Taking out a mortgage before marriage is not difficult. Difficulties begin when common-law spouses decide to formalize the relationship and use obscenities. capital or disperse. You can avoid them if you prepare in advance for drawing up a mortgage agreement and resolving controversial situations. And you should start with the procedure for obtaining funds for real estate.

How to get a housing loan before registering a marriage

According to the law, an apartment can be mortgaged before marriage, but it will be problematic to divide it if the spouses formalize the relationship and then divorce. Also keep in mind that if the loan is not repaid by the time the union is dissolved, not only the real estate will have to be divided, but also the debts (). Obtaining funds for the purchase of living space is possible not only for husband and wife. They are issued:

- just physical persons;

- cohabitants (civil relations);

- people planning to get married.

In the latter case, the couple submits an application to the bank before the wedding. In the case of cohabitants, it is allowed to issue a mortgage to the husband before marriage or to the common-law wife.

The procedure for issuing funds is standard, but there are some differences. They depend on the category of people applying for a loan.

- People in a civil union are more likely to be given a loan to purchase real estate in shared ownership.

- If a couple planning to get married applies for a loan, it is advisable to prepare a prenuptial agreement, because the mortgage before marriage in the event of a divorce will also be divided between the former spouses.

- The bank considers applications from co-borrowers: the main borrower is one person (common-law husband or wife), and the second acts as a joint borrower.

Depending on the situation, the package of documents required for issuing funds also changes. This way, people planning to get married can provide a prenuptial agreement.

Inheritance of a premarital apartment

It is impossible to avoid opening an inheritance case in the event of the death of a husband or wife who is officially married. The entire amount of property belonging to the deceased is subject to division. A person could have made a will before his death, and events will unfold in accordance with it, or relatives will consider it necessary to challenge it.

The will is drawn up by a notary and the latter must certify it in accordance with the law. In this document, the spouse has the right to establish a list of heirs or one of them. The share of each is also determined.

The inheritance process will develop in full accordance with the rules of the law if there is no will. Parents, children, and the remaining spouse have the first right to inheritance.

After the death of a spouse, the joint share of the life partners is determined from the common property and transferred to the surviving one.

The amount of property remaining after determining what is common with the spouse is distributed between people. But at the same time, an additional share is allocated to the spouse so that it is not less than that of the others. It is possible that the spouse will receive a whole half of the real estate purchased during marriage, and another part of the remaining half of the inheritance.

There is no need to waste time to enter into the right of inheritance. You should write a statement and give it to a notary within six months from the date of death of your life partner. The property of one spouse after the death of the second is considered real estate. It doesn’t matter which of them paid for its acquisition, or for whom the documents were subsequently issued.

If the housing was not privatized or the surviving spouse refused this process during the life of his/her spouse, then a certificate of ownership will not be issued. Housing is not considered common if the partners lived in a civil marriage, but they did not consider it necessary to formalize it. But there are exceptions. When cohabiting persons have registered a share of ownership for everyone who lived in the house.

If life partners left for another world on the same day, then their right to inherit joint housing ends. The opening of each inheritance is carried out separately.

Who can get a loan for?

Two options for the development of the situation are allowed: one of the spouses took out a mortgage before marriage and then entered into a union, or cohabitants register the property as shared ownership. The rights and responsibilities of individuals vary depending on the chosen lending method. As long as the couple is in a relationship, it doesn't really matter. But when children appear, or the moment comes to divide the apartment taken into a mortgage before marriage during a divorce, such nuances become significant.

Issuance of funds per borrower

A citizen can apply for funds even before entering into official relations. In this case, he is the only borrower, and the housing is registered in his name. In the future, you can change the form of ownership or add a joint borrower if the second cohabitant so desires.

If the mortgage was acquired before marriage and was not transferred to two people during married life, in case of divorce:

- The second spouse risks being left without real estate ().

- The division of loan debts is also excluded.

However, there are more benefits in the long run from taking out a loan together.

Common shared ownership

To ensure that the division of property under a mortgage before marriage does not cause difficulties, you should choose this form of ownership. Common-law spouses or cohabitants can act as joint borrowers under an agreement. In this case:

- one is the title borrower;

- housing is registered as shared ownership.

