An entrepreneur, having employees, makes monthly contributions to the Pension Fund for their future pensions. What kind of pension can an entrepreneur himself claim?

To pay pensioners, the employer makes monthly contributions to the Pension Fund. The employer must pay insurance premiums. The employee himself does not make any payments, except in cases where he himself wants to increase the size of his pension.

Individual entrepreneurs calculate and pay insurance premiums in a special manner. Thus, an individual entrepreneur is obliged to pay insurance premiums not only for his employees, but also “for himself.”

How much does an individual entrepreneur pay contributions “for himself”?

For individual entrepreneurs, a fixed amount of insurance premiums is established, which depends on the amount of income received.

The individual entrepreneur calculates the insurance premium to the Pension Fund “for himself” using the following formula:

fixed portion of 1% on income exceeding 300 thousand rubles (clause 1 of Article 430 of the Tax Code of the Russian Federation).

If the income of an individual entrepreneur in 2021 did not exceed 300 thousand rubles, then he will pay “for himself” insurance premiums for compulsory pension insurance - 32,448 rubles and for medical insurance - 8,426 rubles.

If the income of an individual entrepreneur exceeds 300 thousand rubles, then the total amount of insurance premiums will depend on the actual income and is paid as 1% of the excess amount.

But even in this case, the total amount of insurance premiums should not exceed:

- for compulsory pension insurance - 259,584 rubles;

- for compulsory health insurance - 8,426 rubles.

For example, an individual entrepreneur with an annual income of 2 million rubles will pay to the Pension Fund:

32,448 rubles (1.7 million rubles x 1%) = 32,448 rubles 17,000 rubles = 49,448 rubles.

Should an individual entrepreneur pay insurance premiums if he is disabled?

The Ministry of Finance received requests not only to cancel insurance premiums for individual entrepreneurs in principle, but also specifically for individual entrepreneurs with disabilities, including those who have retired. As a result, officials published Letter No. 03-15-09/32244 dated May 25, 2017, which stated that if an entrepreneur, being disabled, is unable to carry out business activities and fulfill all the requirements of the law, no one obliges him to continue do business. The procedure for registering an individual entrepreneur is also of a declarative nature, that is, until a citizen himself wishes to register as an individual entrepreneur, no one will oblige him to go through the registration procedure. Therefore, if a person is not ready to carry out entrepreneurial activities, does not have the necessary property, does not have entrepreneurial abilities, cannot decide on the type of activity, or does not have the proper education, the required amount of money, skills, etc., one should not become an individual entrepreneur. The same applies to disabled people - if health does not allow them to engage in business and comply with the requirements of the law (including paying insurance premiums “for themselves”), it is advisable to renounce the status of an individual entrepreneur rather than ask for benefits.

Based on the conclusions made by the Ministry of Finance, the fact that an individual entrepreneur has been assigned a disability group does not affect his obligation to pay insurance premiums. Deductions will have to be made, as required by law, from the moment an individual is registered as an individual entrepreneur until the records of individual entrepreneurs are deleted from the Unified Register of Entrepreneurs (USRIP).

The Ministry of Finance, having announced its decision on this issue, also referred to the Determination of the Constitutional Court of the Russian Federation dated March 22, 2012 No. 621-О-О. At the same time, the Ministry of Finance reminded entrepreneurs of the possibility of not paying insurance premiums to the Pension Fund and the Federal Compulsory Medical Insurance Fund in the event of one of the special periods, the list of which is contained in clause 7 of Art. 430 Tax Code of the Russian Federation. After this, questions began to arise as to why, during the period an individual entrepreneur provides care for a disabled person of group 1 (this is one of the grounds for a “break” in the payment of insurance premiums), the individual entrepreneur should not pay insurance premiums, and if the entrepreneur himself is disabled, insurance fees have to be paid. This is due to the fact that the main thing in this situation is the existence of the status of an individual entrepreneur and the responsibilities associated with this fact, which the individual agrees to at the time of registration of the individual entrepreneur.

