Which foreigners are entitled to a Russian pension?

, not only citizens of the Russian Federation, but also citizens of other countries can receive pensions and some other social benefits .

The main condition that must be met for foreigners to receive a Russian pension is confirmation of permanent residence in Russia. In other words, a foreigner can receive a pension with a residence permit in the Russian Federation.

To apply for an insurance pension, a foreigner must meet the following requirements:

- permanently reside in Russia on the basis of relevant documents (residence permit);

- be insured in the pension insurance system (this means that you need to obtain SNILS - it is issued to holders of a residence permit);

- comply with the requirements of Federal Law 400-FZ “On Insurance Pensions” - that is, have the right to a pension based on age, length of service and pension points.

It is important that a foreigner temporarily residing or staying in Russia does not receive the right to a pension . In other words, you cannot receive a Russian pension with a temporary residence permit (TRP).

However, temporarily residing foreigners can have the status of insured in the Russian compulsory pension insurance system, provided that they officially work in Russia.

This is necessary so that in the future, if a foreigner obtains a residence permit or even Russian citizenship, he will have the right to an insurance pension.

It is worth noting that if a foreigner permanently residing in Russia (that is, having a residence permit) applies for a pension, he will receive it even when traveling outside of Russia. But here it is important to remember that if you are absent from Russia for a certain period of time, your residence permit may be revoked.

Thus, citizens of other countries who come to Russia for permanent residence receive the right to a pension . However, the calculation of its size depends on the citizenship of which country the foreigner has.

Citizens of Belarus, as well as other CIS countries (with the exception of a few countries),

the most favorable conditions for calculating pensions Let's consider these conditions in more detail.

Well, what to do - I went to find out if this is true

More precisely, first I called my relatives in Minsk. My second cousin just retired the year before last, but she doesn’t say how much she gets. By the way, all Belarusians are in this. You ask them specifically: how much is the salary, how much is the pension, how much is the rent for the apartment. They will never answer! Not a single number was mentioned!

- Oh, we have good pensions.

- Oh, it costs a lot for rent.

“Our salaries aren’t very good, but they’re enough to live on.”

These are the answers I hear, from which no conclusions can be drawn. This can be said about any country, even about Austria, even about the Republic of Chad.

View article: Christmas cards. Retro photo.

I’ll say right away that some types of social services - for example, child benefits - in the Republic of Belarus are truly higher than ours . Now they pay 427.84 rubles for the first child, and 488.96 rubles for the second and subsequent children up to three years of age (12,700 - 14,600 our rubles). Their benefits are tied to the average salary. For the first child 35% of the average, for the second – 45%. As earnings grow, benefits automatically grow. And they are given out not on the basis of need, but to everyone.

All my figures can be checked on mintrud.gov.by - the official website of the Ministry of Labor and Social Protection of the Republic of Belarus.

Does the Russian Pension Fund take into account experience in the CIS countries?

After the collapse of the USSR in 1991, the procedure for calculating pensions became significantly more complicated. Each now independent country has created its own pension legislation.

To ensure that former compatriots could easily move between countries and apply for a pension in their country of residence, an Agreement on Guarantees in the Field of Pension Security was concluded on March 13, 1992. Almost all countries of the former USSR became parties to the Agreement - with the exception of Georgia, Azerbaijan, Estonia, Lithuania and Latvia.

The agreement was signed by the Governments of Armenia, Belarus, Kazakhstan, Kyrgyzstan, Russia, Tajikistan, Turkmenistan, Uzbekistan and Ukraine . At the same time, the representative of Moldova also signed an agreement, but with the caveat that the Agreement is governed by bilateral agreements.

The main essence of the Agreement is that the pension is paid by the country in which the pensioner lives, regardless of the country in which he earned his work experience. There are no mutual settlements between countries.

The agreement applies to all pensioners and types of pensions, with the exception of the assignment of pensions to military personnel of the countries participating in the agreement. That is, you can receive a pension of the type that is available in your country of residence.

The general rules for assigning pensions to citizens of countries that have signed the Agreement include the following:

- the pension is issued at the place of residence;

- for the purpose of pensions, length of service, including preferential ones, earned in any country that has signed the Agreement is taken into account;

- The size of pensions is calculated based on earnings during periods of work.

If the work occurs during a period when the country has already introduced a national currency, the amount of earnings is recalculated at the rate at the time the pension was assigned. This provision actually neutralizes the earned pension rights of citizens. In most post-Soviet countries, since 1992 (the signing of the Agreement), there have been periods of hyperinflation, so that by the time a pension is issued, earnings have greatly depreciated. - when moving to another country, a person applies for a pension at the new place of residence;

- certificates that are needed to confirm work experience and salary are accepted without any legalization procedures.

