Applying in person

If you bring an application to the Pension Fund of the Russian Federation in person, through a representative or employer, agency employees are required to issue a receipt indicating that they received it. The form of the receipt was approved by Resolution of the Board of the Pension Fund of the Russian Federation dated May 2, 2007 No. 101p.

The services of a transfer agent are free for the applicant - they are paid for by the Pension Fund of the Russian Federation (Section 7 of Appendix 1 to Order of the Ministry of Finance of Russia dated August 21, 2003 No. 79n).

Submitting an application electronically

An application for choosing an investment portfolio (management company) can be submitted electronically by filling out an interactive form through a single portal of state and municipal services or a Personal Account on the website of the Pension Fund of the Russian Federation. The procedure for filling out the interactive form is prescribed in the Instructions approved by Resolution of the Board of the Pension Fund of Russia dated May 12, 2015 No. 157p.

The conditions that must be met for one or another application method are given in the table.

Decision of the Pension Fund of the Russian Federation

Having received an application for choosing an investment portfolio (management company), the branch of the Pension Fund of the Russian Federation can:

- satisfy the application;

- refuse the application;

- leave the application without consideration.

Employees of the Pension Fund of the Russian Federation must notify the person about the decision made by March 31 of the year following the year in which the application for choosing an investment portfolio (management company) was submitted. If a person submitted an application via the Internet, then the Pension Fund of the Russian Federation also sends a corresponding notification in the form of an electronic document.

This procedure is established in paragraph 2 of Article 33 of the Law of July 24, 2002 No. 111-FZ.

For reasons for refusing to approve or consider an application, see the table.

Situation: what should a person do if the Pension Fund of the Russian Federation did not notify him of the decision made on the application to select an investment portfolio (management company) for pension savings?

Please contact the Russian Pension Fund with a written request for clarification of the situation.

Employees of the Pension Fund of the Russian Federation must notify the person about the decision made by March 31 of the year following the year in which the application for choosing an investment portfolio (management company) was submitted. Moreover, if a person submitted an application via the Internet, then the Pension Fund of the Russian Federation also sends a corresponding notification in the form of an electronic document. This follows from paragraph 2 of Article 33 of the Law of July 24, 2002 No. 111-FZ.

The Pension Fund of the Russian Federation may not notify a person about the decision made on the application to select an investment portfolio (management company), for example, if:

- the application is granted;

- the application was not received by the Pension Fund of the Russian Federation;

- The applicant’s data is incorrect (it is unknown to whom and where to send notifications).

Therefore, in order to find out the reason why the Pension Fund of the Russian Federation did not notify a person of its decision, you need to contact him with a written request. Employees of the Pension Fund of the Russian Federation are required to provide a response within three months from the date of receipt. This procedure is provided for by paragraph of Article 33 of the Law of July 24, 2002 No. 111-FZ.

Situation: what to do if the Pension Fund of the Russian Federation unlawfully refused to accept (left without consideration) an application for investing pension savings?

Submit a written complaint to the branch of the Pension Fund of the Russian Federation that refused to satisfy the application (leaving it without consideration) or to a higher division of the Pension Fund of the Russian Federation (Articles 2 and 8 of the Law of May 2, 2006 No. 59-FZ).

You can file a complaint:

- on paper;

- electronic.

This follows from paragraph 1 of Article 4 of the Law of May 2, 2006 No. 59-FZ.

Regardless of the method of filing a complaint, state the current situation and give your arguments.

When filing a complaint electronically, be sure to include the following:

- your last name, first name, patronymic (if any);

- your postal or email address (depending on which of the specified addresses you want to receive a response to).

Please attach to your complaint:

- application for the selection of an investment portfolio (management company), which was submitted to the Pension Fund of the Russian Federation;

- notification of refusal to satisfy the application (about leaving the application without consideration), which was sent by the Pension Fund of the Russian Federation.

When filing a complaint on paper, attach the documents as copies.

If the complaint is submitted electronically, submit the documents:

- in electronic form along with the complaint;

- separately on paper in the form of copies or originals.

