Who is entitled to the basic pension?

You can apply for the basic component in the following cases:

- A person has lost the ability to work due to the development of a disability.

- The child has lost his breadwinner and needs additional financial assistance to support himself until he reaches adulthood.

- There is a need for retirement according to length of service , when the total length of work in production allows you to apply for a pension benefit.

- Reaching the age when the basic pension is due by law.

- The person who wishes to receive a pension is supported by dependents.

The size of the basic component depends on many factors and will differ for different categories of the population.

Composition and structure

The basic component of the pension has an exact amount , which may change due to various factors.

For example, the basic pension if there are dependents will increase in proportion to the number of people under guardianship . And the survivor's pension ceases to be paid when the child reaches the age of majority.

Size of the base for certain categories of the population

The amount of the basic component of the pension depends on many factors, so its size is calculated taking into account the category of citizens applying for benefits:

- How much is it today (minimum) - as a result of indexation in 2021, the basic component of the pension was adopted in the amount of 4982.9 rubles, which is equivalent to the minimum pension in the Russian Federation.

- For law enforcement officers , military personnel are not eligible for a basic pension, since the calculation of pension benefits is carried out in a slightly different way than for civilians, taking into account allowances, length of service and the amount of monthly allowance. Their pension is indexed and increases annually. The minimum pension amount cannot be lower than the basic component at the time the serviceman receives it.

- For disability - the size of the base depends on several criteria, including the disability group. The minimum is 9965.80 rubles, and if there are dependents on support, it increases to 14948.71, taking into account the number of dependents. If a disabled person is not able to care for himself, the minimum amount increases to 21,622.98 rubles, and if he works in the Far North - 14,948.71 rubles.

- In the regions of the Far North , difficult working conditions guarantee an increase in the basic component of the pension, taking into account length of service. The minimum amount is 7474.35 rubles, and if there are dependents, this amount increases by 30% for each dependent.

- If there are dependent dependents , the pension supplement is provided for a maximum of 3 people and depends on which category the recipient belongs to. For residents of the Far North, the premium is 50%, for regions equated to the North - 30%, in the absence of any benefits or subsidies - 50%.

- For officials - fixed pension payments are due to a civil servant only if he takes out an old-age pension. In other cases, pension calculation is carried out individually, taking into account the position held, salary and benefits.

- For working pensioners - if the pensioner continues to work, the law secures his right to receive a basic pension. However, this amount is not subject to indexation. Only after full retirement will its amount be recalculated taking into account the minimum in the region.

- For veterans of the war in Afghanistan , the base is calculated upon reaching retirement age (old age) or disability. In other cases, the size of the pension depends on the position held, as well as benefits provided by the state.

- For individual entrepreneurs - if an individual entrepreneur makes contributions to a pension fund, upon reaching retirement age he can qualify to receive the basic component of the pension.

It is important to know! Thirteenth (13th) pension

The concept and functions of financing the Russian pension fund

The Pension Fund of Russia is a state fund that performs social insurance duties.

Financing in this area becomes the main source of social payments for citizens and performs the following functions:

- accounting of citizens for pension insurance;

- establishing the amount of insurance pensions upon reaching a certain age, disability, or loss of a breadwinner;

- organization of additional payment added to the pension;

- maintenance, investment and distribution of insurance savings;

- providing social benefits to certain categories of citizens;

- issuance of certificates for maternity capital.

Related article: Features of a disability insurance pension and the procedure for assigning it

Insurance contributions received by the State Pension Fund are its property and cannot be spent on other areas of social life that are not within the scope of the Pension Fund. The budget is set annually taking into account projected expenses and income. A report for all funds spent is provided to the Government of the Russian Federation, which controls financial receipts and fulfillment of the fund’s obligations.

The pension budget is called consolidated. This shows that it is formed from budgets of different levels, and is also taken into account when creating forecasts and calculations for the financial year.

The accumulation of contributions occurs as follows. The policyholder deducts a certain percentage of his own salary in accordance with the law or independently makes contributions to the insurance company. The insurer redistributes funds and their investments, so that the insured person receives payments upon the occurrence of an insured event (for example, retirement age).