Thus, when moving to another country within the CIS, citizens have the right to apply for a pension in the country where they actually live.

As for the years for which the length of service of foreign citizens in Russia is taken into account, we will highlight the following periods:

- until December 1, 1991 - the length of service is counted as Soviet according to the legislation of the Russian Federation;

- from December 1, 1991 to December 31, 2001 - the length of service is counted taking into account the Agreement and other bilateral agreements between countries;

- from January 1, 2002 – length of service is counted only if insurance contributions are paid to the Russian Pension Fund.

Russia has a new agreement with Moldova - since December 4, 1995. The agreement with Georgia has been in force since 2002. Both of these agreements assume that Soviet experience is taken into account according to the laws of the Russian Federation, and experience after 1991 is taken into account according to the laws of these countries. A similar situation has applied to Lithuania since 2001.

In practice, this means that the Russian Pension Fund recognizes work experience in Moldova, Georgia and Lithuania from 1991 to 2001 only if there is confirmation of payment of contributions to the budgets of these countries.

Since 1999, there has been an agreement between Russia and Azerbaijan, since 2007 - with Estonia, and since 2011 - with Latvia. The contents of the agreements differ in some aspects, but the essence is that Russia accepts the length of service of citizens of these countries both before 1991 and after.

A special situation is the relationship between Belarus and Russia in the field of the pension system. Unlike other countries, citizens of the Republic of Belarus living in Russia are offered more rights.

What is better in Belarus than in Russia, and vice versa?

Russia is, of course, a wonderful, beautiful country with its pros and cons. And she has room to strive. Living in Belarus, I noticed 5 things in which Belarus is better than Russia.

1.

Low crime rate

2. Quality of products

3. Lack of migrants from Central Asia

4. Improvement

5. Road safety, minimal traffic jams and public transport

Belarus is a country to live in, social advertising in Belarus tells us. But is this really so and is everything perfect here? Unfortunately, there are a large number of quite significant disadvantages.

1.

Low wages

2. High labor emigration

3. Service

4. Lack of jobs

5. High real estate prices

Assignment of pensions to citizens of Belarus living in Russia

On March 29, 2007, the Agreement between the Republic of Belarus and the Russian Federation on cooperation in the field of social security came into force. The document determines the procedure for paying not only pensions, but also many other social benefits to citizens of Belarus in Russia and vice versa.

According to the Treaty, citizens of Belarus living in Russia, and vice versa, are given a choice of 2 options for calculating and paying pensions:

- for service until March 13, 1992, the pension is paid by the country in which the pensioner lives.

For periods after this date - the country in which this experience was earned. For example, a citizen of Belarus lives in Russia. He has experience until March 13, 1992, as well as 7 years of experience in Belarus and 8 years in Russia. If you choose the first option: from Russia he will receive part of the pension for the Soviet period (since he lives in Russia) and for 8 years of service in Russia. Belarus will pay him for the 7 years he worked there. - the pension is assigned and paid only in accordance with the laws of the country where the pensioner lives.

You can only select an option once; you cannot review your choice. At the same time, if you choose the first option, you will not be able to receive a pension from two countries at once for the same period.

It is important that the full pension, calculated in accordance with Russian legislation, will be paid by the Russian Federation to a citizen of Belarus only if he has worked in the Russian Federation for at least 20 years for women and 25 years for men.

If such length of service is insufficient, then the calculated pension amount is divided by 240 or 300 months, respectively, and multiplied by the number of months of service in Russia. In other words, the pension is set in proportion to the minimum required length of service.

The total payment cannot be less than the minimum pension amount. In Russia, this is the living wage for a pensioner. If the pension (even from two countries at once) is in total less than the minimum, the pensioner will be paid in addition to the minimum or basic amount (the country where he lives will pay additionally).

Social pensions are paid only according to the laws of the country where the pensioner lives. When leaving the country, the payment stops until the pensioner receives a pension at the new place of residence.

Thus, the Treaty between Russia and Belarus allows citizens of these states to receive a pension from two countries at once if they managed to work in both Russia and Belarus. This allows you not to “lose” your earnings on currency conversion, which happens to citizens of other post-Soviet countries.

Residents of both countries take advantage of this opportunity. As of 2021, 22.7 thousand people in Belarus received a Russian pension, and in Russia 1.8 thousand people received a pension under Belarusian laws.

What needs to be done to receive a pension when moving?

In both Russia and Belarus, the algorithm of actions for pensioners who have moved is approximately the same.

Watch the video: How the Russian pension is calculated when moving.

Actions of Belarusians when moving to the Russian Federation

- Make sure you are covered by the contract.

- Select a pension payment option.

- Apply with the necessary documents to the pension fund branch located in your area of residence.

