Fixed contributions

Let’s take, for example, an individual entrepreneur who pays only the minimum fixed contributions established by the state.

There are a majority of such individual entrepreneurs in Russia. To accumulate the 30 points necessary for retirement in the future, an individual entrepreneur must carry out entrepreneurial activities and pay fixed contributions for about 30 years. But even in this case, his pension will be minimal. At 2021 prices, 30 points guarantee a pension of RUB 7,951.39. (5334.19 30*87.24), which does not reach the living wage of a pensioner. That is, having worked all his life as an individual entrepreneur and having retired, the former businessman will receive from the state the more than modest pension he has earned and an additional payment up to the subsistence level.

Pension depends on pension points: how to calculate them

The size of the pension depends on how many pension points the entrepreneur has accumulated. For each year of work, he is awarded points or, as they are called differently, annual (individual) pension coefficients (IPC).

Their size depends on how much insurance contributions have been paid to the Pension Fund.

So, in 2021, an individual entrepreneur must pay to the Pension Fund

29,354 rubles + 1% on the amount of income more than 300,000 rubles per year. If the individual entrepreneur pays everything, then 2021 will be counted as a year of insurance experience.

Let's calculate how many points IP Vasiliev will receive for a year of work:

- Calculate the standard of insurance premiums using the formula from the law. We look at the rate set by the state and multiply by 0.16 (16% is the individual part of the insurance premium rate). In 2021, the standard is 1,150,000 X 0.16 = 184,000.

- we divide our insurance premiums for the year by the standard of insurance premiums and multiply by 10. That is, we take part of the insurance premiums of IP Vasiliev, which are taken into account by the state, and substitute it into the formula: (29,354/184,000) × 10 = 1.59 - this is how many points the entrepreneur will receive in a year.

That is, if he works for 10 years, he will accumulate 15.9 points, and if he works for 20 years, he will accumulate 31.8 points. The higher the contributions, the more points the entrepreneur has.

Voluntary contributions

To influence the size of his future pension, an entrepreneur can pay a voluntary fixed payment in an increased amount .

The minimum amount of voluntary insurance contributions is determined as the product of the minimum wage at the beginning of the year and the insurance premium rate, increased by 12 times. The maximum amount is calculated from eight times the minimum wage.

For 2021, the minimum contribution is 29,779.20 . (11280 *22%*12).

The maximum contribution amount for 2021 is RUB 238,233.60. (11280*22% *12*8).

The future pension of an individual entrepreneur depends on the amount of insurance premiums

The future old-age pension of an individual entrepreneur directly depends on the amount of insurance contributions that he pays to the Pension Fund of the Russian Federation. In 2021, its minimum amount is just under 29,500 rubles, provided that the income does not exceed 300,000 thousand rubles.

If it is higher, then an additional 1% of turnover is transferred. According to Art. 425 of the Tax Code of the Russian Federation (part two) dated 08/05/2000 No. 117-FZ (as amended on 05/29/2019)

, 26% of the minimum wage must be transferred to compulsory pension insurance (for hired employees - 22% of their salary).

An entrepreneur is obliged to pay insurance premiums for himself, regardless of the presence or absence of profit.

What is the benefit

Note that the minimum voluntary contribution will add approximately 1 point to the individual entrepreneur’s future pension.

That is, having paid an additional about 30 thousand rubles, the bottom line is that the individual entrepreneur will receive an increase in his future pension of about 90 rubles. per month. Let’s assume that a male individual entrepreneur will live to be 80 years old, that is, he will remain in pensioner status for 15 years. Let's calculate the approximate benefit from paying them voluntary contributions in their youth.

Over 15 years, the increase in pension in 2021 prices will be 16,200 rubles. (90*12*15), and paid the individual entrepreneur 29.8 thousand.

In addition, there is one small nuance here - the former individual entrepreneur will be able to feel these added 90 rubles only if his pension is greater than the subsistence level of a pensioner.

If the individual entrepreneur’s pension is small, the additional 30 thousand rubles he paid will not bring any increase , since in any case he will receive the FSD (social supplement up to the subsistence level). In this case, the size of the FSD will decrease by an additional 90 rubles of his pension, that is, the benefit from the once paid voluntary contributions will not be received by the individual entrepreneur himself, but by the state, which already received these 30 thousand several years ago. That is, the state will receive the benefit twice, but the individual entrepreneur – not once. This is the arithmetic...

At the same time, we note that an individual entrepreneur may need additional points not only to increase his future pension, but also to obtain the right to it in principle. The fact is that if you don’t get enough points, the individual entrepreneur will not be able to get an insurance pension at the age of 65 and will have to wait another 5 years to get a social pension.

We covered this topic in detail in the article “Who will be denied a pension and why.”

In this case, buying pension points can justify itself and bring real dividends to the entrepreneur.

We previously examined the situation with the purchase of points in detail in the article “How much does the Pension Fund sell pension points and who benefits from buying a pension.”

Pension since 2015 for individual entrepreneurs

IP pension

► Pension for individual entrepreneurs

Pension since 2015

► Reform 2015 ► IP experience for pension ► Documents for pension

From 2015, the calculation of pensions for individual entrepreneurs will be similar to the pensions of employees. Read more - pension system reform 2015.