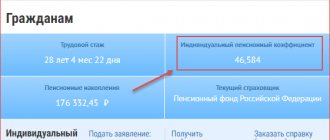

How can an individual entrepreneur find out the size of his pension?

In order for an individual entrepreneur to calculate the size of his future pension himself, he needs to know his individual pension coefficient or points. It is the points that affect the size of the pension.

Pension points are awarded when the individual entrepreneur works.

In general, the more an entrepreneur works and the higher his income, the more points he will receive. And the price of each point is set by the state. For example, the price of a point in 2021 is 93 rubles, in 2021 - 98.86 rubles.

But individual entrepreneurs have a limited amount of insurance premiums “for themselves”.

If his income does not exceed 300 thousand rubles, then in 2021 he will pay only 32,448 rubles.

In addition, the state made concessions for entrepreneurs operating in industries affected by the pandemic. For 2020, they must pay a fixed contribution to compulsory pension insurance in the amount of 20,318 rubles, and not 32,448 rubles (Article 1 of Federal Law No. 172-FZ dated 06/08/2020).

Of course, even a slight reduction in the tax burden is a help for individual entrepreneurs, but lower insurance premiums will inevitably affect the entrepreneur’s pension.

How can I find out how many points an individual entrepreneur has earned during his working life?

There is a formula for calculating points:

Total points for the year = (Amount of premiums paid “for yourself”): (Standard amount of insurance premiums) x 10

The maximum amount of insurance contributions for 2021 for an insurance pension will be 1,292,000 rubles. This value is determined annually by the Government. Then the standard amount of insurance premiums will be: 1,292,000 rubles x 16% = 206,720 rubles.

If an entrepreneur pays insurance premiums “for himself” in the amount of 32,448 rubles, then his total points for one year will be 1.57.

In order for an entrepreneur to retire with the required insurance period, he must have a minimum number of points:

- in 2021 - 18.6;

- in 2021 - 21;

- in 2022 - 23.4;

- in 2023 - 25.8, etc.

So, in order for an individual entrepreneur to retire in 2023, an entrepreneur needs to have 25.8 points with a minimum insurance period of 14 years.

Let’s assume that an individual entrepreneur’s retirement age has arrived, but he doesn’t have enough experience. In this case, the entrepreneur will receive a social pension. In 2021 it is 5,034.25 rubles. The state makes an additional payment to the social pension up to the regional subsistence minimum.

Why does the employer pay contributions to the pension fund for a working pensioner?

I retired 12 years ago, but continue to work. Those. 12 years ago I already earned my pension. With a salary of 50 thousand rubles, 11 thousand are sent monthly to the pension fund. Pension indexation is no more than 3 points, i.e. 200 rubles, looks like a mockery. Wouldn’t it be fair to pay contributions not to the pension fund, but to me personally?

compulsory pension insurance is a system of legal, economic and organizational measures created by the state aimed at compensating citizens for the earnings (payments, rewards in favor of the insured person) received by them before the establishment of compulsory insurance coverage;

Where can an entrepreneur get information about accumulated pension points?

It is best to obtain this information in the following ways:

- through the official Internet portal of the Pension Fund;

- through the government services website;

- by personally visiting a branch of the Pension Fund of Russia or the MFC.

The best way is to contact the government services portal.

To do this, you need to register on the website, fill out all the necessary information: passport details, SNILS.

If an entrepreneur understands that he does not have enough pension points for a decent pension, then he can buy more. To do this, you need to conclude an agreement with the Pension Fund and transfer money to the specified details.

Unfortunately, an entrepreneur who worked and paid insurance premiums “for himself” will have a pension significantly lower than an employee.

The fact is that the employer transfers 22% of insurance premiums for compulsory pension insurance of an employee, which is significantly higher than the fixed amount of insurance premiums paid by individual entrepreneurs.

There is a calculator on the website of the Pension Fund of the Russian Federation that will help you find out the size of your future pension (https://www.pfrf.ru/eservices/calc/).

An individual entrepreneur will be able to simulate various situations, for example, changing the retirement date, because the further this date is pushed back, the higher the pension amount will be.