- Receive a pension.

Actions of Russians when moving to the Republic of Belarus

- Check whether you fall within the terms of the contract.

- Choose the type of pension provision.

- Submit documents and an application to the Committee on Labor, Employment and Social Protection.

- You receive your pension once a quarter.

Documents attached to the application

Along with the application to the pension authority, you must submit:

- Confirmation of experience.

- Certificate of earnings.

Sample certificate of experience

The rest depends on individual circumstances. For example, for working pensioners it is important to provide documentary evidence of the fact that they continue to work.

How is earnings in another currency taken into account?

First of all, let us recall that earnings and insurance premiums paid in other countries can only be taken into account until January 1, 2002, when Federal Law No. 173-FZ “On Labor Pensions” came into force in Russia. According to it, since 2002, the size of the pension is affected only by insurance contributions to the Pension Fund of Russia.

Therefore, contributions that were transferred to the Pension Funds of the CIS countries after 2002 are not taken into account when calculating the Russian pension. Calculation of pension rights at the end of 2001 based on earnings for 2000-2001 can also be carried out only on the basis of personalized accounting data in Russia.

Consequently, only salary data from a certificate containing information about the applicant’s earnings for any 60 consecutive months can be taken into account.

However, earnings data must be taken into account in Russian rubles, whereas after the Soviet period, workers received wages in the national currency of the country where they lived. Therefore, the following order is adopted:

- for periods before the introduction of the national currency, earnings are calculated in Soviet rubles;

- for periods after the introduction of the national currency, the amount is converted into Russian rubles at the official exchange rate on January 1, 2002 (that is, the date when pension rights were converted into pension capital). For periods before January 1, 1998 (denomination in Russia), the amounts are multiplied by 1000 times.

In fact, the calculated pensions turn out to be low - incomes in post-Soviet countries (with the exception of the Baltic states) were low, and exchange rates were unstable. Taking into account the denomination of the ruble, the calculated pensions for citizens of the CIS countries are lower than when working in similar positions in Russia.

How is Belarus inferior to Russia?

Having lived here for a sufficient number of years, I began to notice that in some ways the Republic of Belarus is very inferior to Russia.

High level of digitalization

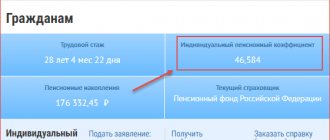

With the introduction of government services, life in Russia has become easier. Make an appointment with a doctor online? Easily. Check your future pension? Please. Check if there are fines and debts? Yes again!

What about in Belarus? Make an appointment with a doctor the old fashioned way, through the phone or by standing in line in the morning at the clinic. You will find out your pension when you get it, but fines are sent in letters the old fashioned way.

A modern payment method via NFC has been established

Today in Russia you can pay with your phone in almost any store, and on buses, as far as I know, you can already pay with a regular bank card. But these “higher” technologies are just beginning to reach Belarus. Today, if you try to pay for something in a store using your phone, you will be refused, because current terminals cannot do this. But in small stores they simply do not know about this possibility.

There is no endemic monopoly in Russia

In large cities there is definitely plenty to choose from. Mobile operator, Internet connection provider, etc. - all this can be chosen. In Belarus, the choice is a little limited; if you want Internet and television, you only have Beltelecom. It is impossible to imagine that an alternative telecommunications provider or telecom operator will appear here.

The same applies to shops. When visiting shopping centers in Minsk, you will notice that the selection of stores there is approximately the same. Only recently (about a year ago) new large brands began to arrive in Minsk (zara, h&m, stradivarius, bershka). And it was also a shock to me that in other large cities of Belarus there is not even a McDonald’s, which, it would seem, is just everywhere.

Gentle taxation

Living in Russia, I didn’t think about taxes often, but here this word literally haunts me. There are taxes on almost everything in Belarus. Sometimes they're just...weird. I think everyone has heard about the tax on parasitism, when the unemployed had to pay a tax for not working? And in Belarus there is a tax on dogs. Once every 3 months, dog owners must pay about 250 Russian rubles.

I will touch on excise taxes in this topic. If in Russia, in stores, as far as I remember, they are only available for alcohol and cigarettes, then in Belarus they are available for almost everything. Juices, teas, coffee, drinks, detergents... So in Russia, in this regard, everything is softer and simpler.

Belarus does not have its own entertainment programs

Russia creates or adapts many TV shows, series, competitions and so on. Many are not even ashamed! And Belarus broadcasts Russian or Ukrainian programs on its channels. In Belarus, they do not create any of their own entertainment content, there are no competitions, they cannot even adapt any world show like “The Voice”. What can we say about creating your own series or films. So, if you decide to watch TV in Belarus, there will only be news from Belarus and a couple of small programs of similar quality.