As before, when calculating a pension from 2015 for an individual entrepreneur, the amount of insurance contributions made by him will be taken into account, that is, those fixed insurance contributions that he pays annually to the Pension Fund and the amount of contributions he voluntarily made to the funded part of the pension.

But the most important thing is that the later the individual entrepreneur retires, the greater the pension he will ultimately receive. This is the main essence of the 2015 pension reform.

IP pension since 2015

The old-age pension of an individual entrepreneur is transformed into an insurance pension and a funded pension.

The insurance part is, as before, fixed payments to the Pension Fund of the Russian Federation by an individual entrepreneur.

Also, when calculating the insurance pension, the length of service of an individual entrepreneur will be taken into account (how an individual entrepreneur can prove his experience), the age of applying for a pension, the amount of contributions paid, as well as non-insurance periods - military service on conscription, parental leave, etc.

The sum of the annual coefficients for the entire work activity of an individual entrepreneur, including non-insurance periods, multiplied by the value of the pension point, together with the fixed payment, will form the basis of the future pension.

Pension for individual entrepreneurs

In addition, from 2015, the requirements for the minimum length of service (from 6 years in 2015 to 15 years in 2024) and the number of pension coefficients for granting a pension will gradually increase (from 6.6 in 2015 to 30 in 2025).

According to the new rules, the full insurance pension will be formed for those citizens who begin working in 2015. For current and future pensioners who started working before 2015, the generated pension capital will be converted into points (individual pension coefficients). At the same time, all earned pension rights are retained in full.

Cumulative pension - the calculation of the size of which will be identical to today’s calculation of the size of the funded part of the labor pension.

That is, the new formula for calculating pensions for individual entrepreneurs from 2015 (and for hired workers) will be applied only when calculating the insurance pension, while the funded pension will be formed as before.

How to calculate your pension from 2015

From now on, the size of the pension will be calculated in points, that is, in the corresponding pension coefficients; the personal labor contribution of each citizen will be assessed using the corresponding pension coefficients.

At the same time, the role of the length of service of an individual entrepreneur or employee in calculating the size of a future pension becomes key.

“Annual pension coefficient” - will be used to calculate the size of the labor pension every year of a citizen’s working activity.

If a citizen’s total insurance experience (periods for which insurance contributions were paid to the pension system) by the date of assignment of the labor pension is more than 35 years, then according to the new rules for calculating the amount of the pension, the labor pension will be assigned in an increased amount.

For each year of insurance (work experience) from 30 to 40 years for women and from 35 to 45 years for men, 1 pension coefficient is additionally accrued:

For 35 years of service for women and 40 years for men, an additional 5 pension coefficients are accrued.

IPC - individual pension coefficient

For each employee or individual entrepreneur upon retirement, their individual pension coefficients will be calculated for each year of work, assessing exactly what amount of earnings in each specific year insurance contributions were paid to the Pension Fund of the Russian Federation. The maximum value of the annual IPC is 10.

For individual entrepreneurs, the “amount of earnings” is his annual income. Let us remind you that, starting from 2014, individual entrepreneurs, in addition to the “fixed” insurance premium, pay 1% of every 300 thousand earned. This 1% percentage will also be taken into account when calculating your pension.

“Increasing” and “lowering” pension coefficients are provided. By multiplying the total individual pension coefficient by its value in a specific year (the year of retirement), we ultimately get the size of your labor pension.

And most importantly, when calculating the size of the insurance pension, all annual pension coefficients are summed up, including special coefficients for later retirement.

Formula for calculating pensions since 2015

SP = (FV x KPV) + (IPK x SPK x KPV), where:

SP – insurance pension in the year the pension was assigned;

FV – fixed payment;

IPC is an individual pension coefficient equal to the sum of all annual pension coefficients of a citizen and bonus coefficients for length of service;

SPK – the cost of one pension coefficient in the year the pension was assigned;

KPV – bonus coefficient for retiring later than the generally established retirement age (has different values for PV and SPK).

In accordance with the above material, it becomes clear that in accordance with the new calculation of pensions since 2015, citizens are forced to “voluntarily” work, as long as possible without receiving a pension from the state? Yes it is. The goal of the reform is clear - in order to receive a “decent” pension, you must reach it as late as possible.

It is precisely this goal - to force citizens to retire as late as possible - that is being pursued by the new pension reform.

There's no point in deluding yourself

Insurance deductibles increase every year, but you should not expect a large pension. If your payments were minimal, then it is unlikely that you will receive more than citizens with a shortage of experience.

The calculation mechanism is quite complex; the pension fund website has a calculator that allows you to calculate your future pension.

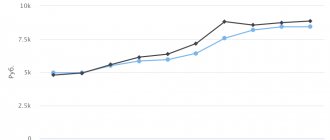

Example. You are an entrepreneur earning 1 million rubles a year. You plan to receive your pension in 35 years. According to the pension calculator, your pension will be slightly less than 14 thousand rubles per month. If you earn 5 million rubles a year. Then the size of your pension in 35 years will already be a little more than 14 thousand rubles. If 10 million rubles - 14532 rubles 64 kopecks.

But you should also understand that in 35 years everything will definitely change, that even now no one will say for sure what kind of pension you can count on. Pension reforms are ongoing and will continue to be implemented.

If, as an individual entrepreneur, you also worked under a work book, then your pension will be higher.