In this situation, in order to perform any actions with property, one common-law spouse will have to obtain notarial permission from the second. To issue a mortgage before marriage, you need to submit to the bank:

- salary certificate (provided either in the form of a bank or in the form);

- work book (certified copy);

- documents for the borrower;

- certificates for children, if any.

These papers are collected by each of the common-law spouses. Representatives of the financial organization will provide a complete list. The procedure for obtaining a mortgage before marriage is as follows:

- The title borrower submits an application to the bank (the application must indicate the existence of a joint borrower).

- If you receive a positive response, send the collected documents to the financial institution.

- Select a suitable property, taking into account the bank's requirements for such property.

- Evaluate the apartment in an expert bureau and draw up a mortgage agreement (they will open an account for you where the down payment is made).

Upon completion of the procedures with the bank, you need to transfer the money to the seller and register the property with Rosreestr. Additionally, a collateral agreement and insurance will be required. If one of the spouses bought an apartment with a mortgage before marriage, the square meters are registered in his name. If they are formalized in a civil union, Rosreestr registers shared ownership.

Recommended article: Mortgage under two documents: registration procedure, documents, list of banks

Important to know: How not to lose your home with a mortgage in a civil marriage

Is the credit history of a mortgage co-borrower important?

Applying for a mortgage for two

A mortgage loan can be legally issued to two owners, even if they are not spouses.

In this case, all responsibilities for repaying the debt fall on the shoulders of two people, and the borrowers themselves have a greater chance that their mortgage application will be approved.

In the process of applying for it, the bank takes into account the income of both people, as a result of which you can count on either more favorable conditions or a larger loan amount.

The assistant will need to collect the same package of documents as the borrower, as well as provide information about employment and salary level.

But before the final signing of all documents in such a situation, you will need to be very careful about the distribution of debt obligations and take the trouble to officially certify them.

You need to understand that such a mortgage before marriage does not imply joint repayment of the debt. The co-borrower simply acts as a kind of safety net and will make interest and monthly mortgage payments only if the main borrower experiences financial difficulties.

But it is possible to draw up a loan agreement in such a way that the obligations of both owners to the bank are equal. And so that after repaying the debt, the co-borrower does not begin to demand his share, despite the fact that he did not take part in the payment process, it is better to fix all rights to the property in advance.

It is recommended that such an agreement be certified by a notary, otherwise the document will not have legal force and, if necessary, it cannot be used as evidence in court.

Is it possible to get a mortgage before marriage using maternal capital?

According to the law, a mortgage before marriage with maternal capital is possible, but subject to certain conditions. You can implement this type of government support in two ways:

- Make as a down payment on a new loan agreement;

- Use as early repayment of an existing loan.

Recommended articles: Maternity capital as a down payment on a mortgage

Early repayment of mortgage with maternity capital

Regardless of the chosen method, the main requirement must be met - to officially provide children with living space. The best option is to use capital as a down payment. Then the housing can be registered as shared ownership, giving each child a share.

If you purchase an apartment before marriage using a mortgage with maternity capital, you need to take into account the provisions. It says that persons who have received the certificate can manage funds to improve their living conditions

. However, you won’t be able to simply pay off your roommate’s loan. It is important that the money is spent in the interests of the children, or you will have to first register the marriage and then repay the loan.

Mortgage in a house under construction

The mortgage borrower receives ownership of the housing under construction after completion of construction. If before marriage an apartment in a building under construction was purchased with a mortgage, and a certificate of ownership was issued after the wedding, the housing is considered a joint acquisition, and the likelihood of its division is extremely high.

If at the time of divorce such a loan is not fully repaid, then there are several options for dividing the property.

1. You, as the borrower, remain the owner of the home, continue to repay the loan, and also compensate your ex-spouse for his share.

2. If you do not have enough funds to pay compensation, you can:

- pay off your mortgage early;

- sell an apartment;

- share the proceeds with your ex-spouse.

3. If you are unable to repay your mortgage early, you can contact the bank. Algorithm of actions in this situation:

- the bank sells the apartment;

- withholds the amount of debt on the loan, interest and transaction costs;

- you receive the remaining amount in your hands and divide it with your ex-spouse.