This follows from Article 7 of the Law of May 2, 2006 No. 59-FZ.

The Pension Fund of the Russian Federation is obliged to respond within 30 days from the date of registration of a person’s written request. In exceptional cases, the period may be extended by no more than 30 days with notification of the citizen who filed the complaint. This procedure is provided for in paragraph 3.1 of the Instruction, approved by Resolution of the Pension Fund Board of November 2, 2007 No. 275p, Article 12 of the Law of May 2, 2006 No. 59-FZ. In addition, the Pension Fund of the Russian Federation, based on the results of consideration of the appeal, must take measures if the applicant’s rights have been violated (clause 1 of Article 10 of the Law of May 2, 2006 No. 59-FZ).

Transfer of pension savings to private management: how will it happen?

The regulator took an unprecedented measure and replaced the state guarantee of the safety of pension contributions, taking into account the level of inflation, with a guarantee from the management company to ensure a minimum level of profitability.

Perhaps this “fad” will be appreciated by UAPF investors who have “excess savings” and, as a result, will not throw their savings into the furnace of the real estate market, but will retrain as competent investors.

– What is the mechanism for transferring pension savings under management to private companies? Who chooses the company?

– Investors can exercise the right to transfer pension savings into trust management of private management companies:

1) those who have not reached retirement age and have pension savings exceeding the “minimum sufficiency threshold”;

Punchers and dodgers 08/06/2021 07:004125

2) those who have entered into pension annuity agreements with insurance companies, providing them with lifelong annuity payments.

The investor will be able to familiarize himself with the list of investment portfolio managers and the investment declarations they offer on the UAPF Internet resource, and then select the management company that best suits his investment preferences. In this case, the choice of two or more companies is not prohibited.

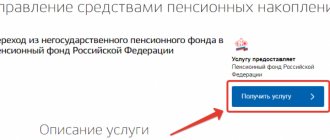

To transfer pension savings to a private management company, the investor must contact the UAPF (in person or through the website) with an application.

The UAPF, having verified the presence of pension savings in the investor’s individual pension account that exceed the sufficiency threshold, or a concluded pension annuity agreement, transfers the corresponding part (balance) of pension savings to the management of a private company within 30 days.

The remaining part of pension savings will continue to be managed by the National Bank.

Aloud about forced vaccination 08/09/2021 15:301179

– Can investors withdraw pension savings transferred to private management companies?

– Definitely not. It is important that the UAPF will continue to take into account pension savings transferred to private management in its information system in the context of individual pension accounts of investors. That is, centralized accounting of all pension assets will be introduced.

UAPF depositors retain the right to transfer their savings to another management company no more than once a year or return them to the management of the National Bank - no earlier than 2 years after the transfer of pension savings to the management company.

Term restrictions are due to the need to plan the investment horizon for managers, as well as to protect the interests of investors themselves during short-term fluctuations in profitability.

Thus, pension savings are retained in the pension system and, upon reaching retirement age, are used to make pension payments according to schedule, conclude a pension annuity agreement, and other purposes provided for by law, including use for improving housing conditions and (or) treatment.

A turning point for the multi-vector nature of Kazakhstan 08/09/2021 12:303598

At the same time, the regulator notes that the use of different investment strategies when transferring savings to private management will help diversify investors’ risks, obtain higher investment returns and, accordingly, increase pension savings.

– Is the safety of pension savings transferred to private management companies guaranteed, taking into account the level of inflation?

– Investors are given the opportunity to participate in the management of their pension assets, create their own pension plan, choose an alternative investment policy for their savings and receive a return that corresponds to the level of their risk appetite.

However, the investor, when choosing an investment portfolio manager and an investment strategy for transferring his pension savings into trust management, assumes investment risks. In this connection, the state guarantee of the safety of pension contributions, taking into account the level of inflation when transferring savings to private management, has been replaced by a guarantee from the management company to ensure a minimum level of return on pension assets accepted for trust management.