Submission rules

Citizens of the Russian Federation can apply for the basic component of a pension upon loss of a breadwinner, disability, or reaching the appropriate age.

To do this, you need to contact the pension fund and provide documents confirming your membership in one of the listed categories.

Age

When it comes to a survivor's pension, the age of the recipient does not matter. An important condition is the child’s minority and incapacity to work. After age 18, payments automatically stop. The exception is full-time university study.

For women, the age for achieving the basic component of the pension is 55 years, for men – 60 years. In some cases, retirement age comes earlier (harmful working conditions, military experience, etc.).

It is important to know! How was pension formed in the Soviet Union?

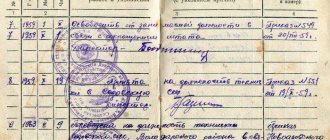

Experience

When calculating the base, an important condition is the number of days worked. If a person has not worked for 8 years, then he cannot apply for a base according to the law. The exception is disability.

For disabled people, it is enough to have one entry in the work book, where it is recorded that he worked for at least 1 day officially. The same scheme applies to calculating the base for the loss of a breadwinner.

If a citizen of the Russian Federation has not worked a day in an official job, he can apply for a social pension, which is calculated without taking into account the base.

Distinctive features of an old-age insurance pension

Almost all norms and rules regarding the registration, calculation and payment of pension benefits of any type are regulated by law, namely by articles of the Federal Law of the Russian Federation under number 400, which has undergone the latest amendments quite recently. Already in 2015, it was decided to divide insurance-type payments into three main types of security:

- For the loss of a breadwinner.

- Due to disability.

- Due to old age.

Now all pensions will be formed on three main basic components - the funded and insurance part, as well as a fixed payment. The rights of pensioners will be taken into account in this way by calculating their earned pension points (IPC). It is extremely important to understand that all previously acquired rights should in no case be infringed upon, that is, the pension may increase, but cannot be reduced in any way.

The first and most important condition, the observance of which will entail the emergence of the right to security of this type, is a completely reliable insurance period for the old-age pension. This means that a person has a work history when the employer actively paid certain contributions to the Pension Fund for its own employee, accumulating his pension. Calculating your work experience is not difficult; the main thing is to correctly identify the periods of work that may be included in it, and understand which ones will have to be excluded. Detailed information about this is given in Article 12 of the Federal Law number 400.

The previously existing definition of “labor pension” is now completely excluded from the legislation, and it can only be used conditionally, to simplify understanding. Previously, labor support depended almost entirely on the contributions that went to the Pension Fund for the employee, but now everything is different. The very concept of an old-age insurance pension implies not only contributions, but also duration, that is, the length of work experience.

Formation and structure of the insurance pension

All citizens who previously received a labor pension have been transferred to insurance-type pensions starting from 2015, but only if they were born before 1966. Younger people can independently choose whether to form an insurance pension for their future or prefer a funded one. The structure of the pension is not complicated; it is collected from only three main indicators:

- The insurance part, formed from the employer's contributions for the employee, which he made throughout his work.

- Accumulation part.

- A fixed payment to the insurance pension assigned by the state.

It won’t hurt to know that, starting in 2014, our government, due to the difficult economic situation and the deficit of the pension fund, decided to redirect absolutely all payments under any pension system to insurance-type contributions. This should make it possible to eliminate the lack of funds. For the period 2014-2018, all payers of taxes and contributions for insurance pensions must be corporatized, which will allow each of them to be included in the register of the Central Bank for maximum protection of savings.

For those who cannot or do not want to read the entire article, just below there is a video detailing what an insurance pension is and how it is calculated to citizens of the Russian Federation.

How is it calculated?

The basic component of the pension is calculated on the basis of documents submitted to the pension fund. Authentication may take up to 3 months, but payments will be accrued from the moment the application is submitted.

The following documents must be provided:

- passport;

- documents confirming official employment and work experience;

- a certificate of a disabled person, as well as a medical certificate, which is issued after passing the relevant commission;

- certificates of marriage, birth of children, death;

- certificate of family composition and place of actual residence;

- certificate of absence of a pension assigned on other grounds.