If at the time of divorce the certificate has not been issued, then the ex-spouse may demand the return of half of the funds paid to the bank from the legally common family budget. Typically, the court will order the mortgage borrower to pay compensation for all years during which the loan was repaid during the marriage. To protect your financial rights, entrust the division of your mortgage property during a divorce to an experienced attorney.

What are the conditions for a marriage agreement when providing housing loans to unmarried people?

Before entering into such an agreement, you should study the provisions.

Draw up a prenuptial agreement for a mortgage before marriage in writing. It will have to be certified by a notary after registration in order for it to come into force. The document determines the form of ownership (equity, joint, etc.), the procedure for division in case of divorce and other nuances.

An agreement can only be concluded if there is an intention to enter into an alliance. In this case, both spouses must be legally capable. The document itself defines exclusively property and financial relations. The agreement is drawn up for a specific period or may be indefinite.

As a general rule, a prenuptial agreement for a mortgage taken before marriage describes the terms of the intended division of property. Therefore, ambiguous language must be avoided. Based on such an agreement, the bank will decide whether to issue a loan. Real estate registration is also carried out in accordance with the provisions of this document.

Before drawing up, it is advisable to study a sample prenuptial agreement for a mortgage before marriage or contact a lawyer. If the agreement is drawn up only to resolve issues of obtaining a loan for real estate, it must reflect the following points:

- what is the share of each joint borrower in the down payment (if any is paid upon receipt of the loan);

- volume of obligations to make monthly payments (percentages or exact amounts);

- what responsibilities will the parties to the agreement have to improve living conditions (repairs, reconstruction, etc.);

- liability of spouses in case of failure to fulfill obligations (late payment, refusal to deposit funds, etc.);

- how jointly acquired property will be divided in case of a mortgage before marriage (it is advisable to link the division options to the reason for the dissolution of the marriage);

- change in shares and distribution of living space when repaying the loan using mat. capital.

If such points are not specified, real estate acquired by one of the future spouses will be considered his personal property. To get a share in it, you will have to work hard.

If you want the division of the mortgage before marriage to take place without such complications, draw up an agreement. It is also concluded if:

- one spouse is against purchasing property on credit;

- the parents of the young couple will also pay for the loan;

- the husband or wife has negative marks in their credit history;

- the residential property will not be used in the life of a married couple.

With this agreement, the pre-marital mortgage in the event of a divorce is divided according to the terms of this document. Therefore, lawyers recommend filing it in any case.

What if the property was purchased with a mortgage in a new building?

If a mortgage is taken out for an apartment in a new building, the situation becomes significantly more complicated. In fact, housing does not exist - neither on paper nor in reality. If the ownership right is registered only after the completion of construction for married spouses, it is recognized as jointly acquired property and after a divorce is divided equally. Even if the mortgage is paid off a couple of months after the marriage is registered. The law does not take into account the injustice of such a situation.

In Russia, concluding a marriage contract is considered a sign of distrust in the spouse.

However, it is time to put aside prejudices and think sensibly. A mortgage can seriously complicate a divorce - whether shared or taken out by one of the spouses before marriage. This is an onerous monetary obligation. Statistics show that divorce occurs on average after 10 years of marriage - the amount spent on repaying the mortgage will be large and in the event of a divorce, half will have to be returned. When entering into marriage, none of the newlyweds think about divorce. However, you can insure yourself against litigation that makes the difficult (legally and morally) fact of divorce unbearable. Legislative protection will help spouses who have divorced maintain a neutral relationship, without negative legal proceedings in the event of a divorce.

Attention! Due to recent changes in legislation, the legal information in this article may be out of date! Our lawyer can advise you free of charge - write your question in the form below:

How to get a tax deduction for a mortgage before marriage

When you purchase residential real estate, you can receive a deduction for the costs of purchasing it, as well as for the interest paid on the loan. In the first case, the deduction for a mortgage before marriage is paid in the amount of 13% of 2,000,000 rubles. In the second situation, the amount is 3,000,000 rubles. But given that the loan is issued for two borrowers, there are some nuances when paying interest on taxes.

- If the loan is issued to only one cohabitant, like an apartment, the second one will not be able to apply for a deduction.