If, at the end of the assessed period, a negative difference arises between the nominal return received by the manager and the minimum return on pension assets, the manager will have to compensate this difference to the investor from his own capital.

The difference between Chinese and post-Soviet privatization 07/28/2021 12:004173

The minimum level of return will be calculated from the weighted average return of pension assets transferred to the management of private management companies on a monthly basis and published on the website of the National Bank of the Republic of Kazakhstan.

– From what source will the investor receive pension payments assigned upon reaching retirement age?

– Pension savings can be transferred by the investor to private management companies and remain under their management until the investor reaches retirement age.

10 days before the investor reaches retirement age, pension savings held in trust by a private manager are subject to return to the UAPF for the purposes of making pension payments according to the schedule, concluding a pension annuity agreement or for other purposes provided for by law.

– Will transfers of funds to fund managers be subject to income tax?

“There is no need to be afraid of the collapse of such a state apparatus” 06.28.2021 16:008360

– A one-time pension payment can be withdrawn by the contributor (recipient) from the UAPF only for the purpose of improving living conditions and (or) paying for treatment.

The transfer by the investor of part of his pension savings to the private management of the management company does not apply to the withdrawal of a lump sum pension payment, since the pension savings subject to transfer to private management remain in the UAPF system.

Thus, pension assets transferred to private management will not be subject to income tax at the time of transfer to private management.

– In what securities will private management companies invest the pension savings of investors? Are there any restrictions in their investment policy?

– The regulator has determined a list of financial instruments in which private management companies can invest pension assets accepted for management, taking into account their credit quality.

Aloud about forced vaccination 08/09/2021 15:301179

This list includes government securities of the Republic of Kazakhstan and foreign states, equity and debt non-government securities issued by both Kazakhstani and foreign organizations, as well as deposits in second-tier banks of the Republic of Kazakhstan and non-resident banks.

In order to diversify the portfolio, limits have been established for investing pension assets: in one issue of financial instruments, in financial instruments issued by one organization and its affiliates, as well as in financial instruments denominated in foreign currency.

In this case, the strategy for investing pension assets will be determined by the management company itself within the framework of the approved investment declaration.

– When transferring funds to a private management company, does the investor have the right to regulate the parameters of the portfolio that will be formed at the expense of his funds (share of foreign exchange instruments, ratio of equity and debt instruments, geographic and industry diversification, etc.)?

– The management of the pension assets of the management company is carried out on the principles of collective investment, which means that the investor agrees with the investment strategy determined by the management company.

Central Asia is languishing without a big project 07/29/2021 11:004394

The investment declaration of the management company determines the structure of the investment portfolio, investment limits by type of financial instrument and other standards for the diversification of pension assets within the limits established by law.

– What are the requirements for management companies to transfer pension savings to them for management?

– Pension asset managers will be selected from existing companies with a license to manage an investment portfolio and experience in the market, which have proven themselves to be effective managers. These companies do not need to obtain additional licenses.

The company's management must comply with additional quantitative and qualitative parameters established by the Agency of the Republic of Kazakhstan for Regulation and Development of the Financial Market for the management of pension assets.

The management company must have sufficient equity capital to cover losses associated with the investment of pension assets. The size of his net worth depends on the volume of pension assets under management.

“I live in Aksai, I work in Moscow” 07/29/2021 09:008154

Among other key parameters, one can highlight the presence of experience in managing client assets and positive results of financial and economic activities over the past few years, as well as the presence in the ownership structure of a large shareholder capable of additional capitalization of the company, if necessary. In addition, to be allowed to manage pension assets in the activities of the management company, there must be no facts of violation of prudential standards, unfulfilled supervisory response measures or sanctions applied by the regulator, as well as facts of unfair behavior in the securities market.

The list of companies that meet quantitative and qualitative parameters will be posted on the Agency’s official Internet resource and updated on a monthly basis.

In case of violation of qualitative and/or quantitative parameters by companies, for example, a decrease in the amount of equity capital, companies will be given time to correct the deficiencies, and, if necessary, existing supervisory measures or sanctions will be applied.