When applying for a survivor's pension, it is necessary to provide documents confirming the existence of a family relationship between the child and the deceased, as well as social poverty.

The basis of the base is the amount that is established after indexation. For 2021, the size is 4982.9 rubles. This amount can be increased by 30%, 50%, 100%, taking into account other circumstances: disability, work in the North, loss of a breadwinner, etc.

It is important to know! How to properly monitor tire pressure?

Recalculation is carried out based on the provision of relevant documents that will increase the size of the basic component. Indexation is carried out annually, so in the future the size of the base will increase in proportion to the increase in the cost of living.

If a person remains working from the moment he becomes eligible to receive a pension, the coefficient increases, which allows him to receive a higher final pension amount:

- 1 year from the date of reaching retirement age – 1.056 (1.036 with early retirement);

- 2 years – 1.12 (1.07);

- 3 years – 1.19 (1.12);

- 4 years – 1.27 (1.16);

- 5 years – 1.36 (1.21);

- 6 years – 1.46 (1.26);

- 7 years – 1.58 (1.32);

- 8 years – 1.73 (1.38);

- 9 years – 1.9 (1.45);

- 10 years – 2.11 (1.53).

Continuing to work even after retirement age increases the coefficient, which in the future will allow the basic component to be doubled.

Insurance pension amount

In order to correctly calculate a pension, pension fund specialists came up with an algorithm that makes the calculations transparent and accessible to everyone. The insurance part of the old-age labor pension is determined by a special formula:

SP = IPK x SPK

Let's break down the concepts:

SP is the same insurance pension that an elderly person will receive.

IPC – pension points or personal pension coefficient.

SPK is the cost of one such pension point, which can be regularly changed by the state to update the provision of pensioners.

Fixed payment

According to the new legislation, the amount of the labor pension will be calculated taking into account the same fixed payment on the basis of which all calculations are based. This figure is clearly specified by the state at the time of assignment of security and has a fixed amount in state currency. Due to inflation, the amount corresponding to the FV changes regularly, namely, it increases from the first of February of each year, which is called indexing. Certain categories of elderly people may be eligible to receive increased EF:

- Children deprived of parental care (orphans).

- Disabled people of the first group.

- Persons who have reached the age of eighty.

- People with 20-25 years of working experience in difficult conditions of the Far North, representatives of small peoples.

- Agricultural employees with at least thirty years of experience.

An increasing coefficient is necessarily applied to the pension fund if a person continues to live in the North at the time of applying for a pension, as well as when a person decides to retire later than his due date.

Definition of the concept and value of IPC

Individual pension points, that is, coefficients, are the main component of the final amount of payments. Therefore, it is very important to understand how this indicator is formed. There is also a formula for this:

IPK = (IPKs + IPKn) x KvSP

Where:

IPK – pension points at the time when the pension will be assigned.

IPKs – points counted in the period before January 15 of the new century.

IPKn – points earned after January 2015.

KvSP - increasing coefficients that arise when assigning old-age and survivor's pensions.

Interestingly, the last point can become a really significant and effective incentive to retire before the due date. For example, in just one year the amount will be increased by seven percent, in five years it will be 45%, and after eight years it will reach a revolutionary 90%, which is very good.

Questions and answers

Citizen N. has been raising a daughter from her first marriage for 10 years. Her ex-husband, with whom she had not maintained any relationship for the last 5 years, died. Previously, he worked on temporary jobs and did not have a permanent job. Citizen N. herself is in a civil marriage and does not work due to a difficult pregnancy. Is she entitled to receive a survivor's pension and how to apply for it? – If a woman is unemployed and has a dependent minor child, she can receive a survivor’s pension, even if her ex-husband did not officially work. In this case, a social benefit is assigned, which is equal to the size of the basic component. If a woman proves that her family is on the verge of poverty, then she can apply for a similar pension for her own maintenance.

Citizen I. is dependent on four minor children. What amount of the basic component is he entitled to if he plans to retire before his children come of age? – at the legislative level, pension supplements are established in the presence of dependents, in the amount of 1/3 of the base for each disabled family member, but not more than for 3 family members. Therefore, the size of the basic component in this case is calculated using the formula: 4982.9+(1661×3)=9965.9 rubles.