Can a pensioner engage in business?

A citizen who has stopped working due to reaching retirement age has the right to start a business at any time. Registration of entrepreneurial activity for a pensioner is no different from the standard procedure. A person must outline the direction of his activity and decide on the taxation system. The legislation provides for five taxation schemes:

- USN (simplified). Suitable for beginner traders. Accounting is simple; 6% is paid from profits to the state treasury.

- BASIC (general). One of the most complex accounting systems. Advantages: you can do any type of business. The scheme is ideal for high turnover and for individual entrepreneurs who are ready to work with value added tax.

- PSN (patent) is used in small industries.

- UTII (imputation) is limited by areas of activity. Used for services.

- Unified agricultural tax (agricultural tax) has restrictions on business areas. Suitable for fishing and agricultural production. Rate – 6%.

To join the ranks of individual entrepreneurs, a retired citizen will need a package of the following papers to submit to the tax service:

- Application form No. 21001.

- Russian Federation passport (original and copy).

- Taxpayer identification number.

- A document confirming payment of the state fee.

The application indicates your full name, tax identification number, date and place of birth, your citizenship and place of registration. Be sure to indicate the type of business activity and its code. It is easy to find the necessary data on the Internet.

Important! Fill out the application form in block letters. Marks and corrections are unacceptable. Otherwise you will have to fill it out again.

A pensioner opens an individual business according to the scheme described below:

- Determination of the scope of activity and definition of OKVED. The legislation allows you to choose several directions at once.

- Choice of taxation system.

- Payment of state duty in the amount of 800 rubles.

- Collection and submission of documents to the tax authorities. A Federal Tax Service employee will issue a receipt for receipt of papers and an application to determine the taxation system.

- Obtaining documentation. If no errors are found when checking the submitted papers, the pensioner will receive a certificate of registration as an individual entrepreneur in 5 days.

- Registration with the Pension Fund of Russia and the Federal Compulsory Medical Insurance Fund.

- Purchase of necessary equipment.

- Opening a bank account.

Every businessman is required to have a seal. A sample is selected for its manufacture.

When an individual who has stopped working under a contract takes up business, he is again classified as a working citizen, and he is deprived of allowances from the state. But there are also positive aspects:

- To open your own business you do not need authorized capital.

- Application of a preferential tax system.

- A monthly pension benefit of a fixed amount, which will increase due to contributions to the Social Insurance Fund.

There is no need to liquidate the company to close the case. They submit an application to the tax authority, where the individual entrepreneur will be closed within 5 working days.

How to increase the size of your insurance pension?

In the event that an individual entrepreneur combines his business with employment, the amount of insurance premiums will be higher and, accordingly, more points will be calculated for the pension.

One of the ways to increase the size of a pension is to defer its application. For example, if an entrepreneur does not receive money within 5 years after the onset of pension grounds, then the amount of old-age payments will increase by 40%.

To increase your pension amount, you can purchase additional pension points.

Should an individual entrepreneur, being a pensioner, pay insurance contributions to the Pension Fund?

Those who consider this state of affairs unfair can refer to the ruling of the Constitutional Court of the Russian Federation dated September 23, 2010 No. 1189-О-О. With this clarification, the judges put an end to the long-term dispute between retired entrepreneurs and the pension system of the Russian Federation.

As for the benefits in the field of taxation of income of such businessmen, everything is even simpler. The legislator, based on the basic principles of the Constitution, established a uniform procedure for taxation of their income for all entrepreneurs, regardless of age.

We recommend reading: Additional payment for pensioners who have reached the age of 80

Procedure for paying taxes by working pensioners

- not pay property taxes on one piece of non-profit property of your choice;

- receive tax deductions from the personal income tax base;

- take advantage of regional and local tax benefits established for pensioners.

We recommend reading: What state allowances are there for combatants?

All earnings of citizens received from labor, authorship or other activities are subject to income tax in our country. In this sense, working pensioners are not much different from “ordinary” citizens who are not of retirement age. They also work, receive a salary and also pay income tax on it.