– What commission is planned to be established for management companies that want to manage part of pension assets? Or will it depend on some factors?

– The maximum amount of commission remuneration for the investment portfolio manager for managing pension assets is established by Article 53 of the Law of the Republic of Kazakhstan “On Pension Provision in the Republic of Kazakhstan” and is an amount not exceeding 7.5% of the received investment income.

Kazakhstan – 100 years ago. August 1921 08/03/2021 09:002389

The actual amount of the commission is determined by the agreement for the management of pension assets concluded between the investment portfolio manager and the UAPF.

– Who will protect the interests of investors in the event of disputes between the investor and the private management company?

– Management of pension assets will be carried out by management companies on the basis of an agreement concluded between the manager and the UAPF, as an organization representing the interests of depositors. The standard form of the agreement is determined by the regulatory legal act of the Agency of the Republic of Kazakhstan for Regulation and Development of the Financial Market.

Considering that, in accordance with the agreement, the UAPF represents the interests of depositors, the protection of their interests will also be carried out by the UAPF.

In turn, the National Bank and the Agency will protect the interests of depositors within their competence.

Requirement for personnel. 2021 08/04/2021 07:002783

– Where and how will the pension savings of investors transferred into trust management by private management companies be stored and accounted for? What will happen to the assets of investors if the management company is deprived of its license or liquidated?

– Accounting and storage of pension assets transferred to trust management will be carried out in a UAPF account opened in a custodian bank unaffiliated with the management company.

One of the key tasks of the custodian bank is to monitor the intended use of pension assets and the compliance of acquired financial instruments using pension assets with the requirements of the law and the investment declaration of the management company.

The management company will have to carry out a tripartite reconciliation of the data of its internal accounting system for pension assets for compliance with the data of the custodian bank and the UAPF, with the frequency established by the tripartite custodial agreement (daily, weekly and monthly). This will ensure transparency and reliability of accounting of pension assets in each of the parties to the custodial agreement and, accordingly, will ensure the safety of pension assets of investors.

In case of suspension or revocation of the management company's license, pension assets stored in the custodian bank will be returned to the UAPF custodial account with the National Bank.

***

© ZONAkz, 2021 Reproduction is prohibited. Only a hyperlink to the material is allowed.

Satisfaction of the application

If the Pension Fund of the Russian Federation has satisfied the person’s application, then no later than March 31 of the year following the year in which the application was submitted, the pension savings will be transferred to the selected management company (clause 1 of Article 34 of the Law of July 24, 2002 No. 111- Federal Law).

The pension savings of citizens who submitted an application for choosing an investment portfolio (management company) simultaneously with an application for payment of additional pension contributions will be transferred within three months from the day the Pension Fund of the Russian Federation received the corresponding application (Part 3 of Article 11 of the Law of 30 April 2008 No. 56-FZ).

NPF web uk extended personal account

At the same time, the profitability of private management companies is extremely variable. If you were born in the year or later and have never exercised the right to choose a management company or non-state pension fund, then your pension savings are currently managed by Vnesheconombank. Your funds will be transferred to the GUK investment portfolio of your choice in March next year. Already now, citizens’ pension savings have been automatically transferred to an expanded investment portfolio.

Usually, a comparative description gives a clear idea and answer to the question - which is better? But not in our case, because these are just two proposed options for managing your funds, each of them is good in its own way. And each of them is not without certain disadvantages; it all depends on the economic situation. Before betting on one of the types of management, objectively assess the current state of affairs and familiarize yourself with modern forecasts.

We recommend reading: Obtaining Tajik citizenship in 2021

Notice from the Pension Fund of the Russian Federation

The Pension Fund of the Russian Federation sends notification about the status of an individual personal account and about the results of investing pension savings only when a citizen applies for this information. This information must be sent within 10 days from the date of application and can be provided both on paper and in the form of an electronic document.

This procedure is established in paragraphs 2 and 3 of Article 32 of the Law of July 24, 2002 No. 111-FZ and paragraph 9 of Article 16 of the Law of April 1, 1996 No. 27-FZ.