- If you take out a mortgage before marriage for two common-law spouses, then each of them independently applies for a personal income tax refund.

- It is important that joint borrowers have shares in residential property. Otherwise, the deduction will be denied.

- Each co-borrower must pay his or her own share of the loan and interest. Documents are submitted to the tax service that clearly outline these parts.

- An apartment taken out on a mortgage before marriage is paid from the account of one borrower - the second will not be able to apply for a deduction.

Otherwise, such compensation is issued according to general rules. You will have to confirm ownership, provide papers proving the existence of housing costs and interest on the loan. If joint borrowers have not yet married, each of them prepares their own package of documents.

Keep in mind that if the apartment was purchased before marriage and for two people, you need to:

- check that each co-borrower has the right to count on a deduction;

- choose the appropriate option for issuing funds (through the employer or tax authorities);

- collect the necessary papers and fill out a declaration with;

- submit a package of documentation to the tax service;

- wait until you receive the funds, and then repeat the procedure next year.

Recommended article: Where to get a mortgage for commercial real estate for individuals

If the borrower took out a mortgage before marriage and later got married, when receiving compensation you will have to follow other rules (you can pay the loan from one account, etc.).

Important to know: How to get a tax deduction for a co-borrower on a mortgage

How to get a tax deduction for renovating an apartment or house

Tax deduction for mortgage interest

How to divide real estate if a loan for housing was issued before the start of the marriage relationship

The situation is complicated, especially if the borrower took out a housing loan before registering the relationship. It is important to consider the current state here:

- The property is still held as collateral by the bank.

- The loan was repaid before the relationship was registered.

- The debt was paid during the marriage.

If the mortgage was issued before the marriage, during a divorce it is divided together with the real estate pledged to the lender. And in this situation you can:

- recognize it as an obligation of one of the spouses - he must compensate the expenses of the second spouse (in the amount of payments made);

- by reissuing the loan separately for the husband and wife;

- repay the loan jointly, and upon completion, divide the property according to the shares assigned to each borrower;

- pay the loan balance ahead of schedule - this is usually done when the bank makes its demand.

If the loan is repaid before marriage, division of property acquired during this period is possible in extreme cases and only on a voluntary basis, or by a court decision. Otherwise, the living space remains with the spouse who paid the loan and in whose name it is registered.

If a mortgage was issued before marriage, but the funds were paid during the period of the union, both spouses can count on the apartment (). Even if the woman was on maternity leave and did not make payments, this cannot be considered a basis for refusing to receive her own share (). But a mortgage taken out before marriage during a divorce is divided based on the funds spent by the spouses to repay it. Therefore, it is worth saving all payment documents if funds are deposited separately.

What compensation options are there for a divorce?

To understand how a mortgage taken out before marriage is divided, you need to proceed from the current situation. As a general rule, the second spouse has the right to receive the following types of compensation:

- registration of a share in the property in his name;

- payment of funds to cover loan costs;

- each spouse receiving their own loan;

- sale of housing followed by division of funds.

In the first case, the wife's share of the mortgage before marriage is calculated based on the expenses actually incurred to pay the loan. If a new loan is issued, then the husband and wife are allocated their own space, for which money is issued. And the sale of residential premises is possible only with the consent of the bank if the property is pledged to it.

Recommended article: How a mortgage is divided during a divorce - important points

How to re-register a mortgage to another person: procedure and conditions

Features of a pre-marital loan for the purchase of housing in a new building

This situation needs to be viewed from a slightly different angle. If a mortgage under a DDU before marriage was issued to one spouse or to a husband and wife together, ownership will arise only after the issuance of a transfer and acceptance certificate. The developer rents out the property after registering the relationship - it is recognized as common, even if the mortgage was received before marriage.

Also, if rights to property arise after entering into an official relationship, the second spouse will be able to count on half of the living space. This practice applies regardless of who made the down payment and regular payments. But keep in mind that if an apartment was purchased with a mortgage before marriage, and the divorce was filed before the property was put into operation, one of the spouses can apply for reimbursement of the expenses that he incurred while paying off the loan (collected through the court).

Recommended article: How to get a Far Eastern hectare

Who has the right to real estate if it was purchased before marriage on credit?

This question cannot be answered unequivocally. Too little initial data. It is necessary to clarify it, considering, if not specific, then typical cases. This is what we will do.

If the debt is fully repaid before the wedding

Art. 36 of the Family Code of the Russian Federation states that the personal property of each spouse is that acquired before marriage with their own funds.

Thus, if before going to the registry office an apartment was purchased and the debt to the bank was fully repaid, then there can be no questions. The property will belong only to the spouse who appeared as the borrower.

If the loan was repaid jointly

And here it’s worth turning to Part 1 of Art. 34 of the RF IC, which states: property acquired during marriage is the joint property of the spouses. The situation with mortgages, of course, stands a little apart from the rest, but some conclusions can be drawn:

- Despite the fact that the purchase and sale transaction was completed by one of the spouses before marriage, the husband and wife together pay off the targeted loan (for the purchase of housing), most likely from family funds.

- Obviously, the second spouse, who did not participate in the mortgage process, has the right to claim a certain share in the property.

- Most likely, the shares in the apartment will not be equal. Their proportions will depend on a number of factors. Firstly, it depends on how much money one spouse managed to contribute before marriage. Secondly, it depends on what part of the loan is repaid from the personal funds of each spouse. In general, you will have to carefully calculate everything. And, most likely, this will have to be done in court.

But there is a more civilized and calm way out of the situation - to conclude a marriage contract.

How to re-register a mortgage and real estate for two after registering a relationship

When starting the procedure, you should take into account that the loan is still being repaid, and the property is pledged to the bank. When the loan has already been repaid, the rules for re-registration of the apartment will be different. If the husband took out a mortgage before marriage, after registering the relationship, a change of co-borrowers is allowed. To do this you need:

- collect documents for a new joint borrower;

- submit papers and an application for a change to the bank;

- get a new contract or additional agreement to it.

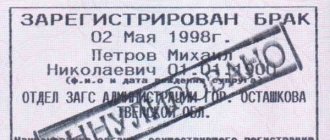

The documentation package must include a marriage registration certificate. The financial institution will also check the solvency of the new borrower. If the mortgage is valid before and after marriage, you can file for divorce.

It is better to formalize the relationship between spouses regarding the repayment of a loan for real estate in a marriage contract. By providing it to the bank, you will be able to reissue the loan in accordance with the provisions of such an agreement. However, the document must be drawn up according to the rules specified in the law.

It is also possible to change the type of ownership. If the husband took out a mortgage before marriage, and his future wife acted as a joint borrower, the housing was registered as shared ownership. After registering the relationship, it should be re-registered as joint ownership.

An application submitted to a creditor is considered within 10 days. The bank then makes a decision:

- The answer is yes - you need to make changes to the loan agreement and register them.

- The answer is negative - you can contact the bank again or file a complaint with the judicial authorities.

In any case, you will need a good reason to reissue the loan and apartment (registration of the relationship and improving the solvency of the couple).

Judicial practice on loan division

Former spouses cannot reach agreement on the division of property - they will have to study the judicial practice on mortgages before marriage during a divorce, and then prepare a claim. Each situation will be considered individually, based on the situation of the husband and wife, as well as the status of the loan. Only the dispute resolution procedure does not change:

- a statement of claim is submitted to the district court branch (at the place of registration of the apartment);

- The claim is accompanied by papers proving the positions of the plaintiff and the defendant;

- On the appointed day, a court hearing is held in which you need to take part.

If a mortgage was obtained before the marriage and paid off during the marriage, each party must provide checks, receipts, and other evidence of loan payments as evidence. It is these materials that are most significant when making a decision. Judicial practice shows that the judge takes into account not only these circumstances:

- the wife took out a mortgage before marriage and made a down payment - an additional advantage for her;

- the involvement of the second spouse in repaying the debt is taken into account (how often and in what volumes he contributed money);

- they also look at the sources for paying the loan (the income of the husband and wife, maternity capital, etc.);

- The decision is also influenced by the presence of minor children, as well as the possibility of dividing the debt.

But the greatest significance, if the mortgage was obtained before the marriage was registered, is the absence of objections from the mortgagee. The third party in the process, if the loan has not yet been repaid, will be the financial institution where the loan was issued.